Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

AbbVie Wants To Be Hunter, Not Hunted Post-Abbott Split

Comment Now Follow Comments

AbbVie, the proprietary drug business of Abbott Laboratories, splits off into its own company next week, officially trading on the New York Stock Exchange on Wednesday.

Though billions of dollars of its sales are at risk from patent expirations in the next three years, new drug maker AbbVie (ABBV) launches next week with a pipeline its management hopes will have a cure for acute future revenue needs.

Next Tuesday, the proprietary drug business of Abbott Laboratories (ABT) officially splits off into AbbVie, a company that will debut in 2013 with $18 billion in annual sales and a market capitalization of about $55 billion. AbbVie begins trading on the New York Stock Exchange Wednesday.

Unlike other drug makers that succumb to acquisitions as their pipelines dry up, AbbVie plans to be around for the long haul. That is what 35-year Abbott veteran Rick Gonzalez who is AbbVie’s CEO and his team are telling Wall Street analysts and investors leading up to the split.

“AbbVie begins with our well established products and a patient-centered approach to a strong pipeline that features more than 20 mid-to-late stage clinical programs,” says Dr. John Leonard, a 20-year Abbott veteran, and current senior vice president of pharmaceuticals and R&D who will be senior vice president and chief scientific officer at AbbVie.

The pipeline will be the story. AbbVie gets off to a good start with one of the drug industry’s biggest successes in Humira, an autoimmune biologic used as a treatment for everything from rheumatoid arthritis and psoriasis to Crohn’s disease. Humira’s sales have more than doubled in the last four years to more than $9 billion annually.

But there is trouble ahead with Humira, which faces its first patent expirations in 2016. Humira accounts for half of AbbVie’s revenue and 70 percent of company profits.

Humira, already in a competitive market against similar biologics made by Amgen (AMGN) and Johnson & Johnson (JNJ) may also see its market share deteriorate from the likes of Pfizer’s (PFE) new rheumatoid arthritis drug Xeljanz.

Meanwhile, AbbVie’s cholesterol drug franchise will soon take hits from patent expirations. Abbott’s sales of cholesterol treatments, including Tricor and Niaspan, will drop more than $1 billion in 2013.

“Longer term, the company needs to build a better pipeline to prepare for increased Humira competition after 2016,” Morningstar analyst Damien Conover wrote in a report earlier this month. “Armed with best-in-class Humira, AbbVie is well positioned to drive strong cash flows to support its next generation of pipeline drugs. With AbbVie’s next generation of drugs not likely to reach the market until 2015 and several midsize drugs losing patent protection, Humira’s cash flows are particularly important.”

Gonzalez has been telling analysts — including many who are new to AbbVie management because Abbott has been historically been followed by medical device rather than pure-play pharmaceutical analysts – that Abbvie has “numerous medicines with breakthrough potential.”

There are 10 drugs in the final so-called Phase III stage of drug development including a potentially promising next-generation hepatitis C drug; the intestinal gel Duopa for the treatment of advanced Parkinson’s disease; daclizumab for multiple sclerosis; and new indications for Humira, which already has 9 indications and has another four in late-stage development such as pediatric Crohn’s disease.

Though unknown to the pure-play pharma crowd on Wall Street, Abbott executives say they have an experienced management team ready to tackle the challenges ahead.

Leonard, who was involved in the early days of the development of AIDS drugs Norvir and later Kaletra, has an international reputation among drug researchers. Norvir was among the first protease inhibitors and along with successor Kaletra made Abbott billions of dollars and put the company on the map in the 1990s when a lot of drug companies were taken over due to dry pipelines.

“AbbVie is a new type of company, a biopharmaceutical company, poised to discover and develop new medicines in some of the most complex areas of health care,” Leonard says.

Also joining Gonzalez is Laura Schumacher, another 20-year Abbott veteran who Abbott CEO Miles White tapped as general counsel and corporate secretary. She will be Abbvie’s general counsel while adding roles as head of business development and external affairs on the Gonzalez team.

Schumacher has been credited over the years with helping guide Abbott out of various regulatory minefields during the White era. Analysts see her as being helpful in pulling together the internal and external talent to navigate the patent expirations that lie ahead.

“AbbVie’s research and development has created a database of intellectual insights that should help increase the odds of successful drug development,” Morningstar’s Conover said. “An entrenched sales force in one of the most sought-after therapeutic areas of immunology should help the firm launch its next generation of drugs and make AbbVie a leading candidate for smaller drug firms needing help to develop and commercialize innovative new drugs.”

http://www.forbes.com/sites/brucejapsen/2012/12/28/abbvie-wants-to-be-hunter-not-hunted-post-abbott-split/

Omeros Reports OMS103HP Phase 3 Clinical Trial Results

-- Second Meniscectomy Phase 3 Clinical Trial Enrollment Targeted for First Half of 2013 --

-- Company to Host Conference Call Today at 5:00 p.m. EST --

SEATTLE, Dec. 27, 2012 /PRNewswire/ -- Omeros Corporation (NASDAQ: OMER) today reported results from its first pivotal Phase 3 clinical trial evaluating OMS103HP in patients undergoing arthroscopic partial meniscectomy surgery. In this multicenter, double-blind, Phase 3 clinical trial comparing OMS103HP to vehicle control in 344 subjects, the pre-specified primary endpoint was the Symptoms Subscale of the Knee Injury and Osteoarthritis Outcome Score (KOOS) – a patient-reported measure that is comprised of questions about knee swelling, clicking, catching and stiffness. In addition, pain measured in the early postoperative period was a pre-specified secondary endpoint. Although the Symptoms Subscale of the KOOS did not reach statistical significance, OMS103HP achieved statistically significant (p=0.0003) reduction of postoperative pain. The pain reduction data were similar in magnitude to those in the Phase 2 clinical trial. OMS103HP also demonstrated improvement across a series of pain-related assessments including postoperative narcotic usage (with more than twice as many OMS103HP-treated subjects taking no postoperative narcotics), incidence of inflammatory adverse events, tourniquet use, and crutch use as well as time to discontinuation of crutches and return to work, a number of which also achieved statistical significance. In this study, as in the earlier clinical trials, OMS103HP was well tolerated. Given the strength and consistency of the data in this Phase 3 clinical trial, Omeros' second OMS103HP Phase 3 trial remains on track and will begin in the first half of 2013.

"The data from this Phase 3 trial are compelling and demonstrate the benefits of preemptive and multimodal treatment during surgery," stated William E. Garrett, Jr., M.D., Ph.D, professor of orthopaedic surgery and team physician at Duke University. "Early postoperative pain is predominantly inflammatory pain, and control of postoperative pain and inflammation is critical to functional recovery in arthroscopy patients. While OMS103HP demonstrated positive KOOS data in the Phase 2 trial, the absence of similar data in this trial does not detract from the drug's therapeutic value in light of its reduction of inflammatory pain. Arthroscopy patients with significant early postoperative pain and inflammation generally face a slower and more difficult recovery."

OMS103HP, added to standard irrigation solution used during arthroscopy, is Omeros' proprietary PharmacoSurgery™ product designed to provide a multimodal approach to reduce pain and inflammation following arthroscopic surgery. Inhibiting inflammation and resultant postoperative pain is critical to the management of arthroscopy patients. Comprised of only anti-inflammatory active ingredients without any anesthetic agents, such as lidocaine or bupivacaine, and delivered directly to the joint in the arthroscopic irrigation solution, use of OMS103HP avoids the frequently reported damage to cartilage cells due to intraarticular delivery of local anesthetics as well as the detrimental effects of systemically delivered analgesics.

"These consistent results – better pain reduction together with less narcotic usage and less frequent incidence of postoperative inflammatory problems – underscore the strength of OMS103HP's unique approach to improving arthroscopy outcomes," stated Christopher C. Kaeding, M.D., professor of orthopedic surgery and head team physician at The Ohio State University. "Orthopedic surgeons understand the importance of preventing postoperative pain and inflammation, and there is increasing evidence that intraoperative joint inflammation is detrimental to the long-term health of the joint. Treatments currently available to us, however, are administered after the surgical insult. OMS103HP, delivered intraoperatively, provides an opportunity to inhibit inflammation and related surgical problems before they begin. OMS103HP could become a key component in the management of arthroscopy patients."

Results from this first Phase 3 arthroscopic meniscectomy clinical trial are expected to be presented at an upcoming major orthopedic sports medicine meeting. Omeros also plans to publish the results in a leading peer-reviewed arthroscopy journal.

"We are pleased with the outcome of this trial," said Gregory A. Demopulos, M.D., chairman and chief executive officer of Omeros. "While not meeting all endpoints, the consistently positive results on pain reduction and the series of related inflammatory measures mark a clear path to approval of OMS103HP. The arthroscopy market is large and these data, together with an early 2013 NDA submission for our ophthalmic surgery product OMS302, set the stage for potentially two near-term market launches."

Re: OCLS...from what I've read Microcyn is nothing more than diluted bleach. There's not much info on their website explaining how it works or why it's superior to other treatments. It's also been pumped by Biomedreports.com which leads me to suspect it's a scam.

BioWorld's Top 10 Countdown of 2012's Most Impactful Stories

By the BioWorld Staff

In the six decades since Watson and Crick discovered the structure of DNA, rarely has a year passed in the biopharmaceutical sector which could be defined as boring. The scientific revelations continue to yield intellectual property for businesses to develop. And investors scramble to identify and back potential blockbuster targets.

2012 was no different. BioWorld's editorial team huddled and voted on the 10 most poignant stories which emerged. Drum roll, please . . .

1 . At Pharma's Long-Dreaded Patent Cliff

As blockbuster drugs began going off patent in droves, big pharmas saw sales swoon, creating potential opportunities for nimble biotechs – particularly in technologies such as therapeutic vaccines, stem cells and tissue replacement. Erosion from generics will erase some $148 billion from pharma industry revenues by 2018, according to a report by global consulting firm PwC, and the bloodletting has already begun. U.S. sales of cholesterol drug Lipitor (atorvastatin), marketed by Pfizer Inc., plummeted from $2.7 billion in the first six months of 2011 to $679 million in the first six months of 2012. AstraZeneca plc recorded a 15 percent decline in third-quarter revenues, to $6.68 billion, as loss of exclusivity on four products – Seroquel IR, Atacand, Nexium and Merrem – pounded its bottom line. Revenues from schizophrenia drug Seroquel IR (quetiapine), alone, dropped by more than $850 million, or 82 percent, in the quarter. Merck & Co. Inc. also lost market exclusivity for asthma drug Singulair (montelukast sodium) in the U.S., with global sales declining $734 million, or 55 percent, to $602 million in the third quarter of 2012. Approval of a generic version of the attention deficit hyperactivity drug Adderall XR (mixed amphetamine salts) late in the second quarter of 2012 saw sales of the product by Shire plc fall 32 percent, to $102 million, in the third quarter. And on the eve of reporting its third-quarter earnings, Eli Lilly and Co. confronted a storm warning from Fitch Ratings, which lowered its outlook on the company from "stable" to "negative," calling the pharma's patent cliff the "steepest in the industry" and predicting significant margin compression in 2014, following the potential losses of antidepressant Cymbalta (duloxetine) and Type I diabetes drug Humalog (lispro) next year. Lilly's revenue swoon began in October 2011 with the loss of market exclusivity for antipsychotic Zyprexa (olanzapine), which had exceeded $3 billion in U.S. sales the previous year. Coupled with the patent cliff, pharmas faced falling drug prices in Europe on the back of austerity and uncertainty in the U.S., which continued to grapple with health care reform in the wake of the Affordable Care Act. Challenges facing the pharma industry were accentuated by the rise of biosimilars. (See #4.)

2. The All-Oral HCV Race

In 2011 , treatment for hepatitis C virus (HCV) advanced big time, with the approvals of new protease inhibitors Incivek (telaprevir, Vertex Pharmaceuticals Inc.) and Victrelis (boceprevir, Merck & Co. Inc.), which produced improved cure rates and shorter treatment durations. But those wins proved to be just the warm-up act for the HCV space, which saw the race for an all-oral regimen – i.e., a regimen free of the side-effect-plagued interferon – kick into high gear in 2012. Observers got an early sign in April, when Gilead Sciences Inc. reported a 100 percent sustained virologic response at four weeks with its Ns5B polymerase inhibitor GS-7977 (now known as sofosbuvir) in combination with Bristol-Myers Squibb Co.'s NS5A inhibitor daclatasvir. Gilead opted to forge ahead with its own GS-5585, an in-house drug similar to daclatasvir, and reported stunning interim results at the American Association for the Study of Liver Diseases in November from the Phase II ELECTRON study, showing a 100 percent response rate at 12 weeks with a GS-7977/GS-5885/ribavirin regimen. And Gilead appears to be leading the pack for now, after safety issues derailed former competitor BMS, which discontinued development of nucleoside HCV drug BMS-986094 in August – those toxicity issues also resulted in a clinical hold for a similar program from Idenix Pharmaceuticals Inc. and likely contributed to BioCryst Pharmaceuticals Inc.'s decision to pull an investigational new drug application for BCX5191 later in the year. But a number of other programs are rapidly advancing behind Gilead's from companies such as Vertex Pharmaceuticals, Medivir AB, Achillion Pharmaceuticals Inc., Roche AG, Merck & Co. Inc. and Abbott. Assuming all goes well, analysts have projected the first all-oral regimens to gain approval as early as 2014.

3. Finally, New Obesity Drugs

2012 was a banner year for obesity. June saw the first approval of a new obesity drug in 13 years. The FDA gave its blessing to Arena Pharmaceuticals Inc.'s lorcaserin, marketed as Belviq, for adults with a body mass index (BMI) of 30 or more, or those with a BMI of 27 with a complicating weight-related condition. Right on the heels of that approval, Vivus Inc.'s Qsymia (phentermine/topiramate) also won approval for a very similar patient group, those with a BMI of 30 or more, or those with a BMI of 27 plus one or more obesity-related comorbidity. Not long after, Orexigen Therapeutics Inc. received some long-awaited signals from the FDA that it could explore a faster path to resubmission of its new drug application for Contrave (naltrexone/buproprion). That's encouraging movement in a field that was effectively stalled for many months while the FDA deliberated over how to handle potential cardiovascular risks for obesity drugs. Signs are pointing to plenty of room in the market for the "big three," as well as many other obesity candidates making progress through pipelines.

4. Two Firsts: Biologic Blockbuster and Biosimilar MAb

Pulling in nearly $8 billion in global sales in 2011 , Abbott's Humira (adalimumab) became the first biologic to become the best-selling drug in the world. The biologic continued to rack up new indications in 2012, strengthening its position as a mega-blockbuster and adding to the allure of monoclonal antibodies (MAbs) as biosimilar targets. Speaking of which, Celltrion Inc.'s Remsima (infliximab) became the world's first officially approved biosimilar MAb when it got the nod from the Korean Food and Drug Administration in June. Celltrion had hoped to have the Remicade (Janssen Biotech Inc.) biosimilar also approved in Europe before year-end. While the U.S. FDA has yet to approve a biosimilar, it made some strides when it released three biosimilar guidances in February.

5. The Rocky Fundraising Road Continued

On the capital markets, biotechnology has done remarkably well despite the continuing turbulent economic landscape, particularly in Europe. According to the BioWorld Stock Report, the sector is poised to close out 2012 up a healthy 25 percent from where it started at the beginning of the year. However, biotech companies have not been able to emulate that success in raising capital. The $17.1 billion raised to date is 26 percent shy of the total generated at the same time last year. It has been particularly tough sledding for private companies trying to raise venture capital and globally they have raised $3.5 billion year-to-date, down 20 percent compared to the same period last year. It looks like the average deal size has also dropped significantly as the number of deals for both periods are about the same.

6. JOBS Act + FDASIA Pass Despite U.S. Political Squabbles

While the U.S. Congress was split by partisan quibbling for much of the year, the two sides came together to pass the Jumpstart Our Business Startups (JOBS) Act and the FDA Safety and Innovation Act (FDASIA). The JOBS Act is expected to have a significant impact on small biotechs by providing new fundraising options and easing the burden of complying with securities laws. FDASIA, or PDUFA V, also will have a big impact on biopharma. Besides setting prescription drug and medical device fees for the next five years, the legislation created new user fees for generic and biosimilar drugs. It also set new performance goals for the FDA, made two pediatric bills permanent, included provisions to advance "breakthrough therapies" and new antibiotics, and stiffened penalties on adulterating, stealing or counterfeiting drugs.

