| Followers | 681 |

| Posts | 141541 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Wednesday, March 25, 2020 8:22:28 PM

By: Greg Schnell | March 25, 2020

* (Click Read Full Story »»» at the bottom of the page for the charts to appear on the post)

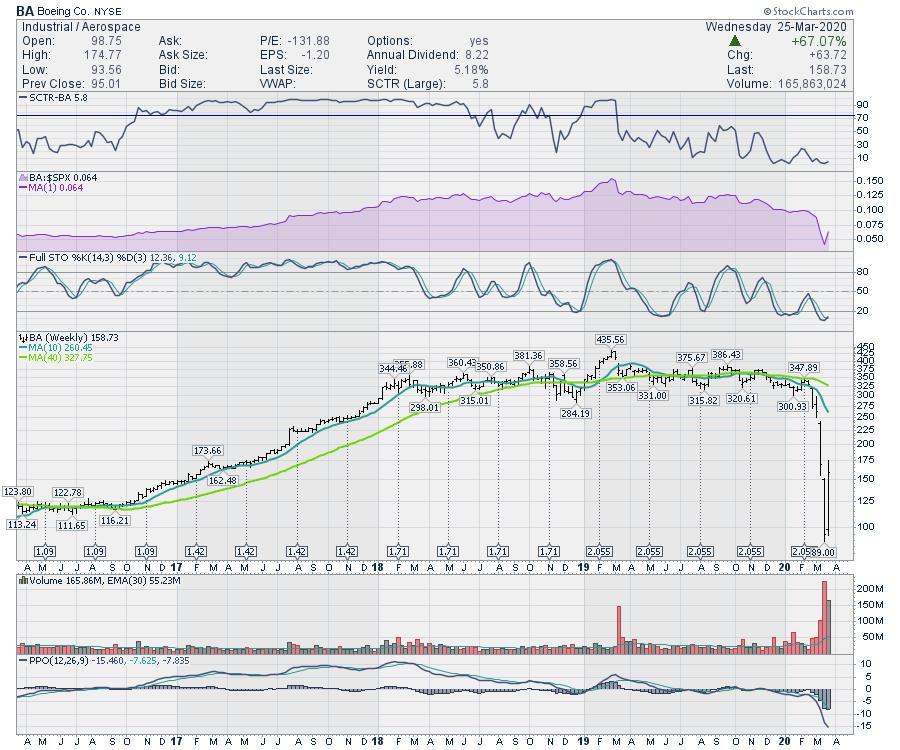

Boeing (BA) had an absolutely beautiful chart that was just a nice smooth ascending line for most of the last five years. It looked like a Dreamliner flight path. With the 737 problems, a slowdown in approval of the 737 MAX changes and a stalled customer base, Boeing is facing some issues. The final part of this flight path map no longer shows a smooth descent, as Boeing's stock flight path looks more like a basketball.

The Boeing boing was pretty significant. The basketball bounce occurred on the back of a broader market bounce, as well as a stabilization injection for Boeing from the Federal government.

Where does this go from here? The real question has to be how much more bad news needs to be built in before Boeing stabilizes. I don't believe aircraft traffic can get much weaker worldwide. The upside on the 737 MAX is some fix should be announced in 2020. The real question will be the amount of labour required to repair each existing plane. The bill for the airlines being grounded now appears to be transitioning to the Federal government, not Boeing, if they can start fixing these while they are parked anyway.

Boeing is one of the most volatile stocks in recent months. It will also be a while before they attract new investors. But it could be much like BP after the Maconda blowout, where the stock started to perform, but the ride up was not a smooth flight path.

All that to say, the easy money might have already been made in Boeing, and the best entry might be on the back of the final pandemic lows. Stay safe and 6' apart!

Good trading,

Greg Schnell, CMT, MFTA

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent BA News

- Workday Shares Drop 12%, VF Corp Divests Assets for Cash Boost, and More • IH Market News • 05/24/2024 12:42:24 PM

- OpenAI and News Corp Seal Partnership, DuPont de Nemours Announces Division, and More News • IH Market News • 05/23/2024 11:40:51 AM

- Betty Sapp Joins BAE Systems, Inc. Board of Directors • Business Wire • 05/22/2024 01:41:00 PM

- Nvidia Profits Set to Challenge Historic High Market; GE Aerospace Announces New Hires, and More News • IH Market News • 05/22/2024 10:37:09 AM

- Testing of Roman Space Telescope’s Primary Instrument Nearing Completion at BAE Systems • Business Wire • 05/21/2024 03:00:00 PM

- BAE Systems signs contract with Sweden for new CV90 combat vehicles • Business Wire • 05/21/2024 01:00:00 PM

- BAE Systems and Eaton successfully test electric drive technology on commercial demonstration truck • Business Wire • 05/20/2024 03:30:00 PM

- Li Auto Stocks Drop Post Earnings; Calhoun Re-elected to Boeing Board, and More News • IH Market News • 05/20/2024 11:03:22 AM

- U.S. Index Futures Edge Slightly Higher in Pre-Market Trading, Oil Prices Dip • IH Market News • 05/20/2024 10:59:35 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 05/17/2024 09:03:47 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 05/17/2024 09:01:44 PM

- OpenAI’s Reddit Partnership Boosts Shares by 14%, Microsoft Embraces AMD Chips for AI, and More News • IH Market News • 05/17/2024 11:36:28 AM

- Boeing ecoDemonstrator to test technologies to improve cabin recyclability, operational efficiency • PR Newswire (US) • 05/16/2024 12:00:00 PM

- BAE Systems to Develop Next-Generation Airborne Decoy Countermeasure • Business Wire • 05/15/2024 02:00:00 PM

- Nike Cuts Jobs at Converse, Ilya Sutskever Departs from OpenAI, WBD Increases Buyback Offer, and More News • IH Market News • 05/15/2024 11:49:06 AM

- Walmart Corporate Job Cuts and Office Centralization, GameStop and AMC Surge, and More News • IH Market News • 05/14/2024 11:26:02 AM

- Novavax Surges 57% Post $1.4 Billion Sanofi Deal; Apple Boosts Data Centers with AI and Internal Chips, and More News • IH Market News • 05/10/2024 12:02:56 PM

- Boeing CFO Brian West to Speak at Wolfe Research Global Transportation & Industrials Conference May 23 • PR Newswire (US) • 05/08/2024 03:00:00 PM

- Tesla’s April Sales Down 18% in China, Amazon’s Multi-Billion Dollar Cloud Expansion in Singapore, and More News • IH Market News • 05/07/2024 11:44:00 AM

- Perficient Stock Soars 52.9% Post-Acquisition; Luminar Declines 10% Amid Workforce Cutbacks, and Other News • IH Market News • 05/06/2024 12:09:00 PM

- Boeing Announces Closing of Senior Notes Offering • PR Newswire (US) • 05/01/2024 11:15:00 PM

- Millennium Space Systems Awarded $414M Space Development Agency Contract • PR Newswire (US) • 04/30/2024 05:50:00 PM

- Alphabet CEO’s Billion-Dollar Wealth, Microsoft’s $1.7B Indonesia Investment, and More News • IH Market News • 04/30/2024 11:58:40 AM

- Philips Stocks Soar 47% Following US Deal, Tesla Bolsters Presence in China, and More News • IH Market News • 04/29/2024 11:11:24 AM

- Anglo American Rejects BHP Group’s Offer, Toyota Invests $1.4 Billion in Indiana, and More News • IH Market News • 04/26/2024 11:48:07 AM

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM