| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Tuesday, March 03, 2020 4:35:52 PM

Clive Maund »» Silver Market Update

By: Clive Maund | March 1, 2020

Much of the reasoning set out in the parallel Gold Market update applies equally to silver, with the most important difference being that silver went into this period weaker and more subdued than gold.

Like gold, silver got whacked on Friday, a development that was presaged by PM stocks caving in the day before on Thursday. Whilst this may have been partly due to paper market chicanery, a more mundane explanation is that, faced with 5 days in a row of deepening losses causing intensifying liquidity problems and margin calls, investors simply started dumping stuff over the side indiscriminately, and that happened to include silver. What this means is that, as this general bearmarket progresses and deepens, we can expect more of the same, similar to what happened in 2008, only worse, because of more extreme debt problems and the complications arising from the virus scare.

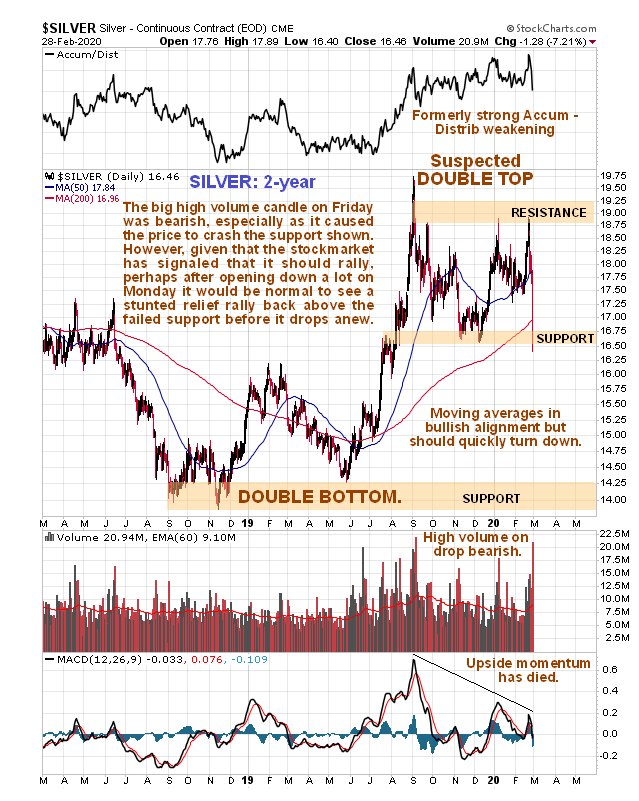

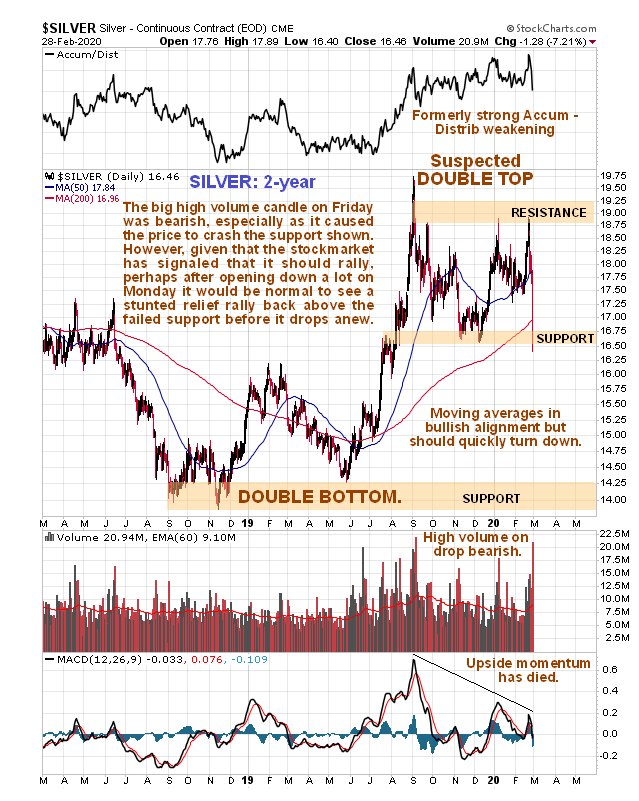

We can see the nasty steep drop on heavy volume on Friday that sliced through two support levels shown and the rising 200-day moving average on the latest 6-month chart, which was clearly very bearish action. Note that a large reversal candle appeared on the broad market index charts on Friday, which means that even though the market may open down quite heavily tomorrow, there is a good chance that it will later bounce back, and if it does silver may hop back above the lower support level, although it is unlikely to get far – what may happen is that it builds out a bear Flag or Pennant before heading lower again later.

The 2-year chart was a positive picture until just a few days ago, but what happened over the past few days has switched it to bearish. It tried to break higher but failed at the quite strong resistance shown, before plunging. Although it may inch its way back above the just failed support level in coming days, it is likely to drop back below it again and then drop, perhaps swiftly, towards the next important support level in the $14 area.

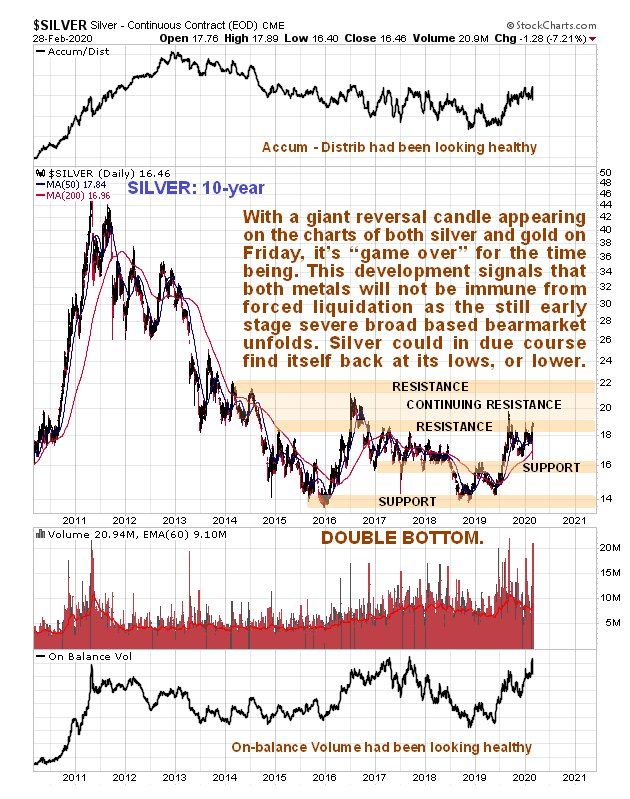

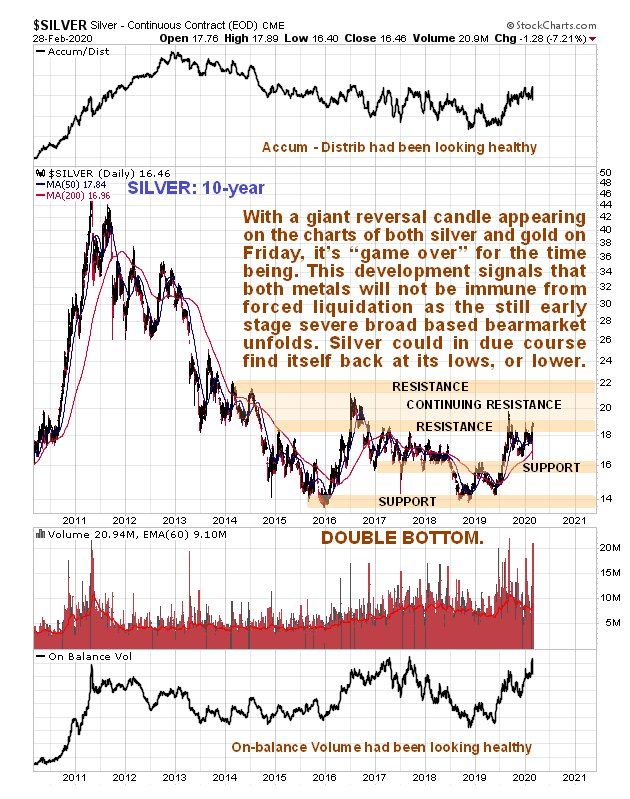

For a long time silver had looked like it was going to break out from the giant Double Bottom base pattern shown on its long-term 10-year chart, but the action of recent days mean that such a development is now “off the table”, and given the likely severity of the general bearmarket now starting, and the fact that, as demonstrated last week, it is likely to have a negative impact on the Precious Metals, at least during the crash phase, it looks likely that silver will test the support at its lows just below $14, and there is nothing to say that it won’t fail leading to silver heading lower still.

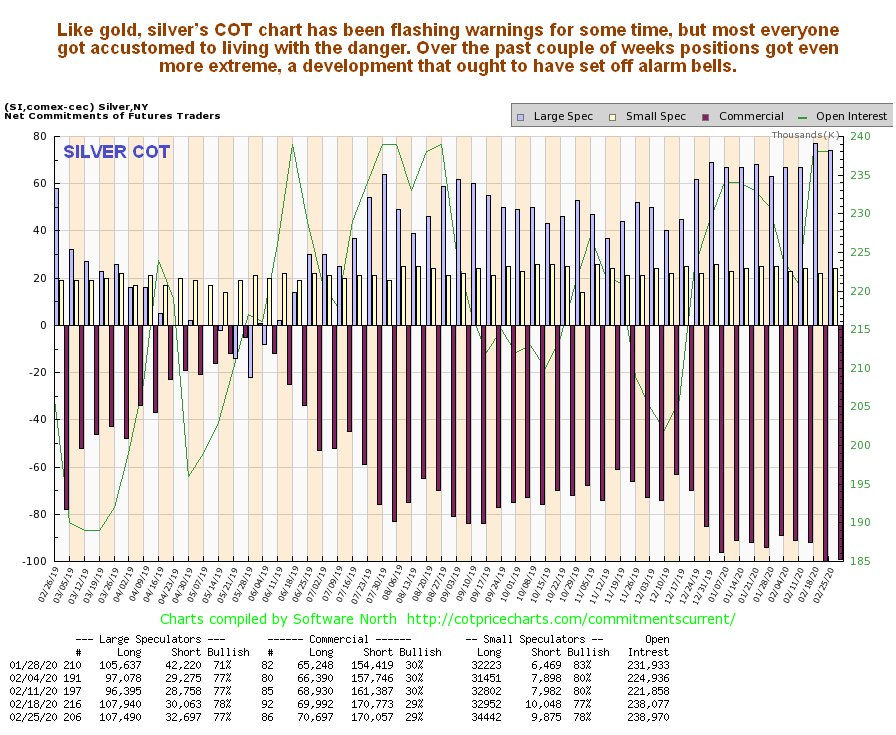

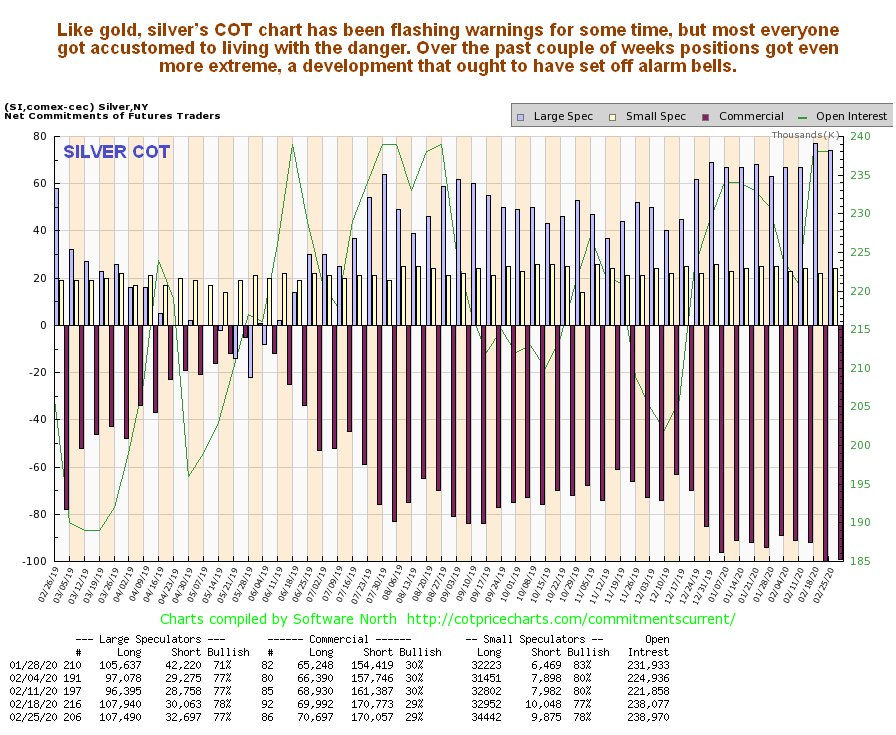

Now we come to what gave the game away that silver was riding for a fall, which is its COT structure. Commercial short and Large Spec long positions had been pushing extremes for a long time, and eventually rose to very high readings. This bred complacency, especially in anyone who bought the argument that more and more QE would lead inevitably to a ramp up of inflation – and we hadn’t sufficiently factored in the impact of the coronavirus and the market implosion it eventually led to. We will have to see what next week’s readings look like, but normally extremes of this magnitude take a lot of unwinding, which means that silver may have considerably further to fall.

Conclusion: silver looks set to get dragged lower by the general bearmarket now starting, at least during the crash phase. Short-term we may see a relief rally to alleviate the oversold condition, which may be used to lighten positions.

[url]https://www.clivemaund.com/free.php?id=67[/tag] »»»

DiscoverGold

DiscoverGold

Click on "In reply to", for Authors past commentaries

By: Clive Maund | March 1, 2020

Much of the reasoning set out in the parallel Gold Market update applies equally to silver, with the most important difference being that silver went into this period weaker and more subdued than gold.

Like gold, silver got whacked on Friday, a development that was presaged by PM stocks caving in the day before on Thursday. Whilst this may have been partly due to paper market chicanery, a more mundane explanation is that, faced with 5 days in a row of deepening losses causing intensifying liquidity problems and margin calls, investors simply started dumping stuff over the side indiscriminately, and that happened to include silver. What this means is that, as this general bearmarket progresses and deepens, we can expect more of the same, similar to what happened in 2008, only worse, because of more extreme debt problems and the complications arising from the virus scare.

We can see the nasty steep drop on heavy volume on Friday that sliced through two support levels shown and the rising 200-day moving average on the latest 6-month chart, which was clearly very bearish action. Note that a large reversal candle appeared on the broad market index charts on Friday, which means that even though the market may open down quite heavily tomorrow, there is a good chance that it will later bounce back, and if it does silver may hop back above the lower support level, although it is unlikely to get far – what may happen is that it builds out a bear Flag or Pennant before heading lower again later.

The 2-year chart was a positive picture until just a few days ago, but what happened over the past few days has switched it to bearish. It tried to break higher but failed at the quite strong resistance shown, before plunging. Although it may inch its way back above the just failed support level in coming days, it is likely to drop back below it again and then drop, perhaps swiftly, towards the next important support level in the $14 area.

For a long time silver had looked like it was going to break out from the giant Double Bottom base pattern shown on its long-term 10-year chart, but the action of recent days mean that such a development is now “off the table”, and given the likely severity of the general bearmarket now starting, and the fact that, as demonstrated last week, it is likely to have a negative impact on the Precious Metals, at least during the crash phase, it looks likely that silver will test the support at its lows just below $14, and there is nothing to say that it won’t fail leading to silver heading lower still.

Now we come to what gave the game away that silver was riding for a fall, which is its COT structure. Commercial short and Large Spec long positions had been pushing extremes for a long time, and eventually rose to very high readings. This bred complacency, especially in anyone who bought the argument that more and more QE would lead inevitably to a ramp up of inflation – and we hadn’t sufficiently factored in the impact of the coronavirus and the market implosion it eventually led to. We will have to see what next week’s readings look like, but normally extremes of this magnitude take a lot of unwinding, which means that silver may have considerably further to fall.

Conclusion: silver looks set to get dragged lower by the general bearmarket now starting, at least during the crash phase. Short-term we may see a relief rally to alleviate the oversold condition, which may be used to lighten positions.

[url]https://www.clivemaund.com/free.php?id=67[/tag] »»»

DiscoverGold

DiscoverGold Click on "In reply to", for Authors past commentaries

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.