Monday, July 21, 2014 9:44:13 AM

tanjazielman Monday, 07/21/14 06:48:33 AM

Re: WithCatz post# 402055

Post # of 402070

Quote:

--------------------------------------------------------------------------------

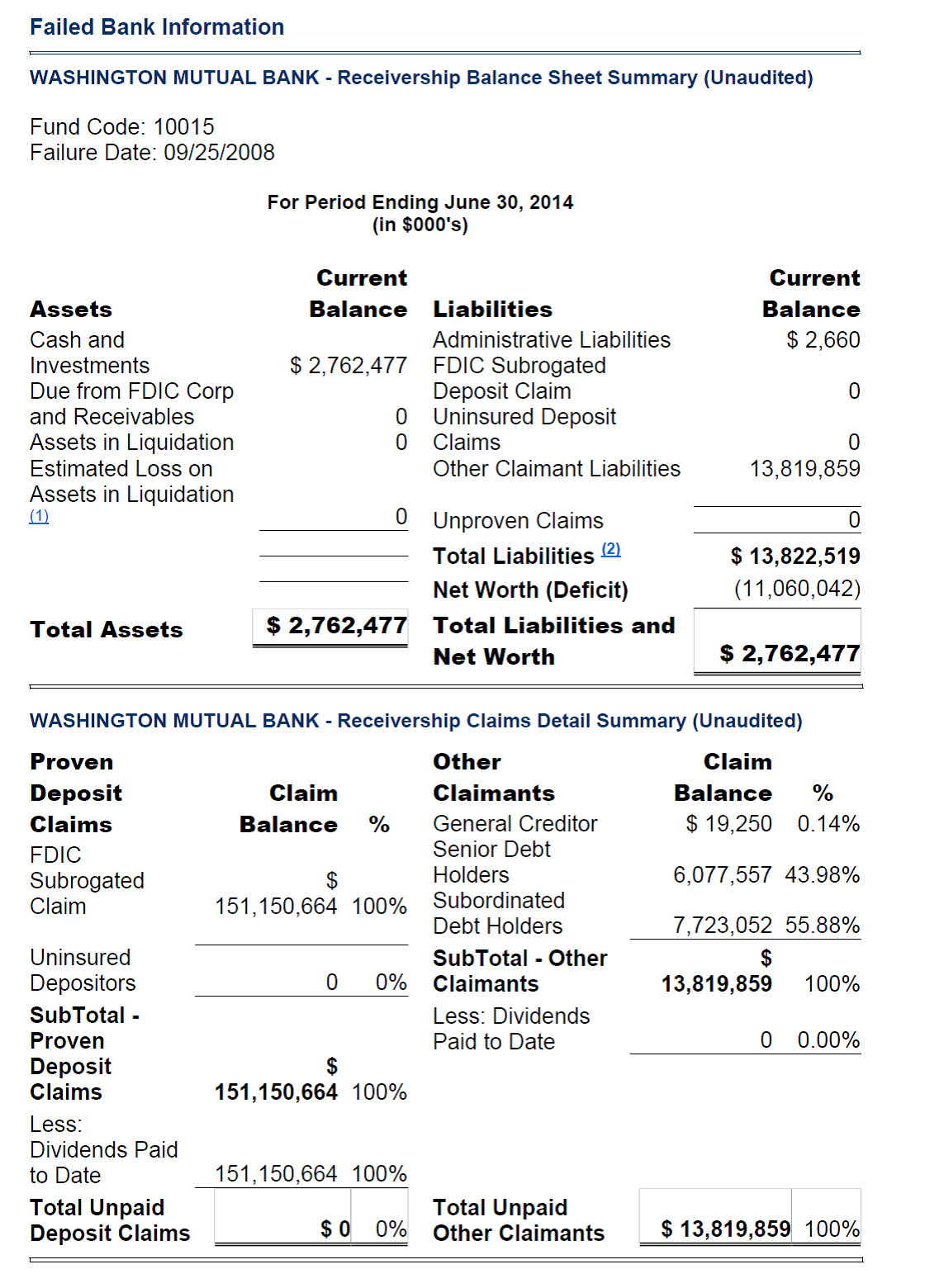

The FDIC hasn't even made it past the $1.9b that JPM paid. Not a dime has reached the $3.2b due to WMB bondholders. So much of the hypothetical is mute. Unless you believe that $10b is coming in somehow.

--------------------------------------------------------------------------------

I believe this quote amount is generous. Look at the liabilities on the Balance Sheet and look at the Creditor amount supported below. BTW, call the LT and ask if WMILT has an existing "creditor certificate" in that amount. I know the answer, but give it a try.

tanjazielman Monday, 07/21/14 06:48:33 AM

Re: WithCatz post# 402055

Post # of 402070

This is not so hard to explain, considering THE SALE IS NOT FINALIZED YET.

Whole bank P&A, 25th of September.

Other than "indemnity claims," per the P&AA, the only claims not on the above FDIC-R Balance Sheet are JPM claims and Deutsche Bank litigation outstanding. Those that purport that the WMB status "as a creditor" to the FDIC-R (not recovery claims, litigation claims, etc.) in the ABANDOMENT ORDER, are gone on the effective date (they were open from the abandonment date to the effective date only).

http://www.fdic.gov/about/freedom/wsj-responsiverecords.pdf

http://www.fdic.gov/bank/individual/failed/wamu_amended_complaint.pdf

tanjazielman Monday, 07/21/14 06:48:33 AM

Re: WithCatz post# 402055

Post # of 402070

And it doesn't matter if there is a surplus of assets in WMB or WMfsb. Any surplus comes to us (WMB bondholders first)

HUH?

It appears there is still some back and forth on JPM not buying all of the WMB (and Subs) loans and servicing rights, although every aspect is clearly reported in the SEC filings and the Audited Financial Statements of JPM from 2008-2013, there are references to the P&AA that are being missed; the P&AA clearly identifies all loans and, if you look at the following, all servicing rights.

Recent COOP News

- Form 8-K - Current report • Edgar (US Regulatory) • 05/24/2024 08:36:48 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/24/2024 08:33:25 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/24/2024 08:28:46 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/24/2024 08:26:19 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/24/2024 08:24:11 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/24/2024 08:22:07 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/24/2024 08:19:44 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/24/2024 08:17:44 PM

- Xome Democratizes Real Estate with Launch of DIY Sales Platform, No Agent Required • Business Wire • 05/22/2024 01:00:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/15/2024 10:47:32 PM

- Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material • Edgar (US Regulatory) • 05/15/2024 12:11:30 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/10/2024 12:12:48 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 05/07/2024 08:22:09 PM

- Mr. Cooper Group Reports First Quarter 2024 Results • Business Wire • 04/24/2024 11:00:00 AM

- Mr. Cooper Group Announces Two New Senior Leaders • Business Wire • 04/23/2024 01:00:00 PM

- Mr. Cooper Group Inc. to Discuss First Quarter 2024 Financial Results on April 24, 2024 • Business Wire • 04/05/2024 03:37:00 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/11/2024 09:34:36 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/04/2024 11:05:39 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/04/2024 11:04:15 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/04/2024 11:03:04 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/04/2024 11:01:41 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/04/2024 10:59:25 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/26/2024 09:28:25 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/14/2024 09:15:59 PM

- Form 3 - Initial statement of beneficial ownership of securities • Edgar (US Regulatory) • 02/09/2024 09:13:50 PM

Avant Technologies Engages Wired4Tech to Evaluate the Performance of Next Generation AI Server Technology • AVAI • May 23, 2024 8:00 AM

Branded Legacy, Inc. Unveils Collaboration with Celebrity Tattoo Artist Kat Tat for New Tattoo Aftercare Product • BLEG • May 22, 2024 8:30 AM

"Defo's Morning Briefing" Set to Debut for "GreenliteTV" • GRNL • May 21, 2024 2:28 PM

North Bay Resources Announces 50/50 JV at Fran Gold Project, British Columbia; Initiates NI 43-101 Resources Estimate and Bulk Sample • NBRI • May 21, 2024 9:07 AM

Greenlite Ventures Inks Deal to Acquire No Limit Technology • GRNL • May 17, 2024 3:00 PM

Music Licensing, Inc. (OTC: SONG) Subsidiary Pro Music Rights Secures Final Judgment of $114,081.30 USD, Demonstrating Strength of Licensing Agreements • SONGD • May 17, 2024 11:00 AM