Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Me too. Bob remind me about AT&T?

(Me too on quick validation of investement thesis)

You mentioned that in your last post. Do they have a deal with AT&T which is a Tier 1 Carrier? I saw some older articles saying AT&T is enabling historic 2G network connectivity through 2020 - maybe as they seek to develop their own alternative to Siyata's UV350 if they know Motoral is going to put up a protective moat for UV350 in the US?

Siyata just announced a confidential Tier 1 US signing of course on Nov 19th which was 6 days after this press release where Motorola Israel is distributing the UV350:

https://www.siyatamobile.com/siyata-mobile-launches-4g-lte-uv350-device-in-israel/

Then, if you read this article in that Motorola started an innovation centre in Tel Aviv (huge tech VC hub) it is not a stretch at all to imagine that the confidential Tier 1 carrier in the US is Motorola. They have the biggest market and most to lose by not partnering with Siyata. Siyata's core staff are ex-Motorola too so only it is easy to strike a deal from a business partner perspective.

https://www.timesofisrael.com/motorola-looks-to-israel-for-new-tech-to-give-it-edge/

that article is most relevant, early hit from Google searching "Motorola Israel"

SIM.V bought a lot the last two days.

I always meant to re-enter Siyata and glad I got the opportunity. Sometimes you just need a kick in the butt like Keith's hugely bullish post of course. Obviously that is a 'Keith pump post' but I've done well also buying the stocks that Keith has doubled down on in the past.

It is worth watching what these two investors think of Siyata's prospects. You can visibly see the fatigue in both of them as they know the story but have grown impatient waiting for promised US sales to materialize.

[url]

https://www.bnnbloomberg.ca/investing/video/fabrice-taylor-discusses-siyata-mobile~1483509[/url][tag]insert-text-here[/tag]

[url]

https://www.bnnbloomberg.ca/investing/video/bruce-campbell-discusses-siyata-mobile~1506454[/url][tag]insert-text-here[/tag]

It is clear that Siyata is on the radar of lots of Canadian microcap investors, and has been for a while. Its not these investors what will drive the price up, it's new investors.

The long-awaited US supply agreement has been signed and the only reason that Siyata isn't higher now IMO is simply becuase the TSX Venture has been under so much pressure the last month.

[url]

https://www.siyatamobile.com/siyata-mobile-signs-supply-agreement-with-leading-tier-1-u-s-cellular-operator-for-uniden-uv350/[/url][tag]insert-text-here[/tag]

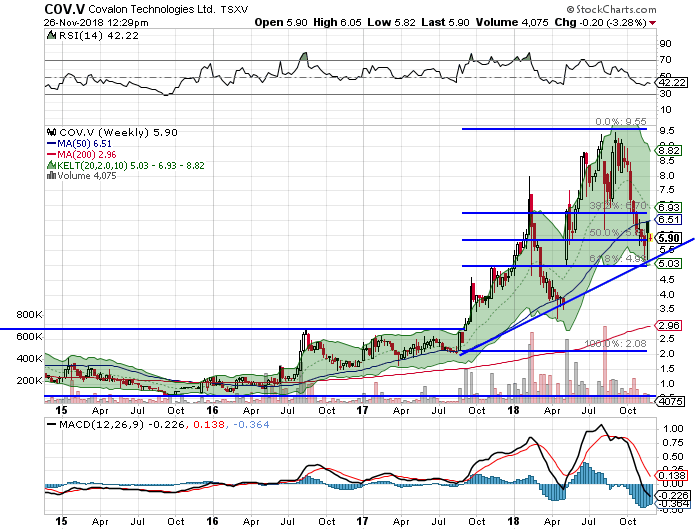

COV.V - finally bought back at $C 5.90 today....

...after selling most around $4.50 prior to big run up this year. Oops. C'est la vie .

Buying back higher but fundamentals better and I'm hoping correction is mostly done.

I'll buy more if she goes down. The intra-day ~$5.00 bottom could be the technical low but who really knows.

CPTMatt - as to your question from a few years ago. The purchase price for Avaguard was high on a P/E basis but not bad on a revenue basis (1.5X). I'm assuming there are huge synergies here and Covalon get immediately get access to Avaguard's US sales channel and maybe there is a play they are thinking of where Covalon use's Avaguard's waterproof shower bandage technology for their core products.

SIM.V - I saw that.

Looks like it was his 'promotional' email service to non-subscribers but judging my reaction on stock today a lot of people know it is Siyata.

AR.TO

Been slammed at work but just took 10 minutes to refresh myself and agree with you Checkmate!

Zinc - bottom may be in?

Been super busy at work and haven't looked at zinc chart in a month and there is a possible head and shoulders bottom in play in $1.15 to $1.20/lb range. We'll see.

Did buy some Trevali a month ago in low $.70's (TV.TO) where it is still bouncing around. It could run to $1.20 very quickly if the H&S bottom holds and Zinc takes a trip to say, $1.30 before year end.

As always, this is the best source to let the charts do the talking:

http://www.kitcometals.com/charts/zinc_historical_large.html#30days

Caliche - Oroco...

...umm you forgot to mention the grade and mettalurgy of Santo Thomas, rendering your post meaningless.

"Billions of pounds of copper"

Feels like a massive pump - you better reply with the details we really need!

USA.TO...must have bottomed

Bought some USAS today...but holding more at higher prices. Americas absolutely cratered. 2019 and 2020 will be the best years as San Rafiela is fully ramped and they start to produce the 1000 Ag/tonne ore in Q3-2019 (2:45:45 in video below)

When PM sector turns, the Canadian share price (USA.TO ~2.95 today) will go +30% to $4.00 very quickly.

- Losing 500k to 700k/quarter from Galena

- Will be a 5m ounce/year (not including base metal credits) by 2020

- the reason for the latest selloff, in addition to PM sector weakness and zinc market weakness, is that they had the worst rainy season in July and August in 22 years in mexico and would lose power for 2 hours/day. I didn't know this as selloff happens, doubt market did as well. Most shareholders with USAS are institutional.

- At 1740 tpd at San Rafael now.

- In discussions to move final San Rafael option payment out a year with Hotshchild. Not too concerned.

This is the Beaver Creek presentation from this weekend.

http://www.gowebcasting.com/events/precious-metals-summit-conferences-llc/2018/09/21/americas-silver-corporation/play/stream/25896

Gold80302

I think you're right....

F.V Fiore Gold - my thesis

Back from vacation. In early August I bought Fiore, a small gold miner that has acheived run-rate production and is Frank Gustra-backed, but you can buy at a massive discount to insiders.

It is very illiquid so I didn't post anything at the time I was buying.

It ticks all the boxes for a producing/cash flowing little microcap miner. Here is a quote from my write up:

"Fiore is trading at low P/NAV of 0.4X (GMP), "2X cash flow in 2018" (per GMP) and ~4.5X P/E (my analysis below)"

I figured the bottom was in during August and I bought in the low $C0.40's. It's a bit lower now of course but still super illiquid. In my write-up I thought it bottomed at $C 0.35 in July and we're revisiting those lows now.

Lucky for everyone here I'm providing my DD linked from Evernote, which is my new tool for tracking core investments and ideas!

https://www.evernote.com/shard/s511/sh/a7d8def0-1361-4bfd-880d-0ecea1361761/ebac8591fdf85e3650f38e8fd027d3d0

VLE.TO

FWIW...if the $20 buyout comes true Valeura will look like Canopy after current pain is over.

https://www.investorvillage.com/groups.asp?mb=19518&mn=3678&pt=msg&mid=18561896

VLE.TO/PNWRF - so...

..Inlani-1 is carried and does not impact their C$ 60mm treasury, it only starts to decline once Equinor has completed their earn-in-obligations, which was after Inlani-1 on the conference call.

FYI - I work in transactions in Canada and I never use the $ it's either the $C or the $US since they are so different now at 0.77 C/US and the world works in $US...but:

Valeura reports in $C, they raised the 60 million in $C, are referring to still just shy of $C 60 million in cash on their balance sheet currently, and I bet that 25 million is $CAD which is $USD 19.2 million for perhaps two wells (Devepinar-1, plus the next one they talked about being permitted between several optional locations) or under $US 10 million per well which is pretty darn reasonable considering limited economies of scale for deep drilling like this in Turkey.

Mistakes like this are endemic in Canadian finance industry FYI so take everything you see coming out of Canadian company with a grain of salt and need to step back and consider if you're dealing with a Loonie or George Washington.

VLE.TO/PNWRF

I listed half-paying attention to conference call but missed that $25MM cost. Was that in the CEO/CFO presentation or did it come out of the questions after?

Inanli-1 is the last well that is 100% carried by Equinor (formerly Statoil) so it has a $0 cost to Valeura in terms of their treasury. Assume $25mm starts with the next well after Inlani-1 which will be Devepinar-1 - the 18km step-out west?

ATU.V - speak of the devil, jumped to $.70 today

+$.08 as we speak.

Sorry I did not reiterate on this one earlier! Just back from vacay.

See my last post FYI. Bull flag, jumped out of creeping upwards flag today.

US investors take note!

Canada doesn’t exist in US news cycle but google “saudi arabia canada” and you’ll see the diplomatic spat that has caused selloff.

There is some risk to Covalom here. Saudi cray cray!

This is blowing up Canadian news FYI

REG.V 714m @ 1.02% Cu-Eq

Currently at $2.20

https://www.regulusresources.com/wp-content/uploads/20180807_NR_AntaKori.pdf

More drill results to come for next couple months.

Checked in with CEO.CA board and everyone here has nothing but good things to say and seem to be former Antares shareholders keeping shares close.

https://ceo.ca/reg

ATU.V/ATUUF

This is actually now my second largest energy position behind Valeura. It would be a lot larger if it was not for Valeura.

Malcolm Shaw's posts are a good intro.

Seperately, Keith from Oil and Gas Investments Bulletin has also recommended Altura and really, really likes the story and it meets his core criteria of well capex payback < year and high recycle ratio that a junior needs to self-fund growth (debt-free).

I hold Malcolm's and Keith's picks on Altura here in high regard.

Honestly, I would own more if Valeura didn't sell off so much as I don't want to sell a single Valeura share in 2018 now that we're down here. I hope I don't regret this.

I did buy a bit more Altura today and I think the chart pattern below may break to the upside in short order. I would be happy if it went down into the mid $0.50s again as would definitively add there.

Zinc may have bottomed Short Term...

..back on July 13.

See my 'manual charting' off the Kitco graphs and then jump to the Kitco page to see the selloff with bottom on July 13.

http://www.kitcometals.com/charts/zinc_historical_large.html#30days

Andy Homes lays out the facts to suggest there could be a nice bounce from here with shorts in a bear trap. Great article below. To quote Andy:

"The money men have steadily increased their bearish bets on zinc to the point that, according to LME broker Marex Spectron, the net speculative short has grown to 29 percent of open interest. That’s the largest short position since November 2015."

Look at the Kitco charts. The last major bottom was November 2015 and zinc ran from $0.65 to $1.60 after that. I doubt we'll get that kind of run this time but takeaway is bias should be to upside for rest of year after recent selloff.

https://www.reuters.com/article/us-metals-zinc-ahome/commentary-zinc-bears-get-taught-another-lesson-in-timing-idUKKBN1KH1ZQ

I've held USA.TO through the pain and if you didn't have any I would advise to add here in next few days.

I have enough USA.TO so I literally just bought Trevali as I wrote this post and convinced myself for a multi-month trade, as it's chart has mirrored Zinc and, as always, will be a go-to name if zinc grinds slowly upwards again.

Neptune Board Chair Insider Buy

Takes down close to $USD 200k in shares on Aug 1st at same price we can buy at now.

https://www.canadianinsider.com/company?ticker=NEPT

http://neptunecorp.com/en/who-we-are/team/

I'm Canadian...

..Canada and Saudi Arabia not getting along.

I doubt this will effect Covalon's business which appears to be with "hospitals assocated with the Ministry of Health".

The MOF would appear to be a national authority.

Saudi Arabia looking to inflict pain on the Canadian government and I doubt they see a small private Canadian-listed company as the government.

this could finally prick the bubble for a few months and let me buy my shares back!

Critical Investor has a great news page.

Stumbled upon the CI website reading a good write up he did on Fiore Gold (F.V).

This is a great page to bookmark as he has feeds from all the main junior mining related websites that are summarized for you reference in one place. Maybe a decent replacement for the Yahoo Metals and Mining feed that is now lost.

https://www.criticalinvestor.eu/

I have a new pick and I'm going to buy tomorrow. It doesn't have a ton of volume so I'll post my write up after I see how things look tomorrow.

Hint: I mention the new pick above!

NGD.TO - not a microcap but epic selloff over?

Anyone looked? In $CAD share price terms it's down from ~$7.50 at peak of early-2016 run to Friday' $1.64.

The news on Friday was that the Rainy River Commissioning was still having trouble taking off and this was enough to likely trigger stop losses around the low $2.00s which was where NGD.TO bottomed in 2015 which could be the bottom of the 2011-2015 gold bear.

CAD 950mm MC after Friday's selloff.

Anyone following or have an opinion?

RIO.V

Is it possible the move from $.70 to $1.00 area was just due to the merging of Rio and Atacama?

Had crazy week and didn't follow but just looked at Stockcharts now and this is historical chart. Stockcharts is very good, of course, at updating historical charts to reflect the current pro-forma captial structure of companies (e.g. mergers, share splits, etc. will be pushed backwards into the historical chart retrospectively)

USA.TO - looks like I'm holding....

...till summer doldrums in gold/silver over. USA.TO really followed zinc down if you've been following that market.

This may be one of those stories that market warms too slowly.

In hindsight $3.50 (TSX - $CAD) is a great buy point, why did I buy in mid-$4's recently LOL?

VLE.TO - My Post from IV

Comparison to Nexgen uranium discovery. Not a perfect comparison but Nexgen retraced to 38.2% Fib line. (I'm a "high level" technical guy FYI). That's basically where we are with VLE if you take the intra-day high in early feb.

https://www.investorvillage.com/groups.asp?mb=19518&mn=3223&pt=msg&mid=18468063

Check out Alacer Gold - who's only asset is an 80% interset in the Copler gold mine in Turkey. Market does not care one iota about the election or Erdogan.

Look at a 1Y chart.

https://ca.finance.yahoo.com/quote/ASR.TO?p=ASR.TO&.tsrc=fin-srch-v1

USA.TO...another update...

We have yet another triangle nearing the end. Hoping USA.TO will jump upwards again. Chart is saying it should, only a matter of time.

USA's SP has been historicall very volatile. I added both USA.TO and USAS this week in anticipation of a nice trade here. Analyst targets are in $7 range. Would be nice to go up there this time.

Market hasn't treated Americas like a zinc stock yet, so I bet it will move with silver sector. Can't remember where I read this, this week, but Sugar is a leading inflation indicator, and hence, leading silver indicator and it getting pretty close to a major bottom. Chart below.

I'm into ATM.V (RIO.V)

Small position at 0.73. They'll have to raise equity, but hopefully at higher prices once market figures out this really is La Arena 2.0 with the same management team.

Slide 17 which has the comparable low-grade heap leach project quals is key here.

http://www.atacamapacific.com/investors/pdf/atacama-corporate-update-1701.pdf

I also found the original 321gold.com feature on the original RIO.V here for a background. La Arena was copper-gold porphyry. I'm not sure is Cerro Manicunga is:

http://www.321gold.com/editorials/moriarty/moriarty020910.html

I reckon they'll redo the 2014 PFS and start with a 30-40K TPD operation doing around 120-140k oz/year similar to most project on slide 12. They allude to this on slide 14. Maybe they can even start smaller as they should have some decent grades at surface (.50 to 1.00 g/t slide 9) in starter pits on the lynx, pheonix and crux zones of the super-pit. Maybe three nice higher grade starter pits. This is a big resource though, so you need to build it out at the start planning for higher extraction levels eventually.

La Arena was initial ROM ore while the Cerro Manicunga PFS envisioned 3 stage crushing, albeit for a huge 80,000 TPD operation. Slide 12 highlights $100mm of capex savings (no secondary or tertiary crushing initially, valley fill heap leach to avoid conveyor). I'm sure RIO already has an idea how to optimize the project to benefit of shareholders.

In general, looking at La Arena vs. La Manicunga I see:

- similar jurisdiction (Andres Peru vs. Chile)

- similar gold grades

- similar sized heap leach operations (assumin La M is 40k TPD)

- Opportunity to optimize initial production to decrease capex and SH dilution on La M like on La Arena

- Both projects discovered decades ago with resource fully delineated and a ton of metallurgy done.

Now that I finish this post I see slide 20 focuses on a full feasibility envisioning single stage crushing, valley fill leach and a production ramp-up so there you go. RIO has done this before. I like.

LC - RIO.V

Thanks for the tip. I remember Bob Moriarty's big article on how the original Rio Alto team had knocked it out of the park bringing La Arena into production out of (financial crisis if I remember)? Great to buy a management team that brings assets into production.

I couldn't confirm RIO.V's market cap at the time of transaction so perhaps this is a source of the market under valuation of ATM.V. PR says ATM.V SHs get 0.6601 shares of 'Amalco' so you need solid information on market caps of both entities to do this. I get a combined 104mm market cap based on what I see vs. "170mm" in the PR at the time of the announcement (RIO.V SP @ 0.96).

Simplistically, RIO.V is down 10% since announcement which was at a 0.96/share so that implies "implied valuation of ATM.V of 0.95/share" has also gone down 10% to around 0.85.

I have a buy order in at 0.72 right now nonetheless.

Anyone have thoughts on correction price?

I sold in mid 4's earlier in 2017 and missed the first run to $7. I literally had my buy orders in for the week to buy back my original Covalon in the 3's and then the latest PR dropped. Tried to buy in 5's right away that morning if I recall but no luck.

Thoughts on where I should try to pick back up within the next couple weeks from more technically oriented biotech traders? Maybe COV will correct to low 6's? 6.10 would be a 33% fib retracement of the big news per below for example.

Market cap here is only CAD 150mm so tons of upside. I'm not going to be too picky here. Lesson learned: pay the ask in the first hour the news dropped. I tried to underbid by .05 or .10 unfortunately. They news was huge....

TAT/VLE

Speak of Devil Malcolm has answered your question. The fractured slide he screen shots is slide 45 in the investor day presentation on the website. It this well is a "gusher" and deliniates the Kesan reservoir as over pressurized over 1km (4000 to 5000m) and that it can be frac'd then Valeura proves up it has a world class resources and we're off to the races.

http://hydracapital.ca/hydra-blog/valeuras-volatility-and-investor-day-give-investors-something-to-talk-about

Also, Acadien is one of of, if not, the best poster on the IV Turkey board and here is his take on the extent to which Thrace can improve turkey's current account deficit (they import 99% of gas)

https://www.investorvillage.com/groups.asp?mb=19518&mn=2676&pt=msg&mid=18318104

Zinc - yet more deliveries on May 31

LC - don't stop posting! love your perspective here.

Here is mine.

Price could have bottomed around start of May but there was another large 2000T delivery on May 31.

http://www.kitcometals.com/charts/zinc_historical_large.html

Trevali is the most liquid go-to-zinc name so we should see a big candle on them when/if the market thinks another trip up is starting. It should go down to 0.95 which is really strong support and TV's "centre of gravity" for the last 5 years.

I'm currently only holding USA.TO and waiting for current triangle to break (hopefully to the upside)

ASO.TO

Took a quick look. They don't have a lot of reserves (maybe $1.5m oz) and have an EV approaching US $500mm so I don't see much more value here though they will produce over 200k oz in 2018 at a nice sub-$900 AISC. They're going to burn through their open pits pretty fast.

I'll hold to see if I can get out at cost which is now $6.60 (formerly .066 before 100:1 consol. Currently just south of $5.00

USA.TO update - if Zinc bottoms soon, then the triangle developing since September 2017 should resolve to the upside. Gold and Silver higher will also help.

Zinc - I sold ASND.TO but am thinking I should buy back some TV.TO and a bit more USA.TO for (hopefully) upcoming trade.

Zinc has been going down but here is my take on the current selloff - uptrend not yet broken.

Recent zinc selloff becuase of some large LME deliveries, we'll have to see market eating through these a bit first, that should but a bottom on price and then we'll see how high she goes in the 8th or 9th inning.

Stats-to-date...

...I said this before but these are awesome especially when you get up to 4/5/6 contest results averaged. Thanks SSKILLZ !

Great takeaway for actual investing strategy.

I generally pick my actual personal top 3 holdings I think should go up and have minimal downside risk from a technical chart perspective at the start of the contest. I then go "on snooze" and usually forget about the contest and don't trade. Has worked for me over 7 contests.

Generally this shows that you should overweight your best ideas, at the right time, in real life.

I'd be curious what KNOWLEDGEISKING's strategy is!

Why you should overweight your best ideas....at the right time...

...or to put it another way, reallocate more to your best ideas when they are cheap.

Skillz puts on the fun "Pick 3" contests and next one starts friday. I generally don't have time to "trade" and have just held my top 3 ideas in these contests for 3-4 month contest duration. Honestly I usually forget the contest is underway.

Strategy has worked well and I'm sitting at an average 13.5% return over that time frame in 6 contests.

I'm generally just picking my top 3 personal holdings which have the least technical (chart) downside risk and not going for the win in any of these.

Hopefully this is a good reminder for anyone who has taken time to read :)

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=140395723

The other takeaway is to buy KNOWLEDGEISKING's top 3 pics. Killing it!

ASO.TO - thanks BOB...

....I will look. Have also held ASO.TO through condolidation and think I am down only 30% through all troubles. Think I bought because of you originally so let's see if this works out.....

SSKILZZ Thanks so much....

..as always for putting this together. Love the stats over the first 7 contests. I'm sitting in 10th for both (return and place). I like!

Zinc - I like TV.TO here...

...for one last kick of the can. Big selloff since February zinc $1.60 short term top appears too large. After looking around I won't by ASND.TO here (not very liquid) but I think Trevali may be good here for a +25% ($1.20 to $1.60) if we get one last silver runup in next coupe months.

COR.V - thanks for reminder LC

Has come right back down from the Pump.

At Jan 31, 2018 (last interim FS) they had $1.6mm of cash and $1.7mm of WC. Hardly any liabilities. They raised a paltry 1.5mm on Feb 27.

They are drilling 16,000m in 2018 so this seems like a good time to enter a position for 2018.

and speak of the devil they have a new presentation out today.

https://www.caminominerals.com/site/assets/files/3088/cor_chapitos_summary_apr_26_2018.pdf

This is just the first drill hole of that 16,000m in 2018 it looks like.

https://www.caminominerals.com/news/camino-continues-to-expand-adriana-zone-with-northwest-step-out-drilling/