Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

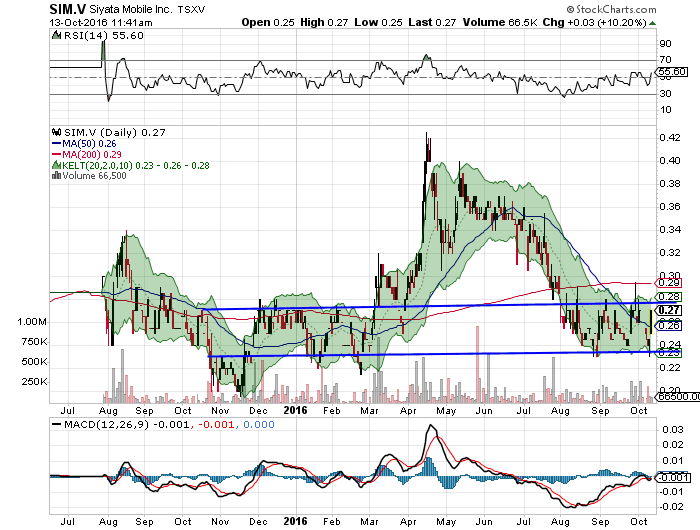

SIM.V - I bought for first time in morning. Thoughts...

...they spun this PR really well. Q2-16 had 2.0M of sales while Q2-15 had 2.8M of sales so Q2-16 could have been artificially low due to timing.

I note the following:

Revenue 9 months YTD 2016: 4.7M (Q2 FS) + 3.6M (press release) = 8.3M

Revenue 9 months YTD 2015: 7.2M

YoY Increase is $1.1M or 15%. Market wants to see higher growth than that. Combination of this and low Q2-16 is probably reason for retracement - and also opportunity for new buyers!

2015 revenues were $9.9M. Based on my above observations they are tracking for roughly $11.4M of 2016 revenues (15% growth). I don't think it is fair to annualize the record Q3-16 revenues.

Basic MC @ 0.27 is 18.7M (69.2M shares). FD MC is 24.7M (91.4M shares). I triple checked that this morning in SEDAR.

Current Price to Sales based on 2016 revenues then is 1.6X Basic and 2.1X Fully Diluted. Pretty Cheap.

If they show over $4M in revenues in Q4 then market should start thinking $16M annualized and potential for $20M in 2017 in which case we shouldn't see these low prices again.

Additional point - last Private Placement was at 0.35 from June and became free trading on October 11th but I doubt anyone from that will sell. You can buy below last PP, but they'll likely need additional funding in next 6 months. Working Capital was $5.5M at June 30, 2016 post-PP but that only included 950k cash.

All amounts above in $CAD eh!

HER.TO - local news article.

If you missed it, the mine GM was the former mine GM as this was a former producer. That is as good as it gets!

This is still a wait-for-the-equity portion of the project finance package story. Not going anywhere till that is announced.

http://www.canberratimes.com.au/act-news/woodlawn-funding-decisions-close-as-test-results-show-mine-could-grow-20160929-grrtn8.html

VTT.V - Two huge Directors added to Board.

Another zinc microcap. See the 321gold article one post-back if you didn't catch original story. Could be lowest capex-to-operations advanced zinc development story for anticipated 2016-2018 supply crunch shortage.

https://www.caesarsreport.com/blog/vendetta-mining-adds-two-high-flyers-to-its-board/

http://vendettaminingcorp.com/wp-content/uploads/2016/10/20161005_VTT_Board-Appointments_Final-1.pdf

CGE.V - Alamos PP to 19.99%

That is a great strategic SH to have. PP @ $.10 but market likes with 800k shares traded in first 20 minutes and up +.02 to $.15.

H Morgan and Co is Chester's private mining company per my earlier posts.

http://finance.yahoo.com/news/corex-announces-equity-financing-alamos-090000531.html

HER.TO - waiting on project financing.

Inital buy at $.16, has drifted down to $.13 while zinc has gone from $.90 to $1.05 close this week.

Heron not going anywhere until equity portion of project finance raise is complete - that is what is holding the share price down.

Heron is now a strong "watch and monitor" until the financing package comes through. When it is announced it could be a "back up the truck" story if Zinc breaks through $1.10 barrier in next two weeks as it is the next-best-pure-zinc-play story to Trevali on either the TSX or ASX as an emerging producer. Trevali went from mid 0.60s to $1.04 this week for me! Hope others also bought.

Offtake will be vital to project finance package of course. They way the market works is LSE pricing is typically paid so Heron should be able to maintain zinc leverage upside. Heron is a small part of the global market and should not impact Wood Mackenzie's forecast of Zinc going to $USD 3800 tonne in next two years on supply deficit crunch. This is roughly equivalent to $USD 1.90 vs. current pricing of $1.05 on LSE.

GPM.V + .10/40% - news leak?

..only 77,000 shares traded so who knows? Now back around mid $.30s where I originally bought. Assays in lab. IR said initial drill results to market in early November.

Best undrilled zinc target in the world in the land of lead-zinc giants with current drill program four decades in the making due to social barriers to drilling. Every other major outcropping gossan has been a mine. This is kind of like the Gurrero gold Belt for gold where every major intrustion-at-surface has been a mine (Tore, Cayden Resource, Goldcorp Los Filos,etc.)

It's gone down pretty close to 200 DMA. EOM.

CNE.TO - added FWIW

TSX down hard today from gold miner sell off but CNE basically flat and getting close to multi month consolidation triangle squeeze that I hope will break to upside. We may know by end of week and should be decisive either way.

Zinc - $1.10 is level to watch this week!

September correction to $1.00 looks like normal rally correction and zinc keeps going up now at $1.09 today! Just shy of $1.10 multi-year ceiling. Per below $1.10 number is one to watch as if zinc keeps going past there we're officially in a bull market and this is not just a mean reversion rally. Need to look back my notes but Wood Mackenzie (authority on zinc) is forecasting prices to peak at $1.80 to $1.90 in 2018 I believe. If we get a new Zinc ETF out of london hording or similar I'm sure someone will try what they can to push it higher.

Resource World Mag - $CAD 20/Year

This is a a downtown Vancouver-based publication that will cover to some extent all the Vancouver mining Juniors in a given year. Often this board identifies the good opportunities before the magazine (Brigus AISC decrease before Primero acquisition, RIC.TO Island Gold Deep, SAS turnaround) but I've found that in my early years of miners investing that this would validate an opinion already formed.

We can't see all the important news too so it has been valuable in identifying lots of other stories for me.

I'll bet money there is a feature on zinc next issue! Up at $1.09 now. Keeps going up!

Only $CAD 20/year for print + Digital version. I would recommend going for print version!

http://www.resourceworld.com/member4/signup.php

Resource World Mag - $CAD 20/Year

This is a a downtown Vancouver-based publication that will cover to some extent all the Vancouver mining Juniors in a given year. Often this board identifies the good opportunities before the magazine (Brigus AISC decrease before Primero acquisition, RIC.TO Island Gold Deep, SAS turnaround) but I've found that in my early years of miners investing that this would validate an opinion already formed.

We can't see all the important news too so it has been valuable in identifying lots of other stories for me.

I'll bet money there is a feature on zinc next issue! Up at $1.09 now. Keeps going up!

Only $CAD 20/year for print + Digital version. I would recommend going for print version!

http://www.resourceworld.com/member4/signup.php

DMI.V

This is a little diamond miner next to De Beers mine in South Africa, which is SA's largest producer. I flipped the 43-101 (inferred resources - very early stage) and the property is an alluvial deposit with thousands of years of erosion depositing sediment from higher up onto their 5km square property.

Digitech and/or Bobwins was into this very early and here are my notes from a presentation at the January Vancouver Resources Conference back from 2012 (found in an email). Missed out on run from 0.35 to 1.70 from 2011-2013. Stock has now drifted down since 2013. Haven't thought about it since 2012.

Went to their presentation with Bobwins. CEO was talking about potential 15 year mine life vs when they acquired it looked like 7 years @ 10,000 tonnes/month.

If I had a position I wouldn't sell, but you would have had to bought below $.60 to make this worth holding. The CEO talked about 10,000-15,000 carats/year which at $120 is $12-$18M in revenue. Assume margins are 50% and you are looking at $6M-$9M in cash flow vs. a $30M MC stock so quite expensive and they won't hit that run rate for 2 years.

No presentation, no webcasts I can find, no coverage so see what I can dig up. Peter paints a bullish story below but is talking his book.

Peter Imholf (very respected Canadian small cap fund manager - great history of top picks) put DMI on the map this week and that is reason for jump so just wait for it to come down.

http://www.bnn.ca/market-call/peter-imhof-top-picks~962204

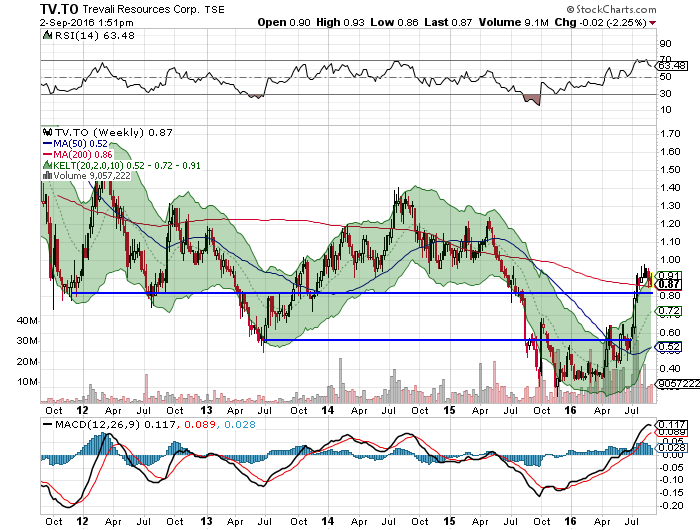

TV.TO - market saying best zinc play.

Zinc bounced of $1.00 or "100 points" as the old boys used to say and now at 1.065 as rally continues.

Trevali has gone from .65 to 1.07 since I bought. If you own keep an eye on upper support if you are trading around position.

Listened to Teck Metals presentaiton from Tuesday conference and they are super bullish on zinc and price move now is just the start. They are one of biggest producers so other option as Bobwins points out is to buy Teck Call Options.

CNE.TO - almost ready for next leg up?

I'm hoping so and added a bunch as time is running out with current consolidation. CNE will move up violently per past 2 years of experience here. Nothing smooth with CNE so you need to anticipate.

Perhaps current consolidation is simply CNE's "centre of gravity" pulling it along per the support I've outlined on 2 year chart at bottom.

My two cents with some more cents backing it up! Sure is quiet around here....

VTT.V - just put on map as zinc play

http://www.321gold.com/editorials/moriarty/moriarty092616.html

See slide 23 - they are in the district of giants where GPM.V is awaiting their first drill results.

http://vendettaminingcorp.com/wp-content/uploads/2016/09/20160831_VTT-Presentation_Q3.pdf

A Director of Vendetta is also a director of Corex Gold (CGE.V) and he mentioned VTT to me briefly before I really figured out the zinc supply issue.

This is a good alternative/diversification play to Heron resources (HER.ax/HER.TO) for an advanced exploration story - maybe even better as this company should be sold to one of neighboring mines.

ALG.V - Red Back 2.0?

This just popped onto my radar if anyone else is interested. Have some world class drill hits in vicinity of Kinross's Tasiast Mine (15M ounces) which will go down in history as the priciest buyout ever at 7B valuation for Red Back Mining (though Kinross did takeover with all shares). That was a side note. Huge discovery nonetheless.

CEO is founder of Semafo from the early days responsible for building the first mine so great management team.

There will be a Denver Precious Metals Summit webcast up from them soon for sure.

That's all for now!

http://algold.com/investors-presentation/

ALG.V - Red Back 2.0?

This just popped onto my radar if anyone else is interested. Have some world class drill hits in vicinity of Kinross's Tasiast Mine (15M ounces) which will go down in history as the priciest buyout ever at 7B valuation for Red Back Mining (though Kinross did takeover with all shares). That was a side note. Huge discovery nonetheless.

CEO is founder of Semafo from the early days responsible for building the first mine so great management team.

There will be a Denver Precious Metals Summit webcast up from them soon for sure.

That's all for now!

http://algold.com/investors-presentation/

Re: CGT.TO + CXB.TO

I should own both of these. I don't but should. Loaded oversold intermediate gold/silver producers this morning when gold up. Will rotate into these.

Both of these have earn-ins with Majors spending the money on exploration. This is the best kind of Junior to own if deposit looks more and more like a mine as you just wait for buy out.

Look at CXB.TO Calibre Mining if you haven't. Franco Nevada Founder Lassonde has a huge position and only $40M MC with earn ins by IAMGOLD, B2GOld and Centerra Gold.

There is no other junior out there with three earn ins like this I am aware of!

http://www.calibremining.com/s/Home.asp

I should really own. Denver Gold Forum presentations should be up this weekend so will put his on my list!

Zinc & Zinc Miners Update

Zinc sold off through most of September but appears to be a normal correction in current multi month rally. Line is my simply support line imposed on the LME price extracted from Kitco.

Trevali TV.TO corrected sideways, was off to the races a few days ago when market digested that the selloff apeared to be a normal correction, and jumped today on some great drilling news.

HER.TO/HER.AX Heron looks like a good buying opportunity as it is at $.13 now and I bought at $.15/.16. This is a development story and they have AUD 23M of cash and AUD 21M of WC so don't need to go to market any time soon so hoping stock moves up with Zinc price. This is the latest BS:

GPM.V Has had an absolutely wicked selloff after it's rally and is at $.26 vs. my $.38 entry price. Selloff just natural and the 'subscription warrants' (whatever they are they simply convert to one share) convert to shares today on the 21st, but I don't expect any more pressure as shareholders who financed GPM this year should hold to drill results. Contacted the company and they anticipate the first release of drilling results (5000m) in early November. First batch of core is at the assay lab now.

SIM.V Bob do you know who competition is?

Maybe one reason for sell off is market sees a competitor winning contracts in the US?

GPM.V - down with zinc....

...zinc walked down from $1.07 to $1.01 today but it looks like uptrend is still intact and this is just regular correction also bringing GPM.V down with it.

I missed this but Aussie explorer Rox announced a huge find (world class 12.7% Zn + Pb grades & 52MT underground) on June 1, 2016. just miles from McArthur River - formerly the world's largest zinc open pit shut down in 2015. Catch is the mineralization averages 750m below surface. Market has caught on and share price has since retraced the gains on the announcement as they see a mine....but maybe in 10-20 years!

http://www.roxresources.com.au/wp-content/uploads/2016/06/RRL1460D-IM_Final.pdf

GPM.V hoping for mineralization at surface but note they are exploring in the "avenue of the zinc giants" near where Rox made this discovery.

SIM.V/SIMFF - seems like the time to buy...

..been following Bob posting on this for a year. It's basically never been cheaper, the last PP was at $.34 with $.50 warrants for two years and now trading at $.24 which is support since if became liquid trading on the TSXV. All amounts below are in $CAD and reference TSXV pricing.

The share price and the revenue growth chart are inverse as of late so it just makes sense to take a position. In 2016 they are tracking roughly for $10M of revenue again based on Q2 results, so flat year-over-year. I am not sure if the bump to $14M in the bottom pic below from their presentation is due the string of recent sales results resulting in strong Q3/Q4 sales or it is a $4M bump from the recent Signifi acquisition they just closed. They didn't pay a lot for Signifi ($350k cash over 2 years, 4.5M shares over 3 years) so I am hoping it is the former in which case Siyata should go higher when results out!

They hit $4.7M sales in the first 6 months so in order to hit $14M for the year they need to average $4.5M/quarter for Q3/Q4 or $9M for H2-16, a double and a higher share price...

If they hat a $14M/year run rate then they are trading at 0.6X sales as current market cap is $9M.

HUM.L - also HUMRF on OTCBB

Volume is actually better on the OTC rather than AIM! 200k/day average vs. 95k/day on AIM.

Since most European and N.A. Investors look to TSX/TSXV for exposure to PM Miners Hummingbird has been floating in the background. Found interview before and Hummingbird was not on a lot of investors radar before August IMO.

Interview here. The CEO discussed 1) They have a number of term sheets for US 30-35M in debt financing needed to fund all capex. Non-dilutive and should be announced in a couplge months 2)the Gonka (slide 13 in presentation if you link back to my last post) site 5km from plant and should grow significantly and have 4-5 g/t u/g material and add 30k ounces/year for 6 years to production now, but this will grow significantly with drilling. 3) They bought from Gold Fields for $20M in stock and Gold Fields sunk over $100M in drilling into the project. Nice deal near bottom of market.

http://www.kereport.com/2016/08/02/exclusive-hummingbird-resources/

There are actually some pretty good posts discussing development stage west african gold juniors on this channel where I found the interview:

https://ceo.ca/HUM.L

HUM.L - also HUMRF on OTCBB

Volume is actually better on the OTC rather than AIM! 200k/day average vs. 95k/day on AIM.

Since most European and N.A. Investors look to TSX/TSXV for exposure to PM Miners Hummingbird has been floating in the background. Found interview before and Hummingbird was not on a lot of investors radar before August IMO.

Interview here. The CEO discussed 1) They have a number of term sheets for US 30-35M in debt financing needed to fund all capex. Non-dilutive and should be announced in a couplge months 2)the Gonka (slide 13 in presentation if you link back to my last post) site 5km from plant and should grow significantly and have 4-5 g/t u/g material and add 30k ounces/year for 6 years to production now, but this will grow significantly with drilling. 3) They bought from Gold Fields for $20M in stock and Gold Fields sunk over $100M in drilling into the project. Nice deal near bottom of market.

http://www.kereport.com/2016/08/02/exclusive-hummingbird-resources/

There are actually some pretty good posts discussing development stage west african gold juniors on this channel where I found the interview:

https://ceo.ca/HUM.L

HUM.L - see page 27 of presentation...

...for west africa gold producer comps. Just got my interactive brokers account up and funded so can buy AIM stocks. Going to buy sunday night (London morning) as technical set-up on HUM great and should have great upside from here. Should open up strongly then IMO.

http://www.hummingbirdresources.co.uk/_downloads/Hummingbird_Investors_Presentation_Q3_2016_4.pdf

Reminder: Zinc keeps going up...

...now at 1.07. I am holding Trevali (TV.TO), Heron (HER.TO or HER.ax) and finally, GPM.V as my initial drilling results sweepstakes play.

This is the best page to monitor pricing and view the context of the rally since January (0.70 to 1.07).

http://www.kitcometals.com/charts/zinc_historical_large.html

I also have some silver bull (SVB.TO/SVBL) but this was more of a play on buying a silver project that hadn't rallied at all at the time but they have a lot of zinc as a sweetener so am definitely still holding.

Trevali should still be the go-to-name as the only producing zinc pure play name around. They need higher prices so think the stock could walk down to the $.80 range where there is multi-year support per below.

USA.TO...

...just back from vacation but think that is a good idea! Should have a lot more upside if gold/silver bull continues as has barely budged to date!

GPM.V - looked into this.

They had 61.5M shares @ Mar 31. They didn't issue shares + warrants as is typical but issued 28.3M 'special warrants" @ 0.15. The special warrants automatically convert to common shares on September 21, 2015 without any further action or funds required.

So FD share count is 89.8 for $CAD 36M MC.

Hopefully we'll get a PR in early december with 'initial observations on drilling results' before we get assays and this will alleviate any of these warrant holders selling after September 21.

http://www.gpmmetals.ca/node/60

GPM.V - securities filings trump...

...the website. In this case this is a good finding only 3M warrants as that means current retracement is just healthy selling after a big run and we shouldn't expect any big downward pressure from selling to fund warrant exercise.

GPM.V - reminder and I see only 3M warrants?

@CPTMATT - Both Dec 31 and Mar 31 FS have only 3M warrants @ 0.28 outstanding. Not sure where you got 28.3M?

This is from an email I just wrote to friend:

Zinc price keeps going up. GPM drill target is 40 years in the making as they couldn’t drill for decades due to aboriginal land claims but is apparently one of most obvious low-hanging fruit targets in the lead-zinc district of Giants (closed Century Mine,MacArthur River and Mount Isa nearby – 3 of world’s largest). Every other major outcropping Gossan has been a mine in Northern Territory. See page 7 of presentation. I’m in around $.40 with ‘intelligent speculation’, not gambling $. Nice retracement of recent rally to $.50. Announced drill program start today. Lead-at-surface is a good indicator of zinc below. Century for example didn’t have zinc-at-surface. They are drilling a lead-at-surface anomaly – the low hanging fruit.

$24M market cap.

Multi-bagger if they hit. 10 bagger long term if they find a 100MT lead-zinc resource (Say takeout at $350M market cap after equity dilution along the way). Don’t think drill program will be a total fail so I think loss potential small too.

http://www.kitcometals.com/charts/zinc_historical_large.html

http://finance.yahoo.com/news/gpm-metals-announces-commencement-drill-120945529.html

http://www.gpmmetals.ca/sites/default/files/GPM_July2016_02.pdf

SMT.TO - reminder. Late comer to Silver Rally...

...SMT gets about 30% of revenues from silver. Traded like a silver stock in 2011. I have been holding as it broke it's powerful downtrend line from 2011 top and then traced out a consolidation triangle even though this stock is super thinly traded. They are going to start mining their Esparanza zine which has highest grades discovered in 70 year mine life - yep, Yariococha has been operating for 70 years. Think I am going to add more here as looks like now it will go up....Just makes sense as a trailing operating silver-equivalent play.

RE: TGZ.TO...

...haven't looked closely in a year. They're only up a 100%/year which is below sector average so could be good one to look at. Anyone have an update?

GPM.V and Zinc...

...ummm Zinc has been on a tear and keeps going higher currently at 1.02 up from 0.97 at start of the month. Keep this page on your watchlist. TV.TO is up +.07 today and is now up 30% since I pointed out it was breaking past major resistance last week.

http://www.kitcometals.com/charts/zinc_historical_large.html

Spent a few hours looking around during work downtime. GPM's target will not be another Century Mine, as Century was not an outcropping Gossan but was a Sedex deposit discovered through years of careful, regemented exploration I do not understand (highh level outcome of my research). LEAD AT SURFACE IN A GOSSAN in the Northern Territory is a key marker of a lead-zinc deposit at depth. See extract from exlopration book extract I found as most relevant hit on google search. The geologist leading the exploration for GPM did his thesis on MacArthur River to that is a good sign.

Also - I bought HER.V today. More speculative than GPM but they have AUD $25M in cash so no need to finance in near term and can hopefully just sit and attract interest as people start thinking about zinc pure-play alternatives to Trevalis as speculative juices start to froth in zinc market.

PRU.TO - if long see slide 13

AUD $100M of new equity capital raised so all this money knows this but costs peak in October 2016 but would expect low to be put in place a few months before this but I don't expect any major selloff, but supports a correction. PRU just likely to be flat the next couple months so I am going to lighten up a bit temporarily and try to add-back near bottom of channel. Traded a bit today for CNE.TO if you look over on Junior energy board.

The cost for the new equity was AUD 0.50/share. AUD and TSX ($CAD) share price basically the same for twin-commodity currencies.

I think there is a risk then that PRU.TO could drift down to 0.50 over the next month which is also bottom of uptrend channel below.

This is a new presentation.

http://www.perseusmining.com.au/aurora/assets/user_content/01756426.pdf

WAF.V/WAF.AX - bought on maybe Roxgold 2.0

Been watching WAF.V and pulled the trigger today on news. WAF.V is in Burkina Faso, has a $CAD 85M MC, just raised AUD 12.5M, and is hitting ultra-high grade gold ore shoots at depth. They announced 18m @ 82.3 g/t today at 100m depth which could be near bottom of an M5 open pit. Current price is AUD 0.24 and Hartleys has a very speculative NAV14% target of AUD 0.48 at spot gold. When project is derisked that may be AUD 0.80 target at NAV5% (lower discount rate)

http://www.westafricanresources.com/wp-content/uploads/2016/07/01757971.pdf

Idea here is there is:

1) at least a 500k oz heap-leach project on M5 prospect

2) In a few months market will see a combined M1 (low grade oxide) M5 (high grade shoots) open pit scenario with a 10 year mine life per Hartleys analyst report below

3) Blue sky is that WAF.V develops in Roxgold 2.0 and the current success on deep exploration at M5 delineates an ultra-high grade underground

Here are some highlights from the Hartley's report (only anayst report out - Australian firm).

WEST AFRICAN RESOURCES LTD (WAF)

Site visit confirms a first class discovery at Tanlouka

West African Resources (WAF) continues to discover significant high grade

mineralisation at the M1 prospect, Tanlouka project in Burkina Faso. The

high grades now have strong continuity over ~300m of strike at M1 South and another ~300m of strike at M1 North. The M1 South prospect is faulted and offset with discrete zones of ~80-100m strike length, while the M1 North body is interpreted as one continuous body. We believe the M1 prospect (North & South) is likely to be a high grade open pit mine transitioning into a high grade underground mine at depth.

One of the best we’ve seen in West Africa for some time

The M1 discovery is one of the best high grade discoveries in West Africa for some time and is testament to the persistence and expertise of the WAF exploration team. Our recent site visit to Tanlouka confirmed WAF as one of the better West African gold explorer/developers around. The combination of strong management and a first class discovery should continue to drive further share price appreciation in the near term.

Our initial estimates suggest the M1 discovery has potential to grow into a high grade (~2-3g/t Au) open pit mine transitioning into a high grade (~5-10g/t Au) underground mine. The M1 prospect will most likely be blended with the lower grade (~1.5g/t Au) M5 deposit which should provide the bulk of the tonnes to a CIL processing plant. We see potential for a blended head grade of ~2.0-2.5g/t Au at low strip ratios (currently ~2:1 LOM strip ratio at M5).

What does the combined M1 & M5 mining scenario look like?

We now model a (pre-study) mining scenario which combines the existing M5

deposit (23.6Mt @ 1.7g/t Au for ~1.3Moz, 1g/t lower cut) with the M1 high

grade discovery. Our initial estimates suggest the M1 discovery combined

with the M5 deposit is likely to justify a CIL processing plant in the order of ~2.5Mtpa. The bulk of the tonnes (up to ~2.0Mtpa) could come from the M5 deposit and the M1 discovery should deliver the high grade “sweetener”. We see potential for the combined (M1 & M5) mining scenario to produce in the order of ~150-170kozpa at low operating costs (<US$700/oz).

We now model (pre-study) the Tanlouka project to generate ~160kozpa at

AISC of ~US$660/oz over a minelife of 8 years from FY18 onwards. This

assumption is based on M1 (North & South) delivering an initial open pit

followed by an underground mining scenario. These assumptions will require further exploration and infill drilling success at M1 (North & South).

High grade at M1 distinguishes from peers, maintain Spec Buy

In our opinion the discovery of high grade mineralisation at M1 distinguishes the Tanlouka project from West African gold developer peers. We see a strong likelihood of further high grade mineralisation at M1 (North & South) and see potential for further parallel mineralisation to be discovered. We like the prospects to the north (of M1 North) and towards the Laterite Hill. The Company will now continue drilling to define the extent of the M1 discovery and gain a better understanding of the scale and potential of the high grade mineralisation. We look forward to further strong newsflow as the drilling program ramps-up and explores the full extent of the M1 discovery.

We maintain our Speculative Buy recommendation and a price target of

40cps, NAV of 36c, spot NAV of 48c

Target summary. NAV is at $USD 1200 long term gold.

Claude Cormier..

...looks like he has stopped Ormetal for good. Health reasons I would assume. Anyone who has used his letter for years can reccomend an alternative you liked in the last gold bull? Got the free subscription to Speculative Investor but not very impressed at first glance.

2 more Zinc Miner Stories.

Heron and GPM Metals Ignore AZ.TO - too expensive and resource hella deep.

https://ceo.ca/@kipkeen/3-zinc-plays-with-nearterm-catalysts

HER.V/HRR.AX - AUD $28M in cash (Mar 31), CAD $58M MC.

Looked briefly per Lone Clone's suggestion.

Feasibility in place with AUD $163M in funding to production for underground mine with NPV of AUD 207M ($1.00 Zn, $3.00 Cu LT pricing).

Could probably finance 50:50 with debt equity but that would still require another AUD $50M in equity which at would dilute current equity owners down to a 58% interest at current share prices.

GPM.V

I've watched GPM.V become a two bagger the last couple months while knowing of the story. They are drilling now and blue-sky potential is that this is the next MacArthur River lead-zinc open pit. If you look at their presentation the Northern Territory Mineral board also mentions the Walker Gossan as analogous to MacArthur River. Did some sleuthing and MacArthur River was discovered from the high lead values in the outcropping Gossan (weathered oxides) - exactly what GPM.V has in it's surface sampling (see their presentation). Zinc at surface not necessarily an indication of zinc in the lower sulphides. Walker Gossan will not be another Century Mine (nearby and was world's largest Zinc mine but closed in 2014) as apparently mineralization there a bit different. Up 200%+ but still only $C 35M market cap and could be zinc exploration story of H2-2016. AZ.TO taylor deposit is 1500-2500 feet in depth - this does not justify a $C 403M MC.