Monday, April 27, 2020 4:12:31 PM

>>> MEI Pharma Set To Explode With Announcement Of Lucrative Partnership

Seeking Alpha

Apr. 27, 2020

Stock Doctor

https://seekingalpha.com/article/4340118-mei-pharma-set-to-explode-announcement-of-lucrative-partnership

Summary

$250 million market cap is extremely low after signing a $700 million agreement with Kyowa Kirin, which gives $100 million upfront with 50-50 revenue sharing in the US and tiered royalties for ME-401.

Extensive drug pipeline for a small-cap biotech with 4 different candidates in which two are already partnered.

Analysts' price targets following partnership reflect 3-5 times upside.

It has been quite some time since my last stock recommendation. However, I have continued to be on the lookout for small-cap biotech stocks that are dramatically undervalued. With the pandemic leaving a lot of uncertainty in the markets, I have been looking not only for small-cap stocks with a lot of upside but also a substantial amount of cash on hand to fund operations and not have to dilute under poor market conditions. In the small-cap space, this is not easy to come by. However, MEI Pharma (MEIP) looks to be a hidden gem right now. I last recommended MEI Pharma almost 4 years ago when it was trading at a $50 million market cap. Although, the stock has quadrupled since then, the pipeline has gotten much better, and with the recent announcement of the mega deal with Kyowa Kirin, the small-cap company’s strategy has been validated and significantly derisked.

It is shocking to me that the stock did not move more on announcing the deal. It initially jumped up to $3.64 per share but has fallen back to ~$2.40, which is where the shares were trading in early March before the deal. To be trading at a ~$250 million market cap after such a big deal for a small-cap stock is unheard of. The deal was for just one of its drug candidates, a phosphatidylinositol 3-kinase delta (PI3Kd) also known as MEI-401, which is in clinical development for the treatment of B-cell malignancies. Usually, deals involving small-cap biotechs are very light on upfront payments, and instead, are back-end loaded on milestones so that little risk is taken by large pharma. However, this deal stands out to me because of the hefty $100 million upfront cash payment, combined with the ability to get almost $600 million more in milestone payments. In addition, MEI Pharma retains 50% of sales in the US with cost sharing and tiered royalties overseas.

In my opinion, MEI Pharma is a steal at the current valuation with now ~$200 million of cash on hand, a very strong drug pipeline and a big-time partnership. With several catalysts on the horizon in the short term, I think the stock could easily double or triple from current levels.

Best-in-Class HemOnc Clinical Pipeline

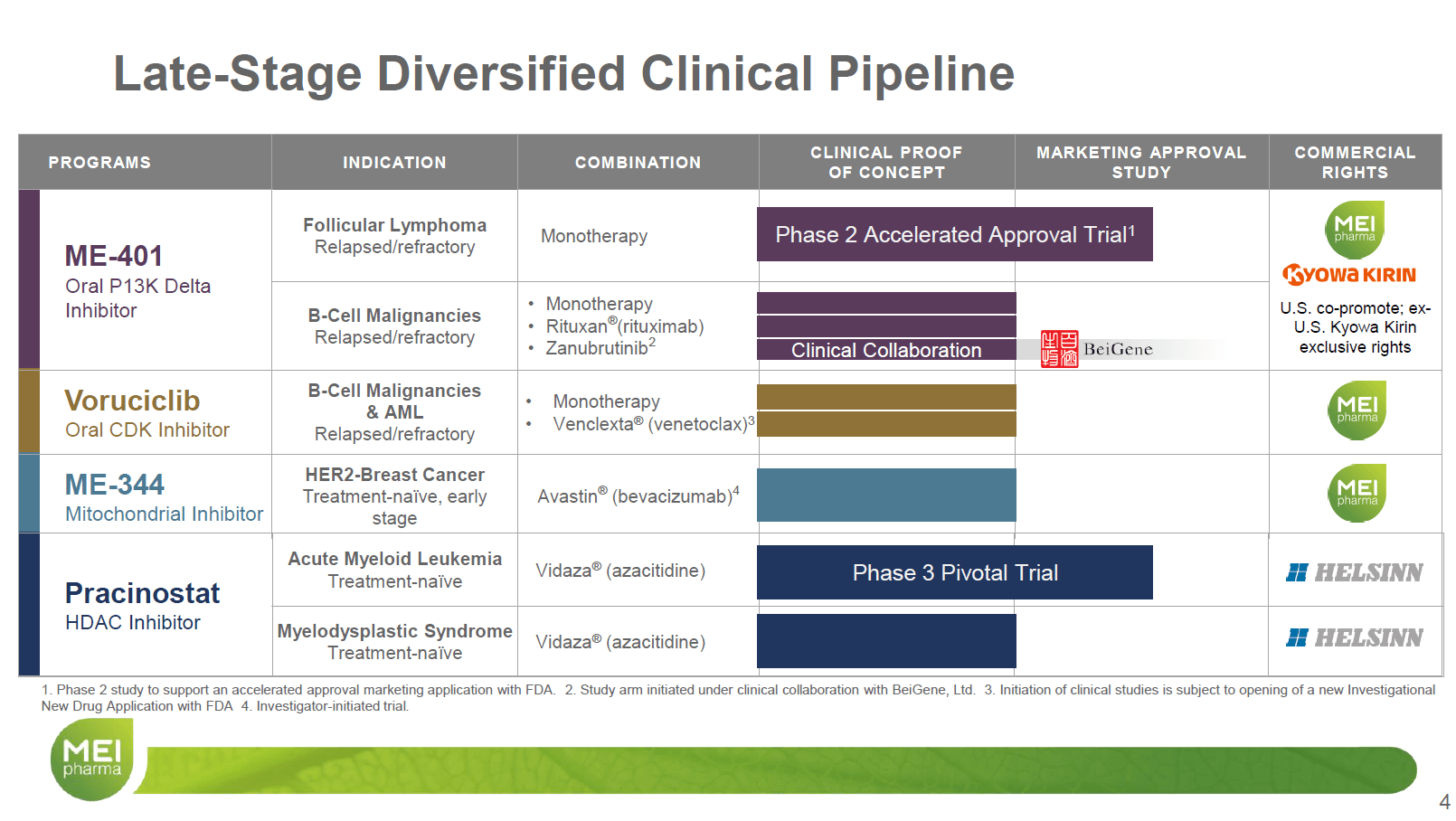

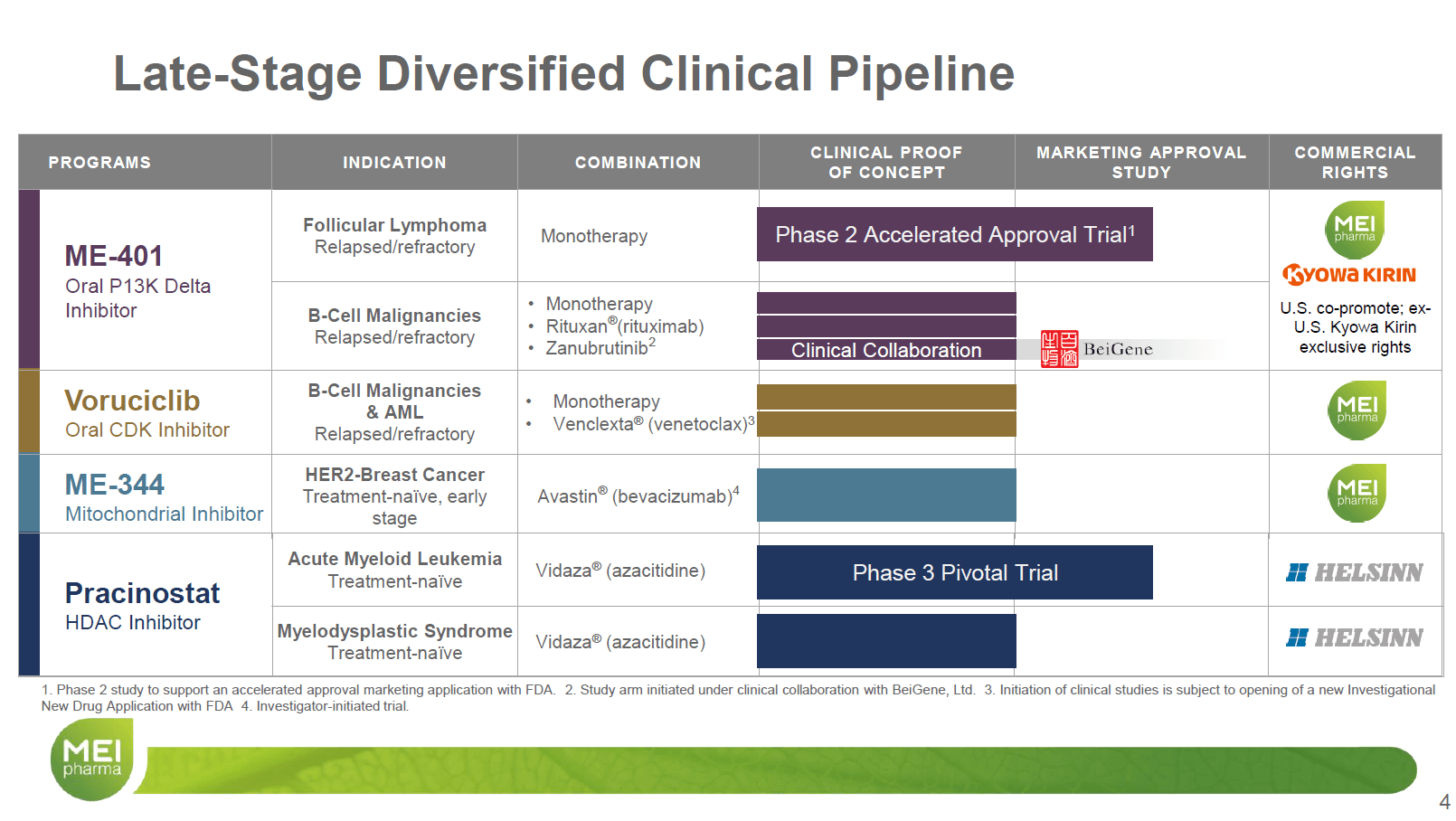

It is rare to find a biotech with a $250 million market cap having such a diverse clinical pipeline. Most small-cap biotech companies have their hopes pinned on a single drug.

Source: April 2020 Corporate Presentation

Pracinostat

One of the most advanced drugs in the pipeline is Pracinostat, an HDAC inhibitor for the treatment of MDS and AML, which was licensed to Helsinn in 2016 for $20 million upfront and ~$450 million in milestone payments, along with tiered royalty payments on sales. The excitement of Pracinostat plus Azacitidine in elderly newly diagnosed AML patients stems from the Phase 2 clinical trial results, where complete remission was observed in 42% (21 of 50 patients) and median overall survival was over 19 months. This compares favorably to Azacitidine alone with a CR of 19.5% and a median OS of 10.4 months. Helsinn is now enrolling the Phase 3 clinical trial, which, in my opinion, has a high likelihood of success, as the responses seen to date have been some of the most durable ones ever documented in this patient population. In addition, Helsinn and MEI Pharma are in the process of completing a Phase 2 dose escalation study in MDS, which has already passed an interim analysis and should report out in the middle of this year.

Voruciclib

Voruciclib is a novel, oral CDK inhibitor that is fully owned by MEI Pharma and being looked at in numerous blood cancers. It has not only shown single agent activity but has the potential of overcoming Venetoclax resistance by inhibiting MCL1. Venetoclax does ~$1 billion in revenue annually. Phase 1 clinical trial updates should be available in 2020.

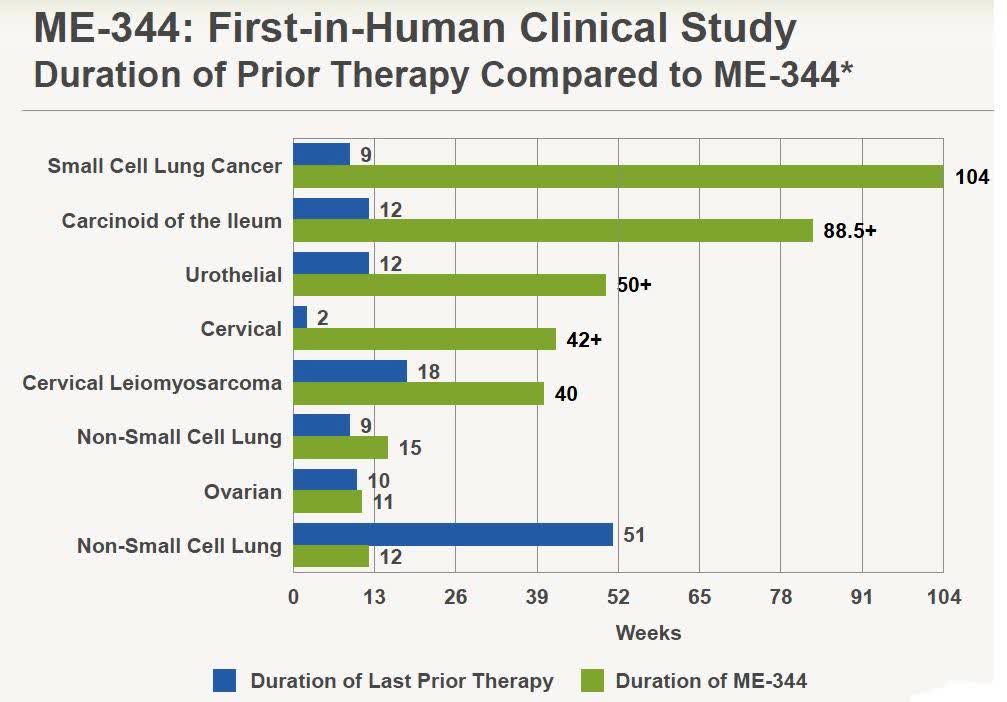

ME-344

ME-344 is a very unique compound, an isoflavone-derived mitochondrial inhibitor drug candidate with broad anti-tumor activity. The dose escalation Phase 1 clinical trial was published in the journal Cancer with impressive results on a variety of refractory/recurrent cancers. Importantly, over 70% of the patients had at least 3 prior therapies and were progressing. So this was considered a hard-to-treat cohort due to significant prior drug exposure. Upon evaluation, 38% (8/21) of patients experienced stable disease or partial response, with 7 of those patients' response being longer than their previous therapy. Several of the responses were dramatic.

Source: Bank of America Presentation 2015

In a separate Phase 1 clinical trial published at ASCO in 2019, ME-344, in combination with Avastin, showed impressive biological activity in early HER2-negative breast cancer and met the primary endpoint of showing a decrease in cellular tumor proliferation. Using a marker for proliferation, the study showed a mean relative decrease of 23% in the combination group compared to a 186% increase in the Avastin monotherapy group (P < 0.01). The study is ongoing. The compound is fully owned by MEI Pharma, and next steps have not been detailed to date.

ME-401

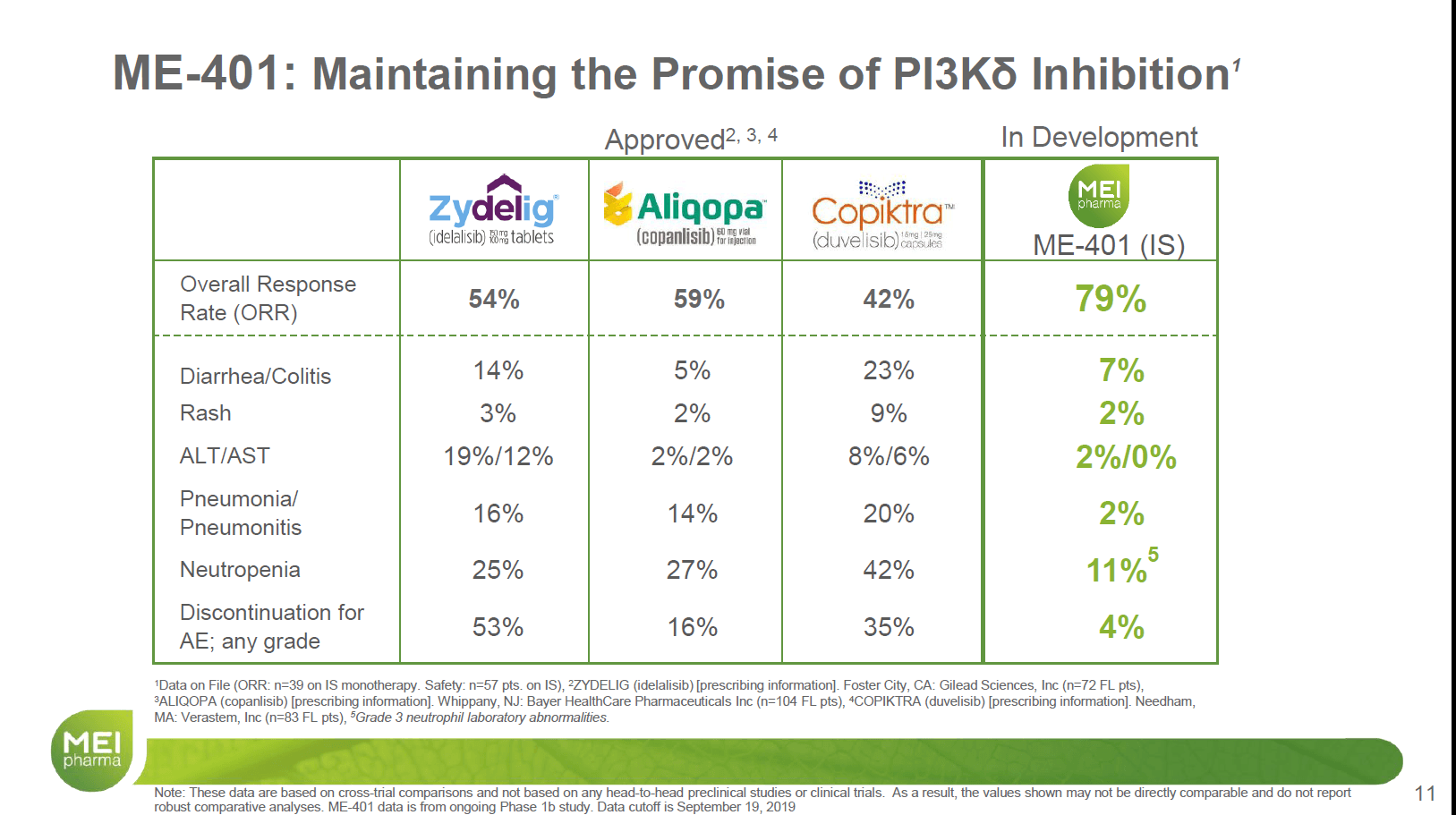

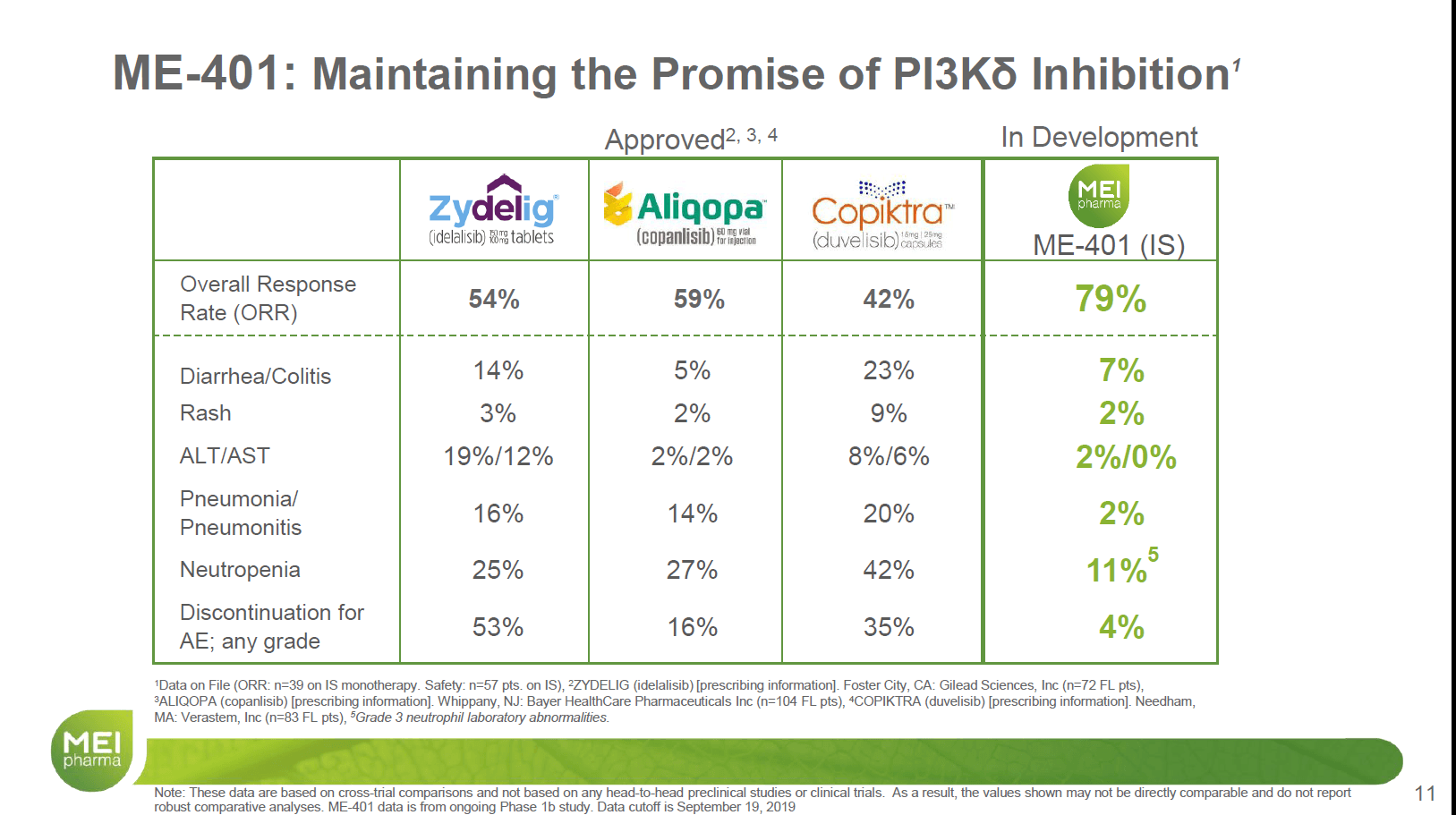

Last but certainly not least, ME-401, or PI3Kd, is the compound that has the most excitement around it, and MEI Pharma just signed the deal with Kyowa Kirin described above. Importantly, MEI Pharma and Kyowa Kirin had signed a deal in 2018 giving them exclusive rights to the drug in Japan, which resulted in a $10 million upfront payment. However, as the data has materialized over the last 2 years, Kyowa Kirin has obviously liked what they’ve seen and significantly increased its stake in the drug. With B cell malignancies being a billion-dollar-a-year market, PI3Kd is looking like the best-in-class PI3K drug compared to other FDA-approved drugs with significantly better response rates and, more importantly, less adverse side-effects which have hampered the uptake of others.

Source: April 2020 Corporate Presentation

The drug is currently being studied in a Phase 2 clinical trial for patients with relapsed or refractory follicular lymphoma, which the company was just awarded Fast Track designation for last month. In addition, several ongoing Phase 1 studies are evaluating ME-401 as a monotherapy and in combination with rituximab or zanubrutinib in B-cell malignancies.

Financials and Risks

Investors in small-cap biotech stocks know risks are high, as prices regularly swing wildly in either direction based on catalysts. With a healthy drug pipeline and a large cash position, I believe the risk at current levels is buffered. With already nearly $100 million of cash on hand, and now the addition of another immediate $100 million, MEI Pharma is well-funded. The company has no debt and a relatively low cash burn rate for a biotech at $10-15 million a quarter. With development costs now being shared for MEI-401, this should also free up some cash to get more aggressive in the progression of other drugs in the pipeline or even be opportunistic in acquiring other drug candidates.

Conclusion

MEI Pharma stands out as a hidden gem in the crowded, often overvalued small-cap biotech space. It is trading at almost cash levels with a broad clinical pipeline and a recently signed lucrative partnership with Kyowa Kirin that gives MEI Pharma a good chance of getting ME-401 to market. The stock is currently trading at a ridiculously low market cap of only ~$250 million. I might not be the only person that thinks MEI Pharma is a hidden gem on Wall Street. Following the deal, Wells Fargo slapped a $13 price target on the stock, representing 5 times its current level. Likewise, JonesTrading upped their price target to $9. As more investors become aware of the company, I don’t think it will be undervalued for long.

<<<

Seeking Alpha

Apr. 27, 2020

Stock Doctor

https://seekingalpha.com/article/4340118-mei-pharma-set-to-explode-announcement-of-lucrative-partnership

Summary

$250 million market cap is extremely low after signing a $700 million agreement with Kyowa Kirin, which gives $100 million upfront with 50-50 revenue sharing in the US and tiered royalties for ME-401.

Extensive drug pipeline for a small-cap biotech with 4 different candidates in which two are already partnered.

Analysts' price targets following partnership reflect 3-5 times upside.

It has been quite some time since my last stock recommendation. However, I have continued to be on the lookout for small-cap biotech stocks that are dramatically undervalued. With the pandemic leaving a lot of uncertainty in the markets, I have been looking not only for small-cap stocks with a lot of upside but also a substantial amount of cash on hand to fund operations and not have to dilute under poor market conditions. In the small-cap space, this is not easy to come by. However, MEI Pharma (MEIP) looks to be a hidden gem right now. I last recommended MEI Pharma almost 4 years ago when it was trading at a $50 million market cap. Although, the stock has quadrupled since then, the pipeline has gotten much better, and with the recent announcement of the mega deal with Kyowa Kirin, the small-cap company’s strategy has been validated and significantly derisked.

It is shocking to me that the stock did not move more on announcing the deal. It initially jumped up to $3.64 per share but has fallen back to ~$2.40, which is where the shares were trading in early March before the deal. To be trading at a ~$250 million market cap after such a big deal for a small-cap stock is unheard of. The deal was for just one of its drug candidates, a phosphatidylinositol 3-kinase delta (PI3Kd) also known as MEI-401, which is in clinical development for the treatment of B-cell malignancies. Usually, deals involving small-cap biotechs are very light on upfront payments, and instead, are back-end loaded on milestones so that little risk is taken by large pharma. However, this deal stands out to me because of the hefty $100 million upfront cash payment, combined with the ability to get almost $600 million more in milestone payments. In addition, MEI Pharma retains 50% of sales in the US with cost sharing and tiered royalties overseas.

In my opinion, MEI Pharma is a steal at the current valuation with now ~$200 million of cash on hand, a very strong drug pipeline and a big-time partnership. With several catalysts on the horizon in the short term, I think the stock could easily double or triple from current levels.

Best-in-Class HemOnc Clinical Pipeline

It is rare to find a biotech with a $250 million market cap having such a diverse clinical pipeline. Most small-cap biotech companies have their hopes pinned on a single drug.

Source: April 2020 Corporate Presentation

Pracinostat

One of the most advanced drugs in the pipeline is Pracinostat, an HDAC inhibitor for the treatment of MDS and AML, which was licensed to Helsinn in 2016 for $20 million upfront and ~$450 million in milestone payments, along with tiered royalty payments on sales. The excitement of Pracinostat plus Azacitidine in elderly newly diagnosed AML patients stems from the Phase 2 clinical trial results, where complete remission was observed in 42% (21 of 50 patients) and median overall survival was over 19 months. This compares favorably to Azacitidine alone with a CR of 19.5% and a median OS of 10.4 months. Helsinn is now enrolling the Phase 3 clinical trial, which, in my opinion, has a high likelihood of success, as the responses seen to date have been some of the most durable ones ever documented in this patient population. In addition, Helsinn and MEI Pharma are in the process of completing a Phase 2 dose escalation study in MDS, which has already passed an interim analysis and should report out in the middle of this year.

Voruciclib

Voruciclib is a novel, oral CDK inhibitor that is fully owned by MEI Pharma and being looked at in numerous blood cancers. It has not only shown single agent activity but has the potential of overcoming Venetoclax resistance by inhibiting MCL1. Venetoclax does ~$1 billion in revenue annually. Phase 1 clinical trial updates should be available in 2020.

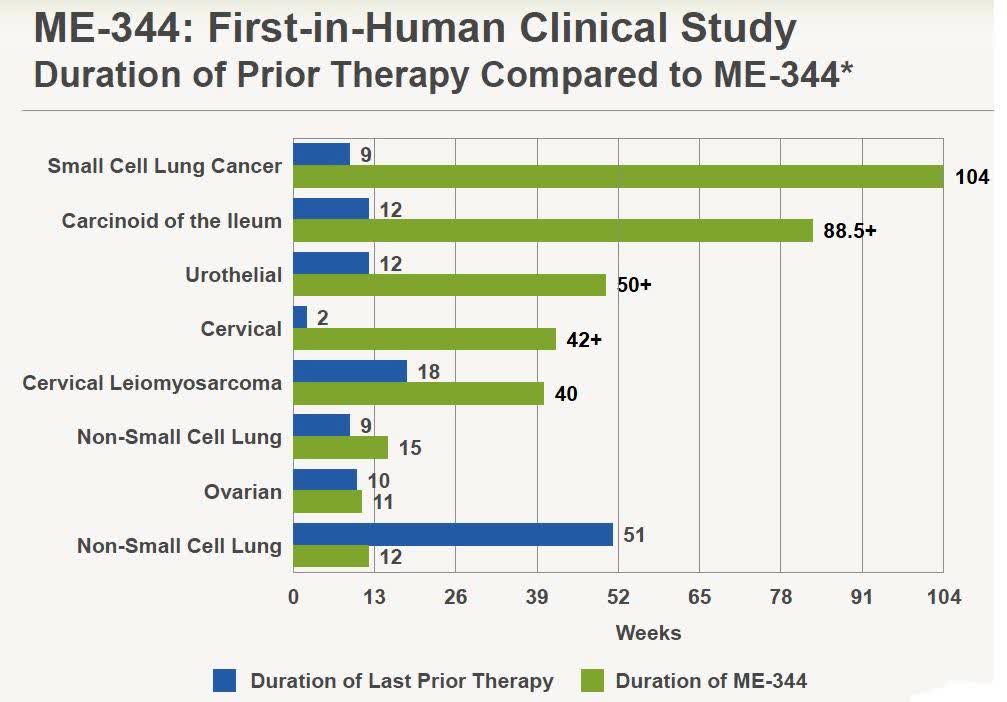

ME-344

ME-344 is a very unique compound, an isoflavone-derived mitochondrial inhibitor drug candidate with broad anti-tumor activity. The dose escalation Phase 1 clinical trial was published in the journal Cancer with impressive results on a variety of refractory/recurrent cancers. Importantly, over 70% of the patients had at least 3 prior therapies and were progressing. So this was considered a hard-to-treat cohort due to significant prior drug exposure. Upon evaluation, 38% (8/21) of patients experienced stable disease or partial response, with 7 of those patients' response being longer than their previous therapy. Several of the responses were dramatic.

Source: Bank of America Presentation 2015

In a separate Phase 1 clinical trial published at ASCO in 2019, ME-344, in combination with Avastin, showed impressive biological activity in early HER2-negative breast cancer and met the primary endpoint of showing a decrease in cellular tumor proliferation. Using a marker for proliferation, the study showed a mean relative decrease of 23% in the combination group compared to a 186% increase in the Avastin monotherapy group (P < 0.01). The study is ongoing. The compound is fully owned by MEI Pharma, and next steps have not been detailed to date.

ME-401

Last but certainly not least, ME-401, or PI3Kd, is the compound that has the most excitement around it, and MEI Pharma just signed the deal with Kyowa Kirin described above. Importantly, MEI Pharma and Kyowa Kirin had signed a deal in 2018 giving them exclusive rights to the drug in Japan, which resulted in a $10 million upfront payment. However, as the data has materialized over the last 2 years, Kyowa Kirin has obviously liked what they’ve seen and significantly increased its stake in the drug. With B cell malignancies being a billion-dollar-a-year market, PI3Kd is looking like the best-in-class PI3K drug compared to other FDA-approved drugs with significantly better response rates and, more importantly, less adverse side-effects which have hampered the uptake of others.

Source: April 2020 Corporate Presentation

The drug is currently being studied in a Phase 2 clinical trial for patients with relapsed or refractory follicular lymphoma, which the company was just awarded Fast Track designation for last month. In addition, several ongoing Phase 1 studies are evaluating ME-401 as a monotherapy and in combination with rituximab or zanubrutinib in B-cell malignancies.

Financials and Risks

Investors in small-cap biotech stocks know risks are high, as prices regularly swing wildly in either direction based on catalysts. With a healthy drug pipeline and a large cash position, I believe the risk at current levels is buffered. With already nearly $100 million of cash on hand, and now the addition of another immediate $100 million, MEI Pharma is well-funded. The company has no debt and a relatively low cash burn rate for a biotech at $10-15 million a quarter. With development costs now being shared for MEI-401, this should also free up some cash to get more aggressive in the progression of other drugs in the pipeline or even be opportunistic in acquiring other drug candidates.

Conclusion

MEI Pharma stands out as a hidden gem in the crowded, often overvalued small-cap biotech space. It is trading at almost cash levels with a broad clinical pipeline and a recently signed lucrative partnership with Kyowa Kirin that gives MEI Pharma a good chance of getting ME-401 to market. The stock is currently trading at a ridiculously low market cap of only ~$250 million. I might not be the only person that thinks MEI Pharma is a hidden gem on Wall Street. Following the deal, Wells Fargo slapped a $13 price target on the stock, representing 5 times its current level. Likewise, JonesTrading upped their price target to $9. As more investors become aware of the company, I don’t think it will be undervalued for long.

<<<

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.