Wednesday, July 18, 2018 9:49:11 PM

All of this is on the premise that Zion Oil and Gas has found Oil, I can not guess very well if the find is Natural gas but a good idea would be 1/8th of the Oil size. I have read 1/6th so I will use 1/8th to be conservative.

I use a find of 1 Billion barrels in my calculations for the most part.

First we look at how other companies are valued. There are many things like cost of the barrel out of the ground. It will be almost impossible to get these values right for many reasons, but most of all is it is in Israel, not Texas. Laws are different and especially the environmental ones, as heard from the shareholders meeting.

This is good to have and is around 1MB, so as not to large.

US oil and gas reserves study 2017

The original Post with this information was here:

Valuation and Reserves - Hard Data

One method is such:

I will look at two companies, Occidental Petroleum and Pioneer Natural Resources..

Pioneer Natural Resources

Reserves = 1.265 Billion

Production Costs = $10 a barrel

Market Cap = $33 Billion

Occidental Petroleum

Reserves = 1.045 Billion

Production Costs = $16.50 a barrel

Market Cap = $65 Billion

So using those numbers , Lets say 1 Billion barrels...

ZION = (ESTIMATED ONLY)

Reserves = 1.0 Billion

Production Costs = $20 a barrel (In Israel so a guess)

Market Cap = $45 Billion ( in between the two )

Share price at 60 Million shares = $750

Share price at 200 Million shares = $225

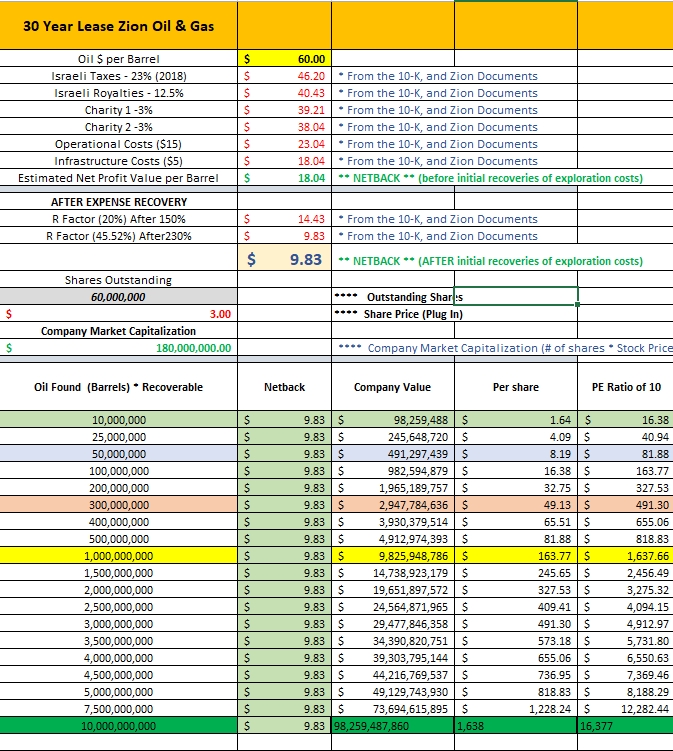

That was one method, another was good ol Excel and some good information and maybe good guesswork. I know I have posted many screenshots, but I thought I would let you modify it or add to it if you like. I was apprehensive about uploading an excel file but I see no other way. Please use your AV to check it, it is clean as far as I know as I just modified my original and uploaded it.

With this one can see that even a 50 million barrel field will make be a winner!!

Link to spreadsheet so you can play with the numbers and make adjustments if needed....Excel

Zion Oil Excel Spreadsheet

Just click and download and AV check if you want.

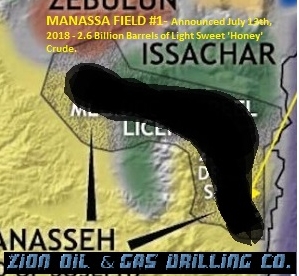

The important thing and I do not want to leave this out even though I think it highly unlikely, but with Him in charge all things are possible. What if it is larger, VERY much larger?

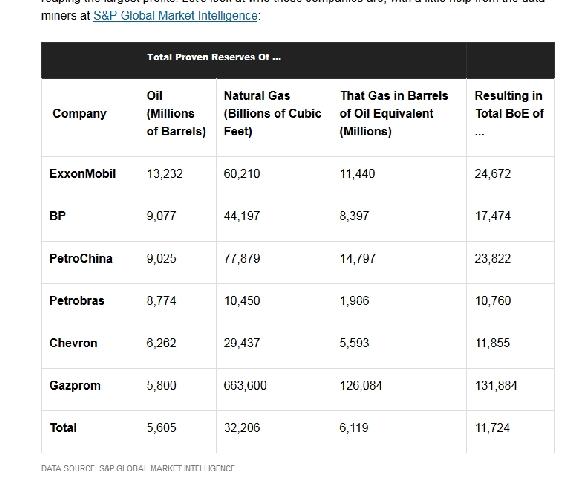

Here you will get an idea of what the big boys are, these are the companies with billions of barrels of reserves. Note: this is not tens of billions as that becomes nation size. Examples being Saudi Arabia, Nigeria, & Norway for just a few.

Being realistic and the engineer in me talking, what if the HOLE is dry?

Zion's shares drop quiet low, guessing near the dollar level. Then they will try and raise more capital and drill again. I will most likely not be a part of that one except for my original 100 shares. News is not as forthcoming as in the past and as we have discussed on here, there could be a multitude of reasons.Of course with the SEC news, we now know a little more about why the deliberate silence. Worry not though, we know that ZN will come out of this fine. Refinement is not a bad thing sometimes. I too think it a spiritual attack. If this company did not have the founding principles it does, a Christian one, there is no doubt the attacks would be far less in my opinion.

That being said, I am not worried about it as I do think they have crude oil now. That is why I have 4X the shares I have ever had. That is my gut...

UPDATE:

Let's see, when estimates were being made they were made considering proven reserves (What I think they are working on right now btw).

The reason it is where it is at, say $3.33 is because there is a huge upside if oil in commercial quantities have been found. Of course it was closer to $4 until the shenanigans started and the SEC soon sent Zion a letter and is now a stock that is 10% shorted, but that is for another day. Here is a post with more information on this topic.

Summary Review of the SEC Inquiry and the Active Shorting of Zion Stock

One of the things that was said was that our company was paying their executives too much. I do not think that is what the SEC is after but with attacks, who knows. Anyhow the pay thing was debunked fairly quickly here:

Executive Pay and Zion Oil

Possible Pricing and Calculations

Where do these figures come from? They are only guesstimates from someone (me), no guarantees at all. The numbers are there and the spreadsheet is above. Play with them and see what you can some up with.

In comparisons with companies with the 1 Billion barrels (decided be me to meet the stated goals of the company) not by Zion or anyone else. There is a way to at least get a ballpark figure. It has been calculated many ways and of course it is all subjective but in the ballpark comes to some point of reasonableness.

Of course I am using West Texas Intermediate (WTI) and not Brent. I will use WTI for now as Brent is even more! <> COM Brent Crude (ICE)

I wonder which Zion has agreed to sell by if they sell oil. My vote is WTI as the company is based in Texas. I also hope it is light, sweet Crude. The good stuff. Givot's was listed as:

commercial quantities of high quality crude oil (API 39-40)

I do not know what that means. Maybe someone can elaborate.

Now the question was asked, "What happens if we hit a big one?" This is a very legit question and I had thought that we could borrow the funds to drill the next wells from the exiting derrick site. I think we could do up to four from that location.

I did not want any more share dilution. When I first came on board, there were only 10 million shares. There are now roughly 60 million shares. I thought that should be the path.

Then someone posted this, and I think it is a much better idea for long term shareholder value.

Jryan, yes long term shareholder value is ZN's stated goal, and that is in alignment with what both you and I desire. Lets consider a couple of fund raising paths associated with long term value.

First, assume that a company without revenue who finds a big reservoir will not have cash flow for some amount of time to pay for operations and provide capital.

Therefore, outside financing has to be considered and there are two paths:

A. Borrow funds (debt), or

B. Issue shares (equity).

Both A and B dilute the future value of the shares, but in different ways.

A reduces earnings per share due to interest payments, but with fewer shares outstanding.

B increases the shares outstanding, so the earnings are spread over additional shares, lowering earnings per share.

From a pure accounting standpoint, an optimum point between debt and equity can be found which maximizes earnings per share, which in turn maximizes the price per share.

However, from an operational standpoint the two paths behave very differently. I worked for an S&P 500 company in the computer industry that took on debt to reduce shares which put the dividend payment at risk during a downturn. The company might have done considerably better had it been able to use cash flow to raise the dividend or invest internally. Later, I was in the oil industry and saw first hand the impact on cash flow when oil went from $100/bll to $25/bll. Many players were wiped out due to high interest payments.

So, from an accounting standpoint, I agree that debt issues could maximize earnings per share for a range of scenarios. However, from an operational standpoint I would much prefer to be with a company that grew with equity issues and was debt-free. That company can weather storms with a positive earnings per share.

So as you can see, that just plain makes sense! The more I think about it, a $15 share price and a 5 million share offering doesn't really dilute the shareholders that much, less than 10%, yet it would raise over $75 million dollars. What would that get us? I think the 4 extra wells and possibly a drilling rig of our own.

Still, at only $10 a share that is still $50 million to develop what we need to. What about cash flow?

I would guess somewhere around $10 million a month (5000 bpd). If we take that out to a quarter, then you have $30 million in cash flow. Of course at some point there would be dividends. If we take 1/2 of that for investors, that is $1 a year or so if my math is right. Of course the share price would be up there also. I am just not sure how one would calculate that. I am sure we would be fine.

Another thing, skeptics say there is no oil, well that is just not true. Some of you might not have heard of Givot Olam. Well they found oil. Here is a quick summary:

Givot Olam Information

With Zion quiet now, I seem to remember that the last wells were not like this. I know nothing more, just a hunch I guess. Its the little things that grab me now..

Like this: Why post this? If one cannot say anything for what ever reason, I think there was a message here. One of hope and one of joy!

What a nice day it will be if something like this was announced,

Recent ZNOG News

- Form 8-K - Current report • Edgar (US Regulatory) • 08/22/2024 09:17:16 PM

- Form 424B5 - Prospectus [Rule 424(b)(5)] • Edgar (US Regulatory) • 08/22/2024 09:16:23 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/06/2024 08:30:34 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 07/09/2024 08:00:20 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/26/2024 07:38:34 PM

- Form 424B5 - Prospectus [Rule 424(b)(5)] • Edgar (US Regulatory) • 02/26/2024 07:37:29 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 01/29/2024 04:44:22 PM

- Form 424B5 - Prospectus [Rule 424(b)(5)] • Edgar (US Regulatory) • 01/29/2024 04:43:39 PM

- Form SC 13G - Statement of acquisition of beneficial ownership by individuals • Edgar (US Regulatory) • 01/25/2024 07:42:44 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/23/2024 02:54:41 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 01/10/2024 09:31:36 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/09/2024 07:45:12 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/08/2024 07:33:31 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/08/2024 07:26:42 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/08/2024 07:19:45 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/08/2024 07:08:07 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/08/2024 06:58:32 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 12/20/2023 04:50:59 PM

- Form 424B5 - Prospectus [Rule 424(b)(5)] • Edgar (US Regulatory) • 12/20/2023 04:49:39 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 12/12/2023 07:38:56 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 12/06/2023 05:43:07 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 11/09/2023 09:31:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 11/06/2023 02:38:05 PM

- Form 424B5 - Prospectus [Rule 424(b)(5)] • Edgar (US Regulatory) • 11/06/2023 02:35:45 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 10/02/2023 03:35:05 PM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM

Dear Cashmere Group Holding Co. AKA Swifty Global Signs Binding Letter of Intent to be Acquired by Signing Day Sports • DRCR • Sep 19, 2024 10:26 AM

HealthLynked Launches Virtual Urgent Care Through Partnership with Lyric Health. • HLYK • Sep 19, 2024 8:00 AM

Element79 Gold Corp. Appoints Kevin Arias as Advisor to the Board of Directors, Strengthening Strategic Leadership • ELMGF • Sep 18, 2024 10:29 AM

Mawson Finland Limited Further Expands the Known Mineralized Zones at Rajapalot: Palokas step-out drills 7 metres @ 9.1 g/t gold & 706 ppm cobalt • MFL • Sep 17, 2024 9:02 AM

PickleJar Announces Integration With OptCulture to Deliver Holistic Fan Experiences at Venue Point of Sale • PKLE • Sep 17, 2024 8:00 AM