Saturday, January 28, 2017 5:44:41 AM

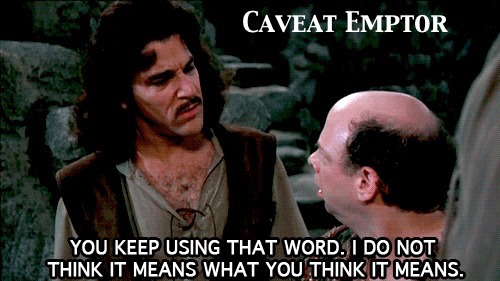

This explains well Apple's plight and why Liquidmetal is not going to do anything to reverse this trend.

Apple will be non-relevant within 5-10 years.

Too much competition and margins will continue to shrink. Apple will no longer command premiums. It is junk.

Some points about your opinions.

From the post you linked,

Oppo is one of the fastest-growing smartphone brands in China which has made its name through high-spec low-priced devices, being sold through bricks and mortar stores.

Oppo is using the same MO that 2 other Phone makers used and are now facing bankruptcy.

1)LeEco

2)Xiaomi

No profit or margins to speak of in selling high-spec devices for low prices.

Regarding Competition and margins, Apple has never ever had the Lions share of smartphone sales (Android) but Apple does earn more than 90% of the smart phone market Profits. So your opinion about too much competition and shrinking margins is completely irrelevant to Apples successful Business model.

Regarding LiquidMetal, Apple is already using BMG to make their iDevices stronger, magical, reliable.

When Apple decides to make a case out of BMG it will further seperate Apple products from the rest of the competition and make its iDevices even more desirable. If Apple chooses to use the Trademark LiquidMetal, it will be the only Company allowed to do so for CE, no other competitor can say the same, unlike now where they all claim to have beautiful aluminium bodies in competition with current iPhone models.

Regarding relevance, Apple is moving towards services such as Apple Pay, Apple Music and is now producing TV content. Apple is growing in relevance beyond its iTunes and App stores.

Recent LQMT News

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 05/20/2024 08:11:00 PM

- Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB • Edgar (US Regulatory) • 05/15/2024 08:49:57 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 05/09/2024 09:05:11 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 11/21/2023 10:15:45 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/21/2023 10:26:27 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 08/10/2023 08:37:18 PM

Glidelogic Corp. Becomes TikTok Shop Partner, Opening a New Chapter in E-commerce Services • GDLG • Jul 5, 2024 7:09 AM

Freedom Holdings Corporate Update; Announces Management Has Signed Letter of Intent • FHLD • Jul 3, 2024 9:00 AM

EWRC's 21 Moves Gaming Studios Moves to SONY Pictures Studios and Green Lights Development of a Third Upcoming Game • EWRC • Jul 2, 2024 8:00 AM

BNCM and DELEX Healthcare Group Announce Strategic Merger to Drive Expansion and Growth • BNCM • Jul 2, 2024 7:19 AM

NUBURU Announces Upcoming TV Interview Featuring CEO Brian Knaley on Fox Business, Bloomberg TV, and Newsmax TV as Sponsored Programming • BURU • Jul 1, 2024 1:57 PM

Mass Megawatts Announces $220,500 Debt Cancellation Agreement to Improve Financing and Sales of a New Product to be Announced on July 11 • MMMW • Jun 28, 2024 7:30 AM