Monday, July 03, 2017 2:09:06 PM

1H-2017 /Q2 SheffStation Portfolio results :)

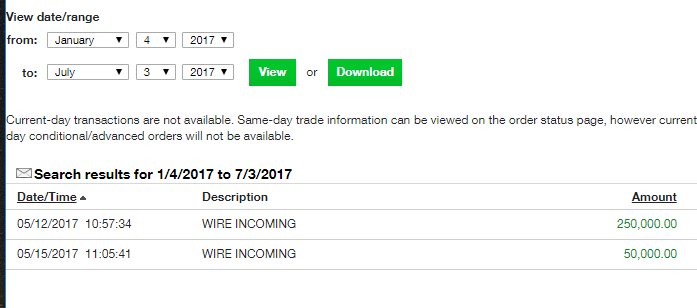

Q2-17 YTD up 72.8% from starting value 1,250,000. Ending value $2,160,930 (actual $2,460,930 see screen cap below. Added $300k cash in May)

Another solid trading quarter, although the first two months seemed like two steps forward and 1 or 2 steps back. Hopefully my results are proof postitive that Sheff's bio trading style works!!!! I am probably a little more patient then Sheff with my trades and maybe I trade a few larger SMID's, othewise we are pretty similar. Alternatively my version of a Total Economy portfolio (mainly bio's but larger SMIDS and companies like $CELG) is also doing well, easily outperforming IBB. But it's not having a 2017 like my SheffStation BioHunter account. I am finding it's more difficult to trade my BioHunter portfolio as the account value is now almost 2.5M. (actually today's close is 2.506M!) Some of the nano cap names Sheff and I like to catalyst trade can be a bit thin on daily volume. Going into 2H, I am going to be cautious around not giving too much back, so I may be less active and move position sizes down a bit.

Q2 Winners: traded $ADMP, $STML, $SELB, $SRPT, $NEOS, $DRRX, $ITEK, $AVEO, $ZSAN, $MRNS, $RXDX, $NBIX, $BLUE, $PIRS + several others, but these stand out from memory. Some like $NEOS, $STML and $ITEK, I traded 2 or 3 different times as they offered great channel trading.

$PIOE was a massive win as well. For those that followed that trade my SheffStation account had half my total pos. I made a few post on $PIOE IHub board.

Most who follow me know I have been pounding the table on $PIRS since 2016. It's been ripping in 2017 and I will continue to hold vs trade. I have trimmed some to keep position size to 12%

$MTNB - I gave back some of my Q1 booked gains on this one, but happy with how I traded and risk management. June 3 data gave traders an opp for early look at platform tech and efficacy. Traders then had opportunity to exit for only 10% loss. So risk reward for holding until June 3 was absolutely in my tolerance window. As most know after the NIH data I assumed they would fail VVC trial.

$PSDV was frustrating, traded and booked gain from 1.70 to 2.20-2.30. Then repurchased for data and gave a bunch back.

$VYGR, $CRVS, $ECYT, $CLRB, $SKLN, $MRUS, $EIGR were my main losing trades. I am still suffering with $VYGR and $CLRB. See below on active positions.

Trading lessons - $CRVS mainly re learning known lessons. Book profits, pigs get happy hogs get slaughtered. Purchased at $13-$14 but did not take enough profits at $20's and got smashed AAN poster data. Ultimately exited $10-11. $EIGR I was not aggressive enough on exit. Stock probably too thin for my account size, got smashed on it. $VYGR and $CLRB slow bleed down action, I tend to get caught in these slow bleeders, as mental stop losses didn't trigger. I don't use actual stop losses in bios due to bear raids near data and SMID bio daily vol. So I can struggle with loss management on the slooowwww bleeders. I do like $VYGR going into 2H with key catalyst July. The news last week should dampen the main bear argument around commercial viability.

Primary Current positions 3% or more:

$EARS - starter .66 ave

$STML - solid $7.90 ave (took 35% off table after data)

$VYGR - solid $10.8x ave

$PRTK solid pos $21.75 ave

$NEOS - 11% repurchased after PDUFA $7.45 ave

$AXSM solid 5.32 ave grabbe a bunch today

$ADMS starter $16.92

$EYEG starter $1.32

$DVAX solid $9.65

$VYGR solid $10.81

$CLRB starter $2.10

$PIRS - longterm hold 12% pos

$PIOE - full pos, holding for next leg as company needs to use M&A to unlock NOL (net operating tax loss ) which is their main asset post bankruptcy. ONLY NON BIO I OWN.

I own are am watching some of these others. Current pos size too small to list. $ARNA, $RPRX, $ABIO, $ACRX,$IPCI, $CERC. Overall I am 90%+ investest here. I think we move higher after the major breakouts of $XBI and $IBB. We might retest support, even so I would still be bullish here unless IBB breaks support with volume.

-TheBioHunter

@TheBio_Hunter

Post is information only. It is not meant to be a recommendation to buy or to sell securities nor an offer to buy or sell securities. My opinions only!

Q2-17 YTD up 72.8% from starting value 1,250,000. Ending value $2,160,930 (actual $2,460,930 see screen cap below. Added $300k cash in May)

Another solid trading quarter, although the first two months seemed like two steps forward and 1 or 2 steps back. Hopefully my results are proof postitive that Sheff's bio trading style works!!!! I am probably a little more patient then Sheff with my trades and maybe I trade a few larger SMID's, othewise we are pretty similar. Alternatively my version of a Total Economy portfolio (mainly bio's but larger SMIDS and companies like $CELG) is also doing well, easily outperforming IBB. But it's not having a 2017 like my SheffStation BioHunter account. I am finding it's more difficult to trade my BioHunter portfolio as the account value is now almost 2.5M. (actually today's close is 2.506M!) Some of the nano cap names Sheff and I like to catalyst trade can be a bit thin on daily volume. Going into 2H, I am going to be cautious around not giving too much back, so I may be less active and move position sizes down a bit.

Q2 Winners: traded $ADMP, $STML, $SELB, $SRPT, $NEOS, $DRRX, $ITEK, $AVEO, $ZSAN, $MRNS, $RXDX, $NBIX, $BLUE, $PIRS + several others, but these stand out from memory. Some like $NEOS, $STML and $ITEK, I traded 2 or 3 different times as they offered great channel trading.

$PIOE was a massive win as well. For those that followed that trade my SheffStation account had half my total pos. I made a few post on $PIOE IHub board.

Most who follow me know I have been pounding the table on $PIRS since 2016. It's been ripping in 2017 and I will continue to hold vs trade. I have trimmed some to keep position size to 12%

$MTNB - I gave back some of my Q1 booked gains on this one, but happy with how I traded and risk management. June 3 data gave traders an opp for early look at platform tech and efficacy. Traders then had opportunity to exit for only 10% loss. So risk reward for holding until June 3 was absolutely in my tolerance window. As most know after the NIH data I assumed they would fail VVC trial.

$PSDV was frustrating, traded and booked gain from 1.70 to 2.20-2.30. Then repurchased for data and gave a bunch back.

$VYGR, $CRVS, $ECYT, $CLRB, $SKLN, $MRUS, $EIGR were my main losing trades. I am still suffering with $VYGR and $CLRB. See below on active positions.

Trading lessons - $CRVS mainly re learning known lessons. Book profits, pigs get happy hogs get slaughtered. Purchased at $13-$14 but did not take enough profits at $20's and got smashed AAN poster data. Ultimately exited $10-11. $EIGR I was not aggressive enough on exit. Stock probably too thin for my account size, got smashed on it. $VYGR and $CLRB slow bleed down action, I tend to get caught in these slow bleeders, as mental stop losses didn't trigger. I don't use actual stop losses in bios due to bear raids near data and SMID bio daily vol. So I can struggle with loss management on the slooowwww bleeders. I do like $VYGR going into 2H with key catalyst July. The news last week should dampen the main bear argument around commercial viability.

Primary Current positions 3% or more:

$EARS - starter .66 ave

$STML - solid $7.90 ave (took 35% off table after data)

$VYGR - solid $10.8x ave

$PRTK solid pos $21.75 ave

$NEOS - 11% repurchased after PDUFA $7.45 ave

$AXSM solid 5.32 ave grabbe a bunch today

$ADMS starter $16.92

$EYEG starter $1.32

$DVAX solid $9.65

$VYGR solid $10.81

$CLRB starter $2.10

$PIRS - longterm hold 12% pos

$PIOE - full pos, holding for next leg as company needs to use M&A to unlock NOL (net operating tax loss ) which is their main asset post bankruptcy. ONLY NON BIO I OWN.

I own are am watching some of these others. Current pos size too small to list. $ARNA, $RPRX, $ABIO, $ACRX,$IPCI, $CERC. Overall I am 90%+ investest here. I think we move higher after the major breakouts of $XBI and $IBB. We might retest support, even so I would still be bullish here unless IBB breaks support with volume.

-TheBioHunter

@TheBio_Hunter

Post is information only. It is not meant to be a recommendation to buy or to sell securities nor an offer to buy or sell securities. My opinions only!

-BioHunter

Twitter: @TheBio_Hunter

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.