That MCIM report was authored by banned securities violator Robert Gandy

http://www.otcmarkets.com/financialReportViewer?id=198411#investments

Who is Robert Gandy?

Robert Gandy was one of the masterminds behind the PGIE scam

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=90554213

Robert Gandy along with Marcellous McZeal was charged by the SEC for carrying out a scheme where Gandy created fake back dated debt Notes and other bogus documents then illegally issued himself free trading stock to sell while pumping the stock with lies

http://www.sec.gov/litigation/litreleases/2013/lr22765.htm

https://www.sec.gov/litigation/complaints/2013/comp22765.pdf

The SEC permanently enjoined Gandy from any future violations and barred him from participating in any future penny stock offerings

https://promotionstocksecrets.com/wp-content/uploads/2018/01/SECvsGandyOrder.pdf

What is Robert Gandy's role here?

You won't find Robert Gandy in the public disclosures on the OTC Markets made by MCIM because of Gandy's penny stock ban. Gandy is trying to hide his involvement in MCIM.

But the fact is that Robert Gandy is the main player involved in MCIM.

Robert Gandy's involvement gets exposed thanks to a 3(a)10 suit filed in Broward County, Florida

Case #CACE17018153 - CF3 Enterprises Llc vs. Macau Capital Investments Inc

https://www.scribd.com/document/385303077/MCIMCF3Complaint

On 10-02-2017, CF3 Enterprises LLC did a 3(a)10 transaction with MCIM. CF3 Enterprises LLC agreed to pay $4,522,218 in debts for MCIM in exchange for discounted free trading stock.

https://www.scribd.com/document/385303077/MCIMCF3Complaint

CF3 Enterprises LLC is represented by Clarence Fitchett

It has a website located at http://www.cf3enterprisesllc.com/

According to the Complaint at the above link, the $4,522,218 will cover the following debts:

a) $75,000 owed to Caraso SA

https://www.scribd.com/document/385304025/m-Cim-Barry-Miller-Contract

Casaro S.A. is a Panama entity controlled by attorney Barry Miller who is the long time attorney of Richard Astrom and also the long time attorney for MCIM.

Barry Miller

Casa 9, Calle 5, Villa Zaita

Las Cumbres, Panama

panalaw.com.pa

The money was owed to Barry Miller as a retainer fee for future legal services

b) $327,218 owed to Parisian Summer Inc

https://www.scribd.com/document/385304321/Mc-i-Ma-Strom-Note-Anthony-Reed

Parisan Summer Inc is controlled by Richard Astrom. When Astrom sold the MCIM shell on September 14, 2017 he sold it for $360,000, $320,000 of the balance ended up as a debt Note owed to Astrom which Astrom transferred to Parisan Summer Inc. The transaction included $7,218 in attorneys fees owed to Stuart Reed ($3,000) and Laura Anthony ($4,218) for assisting in the transaction bringing the amount owed to Astrom to $327,218.

c) $4,000,000 owed to Silverback Promotions LLC for mostly future services

https://www.scribd.com/document/385303698/Gandy-Contract

Silverback Promotions LLC is controlled by Robert Gandy.

http://www.sbpromotionsllc.com/

Here is that $4,000,000 contract between MCIM and Robert Gandy

https://www.scribd.com/document/385303698/Gandy-Contract

$4,000,000 is a ridiculous amount of money especially knowing Robert Gandy's background/history. A closer look at the contract shows that on September 14, 2017, the same day that Richard Astrom sold control of the MCIM shell to ECO Acquisition Corp (Hershell Hayes), Hayes agreed to pay Robert Gandy $166,666.66/month for the next 24 months for Silverback Promotions LLC to provide assistance with business development.

Obviously Gandy played an integral role in the peddling of the MCIM shell from Richard Astrom to Hershell Hayes which explains why the MCIM shell is set up to enrich Robert Gandy.

d) $100,000 owed to INS Consulting LLC because of some advertising/investor relations agreement

https://www.scribd.com/document/385304615/m-Cim-Derek-Mccarthy

INS Consulting LLC is controlled by Derek McCarthy

e) $20,000 owed for legal services related to the 3(a)10 transaction

https://www.scribd.com/document/385304780/MCIM3a10LegalFees

The 3(a)10 settlement was approved by the Court on November 7, 2017.

https://www.scribd.com/document/385304963/MCIMC3Fsettlement

The 3(a)10 agreement is structured as an illegal kickback scheme

Not only does the whole 3(a)10 settlement pose a massive dilution threat for MCIM moving forward, it is a flat out illegal arrangement.

3(a)10 can only be used for bona fide debts. The $4,522,218.00 in claims that CF3 Enterprises LLC made against MCIM were not bona fide debts.

1) CF3 Enterprises LLC hadn't paid a penny to any of the owners of any of the debts therefore CF3 Enterprises LLC had no bona fide claims at the time of the lawsuit. You can see by the following document provided in the case that CF3 plans on making the payments in the future

https://www.scribd.com/document/385306601/Mc-i-Mc-f-3-Payment-Schedule

2) Most of the $4,522,218.00 was for money MCIM didn't owe yet therefore they were not "debts". As of the time of the lawsuit, MCIM was only on the hook to Robert Gandy for $166,667 (one month of service). The majority of the $4,000,000 going to Robert Gandy is for future services.

The way the 3(a)10 transaction is structured between MCIM and CF3 Enterprises LLC is as an illegal kickback scheme where MCIM will be issuing the free trading stock to CF3 Enterprises LLC first to sell into the market then CF3 Enterprises LLC will be using the money it makes from selling the stock to pay off the $4,522,218.

We know this is the case because it is right in the MCIM filings that the debts will be paid off by the proceeds that CF3 Enterprises will make by selling their shares into the market:

https://backend.otcmarkets.com/otcapi/company/financial-report/190412/content

CF3 acquired these claims from unrelated third parties under agreements pursuant to which CF3 agreed to sue the Issuer for the aggregate amount of these claims, enter into and seek court approval of the Settlement Agreement and distribute to these third parties money that it would receive from sales of shares issued pursuant to the Settlement Agreement, which sales will occur in several monthly tranches

The attorneys that signed off on the illegal 3(a)10 transaction were Laura Anthony representing Macau Capital Investments Inc (MCIM) and Stuart Reed representing CF3 Enterprises LLC.

Laura Anthony and Stuart Reed both work out of the law firm - Legal & Compliance LLC so the settlement was obviously pre-arranged by both parties.

http://www.legalandcompliance.com/going-public-law-firm/securities-attorneys/laura-anthony-esq-3/

http://www.legalandcompliance.com/going-public-law-firm/securities-attorneys/stuart-reed-esq-3/

According to MCIM disclosures, CF3 Enterprises LLC will get its free trading stock at a 50% discount to the lowest market price of the stock over the previous 30 days. CF3 Enterprises received its first 10,000,000 shares on April 6, 2018. MCIM didn't disclose how much debt that covered and since MCIM didn't trade the 30 days prior to April 6, 2018 it is anybody's guess.

Mysterious 3rd Party with a boat load of free trading stock

Not only is the kickback arrangement a major problem, but you'll notice at the beginning of the screenshot taken from the MCIM disclosure statements it states that MCIM issued 44,238,665 shares to an "unrelated 3rd party" as part of the settlement agreement with CF3 Enterprises LLC.

That is another major problem because if you review the 3(a)10 Complaint and settlement agreement you'll see that there is no mention of an 3rd party receiving a payment in stock as part of the agreement

https://www.scribd.com/document/385303077/MCIMCF3Complaint

https://www.scribd.com/document/385304963/MCIMC3Fsettlement

So who was the unnamed party that received the 44,238,665 free trading shares of stock? Was it Robert Gandy? Were those shares paid to Gandy to cover his $55,000 retainer fee mentioned in his contract?

https://www.scribd.com/document/385303698/Gandy-Contract

At the current MCIM price those 44,238,665 free trading shares carry a value of around $4,000,000.

44,238,665 shares fell under the 10% reporting status thanks to Hershell Hayes and Monique Hayes issuing themselves 4,500,000,000 shares a few months earlier. So unless MCIM decides to disclose who the unrelated 3rd party was that got rich through the illegal 3(a)10 transaction, we may never know.

MCIM adds a fake backdated debt Note to the equation

In true Robert Gandy fashion, according to the most recent MCIM disclosures from May of 2018, MCIM has now added a fake back dated debt Note to the equation.

MCIM used to have a bunch of old OTC disclosure statements for the periods from 2015 - 2017 which MCIM has now made inactive

select the "Inactive" or "All" tab at the following link and you'll find them

https://www.otcmarkets.com/stock/MCIM/disclosure

What you will not find in those old financial statements and disclosures is any mention of CF3 Enterprises LLC or any mention of CF3 Enterprises LLC loaning money to MCIM. CF3 Enterprises LLC didn't exist in MCIM's history prior to the illegal 3(a)10 transaction from the fall of 2017.

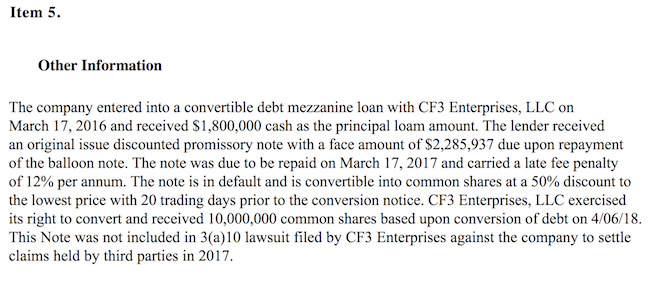

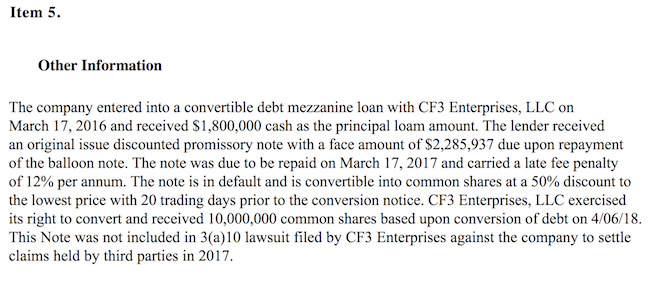

Now in the most recent disclosure statements from May 2018, MCIM is claiming that CF3 Enterprises LLC gave MCIM $1,800,000 in March of 2016 which was turned into a $2,285,937 promissory Note which can now be turned into discounted free trading stock at a 50% discount to the lowest MCIM trading price over the previous 20 days.

https://backend.otcmarkets.com/otcapi/company/financial-report/194333/content

That is about as obvious a fake back dated debt Note as you'll ever find in a public Issuer. They back dated the fake Note to March of 2016 so it would be 2 years old as of the April 6, 2018 issuance of 10,000,000 shares to CF3 Enterprises LLC.

So why back date a debt Note when you already have an arrangement to get rich off of a bogus $4,522,218 kickback arrangement?

That's easy to answer. It's because the 3(a)10 arrangement was exposed an illegal kickback arrangement.

MCIM wasn't the only Richard Astrom/Robert Gandy shell to do an illegal 3(a)10 arrangement with CF3 Enterprises LLC.

DRWN and MSPC also made very similar arrangements with CF3 Enterprises LLC

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=138052885

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=139148668

Like with MCIM, Robert Gandy became a key insider in DRWN and MSPC just ahead of CF3 Enterprises LLC entering the picture and offering to pay off past liabilities through the illegal kick back arrangement.

There is no question that CF3 Enterprises LLC is operating under the direction of Robert Gandy.

When DRWN and MSPC became big pump & dumps earlier this year it was exposed that their 3(a)10 transactions with CF3 Enterprises LLC was not legal and both DRWN and MSPC terminated their illegal kickback arrangements with CF3 Enterprises LLC.

You'll notice in the screenshot for the fakeback dated Note that the 10,000,000 shares issued to CF3 Enteprises LLC on April 6, 2018 that was previously disclosed as being a payment towards the 3(a)10 transaction is now being disclosed as a payment towards the fake back dated debt Note.

It appears that MCIM also became aware of the fact that the 3(a)10 arrangement is illegal and they too decided to move away from the 3(a) 10 arrangement and look for other ways to use the shell as a Robert Gandy insider enrichment scheme.

Why did they chose the $2,285,937 number for the fake back dated debt Note?

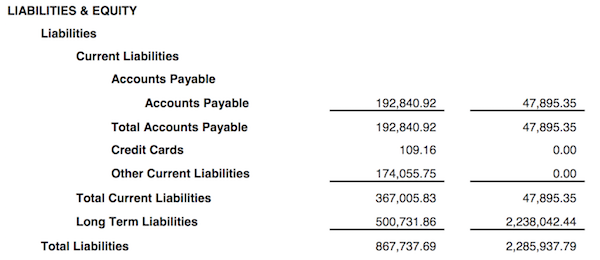

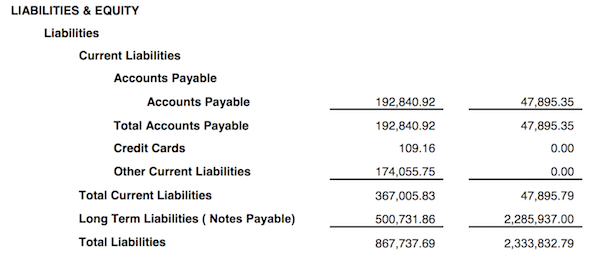

I think that is because in those old (now inactive filings), MCIM had $2,285,937 in total liabilities as of December 31, 2016

https://backend.otcmarkets.com/otcapi/company/financial-report/183990/content

You'll notice no mention of any Notes in that now inactive annual report for the period ending December 31, 2016 and no mention of CF3 Enterprises.

Now look at the restated annual report for the period ending December 31, 2016 which was filed in May of 2018. The $2,285,937 is now listed as a Debt Note.

https://backend.otcmarkets.com/otcapi/company/financial-report/194045/content

I can tell you with 100% certainty that CF3 Enterprises never gave $1,800,000 to MCIM. The debt Note is fake and it was backdated to March of 2016.

There is so much illegal stuff going on with MCIM that it is crazy.

#1) Robert Gandy is operating through MCIM against his SEC Orders

#2) MCIM has an illegal kickback arrangement in place through a bogus 3(a)10 transaction

#3) MCIM has a fake back dated debt Note on the books which is being used to illegally created unregistered free trading stock to dump into the market - which is the exact same thing that Robert Gandy got busted for in 2013 because of his PGI Energy Inc (PGIE) scam

Just a heads up that this is going to be reported to the SEC.

Hopefully the SEC will take action in not too distant future and shut this Robert Gandy insider enrichment scheme down.

And hopefully this time Robert Gandy will find himself in handcuffs with an Indictment filed against him.

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM