| Followers | 246 |

| Posts | 2992 |

| Boards Moderated | 1 |

| Alias Born | 06/16/2015 |

Monday, March 20, 2017 2:34:30 PM

Valuation JUST for the RAW oceanfront land recently acquired is calculated below based on a direct comparison to land in the area. It shows the value contributed to the PGUS pps equal to today's price - ALL BY ITSELF. And that's with no plan for use.

Add the plan for use - Cielo Mar - and that value goes up significantly. Add a first market offer for the Cielo Mar development and it's much higher still!

And in a few short months - before the end of this year, it goes up 10-fold from there with the master plan completed.

And now add the Ag business, which has high margins, the market is growing significantly every year and simply will not stop due to the increasing demand for produce in the U.S.... and the enormous amount of land we have for growth - and the fact that it is already being established with a $1.2M contract (with expected 55-60% profit margin).

Very much undervalued... high potential for gains such that you can hold a large position with very low risk...

Calcs and results are below, but refer to my much earlier post about this for more details and additional land "comps":

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=127900999 (post #32289)

Oceanfront Land - valuation in PPS (THIS IS NOT THE VALUATION FOR PGUS, JUST THE ADDITION TO THE VALUATION - see further below for the basis)

LAND ASSET VALUE UPON CLOSING (resale/market value), CONSERVATIVE ESTIMATE: $7.2M (ProGreen's portion)

CONTRIBUTION TO VALUATION = $8.08M / 350M (shares O/S) = $0.0231 pps

LAND ASSET VALUE UPON COMPLETION OF THE INITIAL MASTER PLAN DRAWINGS (PROPERTY OUTLINE, IMAGES, WHATEVER IS NEEDED FOR A MARKET OFFER OF RESERVATIONS OR ANYTHING) & INITIAL MARKET OFFERING: (10% x $921M) / 2 = $46M (ProGreen's portion)

CONTRIBUTION TO VALUATION = $46M / 350M (shares O/S) = $0.1314 pps

LAND ASSET VALUE UPON COMPLETION OF DETAILED MASTER PLAN AND PERMITS ISSUED: $921M / 2 = $460M (ProGreen's portion)

CONTRIBUTION TO VALUATION = $460M / 350M (shares O/S) = $1.314 pps

-----------------------------

Basis for LAND ASSET VALUE

We are looking at 2024 hectares (5000 acres), including 4.7 miles directly on the ocean (oceanfront). This 4.7 miles is ALL premium oceanfront, ALL with a view of the ocean and right on it, and much of the rest has direct views of the ocean from higher elevations - so, in MY mind, this is nearly ALL premium land. And it's in the perfect spot in a bay, the Bay of El Rosario, directly across from 2 little islands. A perfect location for the view, for fishing and watersports, for a marina, for whale watching and more!

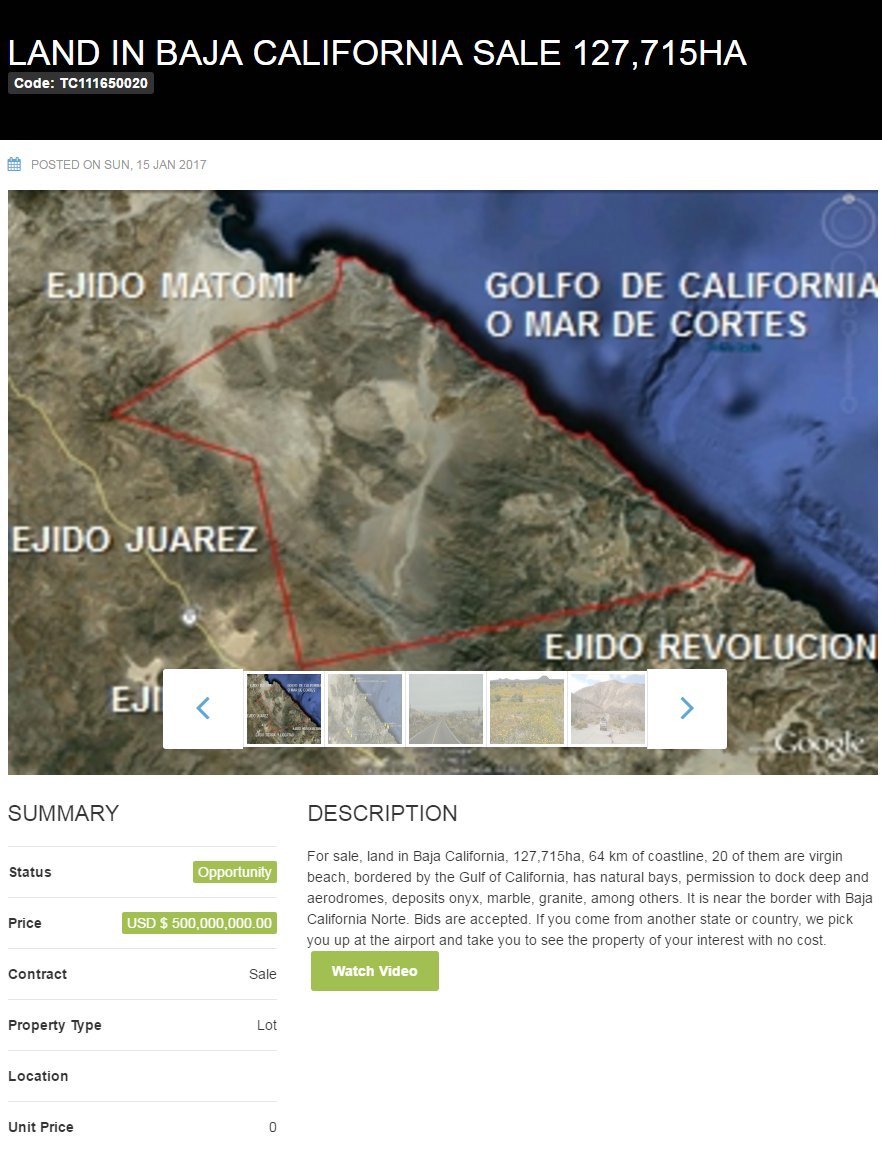

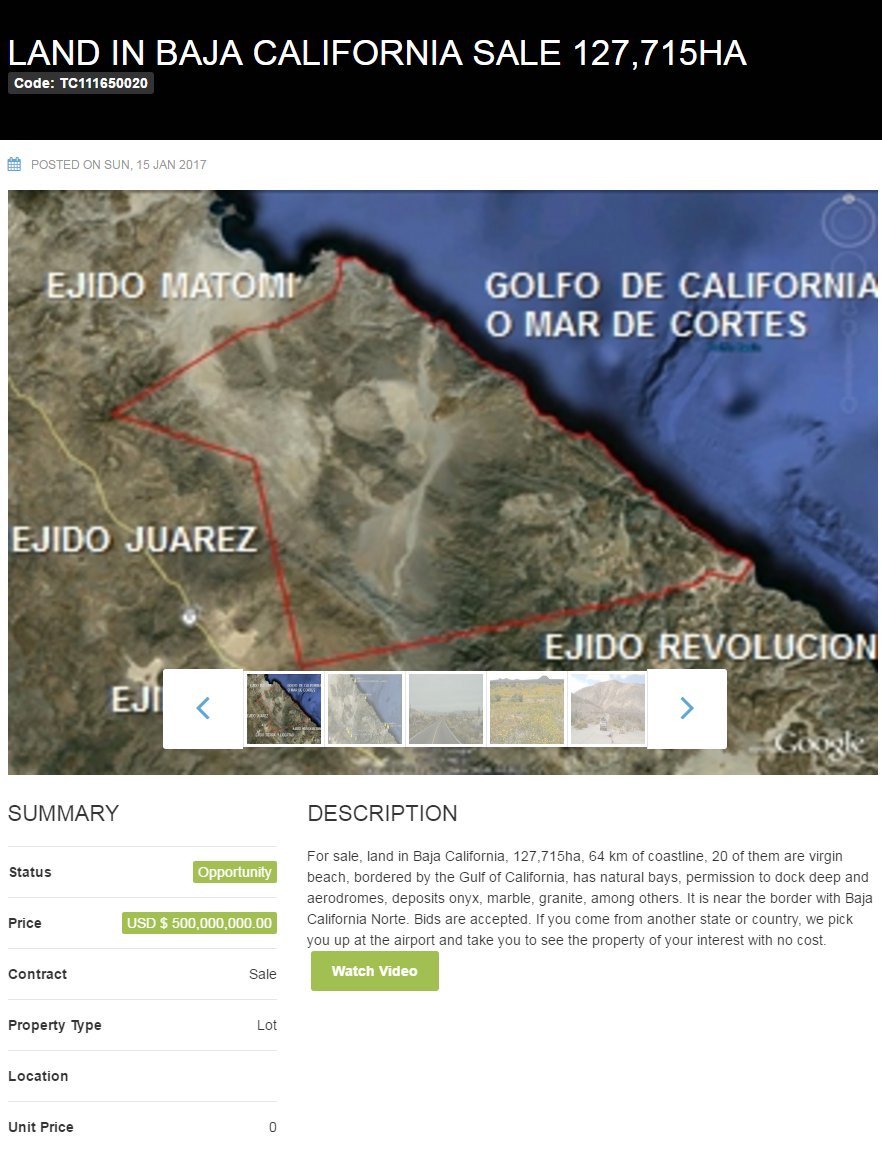

The following value estimation uses a piece of land that is currently on the market in Baja California:

https://cancun.estate/investment-opportunity-land-in-baja-california-bids-are-accepted

Note that this land is just "raw" land, with no plans. Not just no "master plan", but no plans at all, much like our Cielo Mar land before Jan first began forming the idea - certainly well before he even began negotiating the acquisition.

Using the link below, it can be seen that this land is fairly close to the region in Baja where we have the 5000 acres for Cielo Mar, and where ProGreen currently controls the 14,000 acres of land targeted initially for agricultural use.

https://www.google.com/maps/place/29%C2%B028'02.7%22N+114%C2%B010'12.0%22W/@29.6341925,-115.091991,149917m/data=!3m1!1e3!4m5!3m4!1s0x0:0x0!8m2!3d29.46742!4d-114.170002?hl=en

On the map in the link above, you can see where this land is located - the red "pin". To the left, in the bay area with the two small islands nearby... that is the Cielo Mar site.

Here's the advertisement for the $500M land (from the link above):

The image I created here gives a clearer view of the land:

The following 2 images are close-ups showing some sections with 3 or 4 miles of coastline. It can be seen here that large portions of this land could not be developed (very efficiently) for residential/commercial construction. Also, there is VERY LITTLE which could actually be developed with oceanfront views, far less than 1%. And much less that could actually BE on the oceanfront. So ANY portion of this land would have a MUCH LOWER lower value in the market than our Cielo Mar land.

Just to repeat what I stated above between the images - for clarity... Though this land shows up to maybe 3 or 4 miles of coastline, it can be seen here that large portions of this land could not be developed (very efficiently) for residential/commercial construction. Also, there is VERY LITTLE which could actually be developed with oceanfront views, far less than 1%. And much less that could actually BE on the oceanfront. So ANY portion of this land would have a MUCH LOWER lower value in the market than our Cielo Mar land. And ANY portion that COULD be developed like our land, IF it WOULD have the oceanfront, would therefore be priced MUCH HIGHER than the land in bulk.

This example has a market price of $500M for 127,715 hectares, which is about 69x the size of the land that we are acquiring: 127,715 / 2024 = 63.1.

So, the price for 2024 of the total 127,715 hectares would be $500M / 63.1 = $7.924M. But the great majority of the land in this example is completely unusable (or very difficult and therefore not feasible) for residential/commercial construction, and only a small portion could actually be called ocean"view" and much less could be ocean"front" as it pertains to residential properties. This is because of the rough terrain that constitutes the waterfront areas. Even the claim (in the ad) that 20 of the 64 km of coastline is "virgin beach" is a stretch, because much of that "beach" is backed directly by heavy terrain which would not allow for construction with a view of the water. Note that in the "kitchen sink" advertisement, the seller is also pitching the potential for mining on the land in an effort to assign some value to much of the land that cannot be used for construction (with this in mind - mining - it's also possible that much of this land is not very "green" if previous mining operations have contaminated soil and/or ground water supply).

From a real estate value perspective, if a buyer were to cherry pick smaller portions of the land offered in this example in order to obtain only the best land for developing waterfront views and premium waterfront properties, the price would be multiples of the bulk land price (per hectare). Arguably, the multiple could be 3x or higher, but for conservative estimating I will use a multplier of 2x. This number, though arbitrary, seems very reasonable considering that 20 of the 64km is considered "virgin beach" and that upon closer inspection a far smaller portion could even provide a view of the water. This gives a price of 2 x $7.924M = $15.848M.

ProGreen acquired the Cielo Mar land for ProGreen with Contel as part of the Procon JV, for "pennies on the dollar," and ProGreen owns 51% of Procon, so ProGreen sees 51% of value and proceeds. I previously guessed that we might be paying $1.44M for this land but, as it turns out, we paid $500K. But this has NOTHING to do with the actual value - of just the raw land, I mean, before any value is add from plans and of course future profits. With 51% ownership, we just added 51% x $15.848M = $8.08M in value to the business.

LAND ASSET VALUE UPON CLOSING (resale/market value), CONSERVATIVE ESTIMATE: $15.848M with $8.08M being ProGreen's portion at 51% ownership and controlling interest in Procon.

CONSERVATIVE VALUE ESTIMATE: With 350M O/S, the RAW LAND for Cielo Mar just added $8.08M / 350M = $0.0231 in value to the PPS.

Add the plan for use - Cielo Mar - and that value goes up significantly. Add a first market offer for the Cielo Mar development and it's much higher still!

And in a few short months - before the end of this year, it goes up 10-fold from there with the master plan completed.

And now add the Ag business, which has high margins, the market is growing significantly every year and simply will not stop due to the increasing demand for produce in the U.S.... and the enormous amount of land we have for growth - and the fact that it is already being established with a $1.2M contract (with expected 55-60% profit margin).

Very much undervalued... high potential for gains such that you can hold a large position with very low risk...

Calcs and results are below, but refer to my much earlier post about this for more details and additional land "comps":

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=127900999 (post #32289)

Oceanfront Land - valuation in PPS (THIS IS NOT THE VALUATION FOR PGUS, JUST THE ADDITION TO THE VALUATION - see further below for the basis)

LAND ASSET VALUE UPON CLOSING (resale/market value), CONSERVATIVE ESTIMATE: $7.2M (ProGreen's portion)

CONTRIBUTION TO VALUATION = $8.08M / 350M (shares O/S) = $0.0231 pps

LAND ASSET VALUE UPON COMPLETION OF THE INITIAL MASTER PLAN DRAWINGS (PROPERTY OUTLINE, IMAGES, WHATEVER IS NEEDED FOR A MARKET OFFER OF RESERVATIONS OR ANYTHING) & INITIAL MARKET OFFERING: (10% x $921M) / 2 = $46M (ProGreen's portion)

CONTRIBUTION TO VALUATION = $46M / 350M (shares O/S) = $0.1314 pps

LAND ASSET VALUE UPON COMPLETION OF DETAILED MASTER PLAN AND PERMITS ISSUED: $921M / 2 = $460M (ProGreen's portion)

CONTRIBUTION TO VALUATION = $460M / 350M (shares O/S) = $1.314 pps

-----------------------------

Basis for LAND ASSET VALUE

We are looking at 2024 hectares (5000 acres), including 4.7 miles directly on the ocean (oceanfront). This 4.7 miles is ALL premium oceanfront, ALL with a view of the ocean and right on it, and much of the rest has direct views of the ocean from higher elevations - so, in MY mind, this is nearly ALL premium land. And it's in the perfect spot in a bay, the Bay of El Rosario, directly across from 2 little islands. A perfect location for the view, for fishing and watersports, for a marina, for whale watching and more!

The following value estimation uses a piece of land that is currently on the market in Baja California:

https://cancun.estate/investment-opportunity-land-in-baja-california-bids-are-accepted

Note that this land is just "raw" land, with no plans. Not just no "master plan", but no plans at all, much like our Cielo Mar land before Jan first began forming the idea - certainly well before he even began negotiating the acquisition.

Using the link below, it can be seen that this land is fairly close to the region in Baja where we have the 5000 acres for Cielo Mar, and where ProGreen currently controls the 14,000 acres of land targeted initially for agricultural use.

https://www.google.com/maps/place/29%C2%B028'02.7%22N+114%C2%B010'12.0%22W/@29.6341925,-115.091991,149917m/data=!3m1!1e3!4m5!3m4!1s0x0:0x0!8m2!3d29.46742!4d-114.170002?hl=en

On the map in the link above, you can see where this land is located - the red "pin". To the left, in the bay area with the two small islands nearby... that is the Cielo Mar site.

Here's the advertisement for the $500M land (from the link above):

The image I created here gives a clearer view of the land:

The following 2 images are close-ups showing some sections with 3 or 4 miles of coastline. It can be seen here that large portions of this land could not be developed (very efficiently) for residential/commercial construction. Also, there is VERY LITTLE which could actually be developed with oceanfront views, far less than 1%. And much less that could actually BE on the oceanfront. So ANY portion of this land would have a MUCH LOWER lower value in the market than our Cielo Mar land.

Just to repeat what I stated above between the images - for clarity... Though this land shows up to maybe 3 or 4 miles of coastline, it can be seen here that large portions of this land could not be developed (very efficiently) for residential/commercial construction. Also, there is VERY LITTLE which could actually be developed with oceanfront views, far less than 1%. And much less that could actually BE on the oceanfront. So ANY portion of this land would have a MUCH LOWER lower value in the market than our Cielo Mar land. And ANY portion that COULD be developed like our land, IF it WOULD have the oceanfront, would therefore be priced MUCH HIGHER than the land in bulk.

This example has a market price of $500M for 127,715 hectares, which is about 69x the size of the land that we are acquiring: 127,715 / 2024 = 63.1.

So, the price for 2024 of the total 127,715 hectares would be $500M / 63.1 = $7.924M. But the great majority of the land in this example is completely unusable (or very difficult and therefore not feasible) for residential/commercial construction, and only a small portion could actually be called ocean"view" and much less could be ocean"front" as it pertains to residential properties. This is because of the rough terrain that constitutes the waterfront areas. Even the claim (in the ad) that 20 of the 64 km of coastline is "virgin beach" is a stretch, because much of that "beach" is backed directly by heavy terrain which would not allow for construction with a view of the water. Note that in the "kitchen sink" advertisement, the seller is also pitching the potential for mining on the land in an effort to assign some value to much of the land that cannot be used for construction (with this in mind - mining - it's also possible that much of this land is not very "green" if previous mining operations have contaminated soil and/or ground water supply).

From a real estate value perspective, if a buyer were to cherry pick smaller portions of the land offered in this example in order to obtain only the best land for developing waterfront views and premium waterfront properties, the price would be multiples of the bulk land price (per hectare). Arguably, the multiple could be 3x or higher, but for conservative estimating I will use a multplier of 2x. This number, though arbitrary, seems very reasonable considering that 20 of the 64km is considered "virgin beach" and that upon closer inspection a far smaller portion could even provide a view of the water. This gives a price of 2 x $7.924M = $15.848M.

ProGreen acquired the Cielo Mar land for ProGreen with Contel as part of the Procon JV, for "pennies on the dollar," and ProGreen owns 51% of Procon, so ProGreen sees 51% of value and proceeds. I previously guessed that we might be paying $1.44M for this land but, as it turns out, we paid $500K. But this has NOTHING to do with the actual value - of just the raw land, I mean, before any value is add from plans and of course future profits. With 51% ownership, we just added 51% x $15.848M = $8.08M in value to the business.

LAND ASSET VALUE UPON CLOSING (resale/market value), CONSERVATIVE ESTIMATE: $15.848M with $8.08M being ProGreen's portion at 51% ownership and controlling interest in Procon.

CONSERVATIVE VALUE ESTIMATE: With 350M O/S, the RAW LAND for Cielo Mar just added $8.08M / 350M = $0.0231 in value to the PPS.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.