Jan. 19, 2018

Dave Dierking, CFA

Summary

- A pair of blockchain ETFs debuted on Wednesday.

- Both funds will focus on companies that either invest in, develop or profit from blockchain technology.

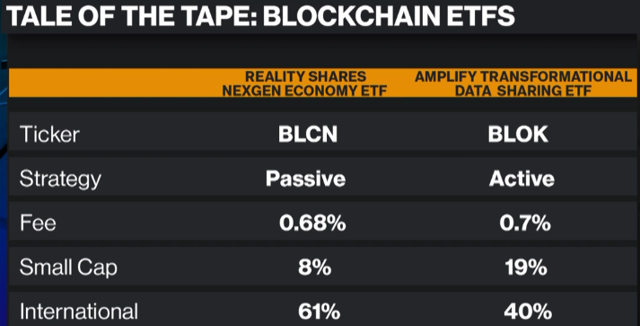

- BLOK is actively managed and BLCN is passively managed, but that's far from the biggest difference between the two.

- There's only 61% overlap between the two funds currently.

The funds have notable differences in small cap and international exposure, as well as methodologies for selecting names.

Bitcoin ETFs have gotten the thumbs down from SEC regulators, but ETFs based on their underlying technology are alive and well. Two brand new blockchain ETFs - the Amplify Transformational Data Sharing ETF (BLOK) and the Reality Shares Nasdaq NextGen Economy ETF (BLCN) - both debuted this week amid a lot of hype, a fair amount of concern from the SEC and some questions surrounding exactly how the two funds are different.

You’ll notice right off the bat that neither fund has the word “blockchain” in its name. That’s not by accident, as the SEC came in at the last minute and asked both providers to rename their funds or risk delaying their launch. The SEC’s concern is understandable. In recent weeks, we’ve seen a number of companies make strategic 180 degree turns, add “Blockchain” to their name and see their stock prices skyrocket by several hundred percent. The SEC’s primary concern is that investors are going to invest in a product they don’t really know much about just because it has “Blockchain” in the name, and put themselves at substantial risk of losses. The other concern is that these funds aren’t pure blockchain plays. Both of these funds have names, such as Intel (INTC), JPMorgan Chase (JPM) and Microsoft (MSFT), in their portfolios. While these companies are indeed developing blockchain-related technology, it’s a very small part of their overall business model at the current moment. That being said, the two funds are still being warmly received by investors. Combined, the two funds are going to near $40 million in shares traded on their opening day, and well over that on their second.

At first blush, it might seem like the biggest differentiator between the two funds is that BLOK is actively managed and BLCN is a passive index fund. While that’s true, the two portfolios are actually quite different and they go about selecting names for them in distinct ways. According to Bloomberg, the two funds only have 61% overlap in assets, and both have their individual sources of risk. BLCN has a much larger percentage of assets dedicated to overseas companies, while BLOK has much more invested in small caps.

To better understand how these two blockchain ETFs compare and contrast, let’s break down each one.

Reality Shares NexGen Economy ETF (BLCN)

BLCN is benchmarked to the Reality Shares NexGen Economy Index, an index that selects and weights companies according to its proprietary Blockchain Score. In short, the index looks to include only those companies which have made a meaningful investment and commitment to blockchain technology development, and avoid those companies which have made radical strategic pivots to blockchain, but have yet to really commit to the space.

The Blockchain Score is developed by looking at seven distinct factors. Some of these factors include the number of blockchain-related patents or corporate filings issued by companies, the presence in the blockchain community through institute memberships, such as the Ethereum Enterprise Alliance, and the overall potential impact to the blockchain economy. In other words, you won’t (yet) find names, such as Riot Blockchain (RIOT), Kodak (KODK) or Long Blockchain (LBCC), anywhere in this portfolio.

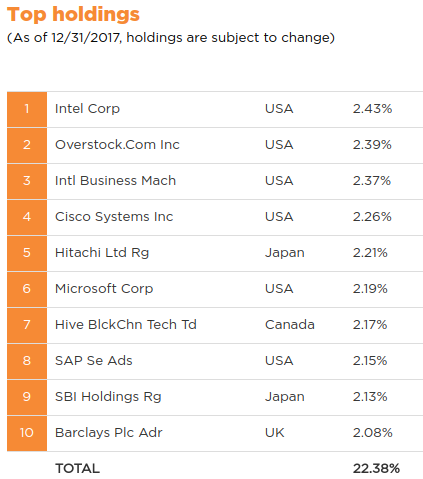

Look at the composition, though, and one trend remains clear.

Investors hoping for a pure blockchain play are going to be very disappointed. BLCN reads a lot like a large cap tech ETF with some more focused blockchain businesses thrown in. Granted, each of these mega-techs is making meaningful investments into blockchain, but how much is that really going to impact the company’s bottom line?

Amplify Transformational Data Sharing ETF (BLOK)

As mentioned, BLOK is actively managed and, as such, may be better positioned to react to rapid developments in the space. In pursuing its investment strategy, the fund’s portfolio managers seek investments in companies across a wide variety of industries that are leading in the research, development, utilization and funding of transformational data sharing technologies. Their involvement in blockchain is defined as:

actively engaging in the research and development, proof-of-concept testing, and/or implementation of transformational data sharing technology.

profiting from the demand for transformational data sharing applications such as transaction data, cryptocurrency and supply chain data.

partnering with and/or directly investing in companies that are actively engaged in the development and/or use of transformational data sharing technology.

acting as a member of multiple consortiums or groups dedicated to the exploration of transformational data sharing technology use.

In this sense, the methodology of BLOK is similar to that of BLCN, except that it takes a more qualitative, human-involved approach. Despite the relative similarity in approaches, the top 10 of BLOK also looks much different than BLCN’s.

BLOK and BLCN only share five names in their top holdings, and BLOK is much more top-heavy (61% of assets in the top 15 holdings for BLOK, compared to just 32% for BLCN). Given its much larger focus on small caps, BLOK could have a bit more “boom or bust” potential. These companies can be more quickly and deeply affected by advances in blockchain, which could be either good or bad depending on how successful they are at blockchain development.

Conclusion

The SEC demanded that these two ETFs remove the word “blockchain” from their names, but investors appear to be having little trouble finding them. The two funds combined are poised to pass $100 million in trading volume on just their second, putting them ahead of the pace of the recent successful launch of the Marijuana ETF (MJX).

I like that both of these funds have a nice mix of both tech and financials exposure, about 85% of assets total in both funds, with a mix of about ? tech and ? financials. One of the biggest “concerns”, obviously, is that these ETFs are far from pure blockchain plays. Scanning through the holdings of each fund, I’d estimate that only about 10% of assets are near-pure blockchain plays. Currently, these funds are more large-cap tech and financials ETFs, but there’s a lot of blockchain-related growth potential here.

These funds are probably headed towards billion-dollar status at some point in the relatively near future. Even though BLOK is looking like the very early leader in the race between the two (it’s trading at about double the volume of BLCN), I like BLCN in the long term given it’s passive nature, its slightly lower expense ratio (it’s a very minor difference, but even small differences in expense ratios have shown to be big drivers in net flows) and more quantitative approach to stock selection. Given the current buzz around blockchain and cryptocurrencies, both of these funds have the look of successful launches.

CBD Life Sciences Inc. (CBDL) Launches High-Demand Mushroom Gummy Line for Targeted Wellness Needs, Tapping into a Booming $20 Billion Market • CBDL • Oct 31, 2024 8:00 AM

Nerds On Site Announces Q1 Growth and New Initiatives for the Remainder of 2024 • NOSUF • Oct 31, 2024 7:01 AM

Innovation Beverage Group Receives Largest Shipment of its Top-Selling Bitters to Date in the U.S.-Ready to Meet Growing Demand from Expanding Distribution Network • IBG • Oct 30, 2024 12:22 PM

Element79 Gold Corp to Update Investors on the Emerging Growth Conference on October 31, 2024 • ELMGF • Oct 30, 2024 9:08 AM

CBD Life Sciences Inc. (CBDL) Announces Grand View Research Report Findings on High - Growth CBD Equine Market, Aiming to Drive Unprecedented Shareholder Value • CBDL • Oct 29, 2024 10:19 AM

Integrated Ventures Announces Partnership And Lease Agreement with Driptide Wellness - Leading Health and Wellness Provider. • INTV • Oct 29, 2024 8:45 AM