| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Tuesday, March 10, 2020 10:15:29 AM

By: Tim Taschler | March 9, 2020

* (Click Read Full Story »»» at the bottom of the page for the charts to appear on the post)

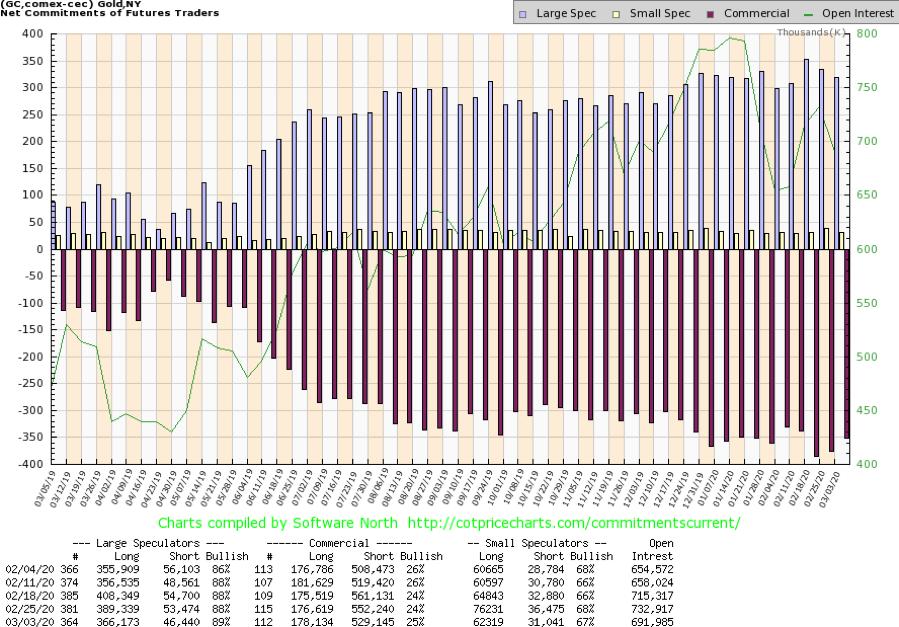

I last wrote about the Gold COT in January and thought it was time to take another look. As you can see from the chart below, not much has changed:

Source: Software North, 3/6/20

The large specs (blue bars above) are still close to their record net long position.

My preference is to watch the COT positioning that combines both futures and options. This comes from CFTC, as shown below:

Source: CFTC, 3/6/20

I take the CFTC data and drop it into a spreadsheet in order to better visualize how positions look. I also like to see how the Swap Dealers are positioned versus the Producers (the two combined are what is reported as the Commercial position):

Source: Author, 3/6/20

The CFTC defines the reporting groups as follows:

1. Producer/Merchant/Processor/User. A "producer/merchant/processor/user" is an entity that predominantly engages in the production, processing, packing or handling of a physical commodity, using the futures markets to manage or hedge risks associated with those activities.

2. Swap Dealer. A "swap dealer" is an entity that deals primarily in swaps for a commodity and uses the futures markets to manage or hedge the risk associated with those swaps transactions. The swap dealer's counterparties may be speculative traders, like hedge funds, or traditional commercial clients that are managing risk arising from their dealings in the physical commodity.

3. Money Manager. A "money manager," for the purpose of this report, is a registered commodity trading advisor (CTA); a registered commodity pool operator (CPO); or an unregistered fund identified by CFTC. These traders are engaged in managing and conducting organized futures trading on behalf of clients.

4. Other Reportables. Every other reportable trader that is not placed into one of the other three categories is placed into the "other reportables" category.

What stands out to me in this most recent report is that the Swap Dealers are 80% shorter than the Producers and hold almost 65% of the overall short position. This is visible in the purple line below, with the green line showing the Producers and the brown line the Managed Money:

Source: Eikon, 3/6/20

I also find it interesting that the "Other Reportables" position has quickly grown to a record long position (chart below). I am not sure what to make of this or the record short Swap Dealers position. It might have something to do with the ETF/ETN market (GLD, UGLD, DGLD, etc.).

Source: Eikon, 3/6/20

There was a 5.8% drop in the Managed Money long position and a 1.8% drop in the Other Reportable long position, which makes sense to me. As you can see on the chart below, which shows price action during the 5-day COT reporting period, there was a 6% drop in the gold price from high to low that coincided with a 10% drop in the SPX. The bulk of the selling in both assets came on 2/28, which could have been related to month-end position adjustments, or simply a liquidity-driven event.

Source: StockCharts.com, 3/6/20

Regardless of the "why," it makes perfect sense to me that Managed Money/Other Reportables liquidated positions on the selloff in gold (or even caused the selloff) and the Commercials covered some shorts, taking the other side of the trade. Remember, Commercials are, for the most part, price "takers" – they "take" the other side of what the Large and Small Speculators are doing. That applies to both the Producers and the Swap Dealers, as they are "hedgers" who are offsetting risk from their business activities (mining, jewelry, swaps).

I do continue to be concerned by the roughly $61.5 billion notional (contract) value of gold longs. These players tend to be highly levered (up to 30-to-1) CTAs and hedge funds that are typically trend followers. If the trend changes, or if there are more liquidity-driven trading days like 2/28, these near-record longs will most likely sell. So be careful out there, as markets are extremely headline-sensitive!

Questions and comments are always welcome: ttaschler@sprottglobal.com.

Tim Taschler, CMT

Sprott USA

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent GDX News

- YieldMax GDXY Name Change • GlobeNewswire Inc. • 01/25/2024 04:22:00 PM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM