Friday, July 19, 2019 8:16:29 AM

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=135550937

________________________________________________________________

* The Market is a "Forward-Looking Mechanism"

* Traders move the Price of the stock Down

6-to-9 months in advance,

to a Price Level that is seen as,

a "Point of Maximum Opportunity"

and "Fairly Valued".

________________________________________________________________

* The insiders "pull the price down",

for the funding of their operations,

by increasing the "shares outstanding",

and the "authorized shares",

and when the price of the stock,

reaches the price level,

where the "VC"s want to "Buy",

(0.0001 and 0.0002)

the stock finally bottoms,

and you then see the accumulation.

________________________________________________________________

* The Price of the stock is - "Artificially Depressed" !

* The Price has been pulled Down Artificially,

by lack of Trader Interest,

as a result of a "temporary" lack of News.

* A Huge Price Climb - is about to happen !

_________________________________________________________________

The Pond-Fishing Play

They Trade at the Bid 0.00 - Ask 0.0001 Level

aka "The Patience Play"

because you have to tie your money-up,

for 3-to-6 months in some cases,

accumulating it slowly,

while you wait for the time

the stock receives the promotion,

and the "Run" from the promotion,

begins to lift the price,

out of the multi-month trading range.

Called a "pond",

because it starts

from a "dead still pond surface" in price.

This means that there is a long period of time

with no price movement at all.

There are "3-volume surges"

during this time,

to signal random accumulation at these low prices.

That one action,

of "3-volume surges" without price change,

is an OTC "tell" or, "signal" ,

that funding may be taking place.

Video

You want to

accumulate

while the price is staying low.

_________________________________________________________________

_________________________________________________________________

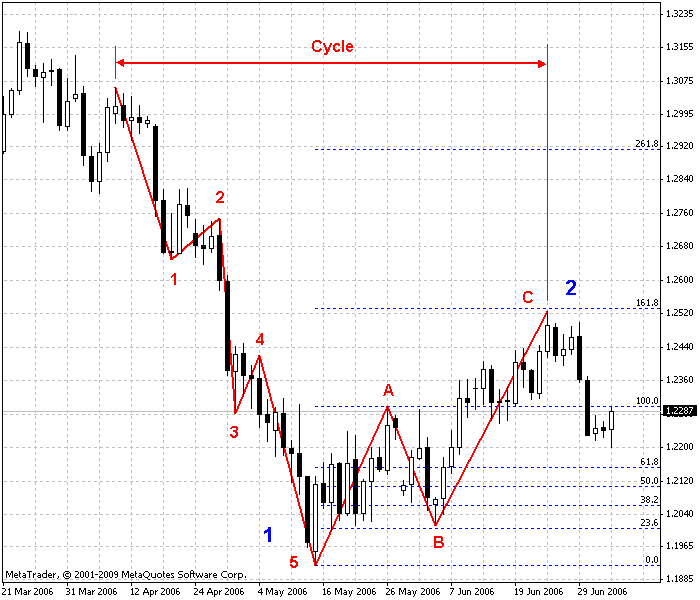

ABWN - Buy after a EW 5-Wave Decline

Buy after an Elliott Wave 5-Wave Decline

________________________________________________________________

The Elliott Wave 5-Waves Sequence

A Basic "A,B,C Corrective Wave"

https://www.metatrader5.com/en/terminal/help/objects/elliott/elliott_theory

________________________________________________________________

Elliott Wave Basics

http://www.acrotec.com/ewt.htm

Elliott Wave Theory

http://ta.mql4.com/elliott_wave_theory

Buy after an Elliott Wave,

5-Wave decline sequence !

A Basic "A,B,C Corrective Wave"

Buy, ONLY when the stocks price,

is trading under the Blue 8-day M.A.

when the Blue 8-day M.A. is under the Red 34-day M.A.

_________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Embedded Chart

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Chart

ABWN - Targets 0.0012 / 0.0016

_________________________________________________________________

________________________________________________________________

Impulse Wave 1 - The Accumulation Stage

the Wave right after a prolonged downtrend.

Wave 1

The stock makes its initial move upwards.

This is usually caused

by a relatively small number of people

that all of the sudden

(for a variety of reasons, real or imagined)

feel that the price of the stock is cheap

so it’s a perfect time to buy.

This causes the price to rise.

Wave 2 - Stock Declines

At this point,

enough people who were in the original wave

consider the stock overvalued and take profits.

This causes the stock to go down.

However, the stock will not make it to its previous lows

before the stock is considered a bargain again

Wave 3

This is usually the longest and strongest wave.

The stock has caught the attention of the mass public.

More people find out about the stock and want to buy it.

This causes the stock’s price to go higher and higher.

This wave usually exceeds the high created at the end of Wave 1.

Wave 4

Traders take profits

because the stock is considered expensive again.

This Wave tends to be weak

because there are usually more people

that are still bullish on the stock

and are waiting to “buy on the dips.”

Wave 5

This is the point that most people get in on the stock,

and is mostly driven by hysteria.

You usually start seeing the CEO of the company

on the front page of major magazines

as the Person of the Year.

Traders and investors start coming up with

ridiculous reasons to buy the stock

and try to choke you when you disagree with them.

This is when the stock becomes the most overpriced.

Contrarians start shorting the stock

which starts the ABC pattern.

________________________________________________________________

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM