| Followers | 683 |

| Posts | 142174 |

| Boards Moderated | 35 |

| Alias Born | 03/10/2004 |

Monday, March 21, 2016 7:17:16 AM

* March 21, 2016

Whilst silver had a good week last week, outperforming gold and rising to multi-month new high, it looks like that may have been its “swan song” for a while. It looks quite positive at first sight on its latest 6-month chart with the new high and moving averages starting to swing into a more positive alignment, but once you “look under the hood” you quickly realize things are not so good at all.

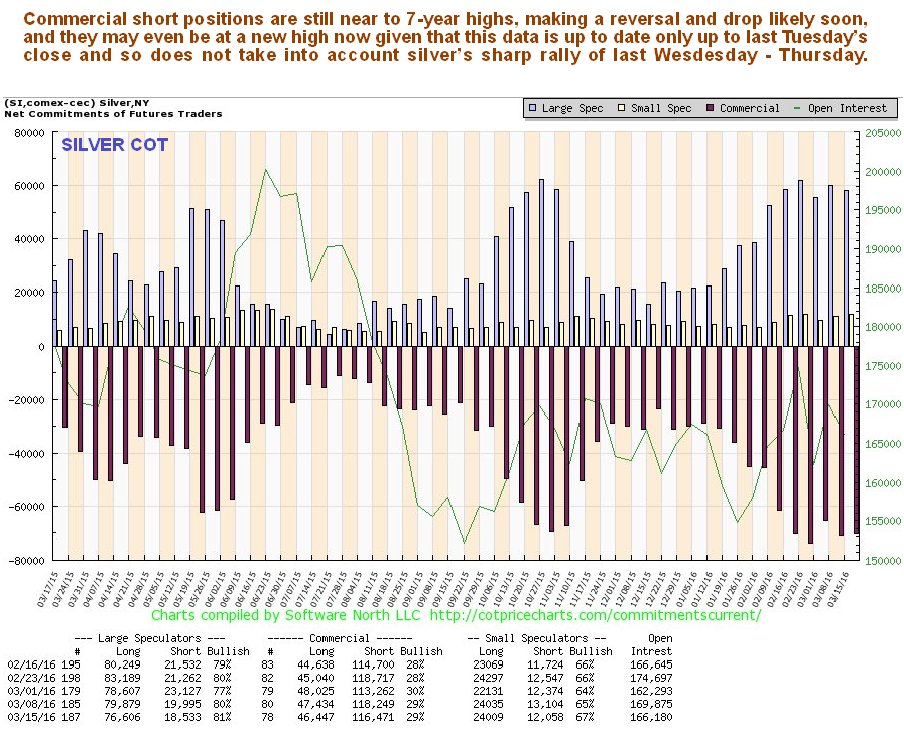

The 1-year chart does not look so hot. It shows silver trying to break out above the upper boundary of a curved downtrend, and not quite succeeding, thus making it vulnerable to slumping back across the channel again. The latest COT chart, which goes back a year, is placed beneath the 1-year silver chart for direct comparison. As we can see it looks pretty horrendous, with Commercial short positions up near to 7-year highs, which greatly amplifies the risks of silver now going into retreat again.

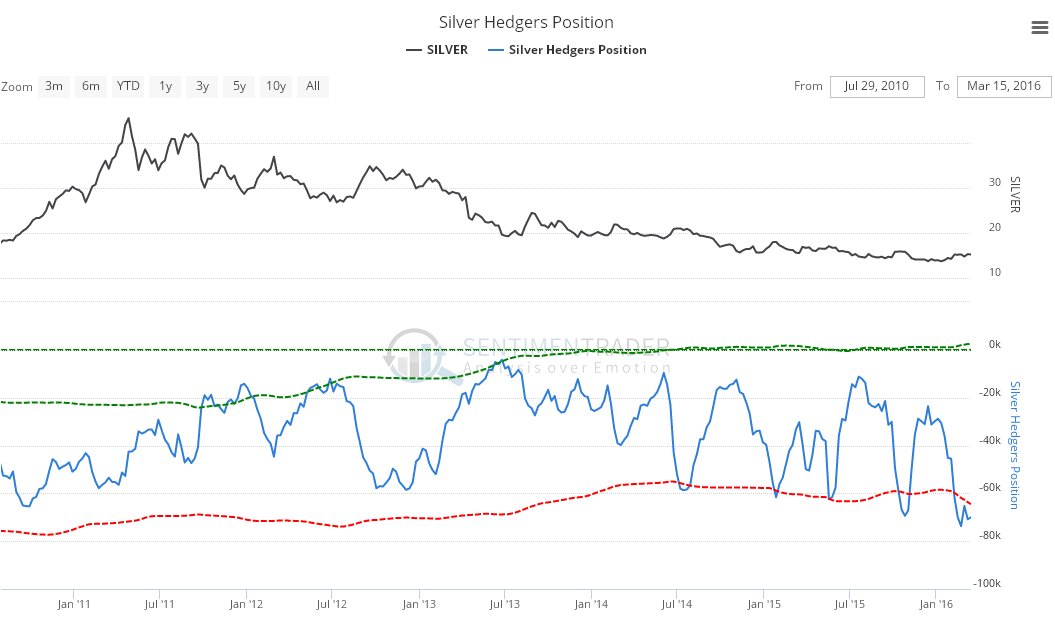

The long-term Hedgers chart, a form of COT chart, looks downright awful and flat out bearish…

Chart courtesy of www.sentimentrader.com

The latest silver Optix, or optimism chart, looks much less threatening. It is in middling ground and in itself does not give us much clue what to expect one way or the other – we will have to go on other factors, which we are.

Chart courtesy of www.sentimentrader.com

The 6-year chart quickly brings us right down to earth, it shows that silver has made less of an attempt to break out of its long-term downtrend than gold has. It is near the top of it and with its slow stochastic rolling over at a high cyclical peak, looks set to drop back again, possibly to new lows, and this risk is exacerbated by the now decidedly bearish looking COTs, which we just looked at, and the prospect for a near-term dollar rebound.

The 6-year chart for silver relative to gold shows that, even though silver had a flurry of outperformance last week, it is still well within its relative downtrend, which looks set to reassert itself shortly, increasing the chances of a silver reacting back quite hard.

Conclusion: although bugs are getting worked up and excited about its advance last week and attempt to break above $16, silver looks done here and set to slump back across its long-term downtrend channel.

http://www.clivemaund.com/article.php?art_id=67

• George.

Click on "In reply to", for Authors past commentaries.

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• gtsourdinis

Recent GOLD News

- Barrick and Zijin Contribute $1 Million to Support Papua New Guinea Landslide Victims • GlobeNewswire Inc. • 06/07/2024 11:18:39 AM

- Form SD - Specialized disclosure report • Edgar (US Regulatory) • 05/29/2024 08:01:04 PM

- Barrick’s Sustainability Strategy Delivers Real Value to Stakeholders • GlobeNewswire Inc. • 05/15/2024 11:00:00 AM

- Barrick Announces Extensive Exploration Partnership with Geophysx Jamaica • GlobeNewswire Inc. • 05/01/2024 10:15:00 AM

- Barrick to Ramp Up Production As It Remains On Track to Achieve 2024 Targets • GlobeNewswire Inc. • 05/01/2024 10:00:00 AM

- Barrick Declares Q1 Dividend • GlobeNewswire Inc. • 05/01/2024 09:59:00 AM

- Barrick Announces Election of Directors • GlobeNewswire Inc. • 04/30/2024 08:15:55 PM

- Barrick On Track to Achieve 2024 Targets • GlobeNewswire Inc. • 04/16/2024 11:00:00 AM

- Notice of Release of Barrick’s First Quarter 2024 Results • GlobeNewswire Inc. • 04/09/2024 11:00:00 AM

- Strategy-Driven Barrick Builds on Value Foundation • GlobeNewswire Inc. • 03/28/2024 09:20:38 PM

- Barrick Hunts New Gold and Copper Prospects in DRC From Kibali Base • GlobeNewswire Inc. • 03/20/2024 02:00:00 PM

- Barrick Opens Academy at Closed Buzwagi Mine • GlobeNewswire Inc. • 03/18/2024 08:00:00 AM

- Barrick to Grow Production and Value on Global Asset Foundation • GlobeNewswire Inc. • 03/15/2024 11:53:01 AM

- Loulo-Gounkoto Delivers Another Value-Creating Performance • GlobeNewswire Inc. • 03/10/2024 10:00:00 AM

- Passing of the Right Honorable Brian Mulroney • GlobeNewswire Inc. • 03/02/2024 01:17:35 AM

- Kibali and DRC Partner to Promote Local Content • GlobeNewswire Inc. • 03/01/2024 02:22:43 PM

- Tanzanian Parliamentary Committee Lauds Barrick’s Work at North Mara • GlobeNewswire Inc. • 02/23/2024 12:00:00 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 02/14/2024 10:28:08 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 02/14/2024 08:05:25 PM

- Clear Strategies and Strong Partnerships Set Barrick Up to Outperform, Says Bristow • GlobeNewswire Inc. • 02/14/2024 11:00:00 AM

- Barrick Announces New Share Buyback Program • GlobeNewswire Inc. • 02/14/2024 10:59:00 AM

- Barrick Declares Q4 Dividend • GlobeNewswire Inc. • 02/14/2024 10:58:00 AM

- NGM Strongly Positioned for Growth • GlobeNewswire Inc. • 02/10/2024 01:00:16 AM

- Form SC 13G - Statement of acquisition of beneficial ownership by individuals • Edgar (US Regulatory) • 02/08/2024 03:03:08 PM

- Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16] • Edgar (US Regulatory) • 02/08/2024 12:46:55 PM

Last Shot Hydration Drink Announced as Official Sponsor of Red River Athletic Conference • EQLB • Jun 20, 2024 2:38 PM

ATWEC Announces Major Acquisition and Lays Out Strategic Growth Plans • ATWT • Jun 20, 2024 7:09 AM

North Bay Resources Announces Composite Assays of 0.53 and 0.44 Troy Ounces per Ton Gold in Trenches B + C at Fran Gold, British Columbia • NBRI • Jun 18, 2024 9:18 AM

VAYK Assembling New Management Team for $64 Billion Domestic Market • VAYK • Jun 18, 2024 9:00 AM

Fifty 1 Labs, Inc Announces Acquisition of Drago Knives, LLC • CAFI • Jun 18, 2024 8:45 AM

Hydromer Announces Attainment of ISO 13485 Certification • HYDI • Jun 17, 2024 9:22 AM