Tuesday, February 11, 2020 9:49:07 PM

>>> Axsome Therapeutics: There Still Remains A Lot Of Upside Potential For 2020

Seeking Alpha

Feb. 11, 2020

https://seekingalpha.com/article/4323151-axsome-therapeutics-still-remains-lot-of-upside-potential-for-2020?utm_medium=email&utm_source=seeking_alpha&mail_subject=axsm-axsome-therapeutics-there-still-remains-a-lot-of-upside-potential-for-2020&utm_campaign=rta-stock-article&utm_content=link-2

Summary

Axsome Therapeutics is set to grab a big share in the major depressive disorder indication.

The company’s late-stage migraine drug, AXS-07, has demonstrated robust efficacy in acute migraine indication.

Investors should consider these risks.

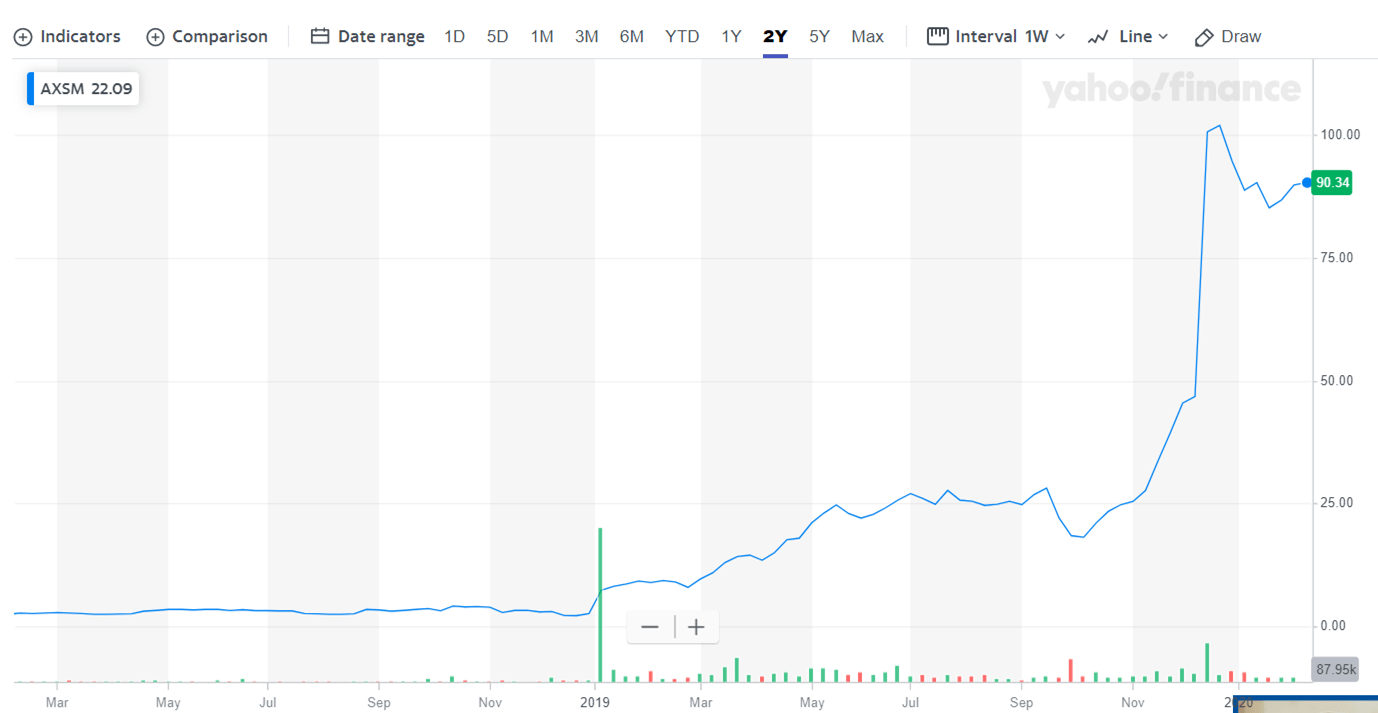

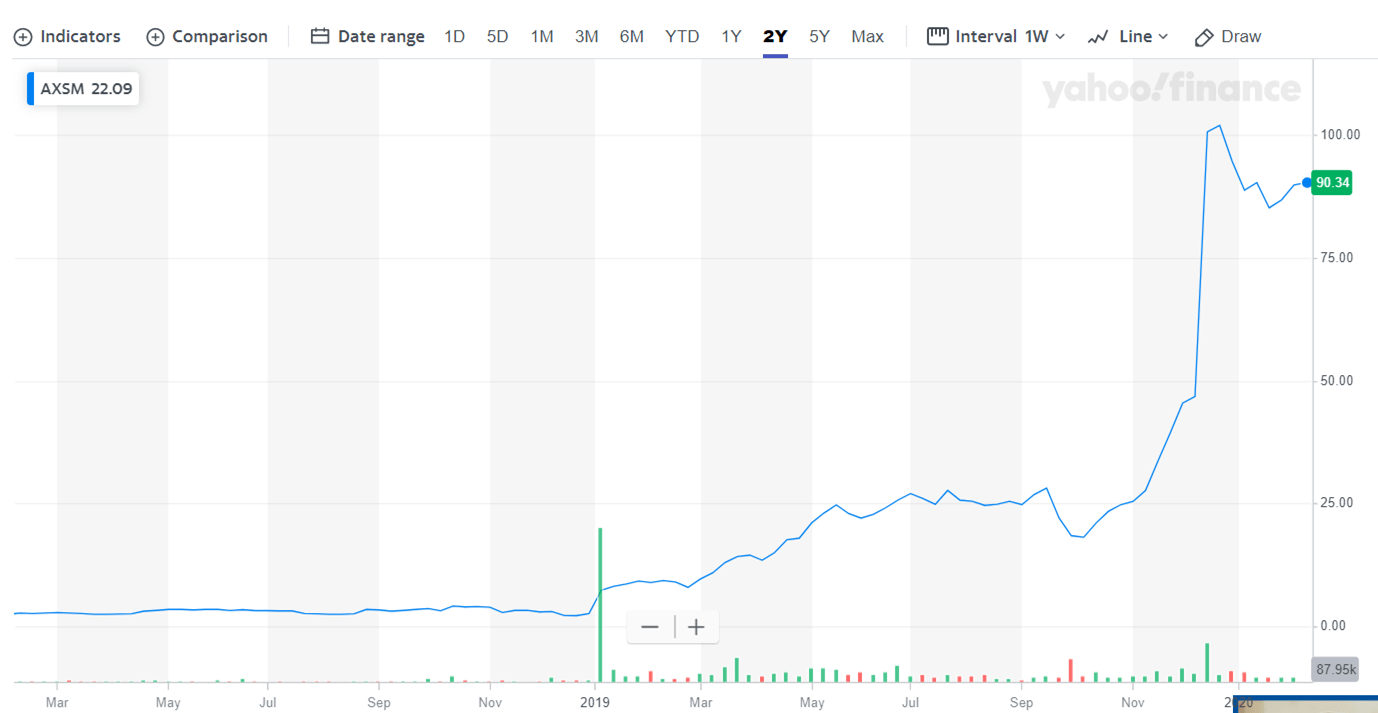

Axsome Therapeutics (AXSM) rose by almost 3600% in 2019. Despite this mind-boggling rally, there is still significant upside potential in the stock for 2020. Today, we will see why Axsome Therapeutics is a top-notch investment opportunity for 2020.

Company overview

Axsome Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on neurological and psychiatric disorders. The company’s late-stage pipeline has four clinical-stage candidates, AXS-05, AXS-07, AXS-12, and AXS-09. They are being studied in different indications such as treatment-resistant depression, major depressive disorder, agitation in Alzheimer's disease, smoking cessation, migraine, narcolepsy, and other CNS (central nervous system) disorders.

Axsome Therapeutics' market capitalization has jumped from around $85 million in early 2019 to $3.33 billion in February 2020. The company has released exceptional results for its investigational products in 2019.

AXS-12 is racing ahead to become a treatment option in narcolepsy indication

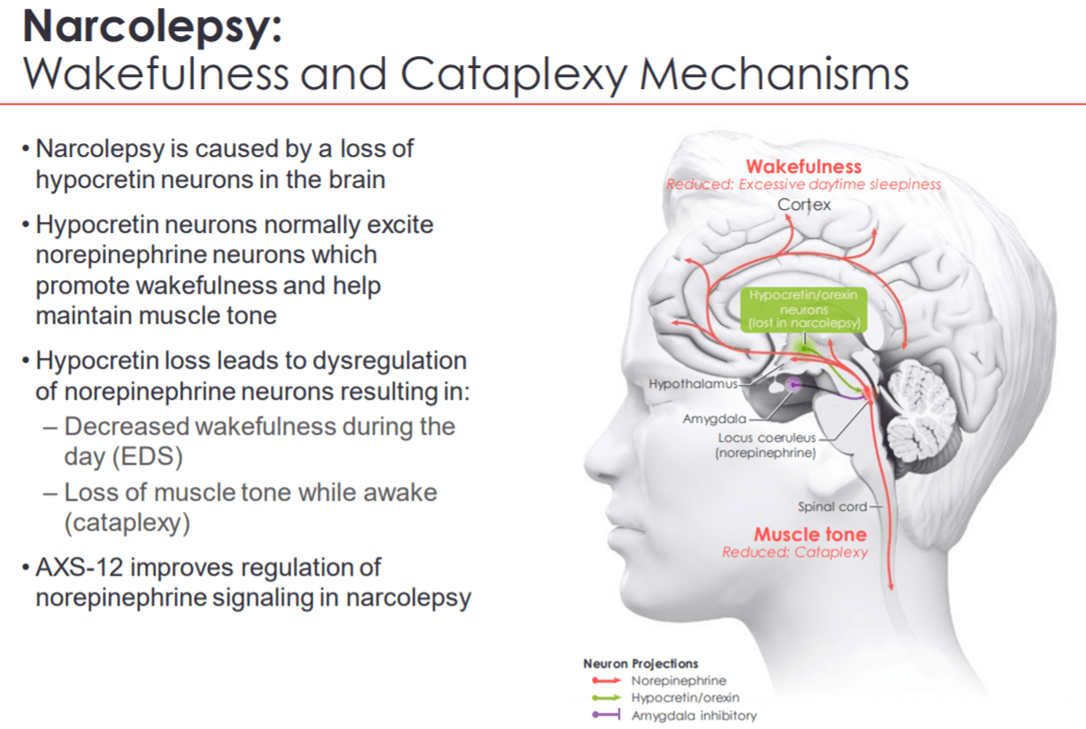

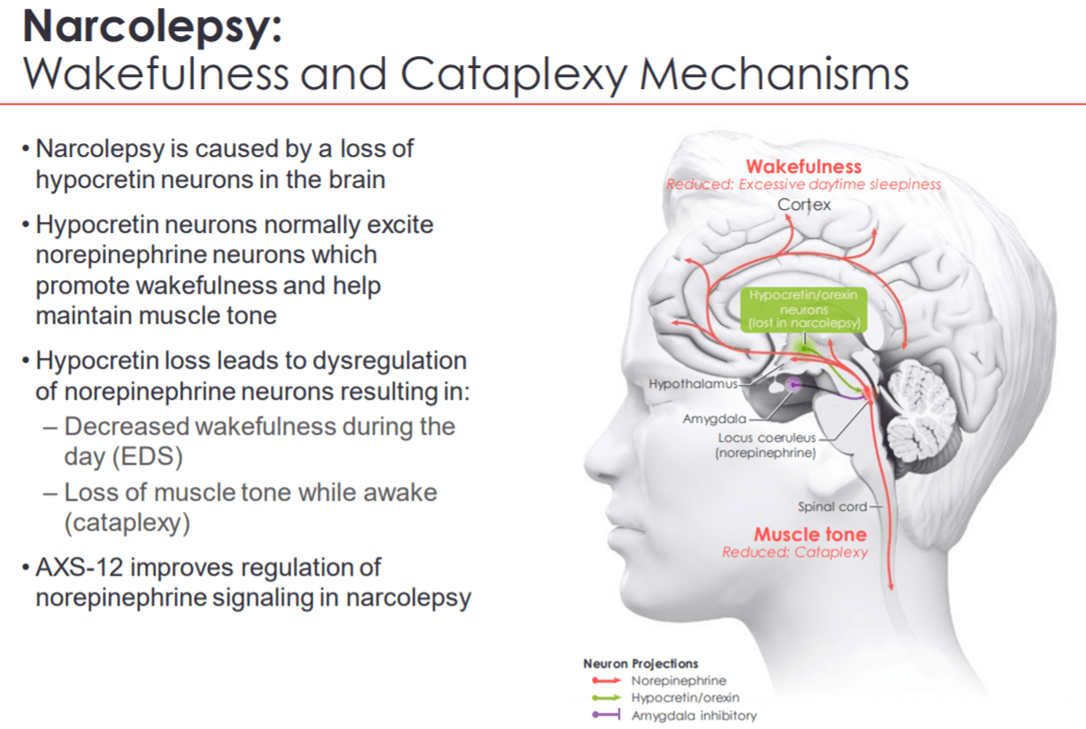

According to SleepFoundation.org, “Narcolepsy is a sleep disorder characterized by excessive sleepiness, sleep paralysis, hallucinations, and in some cases episodes of cataplexy (partial or total loss of muscle control, often triggered by a strong emotion such as laughter). Narcolepsy occurs equally in men and women and is thought to affect roughly 1 in 2,000 people.

Narcolepsy affects around 185,000 patients in the U.S., with around 50% diagnosed and only 25% treated for the condition. There are very limited off-label treatment options available for this condition and most of them are scheduled substances. Branded versions of Methylphenidate such as Ritalin, Methylin, Concerta, Quillivant, and Daytrana are being currently used for treating narcolepsy patients.

The highly selective norepinephrine reuptake inhibitor, AXS-12 (reboxetine), has been designed to improve the regulation of norepinephrine signaling. This oral therapy also has a robust safety and tolerability profile. Hence, it will most likely not be a scheduled substance. The drug has been granted U.S. FDA Orphan Drug designation for the treatment of narcolepsy.

