Tuesday, March 31, 2020 5:15:45 PM

Stocks Suffer Worst Start To A Year Ever

Stocks Suffer Worst Start To A Year Ever... As Trump Approval Reaches Record High

by Tyler Durden ZeroHedge

Here's a chart that no one suspected would happen (most of all not the media and the democrats)... as stocks crashed by record amounts in March, President Trump's approval rating has soared to the highest of his presidency...

So how bad was Q1?

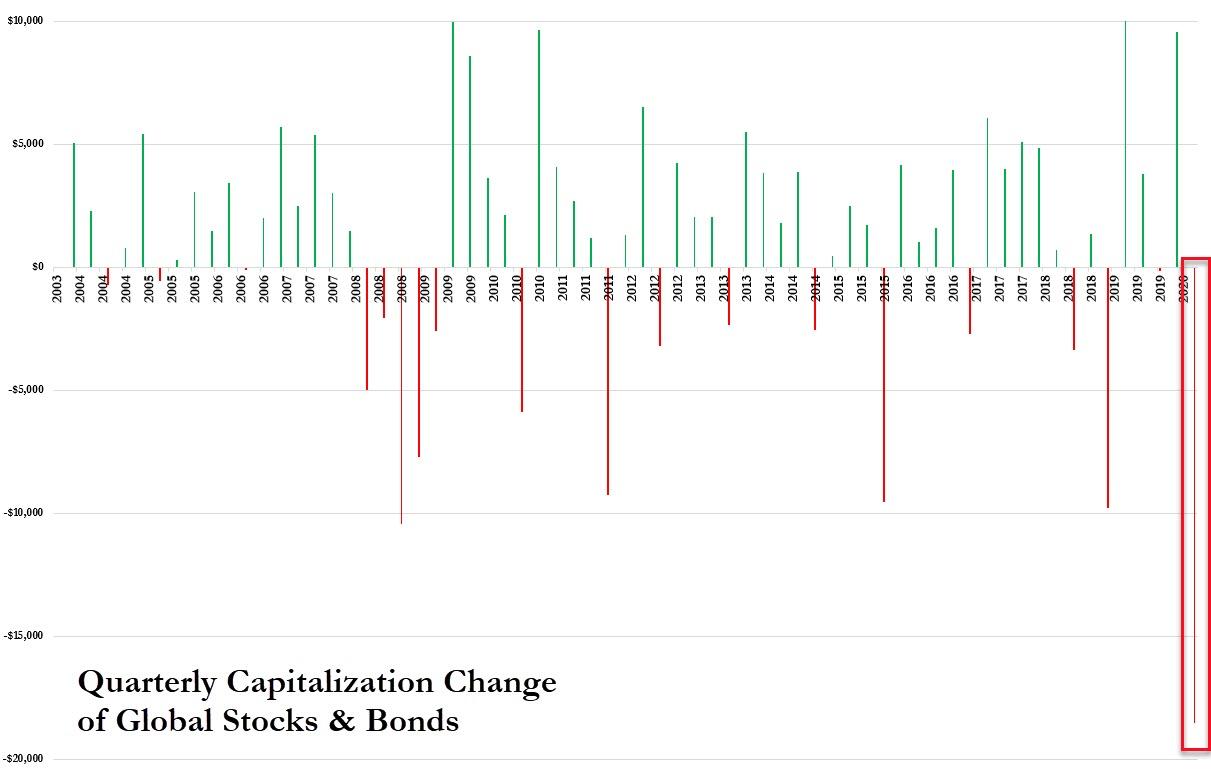

Q1 was the world's biggest quarterly capitalization loss (in bonds and stocks) ever...

With bonds adding a modest $1.1 trillion while stocks lost a record-smashing 19.6 trillion...

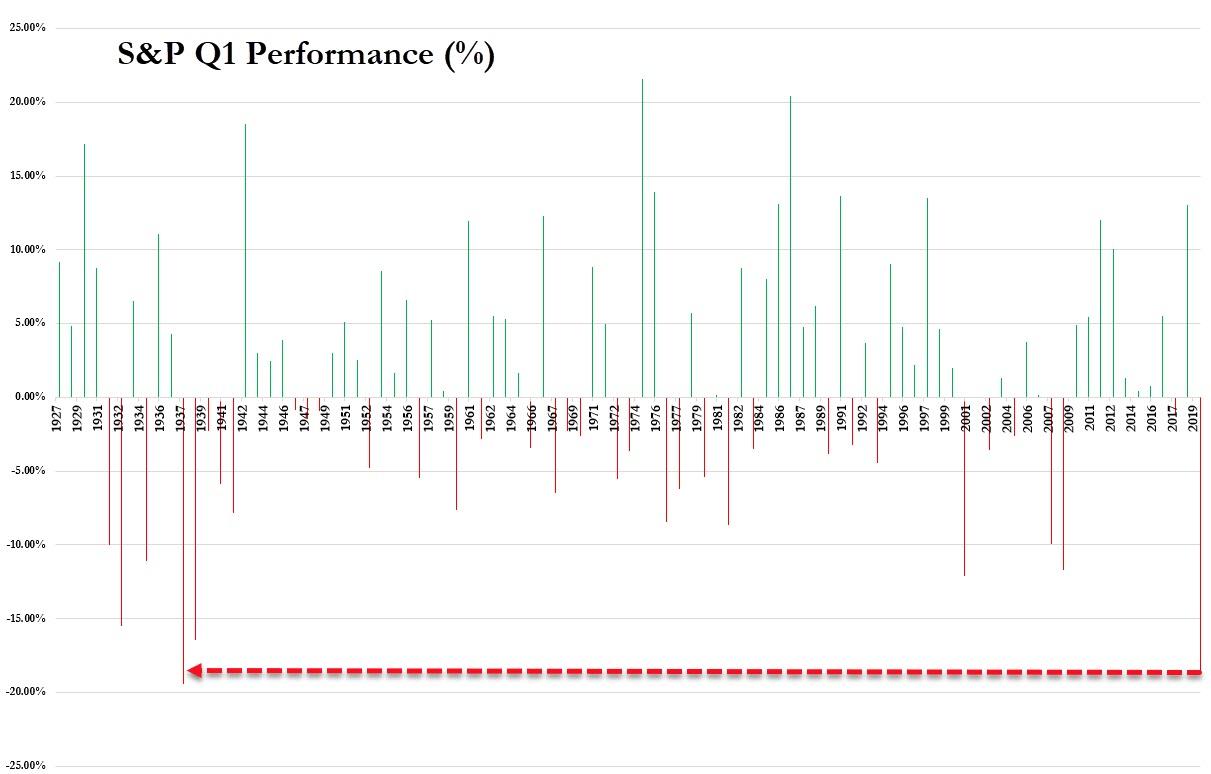

This was The S&P's worst Q1 since 1938 (and worst overall quarter since Q4 2008) and March was worst month for S&P since Oct 2008.

Additionally, stocks suffered the first back-to-back-to-back monthly losses since Oct 2016.

30Y Yields fell in all three months in Q1. This is the biggest Q1 crash in 30Y Yields since 1986 (and biggest quarterly decline in yields since Q3 2011). 2Y Yields plunged 136bps in Q1 (down 6 quarters in a row) - the biggest yield drop since Q1 2008.

cont............

There's going to be a Whole LOT of ""PIMPS"" on Wall Street Looking for a NEW Line of Work in MAY........Like selling USED CARS!!!!!!!!!!

Coronavirus sell-off will worsen again in April, taking out the March low

Jeffrey Gundlach says the coronavirus sell-off will worsen again in April, taking out the March low

By Yun Li

DoubleLine Capital CEO Jeffrey Gundlach made the remarks in an investor webcast on Tuesday.

The so-called bond king said earlier this month that there’s a 90% chance the United States will enter a recession before the year is over due to the coronavirus pandemic.

DoubleLine had $148 billion in assets under management as of the end of 2019, according to its website.

DoubleLine Capital CEO Jeffrey Gundlach believes the coronavirus sell-off is not over yet and the market will hit a more “enduring” bottom after taking out the March low.

“The low we hit in the middle of March… I would bet that low will get taken out,” Gundlach said in an investor webcast on Tuesday. “The market has really made it back to a resistance zone and the market continues to act somewhat dysfunctionally in my opinion ... Take out the low of March and then we’ll get a more enduring low.”

The S&P 500 tumbled into a bear market at the fastest pace ever as the coronavirus pandemic caused unprecedented economic uncertainty. The equity benchmark hit a three-year closing low of 2,237.40 on March 23, more than 30% from its record high reached in February.

The so-called bond king compared the current stock rout to the ones in 1929, 2000 and 2007. He said during 1929 sell-off, the market “went sideways” for almost a year and then the economy worsened again.

The Dow Jones Industrial Average and S&P 500 just posted their worst first-quarter performances ever, losing 23% and 20%, respectively. The Dow also had its worst overall quarter since 1987 while the S&P 500 had its biggest quarterly loss since 2008.

Some on Wall Street are calling for a “V” shaped recovery in the U.S. economy — a sharp drop in GDP in the second quarter and a swift snapback in the third quarter. Gundlach believes those estimates are “highly, highly optimistic,” adding GDP forecasts that don’t show negative growth for this year are “outrageously improbable.”

Gundlach said earlier this month that there’s a 90% chance the United States will enter a recession before the year is over due to the coronavirus pandemic.

DoubleLine had $148 billion in assets under management as of the end of 2019, according to its website.

Recent GORO News

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/06/2024 07:21:04 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/06/2024 07:19:30 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/06/2024 07:16:38 PM

- Gold Resource Corporation Reports Financial Results for the First Quarter 2024 • Business Wire • 05/02/2024 11:00:00 PM

- Gold Resource Corporation Will Reschedule Release of Its First Quarter 2024 Results • Business Wire • 04/30/2024 12:16:00 AM

- Gold Resource Corporation Announces Preliminary First Quarter Production Results • Business Wire • 04/16/2024 01:02:00 AM

- Gold Resource Corporation Reports Results of Operations for the Year Ended December 31, 2023 • Business Wire • 03/13/2024 08:59:00 PM

- Gold Resource Corporation Announces Preliminary Fourth Quarter and Year-End Results • Business Wire • 01/30/2024 05:15:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/10/2024 10:46:55 PM

- Gold Resource Corporation Reports High Grade Drill Results at the Don David Gold Mine • Business Wire • 12/11/2023 11:37:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 11/07/2023 02:42:24 AM

- Gold Resource Corporation Reports Third Quarter Operational Results and Announces the Initiation of a Review to Evaluate Strategic Alternatives • Business Wire • 11/07/2023 02:22:00 AM

- Gold Resource Corporation Will Reschedule Release of Its Third Quarter 2023 Results • Business Wire • 11/03/2023 01:48:00 AM

- Gold Resource Corporation Reports the Filing of a SK1300 Initial Assessment for the Back Forty Project • Business Wire • 10/26/2023 10:31:00 PM

- Gold Resource Corporation Announces Q3 2023 Conference Call • Business Wire • 10/23/2023 07:35:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 10/20/2023 10:01:30 AM

- Gold Resource Corporation Announces Preliminary Third Quarter Results • Business Wire • 10/16/2023 10:34:00 PM

- Gold Resource Corporation Reports Continued Positive Drill Results at Don David Gold Mine • Business Wire • 09/12/2023 10:16:00 PM

- Form 3 - Initial statement of beneficial ownership of securities • Edgar (US Regulatory) • 08/10/2023 03:15:54 PM

- Change in Chief Financial Officer and the Appointment of Chet Holyoak As Interim Chief Financial Officer • Business Wire • 08/02/2023 10:45:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 08/02/2023 09:00:11 PM

- Gold Resource Corporation Reports Mid-Year Operational Results • Business Wire • 07/26/2023 08:55:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 07/26/2023 08:49:33 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 07/26/2023 08:40:17 PM

- Gold Resource Corporation Announces Year-to-Date Production Results, Reaffirms 2023 Production Guidance • Business Wire • 07/13/2023 10:24:00 PM

NanoViricides Reports that the Phase I NV-387 Clinical Trial is Completed Successfully and Data Lock is Expected Soon • NNVC • May 2, 2024 10:07 AM

ILUS Files Form 10-K and Provides Shareholder Update • ILUS • May 2, 2024 8:52 AM

Avant Technologies Names New CEO Following Acquisition of Healthcare Technology and Data Integration Firm • AVAI • May 2, 2024 8:00 AM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM