| Followers | 75 |

| Posts | 8725 |

| Boards Moderated | 0 |

| Alias Born | 06/05/2014 |

Monday, October 16, 2017 4:26:47 AM

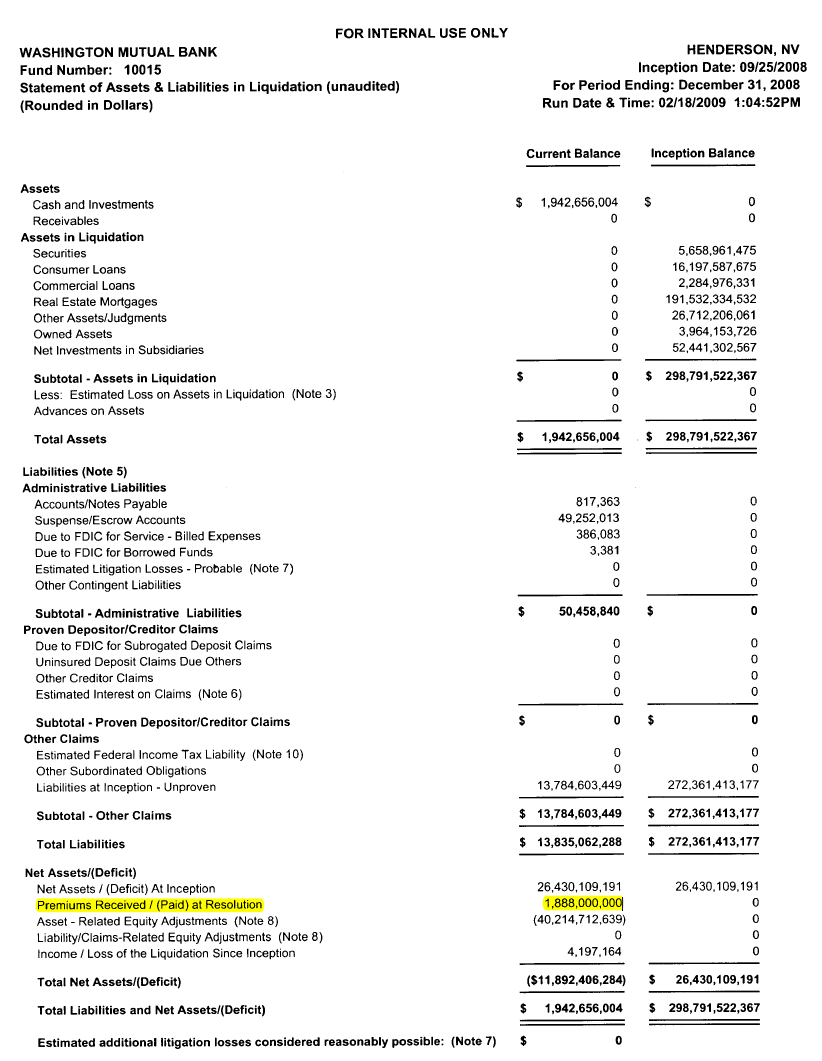

Do you know this document?

These $40.2 B in "asset - related equity adjustmens" is exactly the sum of the "Subtotal - Other Claims" ($13.7B) (IMO the WMB Bonds which JPM did not acquire) and the total equity "Net Assets At Inception" ($26.4B), which JPM either did not get at the time of the inception or had to pay for it later IMO

$13,784,603,449 + $26,430,109,191 = $40,214,712,640 (1$ rounding difference)

Or is there another reason why the FDIC subtracts the $26B in equity in addition to the 13.7B Liabilities?!?

Note: These $40.2B is also roughly the difference from your $258.5B to the $299B from your post

$299B - $258.5B = $40.5

BTW, thank you for your post although I DO NOT believe your calculations and assumptions about the mortgages and $299B coming back to the estate are true.

I am in the camp of $10B to $30B...

FDIC internal inception balance sheet, as of 09/25/2008:

Your post:

Just a little Research and all IMHO…

This is how I see the bankruptcy liquidation and it’s only possible out come…

All IMHO…

This is a Whole Bank… Bankruptcy liquidation…

Everything must be sold…and the Debt and contractual obligations must be repaid by order of seniority… and the rest must be distributed to equity…

On 9/25/2008…

Washington Mutual Bank and Washington Mutual Bank fsb… along with the loan portfolio was seized… and sold to JPMC… in pursuant to the Purchase and Assumption Agreement…

The loan portfolio… was WMI’s predominate source of revenue… so, with out it…

On 9/26/2008… the very next day… WMI/WMIIC filed for Bankruptcy… All the Assets now must be liquidation and turned into cash… the Debt and contractual obligations must be paid… and the rest will be distributed to equity… this is Bankruptcy law.

From WMI LIQUIDATING TRUST, 2016 10-K (link at Bottom)

…The FDIC sold substantially all the assets of WMB, including the stock of WMB fsb, to JPMorgan Chase Bank, National Association (“JPMC”), pursuant to that certain Purchase and Assumption Agreement, Whole Bank, dated September 25, 2008 (the “Purchase and Assumption Agreement”).

Washington Mutual Bank fsb (“WMB fsb”), is a subsidiary of Washington Mutual Bank (“WMB”), which is a subsidiary of WMI… the holding company… WMI owned everything. Which now has to be sold and converted to cash.

IMHO… This cash is at the FDIC corporate and soon to be at the WMI Liquidating Trust.

In 2008 we can see Assets of $258,576,810,000

Here from the…

FEDERAL DEPOSIT INSURANCE CORPORATION (FDIC)

MERGER DECISIONS ANNUAL REPORT TO CONGRESS (2008)

Failed or Closed Bank Mergers (link at Bottom)

From page 18.

Total Assets (000’s)

JPMorgan Chase Bank, NA 1,378,468,000

Assets Acquired (000’s)

Washington Mutual Bank 258,576,810

Note that it says “Assets Acquired” and not liabilities Acquired.

This is a list of all Assets…

“Assets Acquired” would include Assets with out liabilities and Assets with liabilities.

“Liabilities Acquired ” would only include Assets with liabilities.

The $258 Billion is a list of mix Assets with liabilities, like mortgages with a financial obligation… and Assets that are free and clear of any liabilities… no Debt was acquired.

The $258,576,810,000 would be for the two Banks, the Deposit and servicing rights and the loan portfolio…

So… From the FDIC in 2008 we have “Assets Acquired” by JPMC … $258,576,810,000

On January 13, 2010 - Testimony before the Financial Crisis Inquiry Commission

JPMC states…

With the acquisition, we purchased approximately $240 billion of mortgage and mortgage related assets… with $160 billion in deposits…. and $38 billion in equity… We immediately wrote down most of the bad or impaired assets (approximately $31 billion)…. and established proper reserves for the remaining assets, ….as well as for severance and close-down costs.

So now here in 2010… we have, $240 billion of mortgages and mortgage related assets…

(Which are the Assets with a financial obligation associated with them. Or we can say… there the Assets Acquired with liabilities)

And the 1.9 Billion Dollars JPMC paid for the Deposit and servicing rights…

And $38 billion in equity, which are Assets minus their Debt, like the 2 Banks. . (The Assets Acquired with out liabilities)… no Debt was acquired

$240 billion plus 1.9 Billion plus the $38 billion.

Is equal to $279.9 Billion Dollars…

JPMC said, “we purchased approximately $240 billion of mortgage and mortgage related assets…”

Then JPMC said, “and established proper reserves for the remaining assets”

Which means they paid $279.9 Billion Dollars between 2008 and 2010…

Which was for the mortgages and mortgage related assets… plus the Deposit and servicing rights and the $38 billion in equity…

Then they said… they set aside money for the remaining assets…

You set money aside… for the “remaining assets”… Only if you already paid for the main portion of the Assets…

So… From JPMC, in 2010… we now see… Assets purchased $279.9 Billion Dollars.

Then in 2015 we see… $299 Billion Dollars…

From… the Third Quarter 2015 CFO Report to the Board… page 7. (Link at Bottom)

”Excludes WAMU with total assets of $299 billion and zero estimated losses to the DIF” (Deposit Insurance Fund)

If we take the $299 Billion and subtract the $279.9 Billion we get $19.1 Billion Dollars…

So… the $19.1 Billion Dollars represents the “remaining assets”… and were paid for between 2010 and 2015… this is from the FDIC-Corporation in 2015…

So… From JPMC and the FDIC, from 2008 to 2015… it’s now… Assets Acquired and purchased $299 Billion Dollars… This is cash money…

In a Prepared Statement from MARY F. WALRATH U.S. BANKRUPTCY JUDGE Dated MARCH 23, 2017… (Link at Bottom)

PREPARED STATEMENT OF MARY F. WALRATH U.S. BANKRUPTCY JUDGE FOR THE DISTRICT OF DELAWARE before UNITED STATES HOUSE OF REPRESENTATIVES

She states…

The WaMu bankruptcy case was by many objective standards a successful case. In excess of $7 billion was distributed to creditors and shareholders. Virtually all creditors received 100% of their claims with post-petition interest and shareholders received stock and warrants in a subsidiary that was capitalized with $150 million in new money.

Here where she says…. “In excess of $7 billion was distributed to creditors and shareholders. Virtually all creditors received 100% of their claims with post-petition interest”…

She said 100% of all creditors were paid in full… with about $7 billion Dollars…

So the Debt went down from its $13.8 Billion to about $7 Billion…

The Initial Distribution…

Here from the… WMI LIQUIDATING TRUST, 2016 10-K

It states…

On or about the Effective Date, the Debtors distributed $6.5 billion of cash to creditors with Allowed Claims (“Initial Distribution”).

As we can see the Initial Distribution just about paid off all of the creditors Debt…

I believe the $7 Billion Dollars… includes lawyer’s fees, court fees, and the FDIC’s fees…

So if we take the $299 Billion and add about $7 billion Dollars… this would represent the total value of the WaMu Estate… $306 Billion Dollars… and if we add in the rounding off portion and the “In excess of “ portion… it would be closer to the OTS Fact Sheet Statement… (Office of Thrift Supervision)

OTS Fact Sheet on Washington Mutual Bank (link at Bottom)

Total assets as of June 30, 2008: $307.02 billion

We went from $258 Billion Dollars to $306 Billion Dollars in “Assets Acquired”, and when we subtract the $7 Billion to pay the Debt, it’s $299 Billion Dollars…

The $299 Billion Dollars is free from any Debt or financial obligation.

IMHO…

The $299 Billion Dollars, would be all cash from the sale of all the Assets to JPMC

So… even if WMIH could or wanted to buy Assets from the WMI-LT… they cant because all the Assets were sold to JPMC in a whole Bank purchased… it’s this cash from the sold Assets that will go to equity…

I’ve seen some take the $299 Billion and subtract the $258 Billion…

Thinking that the $258 Billion… is the MBS liability… and as a liability it must be repaid…

If you pay the MBS investors $258 Billion Dollars… you’re also giving them the cash from the free and clear Assets… (Which is the company’s equity)

The $258 Billion Dollars… doesn’t represent the amount owed to the MBS investors…

The $258 Billion Dollars represents the price or Book Value of the Assets, which have a financial obligation, associated with them (it’s not the amount of the obligation)…

It’s the Total of those Assets, plus the Assets that are free and clear of any liabilities … At this point in time, In 2008…

For example… all IMHO…

Lets look at it as one investment…

WaMu creates a mortgage for the homeowner… the homeowner pays WaMu a monthly payment … the principle amount of the payment goes to pay down the principle amount of the mortgage… and the interest part of the payment, is WaMu’s profit…

WaMu receives the entire monthly payment… So WaMu owns the entire investment…

WaMu has to wait 30 years to recoup their investment… so instead of waiting 30 years…

WaMu creates a security… and uses half the mortgage payment to pay back the security (to make it easier for me I’m going to say half-and-half)

WaMu sells the securities to the investors… the investors pay WaMu cash money… this is like WaMu borrowing money from the investors… so… as a guarantee, WaMu use half the mortgage payment to pay back the investors (the owners of the securities)

The investors receive half the principle amount and half the interest from the monthly payment… So the securities are backed by the mortgage payments (known as MBS)… this is the financial obligation to the MBS investors (it’s the liability associated with the mortgages)…

Even though WaMu owns the mortgage… WaMu receives half the mortgage payment and the MBS investors receive half the mortgage payment…so from an investment point of view… WaMu owns… half the investment and the MBS investors own half the investment.

So… when the new bank (JPMC) comes in and wants to buy this investment…

JPMC pays WaMu, for WaMu’s half of the investment… (This would be the mortgage part of the $258 Billion Dollars in the Assets Acquired) and instead of paying the MBS investors for their half of the investment… JPMC leaves their part as is…and just assumes the financial obligation to the MBS investors…

JPMC took WaMu’s position in WaMu’s half of the investment… and the MBS investors half stays the same.

So… we can’t take $258 Billion Dollars away from the $299 Billion Dollars and pay the MBS investors … because the MBS investors are being repaid from their half of the mortgage payments… which is their half of the investment, and is still intact…

The $258 Billion Dollars represents the Assets Acquired, which have a financial obligation, associated with them… and the Assets that don’t… it’s not the Debt or the amount owed to the MBS investors…

Also…

If the $258 Billion Dollars represents the Debt to the MBS investors

You would be paying off the entire MBS portfolio… all of the MBS investors would be paid in full… and no one would be making money… including the MBS investors… There would be no need for the MBS Trust or a Trustee… and if all the MBS are paid in full… you have to ask yourself… what did JPMC Assume?

From ROSEMARY M. COLLYER court…

“… and JPMC assumed liabilities under the P&A Agreement of roughly $300 billion”

And also… Taking $258 Billion from $299 Billion would imply WaMu had $258 Billion in Debt… which we know they don’t … the Debt is only $7 Billion Dollars…

IMHO

JPMC paid $258 Billion Dollars to WaMu for the Assets… and assumed the financial obligation, associated with them…

The $258 Billion is a mix of Assets with liabilities, like mortgages with a financial obligation… and Assets with no liabilities like those that are free and clear of any liabilities…

It’s a list of total Assets… at a particular point in time…2008

In my example, I used half-and-half…

If WaMu’s half is $240 billion in mortgages… then the MBS investors half is $240 billion in mortgage back securities… and they will receive their half of the mortgage payments… with their interest (their profit), until their paid in full…

In a scenario where WaMu had to pay off the MBS investors…

JPMC would have to pay WaMu for both halves of the investment… which would be $480 Billion Dollars… then WaMu would pay the MBS investors their half, $240 Billion and WaMu would keep their half of the $480 Billion… which is $240 Billion Dollars… either way WaMu receives their $240 Billion Dollars.

Then JPMC would create their own MBS, and sell them to new MBS investors…

This would allow them to recoup half of the $480 Billion Dollars and at the same time create a situation where they can charge the MBS investors a monthly fee for processing their payments… This would be an ideal situation for JPMC…

But this ideal situation already exist… all JPMC has to do, is pay WaMu for their half of the investment, the $240 Billion Dollars… and not the $480 Billion… then assume the obligation to the current MBS investors… and charge the current MBS investors a monthly fees, for processing their payments… This is the ideal situation…

It works out for JPMC… it works out for WaMu and it works out for the MBS investors.

So… if the $258 Billion Dollars from 2008… is now, $299 Billion Dollars in 2017… and all of the Debt has been paid … and all the financial obligations has been assumed by JPMC…

Then the $299 Billion Dollars is free from any Debt or financial obligation.

This amount would go to the old Equity Holders…$299 Billion Dollars

From these next three excerpts… we can see the bankruptcy liquidation process and it’s only possible out come…

This first part…

From the FDIC Book titled “Managing the Crisis”

CHAPTER 10, TREATMENT OF UNINSURED DEPOSITORS AND OTHER RECEIVERSHIP CREDITORS page 249 (link at Bottom)

National Depositor Preference

The National Depositor Preference Amendment (Public Law No. 103-66 Section 3001

[a]), enacted on August 10, 1993, standardized the asset distribution plan for all receiverships, regardless of the institution’s charter, and gave priority payment to depositors, including the FDIC as “subrogee” for insured deposits.

…claims are paid in the following order of priority:

1. Administrative expenses of the receiver;

2. Deposits (the FDIC claim takes the position of the insured deposits);

3. Other general or senior liabilities of the institution;

4. Subordinated obligations; and

5. Shareholder claims.

As we see…

All receivership distributions of asset… are standardized and are paid by order of seniority…

Item #1. Administrative expenses of the receiver; are paid first… this is why I believe the $7 Billion Dollars… includes lawyer’s fees, court fees, and the FDIC’s fees…

I want to point out…

Number 5. Shareholder claims… Whether it’s a creditors claim or a Shareholder claim… the word “claim” refers to their claim on the Assets…

As in this excerpt from Annex C.

… Further, distribution to Tranche 6 will be shared 75% and 25% pro rata between claims on account of Preferred Equity Interests and Common Equity Interests, respectively.

Preferred and Common Equity Interests… refers to their claim on the Assets… It’s everyone’s individual brokerage account combined… What you had in your brokerage account as shares of WAMU… is your claim…

And since… All of the Assets are being converted to cash… your claim is on that cash…

In short… your Equity Interests… is your claim on the Assets… or your claim on the proceeds from the sale of the Assets…

This next excerpt is from…

Bank Liability Structure

By… Suresh Sundaresan and Zhenyu Wang, March 2014

Sundaresan is from the Graduate School of Business at Columbia University.

Wang is from the Kelley School of Business at Indiana University

From page 8.

A typical bank is owned by its common equity holders, who garner all the residual value and earnings of the bank after paying the contractual obligations on deposits and subordinated debt. The first slice of value that equity owners lay claim to is the difference between assets and debt: V - (D + D1), also on the liability side in Figure 1. This slice, referred to as the tangible equity or book-value of equity, is the value equity holders would receive if bank assets are liquidated at fair value and all debt is paid off at par. A larger book-value of equity means a smaller loss for depositors and subordinated debt holders at after liquidation. Hence, regulators regard it as bank capital of the highest quality, the core Tier 1 capital.

(We can’t go around that first sentence… A typical bank is owned by its common equity holders)

The first slice of value that equity owners lay claim to is the difference between assets and debt: V - (D + D1)

$299 Billion = $306 Billion in Assets - $7 Billion in Debt

Book-value of equity = $299 Billion

So…

It’s the common equity holders… who have the contractual obligation to the other investors… including the preferred shareholders…

As the owners of the company… it’s the common equity holder’s Assets that have to be liquidated and turned into cash… this cash and all of the other cash from WaMu’s bank accounts, plus the tax returns. And the cash generated from its subsidiary WMMRC in runoff mode … (now WMIH’s subsidiary)… plus the liquidation of WMI/WMIIC.

It’s all of this cash, (about $306 Billion Dollars) that is used to pay off any debt or contractual obligations… including the Preferred Shareholders.

And any money left over… it’s distributed among the common equity holders…

This is how I see the End…All IMHO… GLTA

With all due respect, and thank you all for all of your due diligence.

Stay safe… Stay healthy

Sorry for the long post…

All IMHO and GLTA…

Jiminy…

Jiminy Christmas…

Just my opinion, research and curiosity…

Not intended to serve as a basis for investment in any security of any issuer. GLTA

WMI LIQUIDATING TRUST, 2016 10-K

(FDIC) MERGER DECISIONS ANNUAL REPORT TO CONGRESS (2008)

Third Quarter 2015 CFO Report to the Board… page 7

Prepared Statement from MARY F. WALRATH U.S. BANKRUPTCY JUDGE

OTS Fact Sheet on Washington Mutual Bank

From the FDIC Book titled “Managing the Crisis”

From the FDIC Book titled “Managing the Crisis” CHAPTER 10, page 249

Bank Liability Structure

=====> Just my personal opinion, no investment advice!

=====> I am long WMIH

Recent COOP News

- Mr. Cooper Group Reports First Quarter 2024 Results • Business Wire • 04/24/2024 11:00:00 AM

- Mr. Cooper Group Announces Two New Senior Leaders • Business Wire • 04/23/2024 01:00:00 PM

- Mr. Cooper Group Inc. to Discuss First Quarter 2024 Financial Results on April 24, 2024 • Business Wire • 04/05/2024 03:37:00 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/11/2024 09:34:36 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/04/2024 11:05:39 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/04/2024 11:04:15 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/04/2024 11:03:04 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/04/2024 11:01:41 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/04/2024 10:59:25 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/26/2024 09:28:25 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/14/2024 09:15:59 PM

- Form 3 - Initial statement of beneficial ownership of securities • Edgar (US Regulatory) • 02/09/2024 09:13:50 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/09/2024 12:00:29 PM

- Mr. Cooper Group Reports Fourth Quarter 2023 Results • Business Wire • 02/09/2024 12:00:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/01/2024 09:30:02 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/30/2024 09:26:40 PM

- Mr. Cooper Group Inc. Announces Pricing of Offering of $1 Billion of Senior Notes • Business Wire • 01/29/2024 11:02:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 01/29/2024 12:55:56 PM

- Mr. Cooper Group Inc. to Discuss Fourth Quarter 2023 Financial Results on February 9, 2024 • Business Wire • 01/11/2024 09:55:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 01/09/2024 09:00:53 PM

- Mr. Cooper Group Appoints Mike Weinbach as President • Business Wire • 01/09/2024 09:00:00 PM

- Meta CEO Sells $428 Million in Shares Since November, AMC Hits New Record Low, and More • IH Market News • 01/04/2024 09:51:01 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/02/2024 09:19:20 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 12/29/2023 08:45:45 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 09:08:37 PM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM

Avant Technologies to Implement AI-Empowered, Zero Trust Architecture in Its Data Centers • AVAI • Apr 29, 2024 8:00 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • BLO • Apr 25, 2024 8:52 AM