Tuesday, July 07, 2015 7:59:45 PM

Sheesh, Peg, we all know Greece fudged their figures for years and that Goldman Sachs was complicit in that .. we all know there has been blame on both side and you know that ALL in these Greece chats have posted that understanding before .. Germany is being portrayed as a bad guy because they have been and still are being the biggest bad guy in recent times .. they have benefitted most from the euro and still are .. and and and we all know that much of the blame lies in the way the EU was set up .. yet another on all of that ..

The Guardian view on the Greek crisis: the European project itself is at stake

Editorial

As Greece prepares to hold its referendum, the stakes are high for the 60-year-old project of a peaceful, united Europe

‘A Greek exit from the EU is an outcome no one should want. Whatever the result of the Greek referendum, Europe must not be allowed to self-destruct.’ Photograph: Petros Karadjias/AP

Tuesday 30 June 2015 15.42 EDT

Last modified on Monday 6 July 2015 03.24 EDT

If you believe political leaders in Berlin, Paris, Brussels, this Sunday marks a make-or-break moment not only for the eurozone but for the EU itself. An extraordinary state of affairs given that – on one level at least – the only thing happening this weekend is that Greece, a country representing just 2% of the entire EU population, will hold a referendum on whether or not to accept the latest deal offered by creditors. The rhetoric coming from Athens is as heated, [ yet more honest and for more good reason, i believed then and still do ] where there is talk of European “blackmail” against the free will of Greek voters, as if Europe’s creditor nations don’t have voters of their own. If cool heads are to prevail, they must first reflect on how things have turned so sour. Unless a last-minute deal can be reached between Greece and its creditors .. http://www.theguardian.com/business/live/2015/jun/30/greek-debt-crisis-day-of-decision-for-tsipras , the only thing that can be hoped for is serious damage limitation. In the worst-case scenario of a Greek exit from the euro, it would pile disaster upon disaster if the country were to leave the European Union. Europe must stare into this abyss to prevent itself from falling into it.

--

Live Greek debt crisis: Tsipras gets final ultimatum to reach deal or face Grexit - live

On Sunday, European leaders will meet for a summit that will decide whether Greece gets another bailout or leaves the eurozone

Read more .. http://www.theguardian.com/world/live/2015/jul/07/greek-debt-crisis-alex-tsipras-seeks-last-chance-deal-live

--

[ though it would be tough for all i believe the abyss is overstated.. for Greece, for the EU and for the world .. e.g. China is more of a worry for Australia ]

No side bears sole blame for the current mess. [ we have posted all of this before ] From the very start, the idea of a common European currency was built on a logical flaw. Put at its crudest, monetary union all but requires fiscal union, which in turn requires political union. Yet when the euro was launched, there were no such institutions or mechanisms, just the perennial but vague hope of ever closer union. What’s more, the world’s largest currency area was run on two unsustainable economic motors: Germany exporting ever more to southern Europe and the rest of the world, and southern Europe relying on cheap credit. That fragile system was crushed under the rubble of the financial crisis.

Nor is there much dispute that creditors have mismanaged the Greek dossier .. http://www.theguardian.com/world/2015/jun/29/alexis-tsipras-must-be-stopped-the-underlying-message-of-europes-leaders .. ever since the first bailout in 2010. The troika of creditors – the European Central Bank, the EU commission and the IMF – told Greece that the only way to fix its economy was to adopt severe austerity, medicine that felt to Greeks like the shredding of cherished labour rights and benefits. This programme not only failed to make the debt sustainable; it has recreated the kind of poverty that western Europe thought it had left behind. Meanwhile, the bulk of the €240bn (£170bn) total bailout money Greece received in 2010 and 2012 went straight back to the banks .. http://www.theguardian.com/world/2015/jun/29/where-did-the-greek-bailout-money-go .. that lent it money before the crash.

But both sides in this clash have motives of their own, not all of them unconnected with democracy. The creditors point to some of Europe’s hardest-hit nations, the likes of Portugal and Ireland, whose voters have endured their own austerity and who would look askance if Greece .. http://www.theguardian.com/world/greece .. were now let off the hook. Even the reviled IMF can explain its hard line: given the bitter programmes it has imposed on countries from the global south, it can hardly now be lenient towards a European country that is, relatively, better off.

Greece’s woes are not wholly of others’ making. Witness the decades of clientelist Greek politics of left and right, the notoriously poor tax collection, and the fudging of statistics when the country joined the euro in 2001. Much of this predated Alexis Tsipras .. http://www.theguardian.com/world/alexis-tsipras .. and Syriza, but it’s also true that the party won power in January partly by promising that less would have to change than, in reality, it would.

Nor has the Greek prime minister helped his cause by framing Sunday’s referendum question in terms that hardly suggest a great democratic moment. The question put to Greek voters is so technical that it defies understanding, [ that i see as a furphy, i believe most of the voters knew exactly what they were voting for ]and it relates to an offer (made by creditors on 25 June) that has since disappeared. Negotiations were cut off by Greece before a belated new offer could even be considered.

For all that, Greece’s break from the eurozone, not to mention the EU, would amount to a historic weakening of Europe at moment when solidarity has never been more needed. [ yes, it would be a weakening ] It may be possible to have a Greek default without a Grexit from the euro, but that will require much creativity – something that has been lacking from this generation of unstatesmanlike European leaders. It is also unclear whether a euro-Grexit would lead to a Greek withdrawal from the EU altogether: the legal debate is complex.

--

Insert: Exiting the euro currency union and the European Union would also involve a legal minefield that no country has yet

ventured to cross. There are also no provisions for departure, voluntary or forced, from the euro currency union.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=115170693

--

This would nevertheless be the absolute worst scenario. A Greek exit from the EU is an outcome no one should want. Whatever the result of the Greek referendum, Europe must not be allowed to self-destruct. The brinkmanship must end,

--

INSERT: But he also recognises that despite all the brinkmanship and posturing, the time has come to find face-saving solutions.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=110902488 .. also

Enough 'terrorist' fearmongering. Enough blackmailing brinkmanship. Enough added austerity. They failed. Time for reconciliation now ..

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=115167614 .. and

Tsipras Budges on Greece’s Debt, but Meets a Cool Response ..

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=115104549

--

if the 60-year-old project of a peaceful, united Europe is to be pulled back from the brink.

This article was amended on 6 July 2015. An earlier version referred to “some of Europe’s poorest nations” where “some of Europe’s hardest-hit nations” was meant.

http://www.theguardian.com/commentisfree/2015/jun/30/the-guardian-view-on-the-greek-crisis-the-european-project-itself-is-at-stake

virtually all of that has been said here before, too .. a bit of a large one from Feb, 2015 ..

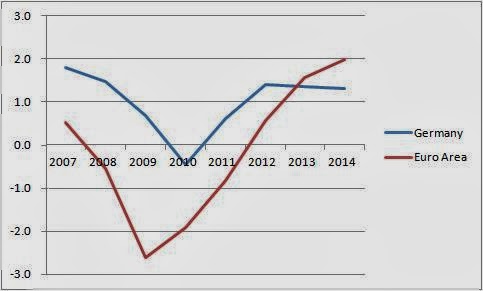

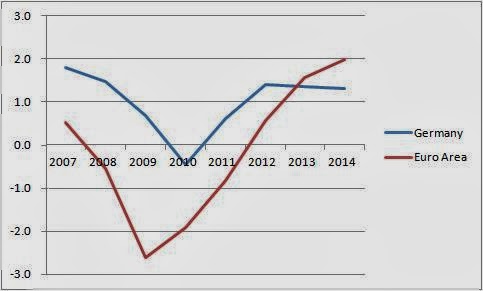

"The problem arises because the ECB is unwilling or unable to target 2% inflation. That in theory allows Germany to attempt to force the EZ as a whole to make the required internal adjustment without inflation in Germany exceeding 2%. It can do this by a restrictive fiscal policy. This is exactly what it has done. The figure below shows the underlying primary financial balance in Germany and the whole EZ (including Germany). (Source: Oct 2013 OECD Economic Outlook.) The projected German surpluses are expected to bring down the debt to GDP ratio from 51% of GDP in 2012 to 48.5% of GDP in 2014.

Other EZ countries are defenseless against this deflation, because of imposed austerity or the EZ Fiscal Compact. As a result, the path we seem to be on involves German inflation at around 2% and average EZ inflation well below 2%. This may be in Germany’s narrow national interest, but for the EZ as a whole it is much more costly, partly because of the difficulties of reducing inflation when it is close to zero. Deflation in the EZ as a whole is also costly for those outside the EZ when everyone’s interest rates are near zero (see Francesco Saraceno here)."

http://mainlymacro.blogspot.co.uk/2013/11/the-view-from-germany.html

Charges of Hypocrisy

Hypocrisy has been alleged on multiple bases. "Germany is coming across like a know-it-all in the debate over aid for Greece", commented Der Spiegel, while its own government did not achieve a budget surplus during the era of 1970 to 2011

although a budget surplus indeed was achieved by Germany in all three subsequent years (2012–2014)[130] – with a spokesman for the governing CDU party commenting that "Germany is leading by example in the eurozone – only spending money in its coffers". A Bloomberg editorial, which also concluded that "Europe's taxpayers have provided as much financial support to Germany as they have to Greece", stated the German role and posture in the Greek crisis thus:" .. alas, dang, so much slips recall .. http://investorshub.advfn.com/boards/read_msg.aspx?message_id=110746844

Peg, i'd expected and hoped you had read Stephanie's Spiegels before then .. haven't been there but seems your France24 perspective is rather narrow which

would be expected, of course .. now for some breakfast (is going on 10) and .. lolol .. to read more than the two only so far of the board since leaving my yesterday ..

The Guardian view on the Greek crisis: the European project itself is at stake

Editorial

As Greece prepares to hold its referendum, the stakes are high for the 60-year-old project of a peaceful, united Europe

‘A Greek exit from the EU is an outcome no one should want. Whatever the result of the Greek referendum, Europe must not be allowed to self-destruct.’ Photograph: Petros Karadjias/AP

Tuesday 30 June 2015 15.42 EDT

Last modified on Monday 6 July 2015 03.24 EDT

If you believe political leaders in Berlin, Paris, Brussels, this Sunday marks a make-or-break moment not only for the eurozone but for the EU itself. An extraordinary state of affairs given that – on one level at least – the only thing happening this weekend is that Greece, a country representing just 2% of the entire EU population, will hold a referendum on whether or not to accept the latest deal offered by creditors. The rhetoric coming from Athens is as heated, [ yet more honest and for more good reason, i believed then and still do ] where there is talk of European “blackmail” against the free will of Greek voters, as if Europe’s creditor nations don’t have voters of their own. If cool heads are to prevail, they must first reflect on how things have turned so sour. Unless a last-minute deal can be reached between Greece and its creditors .. http://www.theguardian.com/business/live/2015/jun/30/greek-debt-crisis-day-of-decision-for-tsipras , the only thing that can be hoped for is serious damage limitation. In the worst-case scenario of a Greek exit from the euro, it would pile disaster upon disaster if the country were to leave the European Union. Europe must stare into this abyss to prevent itself from falling into it.

--

Live Greek debt crisis: Tsipras gets final ultimatum to reach deal or face Grexit - live

On Sunday, European leaders will meet for a summit that will decide whether Greece gets another bailout or leaves the eurozone

Read more .. http://www.theguardian.com/world/live/2015/jul/07/greek-debt-crisis-alex-tsipras-seeks-last-chance-deal-live

--

[ though it would be tough for all i believe the abyss is overstated.. for Greece, for the EU and for the world .. e.g. China is more of a worry for Australia ]

No side bears sole blame for the current mess. [ we have posted all of this before ] From the very start, the idea of a common European currency was built on a logical flaw. Put at its crudest, monetary union all but requires fiscal union, which in turn requires political union. Yet when the euro was launched, there were no such institutions or mechanisms, just the perennial but vague hope of ever closer union. What’s more, the world’s largest currency area was run on two unsustainable economic motors: Germany exporting ever more to southern Europe and the rest of the world, and southern Europe relying on cheap credit. That fragile system was crushed under the rubble of the financial crisis.

Nor is there much dispute that creditors have mismanaged the Greek dossier .. http://www.theguardian.com/world/2015/jun/29/alexis-tsipras-must-be-stopped-the-underlying-message-of-europes-leaders .. ever since the first bailout in 2010. The troika of creditors – the European Central Bank, the EU commission and the IMF – told Greece that the only way to fix its economy was to adopt severe austerity, medicine that felt to Greeks like the shredding of cherished labour rights and benefits. This programme not only failed to make the debt sustainable; it has recreated the kind of poverty that western Europe thought it had left behind. Meanwhile, the bulk of the €240bn (£170bn) total bailout money Greece received in 2010 and 2012 went straight back to the banks .. http://www.theguardian.com/world/2015/jun/29/where-did-the-greek-bailout-money-go .. that lent it money before the crash.

But both sides in this clash have motives of their own, not all of them unconnected with democracy. The creditors point to some of Europe’s hardest-hit nations, the likes of Portugal and Ireland, whose voters have endured their own austerity and who would look askance if Greece .. http://www.theguardian.com/world/greece .. were now let off the hook. Even the reviled IMF can explain its hard line: given the bitter programmes it has imposed on countries from the global south, it can hardly now be lenient towards a European country that is, relatively, better off.

Greece’s woes are not wholly of others’ making. Witness the decades of clientelist Greek politics of left and right, the notoriously poor tax collection, and the fudging of statistics when the country joined the euro in 2001. Much of this predated Alexis Tsipras .. http://www.theguardian.com/world/alexis-tsipras .. and Syriza, but it’s also true that the party won power in January partly by promising that less would have to change than, in reality, it would.

Nor has the Greek prime minister helped his cause by framing Sunday’s referendum question in terms that hardly suggest a great democratic moment. The question put to Greek voters is so technical that it defies understanding, [ that i see as a furphy, i believe most of the voters knew exactly what they were voting for ]and it relates to an offer (made by creditors on 25 June) that has since disappeared. Negotiations were cut off by Greece before a belated new offer could even be considered.

For all that, Greece’s break from the eurozone, not to mention the EU, would amount to a historic weakening of Europe at moment when solidarity has never been more needed. [ yes, it would be a weakening ] It may be possible to have a Greek default without a Grexit from the euro, but that will require much creativity – something that has been lacking from this generation of unstatesmanlike European leaders. It is also unclear whether a euro-Grexit would lead to a Greek withdrawal from the EU altogether: the legal debate is complex.

--

Insert: Exiting the euro currency union and the European Union would also involve a legal minefield that no country has yet

ventured to cross. There are also no provisions for departure, voluntary or forced, from the euro currency union.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=115170693

--

This would nevertheless be the absolute worst scenario. A Greek exit from the EU is an outcome no one should want. Whatever the result of the Greek referendum, Europe must not be allowed to self-destruct. The brinkmanship must end,

--

INSERT: But he also recognises that despite all the brinkmanship and posturing, the time has come to find face-saving solutions.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=110902488 .. also

Enough 'terrorist' fearmongering. Enough blackmailing brinkmanship. Enough added austerity. They failed. Time for reconciliation now ..

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=115167614 .. and

Tsipras Budges on Greece’s Debt, but Meets a Cool Response ..

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=115104549

--

if the 60-year-old project of a peaceful, united Europe is to be pulled back from the brink.

This article was amended on 6 July 2015. An earlier version referred to “some of Europe’s poorest nations” where “some of Europe’s hardest-hit nations” was meant.

http://www.theguardian.com/commentisfree/2015/jun/30/the-guardian-view-on-the-greek-crisis-the-european-project-itself-is-at-stake

virtually all of that has been said here before, too .. a bit of a large one from Feb, 2015 ..

"The problem arises because the ECB is unwilling or unable to target 2% inflation. That in theory allows Germany to attempt to force the EZ as a whole to make the required internal adjustment without inflation in Germany exceeding 2%. It can do this by a restrictive fiscal policy. This is exactly what it has done. The figure below shows the underlying primary financial balance in Germany and the whole EZ (including Germany). (Source: Oct 2013 OECD Economic Outlook.) The projected German surpluses are expected to bring down the debt to GDP ratio from 51% of GDP in 2012 to 48.5% of GDP in 2014.

Other EZ countries are defenseless against this deflation, because of imposed austerity or the EZ Fiscal Compact. As a result, the path we seem to be on involves German inflation at around 2% and average EZ inflation well below 2%. This may be in Germany’s narrow national interest, but for the EZ as a whole it is much more costly, partly because of the difficulties of reducing inflation when it is close to zero. Deflation in the EZ as a whole is also costly for those outside the EZ when everyone’s interest rates are near zero (see Francesco Saraceno here)."

http://mainlymacro.blogspot.co.uk/2013/11/the-view-from-germany.html

Charges of Hypocrisy

Hypocrisy has been alleged on multiple bases. "Germany is coming across like a know-it-all in the debate over aid for Greece", commented Der Spiegel, while its own government did not achieve a budget surplus during the era of 1970 to 2011

although a budget surplus indeed was achieved by Germany in all three subsequent years (2012–2014)[130] – with a spokesman for the governing CDU party commenting that "Germany is leading by example in the eurozone – only spending money in its coffers". A Bloomberg editorial, which also concluded that "Europe's taxpayers have provided as much financial support to Germany as they have to Greece", stated the German role and posture in the Greek crisis thus:" .. alas, dang, so much slips recall .. http://investorshub.advfn.com/boards/read_msg.aspx?message_id=110746844

Peg, i'd expected and hoped you had read Stephanie's Spiegels before then .. haven't been there but seems your France24 perspective is rather narrow which

would be expected, of course .. now for some breakfast (is going on 10) and .. lolol .. to read more than the two only so far of the board since leaving my yesterday ..

It was Plato who said, “He, O men, is the wisest, who like Socrates, knows that his wisdom is in truth worth nothing”

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.