Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

IOTX altcoin actually will l run up in a blink to $2 like PRO propy did.. stay tuned..

Great news!! We win!!

SUKU altcoin on Top #1 list for $1+ run up. Stay tuned..it's one of the last low Tokens on CB that is making the move up to higher priced tokens, great news!!

Nice entry the run is starting now!! To $5

Next altcoin runner SHIB news out!!!

To rise exponentially to Pennyland!!

We rich!

Next runner C98 altcoin #1trending on explodes to $1+

The Crypto projects C98 To $3 near term

Back to prepandemic levels...

FOMO and MOASSSSSSSSS sends it.

Boooom!!

DIA altcoin #1trending on explodes to $1+

The Crypto projects DIA to $5 near term

Boooom!!

CRCW Penny crypto tech stock currently at .002 ! $$$ 52 week high 27 cents !!!

FOX altcoin worth $1+ Most Trending Crypto Coins on Uniswap – ShapeShift FOX

ShapeShift FOX Token (FOX)

The ShapeShift FOX Token has shown promising performance. It recorded 14 out of 30 (47%) green days over the last month, with a 9.29% price volatility. However, this volatility suggests fluctuations in price, potentially offering opportunities for traders.

ASM altcoin get in now b4 $1!!!!!

Over .13 explodes exponentially to $1+

It's up over 800% for the year!!!!!

Sooon + 3000%

Do a 5yr chart!!

QUICK!!!!!

ASM surges to .15 tonight!. On list for cryptocurrencies under .20 that will Explode to $2. Word is out! Been saying it..

Glta!!

ASM is on FIIIIIIIIIIIIIIIRE to a Dooooooollar!!

Nothing is stopping her!!! PSar Comfirms run up with bbands, 5YR ATH...dictating $1+ soon and FOMO well... would you want to miss out????

We rich!!!

ASM altcoin been on FIRE since Aug 2023

Do the 1YR Chart!

ASM altcoin to $2+ OMG on list of potential coins priced under 0.2 with a potential of 3000% run up!!

Over 068 runs to $2 ish...

Yeah looks like it just passed the 1yr chart is history ....Check it out!!

Major Breakout!!!!

congrats!!!

To Dollar land!!!!

LCX altcoin to $4+ OMG on list of potential coins priced under 0.2 with a potential of 3000% run up!!

Major Breakout!!!! Just like UMA !!!!!!

We rich!!

With first regulated crypto exchange in Europe with this etf interesting. LCX can play a big roll in tokenization of assets in the future. WEF Davos right next to coinbase $BTC.X $ETH.X

Next up C98 Runs to $1 + on latest STRONG BUY TOP 5 Crypto for 2024 to be in... news out!!!

The Crypto teams expects C98 to

Move to a $5 valuation near term due to recent developments.

Congrats!!

ASM altcoin Over .10 in a few min then on strong buy RADAR to $1 Today! Prepandemic to $5!!!!!

Just.past 1hr high!!!!+ Boom

Congrats #1

Top Altcoins to Buy January 7: SOL, SEI, GMT

Top Altcoin: Top altcoins SOL, SEI, and GMT, hold the potential for a strong bounce if the US SEC approves Spot Bitcoin ETF next week

Top Altcoin: On Sunday, the crypto market has been trading the majority as all eyes are set on the potential approval of Spot bitcoin ETFs. This could be a calm-before-the-storm situation as either result of this topic would like to trigger a massive move on the respective side.

As the general market sentiment remains in a state of flux, certain altcoins such as Solana(SOL, SIE, GMT offer new entry opportunities to go long.

Yeah, it’s basically done.

GMT said to go to $5+ don't wait!!!!

Enjoy!!

Great news!!! WE ARE RICH•°°°

Next up is JASMY altcoin.... Strong Buy ALERT.......02 to 05 coming up!!!!!! FOMO...macd pSar sends it.. THEN TO $1 pre PANDEMIC !

Yes!!!!!!! T O D A Y !!

HUGE WHALE VOLUME!!

COVAL altcoin Back to $0.093 just out!!!!!

The Crypto Team has got a watch alert out for the COVAL token rise to $0.093 near term. The token has passed the 1yr ATH and its on its way back to $1 on latest developments.

FOMO will help lead the way up.

Congrats!!!

MINA altcoin Got a $5 upgrade!!!!!!+ up we go $1 in a few min..

Then KABOOOOOM!!!

All techs macd.. pSar now bbands $5

FOMO n MOASSSSSSSSS..Asian waking up!!

CONGRATS!!!

ACH NEWS!!

Russia Looking To Legalize Crypto Payments in International Trade, According to Deputy Finance Minister: Report

ACH Alchemy Pay, to surge to $1!!

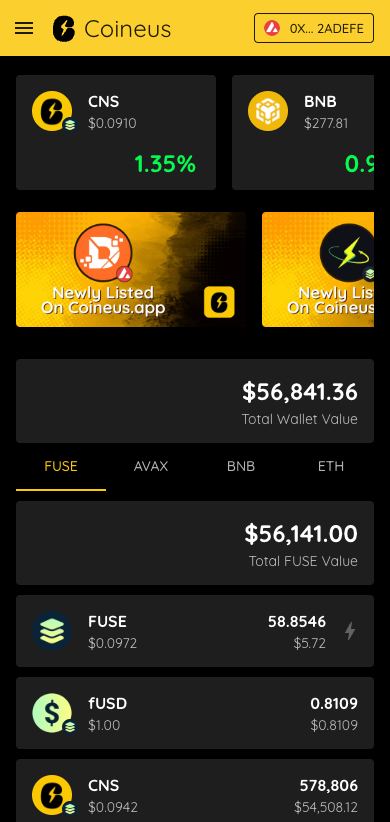

COINEUS is making serious progress and big moves on Fuse Network!

Divvy token (SmartDeFi) has only recently relaunched as Coineus on Fuse Network. The progress made in only 8 weeks since launch on July 16th is truly remarkable.

One needs to consider that Coineus is building utilities that makes it easier for Fuse Network participants (project leaders, traders and holders) to track their wallet/project balances, monitor stats, claim rewards, stake Fuse (CNS is a Fuse validator!), stake CNS (through CNS One) and since recently even bridge BNB to Fuse.

Fuse Network is an EMV compatible blockchain and from our experience navigating through it, there seems to be a lack of projects with a similar focus which is basically to make the lives of project leaders and investors so much easier by handing them a one-stop-shop on Fuse Network for everyday project monitoring and token management.

We can see Coineus developing in a launchpad on Fuse Network in order for new projects to develop their token contract, hold their private sale and to set-up lockers etc. on Fuse Network. And with the speed Coineus is developing now... it could very well be expected sooner than later!

Coineus app - 8 weeks of progress in one picture

Check live app here: Coineus app

Business model & Mcap:

There are multiple ways Coineus is generating income and volume. App users need to hold 100 CNS to enable and experience all of the app features. Projects can list their tokens by paying 1000 CNS. Fuse holders can stake their Fuse with Coineus. Coineus receives validator/staking rewards that will benefit the project. As the utilities develop further, many more ways to generate income and volume will follow.

Coineus is currently still under 200k mcap and it seems investors just can't keep up with the speed in development. We think Coineus is already highly undervalued considering the progress made in only 8 weeks time. Consider where the project would be after 8 months. Development is the key focus now with little marketing going

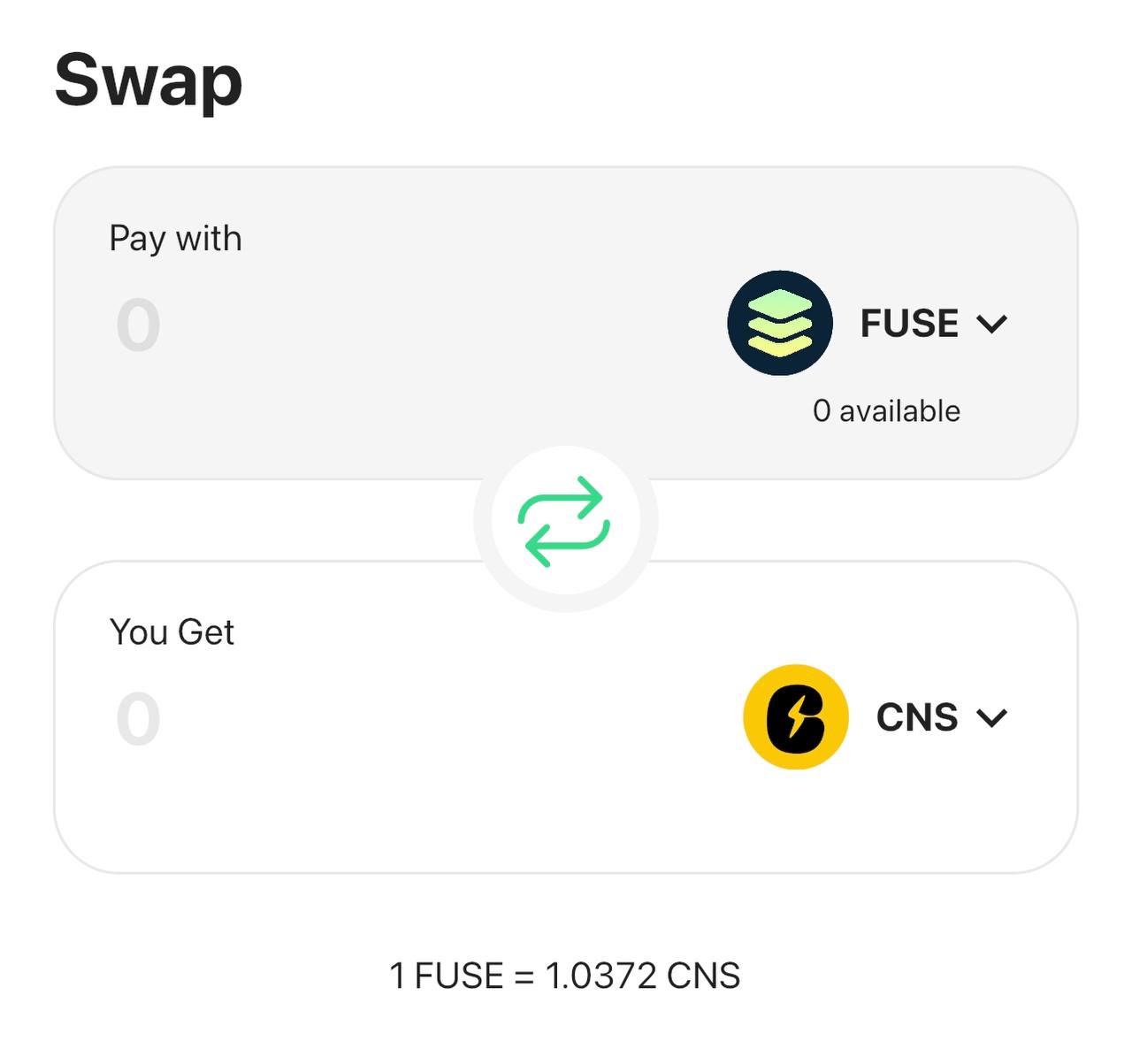

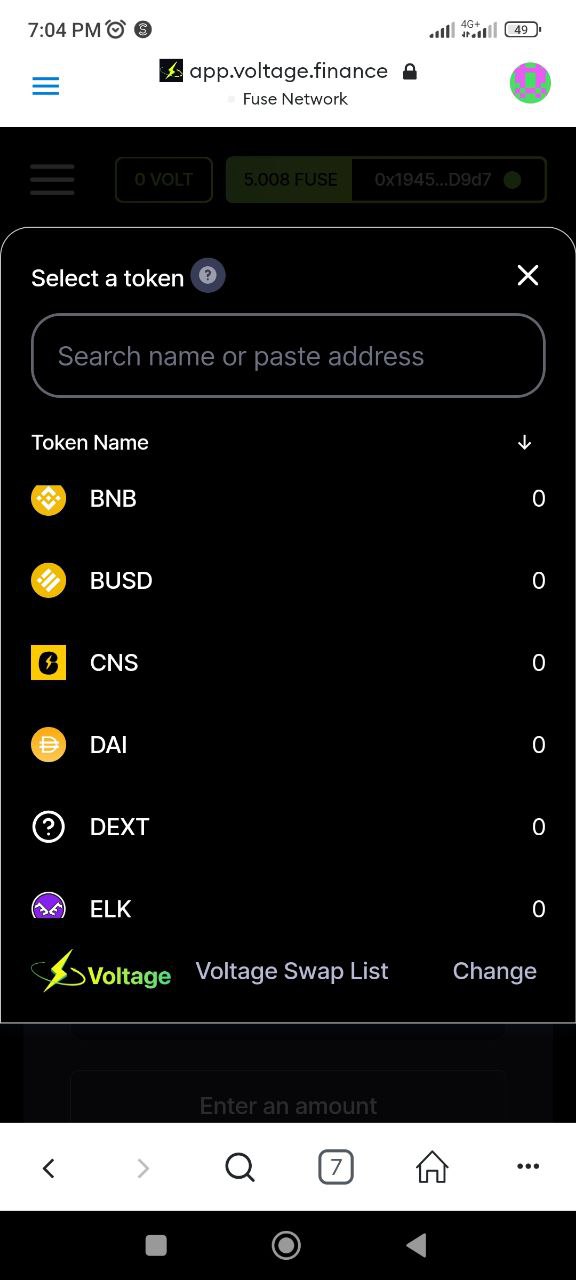

The progress made by Coineus on Fuse Network - with great support of their loyal community - is being noticed by Fuse Network itself and by Voltage Finance, the leading Dex on Fuse Network, which resulted in official verifications and listings on their platforms.

Coineus is now officially verified and listed on Fuse Cash app (= Default Swap Listing and FIAT GATEWAY!)

Coineus is now officially verified and listed on Voltage Finance:

Buy Coineus here: Voltage Finance app

Contract: Coineus token contract

Chart: Coineus chart

Learn more about: Coineus on Telegram

Follow: Coineus on Twitter

----

RBL is a small crypto investment fund and has a long-term holder position in Coineus. This is not financial advice or advice to buy any cryptocurrency. Always do your own research.

----

If you ever missed out on Red Bull, Monster... read this!

The global energy drinks market was valued at $45.80 billion in 2020, and is projected to reach $108.40 billion by 2031, growing at a CAGR of 8.2% from 2022 to 2031. [source]

Cryptoblast. Taste, hold, earn!

Cryptoblast is a crypto backed energy drink and perhaps the first crypto project to launch a tangible product through Amazon which includes Amazon brand registry (brand recognition & awareness!). Cryptoblast is a registered company, trade marked and a distribution deal to deliver their cans to retail shops across North America and Canada is already signed. Cryptoblast will soon be in stores and vending machines right there next to.... Red Bull and Monster!

While the distribution to retail is their next tangible product milestone, Metaverse deals are in the making for their online product. Online Meta players can purchase Cryptoblast energy boosters for their avatar. Like a digital energy drink. Can you see how reality and virtual reality merge into one and how human & avatar share the same energy boosting experience while paying money for both products?

Cryptoblast [CBT] holders receive 8% ADA rewards and a stunning 30% of net company profits.

Will the younger generations make Cryptoblast go viral once they start discovering? I mean... a crypto backed energy drink! Rewards for token holders, Metaverse, NFT collecting, cool merchandise... Cryptoblast has it all!

August was a great month for Cryptoblast! +68% +live on Amazon See monthly chart below.

One can buy Cryptoblast (CBT) directly via the buy widget through their official website.

See Screenshot below.

Telegram: https://t.me/CRYPTO_BLAST_TOKEN

Contract: https://bscscan.com/token/0x0853eabe53157d911e0137a9ef987874289ae9d0

Chart: https://www.dextools.io/app/bnb/pair-explorer/0x4396491ba7e7f2fe2813ce03da7cbdd4bea6ea23

RBL is a crypto investment fund and has accumulated a 2% + 0.5% long-term holder position in Cryptoblast. This is not financial advice or advice to buy any cryptocurrency. Always do your own research.

----

$APDL Solid play for next month

https://finance.yahoo.com/news/marathon-digital-holdings-secures-hosting-200500740.html

More Blockchain mining capacity coming online in August from multiple projects!

News out with MDT acquisition to sail to $1+

Congrats!!

The latest report confirms that Chain, the blockchain infrastructure solution company, has successfully acquired the Measurable Data Token and its ecosystem products in a payment deal value of over $100 million.

SYN coin ready to surge like BOND did..

To $5 now in play!! It's a lock!!

Do your DD , macd pSar technical with FOMO

Sends..SYN to $5+..

Great news!!

I'm not making this up.. I gave u BOND now at $8!!

I now give u SYN ...same surge up!!

BOND this one reiterated for new listing to $10+

Congrats!!

BOPO Blockchain technologies great listen...Fast forward to when Troy from HYFI speaks times below. Really explains all about HyFi Platform, ILOs, & rollout. Link below here are the times to listen on the video. BOPO has not launched yet....awaiting symbol change from Finra...but ready to go with exchange.

51:00 20 sec

1:20 30 sec

1:29 10 sec.

1:38. 50 sec

1:46 22 sec

$BOPO So this is why Im so high on this co & why its my #1 Accumulation-Fast forward to when Troy from HYFI speaks times below. Really explains all about HyFi Platform, ILOs, & rollout.

— stockrocket1 (@StockRocket1) December 8, 2021

54:00 20 sec

1:20 30 sec

1:29 10 sec.

1:38. 50 sec

1:46 22 sec https://t.co/SDg9AMl4qD

$BOPO CEO: "I've had face to face discussion with some of the largest fossil fuels producers in the world"

— Bautista Garcia Centurion (@Bautigcenturion) December 14, 2021

Companies with billions of dollars coming to list on HYFI Platform 👀👀

FULL PRESENTATION:https://t.co/tdCS7CFoQX pic.twitter.com/nT7iQaHkeX

$BOPO .42 IS MY #1 HOLDING ALONG WITH $CFVI $CFVIW...DO SOME DD, READ MY POSTS...MY PERSONAL TARGET $7+ THEN NASDAQ AS PER COMPANY FILINGS...1 OF A KIND STOCK...LATER GUYS WORK. https://t.co/Nmu4At9Ckn

— stockrocket1 (@StockRocket1) February 10, 2022

$BOPO is going a record setter. Do a search-there are few people that are holding shares of the small float. Go look what happened on when WPP spun off BOPO & made it HyFi Platform.PPS went from .05 to .70 in literally minutes. SUPPLY & DEMAND-I have 0 DOUBTS My Target of $7+. https://t.co/TXqTBUpNLx

— stockrocket1 (@StockRocket1) February 12, 2022

$BOPO .45 DOLLARLAND soon!Many material events TBA! Fractionalized ownership in Metaverse🔴 Environmental🟢Energy🟦Tech🟪Med🔷Logistic co.s on HYFI exchange-The future of co ownership w/o getting killed w/dilution & toxic debt! NFTs are revenue generating. https://t.co/yRwbLoCZL6 pic.twitter.com/gx3jx6hIUc

— stockrocket1 (@StockRocket1) February 11, 2022

$BOPO I strongly feel is a 1 of kind stock offering some of the biggest commodities on the planet.* See pics. To get listed on HYFI Exchange companies are heavily vetted & have to give up ownership in 1 of several types of NFTS. NO SCAMS, DILUTION, NOTES to hurt your investment. pic.twitter.com/DSIhTLrVtB

— stockrocket1 (@StockRocket1) February 11, 2022

$BOPO....more dd for you. Going to many dollars like I predicted $ALPP, $NXMH, and $MTRT would. pic.twitter.com/ul9jwpguUU

— stockrocket1 (@StockRocket1) February 11, 2022

$BOPO .42 IS MY #1 HOLDING ALONG WITH $CFVI $CFVIW...DO SOME DD, READ MY POSTS...MY PERSONAL TARGET $7+ THEN NASDAQ AS PER COMPANY FILINGS...1 OF A KIND STOCK...LATER GUYS WORK. https://t.co/Nmu4At9Ckn

— stockrocket1 (@StockRocket1) February 10, 2022

$BOPO .43 fueling up to do a $MTRT... I called that one at .17. $BOPO will have a similar low float parabolic move...Many material events including launch of HYFI Exchanged and symbol change.* see my many dd posts and do some of your own. https://t.co/8dboHtfWcs

— stockrocket1 (@StockRocket1) February 11, 2022

$BOPO I strongly feel is a 1 of kind stock offering some of the biggest commodities on the planet.* See pics. To get listed on HYFI Exchange companies are heavily vetted & have to give up ownership in 1 of several types of NFTS. NO SCAMS, DILUTION, NOTES to hurt your investment. pic.twitter.com/DSIhTLrVtB

— stockrocket1 (@StockRocket1) February 11, 2022

$BOPO .42 IS MY #1 HOLDING ALONG WITH $CFVI $CFVIW...DO SOME DD, READ MY POSTS...MY PERSONAL TARGET $7+ THEN NASDAQ AS PER COMPANY FILINGS...1 OF A KIND STOCK...LATER GUYS WORK. https://t.co/Nmu4At9Ckn

— stockrocket1 (@StockRocket1) February 10, 2022

$BOPO PAY ATTENTION #1 STOCK FOR 2022. SOME OF THESE ARE BILLION $ COMPANIES...NOTICE HYFI on TOP of lasts picture...They are the parent co...These companies will be taking their projects to HyFi Platform as per yesterday interview disclosing partners. $CFVI $DWAC $ALPP $JPEX pic.twitter.com/PiyvphZGuO

— stockrocket1 (@StockRocket1) December 30, 2021

DD BOPO DD compilation--->1 of the biggest BLOCKCHAIN/NFT projects on OTC--->

https://www.otcmarkets.com/stock/BOPO/security

http://hyfi-corp.com

https://hyfi.exchange

$BOPO So this is why Im so high on this co & why its my #1 Accumulation-Fast forward to when Troy from HYFI speaks times below. Really explains all about HyFi Platform, ILOs, & rollout.

— stockrocket1 (@StockRocket1) December 8, 2021

54:00 20 sec

1:20 30 sec

1:29 10 sec.

1:38. 50 sec

1:46 22 sec https://t.co/SDg9AMl4qD

$BOPO CEO: "I've had face to face discussion with some of the largest fossil fuels producers in the world"

— Bautista Garcia Centurion (@Bautigcenturion) December 14, 2021

Companies with billions of dollars coming to list on HYFI Platform 👀👀

FULL PRESENTATION:https://t.co/tdCS7CFoQX pic.twitter.com/nT7iQaHkeX

$BOPO .42 IS MY #1 HOLDING ALONG WITH $CFVI $CFVIW...DO SOME DD, READ MY POSTS...MY PERSONAL TARGET $7+ THEN NASDAQ AS PER COMPANY FILINGS...1 OF A KIND STOCK...LATER GUYS WORK. https://t.co/Nmu4At9Ckn

— stockrocket1 (@StockRocket1) February 10, 2022

$BOPO is going a record setter. Do a search-there are few people that are holding shares of the small float. Go look what happened on when WPP spun off BOPO & made it HyFi Platform.PPS went from .05 to .70 in literally minutes. SUPPLY & DEMAND-I have 0 DOUBTS My Target of $7+. https://t.co/TXqTBUpNLx

— stockrocket1 (@StockRocket1) February 12, 2022

$BOPO .45 DOLLARLAND soon!Many material events TBA! Fractionalized ownership in Metaverse🔴 Environmental🟢Energy🟦Tech🟪Med🔷Logistic co.s on HYFI exchange-The future of co ownership w/o getting killed w/dilution & toxic debt! NFTs are revenue generating. https://t.co/yRwbLoCZL6 pic.twitter.com/gx3jx6hIUc

— stockrocket1 (@StockRocket1) February 11, 2022

$BOPO I strongly feel is a 1 of kind stock offering some of the biggest commodities on the planet.* See pics. To get listed on HYFI Exchange companies are heavily vetted & have to give up ownership in 1 of several types of NFTS. NO SCAMS, DILUTION, NOTES to hurt your investment. pic.twitter.com/DSIhTLrVtB

— stockrocket1 (@StockRocket1) February 11, 2022

$BOPO....more dd for you. Going to many dollars like I predicted $ALPP, $NXMH, and $MTRT would. pic.twitter.com/ul9jwpguUU

— stockrocket1 (@StockRocket1) February 11, 2022

$BOPO .42 IS MY #1 HOLDING ALONG WITH $CFVI $CFVIW...DO SOME DD, READ MY POSTS...MY PERSONAL TARGET $7+ THEN NASDAQ AS PER COMPANY FILINGS...1 OF A KIND STOCK...LATER GUYS WORK. https://t.co/Nmu4At9Ckn

— stockrocket1 (@StockRocket1) February 10, 2022

$BOPO .43 fueling up to do a $MTRT... I called that one at .17. $BOPO will have a similar low float parabolic move...Many material events including launch of HYFI Exchanged and symbol change.* see my many dd posts and do some of your own. https://t.co/8dboHtfWcs

— stockrocket1 (@StockRocket1) February 11, 2022

$BOPO I strongly feel is a 1 of kind stock offering some of the biggest commodities on the planet.* See pics. To get listed on HYFI Exchange companies are heavily vetted & have to give up ownership in 1 of several types of NFTS. NO SCAMS, DILUTION, NOTES to hurt your investment. pic.twitter.com/DSIhTLrVtB

— stockrocket1 (@StockRocket1) February 11, 2022

$BOPO .42 IS MY #1 HOLDING ALONG WITH $CFVI $CFVIW...DO SOME DD, READ MY POSTS...MY PERSONAL TARGET $7+ THEN NASDAQ AS PER COMPANY FILINGS...1 OF A KIND STOCK...LATER GUYS WORK. https://t.co/Nmu4At9Ckn

— stockrocket1 (@StockRocket1) February 10, 2022

$BOPO PAY ATTENTION #1 STOCK FOR 2022. SOME OF THESE ARE BILLION $ COMPANIES...NOTICE HYFI on TOP of lasts picture...They are the parent co...These companies will be taking their projects to HyFi Platform as per yesterday interview disclosing partners. $CFVI $DWAC $ALPP $JPEX pic.twitter.com/PiyvphZGuO

— stockrocket1 (@StockRocket1) December 30, 2021

Shiba Inu (SHIB) tops Ethereum wallet holdings again despite recent price slump

https://coingape.com/shiba-inu-shib-tops-ethereum-wallet-holdings-again-despite-recent-price-slump/

iETH iEthereum token? Does anyone have any information regarding this very interesting token?

seems to have huge potential. Please post opinions on the iETH:USD page

many interesting questions have been asked but nobody has any information or opinions.

Seems to me Apple corp would have made a public statement about the logo if they were not a part of the project? Please comment. Thanks. curious what others have to say.

$FBN. I just created a board for it. May be worth a look. Have a great weekend.

Threefold token (https://threefold.io/) the Digital Farmers Will Take Back the Internet: https://medium.com/@livontheblock/digital-farmers-will-take-back-the-internet-19726f6e96f8

Newly Updated PlusOne Coin Faucets - Free PlusOne Coin

US

https://ih.advfn.com/faucet/1wwkj5

https://ih.advfn.com/faucet/fico66

https://ih.advfn.com/faucet/8qq77n

https://ih.advfn.com/faucet/pogpen (may reload soon)

UK

https://uk.advfn.com/faucet/dup3i4

Nice New PlusOne Coin Faucets - Get Free Coin

US

https://ih.advfn.com/faucet/1wwkj5

https://ih.advfn.com/faucet/fico66

https://ih.advfn.com/faucet/pogpen (may reload soon)

UK

https://uk.advfn.com/faucet/dup3i4

https://exitscam.me/2mylow4crypto

You want to play a game? The link above directs you to the platform, it is a simulated ICO exit scam. It is interesting to say the least. I could explain more, but it would be easier if you just take a look for yourself. So click the link, let's here your opinions. That is if you think you're brave enough. I double dog dare you! It's all fun and games until someone gets rich, then the process starts again.

IOTA is going to be huge if you have patience..

My Crypto holdings for long term are..

1.14.. Bitcoin

3.6.. Ethereum

501.. Iota

11,313 Tron

7K PoET

1800 Bitshares

JUST LAUNCHED!! "CoinFi (COFI)" --- the looming BLOOMBERG of cryptocurrencies --- to the Moon via open-market trading!! Let's get ready to RUMMMMMBLE!! Listen up, my IHub road-dogs, homeboys, & otherwise Crypto World obsessive-compulsives. Today, 1-29-18 (Mon.), at precisely 6:00 a.m. (PacificTime), here in balmy San Diego, CA, USA, via the Kucoin exchange (Hong Kong), I grabbed 31,765 COFI tokens at $0.31-ea., which cost me $9,500 (US) --- my f--king life's savings!! HA! Yes, indeed!! The conventional wisdom behind ANY kind of investing is do NOT put all one's eggs into ONE basket. Well, screw that!! I truly believe, in just a couple months, CoinFi (COFI) will transform my paltry $9,500 (US) 'life savings' into SEVERAL MILLION BUCKS!! Why? Because CoinFi (COFI) is destined to become the BLOOMBERG of the Crypto World. God bless IHUB, and ALL you guys!!!!!

New ICO, Thorn coin. starts Jan-20 https://thorncoin.com/ref/ftliicfp8apzhfs7

Great CNET call, 1100% in one day. Just crazy!

$SNWR on NEW CRYPTO ALERT! Sanwire Corporation just updated their website a few hours ago. They have their own CRYPTOCURRENCY called COMITCOIN!

Sanwire's ComitCoin already has a Market Cap of $17 Million!!!!

http://Sanwirecorporation.com

http://sanwiresoftware.com/projects/comit-coin/

https://www.xchain.io/asset/COMITCOIN

Chart: https://www.stockscores.com/charts/charts/?ticker=snwr

,,,,,,,THANK YOU

I most certainly grabbed some nFusz today! The share price is going north from here imvho! Thanks for posting that link .... great stuff! $FUSZ$

I hope you grabbed some nFusz shares, might be some .11s early tomorrow and then should bounce, because who is going to sell below .10 with that big pr coming.

Saw this interesting link today:

https://otc.watch/bitcoin-stocks/

Fusz is going to multi dollars imo!

FUSZ: Deal with Oracle!

https://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=12456078

|

Followers

|

6

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

166

|

|

Created

|

12/20/17

|

Type

|

Free

|

| Moderators | |||

Bitcoin is a form of digital currency, created and held electronically. No one controls it. Bitcoins aren’t printed, like dollars or euros – they’re produced by people, and increasingly businesses, running computers all around the world, using software that solves mathematical problems.

It’s the first example of a growing category of money known as cryptocurrency.

Bitcoin can be used to buy things electronically. In that sense, it’s like conventional dollars, euros, or yen, which are also traded digitally.

However, bitcoin’s most important characteristic, and the thing that makes it different to conventional money, is that it is decentralized. No single institution controls the bitcoin network. This puts some people at ease, because it means that a large bank can’t control their money.

A software developer called Satoshi Nakamoto proposed bitcoin, which was an electronic payment system based on mathematical proof. The idea was to produce a currency independent of any central authority, transferable electronically, more or less instantly, with very low transaction fees.

No one. This currency isn’t physically printed in the shadows by a central bank, unaccountable to the population, and making its own rules. Those banks can simply produce more money to cover the national debt, thus devaluing their currency.

Instead, bitcoin is created digitally, by a community of people that anyone can join. Bitcoins are ‘mined’, using computing power in a distributed network.

This network also processes transactions made with the virtual currency, effectively making bitcoin its own payment network.

That’s right. The bitcoin protocol – the rules that make bitcoin work – say that only 21 million bitcoins can ever be created by miners. However, these coins can be divided into smaller parts (the smallest divisible amount is one hundred millionth of a bitcoin and is called a ‘Satoshi’, after the founder of bitcoin).

Conventional currency has been based on gold or silver. Theoretically, you knew that if you handed over a dollar at the bank, you could get some gold back (although this didn’t actually work in practice). But bitcoin isn’t based on gold; it’s based on mathematics.

Around the world, people are using software programs that follow a mathematical formula to produce bitcoins. The mathematical formula is freely available, so that anyone can check it.

The software is also open source, meaning that anyone can look at it to make sure that it does what it is supposed to.

Bitcoin has several important features that set it apart from government-backed currencies.

The bitcoin network isn’t controlled by one central authority. Every machine that mines bitcoin and processes transactions makes up a part of the network, and the machines work together. That means that, in theory, one central authority can’t tinker with monetary policy and cause a meltdown – or simply decide to take people’s bitcoins away from them, as the Central European Bank decided to do in Cyprus in early 2013. And if some part of the network goes offline for some reason, the money keeps on flowing.

Conventional banks make you jump through hoops simply to open a bank account. Setting up merchant accounts for payment is another Kafkaesque task, beset by bureaucracy. However, you can set up a bitcoin address in seconds, no questions asked, and with no fees payable.

Well, kind of. Users can hold multiple bitcoin addresses, and they aren’t linked to names, addresses, or other personally identifying information. However…

…bitcoin stores details of every single transaction that ever happened in the network in a huge version of a general ledger, called the blockchain. The blockchain tells all.

If you have a publicly used bitcoin address, anyone can tell how many bitcoins are stored at that address. They just don’t know that it’s yours.

There are measures that people can take to make their activities more opaque on the bitcoin network, though, such as not using the same bitcoin addresses consistently, and not transferring lots of bitcoin to a single address.

Your bank may charge you a hefty fee for international transfers. Bitcoin doesn’t.

You can send money anywhere and it will arrive minutes later, as soon as the bitcoin network processes the payment.

When your bitcoins are sent, there’s no getting them back, unless the recipient returns them to you. They’re gone forever.

So, bitcoin has a lot going for it, in theory. But how does it work, in practice? Read more to find out how bitcoins are mined, what happens when a bitcoin transaction occurs, and how the network keeps track of everything.

In the event that BTC-USD sees new lows, we can expect solid support in the upper $9900s to low $10,000s. From there we will likely see a bounce leading to a consolidation period, where the market will ultimately decide if it wants to resume the downtrend or break upwards. Given the fact that we broke out of a distribution trading range, it is likely that we will resume this down trend after any potential consolidation.

Distribution is the top of the market cycle and leads to a markdown in price once the trading range is broken. However, this is all up in the air right now and we will still have to see how bitcoin handles the next phase of consolidation. For now, I don’t anticipate any radical lows ranging beyond the linear trend support shown above.

At this point, it doesn’t appear we have reached a selling climax. Although the selling has been intense, there is nothing terribly notable on the macro view of last nights aggressive moves:

You probably woke up this morning to a portfolio streaked in red, and you likely came to the logical conclusion that the market is getting massacred at the moment. Congratulations, you’d be right. If you’re a veteran investor, this is par for the course, another adrenaline-inducing day in this amusement park we call a market. If you’re new to the game, you might regret investing in that magic internet money your coworker used to pay off his mortgage. Either way, there’s little reason to panic, and there’s even less of a reason to be surprised.

Yesterday, the cryptocurrency market topped-off a few bucks shy of a $650bln total valuation. This all-time high had crypto’s market capitalization up from $250bln back in the 21st of November. That’s a 159% increase in only a month. To put this into perspective, the United State’s stock market took a full year to increase 8% in total market cap between 2015-2016.

This correction is long overdue. The market’s been riding on the back of a gold-studded bull for the past two months, so it’s only natural that a bear has snatched it up in its bloody clutches.

Besides, this bloodbath is nothing we haven’t seen before. Back in September, the crypto market fell into a bearish slump after a bullish frenzy in August. Bitcoin and Ethereum both lost around 68% and 78% of their respective values in two weeks, and Litecoin fell a gut-punching 105% over a matter of days. From these ashes, however, the market rose to the highs we just experienced. It wasn’t doomsday, just the fallout of a booming summer.

Granted, this blindside correction has Bitcoin down nearly 50% from 5 days ago, an unfortunate departure from its all-time high of $20k. But the healthier the prosperity, the harsher the correction, especially at a time when institutional adoption is on the rise. In December alone, we’ve seen the inauguration of Bitcoin futures, doors open for cryptocurrency ETFs, and policy makers scramble to accommodate crypto intoformal regulation.

Bitcoin and friends’ gains over the past month have run alongside a triage of attention from global governments, the general public, and legacy financial institutions. The same factors that slung the market to the stratosphere are likely the same tethers dragging it back down to earth. But these catalysts of success and disaster, of investor ecstasy and despair, are the very stimulants that will sustain crypto in 2018 and the years to come.

Cryptocurrencies have too much momentum going into the new year for this to be its coup de grâce. Let alone Bitcoin’s attraction as a financial assets, but many platforms and currencies are pioneering enterprise solutions that businesses have started to adopt. Blockchain adoption is waiting patiently on the international stage’s doorstep, and come 2018, a slew of mainnet and product launches will only push crypto further into the public and corporate folds.

If you just bought in at an all-time high, my sympathies, friend. It’s a tough first correction to stomach, and so far, it’s been a long way down. But don’t fill those sell orders just yet. This bubble’s got plenty of room left to grow before it grows anywhere close to the $2.9 trillion burst that crashed the dot.com craze.

So stop refreshing your portfolio, make a cup of hot cocoa–hell, add some peppermint schnapps if you need to–and go enjoy your holiday. The market may continue bleeding yet, but once the scrapes and bruises heal, it’ll come back stronger than before. Just hunker down, relax, hold, and we’ll see you in 2018.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |