Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Insurance policies exclude coverage for fraud. Ryan has already experienced this clause and sued an insurance company and the case was dismissed.

Poor Halbert raised a moron. SEC already has its hook set on Ryan. Now the creditors are coming.

Pursuant to the Plan Support Agreement, the Debtor’s largest secured creditor, Empery, as agent for MP

Collateral, agreed to cap its prepetition secured claim for the Empery Loans at $18 million and carveout any recovery

above $12 million for the benefit of general unsecured creditors, which proceeds will be used in part to establish a

litigation trust to pursue the estate’s claims against the Debtor’s current and former directors and officers, including

Ryan Drexler.

PeonyVMW...."profitable" is questionable at best and not likely in my opinion. Revenues are not being reported corollated to expenses. For example, one the largest revenue streams reporting is Coupang (the S Korean Amazon) but encompass several months of revenues (perhaps quarterly, maybe semi-annual, but I'm guessing) but are reported as revenue in just a single month occasionally and not every month, yet the expenses reported are not corollated and are month to month upon orders via the DIP financing. We don't know if "profitable" is accurate if you attribute perhaps 3 months of revenue to only 1 month of expenses on your largest revenue stream.

Gone is the $20m Beverly Hills mansion. Poof goes the Malibu beach pad. Now someone has moved to Reno, NV. https://www.zillow.com/homedetails/724-Marewood-Trl-Reno-NV-89511/251962686_zpid/

To get on the good side of local law enforcement, why not bribe them with leftover product you stole from the suppliers. I'm sure law enforcement isn't investigating this.

Big Thanks to Ryan Drexler from MusclePharm for dropping by some Combat Energy Drinks for our officers as well as their generous contributions to RPD’s upcoming fitness facility and support of our Officers wellness! #WeLiveThis #EnergizeRPD #OfficerWellness pic.twitter.com/BEoBD0GzZE

— Reno Police (@RenoPolice) March 2, 2022

SLC, notice /s ?

you will most commonly see /s to denote some online comment as sarcasm.

Peony, I am not a premium member so do not have access to PM. My allegations regarding Ryan Drexler committing PPP fraud is based on the following facts:

From the Treasury Department:

The funds will be used to retain workers and maintain payroll or to make mortgage, lease, and utility payments.

Payroll costs are capped at $100,000 on an annualized basis for each employee.

.jpg)

If you want to read what happened behind the scenes the past several months and some of the funniest text message responses to the "good faith" liar Ryan Drexler, click this link.

https://cases.stretto.com/public/x219/12044/PLEADINGS/1204403212380000000044.pdf

Interesting read in how the wolves are now devouring the carcass of the failed trust fund baby of Halbert Drexler.

https://cases.stretto.com/public/x219/12044/PLEADINGS/1204402272380000000144.pdf

Ryan has also downsized from his former Beverly Hills and Malibu estates (where he was delinquent on his property taxes) to a postage stamp lot and tract home in Reno.

Back to very telling IMDB credit: https://www.imdb.com/name/nm3573940/bio

To report fraud on the PPP program, specifically Ryan Drexler who illegally personally pocketed 100% of the PPP funds allocated to Musclepharm:

https://www.sba.gov/partners/contracting-officials/contract-administration/report-fraud-waste-abuse

there are whistleblower awards available.

I, RYAN DREXLER, hereby declare under the penalty of perjury as follows:

1. The following facts are personally known to me and if called to testify thereto, I

could and would competently do so under oath.

2. I am the former CEO of Musclepharm Corporation (“Debtor”) and the former

Chairman of the Board of Directors for Debtor. I tendered my resignation as CEO in early December

2022, but because of litigation brought against the Debtor and I in New York, and the

commencement of this bankruptcy proceeding in Nevada, my resignation did not become effective

until January 8, 2023.

When will we see the PPP program loan of $900k that Ryan illegally diverted 100% to his own salary hit the fraud indictment wire?

December's numbers have been released....https://cases.stretto.com/public/x219/12044/PLEADINGS/1204402252380000000009.pdf

How long before Costco pulls the plug on MusclePharm?

Clearly vendors will likely slow roll delivery on any purchase orders after the MusclePharm Chapter 11.

As far as pre-bankruptcy purchase order deliveries:

If you delivered goods to a debtor in the 20 days before the debtor filed bankruptcy, and those goods were delivered in the ordinary course of business, then you can get administrative claim status of the amount of the goods delivered. See 11 U.S.C. § 503(b)(9). If your claim for administrative expenses is allowed, you jump ahead of all the other unsecured creditors, and in a Chapter 11 case, generally you get paid in full. (Note that the administrative claim is only for the value of the goods, and does not include add ones like taxes, shipping fees, or claims for surcharges. You can still make a claim for those amounts, but they will be an unsecured claim, and not entitled to administrative claim status.) Usually, there is a deadline set early in the case for filing a 503(b)(9) claim, so keep an eye out for notices concerning any “claim bar dates.”

With the limited MusclePharm inventory levels on hand due to cash on hand crunch, it is difficult to see how Costco who accounts for >50% of all Musclepharm revenues will be able to maintain any inventory.

More drama filed today that may be the blueprint for an attempted reorganization plan between Ryan and White Winston/Amerop. Empery successfully gained immediate relief in the courts to arrest this plan as they have collateralized essentially all the MSLP assets and likely demanded the accelerated payment on the notes.

Section 5(b) under the Notes provides that if any event of default occurs, the outstanding principal amount of the Notes, plus accrued but unpaid interest, liquidated damages and other amounts owing in respect thereof through the date of acceleration, shall become, at the holder’s election, immediately due and payable in cash at the Mandatory Default Amount (as defined in the Notes) and further that commencing five (5) days after the occurrence of any event of default and that results in the right or automatic acceleration of the Notes, the Notes shall accrue interest at an interest rate equal to the lesser of eighteen percent (18%) per annum or the maximum rate permitted under applicable law. The October Notes were amended pursuant to a Waiver and Amendment, dated June 3, 2022 (the “Waiver and Amendment”).

More questions than answers.

If "Big E" is CEO why did Ryan sign as CEO in Nevada Bankruptcy Court on December 15th?

Was "Big E" a negotiating piece pre-bankruptcy and is now gone that bankruptcy has been filed?

Honestly "who cares". It's over and there is no coming back. All MSLP retail investors should now change their occupation to "artist" on their social media.

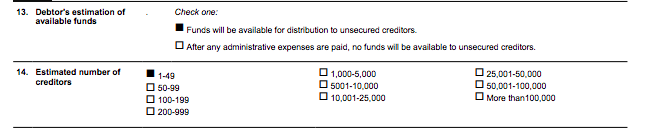

Looks like this initial filing was to stay the auction and tie Empery up. The fact Ryan estimates there will be funds available for unsecured creditors reeks of bankruptcy fraud. We all know the liabilities dwarf the assets and all the reasonable assets were secured often by as many as 3 priority class.

Class 1: Empery

Class 2: Prestige

Class 3: Ryan

I believe the company has 120 days to provide a reorg plan but there really isn't much to reorganize. MSLP doesn't have any burdensome leases or contracts that can alleviate the debt. This was a Ponzi Scheme that sold vendors wares and revenues were collected by Ryan to pay his enormous salary and note interest and then the vendors were stiffed or payed pennies or unreasonable installment agreements that were not adhered. Who wants to manufacture MSLP products without a retainer that is at least Payment in Full of a potential purchase order before any manufacturing?

COGS were nearly equal to Revs anyway and we all know how Revs have declined under Ryan and losing any scaling potential and besides the only real rev stream is Costco and they are pressuring vendor price cuts.

When Gaspari Nutrition went kaput several years ago, Rich bought his old company back. Maybe Brad and Cory would be interested in part deux ;)

When a fake Leonardo like Salvator Mundi sells for $450m, maybe Ryan is hoping for a Hail Mary at auction. ;)

Maybe that's why Ryan describes himself as "artist" at present.

Thought this post under my old moniker was a proper way to end it.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=117659857

Musclepharmcorp.com is gone

https://www.musclepharmcorp.com/

Ryan no longer lists himself as MusclePharm CEO on his Instagram. Now he lists himself as an "artist" ..... I think a better description would be "scam artist"

https://www.instagram.com/drexphotos/?hl=en

Equity wise you would need to sell 1m shares of MSLP at its current price to purchase a single $2 can of that hot selling MSLP Combat Energy drink that was promised to produce $30m in sales. At the most recent reported OS, the entire Market Cap would purchase a couple12 can cases. Turokman of course is still averaging down and in the black ;)

Look again.

The non reliance covers the entire 2021 10-K AND the 2022 Q1.

15 months of non reliance financials.

But as I have opined many times, the MSLP financials have been fraudulent since Ryan became CEO. He threw his former college roommate under the bus for fraudulent Q end stuffing previously.

Stiffed suppliers out of over $40m and actually reported almost half of that figure as profit when suppliers modified their outstanding invoices to collect anything. MSLP has been a fraud and Ponzi Scheme for a long time.

On August 22, 2022, the Board of Directors of the Company determined that the Company’s financial statements contained in its Annual Report on Form 10-K for the year ended December 31, 2021 and its Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 should no longer be relied upon due to errors in such financial statements, and that a restatement of such financial statements is required.

Yikes!! Empery Asset Mgmt. Only has $18m portfolio value and are on the hook for over $8m to MSLP who literally can't pay. Ask any of the suppliers.

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001415684/000149315222026142/form8-k.htm

Any news? It has been 90 days since the maturity date of the senior notes. Shouldn't take a CFO to reveal the status of the notes. They were only 180 day notes to begin with and yet 90 days after the extended maturity date, Ryan can't file an 8-K?

Senior Notes Payable

On October 13, 2021, the Company entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with certain institutional investors as purchasers (the “Investors”). Pursuant to the Securities Purchase Agreement, the Company sold, and the Investors purchased, $8.2 million (the “Purchase Price”) in principal amount of senior notes (the “Senior Notes”) and warrants (the “Warrants”).

The Senior Notes were issued with an original issue discount of 14%, bear no interest and mature after 6 months, on April 13, 2022. To secure its obligations thereunder and under the Securities Purchase Agreement, the Company has granted a security interest over substantially all of its assets to the collateral agent for the benefit of the Investors, pursuant to a pledge and security agreement.

The maturity date of the Senior Notes was extended to May 28, 2022, on April 12, 2022.

The maturity date of the Senior Notes also may be extended under other circumstances specified therein. Subsequent to the extension, interest accrued from April 13, 2022 at 18% per annum until the Senior Notes are paid in full.

The Company is undertaking various initiatives to improve gross margins to become cash flow positive prior to the maturity of the Senior Notes.

These initiatives include improving cost of goods sold on certain raw materials. There can be no assurance the Company will be able to successfully implement such initiatives on a timely basis or at all or that it otherwise will meet the conditions required to extend the Senior Notes.

If the Company is unable to extend the Senior Notes or elects not to do so, the Company will be required to repay the Senior Notes through equity issuances, additional borrowings, cash flows from operations and/or other sources of liquidity.

So we have Ryan admitting company has overstated revenue to the tune of $1m or more and that the past five 10-Qs and the 2021 10-K should be deeemed unreliable.

We have seen two CFOs walk out the door in past 30 days.

The Q2 is 9 days past due and counting.

Was Q1 2022 the final 10-Q we will see from this company?

One thing is for certain, more suppliers are getting screwed and the most likely news to come will be additional lawsuits against MSLP and Ryan.

That was quick. Two CFOs in less than 30 days out the door.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 17, 2022, Eric Chin resigned as Chief Financial Officer, Chief Accounting Officer and Director of MusclePharm Corporation for personal reasons.

MSLP overstates $1m in revenue! What do you want to bet it is related to the energy drink?

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001415684/000149315222023755/form8-k.htm

Even the notification of the 10-Q being late....was late by 2 days. Does Ryan even come in to the office any longer? Oh, that's right....there is no office.

Q2 Financials were due yesterday. The dog ate my homework.

Ryan has been desperately cashing out his last remaining "personal assets" the past year IMO. I personally believe the money his sister transferred to him (by my best guess around $20m) that he poured into the convertible to avoid it becoming part of her divorce settlement, is now lost. Her husband sued her and the Drexler family for fraud.

https://nypost.com/2016/09/14/trust-funder-wife-ripped-me-off-in-business-deal-agency-chief/

But Ryan just sold his remaining real estate property....the house in Bev Hills to former Pimco bond king Bill Gross' young daughter as they shared a driveway on the property. The sale was at a huge discount and went for $20m coincidently.

Doesn't take a rocket scientist to speculate his sister wanted her money back ASAP and Ryan couldn't find the funds to even pay his property taxes on his Malibu house that is torn down and is now "embezzling" $7k a month from the company and shareholders for a rental home. He "embezzled" over $50k for moving expenses too.

This is all my speculation and opinion of course but it is all makes perfect sense and Ryan is now likely broke as a joke and has squandered his entire trust fund that daddy Halbert gave him.

Wonder if Ryan has sold daddy's Silver Lambo yet?

Maybe Sabina instead of trolling me, actually did some research on the information I posted and found it credible and realized she is an idiot.

On July 6, 2022, Sabina Rizvi notified the Board of Directors (the “Board”) of MusclePharm Corporation (the “Company”) of her resignation as President and Chief Financial Officer of the Company, effective July 22, 2022.

I thought Ginger was getting awfully quiet, hence the new $400K a year bookkeeper I wrote made no sense a couple weeks ago.

How fake is this? .

200K shares "reported" trading in one day the middle of the week at .25 cents in desperate pump and dump scheme.

Now Friday the "ask" drops to .18 cents and 100 shares trade all session. Where is that buyer from just a day or two earlier? Doesn't want a -30% discount on his portfolio?

Make any sense? It does in a pump and dump scam with press release touting a "maybe" NASDAQ uplisting.

This can be considered a Ponzi Scheme business (selling 3rd party wares and collecting money, not paying the supplier) and an attempted "pump and dump" fraud on the shares IMO.

This is so shady, but that's CEO Ryan like when he hires one of best friends (despite a mention in the 10-K that there is no relationship between any officers) to become an officer and chair of the compensation committee that grants Ryan a $1m a year raise while the stock is down -90% and Revenue is down -80%.

An all but bankrupt company that is stiffing nearly all its suppliers and borrowing money at up 200% interest gives away 22m share warrants for basically nothing which would dilute current OS by 66%.

Creates a "maybe" NASDAQ uplisting (IMO, fake as they don't even qualify) and put out a Press Release.

Fire off a bunch of fake round trip trades at the very close of trading session to garner attention from penny share retail mooches.

Weeks go by on this equity with literally ZERO share volume but now 200k shares are roundtripping consistently on the pink sheets where their is no retail order rules and MM can basically fill as they wish or just plain fake trades that never initiate nor clear.

https://www.sec.gov/tcr

https://www.sec.gov/oiea/Complaint.html

https://www.sec.gov/tcr .

https://www.sec.gov/oiea/Complaint.html

Remember this post from just 3 weeks ago. Look how the MM pumped all the fake trades right at the bell to stir interest that I laid out had to happen soon in this failing Ponzi Scheme.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=169090313

Madcowelixir

Wednesday, June 08, 2022 1:02:15 PM

Post# 80737 of 80765

Yikes!!! Dilution Alert nearly doubles Outstanding Shares and More Massive Interest Expense as they continue to stiff suppliers to the point Combat Crunch Bars are no longer available. So $2.5m in cash supplied and draws ~20% interest in 6 months and 22m "free" shares (see below). Crazytown!

Quote:

MusclePharm announces additional private placement of $2.5M senior secured notes

Jun. 07, 2022 5:50 AM ETMusclePharm Corporation (MSLP)By: Niloofer Shaikh, SA News Editor

MusclePharm Corporation (OTCPK:MSLP) has increased its October 2021 offering to provide for the issuance and sale of an additional senior secured notes and warrants.

The company will issue an additional $3,081,875 in principal amount of 20% original issue discount senior secured notes, resulting in gross proceeds of approximately $2.465M.

The notes will be due six months from the issuance date.

The company has also agreed to issue the investors five-year warrants to purchase up to 22,013,393 shares of the company’s common stock which warrants will be exercisable immediately at $0.2310 per share.

The private placement is expected to close on or about June 8, 2022.

Net proceeds will be used for working capital, general corporate purposes and marketing and advertising for the company’s new energy line.

******Hmmmmmm? Now whomever this "secret" preferred shareholder is can literally short up to 22m shares of MSLP risk free. Today's price is ~ the exercise price therefore every share shorted protects the "mystery" financier from further downside so any downward share price is "profit" but also has 22m "free" shares to cover any potential appreciation in stock price. Now you just need volume which the market maker has been desperately trying to stir interest up with these 200k share likely round trip churn trades recently.