| Followers | 689 |

| Posts | 143817 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Tuesday, May 29, 2018 9:45:53 AM

NASDAQ 100 Subscribes To NFLX And INTC Breakouts

By: Tom Bowley | May 29, 2018

The NASDAQ 100 ($NDX) led the action on Friday and last week, thanks in large part to Netflix (NFLX) and a couple of chipmakers - Intel Corp (INTC) and Micron Technology (MU). NFLX surged to an all-time high earlier in the week, easily clearing overhead price resistance, and INTC followed suit by doing the same on Friday. MU is on the verge of such a breakout, gaining 33% in the past month alone, and nearing a $62 close, its highest since 2000:

The NDX was the only major index to finish in positive territory on Friday, leading the bifurcated action. Utilities (XLU, +0.44%) and consumer staples (XLP, +0.16%) led as money rotated mostly toward defensive assets. The iShares 20+ year treasury bond ETF (TLT) closed at its highest level in more than a month, but is now facing serious overhead resistance in the form of gap and trendline resistance:

A break above this area of resistance still leaves overhead price resistance at 121.50-122.00. To reverse the 2018 downtrend, the TLT would need to clear that price level and hold.

Energy (XLE, -2.60%) was crushed on Friday after crude oil prices fell back below $68 per barrel. On Tuesday of last week, the WTIC had closed above $72 per barrel so the big drop in crude prices took its toll on energy shares. The XLE lost 4.52% last week.

Pre-Market Action

Italy is grabbing headlines with its political uncertainty, but the real story - at least in the short-term - is the rapidly declining 10 year treasury yield ($TNX), which is down another 5 basis points this morning to 2.88%. That is likely to spur more buying of defensive assets, continuing the theme from late last week.

Despite the sudden rise in fear and rotation to defensive assets, gold ($GOLD) is down this morning and struggling to clear $1300 per ounce resistance. Crude oil ($WTIC) is down another 1% and is nearing $67 per barrel, its lowest level during May. $66 per barrel is a fairly solid support level, so let's watch to see if that holds.

With 45 minutes left to the opening bell, Dow Jones futures are lower by 163 points.

Current Outlook

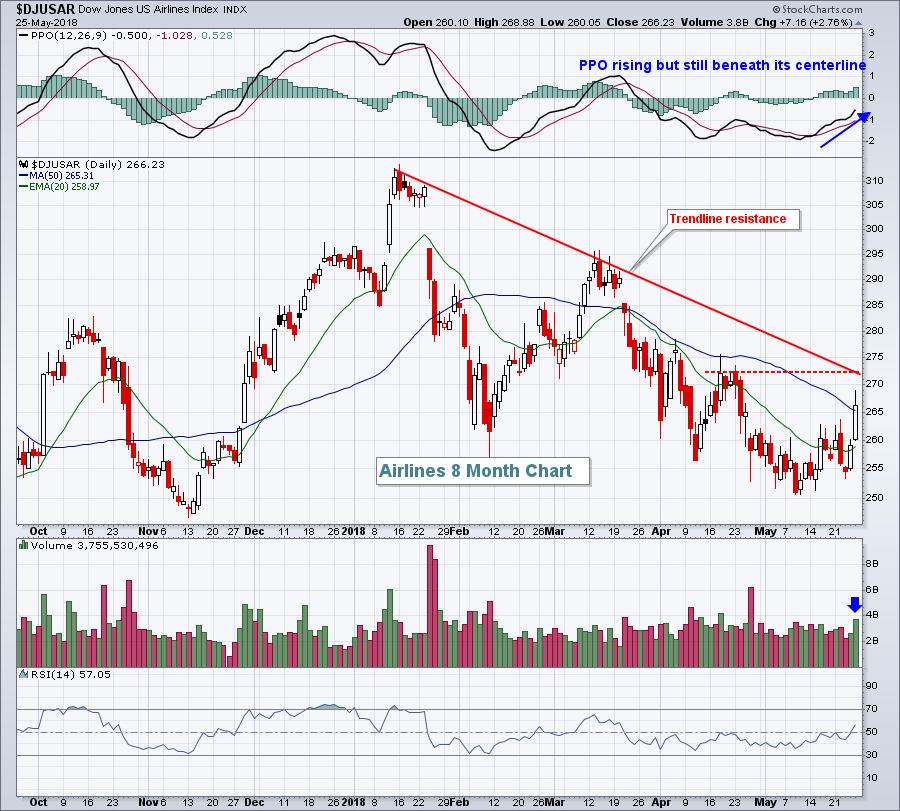

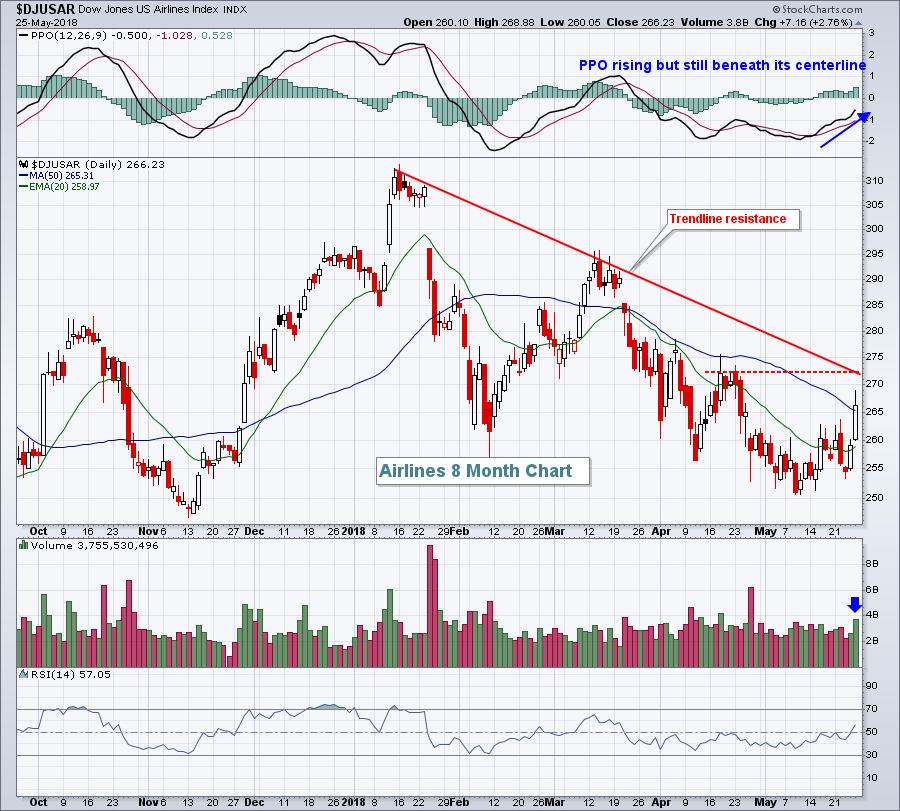

All of our major indices managed to post weekly gains, despite the weakness on Friday. Currently, price action on all major indices remains above key 20 period moving averages - the 20 day moving average on the daily chart and 20 week moving average on the weekly chart. That's a bullish setup. Throw in the positive, and strengthening, PPOs and it's a recipe for higher equity prices. I'd watch the transports ($TRAN) very closely. They broke above price resistance at 10800, then fell back briefly beneath this level only to hold rising 20 day EMA support. The TRAN then closed at another high on Friday. Railroads ($DJUSRR) and truckers ($DJUSTK) have been performing quite bullishly, but airlines ($DJUSAR) had been the laggard. That changed a bit on Friday as the DJUSAR spiked 2.76% and closed back above its 50 day SMA for the first time in more than two months:

There's much more technical work to be done here though. First, note that the PPO remains beneath its centerline. It's difficult to argue there's bullish momentum when the PPO is in negative territory. Next, it appears the 272-273 area could prove to be a difficult one with trendline resistance and the most recent price high intersecting there. But there are other bullish signs to recognize. Check out that increasing volume on Friday's big surge. It was the heaviest daily volume in the group during May and it accompanied price action that cleared the gap resistance established in late-April.

While there are mixed signals for airlines, lower crude oil prices and an already strengthening transportation group suggest the likelihood of continuing improvement for the DJUSAR.

>>> Read More

• DiscoverGold

By: Tom Bowley | May 29, 2018

The NASDAQ 100 ($NDX) led the action on Friday and last week, thanks in large part to Netflix (NFLX) and a couple of chipmakers - Intel Corp (INTC) and Micron Technology (MU). NFLX surged to an all-time high earlier in the week, easily clearing overhead price resistance, and INTC followed suit by doing the same on Friday. MU is on the verge of such a breakout, gaining 33% in the past month alone, and nearing a $62 close, its highest since 2000:

The NDX was the only major index to finish in positive territory on Friday, leading the bifurcated action. Utilities (XLU, +0.44%) and consumer staples (XLP, +0.16%) led as money rotated mostly toward defensive assets. The iShares 20+ year treasury bond ETF (TLT) closed at its highest level in more than a month, but is now facing serious overhead resistance in the form of gap and trendline resistance:

A break above this area of resistance still leaves overhead price resistance at 121.50-122.00. To reverse the 2018 downtrend, the TLT would need to clear that price level and hold.

Energy (XLE, -2.60%) was crushed on Friday after crude oil prices fell back below $68 per barrel. On Tuesday of last week, the WTIC had closed above $72 per barrel so the big drop in crude prices took its toll on energy shares. The XLE lost 4.52% last week.

Pre-Market Action

Italy is grabbing headlines with its political uncertainty, but the real story - at least in the short-term - is the rapidly declining 10 year treasury yield ($TNX), which is down another 5 basis points this morning to 2.88%. That is likely to spur more buying of defensive assets, continuing the theme from late last week.

Despite the sudden rise in fear and rotation to defensive assets, gold ($GOLD) is down this morning and struggling to clear $1300 per ounce resistance. Crude oil ($WTIC) is down another 1% and is nearing $67 per barrel, its lowest level during May. $66 per barrel is a fairly solid support level, so let's watch to see if that holds.

With 45 minutes left to the opening bell, Dow Jones futures are lower by 163 points.

Current Outlook

All of our major indices managed to post weekly gains, despite the weakness on Friday. Currently, price action on all major indices remains above key 20 period moving averages - the 20 day moving average on the daily chart and 20 week moving average on the weekly chart. That's a bullish setup. Throw in the positive, and strengthening, PPOs and it's a recipe for higher equity prices. I'd watch the transports ($TRAN) very closely. They broke above price resistance at 10800, then fell back briefly beneath this level only to hold rising 20 day EMA support. The TRAN then closed at another high on Friday. Railroads ($DJUSRR) and truckers ($DJUSTK) have been performing quite bullishly, but airlines ($DJUSAR) had been the laggard. That changed a bit on Friday as the DJUSAR spiked 2.76% and closed back above its 50 day SMA for the first time in more than two months:

There's much more technical work to be done here though. First, note that the PPO remains beneath its centerline. It's difficult to argue there's bullish momentum when the PPO is in negative territory. Next, it appears the 272-273 area could prove to be a difficult one with trendline resistance and the most recent price high intersecting there. But there are other bullish signs to recognize. Check out that increasing volume on Friday's big surge. It was the heaviest daily volume in the group during May and it accompanied price action that cleared the gap resistance established in late-April.

While there are mixed signals for airlines, lower crude oil prices and an already strengthening transportation group suggest the likelihood of continuing improvement for the DJUSAR.

>>> Read More

• DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.