Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

"oil demand should peak within the current decade"

The Tipping Point In Global Oil Demand

By Salman Ghouri - Sep 04, 2023

https://oilprice.com/Energy/Crude-Oil/The-Tipping-Point-In-Global-Oil-Demand.html

Oil demand to slow sharply by 2028, putting peak in sight - IEA

Global oil demand is expected to slow "almost to a halt" within five years, the International Energy Agency said in a report Wednesday, as higher prices and supply concerns will likely speed up the shift to clean energy sources and electric vehicles.

Demand will rise 6% between 2022 and 2028 to reach 105.7M barrels per day on robust demand from the petrochemical and aviation sectors, the IEA said in its medium-term oil market report. But annual demand growth is expected to shrink from 2.4 mb/d this year to just 0.4 mb/d in 2028.

Notably, the use of gasoline for vehicles is set to decline after 2026, given increased adoption of EVs and biofuels.

"The shift to a clean energy economy is picking up pace, with a peak in global oil demand in sight before the end of this decade," IEA Executive Director Fatih Birol said.

IEA expects growth in China demand, which has seen a muted recovery after lifting COVID-19 restrictions, to slow markedly starting next year.

In a separate report, IEA said global oil demand will grow by 2.4 mb/d in 2023 to 102.3 mb/d, outpacing last year's 2.3 mb/d increase. China is expected to account for 60% of the gains.

https://seekingalpha.com/news/3979728-global-oil-demand

EVs Made the First Visible Dent into Gasoline Consumption

by Wolf Richter • May 11, 2023

Gasoline sales have already been stagnating for years, interrupted by big drops in demand.

By Wolf Richter for WOLF STREET.

Gasoline consumption in the US dipped by 0.4% in 2022, from 2021, to 369 million gallons per day, all grades of gasoline combined, below where it had been in 2002, and down by 5.7% from 2019, and by 5.9% from the peak in 2018, according to data from the Energy Department’s EIA.

And yet, in 2022 employment grew by 4.8 million. And miles driven increased by nearly 1%. It’s not that economic activity declined or that people drove less. But they bought less gasoline

Why the drop in gasoline consumption despite more miles driven?

The primary long-term structural factor at work is the rising fuel economy of the vehicles in the national fleet. This started many years ago, and it continued in 2022

Why the dip in gasoline consumption in 2022 from 2021, instead of further recovery from the 2020 lows?

Ah-ha, finally, a long-anticipated moment. The growth of EVs in the national fleet inched to the visible surface of gasoline consumption. EV sales in 2022 grew to a share of about 7% of total new vehicle sales in the US. In California, EV sales in 2022 accounted for 17% of total sales. These numbers are starting to show up at the gas station as a decline in gasoline sales.

Even though the market share of EVs in the US reached 7% in 2022, up from near 0% a decade ago, their share of the national fleet in operation is still minuscule, and for now, the impact on gasoline sales is small in the US overall. But we can finally see this first little dent.

The impact of EVs on gasoline consumption was bound to show up, and it was part of the mix in prior years, but at such low levels that it got lost in the shuffle.

Sales shift from refiners and gas stations to electric utilities.

Conversely, as gasoline consumption declined in 2022, electricity generated and sold to end-users in the US finally broke out of the 15-year stagnation and set a new record, in part because of EVs (there are also other new power-hogs, such as crypto mining, which has taken off in the US a few years ago).

Electric utilities, for years stuck in a no-growth business in many parts of the country, are licking their chops at the prospects of being able to sell more electricity

https://wolfstreet.com/2023/05/11/evs-made-the-first-visible-dent-into-gasoline-consumption/

The global market for internal-combustion vehicles peaked in 2017 and is now in "structural decline," Bloomberg New Energy Finance declared in a recent report.

BNEF reported in 2021 that global internal-combustion car sales had already peaked, but didn't mark that peak with a precise year. It now also predicts that oil demand for transportation will peak in 2027,

https://www.greencarreports.com/news/1138993_combustion-vehicle-sales-peaked-in-2017-peak-oil-due-in-2027

Diesel Shortage Code Red (Is It Time To Panic?

Kathy Woods Is a waitress ,The fools that gave Elizabeth Holmes billions also like Kathy.

This is a MUST Watch as electrifying the U.S. is a pipe dream.

.

https://vimeo.com/781542214

.

Ray Kowalik CEO of Burns and Mcdonnell

What is Burns and McDonnell known for?

Burns & McDonnell is among the largest Engineering/Architecture companies in the US and a prominent contributor to US market for electrical designs. It is also active in the construction of military facilities, wind and solar energy installations, aviation, health care, and is active in the oil and chemical industry. Nuclear also.

Ray says there is zero integration between any of the energy installations. Not one of the connections from all of the Different energy systems will fit any other system

and it will take $1 Trillion a year for more than 50 years to integrate.

Burns & McDonnell is a family of companies bringing together an unmatched team of 10,000 engineers, construction and craft professionals, architects, and more to design and build our critical infrastructure. With an integrated construction and design mindset, we offer full-service capabilities.Sep 29, 2022

Ray Kowalik was interviewed by RI PBS Llewellyn King

The electrification of AmericaDecember 17, 2022 by

As the White House looks at how electrification can help the nation meet its climate and equity goals, Llewellyn King and Ray Kowalik, Chairman and CEO of Burns & McDonnell, discuss the power generation future.

=================================

insert-text-here

$500 -$1,000 is in the cards for ARKK by 2028 IMO.eom

ARKK Chart

Look at the 5 year chart for a great laugh.

https://www.google.com/search?q=ARKK+Chart&rlz=1CABBMB_enUS969US969&sourceid=chrome&ie=UTF-8

kathy woods should be playing with dolls.

What is the feed stock of our world wide society?

Houses, Commercial buildings , Transportation and durable goods?

Thank you Petroleum Industry:0)))

Oil demand could plunge by 30% over the next 5 years, Cathie Wood predicts.Jan. 19, 2023

Crude-oil prices are up thus far in 2023, but fund manager Cathie Wood sees a substantial drop in global oil uptake that could result in a powerful swing lower for the fossil fuel.

“We believe that the demand for oil,” estimated to be at about 100 million barrels a day, “is going to drop over the next five years” by 30%, Wood said on Thursday during a quarterly seminar for clients of ARK Invest’s suite of funds.

That’s “because of not only electric vehicles and the increased in electric-vehicle miles,” but also autonomous taxi services, Wood predicted, referencing her popular holding, Tesla Inc. TSLA, +11.00%.

The ARK Invest CEO made the case that crude oil CL00, -0.38% has held its value, on a relative basis, due to a number of factors, including China’s gradual reopening from its zero-COVID policies and a replenishment of the U.S. Strategic Petroleum Reserves, which were tapped to help mitigate the growing costs of oil last year.

“We could be talking $50 [a barrel],” Wood said.

https://www.marketwatch.com/story/oil-demand-could-plunge-by-30-over-the-next-5-years-cathie-wood-predicts-heres-why-11674169002

Tiago EV starts at around $10,000 ($14,500 upgrade)

Tata Motors, one of India’s largest vehicle manufacturers, has announced a new made-in-India electric car called the Tiago EV, a 5-door hatchback based on the the company’s Ziptron electric car platform, which is optimized for driving conditions in India. The Tiago EV starts at around $10,000 with a 19.2 kWh battery and 3.2 kW charging. The company says it has a range of 250 kilometers. For around $14,500, drivers can upgrade to a 24 kWh battery version with 315 kilometers of range and a 7.2 kW charger.

Tata Tiago EV review: India's most affordable electric car

Egypt new massive gas discovery( 3.5 trillion cubic feet)

Egypt JUST ANNOUNCED It's NEW MASSIVE Gas Discovery( 3.5 trillion cubic feet)That Will Change The Entire Industry Forever

The Egyptian Oil Minister, Tarek El Molla, made a big announcement just last month. He revealed that Egypt had found a massive gas field in the northeastern Mediterranean.

According to the Middle East Economic Survey, the field possesses 3.5 trillion cubic feet of gas.

U.S. poised to become net exporter of crude oil in 2023

https://www.reuters.com/business/energy/us-poised-become-net-exporter-crude-oil-2023-2022-12-19/

HOUSTON, Dec 19 (Reuters) - The United States has become a global crude oil exporting power over the last few years, but exports have not exceeded its imports since World War II. That could change next year.

Sales of U.S. crude to other nations are now a record 3.4 million barrels per day (bpd), with exports of about 3 million bpd of refined products like gasoline and diesel fuel. The United States is also the leading liquefied natural gas (LNG) exporter, where growth is expected to soar in coming years.

The United States already produces more oil than any other country in the world including Saudi Arabia and Russia. U.S. shale fields are aging and production growth this year has been sluggish. Overall output should reach a record 12.34 million bpd next year - but only if prices are lucrative enough to encourage oil drillers to pump more.

Export terminal operators are rushing to boost their capacity to better service the giant tankers that can carry more than 2 million barrels of oil.

"Russia has proven to be an unreliable supplier," said Sean Strawbridge, chief executive of the largest U.S. oil export facility, Port of Corpus Christi. "That really creates a wonderful opportunity for American producers and American energy."

Corpus Christi could see a 100,000 bpd increase in exports next year, Strawbridge said, on top of the record shipments of 2.2 million bpd in October.

LNG HITS RECORD

The United States became the world's largest exporter of liquefied natural gas during the first half of 2022, surpassing Qatar and Australia, on the back of demand from Europe and surging prices.

LNG exports likely will continue to rise into 2023 as Europe scrambles to refill storage depleted this winter, said Matt Smith, analyst at Kpler.

Philippines potential $26.3 trillion OIL and GAS Industry

The economy is moving from a tailwind pushing it along to a headwind holding it back

Posted on December 16, 2022 by Gail Tverberg

https://ourfiniteworld.com/2022/12/16/the-economy-is-moving-from-a-tailwind-pushing-it-along-to-a-headwind-holding-it-back/

Gutting Germany — Part 3: Diesel

https://thehonestsorcerer.medium.com/gutting-germany-part-3-diesel-6c5f7e55d46

Has gasoline demand peaked?Yes it has!

Internal combustion engines are sipping less gas as EV demand is on the rise.

Peak crude oil demand will follow peak gasoline demand this decade or next as ground transportation demand dries up. Crude oil is likely already in a bear market. Lower highs and lower lows with a test below $50 followed by a $50 -70 trading range seems probable.IMO

$100 oil may never be seen again.Price supports may be needed to provide continued investment and stable production as the EV transformation matures.

Perhaps peak food production or peak jobs caused by AI will bring the End Times but Peak Oil doesn't look like the straw that breaks the camel's back.HH

" Demand for the fuel(gasoline), which uses more than a quarter of the world’s crude, has already peaked. Part of that is about electric cars — BloombergNEF estimates that they’re already subtracting about 1.7 million daily barrels from global consumption. Still, much of it is just that plain old internal combustion engines are sipping less gas. New US cars now travel nearly twice as far per gallon as they did at the start of the Obama administration, with light trucks and SUVs increasing efficiency by a more modest 59%."

"After more than a century of almost continual growth, the world’s appetite for oil is peaking, and will soon enter terminal decline."

Analysis by David Fickling | Bloomberg

September 29, 2022

https://www.washingtonpost.com/business/energy/peak-oil-has-finally-arrivedno-really/2022/09/28/f67f2f0a-3f68-11ed-8c6e-9386bd7cd826_story.html

As older, less efficient cars are phased out of the fleet, the entropy of the scrapyard is reducing gasoline demand as rapidly as the innovation of the electric vehicle manufacturer. It’s no accident that major refiners such as Reliance Industries Ltd. are already looking beyond road transport, and reconfiguring their plants to produce aviation fuel and petrochemicals instead.

That’s not enough for those who paint a rosy future for oil demand to point to historic correlations with economic growth and argue that the pattern will repeat once again. Away from forecasters’ spreadsheets, OPEC spare capacity is already wafer-thin, and upstream investment is running at not much more than half its level last time crude prices were in the vicinity of $100 a barrel. The oil industry responsible for supplying additional barrels isn’t spending the money to ensure they’ll turn up — and if that doesn’t happen, consumption has no prospect of growing.

440 nuclear power reactors with 55 under construction currently

"Today there are about 440 nuclear power reactors operating in 32 countries plus Taiwan, with a combined capacity of about 390 GWe. In 2021 these provided 2653 TWh, about 10% of the world's electricity."

"Significant further capacity is being created by plant upgrading."

"About 90 power reactors with a total gross capacity of about 90,000 MWe are on order or planned, and over 300 more are proposed. Most reactors currently planned are in Asia, with fast-growing economies and rapidly-rising electricity demand.Many countries with existing nuclear power programmes either have plans to, or are building, new power reactors."

Plans For New Reactors Worldwide(Updated November 2022)

https://world-nuclear.org/information-library/current-and-future-generation/plans-for-new-reactors-worldwide.aspx

by 2030 145 million electric vehicles will be on the road

Number of electric vehicles

Between 2012 – 2021, around 17 million electric vehicles were sold worldwide (that includes all-electric vehicles and plug-in hybrid vehicles combined). It’s expected that 145 million electric vehicles will be on the road by 2030 (including electric cars, buses, vans, and heavy trucks).

In the past years, we have seen exponential growth in electric car sales.

Electric car sales in USA

USA electric car sales mostly benefited from the launch and first deliveries of electric pick-up trucks in 2022 (greater interest in large vehicles).

The US charging infrastructure is getting built out fast, and Tesla’s opening up the Supercharger network. Also, president Biden is a passionate supporter of the EV industry.

Electric car adoption in the US is happening at a faster pace than predicted. California has the highest EV demand in the USA with 1 million plug-in electric cars sold.

https://tridenstechnology.com/electric-car-sales-statistics/

The future of electric cars and EV industry predictions show that we’ve only just started with the EV revolution.

The future of electric unit sales is expected to reach 16,206.900 cars in 2027.

2022 10.6 mil EV sales (a growth of 57 % over 2021) expected

"For the full year of 2022, we expect sales of 10,6 million EVs, a growth of 57 % over 2021, with BEVs reaching 8 million units and PHEVs 2,6 million units. By the end of 2022 we expect nearly 27 million EVs in operation, counting light vehicles, 70 % are BEVs and 30 % PHEVs. Sales of Fuel Cell Vehicles (FCEV) in the light vehicle sector have declined by -9 % so far and are below 20 000 units annually. Current sales are from 5 vehicle models and most sales are in South Korea and USA. We estimate their current population to ca 55 000 units."

"Global EV sales continue strong. A total of 4,3 million new BEVs and PHEVs were delivered during the first half of 2022, an increase of +62 % compared to 2021 H1."

https://www.ev-volumes.com/

Global EV Sales for 2022 H1

By Roland Irle, EV-Volumes

EV demand poised to turn crude oil demand downward this decade.

(Crude oil bear market may already be here IMO)

"Road transport represents the largest share of demand for crude oil, at 44% (Figure 5) with the pace of transport electrification the most significant factor in determining future demand for oil. Figures 6 to 9 show that the electrification trend in the transport sector is gathering pace with electric vehicle (EV) sales, deployment of charging infrastructure, and battery range (as a proxy for technological development) all showing accelerating trends. In the case of passenger cars, it is easy to envision that in the next decade there will be a sharply reduced market for internal combustion engine vehicles.

The steep rate of change is being driven by evolving government policy. Governments covering 25% of the global market have announced 100% EV sales mandates for 2035, and EV-related subsidies doubled in 2021 to nearly USD 30 billion (IEA, 2022). These kinds of policies are low-hanging policy fruit for the many governments looking for ways to address climate change. They can be combined with popular industrial subsidies aimed at fostering competitive firms in the green markets of the future and employment-creating spending on charging infrastructure.

"As a result, consumer uptake is poised to hit significant tipping points well before 2035, triggered by several factors, including the increasing affordability of electric vehicles. Under most assumptions, EVs are already cheaper on a lifetime basis or even straight off the lot if financed (Clean Energy Canada, 2022; Direct Line Group, 2020; Orvis, 2022). Upfront cost parity is expected to come in the mid-2020s (Bush, 2020). Increasing range, the availability of infrastructure, and growing consumer confidence that comes from familiarity with the technology will also drive EV uptake.

"According to Bloomberg NEF, “The market is shifting from being driven primarily by policy, to one where organic consumer demand is the most important factor. As regulatory drivers begin to play less of a role, consumer adoption dynamics—the ‘S-curve’—take over” (BloombergNEF, 2022). The S-curve describes the uptake of new technology that eventually takes off not in a linear fashion but exponentially, with sudden and overwhelming effects (Foster, 1986). There are numerous examples of such a dynamic with past technologies, including cellphones, personal computers and, ironically, internal combustion engine passenger vehicles.

Another driver of S-curve adoption rates will be the reluctance of new car buyers to purchase a conventional vehicle that they see as having low resale value—a positive feedback effect that will intensify as the market share of EVs climbs (Arib & Seba, 2017). EVs may also play an outsized role in the destruction of demand for oil well beyond their market share. Fleet owners, taxis, and ride-hailing services will be early adopters of EVs, given lifetime cost considerations, and their vehicles are driven many more kilometres than the average (Arib & Seba, 2017). Owners of multiple vehicles will likely also prefer to use the EVs over conventional vehicles if they have a choice, given the significant difference in operating costs.

"To be on track with the IEA’s Net-Zero scenario, 64% of passenger car sales and 5% of truck sales would have to be electric by 2030 (IEA, 2021). The above trends suggest that this trajectory is within range.

From the perspective of road transport—the biggest factor in oil demand—the trends are tracking toward the IEA’s Net-Zero scenario. This would mean a significant displacement of oil demand beginning before 2030 and picking up pace as the share of electric vehicles grows exponentially. Compared to the business-as-usual Stated Policies scenario, the Net-Zero Scenario implies a drop in the demand for oil needed for road transport of 18.8 mbpd by 2030 and 49.9 mbpd by 2050."

By Aaron Cosbey on September 16, 2022

https://www.iisd.org/articles/deep-dive/canada-can-expect-declining-oil-demand

Global Demand for Oil Will Be in Decline by 2030

"Comparing the IEA’s scenarios against observed trends suggests global demand for oil will peak before 2030 and thereafter decline. Similar conclusions have been drawn by other independent analysts (BP, 2022; DNV, 2021; McKinsey, 2022; Rystad Energy, 2022), and, in the same vein, the CER’s only plausible scenario shows Canadian production peaking in 2032.

"Demand reduction will be driven primarily by road transportation, which accounts for 44% of oil demand. Trends in climate policies, technological improvements, and consumer behaviour suggest demand reduction in line with the IEA’s NZE. These will begin before 2030 and will accelerate thereafter."

The East Mediterranean Is Primed For A Natural Gas Boom

By Tsvetana Paraskova - Nov 14, 2022

https://oilprice.com/Latest-Energy-News/World-News/The-East-Mediterranean-Is-Primed-For-A-Natural-Gas-Boom.html

The Eastern Mediterranean could become a “stable supplier of energy” to the European Union if the recent maritime border agreement between Israel and Lebanon spurs more investment in the region, the head of the company that launched the latest gas production project says.

“I think there is a lot more gas to be found,” Mathios Rigas, chief executive of Energean, told the Financial Times in an interview published on Monday.

Energean said at the end of October that first gas was achieved at the Karish field offshore Israel, two weeks after Israel and Lebanon reached a historic agreement to settle their long-running dispute over their maritime border.

“We have delivered a landmark project that brings competition to the Israeli gas market, enhances security of energy supply in the East Med region and brings affordable and clean energy that will displace coal-fired power generation, making a material impact to the environment,” Energean’s Rigas said last month.

The Israel-Lebanon deal could pave the way to more oil and gas exploration in the Eastern Mediterranean region where major gas discoveries have been made in recent years. The settling of the dispute could encourage more investment in gas supply from an area close to the EU which, in the future, could help the bloc diversify its gas supply sources as it seeks to ditch Russian gas dependence by 2027.

More exploration and investments in the Eastern Mediterranean could make the region a “stable supplier of energy” for the EU, Energean’s Rigas told FT.

Under the Israel-Lebanon agreement, the Karish oil and gas field and an area known as the Qanaa prospect are expected to be in Israeli and Lebanese waters, respectively.

A week after the border deal, Lebanon urged French supermajor TotalEnergies, which owns the contract to explore Lebanese waters, to start drilling in Block 9.

Suriname has 30 billion barrel potential of recoverable oil equivalent resources.

"Oil Majors Are Betting Big On Suriname" By Matthew Smith - Nov 14, 2022

https://oilprice.com/Energy/Crude-Oil/Oil-Majors-Are-Betting-Big-On-Suriname.html

"The appeal of offshore Suriname is amplified by the fact that the oil discovered to date has been light to medium with low sulfur content. That means it is cheaper and easier to refine into high-quality fuels, and there is a low carbon cost associated with its extraction compared to the heavier sourer oil grades produced in Venezuela, Colombia and Ecuador. Projects in Suriname have an estimated breakeven price of $40 per barrel Brent, which is expected to fall further as development ramps up, and vital infrastructure is put in place. For these reasons, offshore Suriname is an appealing investment jurisdiction for international energy companies, particularly when it is considered that many Latin American countries have far higher breakeven prices."

"According to Staatsolie, data is has obtained points to offshore Suriname containing up to 30 billion barrels of recoverable oil equivalent resources."

Arthur Berman: “The Devil is in the Diesel” | The Great Simplification #44

Namibia Could Join OPEC If Recent Oil Discoveries Fulfill Potential

https://oilprice.com/Latest-Energy-News/World-News/Namibia-Could-Join-OPEC-If-Recent-Oil-Discoveries-Fulfill-Potential.html

Namibia could consider joining OPEC if recent offshore oil discoveries prove to be large enough for commercial development, Namibian petroleum commissioner Maggy Shino told Bloomberg on Wednesday, as oil majors that have made recent discoveries prepare for appraisal drilling.

TotalEnergies made in February a significant discovery of light oil with associated gas on the Venus prospect offshore southern Namibia. The initial results are “very promising” in the so-called Orange Basin, Kevin McLachlan, Senior Vice President of Exploration at TotalEnergies, said at the time.

Venus in Namibia could be a “giant oil and gas discovery,” TotalEnergies said in an investor presentation last month. Appraisal and testing are slated for 2023.

Shell said in April that it was “very encouraged” by the early results from the deepwater Graff-1 exploration well in the same Orange Basin offshore Namibia, completed earlier this year.

“Over the coming months, we’ll need to conduct further evaluation of the well results, and additional exploration activity, in order to determine the size and recoverable potential of the hydrocarbons that were identified,” said Dennis Zekveld, Shell’s Country Chair in Namibia.

Shell also made a second discovery in the Orange basin in April.

Shell’s Graff and TotalEnergies’ Venus discoveries could be transformational for Namibia, analysts at Wood Mackenzie said earlier this year.

“There’s a new kid on the block in Sub-Saharan Africa’s upstream industry. After two successive giant offshore discoveries, Namibia is the hottest play in the region right now,” WoodMac said in March.

But Namibia, as well as Shell and TotalEnergies, will have to wait until the appraisal and testing programs are completed next year to see if the early promising results really meant that the oil discoveries are giant. The economy of Namibia, neighbor to the south of OPEC producer Angola, is currently valued at around $11 billion. If the discoveries are developed, they could double the country’s GDP.

By Tsvetana Paraskova for Oilprice.com

https://oilprice.com/Latest-Energy-News/World-News/Namibia-Could-Join-OPEC-If-Recent-Oil-Discoveries-Fulfill-Potential.html

"oil production" reached an all-time high in 2019, at nearly 95 million barrels

" the United States is currently the world's largest producer of oil, followed by Saudi Arabia and Russia."

Supplementary notes:

Figures include crude oil, shale oil, oil sands, condensates and NGLs. Liquid fuels from other sources such as biofuels and synthetic derivatives of coal and natural gas are excluded, as well as oil shales/kerogen extracted in solid form.

Global oil production 1998-2021

Published by N. Sönnichsen, Jul 7, 2022

https://www.statista.com/statistics/265203/global-oil-production-since-in-barrels-per-day/

Global oil production amounted to 89.9 million barrels per day in 2021. The level of oil production reached an all-time high in 2019, at nearly 95 million barrels. However, the coronavirus pandemic and its impact on transportation fuel demand led to a notable decline in the following year.

Rising production and consumption

Apart from events surrounding global economic crisis as in the late 2000's and 2020, oil production consistently increased every year for the past two decades. Similarly, global oil consumption only decreased in 2008, 2009, and 2020, but has otherwise increased to a higher level year after year. Oil and oil products remain invaluable commodities as most transportation fuels are petroleum-based and oil is a major raw material for the chemicals industry.

Production by region and country

While total production is rising, regional distribution has shifted, with the share of production declining the most in Europe and the Commonwealth of Independent States (CIS) since 2008, and rising the most in North America. Even though as a region the Middle East still produces the largest share of oil worldwide, the United States is currently the worl'ds largest producer of oil, followed by Saudi Arabia and Russia.

Running Out of Spare Capacity

11/ 19/ 2021

https://blog.gorozen.com/blog/running-out-of-spare-capacity-global-oil-markets?fs=e&s=cl

Petrodollar Collapse: Saudi Arabia Considers Accepting Yuan For Chinese Oil Sales

A Geology Insider Explains Why The Global Energy Crisis Is Going To Get Much, Much Worse

January 30, 2022 by Michael Snyder

https://theeconomiccollapseblog.com/a-geology-insider-explains-why-the-global-energy-crisis-is-going-to-get-much-much-worse/?fbclid=IwAR1IAoJ_nc7unR7oE98y0g5aFA-pLRV-FR04mn6NPAjdJ2Lfuo6DCQr3oqU

Many are learning the prepper mentality the hard way.No TP and empty food shelves was a great learning experience.Many will develop preparedness thinking and practices.I am optimistic while staying realistic.New thinking is here and that includes "food insurance" for families.Many are waking up to the limitations of institutions and the vulnerabilities of our instant gratification life styles. Localization is catching on. The pandemic shook everyone to the core. Some are stressed out and acting out while others are reassessing and changing their lives. The door is wide open for healthy change and many are doing just that.This is the start of a new and much better age.Happy Holidays My Friend!

I agree with you, BUT we need to be growing food locally, starting in our backyards, playgrounds, golf courses, etc. Only 4% of people in the U.S. produce food. Third-world nations are better off surviving starvation because they grow food, save seeds, and practice all survival skills. Just saying. Good luck.

sumisu

We are adapting and changing as always. Things are looking good to me. Got EV, got AI and got new thinking replacing old stagnating thinking. A sustainable and more healthy world is being created as we speak. The key is to avoid systemic seizure while we transition. So far so good even with supply tightness in many areas. We will adjust and transform IMO. No global depression,no WW III and no die off. Just a lot of uncertainty and anxiety as things get bumpy during this birth of a better way of doing everything.Take Care! https://www.tesla.com/semi

TRUCKING INSIDER: "Everything In the Country Is Going To Shut Down" If This Happens

Premiered Sep 6, 2021

An energy crisis is gripping the world, with potentially grave consequences

Will Englund 15 hrs ago

https://www.msn.com/en-us/money/markets/an-energy-crisis-is-gripping-the-world-with-potentially-grave-consequences/ar-AAPjcIE?fbclid=IwAR2xn6etLK8QQwUiBR2GgznIRyzyBKbey1ZOdxyijCOiSR7BXSVeiSCrWrQ

US Heating Oil Supplies Lowest In Decades Ahead Of Winter

by Tyler Durden

Saturday, Oct 09, 2021 - 11:45 AM

https://www.zerohedge.com/commodities/us-heating-oil-supplies-lowest-decades-ahead-winter?fbclid=IwAR0ZAPbJv_o7JwIbHrqP0fAMbgLiRE_cJGzx5pHu3leii2ZohpDumN1BKmk

How will 500,000 products made with fossils as feedstock & process energy be created post fossil fuels?

Posted on September 29, 2021 by energyskeptic

https://energyskeptic.com/2021/how-will-500-million-products-made-from-oil-be-made-after-its-gone/?fbclid=IwAR3_Aoax8anDRsQ7uQ-_1a3RBuzS18xeoWXoK9v2RCOAeq_byMvj0G8AUhY

IEA: The Global Oil Glut Is Gone

By Tsvetana Paraskova - May 12, 2021, 12:00 PM CDT

https://oilprice.com/Energy/Energy-General/IEA-The-Global-Oil-Glut-Is-Gone.html?fbclid=IwAR2iedQKzRRF2VJxMAPANS_4oRuKIXtchN6u4GHGeXhmHOPVzzHCxROZrgg

Toyota warns,yet again,that the infrastructure needed for mass adoption of battery electric vehicles,

remains years away-

https://pjmedia.com/culture/bryan-preston/2021/03/19/toyota-warns-again-about-electrifying-all-autos-is-anyone-listening-n1433674#16162445917512&{"sender":"offer-0-EObzs","displayMode":"inline","recipient":"opener","event":"resize","params":{"height":295,"iframeId":"offer-0-EObzs";;;}}

futr

Gasoline Industry Is About to Become Totally Worthless Morgan Stanley Warns

http://www.marketoracle.co.uk/Article68436.html

-----------------------------------------------------------------------

What we have here is peak oil production,peak global warming hysteria and a birth of a new age of peace and prosperity.The times they are a changin!

"Some parts of Texas were colder than Alaska. Before dawn yesterday morning, it was 5°F in Dallas...and 18° in Anchorage. About 800 daily records for cold temperatures were set in the last week, according to Bloomberg."

"Picture an overheated car (and what we drive), an overcooked dinner (and what we eat), and someone sick with a fever (and how we act). Now imagine that on a planetary scale." https://www.jpost.com/jerusalem-report/climate-change-an-existential-threat-to-humanity-and-how-we-can-survive-643267

In this period of mass hysteria we are demonizing CO2.They want remove CO2 from the atmosphere.This is amazing!As the climate cools more carbon in the atmosphere could help reduce the cooling.

Don't panic! We will survive and we will thrive.Gloom n Doom thinking is a disease.Positive change is breaking out in 2021 and the next ten years will be fun as hope increases and healthy changes bring healing and harmony to all.Reforms in schools,courts and prisons will open up a wonderful era of peace,prosperity and joy.

From a letter I wrote and am sharing with some national leaders:

Dear.....,

I am full of hope that a better America is about to emerge

from a terrible period of pain and destruction.I am determined

to do what is required to see the promise of our Constitution become reality

and clearly the time for major change has arrived.While sheltering in place

I have been searching for the best solutions we can now put to work.The key

ingredients for our goals are inside us and they are crying out to be fully

expressed in our institutions.

I believe we must treat others as we would like to be treated in

our schools("Teach Like Finland" by Timothy Walker),

in our courts("Restorative Justice", Fania Davis) and

in our prisons("Incarceration" by Christine Montross).

IMO the 3 authors above must be involved in the transformation of our nation.

A note I wrote that I am sharing with friends and family:

Be Kind To Your Mind:

Lifting Our Thoughts

One beautiful way of lifting our thoughts to a higher level and thus raising our energy is to tap into a stored memory of joy, love or self-confidence. It takes only a few moments to make this happen.

Choose a time when you felt full of joy, love or self-confidence. You can choose another high-energy feeling if you wish. Close your eyes for a few minutes and picture how you felt at that time. Remember it with all your senses. As you breathe in and out, feel that experience all through your body.

The HeartMath Institute suggests that you place your hand over your heart during this exercise. After a few minutes, you can open your eyes. Practice this a few times to establish this memory within you.

When you feel yourself filling with emotions like fear or anger, place your hand over your heart and watch how the negative feelings are replaced by feelings of joy and love. Remember that everything begins with a thought. A thought of fear leads to a feeling of fear. A thought of resentment leads to feelings of anger. When you become willing to get out of your head and come from your heart, your feelings change to loving feelings.

John Grassi, a teacher I had in graduate school, told me a wonderful story to illustrate this. At recess one day, two young students were getting ready to have a fight. A girl caught the attention of one of the boys and put her hand over her heart to remind him to come from his heart. In turn, that boy put his hand over his heart and stopped acting out his anger. The second boy saw this gesture, put his hand over his heart-and the fight was over.

It is such a simple exercise but it works every time we have the willingness to change.

Neale Donald Walsh writes, "The Highest Thought is the thought which contains joy. The Clearest Words are those that contain truth. The Grandest Feeling is that which you call love. Joy, truth and love. These three are interchangeable, and one always leads to the other. It matters not in which order they are placed."

Here is a guided imagery that can help connect you with a higher frequency of energy for faster healing:

Imagine that you have a cord connected from the top of your head reaching up to all the energies of the universe. You can feel it vibrating. See a glow of light all around you, expanding wider and wider until all you see is light. Feel it vibrating as you sit in the center of all this energy. Feel your entire body alive and connected to this higher frequency. Feel yourself surrounded by love. In this powerful place, say to yourself, All the energies of the universe are healing my body today. See this manifesting. Know this is a reality.

Now give thanks for the manifestation of this affirmation.

-----------------------------------------------------------------------------------------------------------------------------------------------------

Making time every day for listening to guided meditations can work wonders.You can "loop" these videos by right clicking on the image and selecting "loop" so they repeat over and over causing you to drift off into a dream state allowing the affirmations to access your subconscious mind to reprogram your brain with upgraded "software":

I Am Worthy | Affirmations for Self Esteem and Self-Love

Shell, in a Turning Point, Says Its Oil Production Has Peaked

Europe’s largest oil and gas producer said oil production would gradually decline 1 or 2 percent annually, underscoring the company’s desire to shift to greener energy.

As Europe’s largest oil and gas producer, Shell has faced skepticism about how willing or able it will be to shift from oil production.Credit...David Zalubowski/Associated Press

https://www.nytimes.com/2021/02/11/business/shell-oil-production.html?smid=fb-share&fbclid=IwAR3G79DlPOwEDiVgls-I2f-yFbIpeOqG_9n5XpCbse6rPv1GhXphK2J1JQM

Setting the Stage for an Oil Crisis

01/ 27/ 2021

http://blog.gorozen.com/blog/setting-the-stage-for-an-oil-crisis?fbclid=IwAR1w9PPVWvA4wMbgmRiHSJE_KoEYktvPoEyCrO2WNk0lyQnf_fZ3EDLXgOE

We believe we are on the cusp of a global energy crisis. Like most crises, the fundamental causes for this crisis have been brewing for several years but have lacked a catalyst to bring them to the attention of the public or to the average investor. The looming energy crisis is rooted in the underlying depletion of the US shales along with the chronic disappointments in non-OPEC supply in the rest of the world. The catalyst is the coronavirus.

The initial phase of the crisis that took prices negative is behind us and the next phase which, should take prices much higher, is in its infancy. Global energy markets in general, and oil markets in particular, are slipping into a structural deficit as we speak. We believe energy will be the most important investment theme of the next several years and the biggest unintended consequence of the coronavirus.

Investors’ focus has shifted to how quickly supply can be brought back to meet recovering demand. While most investors believe the lost production will be easily brought back online, our models tell us something vastly different. While OPEC+ production will likely rebound, non-OPEC+ supply will be extremely challenged. Instead of recovering, our models tell us that non-OPEC+ production is about to decline dramatically from today’s already low levels.

Thus far, the slowdown in non-OPEC+ production has come entirely from proactively shutting in existing production. These wells were mostly old and only marginally economic before prices collapsed in 2020. Going forward, production will be impacted by a different and longer-lasting force. Low prices led producers to curtail nearly all new drilling activity. As recently as March 13th, 2020, there were 680 rigs drilling for oil in the United States. In less than four months, the US oil directed rig count fell by 75% to 180 – the lowest level on record.

Shale wells enjoy strong initial production rates but suffer from sharp subsequent declines. Basin production falls quickly unless new wells are constantly drilled and completed to offset the base declines. Considering US shale production was already falling sequentially back in November of 2019 when the rig count was above 700. Today’s 373 rigs all but guarantee production will collapse going forward.

Low prices have led to a sharp drilling slowdown in the rest of the world as well. Between February and June of 2020, the non-US rig count fell by 40% to 800 – also the lowest on record. We have often written about the depletion problem facing the non-OPEC+ world outside of the US shales. Over the last decade, this group has seen production decline slowly and steadily as a dearth of new large projects has not been enough to offset legacy field depletion. By laying down half their rigs, this group ensured that future production would be materially impacted.

Analysts continue to focus their attention on what has already happened (the shutting-in of existing production) instead of looking at what is yet to come. The unprecedented drilling slowdown is only now starting to impact production. Going forward, supply will plummet leaving the market in an extreme deficit starting now.

This blog was an excerpt from our broader white paper Top Reasons to Consider Oil-Related Equities. If you are interested in reading more about this topic, please download the white paper below.

http://info.gorozen.com/top-reasons-to-consider-oil-related-equities?hsCtaTracking=47e6c6b6-cc98-4b4f-9d15-7a5d50ca23d5%7C5cf430a6-e13b-40f4-8869-9ce96f4b8a19

The Energy Cliff - The End of Oil | Steve St Angelo + Nicholas Trinkett

A dive into the world of oil production and demand with two interesting perspectives. Both provide lots of detailed data to help predict the future of oil and energy in this fast changing sector.

Peak Oil in South & Central America

By Matt Mushalik, originally published by Crude Oil Peak

January 5, 2021

https://www.resilience.org/stories/2021-01-05/peak-oil-in-south-central-america/

UK North Sea Summary Part I: Licensing, Drilling, Discoveries and Development

12/25/2020

George Kaplan Natural Gas Production, North Sea, Oil Production, Reserves and Resources

http://peakoilbarrel.com/uk-north-sea-summary-part-i-licensing-drilling-discoveries-and-development/?fbclid=IwAR0pUHnjGDv9z6vDaBfvB-CtStNl2oJhny4hl2SNRGWEfV9SjLkp7EPC7CA

Chef José Andrés urges Biden to think of food as 'national security issue' as millions go hungry

https://finance.yahoo.com/news/chef-jose-andres-urges-biden-to-think-of-food-as-national-security-issue-as-millions-go-hungry-114232107.html

“We need to have somebody near the president, near the power centers that thinks of food as a national security issue. The same way that September 11 happened, the same way that this pandemic happened one day we may be in a moment where all that food that looks plentiful right now is not there anymore,” Andrés said. “Let's make sure we give the importance to food it deserves. The most important energy on planet Earth is not oil. Oil only moves my car. The most important energy on this planet is food, more food moves all of us.”

The money printing is working and the dollar is in good shape so we are not going to plunge into a depression.Yes there is pain but not enough damage being done to bring the system down.Food issues will improve as checks are being issued and the Biden/Harris team will likely address food deserts and expand food stamps.There may even be a Secretary of Food. Secretary of Food article by José Andrés: https://www.nytimes.com/2020/12/08/opinion/covid-pandemic-food-crisis.html?auth=login-google1tap&login=google1tap I am a chef who believes in feeding the many, not just the few. So when quarantines were first introduced around the United States earlier this year, my team at World Central Kitchen, a network of chefs and community organizers stationed around the globe, looked for places where we could feed the masses affected by the combined crises of the pandemic and the recession that it has caused.

You didn’t need to be a genius to find them. The communities suffering most from the effects of Covid-19 are those suffering most from the effects of poverty and economic injustice — places like the Navajo Nation in the American West, which is larger in area than 10 of our states but often remains forgotten when we tell the American story.

For a fraction of the cost of an industry bailout, we can upgrade public school kitchens across the United States and pay the real cost of a free and nutritious school lunch. In times of disaster, our schools can become community kitchens; there are still food deserts in this country, but there are few school deserts. We can dramatically improve the health of our most vulnerable families by improving the food supplies in our corner stores and in our classrooms.

Rather than relying on private donors to fund charities and nonprofits, we can spend federal funds to get our cafes and restaurants back on their feet while the Federal Emergency Management Agency pays for real food programs. We can target our subsidies toward smaller farms and farmers selling healthier foods to their local markets. More than a century after Upton Sinclair’s revelations about the squalid conditions of meatpacking plants in Chicago, we can improve life for our essential workers not only in the fields but in those same plants today.Above all, we can prioritize and streamline food policy under a new cabinet-level Secretary of Food and Agriculture, with a seat on the National Security Council and a mission to improve our nation’s sustenance. We know that a poor diet leads to poor health, so while we wait for new coronavirus vaccines and therapies, improving the quality of our nourishment is the best way to improve our health. We need to prepare not just for recovery but for the next pandemic and the catastrophic threats represented by the climate crisis. By doing so, we can heal much more than hunger.

In central California, in the middle of the pandemic, my team was preparing meals for some members of the United Farm Workers, who pick America’s crops. “We work so hard so that people can get food on their tables. And yet we are the ones who do not have food for ourselves,” said Carolina Elston, who picks blueberries and table grapes. “Receiving this food is a recognition of how hard we work and contribute to the well-being of the country.”

Food is the fastest way to rebuild our sense of community. We can put people back to work preparing it, and we can put lives back together by fighting hunger. We need to hope for a better world in 2021, and there’s nothing more hopeful than the thought of sharing our food, and feeding a nation.

José Andrés is a chef and the founder of World Central Kitchen.

Before the pandemic, I believed there was a possibility to achieve many things. BUT Covid-19 has wrecked the economy and our debts at all levels of our nation will balloon in attempting a recovery.

I have been elated over gardening starting to mushroom in popularity, although it takes at least 10 to build and continually refine a garden to maximum production. I set the example in my part of the country, but few follow me. If local food shortages begin to develop, I will contact my mayor and propose that playgrounds be turned into Victory gardens, except for a small kids area of swings etc., where the kids can play and see food actually growing in the ground, instead of seeing food on grocery shelves.

There will be many sector collapses, but I have an open mind to a better future. You have to have that attitude in being a gardener.

Thanks for the book recommendation!

sumi

Interesting article that deserves to be addressed.I think we will find a good energy usage mix that will work for 50-100 years until better energy solutions emerge.We will continue to use crude oil and all it's products just at a sustainable rate that allows us to avoid a peak oil production crash.The ev/nuclear solution isn't expected to eliminate crude oil use just offset it for a time.We need to continue industrial growth and bring modern farming to all regions which requires modern farming vehicles and fertilizers.We can do this.America did it.We lost forests and now we have new forests.We will adjust!"Apocalypse Never" by Michael Shellenberger is a must read.He covers food production,plastics,global warming hysteria and nuclear power.There are real reasons to be hopeful.Social justice,economic and spiritual issues are being addressed.Yes they are.Enjoy the book!

One Little Problem With The "All-Electric" Auto Fleet: What Do We Do With All The "Waste" Gasoline?

by Tyler Durden

Monday, Dec 14, 2020 - 17:40

Authored by Charles Hugh Smith via OfTwoMinds blog,

https://www.zerohedge.com/technology/one-little-problem-all-electric-auto-fleet-what-do-we-do-all-waste-gasoline?fbclid=IwAR0lFWYXDvYTTqZx9DbKVkMuX0QnS7SbQrca4iYOtos8yhPsqOiS633hI3Y

The title of this board, Peak Oil - Epochal Event of Our Lives, purposely includes the word epochal, meaning without parallel.

Why will Peak Oil be without parallel?

Look at past events in the Middle East, which interrupted the supply of oil throughout the world and especially in the United States. These disruptions were geopolitical events and were ultimately resolved with diplomacy.

Peak Oil, on the other hand, will be a geological event, something that mankind has never faced before and certainly cannot control. It will inevitably occur when world oil production has reached its maximum capacity, as oil is a finite resource.

Illustrated below is Hubbert's Curve, which shows the growth, peak, and decline of worldwide, regional, and individual wells. This sequence continues to occur as world population dramatically increases and as Asia, in particular, accelerates its industrialization and its citizenry expands car ownership.

HUBBERT CURVE

Regional Vs Individual Wells

Peak Oil will adversely affect many aspects of our lives. For example, over the last 100 years, gas powered engines have contributed to the discovery and expansion of the automobile and airplane industries. Recently the population of the United States reached 300 million and vehicles now total 225 million. Future population growth, with a corresponding increase in vehicles, will further deplete oil supplies.

Agriculture has changed from numerous labor and animal-intensive family farms to a machine-intensive industry primarily controlled by corporations. Further, much of the increased productivity of farm soil emanates from petroleum-based fertilizers.

Transportation and agriculture are just two segments of society that must adjust to prospective oil declines. The critical question is how will our entire society adjust to a worldwide oil scarcity.

M. King Hubbert, a Shell geologist, predicted in 1956 that oil production in the United States would peak between 1965 to 1970. In hindsight, it did peak in 1970.

Mr. Hubbert's warning was given, yet it has been largely ignored. Oil discoveries and plentiful oil reserves in Alaska and the North Sea made many people complacent. In addition, new technologies were developed, so that oil was sucked up from the earth as if by giant straws. Although oil was abundant in the 1980's and 1990's, reserves in this century are in demonstrable decline.

China, in particular, recognizes the potential shortage of oil. It canvasses the world making oil deals to secure its energy future. It is also currently building 30 nuclear reactors and 7 hydroelectric dams to supplement its energy needs.

Sadly, the United States lingers behind. Its attitude seems to be that oil will always be abundant, probably because it has been in the past. Even with the dramatic crude oil price increases of the past three years, there still is a reluctance to confront this potential problem.

PURPOSE OF THIS BOARD

One purpose of this board is to provide I-Hub members with a repository of Peak Oil articles. Hopefully these will stimulate interest in the topic and I invite readers to post their thoughts.

Another important purpose of this board is to help people in preparing for or coping with the Peak Oil event. To this end, various links by category have been supplied below.

Good luck!

sumisu

========================================================================

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

TABLE OF CONTENTS :

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

GETTING READY FOR PEAK OIL & SUSTAINABLE LIVING

A companion #board-9881 titled "SUSTAINABLE LIVING FOR CHALLENGING TIMES" was spun off from this board to provide an archive of postings and sources of information which will aid individuals and communities to adopt and survive in a world of declining energy resources.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

PEAK OIL READING LIST FROM JIM PUPLAVA

http://www.financialsense.com/resources/peakoil.html

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

PEAK OIL SITES, BLOGS, & ORGANIZATIONS

Peak Oil Clock http://sydneypeakoil.com/peak_oil_clock/

ASPO - USA http://www.aspo-usa.com/index.php?option=com_frontpage&Itemid=35

ASPO - INTERNATIONALhttp://www.peakoil.net

Beyond Oil, The View from Hubbert's Peak by Kenneth S. Deffeyes http://www.princeton.edu/hubbert/index.html

Dry Dipstick http://www.drydipstick.com

Energy Balance http://tinyurl.com/42awvh

Energy Bulletin http://www.energybulletin.net/

Energy Bulletin: Peak Oil Primer and Links http://www.energybulletin.net/primer.php

Energy Outlook http://energyoutlook.blogspot.com/

Global Public Media - Public Service Broadcasting For A Post Carbon World http://globalpublicmedia.com/

Life After the Oil Crash http://www.lifeaftertheoilcrash.net/

National Petroleum Council http://www.npc.org

NEI Nuclear Notes http://neinuclearnotes.blogspot.com/

Peak Oil Design http://peakoildesign.com/

Peak Oil News & Message Boards http://www.peakoil.com/

PLENTY http://www.plentymag.com/

Post Carbon Institute http://www.postcarbon.org/

Simmons & Company International http://www.simmonsco-intl.com/research.aspx?Type=msspeeches

The Coming Global Oil Crisis http://www.oilcrisis.com

The Oil Drum http://www.theoildrum.com/

The View From The Peak http://www.theviewfromthepeak.net

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

NARRATIVE LINKS

Peak Oil FAQ #msg-33046927

Peak Oil Report by Peak Oil Associates International #msg-32147901

Evolutionary psychology and peak oil #msg-30634038

Roscoe Bartlett Discusses His Special Order Speeches #msg-29893771

OIL SHOCK AND ENERGY TRANSITION by Andrew McKillop, May 7, 2008 #msg-29196735

Energy Bull Market Fundamentals Remain Strong, Chris Puplava, 2008 http://tinyurl.com/5nze3h

The Truth About Oil by Vasko Kohlmayer, 05 08 08 http://tinyurl.com/3guotj

The Gospel According to Matthew, by Mimi Swartz, 02/01/08 #msg-26286577

Another Nail in the Coffin of the Case Against Peak Oil, Matt Simmons, Nov 2007

http://www.simmonsco-intl.com/files/Another%20Nail%20in%20the%20Coffin.pdf

Megaprojects update: Just how close to Peak Oil are we? 10/18/07 Chris Skrebowski: Trustee of the Oil Depletion Analysis Centre http://tinyurl.com/33rl3q

Crisis, what energy crisis? Euan Mearns, The Oil Drum: Europe. 07/03/07 Over 50 links to Oil Drum articles from the past year are provided which combined provide a comprehensive overview of the issues surrounding peak oil and energy decline. http://www.energybulletin.net/31608.html

On the Precipice: Energy Security & Economic Stability on the Edge - by Daniel Davis 07/17/07 http://www.aspo-usa.com/assets/documents/Danny_Davis_On_the_Precipice.pdf

Evolutionary psychology and peak oil: A Malthusian inspired "heads up" for humanity. by Dr. Michael E. Mills http://www.drmillslmu.com/peakoil.htm

Peak oil: Facts converge with theory http://tinyurl.com/2gtud4

11 incontrovertible truths of oil production & peak oil arguments by PeakEngineer, 05/23/07 #msg-19902674

Peak Oil, Carrying Capacity and Overshoot: Population, the Elephant in the Room, © Copyright 2007, Paul Chefurka http://www.paulchefurka.ca/Population.html

CRUDE OIL Uncertainty about Future Oil Supply Makes It Important to Develop a Strategy for Addressing a Peak and Decline in Oil Production, GAO Report, 03/29/07 http://www.gao.gov/new.items/d07283.pdf

DIE OFF - a population crash resource page http://www.dieoff.com/index.html

Portland, Oregon City Council unanimously creates a peak oil task force - 05/10/06 http://www.portlandpeakoil.org/

Testimony before the Australian Senate by Dr. Samsam Bakhtiari, a senior expert employed by the National Iranian Oil Company (NIOC), 07/11/06 http://www.aph.gov.au/hansard/senate/commttee/S9515.pdf

The Hirsch Report - February 2005 #msg-10310387

The Financial Sense Energy Resource Page http://www.financialsense.com/energy/main.htm

Financial Sense Big Picture Archive http://www.financialsense.com/fsn/2006.html

OIL: A TRAVELOGUE OF ADDICTION by Chicago Tribune, 07/29/06 (Suggested viewing: Open link and click on Watch documentary, left-hand column). http://tinyurl.com/h78ve

Exploring emotional reactions to peak oil by Kathy McMahon http://www.energybulletin.net/19718.html

Denial Of Energy Crisis Is A Conditioned Response, By Dave Wheelock #msg-25561271

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Hubbert peak theory From Wikipedia, the free encyclopedia http://en.wikipedia.org/wiki/Peak_oil

A Tribute To M. King Hubbert http://www.hubbertpeak.com/Hubbert/

Outlook for Fuel Reserves http://www.mkinghubbert.com/files/hubbert_1974.pdf

Nuclear Energy and the Fossil Fuels by M. King Hubbert, 1956 Published on 8 Mar 2006 by Energy Bulletin. Archived on 8 Mar 2006. http://www.energybulletin.net/13630.html

Shell Execs Briefed on Peak Oil in 1956

EXPONENTIAL GROWTH AS A TRANSIENT PHENOMENON IN HUMAN HISTORY

http://www.hubbertpeak.com/Hubbert/wwf1976/

Are we at the peak of oil production? #msg-39230370#msg-29389791

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

ROBERT L. HIRSCH

The Hirsch Report - February 2005 #msg-10310387

Robert L. Hirsch from Wikipedia - http://en.wikipedia.org/wiki/Robert_L._Hirsch

Robert Hirsch - Peak Oil Video - #msg-33832912

FSN: Energy Roundtable: Jim Puplava, Matthew Simmons, Robert L. Hirsch, & Jeffrey G. Rubin Discussion - 02/02/08 http://www.financialsense.com/Experts/roundtable/2008/0202.html

Dr. Robert Hirsch: "We Are Staring Directly Into An Energy Storm in The Next 2-3 Years"

#msg-69993495

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Simmons & Company web site

http://www.simmonsco-intl.com/research.aspx?Type=msspeeches

Book Review: Twilight in the Desert - The Coming Saudi Oil Shock and the World Economy by Matthew R. Simmons

Read more: http://blogcritics.org/books/article/book-review-twilight-in-the-desert/#ixzz0nXMuOsbg

Peak Oil Solution: The Simmons Plan

http://blogs.forbes.com/energysource/2010/02/10/peak-oil-solution-the-simmons-plan/

Presentation at 2006 Boston World Oil Conference, 10/26/2006

http://video.google.com/videoplay?docid=-429585738009344102#

President Carter's Address to the Nation On Energy Policy (April 18, 1977) Video: http://www.youtube.com/watch?v=4Y6pPF_lzsU

Transcript: http://www.pbs.org/wgbh/amex/carter/filmmore/ps_energy.html

Energy Policy and Conservation Executive Order 12003, July 20th, 1977

http://www.presidency.ucsb.edu/ws/index.php?pid=7842

Carter's Brave Vision on Energy by David Morris, Monday, October 10, 2005 by the Minneapolis Star Tribune

http://www.commondreams.org/views05/1010-27.htm

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Congressman Bartlett is leading efforts to change U.S. energy policy to address the challenges of peak oil. U.S. oil production peaked in 1970 and is in permanent decline. World oil production will also peak - perhaps disastrously soon. http://bartlett.house.gov

Congressman Roscoe Bartlett video on Peak Oil in 7 parts. . .

The House of Representatives formed a Peak Oil caucus in 2005 with 8 members: #msg-30864250

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

NATIONAL GEOGRAPHIC ON PEAK OIL

"Tapped Out" by Paul Roberts, August 2008 http://ngm.nationalgeographic.com/2008/06/world-oil/roberts-text

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

AUDIOS & VIDEOSPeak Oil - Chris Martenson http://www.chrismartenson.com/peak_oil

Twilight In the Desert http://www.youtube.com/watch?v=QfEO3PCEeis

Peak Oil - Robert Hirsch http://www.youtube.com/watch?v=qSbfvZiJ9g0

Peak Oil - Crude Impact #msg-30619202

CNN Special Investigation - OUT OF GAS #msg-30188572

91 86 90 - Peak Oil Number-Crunching http://www.youtube.com/watch?v=oC-koGwRu_A

Oil and the 'New International Energy Order' - Michael Klare, 04 14 08 http://tinyurl.com/59947u

"A conversation with John Hofmeister" - Charlie Rose, 03 25 08 http://tinyurl.com/23o8py

Video: A High-Risk Barrel, September 28, 2007 http://novakeo.com/?p=1054&jal_no_js=true&poll_id=10

Matt Savinar - Coast to Coast, 10/07 http://klrietmann.bingodisk.com/bingo/public/Savinarc2c111.mp3

A Crude Awakening http://tinyurl.com/yp88uu

Matthew Simmons on Peak Oil, ASPO Conference at Boston University 10 27 06 http://video.google.com/videoplay?docid=-429585738009344102&q=peak+oil'

Dr. Kenneth Deffeyes on Peak Oil, 2005 Energy Conference - http://video.google.com/videoplay?docid=2992397199507996758&hl=en

Peak Oil, Richard Heinberg, 09/11/06 http://video.google.com/videoplay?docid=-2141508903056009420

Peak Oil: Fireside Chat with Julian Darley - http://video.google.com/videosearch?hl=en&q=julian%20darley%2C%20boston%20world%20oil%20conference&um=1&ie=UTF-8&sa=N&tab=wv#q=julian+darley&hl=en&emb=0

Peak Oil & The Party's Over http://www.youtube.com/watch?v=0Xl3J4Kpy88&feature=PlayList&p=F39AC0DCDA7ADEC2&index=0&playnext=1

Peak Oil: Gas Prices, Supply Depletion & Energy Crisis: From NewCulture.org, 07 27 06 http://www.youtube.com/watch?v=DMQd5nGEkr4&mode=related&search

The Long Emergency: Surviving Catastophies of the 21st Century, 10 30 05 http://tinyurl.com/2g6p35

Real Oil Crisis - 11 24 05 (Video Presentation) http://www.abc.net.au/catalyst/stories/s1515141.htm

The Geopolitical Consequences of Peak Oil: Michael Klare, 10 27 06 http://video.google.com/videoplay?docid=-3121561902567229690&hl=en

The End of Suburbia http://www.youtube.com/watch?v=Q3uvzcY2Xug&feature=related

World Made By Hand (Video Promo) http://www.youtube.com/watch?v=PbEe8v4YpgA

T. Boone Pickens on CNBC [discusses alternative energies] http://www.youtube.com/watch?v=ylI4iQ-5iXg

Dr. Al Husseini, retired head of exploration and production for Saudi Aramco, interview with CNBC on 03/27/08: http://www.cnbc.com/id/15840232?video=697807590&play=1

RICHARD HEINBERG on OUR POST-CARBON FUTURE http://tinyurl.com/636juw

Megan Quinn Bachman - Peak Oil, Community & The Future in four parts:

Calm Before the Storm, Richard Heinberg http://www.youtube.com/watch?v=ajqgOCxGEAo

Running on Empty: Life Without Cheap Oil http://www.youtube.com/watch?v=Jqg3P3wOV60

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

A 10% Reduction in America's Oil Use in Ten to Twelve Years An Overlooked, Practical, and Affordable Approach Using Mature Existing Technology by Alan S. Drake, May 2006 • Rev. October 2006 http://www.lightrailnow.org/features/f_lrt_2006-05a.htm

Electrification of transportation as a response to peaking of world oil production by Alan S. Drake 12/19/05 in Light Rail Now http://www.energybulletin.net/14492.html

Public Transport Industry Issues http://www.lightrailnow.org/industry_issues.htm#electrification

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

COMMUNITY SOLUTIONS & NEW URBANISM

The Community Solution http://www.communitysolution.org/

WORLD CHANGING http://www.worldchanging.com/about/

How to Wean a Town Off Fossil Fuels http://www.worldchanging.com/archives/005135.html

A Community Solution to Peak Oil: An interview with Megan Quinn http://www.energybulletin.net/5721

Sustain Lane | The Healthy, Sustainable Living Community Resource http://www.sustainlane.com/

Culture Change http://culturechange.org/cms/index.php

Communities, Refuges, and Refuge-Communities by Zachary Nowak http://www.energybulletin.net/21172.html

Karavans - Moving Toward a New World of Self-Sufficiency, Sustainability, and Genuine Community http://www.karavans.com/peakoil.html

New Urbanism http://www.newurbanism.org/

The New Urbanisn http://www.newurbannews.com/AboutNewUrbanism.html

Online NewsHour - New Urbanism http://www.pbs.org/newshour/newurbanism/

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

OTHER NATIONS - STATUS FOR PEAK OIL

Closing the 'Collapse Gap': The USSR was better prepared for peak oil than the US - by Dmitry Orlov, 12/04/06

http://www.energybulletin.net/node/23259

The power of community: How Cuba survived peak oil - by Megan Quinn, 02/25/06 http://www.energybulletin.net/13171.html

"Flush With Energy" By THOMAS L. FRIEDMAN August 10, 2008 #msg-31394853

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

FSN: Lutz Kleveman, 01/24/04 - "The New Great Game: Blood and Oil in Central Asia"

http://www.financialsense.com/Experts/2004/Kleveman.html

FSN: Michael T. Klare, 01/15/05 - "Blood and Oil" http://www.financialsense.com/Experts/2005/Klare.html

FSN: Michael T. Klare, 6/21/08. "Rising Powers, Shrinking Planet: The New Geopolitics of Energy" http://www.financialsense.com/Experts/2008/Klare.html

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

CANTARELL OIL FIELD & DEPLETION

Cantarell Field by Wikipedia

http://en.wikipedia.org/wiki/Cantarell_Field

Cantarell, The Second Largest Oil Field Is Dying, by G.R. Morton, 08 14 04

http://www.energybulletin.net/node/1651

Cantarell Decline Perspective, Jim KIngsdale's "Energy Investment STRATEGIES" 07 08 08

http://www.energyinvestmentstrategies.com/2008/07/08/cantarell-decline-perspective/

A Storm Called Cantarell by Sean Brodrick, "Money and Markets' 09 03 08

#msg-31902352

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Export Land Medel by Wikipedia

http://en.wikipedia.org/wiki/Export_Land_Model

What the Export Land Model Means for Energy Prices By: Doug Casey, Casey Research LLC, 06 04 08 http://www.321energy.com/editorials/casey/casey060508.html

An Update on Mexico Export Land Model by GraphOilogy 01 22 08

http://graphoilogy.blogspot.com/2008/01/update-on-mexico-export-land-model.html

Oil Outlook: "Export Land Model" by Jeff Rubin on CNBC, October 2007

http://www.youtube.com/watch?v=9Ed9jsKAOHU

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

CHARTS AND ILLUSTRATIONS OF INTEREST

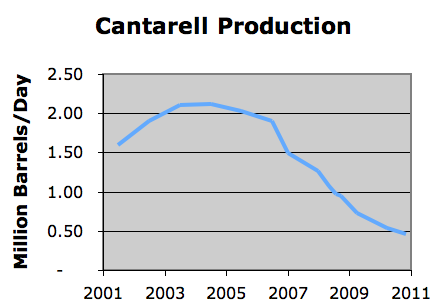

A significant example of collapsing oil production is Cantarell, recently the largest oil field in the Western Hemisphere. From over 2 million barrels per day in 2004-2005, Cantarell is now producing at around 700,000 barrels per day. [credit chart to energycrisis.com]

The amount of oil you can produce can only ever equal the amount of recoverable oil you discover. The area under both curves must eventually be equal. [ http://futureproofkilkenny.org/?page_id=110 ]

[source: http://tonto.eia.doe.gov/oog/info/gdu/gasdiesel.asp

| Explanation of Terms | |

| Gasoline Pump Data History | |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |