| Followers | 245 |

| Posts | 2993 |

| Boards Moderated | 0 |

| Alias Born | 06/16/2015 |

Monday, January 16, 2017 7:25:33 PM

I see the current value PGUS as follows, based on numbers provided and the basis given further below.

DIRECT VALUE CONTRIBUTION FROM 1st LAND TRACT = $21.4M / 349M (shares O/S) = $0.061 pps

+

Very high intangible value of JV (incl. pennies-on-the-dollar land owner relationships) & contract assets (e.g. ~14,000 acres of land under control), and the strategic business entities formed in Baja

+

Speculative value of further business development within this year (including increased ag land use, acquisition of the oceanfront land)

I believe the intangible and speculative values are multiplicative and raise the direct value from the initially expected revenue stream by a factor of 2. As an emerging growth company that is only just beginning to generate revenue, this is a very reasonable adjustment, IMHO. So the value of PGUS at this moment is arguably in the range of $0.12 pps. PGUS is significantly undervalued with today's price being far less than a dime.

-----------------------------------------

I see the minimum value of PGUS upon closing the oceanfront land deal as follows, based on numbers provided and the basis given further below.

DIRECT VALUE CONTRIBUTION FROM 1st LAND TRACT = $21.4M / 349M (shares O/S) = $0.061 pps

+

Very high intangible value of JV (incl. pennies-on-the-dollar land owner relationships) & contract assets (e.g. ~14,000 acres of land under control), and the strategic business entities formed in Baja

+

LAND ASSET VALUE UPON CLOSING (resale/market value), CONSERVATIVE ESTIMATE: $7.2M (ProGreen's portion)

CONTRIBUTION TO VALUATION = $7.2M / 349M (shares O/S) = $0.021 pps

+

Speculative value of further business development within this year (including increased ag land use, oceanfront land development moving to the next level)

I believe the intangible and speculative values are multiplicative and raise the direct value from the initially expected revenue stream plus resale value of the oceanfront land by a factor of 2. As an emerging growth company that is only just beginning to generate revenue, this is a very reasonable adjustment, IMHO. So the minimum value of PGUS upon closing on the oceanfront land is arguably in the range of $0.16 pps - when including only the direct resale value of the property. However, much more is expected from this property, and this is where the valuation can be much higher and will be based entirely on the vision and speculation time horizon of investors. This is because in possibly a very short time - within a few short months - ProGreen could begin monetizing the oceanfront land, which could easily double the business value. And within perhaps this year even, we could see permits issued and the business could be valued 10x higher than that!

-----------------------------------------

Oceanfront Land Development (ProGreen Village) Valuation in PPS (see further below for the basis)

LAND ASSET VALUE UPON CLOSING (resale/market value), CONSERVATIVE ESTIMATE: $7.2M (ProGreen's portion)

CONTRIBUTION TO VALUATION = $7.2M / 349M (shares O/S) = $0.021 pps

LAND ASSET VALUE UPON COMPLETION OF THE INITIAL MASTER PLAN DRAWINGS & INITIAL MARKET OFFERING: (10% x $921M) / 2 = $46M (ProGreen's portion)

CONTRIBUTION TO VALUATION = $46M / 349M (shares O/S) = $0.132 pps

LAND ASSET VALUE UPON COMPLETION OF DETAILED MASTER PLAN AND PERMITS ISSUED: $921M / 2 = $460M (ProGreen's portion)

CONTRIBUTION TO VALUATION = $460M / 349M (shares O/S) = $1.32 pps

Agriculture Land Valuation in PPS Considering only the farmable portion, ~1/3 of the land

Revenue for growing / supply direct to US importers is on the order of 10 TIMES what we were expecting for leasing the land!

As an example, Contel could produce 2 cycles in a year, first cycle for garlic at $6,000 per acre PLUS the second cycle for onion at $4,000 per acre (I'm using the MIDRANGE values here). That's $10,000 per acre per year for growing, compared to the $800-$1,200 per acre per year for leasing!!

Using these MIDRANGE numbers, we see $10,000 per farmable acre - that's $10,000 x 150 acres = $1,500,000 revenue PER YEAR just from growing on HALF of THIS tract! If the farming operation costs are ~$300K (2 cycles x $150K/cycle), this gives a profit of $1.2M. ProGreen's portion is then $600K. Using the Stern "Current" P/E ratio of 35.65 for the farming/agriculture sector, this contributes a valuation of 35.65 x $600K = $21.4M.

With nothing else accomplished this entire year but utilization of the prepared 150 acres from the 1st 300 acre land tract:

PPS VALUATION (1st tract) = $21.4M / 349M (shares O/S) = $0.061 pps

Now consider "As more buyers are coming online, we are likely to accelerate further preparation of additional land for the growing operations in order to satisfy the increasing commitments, starting with the 760 HA* (1,900 acres) tract for which we have made the access road, referred to in the previous announcement in May."

Extending the growing operation to 400-600 (estimate - say 500) farmable acres on the 1,900 acre tract could yield $10,000 x 500 acres = $5M additional revenue. If farming operation costs are ~$1M ([500/150] x $150K/cycle x 2 cycles), this gives a profit of $4M. ProGreen's portion is then $2M. Using the "Forward" P/E ratio of 24.78 for the farming/agriculture sector, this contributes a valuation of 24.78 x $2M = $49.5M

PPS VALUATION (1,900 acre tract) = $49.5M / 349M (shares O/S) = $0.142 pps

And we have much more land under our control for further growth. If the growing operation were extended to, say 3,000 (estimate) farmable acres on the remaining ~11,100 acres (3-year option), we see additional revenue of $10,000 x 3,000 = $30M. If costs are ~$6M ([3,000/150] x $150K/cycle x 2 cycles), this gives a profit of $24M. ProGreen's portion is then $12M. Using the P/E ratio of 24.78 for the farming/agriculture sector, this contributes a valuation of 24.78 x $12M = $297M

PPS VALUATION (3-year option land under control) = $297M / 349M (shares O/S) = $0.851

-----------------------------------------

Basis for LAND ASSET VALUE

We are looking at 1842 hectares (4550 acres) PLUS whatever the additional 1.6 miles of oceanfront lands adds to this: 1842 hectares + 1.6 miles "linear" (for a total of 4.0 miles of oceanfront).

Since we don't know the added land size for the "+1.6 miles of oceanfront" I will just be conservative and use the 1842 hectares (and we can just KNOW that the value will be substantially higher due to the additional 1.6 miles of premium oceanfront land).

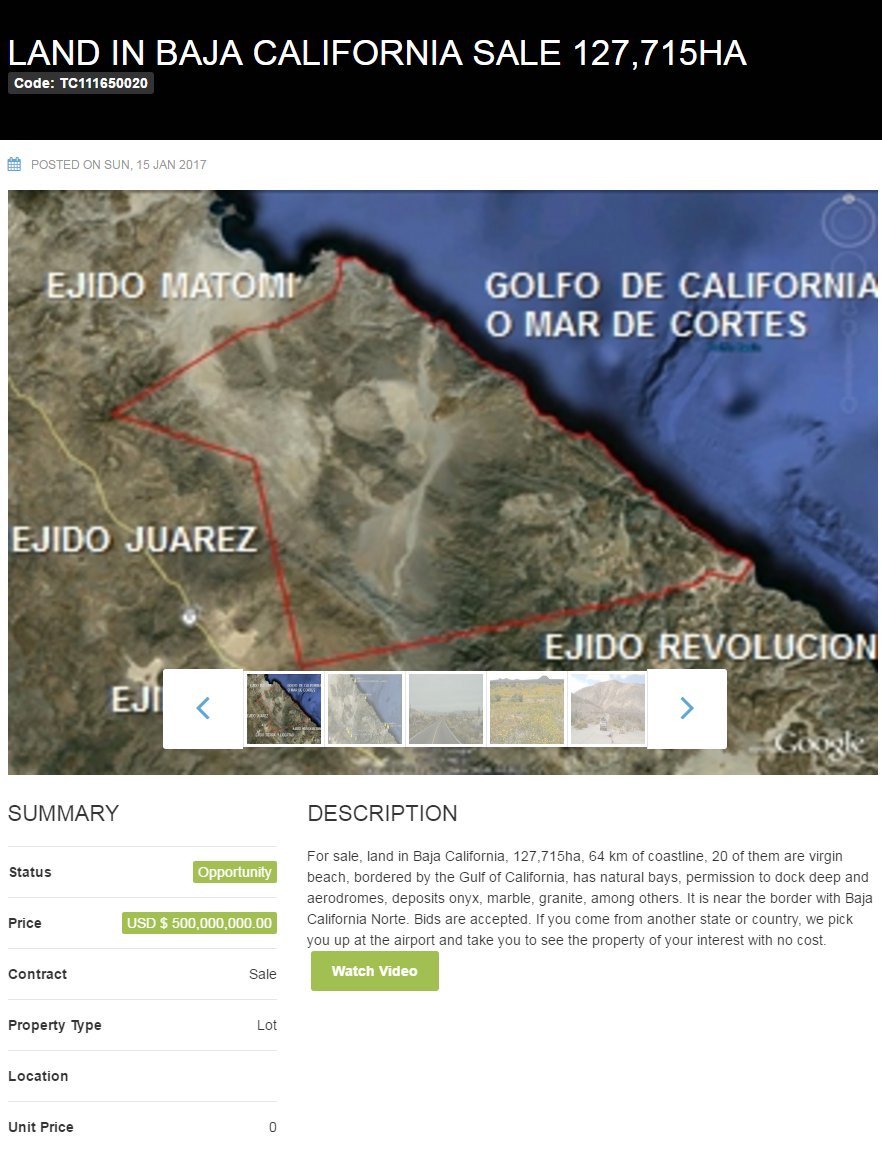

The following value estimation uses a piece of land that is currently on the market in Baja California:

https://cancun.estate/investment-opportunity-land-in-baja-california-bids-are-accepted

I am quite confident that this is not the land that we are acquiring, as I believe Jan when he states that we are acquiring land with 4.0 miles of oceanfront - he is describing land that can be developed on the 4 miles of oceanfront for residential/commercial construction. However, it is very applicable here for valuing the oceanfront land that we will be acquiring.

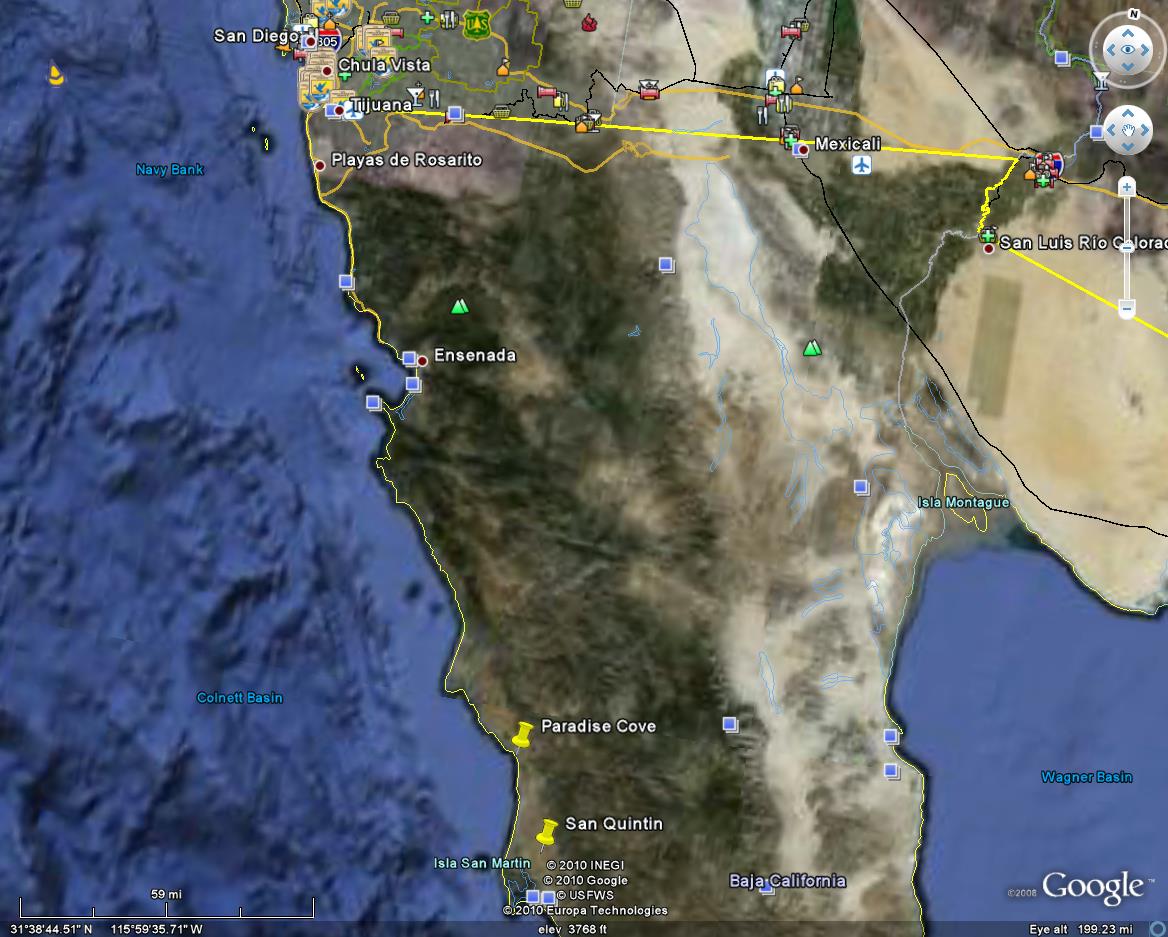

Using the link below, it can be seen that this land is fairly close to the region in Baja where ProGreen currently controls the 14,000 acres of land targeted initially for agricultural use. Though this land example is on the Gulf side, I expect that the land that we are acquiring is on the Pacific side. The Baja Peninsula is characterized by a mountain and hill range that more or less divides the two coastlines much like the Rockies divide the US. Since everything Jan has done to-date has been on the Pacific side, and his experience and connections seem to be on this side, it follows that the oceanfront property is likely to be on the Pacific side and, more to this point, is likely to be in the general latitudinal region of El Rosario (my opinion only). This link will open a Google map to the land, and zooming/panning can be used to see where the land is situated:

https://www.google.com/maps/place/29%C2%B028'02.7%22N+114%C2%B010'12.0%22W/@29.3362926,-114.4544302,105830m/data=!3m1!1e3!4m5!3m4!1s0x0:0x0!8m2!3d29.46742!4d-114.170002?hl=en

The image I created here gives a clearer view of the land:

The following 2 images are close-ups showing some sections with 3 or 4 miles of coastline. It can be seen here that large portions of this land could not be developed (very efficiently) for residential/commercial construction, and so would likely have a much lower value in the market than what Jan is acquiring for ProGreen.

This example has a market price of $500M for 127,715 hectares, which is about 69x the size of the land that we are acquiring: 127,715 / 1842 = 69.33.

So, the price for 1842 of the total 127,715 hectares would be $500M / 69.33 = $7.212M. But the great majority of the land in this example is completely unusable (or very difficult and therefore not feasible) for residential/commercial construction, and only a small portion could actually be called ocean"view" and much less could be ocean"front" as it pertains to residential properties. This is because of the rough terrain that constitutes the waterfront areas. Even the claim (in the ad) that 20 of the 64 km of coastline is "virgin beach" is a stretch, because much of that "beach" is backed directly by heavy terrain which would not allow for construction with a view of the water. Note that in the "kitchen sink" advertisement, the seller is also pitching the potential for mining on the land in an effort to assign some value to much of the land that cannot be used for construction (with this in mind - mining - it's also possible that much of this land is not very "green" if previous mining operations have contaminated soil and/or ground water supply).

From a real estate value perspective, if a buyer were to cherry pick smaller portions of the land offered in this example in order to obtain only the best land for developing waterfront views and premium waterfront properties, the price would be multiples of the bulk land price (per hectare). Arguably, the multiple could be 3x or higher, but for conservative estimating I will use a multplier of 2x. This number, though arbitrary, seems very reasonable considering that 20 of the 64km is considered "virgin beach" and that upon closer inspection a far smaller portion could even provide a view of the water. This gives a price of 2 x $7.212M = $14.4M.

I will assume that the deal for this purchase is consistent with the leverage position that Jan has developed using Contel and the relationship with the land owners who hold their rights to the land through Ejidos, as he's done with the agricultural land. By this, I mean that he is acquiring this land for ProGreen with Contel as part of the Procon JV, for "pennies on the dollar," and that ProGreen will effectively own/control 51% and add this land asset to our balance sheet at the purchase price, with ProGreen receiving 50% of the profit for land use/lease or sales (after first recovering our investment cost - the purchase price). Using 10% of value for the pennies-on-the-dollar price paid, this would be an investment cost of about $1.44M paid, for a current "value" of 50% x $14.4M = $7.2M. I also expect that Jan would make the purchase with terms favorable to ProGreen such that only a small portion of the $1.44M would be paid intially with the remainder payable over 3-5yrs.

So I'm estimating (conservatively) an asset value - to ProGreen - of $7.2M upon closing (though we would likely see only the purchase price paid on the balance sheet, probably in terms of a receivable, as well as a liability for any unpaid amount until paid in full).

LAND ASSET VALUE UPON CLOSING (resale/market value), CONSERVATIVE ESTIMATE: $7.2M (ProGreen's portion)

-----------------------------------------

As soon as an initial master plan drawing is completed, the value increases. Additionally, at this time it is possible that Jan could actually begin monetizing the land by selling reservations for plots to speculative investors (on the future value for personal property or for flipping). Because this is still a very speculative early phase, I will ballpark the total land value (for business/stock valuation purposes) at just 10% of the conservative future value when a detailed master plan is completed sufficient for issuance of permits. So this number is calculated from the result of the next section:

LAND ASSET VALUE UPON COMPLETION OF THE INITIAL MASTER PLAN DRAWINGS & MARKET OFFERING: (10% x $921M) / 2 = $46M (ProGreen's portion)

-----------------------------------------

As soon as a detailed master plan is created and permits are acquired, serious contracts and money can begin flowing and the value would be substantially higher. At this point, we would be looking at a valuation starting with comparable sales of land plots, though the value could be much higher if we were to participate in some of the development/construction.

Based on the following conservative comparisons:

LAND ASSET VALUE UPON COMPLETION OF DETAILED MASTER PLAN AND PERMITS ISSUED: $921M / 2 = $460M (ProGreen's portion)

The following example is truly a low-end baseline for valuation (IMHO), and even this estimate shows enormous profitability!

Take this "master plan" drawing as an example:

http://www.bajaforme.com/Resort_Map/page_2090341.html

(gotta love the browser title for the page, lol: Trailers for Sale or Rent - https://www.youtube.com/watch?v=7ZuQhP3rn6o)

Now, I find this to be an entertaining reference example for the future value of the oceanfront property, to say the least. But it is a reference example, nonetheless.

If you look at the price, $10K, for a 10m x 20m lot size and extrapolate over the 4550 acres, you get 10m(32.8ft) x 20m(65.62ft) = 2,152 sq ft; 4550 acres = 1.982e+8 sq ft; 1.982e+8 / 2,152 = 92,100; 92,100 x $10K = $921M. Now, I will argue that the price of land for the ProGreen Village master plan will be valued much higher than that of a trailer park. But I will still use this as the convervative valuation of the asset once a detailed master plan is completed and permits are issued.

And sure, I would expect that ProGreen will go a bit further with some of the land than just turning it over to other developers. So we will likely see a small portion of the land contributing substantially higher revenue and profits from development and construction. Also, I think there's a high probability that ProGreen will retain ownership of some of the land for generating long-term residual revenue through commercial and/or residential leasing of land and property assets.

(thanks for the DD on this example, Dmdmd2020, good find - http://investorshub.advfn.com/boards/read_msg.aspx?message_id=127264733)

Another example

http://www.northernbajarealestate.com/Listing/ViewListingDetails.aspx?listingId=86694426

$269,000 USD

Beautiful one hectarea (2.5 acre) parcel in La Mision for sale this property is prime and has the best views of the valley, moutains and ocean that you will find in this area! The property also has plenty of water if you want your own well! It is sloping but is already terraced into several levels and could be either a ranch or you could build atleast 5 homes all with amazing views and large lots. Electricity phone and high speed internet are available. Come and take a look youi will love this property!

This one is hilly and 2 miles from the waterfront, so not as good for comparison. Clearly, a property in a master planned development - a resort community - right on the oceanfront or next door to it would have a much higher value.

However, using this price as a baseline, we get $269K x 1,842 hectares = $495M.

-----------------------------------------

FROM A PREVIOUS POST

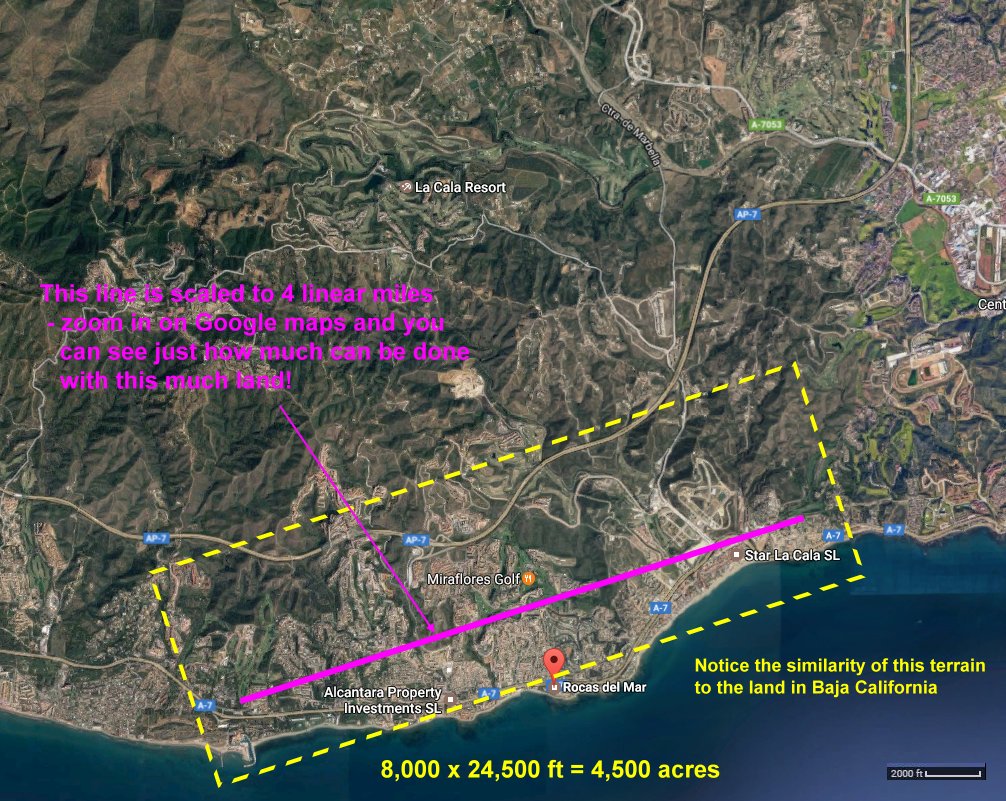

Here is the 4-mile scale overlaid in the area of Spain where Jan built that Rocas Del Mar development. That's a LOT of oceanfront land!!

https://www.google.com/maps/place/Rocas+del+Mar/@36.485388,-4.7539562,26043m/data=!3m1!1e3!4m5!3m4!1s0x0:0x98d40b31d3126321!8m2!3d36.4907433!4d-4.7011037?hl=en

-----------------------------------------

FROM A PREVIOUS POST

Information About the Potential Oceanfront Land Development in Baja

Check this out - 50 acres more than mentioned in the December 12 PR, AND 2.4 MILES of oceanfront!!! And it sounds JUST LIKE that Rocas del Mar area that Jan built in Spain - only MUCH LARGER!

https://progreenus.wordpress.com/2016/12/16/information-about-the-potential-oceanfront-land-development-in-baja/

Information About the Potential Oceanfront Land Development in Baja

We would like to elaborate on the information that we presented in our press release on Tuesday, December 12, 2016.

The land is approximately 4,550 acres gently sloping down towards the sea with 2.4 miles of oceanfront, perfect for exclusive dwellings. The development should be totally “green,” powered by solar, complete with all services, such as paved roads, sewage, water supply, street lighting, etc. Wastewater from sewage plants to be recycled and reused for irrigation of golf courses.

Potentially, we could see this development with:

Commercial Areas for Shopping, Restaurants etc.

Golf Courses

Hotels

Equestrian Center

Marina

Condominiums

A lots, Luxury Prime Oceanfront

B lots

C lots

Sports and Recreation Center

Beach Hotel with Beach Club

With so much land available, we envision mainly low-rise construction to maintain open views.

Further updates and more information will follow when available.

MASTER PROJECT PLAN FOR DEVELOPERS - 4500 ACRES PROGREEN VILLAGE!

The images below give some perspective for the 4500 acres:

http://www.newmediawire.com/news/progreen-s-jv-partner-contel-enters-into-agriculture-operations-in-baja-california-4337196

Quote:

With regard to further real estate investment opportunities, ProGreen is presently in advanced discussions with a landowner concerning the possible acquisition of 4,500 acres of oceanfront land through its subsidiary in Mexico, ProCon Baja. The intention would be to develop a master plan, obtain necessary permits and bring investors and developers into individual real estate projects.

These links take you to Google earth, where you can view a relatively small community - one of several - that Jan developed and built in Spain:

https://www.google.com/maps/place/Rocas+del+Mar/@36.485388,-4.7539562,26043m/data=!3m1!1e3!4m5!3m4!1s0x0:0x98d40b31d3126321!8m2!3d36.4907433!4d-4.7011037?hl=en

https://www.google.com/maps/place/Rocas+del+Mar/@36.4908834,-4.7010807,3a,75y,90t/data=!3m8!1e2!3m6!1shttp:%2F%2Frocasdelmar-beachproperties.net%2Fimages%2Fpz4.jpg!2e7!3e27!6s%2F%2Flh4.googleusercontent.com%2Fproxy%2FtHnxwUh2i27sGx6Q72qyteeRE93SCkHbZVOkDjSedbUmdUjkNI3m-Fmm3uwXGZVQyLDVIeyfJfhVXAlqqCZQUXz_MYVdrddF1UhAG17r7jrZx61px7mHy7u2k5wY_z1HvSx5aWbx9eU6c0tphv4rxuY63_AD5A%3Dw203-h142!7i950!8i669!4m5!3m4!1s0x0:0x98d40b31d3126321!8m2!3d36.4907433!4d-4.7011037!6m1!1e1?hl=en

The following image gives the scale of the Rocas del Mar community, which fits within 10.3 acres. Rocas del Mar is an example of what only one developer could do within the 4,500 acres for an individual real estate project:

This image shows the size of 4,500 acres, which is 7 square miles - the size of a small city. Notice the multiple golf courses. You'll have to use the first link above to zoom in using Google Earth to fully appreciate what all is inside this perimeter... single-family homes in sub-developments, condos, apartments, cottages, grocery stores, a hospital, gas stations, marina, hotels.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.