7. Genomics Finally Arrives (with a Real Purpose)

The completion of the human genome sequence in 2002 raised expectations for a new era of genomics and personalized medicine that turned out to be difficult to live up to. Instead of immediately unlocking cures to countless diseases, the genome seemed to raise 1 ,000 new questions for every one it answered, and in 10 years, little progress has been made in terms of putting that knowledge to use in real-life patients. All of that is beginning to change, though. Not only has 2012 seen the usual parade of scientific advances in genomics, but those advances are making regular appearances in clinical stage research, and becoming deal targets in themselves. More companion diagnostics are being approved, such as Quest Diagnostics Inc.'s anti-JCV antibody test for use with multiple sclerosis drug Tysabri, to screen out patients at risk for a brain infection. The year closed out with two large acquisition deals for genomics companies. Amgen plunked down $415 million to acquire DeCode Genetics, a genomics company that was threatened with bankruptcy liquidation just three years ago. And in September, Chinese company BGI-Shenzhen launched a tender offer for all outstanding shares of Complete Genomics Inc., a major player in the U.S. genomics space, for $117.6 million. It's clear that genomics assets are becoming necessary for growing biotech companies in the here and now, rather than as a minor sideline to be investigated for the future.

8. The First Gene Therapy Is Approved

In theory, gene therapy could abolish the biopharmaceutical industry one day. In reality the insertion of genes to prevent or treat diseases is rife with complex hurdles. But in a major first step for the modality, Glybera (alipogene tiparvovec), a gene therapy from uniQure BV for the super-rare inherited disorder lipoprotein lipase (LPL) deficiency, won marketing approval from the European Commission in November. The first patient was slated to get a commercial form of the product in Germany around the middle of 2013. While awaiting the official nod from regulators, uniQure screened 319 patients and found 32 with the relevant mutation in the LPL gene. The company has four more gene therapy products given clearance to enter clinical trials in Europe.

9. Through the Thicket of Alzheimer's Failures

Alzheimer's drug discovery found itself in a puzzling spot in 2012. Late-stage clinical trials in the indication continued to do what they have been doing for years – fail. This year added Eli Lilly and Co.'s candidate solanezumab, and Pfizer Inc. and Johnson & Johnson's bapineuzumab, which originated with Elan Corp. plc, to the rubble heap. But several research studies provided the strongest evidence yet that misprocessing of amyloid precursor protein or APP is indeed a cause of Alzheimer's disease, not just its consequence. In other words, targeting plaques should work – but it doesn't. Ideas for how to translate what is understood about the basic science of Alzheimer's disease into a working drug include starting treatment earlier, and interfering with the very earliest steps of APP processing in order to prevent the formation of oligomer intermediates as well as the plaques that have been the most common target of experimental therapeutics. But in 2012, that translation once again remained elusive.

10. A Nobel Prize for Regenerative Medicine Breakthrough

Another new treatment modality with as much promise as gene therapy but equally as challenging, gene therapy's troth is to harness the body's own regenerative and healing capabilities. A pair of UK scientists brought regenerative medicine a giant step forward in 2012 with their finding that cells can be reprogrammed to regain pluripotency, and the Nobel Prize in Physiology or Medicine went to stem cell researchers John Gurdon and Shinya Yamanaka. Gurdon's first work in the field came to light a half century ago, when his experiments with frog egg cells were published, though skeptics were many. The much-younger Yamanaka's investigations focused on genes that control the immaturity of embryonic cells, using them to reprogram other cells.

The Most Important New Drug Of 2012

The Food and Drug Administration looks set for a record 2012; with a few days left to go, it has approved 40 new drugs and vaccines, one of the most impressive totals ever, according to data from Pharmaceutical Approvals Monthly and FDA press releases. In this record haul, one medicine stands out for its scientific and medical importance.

Kalydeco, for cystic fibrosis, is a triumph of genetics and drug development, the first medicine to directly affect the genetic defect that causes the disease. It will only help 4% of the 70,000 people who suffer from declining lung function, damaged pancreases, and shortened lives due to CF worldwide, but in those few it has a dramatic effect. It makes medical history for three reasons:

-It’s a genomics triumph: Francis Collins, later famous for heading the Human Genome Project and then the National Institutes of Health, discovered the gene that, when mutated, causes cystic fibrosis 23 years ago. Kalydeco is the first drug to directly counteract this gene, leading to improvements in patients’ lung function.

-A patient group powered it’s development: Kalydeco would probably not exist were it not for the Cystic Fibrosis Foundation, which funded its early development at Vertex and gets a royalty on the drug. This success paved the way for other disease foundations including the Michael J. Fox Foundation, Myelin Repair, and the Multiple Myeloma Research Foundation.

-It’s price: Kalydeco, given alone, will only help a few thousand patients the world over. Like other drugs for very rare diseases, its price is very high: $294,000 per patient per year.

Vertex shares have fallen 37% from their high earlier this year because of doubts by investors that Vertex will succeed in its attempts to dramatically expand Kalydeco’s use by combining it with a second drug that will make it work in CF patients whose disease is caused by other, more common, mutations. Initial results were very promising, but then Vertex had to restate them. Sales of its best-seller, Incivek for hepatitis C, are dropping. But whatever you think of Vertex shares, Kalydeco is already a success, with $113 million in sales in the first nine months of 2012.

Kalydeco was not the only important drug this year, in which the FDA also approved the first flu vaccine made in cells, not chicken eggs (that’s a Novartis product) and several important cancer drugs including Onyx’s Kyprolis, Medivation’s Xtandi, and Roche’s Perjeta. Nor is it the most commercially important — that honor goes to Gilead’s Stribild combination pill for HIV, which could help preserve that company’s HIV franchise through patent experiations. But it’s probably the most exciting as a harbinger of drugs to come.

http://www.forbes.com/sites/matthewherper/2012/12/27/the-most-important-new-drug-of-2012/

ASTX Option Alert Feb 3 put; block trade 4,956 contracts @$.26

Biotech calendar updated...

http://www.biotechinvestorsnetwork.com/#!blank/c1s4r

Sizing Up Elagolix (NBIX) - A Blockbuster Drug

By Jason Napodano, CFA

Featured blog post...

http://www.biotechinvestorsnetwork.com/

Sizing Up Elagolix - A Blockbuster Drug

By Jason Napodano, CFA

Featured blog post...

http://www.biotechinvestorsnetwork.com/

Aegerion Cholesterol Drug Approved. Will It Treat 300 Patients, Or 3,000?

Matthew Herper, Forbes Staff

Aegerion Pharmaceuticals just received approval from the Food and Drug Administration for Juxtapid, a pill to lower cholesterol in patients with a rare genetic disease called homozygous familial hypercholesterolemia (HoFH), in which normal mechanisms for clearing cholesterol from the body don’t work, leading to fatty deposits under the skin and a very high risk of heart attacks. The drug’s FDA-approved package insert can be found here.

Juxtapid will cost $200,000 and $300,000 per year, according to an Aegerion spokesperson. This is not a medicine that is likely to be used in patients with garden variety high cholesterol, or even those with less serious versions of the genetic disease FH. Aside from restrictions placed on it by the FDA (for instance, it will be sold only through a single mail order pharmacy), the drug causes the buildup of fat in the liver, a warning sign that it may also cause liver damage. It was originally dropped as a treatment for high cholesterol by Bristol-Myers Squibb because of the liver toxicity issues, but a University of Pennsylvania cardiologist, Daniel Rader, championed the drug, leading Aegerion to develop it. There is no doubt that patients with HoFH need new medicines.

The big question now is how many people actually have HoFH. Traditionally, this is viewed as a one-in-a-million disease. There are only thought to be 400 patients or so in the U.S. But in the past, makers of rare disease drugs have been able to find more afflicted patients than doctors and investors expected. This happened with Alexion Pharmaceuticals’ Soliris, and, before that, with the rare disease drugs made by Genzyme, now part of Sanofi.

Nicholas Bishop, an analyst at Cowen & Co., wrote in a note to investors last week that the market could be far larger:

To better understand lomitapide’s addressable market size, we conducted a survey of 9 LDL- apheresis center physicians and 18 other lipidologists. Results suggest there may be 2,400 diagnosed functional HoFH patients in the U.S. (under a restrictive label scenario) or as many as 4,000+ patients (under a more liberal label). We believe sell-side expectations vary from 300-3,000 patients.

Bishop says the label matches the “less restrictive” definition.

The question of how many HoFH patients there are is key not only to Aegerion, but to Isis Pharmaceuticals, which has its own HoFH drug, Kynamro, awaiting FDA approval. That drug has not only liver side effects, but also must be injected and can cause painful injection-site reactions. European regulators recently recommended that Kynamro not be approved, but it did get a muted thumbs up from a panel of FDA advisors. If it’s approved, Isis and partner Sanofi will also work to identify patients with HoFH, and the size of the pool of patients could be more important to both companies than which has the better agent.

Please bookmark this biotech events calendar for future reference...

http://www.biotechinvestorsnetwork.com/#!blank/c1s4r

Cheers.

Biotech event calendar updated...

http://www.biotechinvestorsnetwork.com/#!blank/c1s4r

The Next Big Thing In Biotech: 2013 Outlook (SRPT)

http://www.biotechinvestorsnetwork.com/

Cellceutix Comments on New York Times Article Heralding p53 Drugs as the New Age in Cancer Research

BEVERLY, MA – December 24, 2012-- Cellceutix Corporation (OTCBB: CTIX) (the "Company"), a clinical stage biopharmaceutical company focused on discovering small molecule drugs to treat unmet medical conditions, including drug-resistant cancers and autoimmune diseases, today provides commentary on a front page New York Times article published December 23, 2012 title, “Genetic Gamble; New Approaches to Fighting Cancer.”

The article, authored by Gina Kolata, discusses a seismic change in the direction that cancer research may undergo. Major pharmaceutical companies are striving to conduct clinical trials testing their drug candidates against a wide range of cancers, regardless of the tumor's origin. More succinctly, the article focuses on the key protein p53, often referred to as the “Guardian Angel Gene,” and initiatives by Merck & Co. (NYSE: MRK), Roche Holding Ltd. (OTCQX: RHHBY), and Sanofi SA (NYSE: SNY) in “racing to develop their own versions of a drug they hope will restore a mechanism that normally makes badly damaged cells self-destruct and could potentially be used against half of all cancers.”

“I am pleased to see such a high profile article being written on the game changing impact that a p53 drug can have on treating cancers,” said Leo Ehrlich, Chief Executive Officer of Cellceutix. “While I am disappointed that Cellceutix was not mentioned in the article, I understand that the article was likely written before Cellceutix’s clinical trials began. The facts are while other compounds mentioned are not yet in clinical trials, or ready for clinical trials, our flagship p53 compound, Kevetrin is currently in phase 1 trials ongoing at Harvard’s Dana-Farber Cancer Institute and Beth Israel Deaconess Medical Center. I believe that a discerning examination of the article and publicly available information shows that we are not only ahead of these larger companies, but we have a better mechanism which is more likely to function against most cancers. Our research to date shows that Kevetrin affects both wild and mutant types of p53, a claim that to the best of our understanding, the other companies cannot make. It is true that Roche has had Nutlins in clinical trials for years, but has faced ongoing challenges. Our data shows that Kevetrin is non-genotoxic, meaning that it does not damage surrounding normal DNA.”

“As we stated in a press release on April 25, 2011 discussing our poster presentation at last year’s annual meeting of the American Association for Cancer Research, Kevetrin was a standout then amongst any other p53 drug in development,” added Dr. Krishna Menon, Chief Scientific Officer of Cellceutix. “Nothing has fundamentally changed since that day. In fact, the additional laboratory data that we have collected on Kevetrin, reinforces the novel drug’s ability to re-activate p53 to its role as a potent anti-proliferative and pro-apoptotic protein and holds a great deal of promise as a new therapeutic for treating cancer including some of the most difficult to treat types of the disease. The New York Times may have overlooked Cellceutix and Kevetrin, but the organizations that are contacting us to host and sponsor clinical trials certainly have not.”

About Kevetrin™

As a completely new class of chemistry in medicine, Kevetrin™ has significant potential to be a major breakthrough in the treatment of solid tumors. Mechanism of action studies showed Kevetrin's unique ability to affect both wild and mutant types of p53 (often referred to as the "Guardian Angel Gene" or the "Guardian Angel of the Human Genome") and that Kevetrin strongly induced apoptosis (cell death), characterized by activation of Caspase 3 and cleavage of PARP. Activation of p53 also induced apoptosis by inducing the expression of p53 target gene PUMA. p53 is an important tumor suppressor that acts to restrict proliferation by inducing cell cycle checkpoints, apoptosis, or cellular senescence.

In more than 50 percent of all human carcinomas, p53 is limited in its anti-tumor activities by mutations in the protein itself. Currently, there are greater than 10 million people with tumors that contain inactivated p53, while a similar number have tumors in which the p53 pathway is partially abrogated by inactivation of other signaling components. This has left cancer researchers with the grand challenge of searching for therapies that could restore the protein's protective function, which Kevetrin appears to be doing the majority of the time.

The clinical trial titled, "A Phase 1, Open-Label, Dose-Escalation, Safety, Pharmacokinetic and Pharmacodynamic Study of Kevetrin (Thioureidobutyronitrile) Administered Intravenously, in Patients With Advanced Solid Tumors," is available at: http://clinicaltrials.gov/ct2/show/NCT01664000?term=cellceutix&rank=1

I invite everyone to try out this new website I just put online specifically for biotech investors.

I was annoyed by the constant searching all over the net for news, research and info and thought why not put it all in one place on a website. So here it is...

http://www.biotechinvestorsnetwork.com/

also make sure to check out the news & blogs feed...

http://www.biotechinvestorsnetwork.com/#!rss-feeds/c2t8

Comments, suggestions & requests welcome.

I invite everyone to try out this new website I just put online specifically for biotech investors.

I was annoyed by the constant searching all over the net for news, research and info and thought why not put it all in one place on a website. So here it is...

http://www.biotechinvestorsnetwork.com/

also make sure to check out the news & blogs feed...

http://www.biotechinvestorsnetwork.com/#!rss-feeds/c2t8

Comments, suggestions & requests welcome.

Calendar updated...

http://www.biotechinvestorsnetwork.com/

I invite everyone to try out a free website I just put online for biotech investors.

I was annoyed by the constant searching all over the net for news, research and info and thought why not put it all in one place on a website. So here it is...

http://www.biotechinvestorsnetwork.com/

also make sure to check out the news & blogs feed...

http://www.biotechinvestorsnetwork.com/#!rss-feeds/c2t8

Comments, suggestions & requests welcome.

Cleveland Clinics Top 10 Innovations for 2013..

http://www.clevelandclinic.org/INNOVATIONS/SUMMIT/topten/2013.html

#5 is the MelaFind. MELA is down >50% since FDA approval in Nov 2011 and only had 76 systems installed as of the end of 3Q 2012.

from their 3Q conference call...

As of the third quarter, usage has averaged approximately once per day across all customers for the days that dermatologists are in the office.

http://seekingalpha.com/article/988921-mela-sciences-management-discusses-q3-2012-results-earnings-call-transcript?page=3

Elan spinoff looks for redemption in protein folding diseases...

SF Business Times

Pershing Gold: Not A Daytrade But A Long-Term Investment

December 18, 2012

On these hallowed pages - especially in the comments - there seems to be a fairly large contingent of readers who think they can make a quick buck every time a bullish/bearish post on a company comes out. While not impossible, more often than not, those out for a quick profit often end up worse off rather than better. Such as it always has been and such as it always shall be. I'd like to use Pershing Gold (PGLC) - a very promising opportunity, not without risk of course - to illustrate this point, and at the same time, explain why this company presents good risk-adjusted return potential over the longer-term ("longer-term" is crucial to understanding the following, as the title to this post suggests).

If this young company, which should be producing by 2014, continues to execute at the pace it has over the past 12 months, it could potentially be worth up to $1 billion in the next 24-36 months.

In the short time since CEO Steve Alfers has taken over (previous COO of US Operations of Franco-Nevada), the company has grown the land position, previously land-locked constrained, from ~1,500 acres to >25,000 acres, all directly south of Coeur d'Alene's flagship Rochester mine, and adjacent to Newmont's as well (there's more with Newmont but that's beyond the scope of this post).

Steve Alfers has just added another well-respected, experienced resource executive to the Board of Directors with pedigree background, Alex Morrison. He sits on the board of Detour Gold, a $2bn+ company, and was previously the VP & CFO of $8bn Franco-Nevada Corporation. I think it's pretty obvious both Alfers and Morrison wouldn't have joined Pershing Gold, were they not remarkably confident in the firm's prospects. Why would they risk their respective reputations, earned over long careers otherwise?

The updated resource report discussed in the S-1 is coming shortly - before the end of the year - which must be a key reason why Morrison is jumping on board now, and why you probably should at least consider getting in now, too - if you understand this story and the huge upside potential - rather than miss a good deal of growth.

From people I've spoken to, smart money, institutional investors are taking the "wait & see" approach, waiting to buy the stock, most likely because they are waiting on the updated resource report

If the new resource report is near the number the company believes it will be, I think its reasonable to expect the shareholder base will transform from mostly retail to institutional, long term owners.

I think one important factor people are missing is that the stock is already pretty liquid, even with a largely retail base; this is a key factor that should help drive institutional investors into the name. As institutions move into the stock, the price should go up some purely from the share accumulation.

If Pershing Gold can continue drilling as they have in the past 12 months for the next 12 months, I wouldn't be surprised if they're pushing close to 1,250,000 oz, getting ready to commence production in 2014. As they get closer to production, the value of the resources on the balance sheet should increase as well, so we would expect the stock price and firm value to increase, as well, no?

The current ~$100mm market cap implies ~$200/oz for an anticipated 500,000 oz. If the new resource report shows a number closer to the firm's expectations of ~650-750,000 oz, the stock price should rise a bit. (click to enlarge)

This time next year, if I'm even close to right, Pershing is sitting on 1.25 million oz, and things go even close to as expected, they should be valued using a higher $/oz number as they'll be that much closer to starting production.

Thus, even if we keep the multiple at $200/oz on the resources 1.25mm ounces - which could still be a conservative number - barring further discoveries, by simple multiplication the company would have a $250mm market cap.

I believe the company has at least three different options to raise money if needed ("if needed" being the key phrase):

Royalty financing: let us not forget both CEO Alfers & Morrison were formerly high ranking executives at Franco-Nedava, the largest mining resource royalty company in the world. I doubt it'd be too difficult to pick up the phone and call their former colleagues to arrange a deal on rather favorable terms.

Debt financing: which, to silence some of the critics, would not be dilutive, just like a royalty deal. This is corporate finance 101, but from some comments I've received in the past, I felt the need to point this out.

Worse case scenario for shareholders, Pershing issues about $20mm in 2013q2, given the current price and without an update to the existing resources, they'd have to issue about 50 million shares. This would take the share count to about 320 million shares, which given the above assumptions would put the share price around $0.75-$0.80. Even if you're more cynical, the price should be well above where it's trading now.

One of the most compelling reasons why I think this is a solid long-term investment is Barry Honig's involvement. He's a board member, continues to buy stock - and two weeks ago invested >$1,000,000 in the company - has a solid track record, to put it gently. He bought almost 10% of Neuralstem (CUR) at $0.40 and look where it went after:(click to enlarge)

He bought >5% of Broadvision (BVSN) & wrote the company a letter at $8, and guess what happened after? (click to enlarge)When he purchased those stocks, he not only made himself pretty darn good returns on his investments, but investors who followed his moves did as well. This time around, he's buying restricted shares in Pershing that he can't sell/flip for a quick buck; he's in it for the long term, by definition. Given his bird's eye view as a Director and major owner, I think it'd be prudent to assume he's at the very least extremely confident in the company's prospects as a longer-term investment. Just think; he hasn't sold a single share of Pershing Gold since inception. Is that something a quick-buck artist would make? Methinks not.

While each bullet point is crucial to understanding the opportunity, the one immediately above should clarify - with crystal clarity - why this is an investment for the long term, and not a day trade. I've had the chance to speak with some of the Board members, and while I'd be naïve to expect anything besides optimism, combined with their significant long term ownership stakes and the sheer excitement they conveyed, even as a born skeptic, I've got to admit, they explained a very compelling opportunity and addressed most of my initial concerns, which is not easy.

If you think I'm wrong, that's fine, and that's what makes a market, but if that's your position, for your own sake, do the research to support it, because I think you'll find it a difficult to impossible to counter most if not all of these bullet points. You may think both the company and myself are being overly-optimistic, but even then, you should even more heed the previous sentence. Attack me because I've never run a gold mine, resort to ad hominem attacks or whatever floats your boat, but I don't think you can argue against these facts which support my bullish view. Is there risk? Of course, just like with any investment, but if you understand the story and relevant facts, it's pretty apparent this firm is making the right moves to ameliorate them, and as an investor, you have the ability to manage any risk factors yourself, as well with stops/limits, position sizing, etc.

As always: CAVEAT EMPTOR

http://seekingalpha.com/article/1071351-pershing-gold-not-a-daytrade-but-a-long-term-investment

KENNESAW, Georgia, Dec. 11, 2012 /PRNewswire/ — MiMedx Group, Inc. (OTCBB: MDXG), an integrated developer, manufacturer and marketer of patent protected regenerative biomaterials and bioimplants processed from human amniotic membrane, announced today that they will present at the 6th Annual OneMedForum in San Francisco. Parker H. “Pete” Petit, Chairman and CEO, William C. Taylor, President and COO, and Michael J. Senken, Chief Financial Officer, are scheduled to present on Tuesday, January 8th, at 10:00 a.m. Pacific Time at the Sir Francis Drake Hotel. In addition, the executive management team will be attending the JP Morgan 30th Annual Healthcare Conference. A webcast of the OneMed presentation will be available on the Company’s website, www.mimedx.com.

Canaccord presentation...

http://www.wsw.com/webcast/canaccord8/mdxg/

Dew - you used to be quite negative on LPTN... why the change? Do you now see it as a viable investment?

message_id=59253964

message_id=69116993

message_id=72928460

message_id=57985240

Sarepta CEO: $125 Million Offering Demand Was Strong

Add CommentBy Adam Feuerstein12/13/12 - 02:03 PM EST

Stock quotes in this article: SRPT, GILD

BOSTON (TheStreet) -- I chatted briefly by phone with Sarepta Therapeutics (SRPT_) CEO Chris Garabedian following the successful follow-on stock offering that raised $125 million.

"We went out with a target of raising $75 million but by the time we were ready to close the book we were more than three times oversubscribed, almost four times... The book was full of top quality institutional investors, many of whom were not going to get the allocation they wanted, so we decided to upsize the offering."

On Sarepta's new shareholder base:

"Previously, we had about 35% institutional investors. With the close of this offering, we're up to 50%, including a lot of long-only accounts and good fundamental life-sciences investors. It's really nice to see the company's shareholder base change.

On the timing of the stock offering:

"It's hard to find the right [financing] window where we don't have disclosure issues... But we had the 62-week eteplirsen data behind us, investor demand was high and you always worry about macro risk so we decided to get [an offering] in before the end of the year. It's nice to enjoy the holidays knowing we have a very healthy balance sheet."

On plans for the FDA meeting to discuss the possibility of filing accelerated approval for eteplirsen:

"We're sticking with our guidance that we will be requesting a meeting with FDA before the end of the year, which puts us squarely on track to have the meeting in the first quarter."

When can investors expect to hear from Sarepta about the outcome of the FDA meeting?

"We won't be saying anything publicly until we get the final minutes from the FDA meeting, which probably means a March-April timeframe. At that point, we'll update investors on whether or not we will be pursuing an accelerated approval [for eteplirsen.]"

On eteplirsen manufacturing and timing of a possible eteplirsen approval filing:

"We need to have difference discussions with FDA about clinical and manufacturing issues. The plan right now is to meet with FDA about CMC [chemistry, manufacturing and controls] in the second quarter... How or when we file will be dictated by the outcome and feedback we get from FDA at both these meetings."

"We're getting a lot of interest in this program... but we don't need to partner. We expect a partner to be flexible and give us the structure that we're looking for. It's hard to time a potential deal or if one will happen, but with the financing, we are in a strong negotiating position."

[Garabedian also confirmed that if Sarepta does a deal, it will more than likely be an ex-U.S. partnership that encompasses the company's entire exon-skipping drug program.]

"We're not taking [eteplirsen] off the table but a potential partner has to buy into the reproducibility of the eteplirsen data for the follow-on exon-skipping programs... We believe eteplirsen significantly de-risks the development of follow-on exon-skipping drugs and makes the entire program highly leverageable. A partner has to buy into that and bring the right economic terms to the table."

On future disclosure of additional eteplirsen data:

"We're right now figuring out how to communicate expectations for 2013. The JP Morgan conference will likely be the venue where I tell investors what to expect from us in 2013. Right now, we're not giving any guidance on if 74-week eteplirsen data will be shared.

[Garabedian will speak to investors at the JP Morgan Healthcare Conference on Weds. Jan. 9.]

On being nominated for the Best Biotech CEO of 2012 award:

"I was humbled, especially since my mentor John Martin [Gilead Sciences' (GILD_) CEO] is on the list, too. It was a heady experience for me to be mentioned alongside him."

On being told that he's not likely to win the Best Biotech CEO of 2012 award:

"Like they say at the Academy Awards, it's an honor just to be nominated."

-- Reported by Adam Feuerstein in Boston.

I'm still holding my lotto ticket...

Davunetide (NAP) has shown significant reduction in tau phosphorylation in mouse models. In their P2a trial for Alzheimer's davunetide showed significant improvement in memory and ADLs (Activities of Daily Living) @ 15mg BID for 12 wks. The current pivotal trial is 30mg BID for 52 wks.

NAP (davunetide) is an eight amino acid peptide (NAPVSIPQ) that has been shown to provide potent neuroprotection, in vitro and in vivo. In human clinical trials, NAP has been shown to increase memory scores in patients suffering from amnestic mild cognitive impairment, a precursor to Alzheimer's disease and to enhance functional daily behaviors in schizophrenia patients. NAP is derived from activity-dependent neuroprotective protein (ADNP) a molecule that is essential for brain formation, interacting with chromatin associated protein alpha and the chromatin remodeling complex SWI/SNF and regulating >400 genes during embryonic development. Partial loss in ADNP results in cognitive deficits and pathology of the microtubule associated protein tau (tauopathy) that is ameliorated in part by NAP replacement therapy. Recent studies increased the scope of NAP neuroprotection and provided further insights into the NAP mechanisms of action. Thus, it has been hypothesized that the presence of tau on axonal microtubules renders them notably less sensitive to the microtubule-severing protein katanin, and NAP was shown to protect microtubules from katanin disruption in the face of reduced tau expression. Parallel studies showed that NAP reduced the number of apoptotic neurons through activation of PI-3K/Akt pathway in the cortical plate or both PI-3K/Akt and MAPK/MEK1 kinases in the white matter. The interaction of these disparate yet complementary pathways is the subject of future studies toward human brain neuroprotection in the clinical scenario.

http://www.ncbi.nlm.nih.gov/pubmed/21524250

Activity-dependent neuroprotective protein snippet NAP reduces tau hyperphosphorylation and enhances learning in a novel transgenic mouse model.

http://www.ncbi.nlm.nih.gov/pubmed/17720885

Genetic bases of Progressive Supranuclear Palsy: the MAPT tau disease.

http://www.ncbi.nlm.nih.gov/pubmed/21568901

Critical appraisal of the role of davunetide in the treatment of progressive supranuclear palsy

http://www.ncbi.nlm.nih.gov/pmc/articles/PMC3280109/

company presentation...

http://www.allontherapeutics.com/wp-content/uploads/corporate/profile/Allon-Corporate-Overview_Oct2012.pdf

Amniofix profiled in the Oct issue of Wounds...

Scientific and Clinical Support for the Use of Dehydrated Amniotic Membrane in Wound Management

10/1/2012 0 Comments 2284 reads

Login to Download

PDF version

Author(s): Donald E. Fetterolf, MD; and Robert J. Snyder, DPM, MSc

Index: WOUNDS. 2012;24(10):299–307.

Abstract: Amniotic membrane has been employed in the treatment of wounds for almost 100 years, beginning with early application of natural amniotic membrane obtained from labor and delivery to various types of burns and wounds. Amniotic membrane is rich in collagen and various growth factors that support the healing process to both improve wound closure and reduce scar formation. Unique properties of the material include the lack of immunologic markers, conferring an “immune privileged” status on the allografts; antibacterial properties; and the ability to reduce pain on application. The resurgence of interest in the use of amniotic membrane in a number of applications, including wound treatment, has occurred following improved techniques for preserving the natural membrane. Recently, techniques have been developed to dehydrate the material while preserving many of these wound-healing attributes, to produce a temperature-stable allograft. Future research will continue to yield more information on the unique properties of the amniotic membrane allografts.

Introduction

Historically, natural amniotic membranes have been successfully used for wound and reconstructive purposes since the early 20th century. John1 reviewed the subsequent uses of human amniotic membrane over the 20th century to include a number of other applications during that period. These included reconstructive OB/GYN surgery, dentistry, and neurosurgical and general surgical applications.

Davis2 reported a comprehensive review of some 550 cases of skin transplantation at the Johns Hopkins University in 1910. Sabella3 and Stern4 separately reported on the use of preserved amniotic membranes in skin grafting for burns and ulcers in 1913, although they were familiar with each other’s work and collaborated. Amniotic membrane allografts as a wound allograft material have a number of beneficial properties inherent in their makeup. The material provides a natural scaffold for wound healing and contains various important growth factors and biological macromolecules important in wound healing. These molecules have been scientifically found to confer properties that reduce wound pain, suppress infection, suppress scar formation, and provide anti-inflammatory mediators.1,7-10

De Roth5 first used amniotic membrane to repair eye wounds in 1940 after noting other materials used for skin grafting in the eye did not appear to have the inherent healing properties of amniotic membranes. Ophthalmologic use would go on to be one of the most popular applications of the material in the late 20th century.

Now numbering more than 45,000 applications by the ophthalmology community, amniotic membrane has been used for conjunctival reconstruction, burn treatment, pterygium repair, and a number of other similar applications, including use in children.6

In the latter half of the 20th century, natural amniotic membrane began to be used as a wound covering, beginning in the 1960s through the end of the century, with treatment for diabetic neurovascular ulcers, venous stasis ulcers, and various types of postsurgical and posttraumatic wound dehiscence.1,7-11 In these applications, sections of the entire membrane, used in sheet form, were placed on the wound.

However, while the use of amniotic membrane was evidently valuable for the purposes contemplated by the surgeons, it was a somewhat difficult material to incorporate into routine use.

read more...

http://www.woundsresearch.com/article/scientific-and-clinical-support-use-dehydrated-amniotic-membrane-wound-management?page=0,0

One of the more impressive earnings reports I've seen lately...I guess this would qualify as a blowout.. I'm surprised this one isn't getting more interest... a disruptive technology that could dominate the chronic wound care space for years to come.

MiMedx Group Announces Record Third Quarter Results And Raises Revenue Estimates For The Year

Press Release: MiMedx Group, Inc. – Mon, Oct 29, 2012 6:17 PM EDT

Email

KENNESAW, Ga., Oct. 29, 2012 /PRNewswire/ -- MiMedx Group, Inc. (OTC Bulletin Board: MDXG), an integrated developer, manufacturer and marketer of patent protected regenerative biomaterials and bioimplants processed from human amniotic membrane, announced today its results for the quarter ended September 30, 2012.

Highlights of Third Quarter 2012 Results include:

Revenue Increased by more than 3.5 times over Third Quarter of 2011

Quarter over Quarter Revenue increased by 63%

Gross Margins Hit Record Level of 82%

The Company recorded record revenue of $8.0 million for the third quarter of 2012, a 270% or $5.8 million increase over third quarter of 2011 revenue of $2.2 million, and a 63% increase over second quarter of 2012 revenue of $4.9 million. The Company's earnings before interest, taxes, depreciation, amortization and share-based compensation (Adjusted EBITDA*) for the quarter ended September 30, 2012, were $726,000, a $1.7 million improvement as compared to the Adjusted EBITDA* loss of $934,000 for the third quarter of 2011.

For the nine months ended September 30, 2012, the Company recorded revenue of $16.5 million, more than threefold increase over revenue of $5.1 million for the first nine months of 2011. The Company's Adjusted EBITDA* for the nine months ended September 30, 2012 was $2.0 million, a $6.6 million improvement over Adjusted EBITDA* loss of $4.7 million for the first nine months of 2011.

For the 7th consecutive quarter, the Company reported improved gross profit margins. The Company's third quarter 2012 gross margins of 82% is nearly a twenty-three percentage point improvement over third quarter of 2011 gross margins of 59%, and a six percentage point improvement over the Company's second quarter of 2012 gross margins of 77%.

Management Commentary on Second Quarter Results

Parker H. "Pete" Petit, Chairman and CEO stated, "By all the measures that I have traditionally used, I would clearly classify this as "excellent" quarterly performance. When you can increase revenues quarter -over -quarter by more than 60%, increase gross profit margins by 5%, increase the size of your sales organization by 5 times and still maintain positive EBIDTA*, that is excellent quarterly performance. Our third quarter revenue growth was primarily attributed to our EpiFix® wound care product gaining acceptance in numerous Veterans Administration hospitals. Up to this point, our AmnioFix® tissue grafts had provided the majority of our revenue; however, we now expect sales of our EpiFix® tissue grafts to show accelerated growth, especially in wound care. While we are pleased with the prolific growth we achieved in the third quarter, I want to make it very clear that management does not expect revenue to grow at a 60 plus percent quarter- over -quarter rate. We believe that our growth will be very robust, but that the incremental quarter- over- quarter rate we saw last quarter is not going to be achievable in the ensuing quarters. However, we are confident we will exceed the upper end of our previous 2012 revenue goal of $25 million."

The Company reported that prior to the start of the third quarter, it embarked on a strategy to aggressively establish its direct sales force to serve the VA hospitals. "We recognized the significant and timely opportunity we had available to us to increase our presence in the VA hospitals where the reimbursement process for our grafts is well established. Late in the second quarter, we added a sales executive to head up the government sector of our sales force. Throughout the third quarter, we added 19 additional members to that government- focused team of sales executives. With only a partial quarter of activity under our belt, the sales results from our government sales team is dramatic: The professionalism of our sales team and the clinical and cost effectiveness of our grafts will enable strong revenue and profit growth in the future," said Petit.

"This is the fourth quarter in a row where we met or exceeded our revenue goals, with our latest quarter exceeding our revenue goal by a significant margin," commented Bill Taylor, President and COO. "If you add to this, the results of our first EpiFix® Randomized Controlled Trial, where 92% of the patients treated with EpiFix® fully healed in six weeks, I think it is safe to say we had a fantastic quarter. Additionally, we have significantly improved the quality and depth of our and organization, particularly in the sales and management functions, and we are well-positioned for continued strong growth over the coming quarters."

As the Company continues to receive impressive results from studies currently underway to validate the clinical and cost effectiveness of its EpiFix® grafts, used externally, and its AmnioFix® grafts, which are used internally for surgical procedures, MiMedx expects to see reimbursement coverage broaden among commercial health insurance plans and Medicare intermediaries. "We received the Medicare C-code for our EpiFix® grafts on January 1, 2012; however, the various Medicare intermediaries generally do not reimburse products in this category without additional clinical data to support their efficacy and cost-effectiveness. With the excellent results emanating from these clinical studies, we are confident that we will have successful break-throughs in these reimbursement processes. The reimbursement successes we anticipate in the Medicare and commercial insurance coverage sectors, combined with our government focused efforts in the VA hospitals, will set in motion our growth expectations for the years to come," added Taylor.

Revenue Breakdown

The Company also reported the revenue breakdown between its primary regenerative medicine specialties. MiMedx will now report its regenerative medicine specialties in three categories... "Wound Care", "Surgical & Sports Medicine", and "Other." Revenue for the Company's EpiFix® grafts comprises the Wound Care category. Its Surgical & Sports Medicine specialty is comprised of the Company's injectable, orthopedic and surgical applications for its AmnioFix® grafts. The "Other" category of the MiMedx regenerative medicine specialties includes the Company's tissue revenue from its dental and ophthalmic applications and products, as well as revenue from its HydroFix® technology. The third quarter of 2012 marked the first quarter in which Wound Care revenue exceeded Surgical & Sports Medicine revenue. In the quarter, 61% of MiMedx sales volume was for Wound Care, 34% for Surgical and Sports Medicine and 5% for "Other." On a year- to- date basis, Wound Care represents 38%, Surgical & Sports Medicine represents 51%, and "Other" represents 11% of total MiMedx revenue.

Balance Sheet and Cash Flow

Cash and cash equivalents as of September 30, 2012, were $7.6 million, as compared to $2.7 million as of June 30, 2012, and $4.1 million, as of December 31, 2011. During the quarter, the Company raised over $6.2 million from the exercise of warrants and options. Cash flow from operating activities of negative $862,000 for the quarter was due primarily to increases in working capital in line with the Company's sales growth. During the quarter, the Company invested $163,000 in capital equipment to continue its ramp up of tissue processing activities to meet the market demand for its grafts.

Total Current Liabilities increased to $10.5 million as of September 30, 2012. During the quarter, the Company paid off the convertible debt related to the Surgical Biologics acquisition and recorded an additional provision of $1.3 million based upon the forecasted increase in sales volume. The earnout related to the acquisition will be paid in MiMedx common stock in April 2013.

Early in the quarter, a total of 3.3 million Contingent Warrants at an exercise price of $0.01 were voided per the terms of the 2012 Contingent Warrant agreement related to the trading price of the Company's Common Stock.

GAAP Earnings

For the quarter ended September 30, 2012, the Company recorded a Net Loss from Operations of $3.6 million and a $4.4 million loss for the nine months ended September 30, 2012. This represents a $2.0 million increase over the third quarter of 2011 Net Loss from Operations and a $2.9 million improvement over the nine months ended September 30, 2011. Included in the third quarter net loss were the earnout liability charge mentioned previously and a $1.8 million impairment charge. Research and development expenses increased due to the decision to accelerate investment in clinical trials for reimbursement purposes. Selling, general and administrative expenses increased due to the decision to build out the Company's direct sales force for government accounts, as well as to add key management and infrastructure related resources to support the Company's growth.

The Net Loss for the quarter was $4.2 million, or $0.05 per diluted common share, as compared to the Net Loss of $1.8 million, or $0.02 per diluted common share, recorded for the quarter ended September 30, 2011. In addition to the previously mentioned charges and investments, there were also increases of $358,000 in debt discount expense and $113,000 in interest expense related to the Company's convertible debt offerings. The Net Loss for the nine months ended September 30, 2012, of $6.1 million or $0.07 per diluted common share, represents a $1.6 million improvement as compared to the Net Loss of $7.6 million, or $0.11 per diluted common share, recorded for the nine months ended September 30, 2011. Included in reported Net Loss for the first nine months of the year is non-cash related financing expense associated with the debt discount of $1.2 million. This expense will continue to be amortized over the life of the convertible notes.

*Use of Non-GAAP Financial Measures

Management has disclosed adjusted financial measurements in this press announcement that present financial information that is not in accordance with generally accepted accounting principles (GAAP). These measurements are not a substitute for GAAP measurements, although Company management uses these measurements as aids in monitoring the Company's on-going financial performance from quarter-to-quarter and year-to-year on a regular basis, and for benchmarking against other medical technology companies. Adjusted EBITDA*is earnings before interest, taxes, depreciation, amortization, share-based compensation, non-cash impairment and earnout liability charges. For a reconciliation of this non-GAAP financial measure to the most directly comparable financial measure, see the accompanying table to this release. Adjusted financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. Investors should consider adjusted measures in addition to, and not as a substitute for, or superior to, financial performance measures prepared in accordance with GAAP.

Full Year 2012 Estimate

The Company expects its full year 2012 revenue to exceed the upper end of its previous estimate of $20 to $25 million.

Earnings Call

MiMedx management will host a live broadcast of its third quarter of 2012 results conference call on Tuesday, October 30, 2012, beginning at 10:30 a.m. eastern time. A listen-only simulcast of the MiMedx Group conference call will be available online at the Company's website at www.mimedx.com or at www.earnings.com. A 30-day online replay will be available approximately one hour following the conclusion of the live broadcast. The replay can also be found on the Company's website at www.mimedx.com or at www.earnings.com.

Like making 51% from the 3 pt line vs. someone shooting 52% from the foul line. Who's the better shooter?

$ariad ponatinib 51 percent MMR in Phase I trial in 3rd line patients - matches Sprycel (52%) in front line

I hope you took my advice and covered... it may gap up >7 on Monday. 7.25 is 123% fib. These results are stellar and CLDX is way undervalued.

I will be going long soon so you can stop worrying as the bottom is at hand.

Novavax' Phase I RSV Vaccine Data Published in Vaccine

Vaccine was well-tolerated with no evident dose-related toxicity or attributable SAEs

Immunization induced significant increases in neutralizing antibody responses

ROCKVILLE, Md., Dec. 6, 2012 (GLOBE NEWSWIRE) -- Novavax, Inc. (Nasdaq:NVAX) today announced that the journal Vaccine has published the company's data from its 2011 Phase I clinical trial of its respiratory syncytial virus (RSV) fusion (F) recombinant nanoparticle vaccine candidate. The paper was authored by a team of researchers and clinicians at Novavax and Dr. Pedro Piedra of Baylor College of Medicine. Findings from the trial were announced in October 2011 and presented in September 2012 by Novavax at the Respiratory Virus Symposium (RSV 2012) meeting in Santa Fe, New Mexico. The paper is currently available at www.novavax.com under Publications & Presentations/Publications and is expected to be published in the print edition shortly.

Novavax had conducted the blinded, placebo-controlled, dose-escalating Phase I trial to assess the safety and tolerability of aluminum phosphate-adjuvanted and unadjuvanted formulations of its RSV vaccine candidate. A secondary objective of the study was to evaluate total and neutralizing anti-RSV antibody responses and assess the impact of the adjuvant. The authors reported that Novavax' vaccine was well-tolerated, with no evident dose-related toxicity or attributable severe adverse events. At day 60, both RSV A and B microneutralization titers were significantly increased in subjects treated with the Novavax vaccine versus placebo. The authors also reported a 7- to 19-fold increase in the anti-F IgG and a 7- to 24-fold increase in the levels of antigenic site II binding antibodies in vaccine recipients, as well as the induction of serum antibodies capable of competing with palivizumab, a humanized monoclonal antibody (mAb) with known protective efficacy against RSV disease in animals and humans.

"We are encouraged with the tolerability profile demonstrated in this trial as no attributable SAEs or significant dose-related toxicities were observed," said Dr. Gregory Glenn, Novavax' Chief Medical Officer. "In addition, the data suggest that neutralizing responses induced by our RSV F nanoparticle vaccine attain levels previously reported to be associated with a decrease in the risk of RSV hospitalization in selected populations. The presence of high-titered antibodies capable of competitively inhibiting palivizumab binding to the RSV F protein in sera of vaccine recipients but not the majority of sera of unimmunized adults or placebo recipients is novel and should be studied further. This observation suggests that the vaccine induces antibodies with specificities closely similar to palivizumab (Synagis®) that has been shown to have prophylactic efficacy in large clinical trials. Such an observation supports the likely clinical impact of the vaccine-induced antibodies and will assist the planning of future clinical efficacy evaluation of the vaccine."

Novavax is currently conducting a Phase II clinical trial in women of childbearing age to further evaluate the immunogenicity and safety of the RSV F vaccine candidate. This data will inform the future development of the RSV F vaccine to address infant RSV-related lower respiratory tract disease via maternal immunization. The company is also carrying out a Phase I clinical trial in elderly adults to evaluate the immunogenicity and safety of the vaccine candidate in this important population.

http://www.nasdaq.com/article/novavax-phase-i-rsv-vaccine-data-published-in-vaccine-20121206-00981#.UMFjtYM8B8E

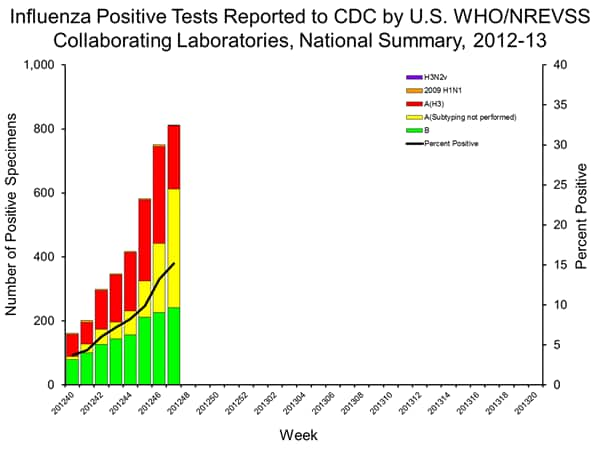

Influenza spiking... highest # of doc visits since 2003...

Situation Update: Summary of Weekly FluView

According to this week’s FluView, flu activity in the United States has increased substantially throughout the nation, most notably in the south central and southeast regions of the country. People who have not already received a flu vaccine should do so now. This FluView update reports on influenza activity for November 18-24, 2012 of the 2012-2013 influenza season.

Below is a summary of these key indicators:

The proportion of visits to doctors for influenza-like illness (ILI) was at the national baseline. This is the earliest in the regular season that influenza activity has reached the national baseline level since the 2003-2004 season. This week, 5 U.S. regions reported ILI activity above region-specific baseline levels and 5 states (Alabama, Louisiana, Mississippi, Tennessee and Texas), experienced high ILI activity.

Four states reported widespread influenza activity (Alaska, Mississippi, New York, and South Carolina). Regional influenza activity was reported by 7 states (Alabama, Idaho, Iowa, Maine, Massachusetts, North Carolina, and Ohio). Nineteen states reported local influenza activity. This is an increase from the 8 states that reported local influenza activity last week.

http://www.cdc.gov/flu/weekly/summary.htm

$8.49 is the 78.6% fib retracement from the $12.20 H on Oct 17. Should hold, consolidate then reverse from here. May take a week or so.

Identification of anomolous biliary anatomy using near-infrared cholangiography.

Sherwinter DA.

Source

Division of Minimally Invasive Surgery, Maimonides Medical Center, 4802 10th avenue, Brooklyn, NY 11219, USA. dsherwinter@maimonidesmed.org

Abstract

BACKGROUND:

Intraoperative cholangiography (IOC) is especially helpful for the detection of anomalous biliary anatomy during laparoscopic cholecystectomy. Fluorescent cholangiography using an intravenously injected fluorophore and near-infrared (NIR) imaging provides similar anatomical detail to standard radiographic cholangiography without ionizing radiation, puncture of the biliary system, or additional operative time. This video shows a laparoscopic cholecystectomy performed under NIR cholangiographic guidance and highlights its ability to identify anomalous anatomy.

METHODS:

The attached video shows a laparoscopic cholecystectomy being performed on a 28-year-old female with a history of biliary colic and ultrasonographic evidence of cholelithiasis. This patient agreed to be part of a larger randomized study looking at near-infrared cholangiography and its ability to prevent common bile duct injuries (approved by the ethics review board of our institution and registered with clinicaltrials.gov Identifier# NCT01424215). This study uses the Pinpoint system (Novadaq, Ontario, Canada) for NIR imaging (Fig. 1). The Pinpoint mates a high definition white light laparoscopic view to the NIR cholangiography, providing an uninterrupted, augmented view of the anatomy. 1 cm(3) of indocyanine green was injected intravenously prior to the procedure.

RESULTS:

As shown in the video, an anomalous duct was identified during dissection and development of the critical view of safety. Because of the possibility that this represented an aberrant right hepatic duct, the cystic duct was controlled and divided distal to the anomalous duct and the gall bladder excised from the fossa in the usual manner. The patient did well without sequelae at 1 week and 1 month follow-up.

CONCLUSION:

Anomolous ductal anatomy of the biliary tree has been reported in up to 23 % of cases.1,2 The ability of IOC to elucidate biliary anatomy and thus prevent bile duct injury has led many to espouse routine cholangiography for all laparoscopic cholecystectomies.3,4 Near-infrared cholangiography (NIRC) is easy to perform, does not add steps to the operative procedure, and produces a similar anatomic roadmap of the hepatocystic triangle to that of standard IOC. Although the clinical significance of the anomalous duct identified in this video is unknown, this video highlights the excellent detail provided by NIRC. Recommendations regarding the routine use of this new technology await the results of an ongoing randomized control study.

Cantor Fitzgerald raises their ISRG tgt to $525 from $475. The firm notes that they hosted a meeting with Intuitive management at company headquarters as part of their Bay Area bus tour, and key takeaways include: 1) Intuitive expects to add single-incision indications in 2013 and sees a significant opportunity in outpatient clinics, 2) management is not ready to call a bottom in U.S. dVP volumes but continues to believe that other procedures are ready to pick up the slack, and 3) Firefly is expected to be included in a greater percentage of units going forward.

from theflyonthewall.com

Novadaq Announces First PINPOINT Purchase Order

Toronto, Ontario - December 5, 2012 -

Novadaq® Technologies Inc. (“Novadaq” or the “Company”) (NASDAQ: NVDQ, TSX: NDQ), a developer of real-time medical imaging systems for use in the operating room, today announced that Maimonides Medical Center in Brooklyn, New York, is the first United States hospital to purchase a PINPOINT® endoscopic fluorescence imaging system. Maimonides has also purchased a set of endoscopes and signed long term contracts for service and supply of disposable kits, which are required for each PINPOINT procedure.