Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

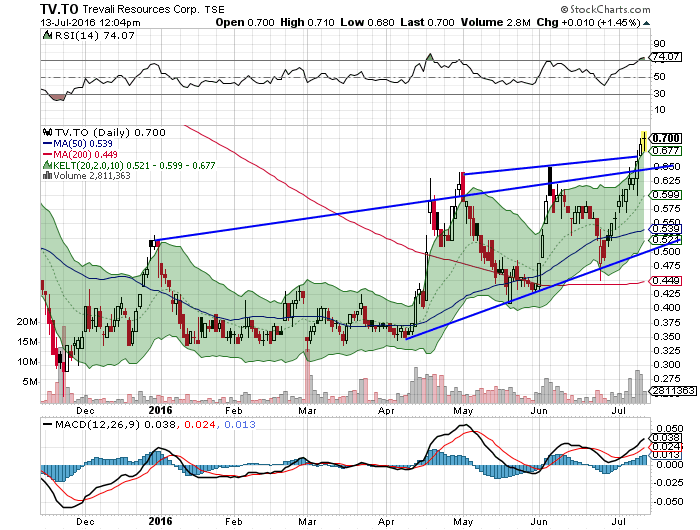

TV.TO - Buying on breakout....

Analyst consensus is around $.90 target price at $1.00 long term zinc price and zinc price has already rocketed up there and this appears to more than a 'mean reversion' rally as if you look on 5 year chart Zinc's centre-of-gravity is $0.80. Zinc went from $0.97 to $0.995 yesterday and this is when Trevali closed above upper channel line in first chart below. Have been watching Trevali since $0.47 bounce off lower channel line. Zinc price has also been moving up in last month despite LME inventories rising. LME inventories also look like they are peaking short term last couple days. Who knows...

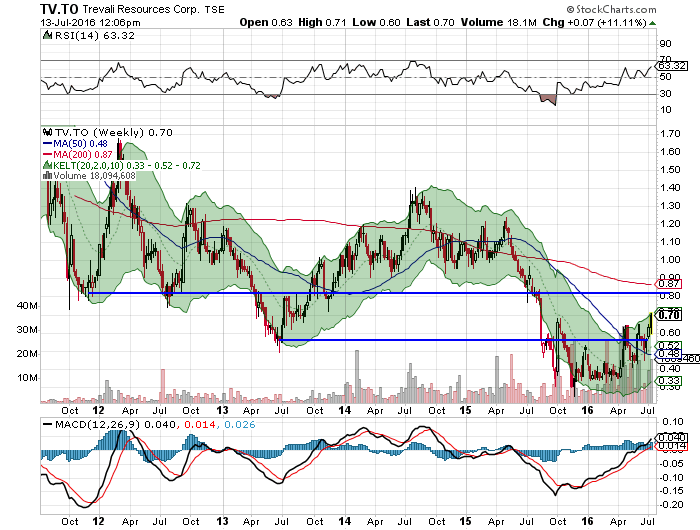

Trevali's centre-of-gravity on 5 year chart below is $0.80 for short term move. Hopefully a lot more than a double if zinc actuall peaks at $3850/tonne ($1.75/lb) in 2018 per my post linked a few back.

Bought at $0.70 this morning for myself and family. Their newly commissioned mine Caribou has LOM grades of 6.99% zinc which is double their Peruvian Santander mine around 3.5%. Timing looks great for Trevali now and I have benefit of never being involved in missed promised from last two years for them. From what I understand of Zinc market, offtakes are typically at global prices, even if they are all with Glencore. Pricing moving in favor of miners as their is a shortage of ore so smelter margins shrinking.

CNE.TO - click about 5 posts back.

Targets around $5.00, but that is before what looks to be some immense upside over next several years that isn't priced in, as well as reserve growth that will get booked for YE 2016, and hopefully priced in during H2-2016. New presentation is pretty excellent so I would recommend flipping. Trend is up for now, though erratically like CNE's past trading. I am back in this morning as looks like $4.20 isn't happening and not arguing with the tape.

http://www.canacolenergy.com/i/pdf/ppt/Canacol%20Energy%20Corporate%20Presentation_6.23.2016.pdf

MML.ax - Bobwins, here is nice summary:

Nice response from CNC Venture in comments at bottom of article.

http://seekingalpha.com/article/3986326-medusa-mining-counting-june-2017

Zinc Fundamentals are amazing.

This is one of my most important posts in last couple months.

Besides TV.TO Trevali and GPM.V Guyana Precious Metals - please reply with any zinc names you have been looking at.

I got to look at the zinc market this last couple weeks in decent detail for work and had access to some valuable research. Fundamentals are amazing. Two of the largest open pit zinc mines in the world - Century (was world's largest too!) and Lisheen were exhausted and closed in the last two years and there have been no major discoveries to replace them. The most respected global metals coverage firm Wood Mackenzie is forecasting a price peak of US$3875/T in 2018 vs. current pricing of around $2134/T ($.97/lb with 2200 lbs in a T). That's almost a double in pricing.

The Zinc market is going into deficit and most materials I have seen are forecasting this to finally materialize in H2-2016.

This Kitco link is a good source to follow zinc market at high level. There is 5 year downtrend in LME zinc warehouse stocks that has not been broken even though stocks have been rising since June 9th. Despite the rising stocks (warehouse stocks and spot zinc should move inversly), the Zinc price has moved from $.90 to $.97 over the same period. Zinc's centre-of-gravity in the last 5 years is $.85 - .95. Price is already through that so this could be more than a mean-reversion rally and maybe the current rally is akin to the current gold rally?

The low of $0.70 corresponds with the commodities market low and according to some sources, investors were throwing in the towel as unexpected zinc stockpiles were put onto the market throughout 2015. That bottom is not too far in to the past. In context the zinc price has held up amazing compared to other base metals.

http://www.kitcometals.com/charts/zinc_historical_large.html

Trevali - TV.TO is one way to play this. Has been a frustrating ride for any investors in last couple years with some high interest debt financing and a 15% dilutive financing in March 2016 in what I understand was a frustrating commissioning process for their second mine Caribou in New Brunswick, Canada. Trevali is now a two-mine company and will be the go-to name on the TSX as the only pure-play zinc producer.

http://www.trevali.com/i/pdf/TV-NR-july-7-2016.pdf

They just have to deliver going forward now. Biggest risk here is principal repayments. Many analysts have Trevali's break-even price at $.80/lb. They have a lot of copper, silver and lead by-products of course and another analysts has their cost of production at $.60 in 2018 at the supposed Zinc market peak which is the middle of the cost curve.

GPM.V is drilling the Walker Gossan in Northern Australia. This was identified as one of the best district lead-zinc prospects back in the 1970's but has never been drilled due to aboriginal issues. Some of the biggest lead-zinc mines in the world (including Macarthur River and Century- mentioned above) are in the vicinity. I have followed this all year but kicking myself as it is already rallying. This is going to the hottest zinc exploration play in the world in H2-16 so still worth buying here IMO. Here is the background you need to read:

http://www.mining.com/web/hedge-fund-chief-warren-irwins-blockbuster-uranium-call-and-his-best-metal-and-oil-plays/

http://www.gpmmetals.ca/sites/default/files/GPM_JUNE_2016_02.pdf

I'll post more when I dig further into both tomorrow.

ORV.TO...

...The AISC in my italics two posts back was GUIDANCE. That being said, if we're in a new gold bull, Gold will be higher next year and we have hopefully heard the worst from ORV.TO so I should buy some more back.

Good quote from Peter Imhof is "never stop watching your losers" as if you followed them for a while you understand the story and are better able to judge if the worst is priced in and a turnaround is ahead.

ORV.TO

I sold out on the release of this in Q2 statements. I should really just add some shares here simply because I think any gold explorer, advanced explorer or producer that hasn't really rallied should this summer. Great find on US Silver getting involved in Orvana.

This is why I sold. AISC exploded and in the dog-house again this year. $1000-1000 AISC never realized otherwise Orvana would be at $.50 now

As a result of the above gold production changes, Orvana also revised its COC and AISC guidance during the second quarter of fiscal 2016 as follows: (i) increased COC from $850 to $950 per ounce to $1,000 to $1,100 per ounce, and (ii) increased AISC from $1,150 to $1,250 per ounce to $1,300 to $1,400 per ounce

http://s2.q4cdn.com/372236871/files/ORV-NR-Q2-2016-SEDAR.pdf

ORV.TO

I sold out on the release of this in Q2 statements. I should really just add some shares here simply because I think any gold explorer, advanced explorer or producer that hasn't really rallied should this summer. Great find on US Silver getting involved in Orvana.

This is why I sold. AISC exploded and in the dog-house again this year. $1000-1000 AISC never realized otherwise Orvana would be at $.50 now

As a result of the above gold production changes, Orvana also revised its COC and AISC guidance during the second quarter of fiscal 2016 as follows: (i) increased COC from $850 to $950 per ounce to $1,000 to $1,100 per ounce, and (ii) increased AISC from $1,150 to $1,250 per ounce to $1,300 to $1,400 per ounce

http://s2.q4cdn.com/372236871/files/ORV-NR-Q2-2016-SEDAR.pdf

ORV.TO

I sold out on the release of this in Q2 statements. I should really just add some shares here simply because I think any gold explorer, advanced explorer or producer that hasn't really rallied should this summer. Great find on US Silver getting involved in Orvana.

This is why I sold. AISC exploded and in the dog-house again this year. $1000-1000 AISC never realized otherwise Orvana would be at $.50 now

As a result of the above gold production changes, Orvana also revised its COC and AISC guidance during the second quarter of fiscal 2016 as follows: (i) increased COC from $850 to $950 per ounce to $1,000 to $1,100 per ounce, and (ii) increased AISC from $1,150 to $1,250 per ounce to $1,300 to $1,400 per ounce

http://s2.q4cdn.com/372236871/files/ORV-NR-Q2-2016-SEDAR.pdf

PRU - only ASX announcement so far...

...Would have been nice if PRU rallied more before they raised but this should set the base for platform of growth for next 5 years.

At least they hedged at $1307 and caught the recent top.

http://www.marketwired.com/press-release/perseus-to-raise-a102-million-of-equity-to-fund-growth-strategy-tsx-pru-2135560.htm

Cameco Interview (re: NXE.TO)

Good interview with Cameco (largest uranium producer) CEO on Uranium market fundamentals (not great)

http://www.mining.com/web/cameco-ceo-tim-gritzel-uranium-market-transformation/

AUE.TO

You'll have to fight through exhibit below as Ihub won't process my spacing.

MNG now owns 55% wih 662M shares (includes note into shares at transaction close) or 1204M shares outstanding. At $CAD 0.06 share price that is ~USD 60M MC.

I note the following in USD:

Cash from MNG (30.0M) today's PR

Current Assets (18.5M) March 30 FS

Current Liab. +43.8M March 30 FS. Inludes current borrowings/lease

Increase in AP + 7.1M Today's PR vs. AP on March 30 BS

LT Borrowings +85.4M March 30 FS

LT Lease + 7.6M March 30 FS

Net Debt +95.4M

MC +60.0M

EV $USD 155.4M

NPV5% Post Tax @ $1300 long term gold: $USD 328M

Reasonable valuation if they get things turned around in light of MND majority interest: 0.7X NPV or $USD 230M.

Upside to equity: $230M-$155M = $USD 85M or $CAD 107M/1204M shares = + $CAD 0.09 to share price to $CAD 0.15 or 150% upside.

Lots of Ifs there and conditional on getting things turned around real fast.

NPV5% is section 1-10 near start and the $1300 is on page 258

http://aureus-mining.com/wp-content/uploads/2015/03/NLGM_43-101_March_2015_Final_Report.pdf

CNE.TO

Sold everything I add for once conveniently right at $4.60 short term top. Not walking away but planning on buying back everything at lower price as looks like we are in for a bit of downtrend for next 1-2 weeks.

Would have just sold some trading shares but if you pop over to the IV O&G board (where CNE is a new favorite but you heard here first!) you'll see a lot of good posts on recent analyst tour that happened (3 of 4 pages back from current page).

Basically, the hoopla around CNE was at an all time high the last couple weeks that is why stock exploded upwards to $4.60. Just going to sit on my cash and wait on a lower entry point as this short term enthusiasm wanes.

Note that a lot of analysts have $5.00 as target (another reason for selling short term) but that is going to get revised upwards even in the next couple months with likely reserve increases and market starts to see future cash flow profile off all the expansion projects discussed in the post below - which is one of the best posts on IV board regarding CNE analyst tour:

http://www.investorvillage.com/groups.asp?mb=17397&mn=38433&pt=msg&mid=16065304

You need to be an O&G board member for that of course.

CNE.TO + 0.29/7% over...

....4:20 so time to light one up?

Jump explained by short term technicals coinciding with potential break upwards from long term ceiling that has been in place since CNE.TO started to publicly present themselves as a contracted natural gas producer since we started following out of bottom of energy market. All technical as volume isn't there.

6 Month View.

2 Year View

CGE.V

Don't know how big Moriarty's position is but I would guess 95% of recent PP is in strong hands who have not sold a share yet. Sellers likely legacy shareholders who were underwater from January 2012 to recently if you look at long term share price. If anything, Moriarty and Tommy put Corex on people's radar.

CNE.TO Upcoming catalysts

http://www.investorvillage.com/groups.asp?mb=17397&mn=38218&pt=msg&mid=16022860

CGE.V – godfather of heap-leach’s sunset project.

Sources for this are the 321gold.com article, CEO.ca article, presentations, coffee with VP of Corporate Development last week and my further thoughts.

This is an initially tiny production play by the most eminently qualified mine builder for this type of play in the industry. Since there have been some world-class heap-leach grades of +1g/t from surface hit on Nicho North and El Nicho, the bigger opportunity here is delineating a district-scale property and then either developing it (with equity dilution) or selling it to Argonaut, Alamos, etc. – another Mexican heap leacher. The closest comparison I can think of is GoldGroup (GGA.TO) out of the 2008 financial crisis lows as they only had their heap leach Cerro Colorado gold mine at that point producing 20-30 oz/year and went from $.15 to $1.90 at 2011 sector high for a 13 bagger.

Chester Millar is 88 and known as the ‘godfather of heap leach’ and was the founder or initial property developer of Glamis, Alamos, Eldorado, Cayden and Castle Gold (latter bought by Argonaut). Got your attention? As likely his last project, he is bringing Corex Gold’s Nicho North zone on their Sonora, Mexico Santana property into production on $500k of capex. He owns a mining services company that is already on-site so most of capital and operating costs are paid via related party contractor fees. Since Chester owns the company this reduces any start-up risk as he doesn’t need to demand immediate repayment from the contractor (H Morgan & Co. Attachment 2 – slides 11-12). Furthermore, H Morgan is in Corex for equity so is also incentivized for successful production.

http://www.corexgold.com/s/NewsReleases.asp?ReportID=660680

Chester does things old school and believes in the non-dilutive, phased development approach using free cash flow to expand the mine. He can do this with the right heap-leach property of course. There is really no one else like him in the business, and no one more eminently qualified. If/when Chester passes, his mine manager is Chris Babcock who has been with Chester for 30 years and was president of Pediment and Castle (both acquired by Argonaut).

Castle’s (now Argonaut) La Colorada project is about 100km NW and Alamos’ Mulatos 50km NE. Management founded both mines and both are also heap leaches. They are pretty darn confident they don’t need to waste any money on studies and can just start leaching Nicho North. Chester’s record from laying pads to first dore pour is 89 days and he is aiming for less than 120 on Nicho North. Pads have already been laid and capacity of these first pads is 1M tonnes (a bit less than 30k ounces @ 1g/t after recoveries). First production is going to be in August or September most likely.

Nicho North is an outcropping hill with basically a zero-strip ratio for intial production, is oxidized and has world-class heap-leach grade drill hits like 93M @ 1.03 g/t from surface in SR08-05 (Attachment 1 – page 34).

This will be a tiny mine to start going for 10-20k gold ounces/year production, but Chester’s aim is to generate free cash flow to expand operations and explore the Santana property with El Nicho (main), North Benjamin, Ubaldo and other zones being prospective targets (Attachment 1 – page 15). El Nicho also has some world-class heap-leach +1g/t grade drill hits from surface. Since mineralization is at surface they don’t need an explosives permit and can mostly just drill and scoop the at-surface mineralization. Initially they are going to run for 8 hours per day at 150 t/hour for 1000 tonnes/day and feed ore into a jaw crusher (provided by Chester’s wholly owned contractor) and crush to ¼ inch before leaching. From the bottle-roll testing they know this will work**. This won’t be optimum crush size or throughput but they’ll find this out from production, rather than a costly feasibility study. Water is trucked in and cheap.

I calculated that after the capital raise that just happened, Corex should have about $500k of working capital after allocating about $500k to capex. Apparently a lot of the trade payables on the balance sheet are technically payables to either Chester or Chester’s wholly owned company as for two years he has personally paid for a number of studies and 19,000m of drilling on Santana and he doesn’t exactly need this money ASAP like most creditors as is ‘in the deal for the equity’. As a result, if Chester doesn’t call those payable the actual working capital is higher. Ultimate plan is the capital raise that just happened is the last one ever. This would only work of course if they explored the property on free cash flow and sold. Apparently Chester’s first hole was the 93M @ 1.03 g/t from surface at Nicho North I mentioned above. He knows where to drill….He has been involved with Corex for about 2 years.

The participants in the recent $1M PP were Chester (50% for $500k), Bob Moriarty (321gold.com), a tiny piece for Tommy @ CEO.ca apparently after the article was done, with rest to a number of senior brokers in Vancouver. These investors not trading these shares. Recent volume likely bag holders from old Corex getting out on volume.

You should note that the two recent articles that introduced Corex to the market were written by private placement participants from the $.05 range (Bob & Tommy), so there is some bias, but their articles don’t smell of that.

I am in at $.16 and would bet we never see Corex below $.12 again where there is a bit of technical support. I would by more down there. I was going to buy lower but the day I went to buy, Moriarty released his article and put Corex on the map so I was forced to buy at lows of the jump on that day.

**I asked Doug about this and bottle roll testing has not been announced to market – perhaps because they can’t or it wasn’t done independently for 43-101 standards? While this would typically be a red flag I am not concerned here and trust Chester.

Attachment 1 – technical presentation

http://www.corexgold.com/i/pdf/technical-presentation.pdf

Attachment 2 – corporate presentation

http://www.corexgold.com/i/pdf/corporate-presentation.pdf

Recent articles

https://ceo.ca/@tommy/mining-legend-chester-millars-formula-for-success

http://www.321gold.com/editorials/moriarty/moriarty051616.html

USA.TO - yep

Jamie Carrasco. Saw that too. Same guy I posted in the video from end of March. He is pretty underwater as sounds like he has held since USA-RX merger +$2.00 stock days.

Ignoring that, the future finally looks bright here in the low $.30's.

He probably participated in the latest $20M PP and the additional $10M subscription receipts financing annoucned this morning but doesn't have to disclose on TV of course.

Story good regardless.

USA.TO - a turn around 3 years in the making

Not much more needs to be said here after you view the presentation. Former SVP of corporate development for Barrick has lead a huge turn around after last 3 years. Bottom likely in at $.30 as just did a large PP with Sprott to finance the San Rafael project.

I was in at $.25 for long term position.

http://www.americassilvercorp.com/i/pdf/presentations/presentation20160505.pdf

Per Jamie Carrasco as a top pick back in the end of March.

http://www.bnn.ca/Video/player.aspx?vid=839317

"Going forward this quarter will the first quarter in years that the cost of production is below the cost of silver"

This is the blue-sky hold thesis

"By 2018 the cost of production (silver) will be zero due to the byproducts" (referring to Mexico fully permitted, brownfield, $22M capex San Rafael project with strong, lead and zinc credits - slide 9 above)

AUE.TO

Definitley gambling shares. This is from Tim Oliver from CEO.CA (kind of like the twitter of the junior mining industry now, but agree most articles are a vicious pump).

what a mess. This thing has been trouble from the get go. I don't know where to start. Apparently they tried to hold onto all their tailings water because they couldn't destroy enough of the Cyanide to meet release standards. Along came a bunch of rain, and they had a spill. Looks as though they gambled and lost. It's a bit of a troubled project with a history of inability to run the plant at capacity. And so on...

Tim Oliver is reputable contributor to Exploration Insights.

http://timoliver.us/about-tim/

AUE.TO - daredguy

Thanks for the reminder. Have an order in for some gambling shares at $.06 after looking quickly. Could double quickly simply on announcement that production has recommenced, then I'll revisit. $.05-$.06 area is long term bottom.

Mine was financed primarily with project finance (debt) but they have some nice open pit grades (3.4 g/t) if they get things running smoothly. Lenders currently 'own' the company until they can prove they can get things running smoothly. Principal repayments due in the next year are 19.1M which doesn't seem so feasible right now thought the first senior facility payment is discussed as only $3.1M which is doable if they can push out repayment. If you take out the debt in current liabilities working capital is zero - I've seen worse. They are also mining and building a stockpile so there is potential for a big turn-around if mine starts up and they run at capacity for several months. Commercial production was declared on Mar 31.

Gambling shares but we'll see what they announce on mine re-start, debt deferally and updated LOM plans. Market is smelling a PP here but they should have enough flexibility to negotiate deferral.

Its always interesting buying a CAD $35M MC company that has been financed with USD $178M of share capital over the years. Ouch. Doesn't matter for us if we're in at bottom.

LYD.TO currently +25% - fully financed today

FYI - I'm pumping out what I think are the best junior ideas in the gold sector and they are generally quality names that haven't participated in the rally like all the conventional producers who are all overvalued right now. Here is another one and will have more all week! I am buying all these as I think the gold bull rides and these have little downside when/if the producers correct over the summer. Stay tuned. Have a coffee booked with another junior in Vancouver-mining-town in a few hours.

Lydian finally has all the pieces in place for their Almulsar project with permit, environmetnal approval, and 90% of mine capex financed between equity, warrants, debt and a stream. They only now need to close an equipment finance facility (for haul trucks) but market doesn't care and sees the pieces FINALLY in place after years of waiting and has bid shares up 25% to 0.38. I have orders in at 0.36.

Took a quick look and found one good analyst report with NAV5% on a post-stream, post-debt repayment basis of CAD $0.74 share price. That is at $1150 gold so equivalent NAV might be CAD $0.90 now at $1280 gold which would be a double from here with NAV to go higher of course in a gold bull.

Lydian is bringing into production what analysts are calling a minimum mine life of 14 yrs with 200k+ oz of gold heap-leached per year over that 14 years at average grade of 0.74 g/t at sector-low AISC. Feasibility study is a 10 year mine life with almost 3M oz of gold produced but they have 5M oz M&I so mine will go longer than that. That gives you a long term horizon to hold Lydian for sure!

Market is desperate for names that haven't participated in the rally and that is a huge bull flag on Lydian after a flat share price year-to-date so I'm buying now and will catch up on DD later! There should be some good analyst reports I can post early next week that come out following today's decision.

http://www.lydianinternational.co.uk/news/2016-news/313-

AVK.TO - a visual of the undervalution.

Chart of project IRR vs. discount to NAV for single asset advanced-stage gold juniors (with no operations) from the end of the Cormark analyst report. See AVK.TO's Kalana project in the bottom right.

Cormark has a $.70 target which would be 0.8X NAV. Other canadian houses have a $.60 target. Cormark is always higher than other houses as their target's are more long term which goes the quality of their research.

PRU.TO - JustForFun

If you check out the AVK.TO presentation I linked in my last or second last post there is a comparison of west african open pit high grade low-AISC deposits and PRU.TO's Yauore deposit to be developed is one of the better ones. This is where the long term value is.

Yaoure came from recent merger/acquisition of UK listed Amara.

PRU could be consolidating before another jump higher. It is trailing sector so has more upside if sector goes higher.

Have not sold and and am not planning to sell any.

AVK.TO - putting the pieces together.

I am a shareholder now with thesis that in short term Avnel's Kalana project is one of the most undervalued (~0.4X NAV at spot) shovel-ready high grade, low AISC gold open pits in West Africa. Their presentation is excellent in this regards if you link back to last post.

If current sector rally just consolidates I think money will move into AVK.TO. Just look at the volume on the chart if you link one post back. 85% is closely held by institutions.

Here is another short outline of the company.

https://ceo.ca/@kipkeen/this-2-million-ounce-gold-deposit-is-eminently-financeable

65% shareholder is Elliot Management - a NY Hedge Fund. This is the biggest black-eye as Elliot exerts control. However, as I mentioned in the last post this is the 5th best development project in West Africa with the other four tightly held or recently acquired (B2Gold - Fekola, EVD.TO - Hounde, PRU.TO - Yaoure, SMF.TO - Natougou). This means Elliot group could put up Kalana for sale as an alternative to financing it, though I think this is unlikely as Elliot Group's Paul Singer has been vocal about positive fundamentals for gold.

So how does Kalana get financed in a fashion that protects Elliot's current equity interest? The answer may lie in this newly formed mine finance shop by Elliot Management, the former CFO of Barrick. The pieces should unravel pretty soon though I would expect perhaps a combination of equity, a stream and external debt.

March 2016

http://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/barrick-cfo-shaun-usmar-stepping-down-after-year-into-job/article29266276/

May 2016 - Paul Singer's thoughts on gold

http://business.financialpost.com/investing/trading-desk/singer-says-gold-rally-just-beginning-as-goldman-sees-losses

No other official news announced on the new Toronto mining finance shop.

AVK.TO/AVNZF - new pick....

..Avnel Gold. will keep my comments limited to fact you should view the presentation for this permitted, DFS advanced gold project in Mali which is basically now the best investable gold open pit in Western Africa now that Fekola (B2 Gold), Yaoure (Perseus), Natougou (Semafo) have been acquired with other best project Hounde owned by Endeavour. Best single asset gold Junior in West Africa, lots of volume recently, but has not participated in rally to date.

Would be a lot higher now if it was more widely owned but core hedge fund Elliot Group owns 65%

http://www.avnelgold.com/wp-content/uploads/IR/AVK-Investor-Presentation.pdf

If you interest is piqued you should read the SA article below, as well as the comments at the end that confirm the public shareholder float is only 15% with 85% held by funds, Elliot Group (65% of that 85%) and the CEO who owns 10%.

\There is also a SA Pro article out by Interant if anyone can post highlights he is "not getting behind Anvel" and I would be curious why.

http://seekingalpha.com/article/3781846-avnel-gold-mining-robust-economics-transformatic-catalysts-will-propel-shares-higher-2016

I find Google Finance...

...is quite good and the shares o/s are usually bang on and seem to be updated perhaps weekly. I'm usually looking at Canadian companies but probably the same for US with exception of pink sheets and OTCBB.

The US Sierra Metals ticker basically doesn't trade.

SMT.TO - Found it.

Dia Bras (former name of Sierra Metals) acquired 82% of Yauricocha for for equity value of USD $285.86M in 2011. That is CAD $365M at today's FX which compares to current trading market cap of SMT.TO of CAD $199M.

Long term commodity price assumptions would of been higher back in 2011, but SMT.TO has developed mine for long term operations, turned it around, and discovered the Yauricocha Zone so perhaps it could be sold for the same value as purchased as a starting point.

So if 82% of Yauricocha can still be sold for $CAD 365M, Sierra's other mines must be worth at least $CAD 35M for $CAD 400M total which would be a double from today's market cap of $CAD 199M.

http://s2.q4cdn.com/485819848/files/doc_news/2011/03-04-2011.pdf

The PR is confusing. Not sure how Dia Bras acquired Corona for an equity value of less that Corona was trading on the Lima exchange.

There is also the issue of $CAD 64M in net debt at 31-Dec-15 but this should reduce through 2017 as cash flow is generated. Other properties could be worth more, etc.

SMT.TO - that is what I will..

..look into going forward. Pretty tight for time these days. Please provide any other suggestions on recent transactions you can think of for comps.

There was the first majestic-silvercrest takeover in 2015 in silver place. US Silver-Scorpio merger to create Americas Silver & Recent Nevsun-Reservoir takeover (but doesn't really count as world class coppoer project).

Let me know if something springs to mind in silver or copper space I am missing.

Me might not know what SMT is worth until they start to produce Esparanza and really drill out the Esparanza zone and other zone's north of the limestone barrier they have never tested before.

SMT.TO - that is what I will..

..look into going forward. Pretty tight for time these days. Please provide any other suggestions on recent transactions you can think of for comps.

There was the first majestic-silvercrest takeover in 2015 in silver place. US Silver-Scorpio merger to create Americas Silver & Recent Nevsun-Reservoir takeover (but doesn't really count as world class coppoer project).

Let me know if something springs to mind in silver or copper space I am missing.

Me might not know what SMT is worth until they start to produce Esparanza and really drill out the Esparanza zone and other zone's north of the limestone barrier they have never tested before.

SMT.TO - that is what I will..

..look into going forward. Pretty tight for time these days. Please provide any other suggestions on recent transactions you can think of for comps.

There was the first majestic-silvercrest takeover in 2015 in silver place. US Silver-Scorpio merger to create Americas Silver & Recent Nevsun-Reservoir takeover (but doesn't really count as world class coppoer project).

Let me know if something springs to mind in silver or copper space I am missing.

Me might not know what SMT is worth until they start to produce Esparanza and really drill out the Esparanza zone and other zone's north of the limestone barrier they have never tested before.

I see DBEXF from seeking alpha but website doesn't list anything and company is listed in Toronto and Lima (only one of the mines - one of SMT's companies).

Can't imagine there is any volume even if there is a US symbol though..

SMT.TO - talked to Corp Dev..

..guy Mike Macallister. Will provide a more thourough update later but here is a quick summary.

- Formerly Dia Bras. Bought flagship Yauricochoa from rich Mexican Family who was not operating mine with long-term sustainability in mind. Family still owns about 10%.

- Apparently since 2011 they have been using jack-leg drilling (manual labour intensive drilling for development) instead of more efficient mechanized jumbo drilling. Should be some opex upside from planned transition. Mine still low cost even with this! (Peru Labour costs)

- Arias Resource Capital owns 51% in two funds. One of the funds has expired and has to liquidate within 2 years so plan is likely to put entire company up for sale in 2017. Have your attention? They won't sell without doing more drilling with the recent discovery of Esparanza zone.

- Although mine has operated for 60 years, it started up on a mountain and althought they are deep, there is a horizontal tunnel out to the processing plant at the 720 level so current mining is only 200m below that tunnel. There are water issues they are encountering as they go deeper though that required them to pre-drill water removal wells before development. See slide 11. Basically, not that deep from an opex perspective.

http://s2.q4cdn.com/485819848/files/doc_presentations/2016/SMT-Corp-Pres-April-2016.pdf

- The Esparanza zone is the most significant discovery in history of mine. They have alread extended a ramp into the zone and plan to start producing from here in Q3-2016. Mike mentioned 5% copper-equivalent but am confirming that number as it is a mix of copper-silver-gold-lead-zinc-silver. See slide 11 above as the ramp is apparently already extended to Esparanza. There is a limestone barrier they never drilled across before this is the reason it took so long to find. Could be large resource upside on the other side.

- this is PR for the Esparanza zone that will be brought into production in Q3.

http://www.sierrametals.com/investors/news-releases/press-release-details/2016/Sierra-Metals-discovers-a-significant-new-high-grade-zone-at-its-Yauricocha-mine-in-Peru/default.aspx

NXE.V - final winter drill results.

So many highlights here. All you need to remember is global average grade mined is 0.1%.

http://www.nexgenenergy.ca/i/pdf/news/NexGen-News-Release-May-5-2016-Assays.pdf

No idea but I'm in Toronto next week...

...where Sierra's head office is so I sent email to their Corp Dev guy to try to grab a coffee and get some intel.

NXE.V - not waiting around...

...Some trading algorithm moved NXE down to that $2.00 level I was talking about last week but market didn't budge and looks like institutions will need to buy in $2.20-2.30 range.

NexGen had CAD $34M in cash in $34M of working capital so are fully funded for 2016 exploration so the Canadian institutional investors who were waiting for correction off of runup off first resource announcement have to buy at these levels.

I'll stop posting on NXE if everyone wants as definitely not a microcap anymore LOL!

SMT.TO - buying more. Why not?

If we have a couple more weeks on this run SMT.TO has to higher eventually. Added more under $1.50 today and going in as a Pick 3 4 pick in a few hours do don't bid up if you join me....

...super illiquid and public float is <50% of shares with a majority controller but some traders will troll their chartlists this weekend for any Silver producers trailing the rally and hopefully focus in on SMT. SMT would probably be up over $3.00 by now if it was liquid and not a minority interest.

Reminder: check out my last post. Just hit best mineralized intercept in multi-decade history of flashhip Yauricocha mine.

SSKILLZ1 - can we pick ETFs?

Couldn't find anything on this on board for contest 1,2 or 3.

TIA