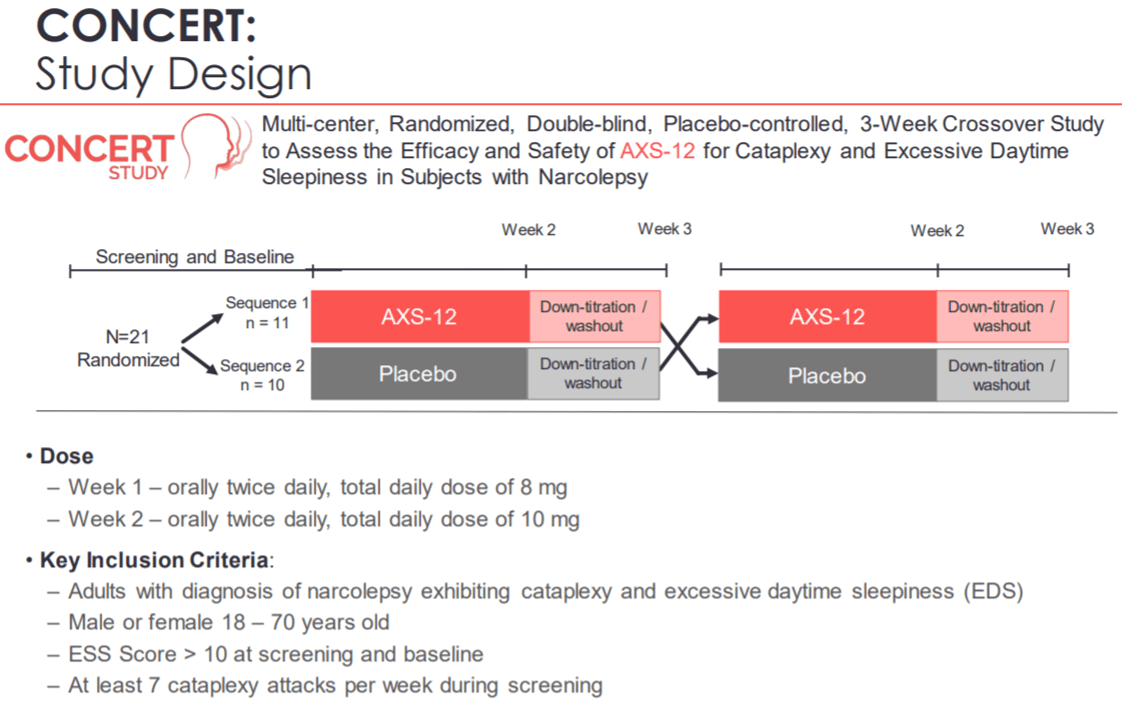

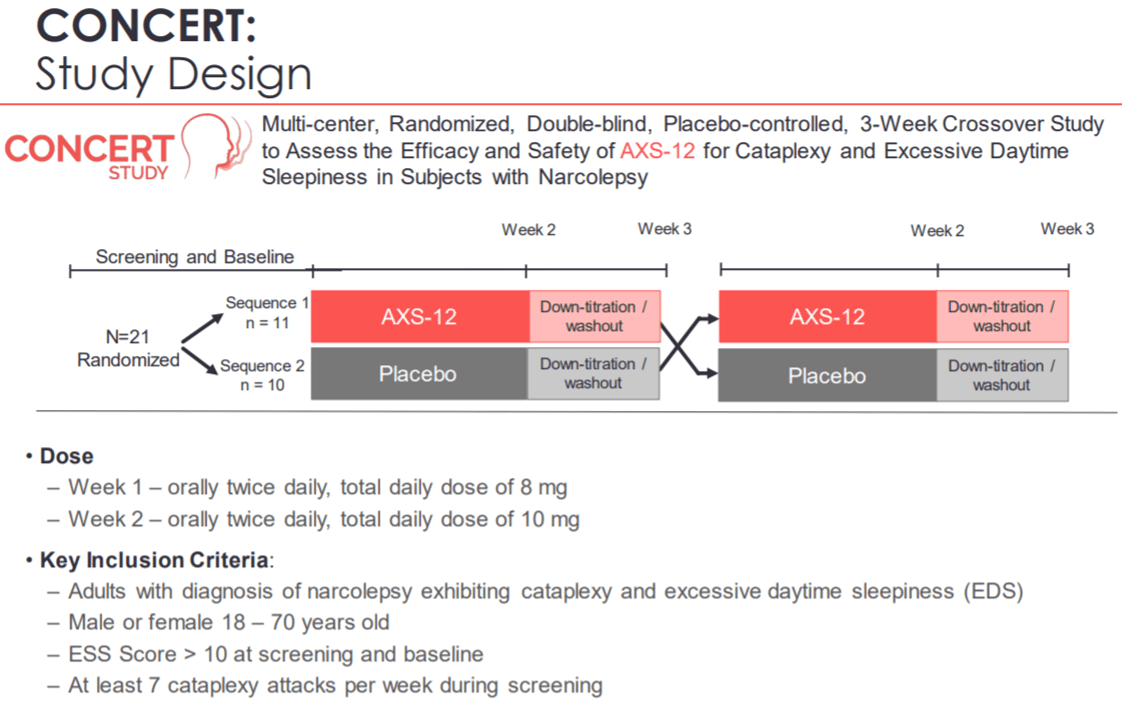

On December 3, Axsome Therapeutics reported positive top line results from the Phase 2 CONCERT trial. AXS-012 demonstrated a statistically significant reduction in cataplexy attacks and reduced excessive daytime sleepiness compared to placebo. Patients treated with AXS-12 reported 14.6 fewer cataplexy attacks as compared to a reduction of 2.6 cataplexy attacks per week for the placebo group.

The drug also improved cognitive function, sleep quality, and sleep-related symptoms compared to placebo. The company now plans to commence a Phase 3 trial in 2020. On January 13, the company entered into an agreement with Pfizer (PFE) for an exclusive U.S. license to Pfizer’s clinical and nonclinical data, and intellectual property for reboxetine, the active pharmaceutical ingredient in AXS-12. This deal can help speed up the development of AXS-012 in narcolepsy indication, thereby getting the product earlier into the market.

AXS-05 can be a potential standard-of-care in MDD indication

Currently, there are 17 million adults in the U.S. who experience major depressive episodes every year. Approximately, 63% fail to achieve remission to initial therapy, and of that 69% fail second-line therapy. Most of the currently approved oral MDD therapies work through monoaminergic mechanisms. The existing antidepressants, however, take an average of 6-8 weeks to take effect. A wide variety of these antidepressants are also associated with sexual dysfunction.

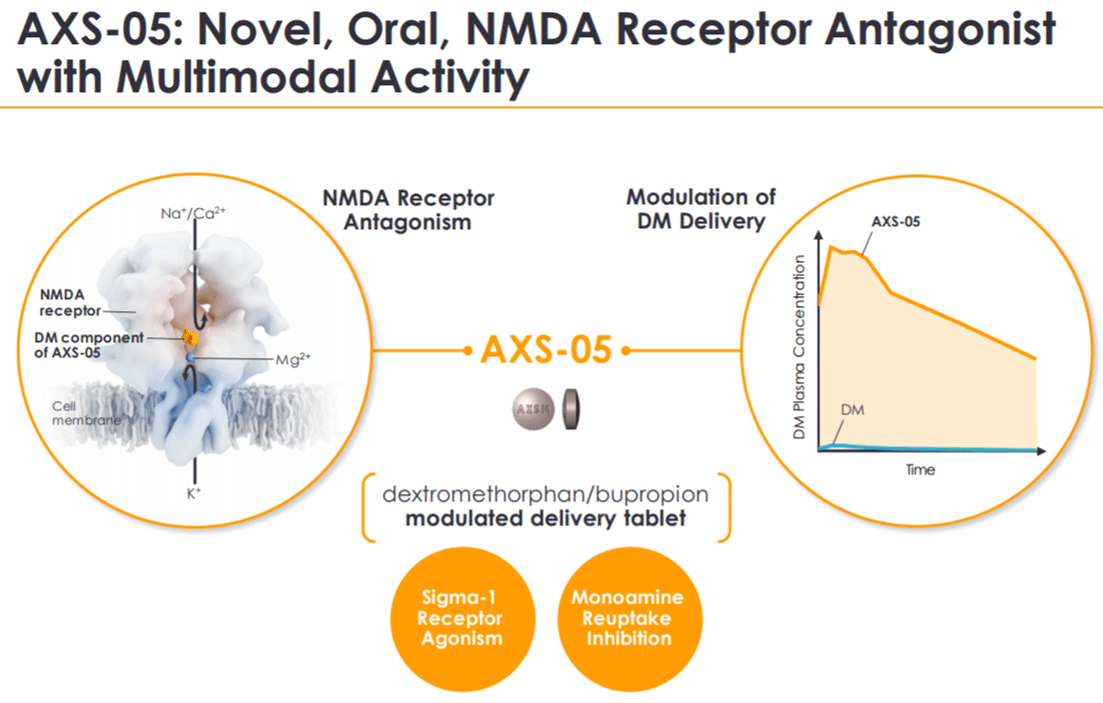

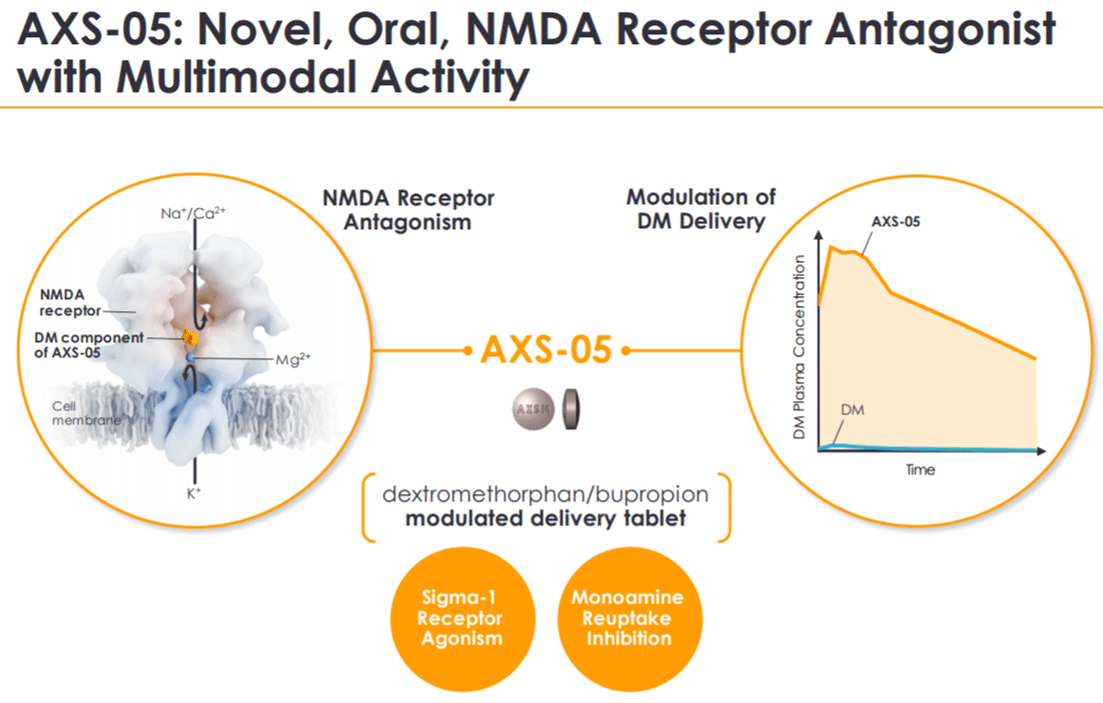

AXS-05 is a combination of serotonin inhibitor dextromethorphan and a nicotine antagonist bupropion. Dextromethorphan has been used as an antidepressant for many years now. Bupropion is the active ingredient present in the majority of OTC (over-the-counter) cough medicines.

On its own, Dextromethorphan is rapidly metabolized in humans, thus preventing the drug from reaching potential therapeutic concentrations in the blood. This makes the drug less effective in treating depression. The combination of Dextromethorphan and Bupropion seems to be working. The latter helps to inhibit dextromethorphan metabolism, thereby allowing an increase in blood concentration of dextromethorphan.

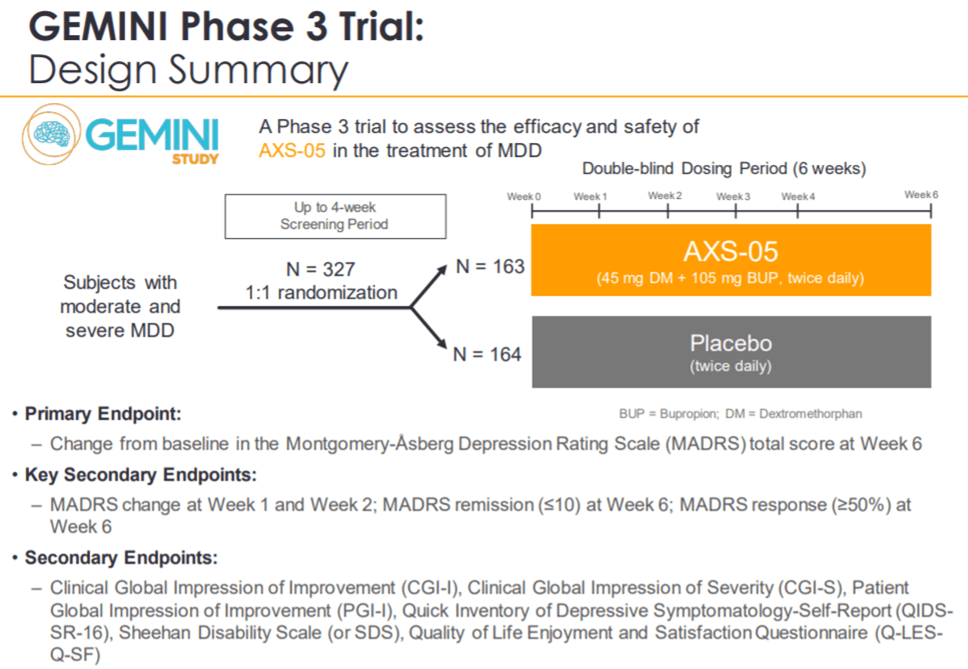

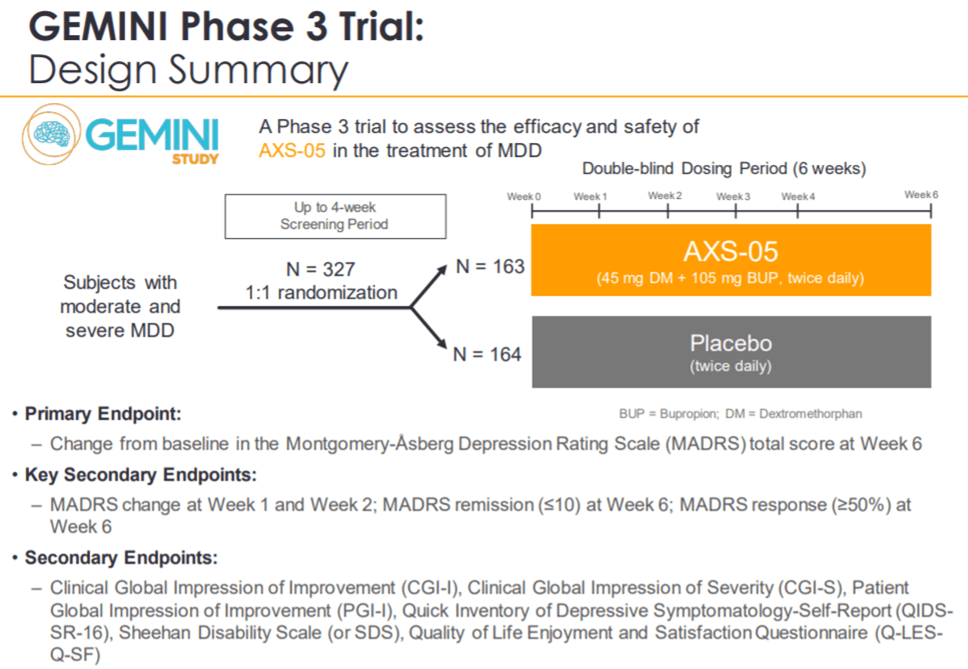

On December 16, Axsome Therapeutics reported positive results from the Phase 3 GEMINI trial, evaluating AXS-05 in MDD indication. The drug demonstrated a statistically significant reduction in the MADRS (Montgomery-Asberg Depression Rating Scale), a scoring system used to evaluate the severity of symptoms in patients. AXS-05-treated patients reported a 16.6 average point reduction in their MADRS scores, as compared to 11.9 average score reduction in the placebo arm. The statistically significant improvement in the MADRS score was reached just after 1-week of therapy. Besides, AXS-05 also demonstrated statistically significant improvement in all secondary endpoints such as remission, disease severity, functional impairment, and quality of life as compared to placebo.

ASX-05 also reported robust safety and tolerability profile with the most common adverse reactions being nausea, headaches, and dizziness. These results were also consistent with those reported from the previous Phase 2 ASCEND study. This is commendable since historically MDD trials have been affected by the high placebo effect. Based on these results, Axsome Therapeutics plans to file an NDA for AXS-05 in MDD indication in the second half of 2020. The drug stands a chance to become a standard of care in this indication due to its high efficacy and safety as well as the faster onset of action.

AXS-05 has succeeded where many have failed

The phenomenal clinical success of AXS-05 was definitely not priced at the company’s stock price prior to December 2019. Then again, it came on the heels of disappointing results from the highly-awaited Sage Therapeutics’ (SAGE) pivotal Phase 3 MOUNTAIN Study, evaluating the effect of SAGE-217 on depressive symptoms in adults with major depressive disorder. In February 2019, the FDA rejected Alkermes’ (ALKS) NDA for ALKS 5461 in major depressive disorder, citing the need for additional clinical data to proceed with the application. In March 2019, Allergan’s (AGN) Rapastinel failed to meet the primary endpoint in pivotal Phase 3 trials in MDD indication.

Subsequent to the GEMINI readout, analysts have revised upwards the probability of regulatory success for the drug. William Blair analyst, Myles Minter, has an estimated 90% probability of success for AXS-05 and peak U.S. sales of $900 million in MDD indication. He also expects AXS-05 to enter the U.S. market in early 2022.

Cantor Fitzgerald analyst Charles Duncan is also impressed with placebo-adjusted effects, speed of onset, the durable and deepening effect over time, and responder rates from the GEMINI trial. He expects the drug to be approved and launched in the U.S. in late 2021. H.C. Wainwright analyst Raghuram Selvaraju also increased the probability of regulatory success for AXS-05 in MDD indication from 50% to 80%.

There are multiple catalysts for AXS-05 in 2020

On January 22, Axsome Therapeutics announced the completion of patient randomization in the Phase 3 STRIDE-1 trial, evaluating AXS-05 in TRD (treatment-resistant depression) indication. The company expects top line data from this trial in the first quarter of 2020. Previously scheduled for the fourth quarter of 2019, the data readout was delayed so as to include TRD patients into the safety database. This was to make the supporting package for AXS-05’s NDA in MDD indication more robust, without extending the timeline of the NDA. In case data from STRIDE trial comes out positive, it would be included in AXS-05’s product label in MDD indication.

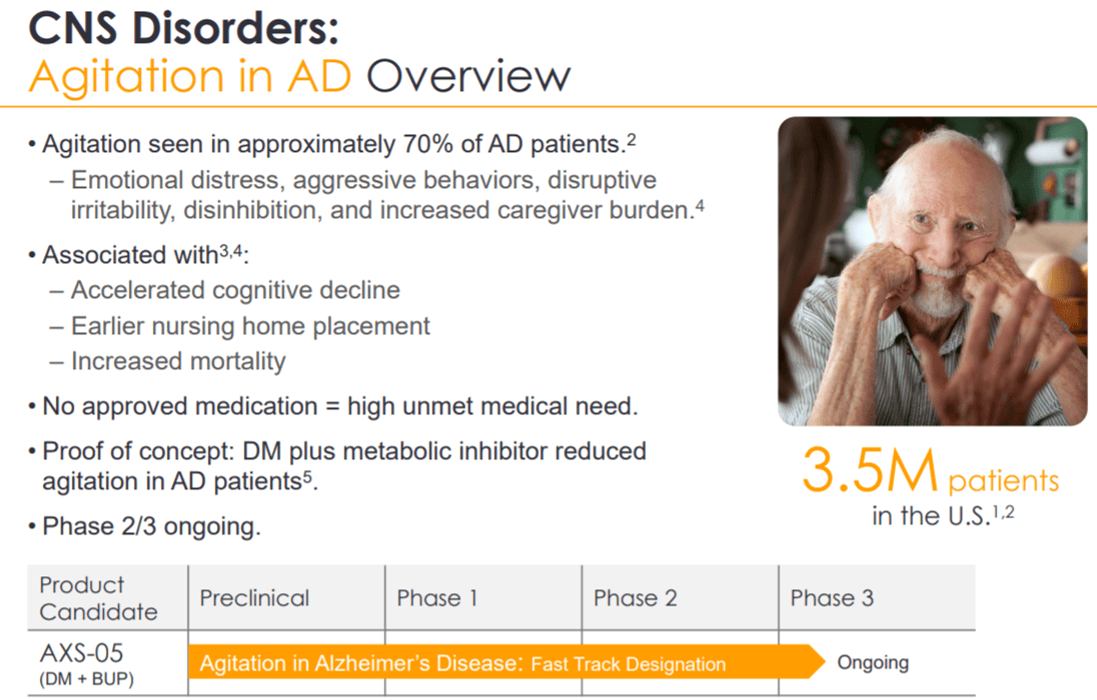

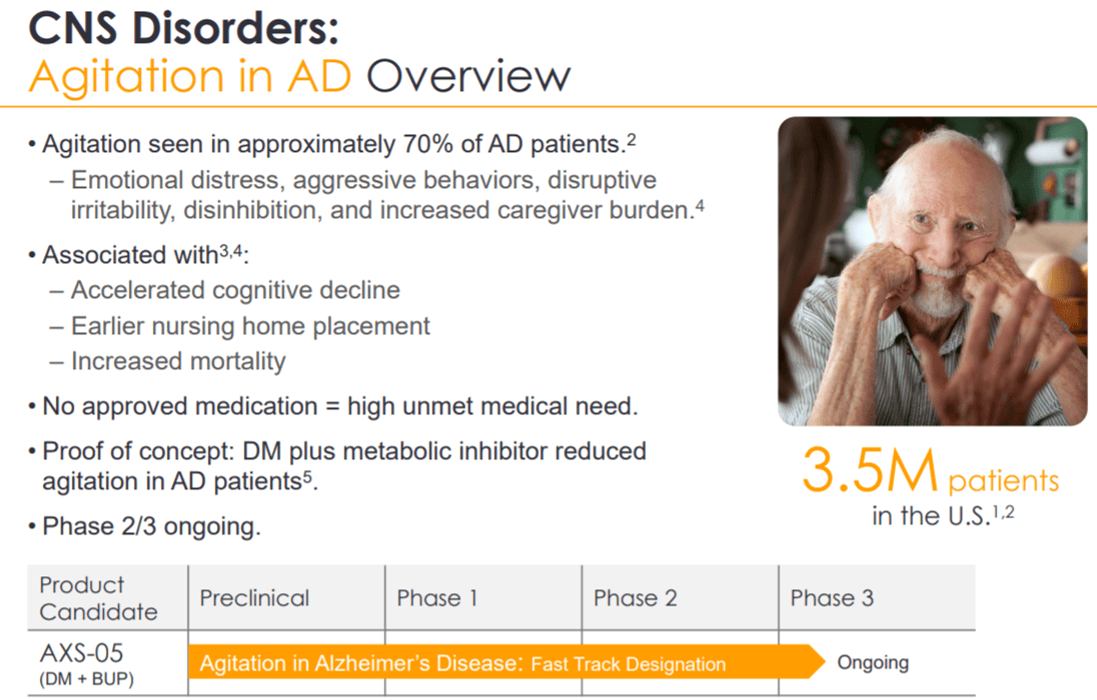

Axsome Therapeutics is also studying AXS-05 in an ongoing Phase 2/3 trial, ADVANCE-1, for treating agitation in AD (Alzheimers’ disease) patients. The company expects top line results from this trial in the first half of 2020.

Subsequent to the positive Phase 2 results released in April 2019, the company plans to have a meeting with the FDA for transitioning to Phase 3 of the program.

AXS-07 is also a key growth driver for Axsome Therapeutics’ stock price

Currently, there are 37 million migraine patients in the U.S. characterized by recurrent attacks of pulsating, often severe and disabling head pain associated with nausea, and sensitivity to light and or sound, migraine is associated with $78 billion in direct and indirect costs annually in the U.S. According to published surveys, 70% of migraine patients are not fully satisfied with existing treatment options. Further, 80% of patients are keen on trying newer therapies.

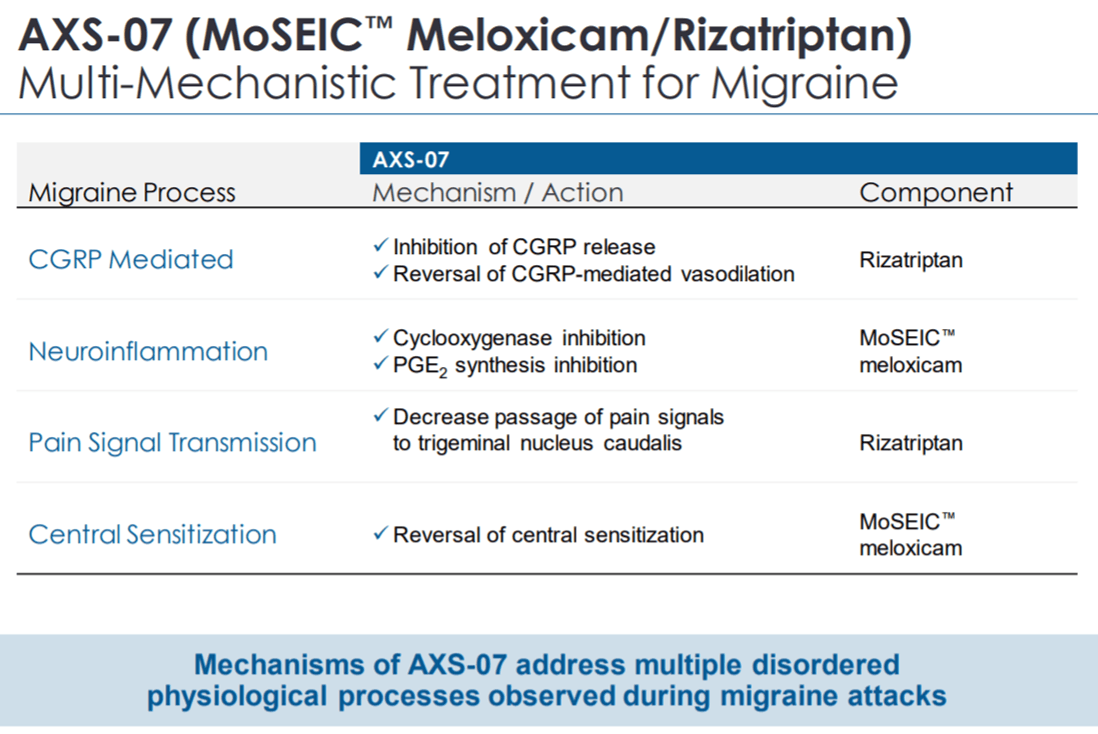

Rizatriptan is one of the most effective migraine treatments available in the market. AXS-07 combines Rizatriptan with MoSEIC meloxicam to provide enhanced efficacy through the synergistic action of these two agents. While Meloxicam is a potent NSAID (Nonsteroidal anti-inflammatory drug) with a long duration of action, it takes time to reach the maximum plasma concentration. The company’s proprietary MoSEIC technology helps meloxicam to rapidly reach the peak plasma levels, without compromising duration of action. Rizatriptan works on different migraine-inducing CNS receptor systems.

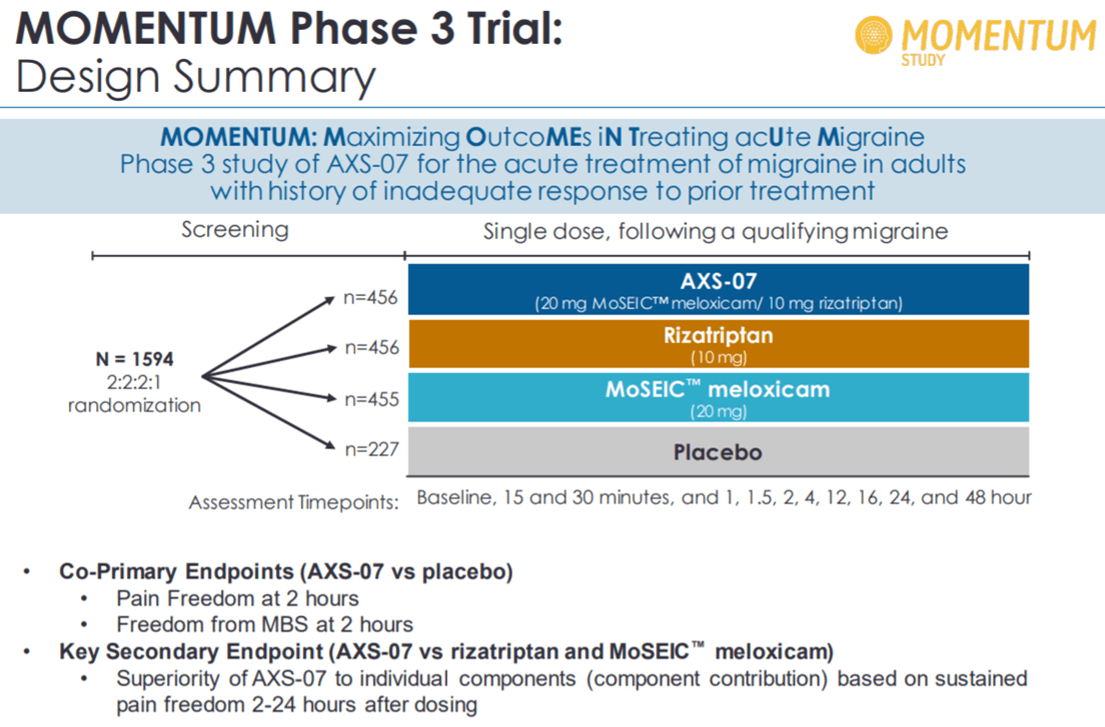

On December 30, Axsome Therapeutics reported positive top line results from Phase 3 trial, MOMENTUM, evaluating AXS-07 for acute treatment of migraine. The trial involved difficult-to-treat migraine patients who had responded inadequately to previous treatments. Here, the drug demonstrated statistically significant improvement in regulatory co-primary endpoints of pain freedom and freedom from most bothersome symptoms at 2 hours as compared to placebo. The drug also demonstrated superiority to rizatriptan active comparator on key secondary endpoint of sustained pain freedom 2-24 hours after dosing. AXS-07 was seen to provide greater and sustained pain relief as compared to rizatriptan. The rapid relief in migraine pain also resulted in significantly reduced use of rescue medication compared to rizatriptan.

In October 2019, Axsome Therapeutics initiated the Phase 3 trial, INTERCEPT, evaluating AXS-07 at the early sign of migraine pain. Top line results from this trial are anticipated in the first quarter of 2020.

Axsome Therapeutic now plans to file an NDA for AXS-07 in acute migraine indication in the second half of 2020.

Investors should consider these risks

Axsome Therapeutics is a clinical-stage company. Although the company’s pipeline is significantly derisked, the R&D failure risk remains. Besides, even if drugs secure regulatory approval, there is no guarantee of commercial success. Hence, there is significant market uncertainty for the products and subsequent volatility inherent in these stocks. Finally, Axsome Therapeutics is a loss-making organization. It may take many more years for the company to actually post profits.

Generic and branded competition can be a key risk for Axsome Therapeutics. Although AXS-012 (Reboxetine) has not being used in the U.S., it has been used for many years in international markets as a depression drug under the brand name Erdonax. While FDA approval may provide the drug with some marketing exclusivity, the possibility of early generic competition remains high.

If approved, AXS-05 may have to compete for the MDD market share with Johnson & Johnson’s (JNJ) Spravato. In March 2019, the FDA approved Spravato (esketamine CIII nasal spray) in conjunction with an oral antidepressant, for the treatment of adults with treatment-resistant depression. In October 2019, the company submitted an NDA for Spravato seeking FDA approval for Spravato in the rapid reduction of depressive symptoms in MDD adult patients who have active suicidal ideation with intent.

There is some possibility of Sage Therapeutics’ Zulresso, approved in post-partum depression, competing with AXS-05. However, it is not a major concern, considering that post-partum depression is a niche segment while AXS-05 may secure approval for a much wider indication.

What price is right for the stock?

According to Finviz, the 12-month consensus target price of Axsome Therapeutics is $144.57. On January 14, Ladenburg Thalmann analyst Matthew Kaplan reiterated Buy rating for the stock and raised his price target from $139 to $165. On December 31, SunTrust analyst Joon Lee reiterated the “Buy” rating and increased the target price from $100 to $140. On December 30, BTIG analyst Robert Hazlett reiterated the “Buy” rating and increased the target price from $97 to $114. On December 30, H.C. Wainwright analyst Raghuram Selvaraju also reiterated the “Buy” rating and increased the target price from $170 to $200. I believe the target price of $140 is easily achievable and is a conservative estimate of the true potential of this stock in 2020.

At the end of September 2019, Axsome Therapeutics had cash worth $43.6 million on its balance sheet. On December 23, the company announced the closing of $200 million public offerings of common stock. This also included full-exercise of the over-allotted shares. H.C. Wainwright analyst Raghuram Selvaraju claims that this cash is sufficient to fund the company’s operations at least till end of 2022. The full exercise of overallocated shares also highlights the ease with which Axsome can currently access public capital. The cash burn estimate seems reasonable considering the company spent $38.6 million from September 2018 to September 2019.

There is no doubt that the stock is not cheap at this point. However, there is still a significant upside potential left in this stock, considering the large indications that the company is targeting and the phenomenal success the pipeline products have witnessed in 2019. In this backdrop, I will recommend aggressive retail investors with at least a one-year investment horizon to consider this stock in 2020.

<<<

Seeking Alpha

Feb. 11, 2020

https://seekingalpha.com/article/4323151-axsome-therapeutics-still-remains-lot-of-upside-potential-for-2020?utm_medium=email&utm_source=seeking_alpha&mail_subject=axsm-axsome-therapeutics-there-still-remains-a-lot-of-upside-potential-for-2020&utm_campaign=rta-stock-article&utm_content=link-2

Summary

Axsome Therapeutics is set to grab a big share in the major depressive disorder indication.

The company’s late-stage migraine drug, AXS-07, has demonstrated robust efficacy in acute migraine indication.

Investors should consider these risks.

Axsome Therapeutics (AXSM) rose by almost 3600% in 2019. Despite this mind-boggling rally, there is still significant upside potential in the stock for 2020. Today, we will see why Axsome Therapeutics is a top-notch investment opportunity for 2020.

Company overview

Axsome Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on neurological and psychiatric disorders. The company’s late-stage pipeline has four clinical-stage candidates, AXS-05, AXS-07, AXS-12, and AXS-09. They are being studied in different indications such as treatment-resistant depression, major depressive disorder, agitation in Alzheimer's disease, smoking cessation, migraine, narcolepsy, and other CNS (central nervous system) disorders.

Axsome Therapeutics' market capitalization has jumped from around $85 million in early 2019 to $3.33 billion in February 2020. The company has released exceptional results for its investigational products in 2019.

AXS-12 is racing ahead to become a treatment option in narcolepsy indication

According to SleepFoundation.org, “Narcolepsy is a sleep disorder characterized by excessive sleepiness, sleep paralysis, hallucinations, and in some cases episodes of cataplexy (partial or total loss of muscle control, often triggered by a strong emotion such as laughter). Narcolepsy occurs equally in men and women and is thought to affect roughly 1 in 2,000 people.

Narcolepsy affects around 185,000 patients in the U.S., with around 50% diagnosed and only 25% treated for the condition. There are very limited off-label treatment options available for this condition and most of them are scheduled substances. Branded versions of Methylphenidate such as Ritalin, Methylin, Concerta, Quillivant, and Daytrana are being currently used for treating narcolepsy patients.

The highly selective norepinephrine reuptake inhibitor, AXS-12 (reboxetine), has been designed to improve the regulation of norepinephrine signaling. This oral therapy also has a robust safety and tolerability profile. Hence, it will most likely not be a scheduled substance. The drug has been granted U.S. FDA Orphan Drug designation for the treatment of narcolepsy.

On December 3, Axsome Therapeutics reported positive top line results from the Phase 2 CONCERT trial. AXS-012 demonstrated a statistically significant reduction in cataplexy attacks and reduced excessive daytime sleepiness compared to placebo. Patients treated with AXS-12 reported 14.6 fewer cataplexy attacks as compared to a reduction of 2.6 cataplexy attacks per week for the placebo group.

The drug also improved cognitive function, sleep quality, and sleep-related symptoms compared to placebo. The company now plans to commence a Phase 3 trial in 2020. On January 13, the company entered into an agreement with Pfizer (PFE) for an exclusive U.S. license to Pfizer’s clinical and nonclinical data, and intellectual property for reboxetine, the active pharmaceutical ingredient in AXS-12. This deal can help speed up the development of AXS-012 in narcolepsy indication, thereby getting the product earlier into the market.

AXS-05 can be a potential standard-of-care in MDD indication

Currently, there are 17 million adults in the U.S. who experience major depressive episodes every year. Approximately, 63% fail to achieve remission to initial therapy, and of that 69% fail second-line therapy. Most of the currently approved oral MDD therapies work through monoaminergic mechanisms. The existing antidepressants, however, take an average of 6-8 weeks to take effect. A wide variety of these antidepressants are also associated with sexual dysfunction.

AXS-05 is a combination of serotonin inhibitor dextromethorphan and a nicotine antagonist bupropion. Dextromethorphan has been used as an antidepressant for many years now. Bupropion is the active ingredient present in the majority of OTC (over-the-counter) cough medicines.

On its own, Dextromethorphan is rapidly metabolized in humans, thus preventing the drug from reaching potential therapeutic concentrations in the blood. This makes the drug less effective in treating depression. The combination of Dextromethorphan and Bupropion seems to be working. The latter helps to inhibit dextromethorphan metabolism, thereby allowing an increase in blood concentration of dextromethorphan.

On December 16, Axsome Therapeutics reported positive results from the Phase 3 GEMINI trial, evaluating AXS-05 in MDD indication. The drug demonstrated a statistically significant reduction in the MADRS (Montgomery-Asberg Depression Rating Scale), a scoring system used to evaluate the severity of symptoms in patients. AXS-05-treated patients reported a 16.6 average point reduction in their MADRS scores, as compared to 11.9 average score reduction in the placebo arm. The statistically significant improvement in the MADRS score was reached just after 1-week of therapy. Besides, AXS-05 also demonstrated statistically significant improvement in all secondary endpoints such as remission, disease severity, functional impairment, and quality of life as compared to placebo.

ASX-05 also reported robust safety and tolerability profile with the most common adverse reactions being nausea, headaches, and dizziness. These results were also consistent with those reported from the previous Phase 2 ASCEND study. This is commendable since historically MDD trials have been affected by the high placebo effect. Based on these results, Axsome Therapeutics plans to file an NDA for AXS-05 in MDD indication in the second half of 2020. The drug stands a chance to become a standard of care in this indication due to its high efficacy and safety as well as the faster onset of action.

AXS-05 has succeeded where many have failed

The phenomenal clinical success of AXS-05 was definitely not priced at the company’s stock price prior to December 2019. Then again, it came on the heels of disappointing results from the highly-awaited Sage Therapeutics’ (SAGE) pivotal Phase 3 MOUNTAIN Study, evaluating the effect of SAGE-217 on depressive symptoms in adults with major depressive disorder. In February 2019, the FDA rejected Alkermes’ (ALKS) NDA for ALKS 5461 in major depressive disorder, citing the need for additional clinical data to proceed with the application. In March 2019, Allergan’s (AGN) Rapastinel failed to meet the primary endpoint in pivotal Phase 3 trials in MDD indication.

Subsequent to the GEMINI readout, analysts have revised upwards the probability of regulatory success for the drug. William Blair analyst, Myles Minter, has an estimated 90% probability of success for AXS-05 and peak U.S. sales of $900 million in MDD indication. He also expects AXS-05 to enter the U.S. market in early 2022.

Cantor Fitzgerald analyst Charles Duncan is also impressed with placebo-adjusted effects, speed of onset, the durable and deepening effect over time, and responder rates from the GEMINI trial. He expects the drug to be approved and launched in the U.S. in late 2021. H.C. Wainwright analyst Raghuram Selvaraju also increased the probability of regulatory success for AXS-05 in MDD indication from 50% to 80%.

There are multiple catalysts for AXS-05 in 2020

On January 22, Axsome Therapeutics announced the completion of patient randomization in the Phase 3 STRIDE-1 trial, evaluating AXS-05 in TRD (treatment-resistant depression) indication. The company expects top line data from this trial in the first quarter of 2020. Previously scheduled for the fourth quarter of 2019, the data readout was delayed so as to include TRD patients into the safety database. This was to make the supporting package for AXS-05’s NDA in MDD indication more robust, without extending the timeline of the NDA. In case data from STRIDE trial comes out positive, it would be included in AXS-05’s product label in MDD indication.

Axsome Therapeutics is also studying AXS-05 in an ongoing Phase 2/3 trial, ADVANCE-1, for treating agitation in AD (Alzheimers’ disease) patients. The company expects top line results from this trial in the first half of 2020.

Subsequent to the positive Phase 2 results released in April 2019, the company plans to have a meeting with the FDA for transitioning to Phase 3 of the program.

AXS-07 is also a key growth driver for Axsome Therapeutics’ stock price

Currently, there are 37 million migraine patients in the U.S. characterized by recurrent attacks of pulsating, often severe and disabling head pain associated with nausea, and sensitivity to light and or sound, migraine is associated with $78 billion in direct and indirect costs annually in the U.S. According to published surveys, 70% of migraine patients are not fully satisfied with existing treatment options. Further, 80% of patients are keen on trying newer therapies.

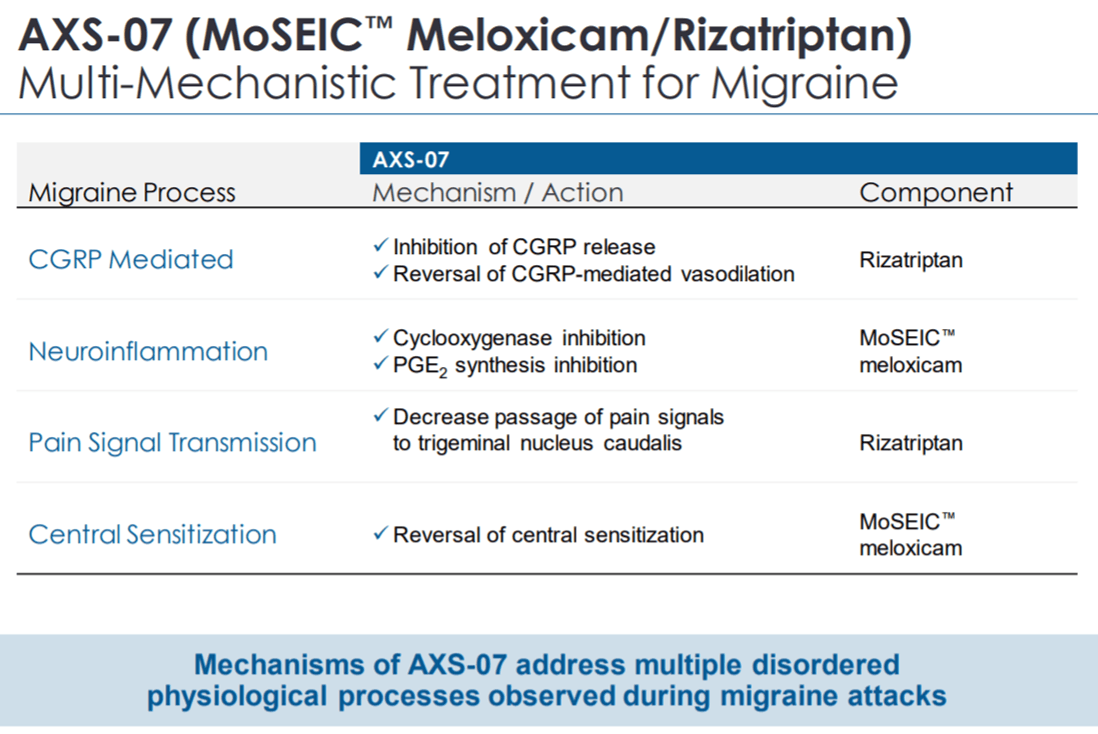

Rizatriptan is one of the most effective migraine treatments available in the market. AXS-07 combines Rizatriptan with MoSEIC meloxicam to provide enhanced efficacy through the synergistic action of these two agents. While Meloxicam is a potent NSAID (Nonsteroidal anti-inflammatory drug) with a long duration of action, it takes time to reach the maximum plasma concentration. The company’s proprietary MoSEIC technology helps meloxicam to rapidly reach the peak plasma levels, without compromising duration of action. Rizatriptan works on different migraine-inducing CNS receptor systems.

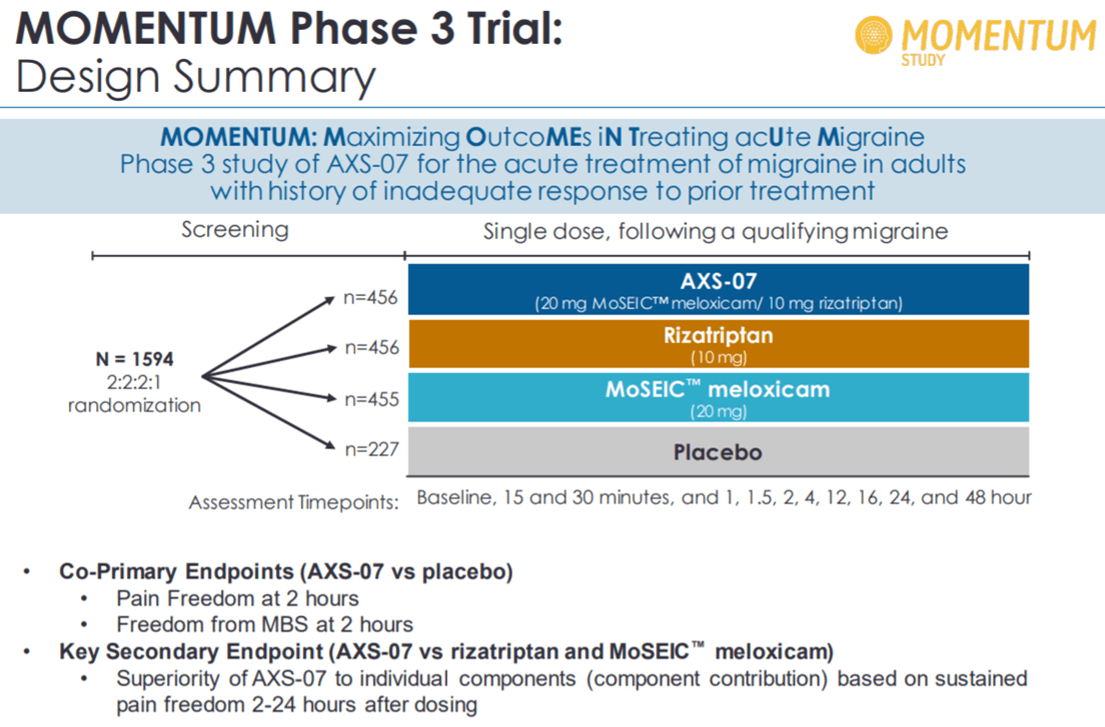

On December 30, Axsome Therapeutics reported positive top line results from Phase 3 trial, MOMENTUM, evaluating AXS-07 for acute treatment of migraine. The trial involved difficult-to-treat migraine patients who had responded inadequately to previous treatments. Here, the drug demonstrated statistically significant improvement in regulatory co-primary endpoints of pain freedom and freedom from most bothersome symptoms at 2 hours as compared to placebo. The drug also demonstrated superiority to rizatriptan active comparator on key secondary endpoint of sustained pain freedom 2-24 hours after dosing. AXS-07 was seen to provide greater and sustained pain relief as compared to rizatriptan. The rapid relief in migraine pain also resulted in significantly reduced use of rescue medication compared to rizatriptan.

In October 2019, Axsome Therapeutics initiated the Phase 3 trial, INTERCEPT, evaluating AXS-07 at the early sign of migraine pain. Top line results from this trial are anticipated in the first quarter of 2020.

Axsome Therapeutic now plans to file an NDA for AXS-07 in acute migraine indication in the second half of 2020.

Investors should consider these risks

Axsome Therapeutics is a clinical-stage company. Although the company’s pipeline is significantly derisked, the R&D failure risk remains. Besides, even if drugs secure regulatory approval, there is no guarantee of commercial success. Hence, there is significant market uncertainty for the products and subsequent volatility inherent in these stocks. Finally, Axsome Therapeutics is a loss-making organization. It may take many more years for the company to actually post profits.

Generic and branded competition can be a key risk for Axsome Therapeutics. Although AXS-012 (Reboxetine) has not being used in the U.S., it has been used for many years in international markets as a depression drug under the brand name Erdonax. While FDA approval may provide the drug with some marketing exclusivity, the possibility of early generic competition remains high.

If approved, AXS-05 may have to compete for the MDD market share with Johnson & Johnson’s (JNJ) Spravato. In March 2019, the FDA approved Spravato (esketamine CIII nasal spray) in conjunction with an oral antidepressant, for the treatment of adults with treatment-resistant depression. In October 2019, the company submitted an NDA for Spravato seeking FDA approval for Spravato in the rapid reduction of depressive symptoms in MDD adult patients who have active suicidal ideation with intent.

There is some possibility of Sage Therapeutics’ Zulresso, approved in post-partum depression, competing with AXS-05. However, it is not a major concern, considering that post-partum depression is a niche segment while AXS-05 may secure approval for a much wider indication.

What price is right for the stock?

According to Finviz, the 12-month consensus target price of Axsome Therapeutics is $144.57. On January 14, Ladenburg Thalmann analyst Matthew Kaplan reiterated Buy rating for the stock and raised his price target from $139 to $165. On December 31, SunTrust analyst Joon Lee reiterated the “Buy” rating and increased the target price from $100 to $140. On December 30, BTIG analyst Robert Hazlett reiterated the “Buy” rating and increased the target price from $97 to $114. On December 30, H.C. Wainwright analyst Raghuram Selvaraju also reiterated the “Buy” rating and increased the target price from $170 to $200. I believe the target price of $140 is easily achievable and is a conservative estimate of the true potential of this stock in 2020.

At the end of September 2019, Axsome Therapeutics had cash worth $43.6 million on its balance sheet. On December 23, the company announced the closing of $200 million public offerings of common stock. This also included full-exercise of the over-allotted shares. H.C. Wainwright analyst Raghuram Selvaraju claims that this cash is sufficient to fund the company’s operations at least till end of 2022. The full exercise of overallocated shares also highlights the ease with which Axsome can currently access public capital. The cash burn estimate seems reasonable considering the company spent $38.6 million from September 2018 to September 2019.

There is no doubt that the stock is not cheap at this point. However, there is still a significant upside potential left in this stock, considering the large indications that the company is targeting and the phenomenal success the pipeline products have witnessed in 2019. In this backdrop, I will recommend aggressive retail investors with at least a one-year investment horizon to consider this stock in 2020.

<<<

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.