None of my comments or posts should be considered a directive to buy or sell a stock. Everyone needs to decide that for themselves.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

i would just love to see .0008 lol

volume is very lite but the good news is its all buys lmbo...

if its due to launch at the end of may...a pr should be coming next week or two i would hope...im calling lol

Due to launch at the end of May, perhaps in time for SOCAP/Europe, GATE is well capitalized and moving fast in a land grab. But it won’t have the market to itself.

launch is due this month i must have missed this the 1st time i read it.

This section from the Angels in Action acquisition press release gives a hint at GATE’s underlying vision and passion: “This acquisition will enable [GATE Global Impact] to achieve a more holistic solution for sustainable investments across multiple customer segments. The convergence of Community Reinvestment, Community Banking and Microfinance will create ‘Impact Banking’ in the US. There is clearly a new customer demographic in the marketplace.”

It goes on: “Purchasing methods and tools have evolved. Microloans repaid with micro-payments. Virtual Good created with Virtual Currency.” In my experience, when entrepreneurs boil things down to sentence fragment nuggets they are in the grip of their vision and can see the future they are aiming at. That’s how I read the last sentence.

Due to launch at the end of May, perhaps in time for SOCAP/Europe, GATE is well capitalized and moving fast in a land grab. But it won’t have the market to itself.

The spunky entrepreneurs at Mission Markets continue to make headway. More significant may be the way GATE Impact plays with ImpactAssets – the about-to-be-launched platform of 50 vetted impact investment funds that is working on linkages with the impact investment client portfolio of other large financial institutions – remains to be seen. ImpactAssets should be ready to launch by SOCAP/Europe.

Though it lacks the sudden floods of capital and the deep technology connections, ImpactAssets brings decades of trust and understanding of the space, along with a pre-vetted portfolio of 50 Impact Funds. So, GATE Impact has dollars and software, while ImpactAssets has pipeline and domain expertise.

Backed by Calvert, Rockefeller Foundation, and the Cordes Foundation, ImpactAssets is creating linkages to asset manager’s software platforms. Those linkages are a key advantage. Since asset managers are compensated by a fixed percentage of the total of the assets under management, they have traditionally tried to dissuade their clients from investing in impact investment companies and funds because those funds and companies are not on their software investment management platforms. So $1 million invested in, say Goodwell’s new platform of funds that might focus on health, mobile, and education in the developing world, is lost income for the investment manager, even if the fund performs at market rate with awesome social impact.

Integrating ImpactAssets’ 50 funds with an investment manager’s portfolio management software lets the gatekeeper kept on an impact investment deal technically under his management. That can transform the gatekeeper into someone eager to respond to pent-up customer demand.

I think there is plenty of room for a lot of platforms, but it will be interesting to see which approach catches on quickest and how they find ways to grow the market together. There is plenty for all; this market is about abundance, about more than monetary value. If the platforms act in a closed way, rather than partnering, it will hurt their business. Brand in the social capital market is joined at the hip with a credible social mission, one that is acted on in the way the social enterprise does business.

Posers can’t build platforms in this market. I am, of course, not saying that any platform is a poser; it’s just that transparency about impact, and whether the profit is appropriate, will be asked more deeply in this marketplace. Mission creep is a mission critical risk in all these platforms; they are built on a trust in their blended value. That’s a deeper level of trust, but it’s also more serious when it’s broken.

The mission is baked in to the market at the intersection of money and meaning. It’s the foundation of any platform that has a chance at viability in the social capital market.

trying to add......wealth transfers from the inpatient to the patient...

5 years from now a handful of us that held all are 1s will be thinking wow and the o/s was so high..and look at it now

thats 1 way to reduce the o/s lol,

ETMM ,,,, 0.0001 ,,,, 15570600,,, 09:35

NITE ,,,, 0.0002 ,,,, 425321374,,, 09:34

UBSS ,,,, 0.0002 ,,,, 100815600 ,,,, 09:30

had to copy n paste..i learned i cant post anything over 48 hrs old n mods cant post anything under 48 lol....i had to copy and paste it new

edit them and re use them if in 15 minutes lol

AGEL "DD" CompilationPosted by: MaxShockeR

In reply to: None Date:5/7/2011 9:27:27 PM

Post #17273 of 17376

AGEL "DD" Compilation

The game plan has changed for AGEL. and it's HUGE, Gates TEchnology, PRudential, Papajohns etc... also dont forget most important of all this is the resignation of Milton.C.AULT.

So a Private Co (Gate Tech) acquires a public traded company (AGEL) = Merger / Acquisition ? will be interesting to see what will happen in the upcoming weeks/months. This will be a huge multi-bagger/runner soon, AGEL + GATE + PRU + PapaJohns = HUGE ? only time will tell patience is key. the Risk/REWARD is good, anyways until more of the story unfolds, heres some info that i found/gathered so far.

Molinari co-founded GATE Technologies with Lori Livingston, who serves as the firm’s chief technology officer.

Ms. Livingston was the founder of Transfer Online, a stock transfer and registrar agency, was one of the first

in the industry to bring transfer agent services and full reporting to the Internet.

More on them here: http://gatetechnologies.com/about/management-team/

http://www.gateus.com - http://www.gate-india.com - http://gate-brazil.com/

> Linked In Profiles <

Vince Molinari http://www.linkedin.com/pub/vincent-molinari/2a/a07/357

Lori Livingston http://www.linkedin.com/pub/lori-livingston/1b/973/681

----------FILINGS----------

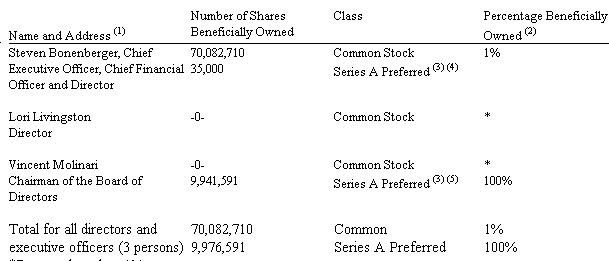

April 11 2011 Form 10 K (p.21 for beneficial ownership)

Jan 12 2011 Form 8K Angel Acquisition Corp. Announces Management Changes - (Milton.C.AULT is GONE, he resigned)

Angel Acquisition Corp. reported in its Form 8K that, on January 10, 2011, the Company accepted the resignation of Steve Bonenberger as Chairman of the Board of Directors of the Company. Mr. Bonenberger will continue to serve as Chief Executive Officer, Chief Financial Officer, Secretary and a member of the Board of Directors. Effective as of the same date, to fill the vacancy created by Mr. Bonenberger's resignation, the Board of Directors appointed Vincent Molinari as Chairman of the Board of Directors. On January 10, 2011, the Company accepted the resignation of Milton C. Ault, III as President. Effective on the same date to fill the vacancy created by Mr. Ault's resignation, the Company appointed Steve Bonenberger, Chief Executive Officer, Chief Financial Officer, Secretary and a member of the Board of Directors, as President <====.The Board of Directors now consists of Steve Bonenberger, Lori Livingston and Vincent Molinari

fully reporting stock SS info on ocmarkets

fully reporting stock SS info on ocmarkets common stock, 15,900,000,000 shares authorized,

8,005,908,229 outstanding March 9 2011

3,923,408,229 shares issued, respectively

Action Type: Amendment

Document Number: 20100460185-97

File Date: 6/24/2010 Effective Date:

Previous Stock Value: Par Value Shares: 25,100,000,000 Value: $ 0.00001 No Par Value Shares: 0 ----------------------------------------------------------------- Total Authorized Capital: $ 251,000.00

New Stock Value: Par Value Shares: 15,900,000,000 Value: $ 0.00001 Par Value Shares: 100,000,000 Value: $ 0.00001 No Par Value Shares: 0 ----------------------------------------------------------------- Total Authorized Capital: $ 160,000.00

Gate Technologies, a New York-based company that specializes in secondary markets, closed on $3.5 million in funding from venture capitalist John Pappajohn. Gate plans to use the money to expand its infrastructure, the company said on Wednesday. Pappajohn is also joining Gate's executive board. Secondary markets, also run by companies such as Sharepost and SecondMarket, have exploded in popularity in recent years, as investors seek out the exchange of shares in hot private companies like Twitter and Facebook. Pappajohn is the founder and president of the Des Moines, Iowa-based firm Pappajohn Capital Resources.

Several people close to the deal say that an unnamed investor actually made an additional $7.5 million investment in GATE Impact. There’s a land grab going in which impact investing is only one vertical that GATE is moving fast to penetrate, along with others.

GATE raised another $3.6 million this spring from private investors to help it acquire other software platforms focusing on emerging, alternative illiquid markets, from secondary stock (competing with SecondMarket) to a peer-to-peer U.S. based microfinance loan platform (Angels in Action, similar to Prosper). GATE Impact was the acquirer of Angels in Action, for an undisclosed price.

GATE Technologies, LLC, announced today that it has acquired controlling interest in Angels in Action ("AIA"), an operating division of Angel Acquisition Corp. (OTCQB: AGEL) (PINKSHEETS: AGEL), enhancing the offerings of its subsidiary, GATE Global Impact ("GGI"). Angels in Action is a Carlsbad, California based company focused on providing microfinance services in the U.S. marketplace. AIA's platform enables eligible American entrepreneurs to secure quick-and-ready financing through peer-to-peer loans and microloans. The terms and conditions of the sale will be announced and fully disclosed in the near term.

GATE Technologies announced today its entrance into the impact investment market with the pilot launch of GATE Global Impact LLC (GATE Impact), which was made possible with a $2.5 million lead investment by Prudential Financial, Inc. (NYSE: PRU) through its Social Investment Program.

GATE Technologies CEO Vincent Molinari said the combination of InfoEx's powerful profiling and relevance technology in conjunction with the ability to deploy relevant third party information to investment professionals through InfoEx's patent-published Indicast product will create the first actionable information trading forum.

GATE Technologies announced today the successful closure of $3.6 million in funding from a group of private investors. GATE plans to use the capital to expand its market infrastructure for providing an end-to-end solution buying and selling illiquid and alternative assets.

Transaction Ensures Ability to Bring End-to-End Solution for Trading of Illiquid Alternative and Impact Investments

GATE Technologies announced today the acquisition of an exclusive license to use Transfer Online's stock transfer and record-keeping software for the trading of alternative and impact investments globally.

"This transaction continues GATE's commitment to developing the best end-to-end solution for the electronic trading of these assets," said Vincent Molinari, co-founder and CEO of GATE.

GATE Pro is a recently approved ATS targeting the $1.2 trillion of private company, restricted securities.

GATE U.S. LLC, the subsidiary of GATES Technologies bringing out the electronic trading platform, is a FINRA-registered broker-dealer, which it says is the first fully electronic trading platform specializing in illiquid assets. The first securities to be offered for trading on GATE Pro will be private company stock and private investments in public equities. GATE Pro’s launch follows its recent approval of ATS status for Rule 144A securities.

“By bringing liquidity, transparency and price discovery to a traditionally opaque marketplace, the GATE Pro platform will – for the first time – bring buyers and sellers of these securities together electronically,” commented Joseph Latona, Head of Trading for GATE US in the press statement.

Stock in privately held companies like Facebook and Twitter are very desirable assets of late, and savvy investors aren't letting the fact that they're not public stand in their way.

Trading at those privately held companies is expected to hit $7 billion this year, a jump of more than 50 per cent.

The trading action itself happens on "private exchanges" — members only stock markets where shares in firms change hands weeks and months before they go on sale to the public in an IPO.

"The only reason you would make a private investment is that you make an assumption that you're going to be getting a public offering of these private shares," CBC business analyst Kevin O'Leary says of the markets.

"All these companies tend to be ones everybody knows are going public in the next 24 months are so," O'Leary says.

The catch? You often need as much as $1 million in liquid assets for a seat at the table.

SharesPost is one such exchange. Since launching in mid-2009, the exchange allows its 50,000 members to bid for shares in 150 companies worth some $400 million.

Gate Technologies LLC is the latest entrant to the space. CEO Vincent Molinari sat down with the CBC's Amanda Lang to talk about the business model, the appeal for investors, and what the impact of these markets might mean for IPOs moving forward.

its their i see it? no or yes?

could be server issue that it what back to the last saved copy...i noticed that as well..

or fill 2 i dont care...just nothing agel new really lol...p

Got 1more space for sticky add away.

agel has no news im just posting stuff that is related...

Sign Up - GATE Impact - Environmental and Social Impact Investing ...

6 days ago - GATE Impact 1212 6th Ave, 8th Floor, New York, NY 10036 PH (646)-449-7980 ...

www.gateimpact.com/page/sign_up/index - Cached

Show more results from gateimpact.com

angel is part of gate u.s...

Angels in Action will serve as the microfinance stage for GATE Impact US.

The GATEway platform will ultimately facilitate Impact Investing and

Microfinance in the US market. This acquisition will enable GGI to

achieve a more holistic solution for sustainable investments across

multiple customer segments. The convergence of Community Reinvestment,

Community Banking and Microfinance will create "Impact Banking" in the

US. There is clearly a new customer demographic in the marketplace.

Purchasing methods and tools have evolved. Microloans repaid with

micro-payments. Virtual Good created with Virtual Currency. "We are proud

to extend our platform in the emerging U.S. Microfinance sector, and

connect with a historically overlooked demographic that has proven

profitable globally," said William Davis, President of GATE Impact, LLC.

“The connection between GATE US and Fidessa is an important milestone for us,” noted GATE President James O’Reilly. “We founded GATE with the intent to streamline the liquidity process, and this engagement with Fidessa brings us closer to fulfilling that goal of bringing liquidity and transparency to the world’s illiquid markets.”

Justin Llewellyn-Jones, managing director of Fidessa in the US, added, “One of the key assets of the Fidessa connectivity network is the breadth and diversity of its membership. We actively seek to bring innovative and different market participants on board. By welcoming GATE US to the network, we strengthen that offering still further, adding a wealth of new opportunities in restricted securities and private equity to our institutional members.”*

GATE US Joins Fidessa Connectivity Network

http://www.highfrequencytraders.com/article/722/gate-us-joins-fidessa-connectivity-network

I see. 0001 for the next few...

now i think you finally see why i kept saying this is a big piece to our puzzle

WASHINGTON (Reuters) – The top securities regulator pledged a rigorous review of potentially outdated private securities trading rules, but stopped short of endorsing changes being advocated by Republican lawmakers.

At a congressional hearing on Tuesday, Securities and Exchange Commission Chairman Mary Schapiro was pressed to make regulatory changes to help small and medium-sized companies more easily raise capital without going public.Republicans want the SEC to raise the 500 shareholder threshold, or else change the rule so that more sophisticated investors who understand the markets will not count toward the total. They say the cap is too low and forces companies to raise capital only with large sophisticated investors and harms the ability of smaller investors to get a piece of the action. They also fear it creates costly logistical challenges for companies as they seek to manage the shareholder total so they do not hit the 500 mark.

"These folks are very sophisticated," said Representative Patrick McHenry. "For heaven's sake, if you look at these substantial institutional players, they've got better research and information than the SEC and the government," he said.

Schapiro sought to strike a balance between lowering regulatory barriers for companies and protecting investors from fraud, telling McHenry that sophisticated investors "are no less deserving of the protections of the securities laws."

She and SEC Corporation Finance Division Director Meredith Cross assured lawmakers the SEC is exploring whether to exempt certain investors from the 500 shareholder rule as part of the SEC's broader review into private securities trading. They also said they are exploring if the 500 number is the right one.

In addition, Cross said the SEC is thinking about soliciting input from the public about potential changes to general solicitation rules.

Some Democrats on the panel expressed skepticism about overhauling rules designed to protect investors.

"I fully support helping U.S. firms access additional capital, but I also believe this must be done without sacrificing critical protections," said the Elijah Cummings, the committee's top Democrat.

no but we can get a great idea of if it is moving forward or shot down at 1st look

most likely true....when has our government ever moved quick ...but we will see how it weighs in...or if its a no go we will no quicker..looking forward to cnn tonight lol

going on now.....why i thought volume would be up today....but gates is keeping everything hush.i don't think news is 3 months out.imo we will know most everything by june 1.gates is moving quick...

agreed their but with out the change in the sec 500 rule gates would not be doing this...they are building this around the change.once that is a go news will come..without the change its not gonna get the same bang is all im saying

yea its 0 lol.....

everything...it 500 share rule is not changed gates has no use for aia.

thanks cappy

can some post L2 at market open...

i expect this to see some volume today....today's hearing should set off the trigger....imo...aia news should follow soon with approval

hearing on Tuesday on the trading of private securities will be the subject of a hearing on Tuesday by lawmakers concerned that the regulations may be stifling the formation of capital.

Goldman Sachs, in a high-profile case, was spooked into limiting an offering of Facebook shares in January to foreign investors out of fear that a sale of the private shares to U.S. customers would violate the rules.

Securities and Exchange Chairman Mary Schapiro and SEC corporation finance director Meredith Cross will appear together at the House Oversight Committee after its chairman, Darrell Issa, questioned whether U.S. rules governing the trading of private shares are outdated and hinder the creation of capital.

The SEC is analyzing whether its rules for private-share issuances are still relevant in an era of buzzed-about offerings, complex investor pools, and online trading platforms that allow investors to quickly swap hot tech company shares.

Schapiro has not said when or how the SEC may modernize these rules, which have prompted cash-hungry companies such as Google to go public and have dictated how investors can get an early piece of the action.

The SEC is also monitoring the lightly regulated world of private-company share trading on online platforms such as SecondMarket and SharesPost. SecondMarket confirmed in January it had received a request from the SEC for information, and its chief executive, Barry Silbert, will be also be on hand to testify Tuesday.

The trading of private shares has featured prominently in the media lately as Wall Street banks and electronic markets seek to offer investors a chance to actively trade stakes in hot technology companies such as Facebook, Zynga and Twitter before they go public.

man had planned to offer U.S. investors a chance to buy Facebook shares but ultimately opted only to sell the shares to foreign investors because of intense media coverage of the deal.

Although the SEC did not ask Goldman to limit its offering, Goldman was concerned the media coverage could have violated a general solicitation ban for private offerings that is intended to protect investors.

The Goldman-Facebook deal also drew attention to another old rule on the books that determines when a company must go public.

Under current regulations, companies must begin filing regular financial disclosures if they exceed 500 shareholders of record. But Goldman Sachs had found a legal way to get around this rule by using a special purpose vehicle that aggregated investors into one.

Schapiro has said the SEC is looking at these rules to see if they should be modernized, and that the SEC is also examining whether regulatory relief should be available for a new capital raising strategy known as "crowdfunding" in which a group of people pool their money together to invest in a business opportunity.

In addition she added that the SEC is reviewing the electronic trading of private shares, noting in a letter to Issa that these platforms raise concerns that the "pricing of securities may be influenced by conflicted market participants who may be buying and selling for their own account as well as facilitating transactions" for others.

On Tuesday, Issa is expected to raise concerns about the outdated rules and whether they are impeding capital formation.

In a letter to the SEC late last month, he asked for the agency to conduct a cost-benefit analysis of the general solicitation ban and how it affects private issuers with no plan to go public.

He also asked the SEC to loosen its 500-shareholder rule, saying it is creating "unintended consequences that constrain liquidity."

In prepared testimony, SecondMarket CEO Silbert will make a similar pitch, saying loosening the rules will "ease pressure on growth-stage companies."

He called for an increase or elimination of the 500-shareholder rule, and said that the general solicitation ban "unnecessarily limits the pool of potentials investors."

(Editing by Steve Orlofsky)

if r/s was gonna happen imo it would have already been done...buy back is more logical at this point...jmo

i agree you can make money here...but it is a scam...just scared as soon as i did they would freeze it...charts don't lie.but cctc does.

.

thats good to laugh on monday..glad i could help.hope you didnt invest your nest egg here..i have followed cctc 3 years.not once has a pr come true...lies n more lies...that is fact.....not my opinion....

imo...agel will see very little volume till news...reason...no 1s..better grab 2s soon that too will be a thing of the past

agreed...hope all is going well for you

added it last night