Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Google Romney going to jail ![]()

http://www.dailypaul.com/247860/attorney-richard-gilbert-could-romney-go-to-jail-for-85-billion-fraud

SEC Charges Boiler Room Operators in Penny Stock Manipulation Scheme

01/26/2012 04:24 PM EST

SEC Charges Boiler Room Operators in Florida-Based Penny Stock Manipulation Scheme

FOR IMMEDIATE RELEASE 2012-18

Washington, D.C., Jan. 26, 2012 – The Securities and Exchange Commission today charged a Fort Lauderdale-based firm and its founder with conducting a fraudulent boiler room scheme in which they hyped stock in two thinly-traded penny stock companies while behind the scenes they sold the same stock themselves for illegal profits.

The SEC alleges that First Resource Group LLC and its principal David H. Stern employed telemarketers who fraudulently solicited brokers to purchase stock in TrinityCare Senior Living Inc. and Cytta Corporation. While recommending the securities in these two microcap companies, Stern sold First Resource’s shares of TrinityCare and Cytta stock unbeknownst to investors who were purchasing them – a practice known as scalping. As Stern was selling the stocks, he also purchased small amounts in order to create the false appearance of legitimate trading activity and induce investors to purchase shares in both companies.

“First Resource and Stern used a telephone sales boiler room to make inflated claims and defraud investors while simultaneously manipulating the price of the stocks and making profits for themselves,” said Eric I. Bustillo, Director of the SEC’s Miami Regional Office. “The SEC will continue to aggressively pursue perpetrators of microcap stock fraud schemes that hound potential investors to buy stock.”

Since the beginning of fiscal year 2011, the SEC has filed more than 50 enforcement actions for misconduct related to microcap stocks, and issued 63 orders suspending the trading of suspicious microcap issuers. Microcap stocks are issued by the smallest of companies and tend to be low priced and trade in low volumes. Many microcap companies do not file financial reports with the SEC, so investing in microcap stocks entails many risks. The SEC has published a microcap stock guide for investors and an Investor Alert about avoiding microcap fraud perpetrated through social media.

According to the SEC’s complaint filed against Stern and First Resource in U.S. District Court for the Southern District of Florida, they violated federal securities laws by acting as unregistered broker-dealers. Stern hired and trained First Resource’s salespeople and gave them information about TrinityCare to prepare sales scripts and pitch the stock to potential investors. Stern reviewed the draft scripts, made edits, and approved the scripts before the salespeople were allowed to use them.

The SEC alleges that Stern gave the salespeople a list of potential investors to cold call and pitch the stocks. First Resource’s salespeople falsely claimed TrinityCare stock “is going to be $5-7 in 6-12 months” and the company “is going to be a half-a-billion dollar company in five years or roughly a $40 stock.” Stern also disseminated a research report on Cytta to investors and falsely touted: “Sales projections for 2010-2014 should exceed $500 million with a pre-tax net of over $400 million.”

The SEC’s complaint alleges that First Resource Group and Stern violated Section 17(a) of the Securities Act of 1933, and Sections 10(b) and 15(a) of the Securities Exchange Act of 1934 and Rule 10b-5. The SEC is seeking permanent injunctions, disgorgement plus prejudgment interest, and financial penalties as well as a penny stock bar against Stern.

The SEC’s investigation was conducted by Jorge L. Riera under the supervision of Elisha L. Frank in the SEC’s Miami Regional Office in coordination with an examination of First Resource conducted by Anson Kwong, Michael J. Nakis, George Franceschini, and Nicholas A. Monaco of the SEC’s Miami office. Edward D. McCutcheon will lead the SEC’s litigation efforts.

The SEC’s investigation is continuing.

# # #

For more information about this enforcement action, contact:

Eric I. Bustillo, Regional Director

Glenn S. Gordon, Associate Regional Director

Elisha L. Frank, Assistant Regional Director

Edward D. McCutcheon, Senior Trial Counsel

SEC Miami Regional Office

(305) 982-6300

Source: http://content.govdelivery.com/bulletins/gd/USSEC-28255b

Max - Thank you for your reply. I'm not a member so can't respond privately. I share you concerns (unrelated to Tytan). Happy holidays to you and yours as well.

Max - You've left TYTN. I see that you have VUIFinancial down as one of the crooked IR firms which TYTN had used but supposedly fired. Would you be willing to share what led to your seeming change of heart with TYTN (besides the .0002 share price)?

TIA

Add Robert Thayer of SMVI. Blatant scam of a company. Some DD by other scammed investors (including myself) uncovers that Thayer is a crook. See the SMVI IHub board.

The company is now dark (OTCMarkets.com) and so is investors' money.

SEC Toughens standards for Reverse Merger Companies

SEC Approves New Rules to Toughen Listing Standards for Reverse Merger Companies

FOR IMMEDIATE RELEASE 2011-235

Washington, D.C., Nov. 9, 2011 — The Securities and Exchange Commission today approved new rules of the three major U.S. listing markets that toughen the standards that companies going public through a reverse merger must meet to become listed on those exchanges.

Additional Materials

NYSE Amex Notice and Order

http://www.sec.gov/rules/sro/nyseamex/2011/34-65710.pdf

NYSE Notice and Order

http://www.sec.gov/rules/sro/nyse/2011/34-65709.pdf

NASDAQ Notice and Order

http://www.sec.gov/rules/sro/nasdaq/2011/34-65708.pdf

Currently, reverse merger companies like other operating companies can pay to be listed on an exchange, where investors can purchase and sell shares of the company. In some cases, regulators and auditors have greater difficulty obtaining reliable information from reverse merger companies, particularly those based overseas. Reverse mergers permit private companies, including those located outside the U.S., to access U.S. investors and markets by merging with an existing public shell company.

In summer 2010, the SEC launched an initiative to determine whether certain companies with foreign operations – including those that were the product of reverse mergers – were accurately reporting their financial results, and to assess the quality of the audits being done by the auditors of these companies. The SEC and U.S. exchanges have in recent months suspended or halted trading in more than 35 companies based overseas citing a lack of current and accurate information about the firms and their finances. These included a number of companies that were formed by reverse mergers. In June, the SEC issued an investor bulletin warning investors about companies that engage in reverse mergers.

“Placing heightened requirements on reverse merger companies before they can become listed on an exchange will provide greater protections for investors,” said SEC Chairman Mary L. Schapiro.

Under the new rules, Nasdaq, NYSE, and NYSE Amex will impose more stringent listing requirements for companies that become public through a reverse merger. Specifically, the new rules would prohibit a reverse merger company from applying to list until:

- The company has completed a one-year “seasoning period” by trading in the U.S. over-the-counter market or on another regulated U.S. or foreign exchange following the reverse merger, and filed all required reports with the Commission, including audited financial statements.

- The company maintains the requisite minimum share price for a sustained period, and for at least 30 of the 60 trading days, immediately prior to its listing application and the exchange’s decision to list.

Under the rules, the reverse merger company generally would be exempt from these special requirements if it is listing in connection with a substantial firm commitment underwritten public offering, or the reverse merger occurred long ago so that at least four annual reports with audited financial information have been filed with the SEC.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=68837051 (posted by scion)

thanks its all team effort to show scams

SEC Microcaps Roundtable "NOTES & Hilites"

Roundtable on the Execution, Clearance and Settlement of Microcap Securities

Roundtable Agenda

U.S. Securities and Exchange Commission

100 F Street N.E. Washington, DC

Station Place I Multipurpose Room

October 17, 2011

1:00 p.m. Call to Order and Opening Remarks: Chairman Mary Schapiro and Robert Khuzami, Director of the Division of Enforcement

Panel 1 — Compliance Challenges Associated with Microcap Securities

Moderator: Peter Curley, Associate Director, Division of Trading and Markets.

Panelists:

Claire Santaniello — Managing Director and Chief Compliance Officer, Pershing

Mihal Nahari — Chief Compliance Officer, The Depository Trust & Clearing Corporation (“DTCC”)

Thomas Merritt — Senior Managing Director, Deputy General Counsel and Corporate Secretary, Knight Capital Group

Steven Nelson — Chairman, Continental Stock Transfer and Trust Company

Marvin Pickholz — Partner, Duane Morris

Brian Lebrecht — Founder, The Lebrecht Group, APLC

David Chapman — Director, Department of Market Regulation, FINRA

Panel 2 — Anti-Money Laundering Monitoring

Moderator: Sarah Green, Bank Secrecy Act Specialist for the Office of Market Intelligence

Panelists:

Betty Santangelo — Partner, Schulte Roth & Zabel

Susan DeSantis — Managing Director and Deputy Chief Compliance Officer, DTCC

Lynne Johnston — US Head of Anti-Money Laundering Compliance, RBC Capital Markets

Harold Crawford — Global Director of Anti-Money Laundering & Sanctions, Brown Brothers Harriman & Co.

Aaron Fox — Managing Director, IPSA International Inc.

Jeff Horowitz — Managing Director and Chief Anti-Money Laundering and OFAC Officer, Pershing

Bill Park — Director, FINRA Department of Enforcement

Panel 3: Potential Changes to the Regulatory Framework Concerning Microcap Securities

Moderator: John Polise, Associate Director, Office of Compliance, Inspections and Examinations.

Panelists:

David Feldman — Partner, Richardson & Patel LLP

Susan Merrill — Partner, Bingham McCutchen

Chris Stone— Vice President of Equity Products, FINRA

Susan Grafton — Of Counsel, Gibson, Dunn & Crutcher

Walter Van Dorn — Partner, SNR Denton US LLP

R. Cromwell Coulson — President, Chief Executive Officer and Director, OTC Markets Group

NOTES and Hilites

All panelists agreed that there needs to be communication and transparency between the agencies to be proactive in routing out pump and dump schemes, the selling of unregistered or questionably registered securities, and microcap fraud.

The Gatekeepers of the DTCC have taken affirmative steps to CHILL many stocks that have suspicious trading activities of allegedly unregistered securities or improperly exempted from registration securities. The DTCC does not have the authority to initiate questions to a Security so the DTCC chills a Security until the chilled Security contacts them and remediates the concerns. The DTCC does not advise any Security or the inquiring public on specific remedies or processes to remove a chill because the " bad actors " would quickly find loopholes and other deceptions to circumvent a DTCC Chill.

A panelist commented that due diligence is a " nonsense phrase " when the trustworthiness of the source is highly questionable, and Legal Opinions should be presumed to be worthless because too many lawyers predicate their Legal Opinions on the trustworthiness of the Issuer without conducting any vetting of the Issuer's information which is often false. It was recommended that the SEC impose strict reqirements on Lawyers who write Legal Opinions to thoroughly vet Transfer Agents and Issuers to ensure their Legal Opinions are accurate.

The DTCC have in place a Risk Assessment team to detect suspicious trading activities involving unregistered securities and questionably exempt from registration securities citing severe concerns about Legal Opinion Letters improperly exempting securities from registration. The DTCC raised concerns about Issuers " lawyer shopping " to find a lawyer who will do the Issuer's bidding without any vetting whatsoever and recommended mandatory rules for Lawyers to follow....or many more Issuers can expect DTCC CHILLS. At the onset of clearance and settlement issues the DTCC's Risk and Assessment can and are invoking CHILLS. Securities that originate onshore and then go offshore to avoid registration and to hide share originations are deceptive practices of offenders, particularly repeat offenders. The DTCC suggested that more SEC Suspensions would be even more effective than DTCC Chills once SARs have triggered.

Various panelists talked about red flags and the necessity for Gatekeepers ( eg Broker Dealers, Transfer Agents, Clearing Firms ) to file SARs ( Suspicious Activity Reports ) to the SEC and DTCC on all suspicious trading activities that invariably involve the selling of unregistered or questionably registered shares. The panel agreed that any microcap company that changes business operations should be cause for a SARs. SEC Chairman Schapiro said that one SARs may not be cause for a Suspension or an Inquiry but she exampled that 3 SARs from various Gatekeepers could. She (and other panelists ) state that SARs are accelerating from 578 reports in 2006 to over 1600 in 2011.

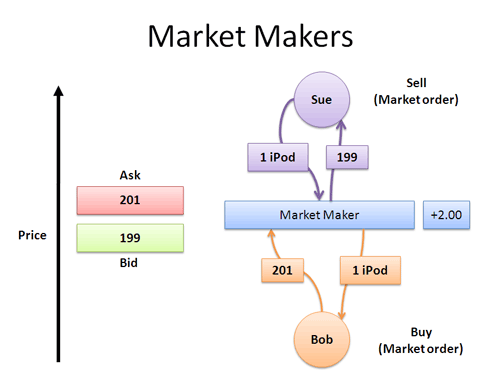

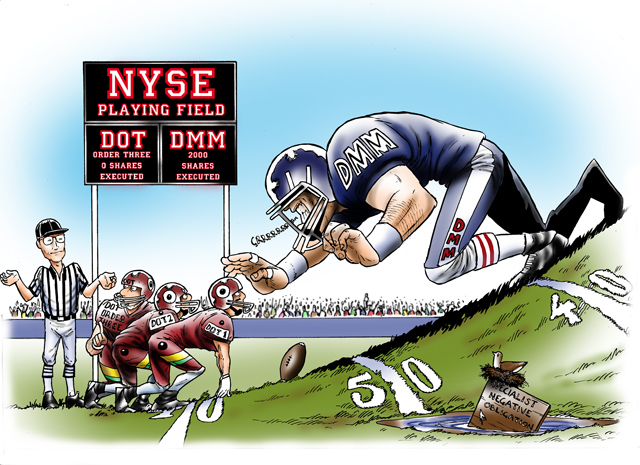

Knight Securities stated that Marker Makers have limited resources to discover information on any Issuer and suggested a collective, central base of information be available for all Gatekeepers to access.

The Division of Enforcement and Anti-Money Laundering ( AML ) expect to implement a central repository of information for all Gatekeepers to access. The objective is to identify ALL suspected and proven offenders and to stop repeat offenders who have been successful at starting up new enterprises after a previous enterprise has expired or been routed out as a fraud.

The Division wants ALL non-reporting Issuers to file timely financials and to conduct a yearly audit. The Division wants OTC stocks to file legal disclosures since company disclosures on websites and via news releases can be deceptive.

Panelists noted that an increasing number of Broker Dealers are refusing to allow trading on non-reporting Securities for all of the aforementioned reasons. Regulation Notice 0905 alerts B.D.'s that they may be wittingly or unwittingly selling unregistered Securities or improperly exempted from registration Securities of Issuers and family / friends of Issuers. Bottom line to B.D.'s is to vet all securities for sale.

Cromwell Coulson, CEO of the OTC Group plauded the tier system for being an excellent resource for the SEC to investigate SARs, conduct Investigations, and invoke Suspensions. Coulson advocated for mandatory requirements for Transfer Agents to file all increases in shares of an Issuer.

Coulson stated the OTC Group has a published list of Lawyers who have written questionable Legal Opinion Letters.

Coulson stated the OTC Group has been given more authority to request additional information from all Issuers, and the OTC Group is downgrading an increasing amount of Issuers to Caveat Emptor for failure to provide requested information.

Coulson recommended that Transfer Agents be required to post accurate Outstanding Shares and to post all officers and directors of Issuers.

Coulson recommended that insiders and promoters be restricted from selling new share issuances for one year.

Coulson stated that even with all the warnings and protections the OTC Group provides that they " can't protect dumb investors ".

Closing statements from various panelists addressed dead shells being used to commit microcap fraud, and that vastly improved technologies allow viral frauds to happen quicker than can be detected, therein the need for a central repository for all Gatekeepers to access to identify the repeat offenders in order to expose a current fraud and take action BEFORE they can start their next fraud.

Panelists also discussed recent Bankruptcy companies where the SEC cannot access vital information and whereby the fraudsters are disseminating false information to manipulate the stocks.

The SEC has accelerated Suspensions of some BK stocks. General Motors was a cited example of stock manipulation and the SEC's delisting of GM stock.

The panel also recommended that Issuer websites be regulated because too many issuers disseminate false information.

The panel stated that SEC reporting microcaps are becoming a favorite of the fraudsters and schemers because they find ingenious ways to defraud on the strength of the reporting company's apparent legitimacy.

Many other comments were made throughout the Roundtable so interested persons should listen to the broadcast.

SEC Roundtable on MicroCaps "Video" has been archived now. It's worth listening to even if it's over 3 Hrs long :)

Roundtable on the Execution, Clearance and Settlement of Microcap Securities Monday, October 17, 2011

http://www.sec.gov/news/otherwebcasts/2011/microcaproundtable101711.shtml

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=68186849 (posted by Janice Shell)

U.S. SECURITIES AND EXCHANGE COMMISSION

Litigation Release No. 22126 / October 14, 2011

Securities and Exchange Commission v. Joseph P. Cillo, Civil Action No. 8:11-cv-02320 (M.D. Fla. October 14, 2011)

On October 14, 2011, the Securities and Exchange Commission (“Commission”) filed a Complaint for Injunctive and Other Relief (“Complaint”) in the United States District Court for the Middle District of Florida in Tampa against Joseph P. Cillo (“Cillo”). This matter involves repeated violations of a penny stock bar by Cillo over a three year period from December 2007 through December 2010.

The Complaint alleges that in November 2007, through a reverse merger with a penny-stock shell company, Cillo became the CEO and controlling shareholder of eFUEL EFN Corp. (“eFUEL”), a purported web development company then based in Tampa, Florida and listed on the OTC Market Group’s “OTC Pink” market tier (formerly the “Pink Sheets”) under the symbol “EFUL.” It further alleges that in connection with an ongoing market manipulation investigation involving eFUEL and other related entities and individuals, the SEC determined that Cillo engaged in various activities related to, and for the purpose of, issuing, trading, and inducing the purchase of eFUEL’s stock. Specifically, Cillo (1) offered and/or issued hundreds of millions of shares of eFUEL stock to third-parties as purported payment for debts and services, (2) drafted and approved multiple press releases touting the company’s business plan and development prospects, and (3) prepared, signed, and submitted periodic reports to the OTC Markets Group in order to comply with the Pink Sheets’ minimal requirements for “adequate current information.” These activities constituted violations of a 1995 Commission order barring Cillo from participating in the offering of any penny stock.

The Complaint alleges that the defendant has violated Sections 21(d)(1) and (e) of the Securities Exchange Act of 1934 (“Exchange Act”) based on his violations of the previous Commission order and Section 15(b)(6)(B)(i) of the Exchange Act. The Commission seeks permanent injunctive relief, an order commanding future compliance with the Commission’s bar, disgorgement plus prejudgment interest, and civil penalties.

http://www.sec.gov/litigation/litreleases/2011/lr22126.htm

i cant pm you. what r u angry about. i hope you know better not to make decisions based on what other people say. or maybe you're just happy bc you think i lost money- thats odd.

i didnt see the tankage coming yet i managed to get out green. why havent you posted in public ever since 4/13/09?

Trade for Trade status = Good or Bad ?

"shifting any security to trade-for-trade certainly protects the interests of the existing investors and it also keeps speculative forces/players at bay from manipulating large intra day movements of the price."

Dear Friend,

There are more than one questions asked. So, to make it easier for you to understand, I am pasting your question is Italics and write my answer below it.

You had mentioned that the change to trade for trade status is not done to protect the share structure. Wouldn't this form of trade system protect the company from massive shorting or a takeover of sorts?

Yes, it is surely not to protect the share structure. But shifting any security to trade-for-trade certainly protects the interests of the existing investors and it also keeps speculative forces/players at bay from manipulating large intra day movements of the price.

Also, what did you mean when you said "No Intra day Trading Allowed"? Does this mean that one would not be able to "flip" the security, another words, make a purchase and then sell that same block in the same day?

Yes, you have correctly understood. If your purchase any security which is in trade-for-trade, you cannot sell the same security on the same day.

And one last clarification... As I read your explanation, it seems that on a CNS system it seems this is the common rolling system. If I purchase 1000 shares for 25.00 I pay 25000.00 to the brokerage firm. Then when I sell those same shares the same day I receive the 25000.00 + the extra 5.00 per share; minus any fees of course.

This also you have correctly understood. In the above given scenario, you would pay $25,000 + the brokerage on the purchase and receive $30,000 - the brokerage. However, as mentioned / explained in the preceding question, you will not be able to purchase and sell on the same day and get only the difference of the purchase and sell price.

Now, on the trade for trade scenario you mentioned I would have to pay $25,000.00 to take possession of the security, but wouldn't I have to pay anyways to receive my shares?

No, because if the security is not in trade-for-trade, then you will be able to sell the same block on the same day and get only the difference as mentioned above. However, if you decide not the sell the shares / securities on the same day irrespective of it being in trade-for-trade, ONLY THEN you will need to pay $ 25,000

Then you explained that the quantity hat I sell would "Have to be Presented for Delivery" what did you mean exactly? would I have to have a physical certificate of sorts? I did not fully understand that.

I will explain. For example, the shares you bought are in trade-for-trade. So, when you purchase the shares, you will not be able to sell it on the same day. So, it will result into "delivery". This means, you will receive shares , either physically in certificate or in dematerialized form (electronic form) in your account. Now, when you sell it, you will "Present" these shares, i.e. give these shares that you have received towards your sell.

I hope this helps...

Warm Regards,

Read more: Hello, I have a question relating to securites and trading. - JustAnswer http://www.justanswer.com/finance/4olnl-hello-i-question-relating-securites-trading.html (posted by steved_45)

Penson Important Info Links

Penson is a clearing firm for lots of discounted brokers and causing lots of problems for traders.

> Penson under investigation Over Possible Violations Of Securities Laws

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=66717518

> Multi Class Action Lawsuits Against Penson Worldwide

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=66717401

> What Triggered Pensons Problems

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=66834506

> Penson's restructuring plans & Letter of New Low price Security Policy

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=66717970

> MicroCap Stocks under a Dime "Article" (Non-DTCC / PENSON / Broker situation)

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=66687899

> Penson Discontinues Execution for Certain Non-DTCC Eligible Securities (incl. Non-DTCC stock list)

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=66063696

> Non-DTCC Eligible Search Utility

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=66063830

$POS

List of Market Makers

http://www.otcmarkets.com/otc-pink/marketActivity/market-maker-info

$TIPS

LFBG - Splitting 1 for 500. From PRE 14c filed 9/23/11:

"This Information Statement informs stockholders of actions taken and approved on September 23, 2011 by the principal stockholders of the Company’s Common Stock and Series C Preferred having the voting rights equivalency of 10,122,333,092 shares of Common Stock (collectively, the “Majority Stockholders”). The Majority Stockholders are the beneficial owners of approximately 55.04% of the issued and outstanding shares of voting capital stock of the Company. The only item approved by written consent of the Majority Stockholders was as follows:

(i)

To effect a One (1) for Five Hundred (500) reverse stock split (1:500), whereby, on October 24, 2011 (subject to FINRA review of the reverse split and its notification date to the markets), for every five hundred shares of Common Stock then owned, each stockholder shall receive one share of Common Stock, with fractional shares being rounded up the nearest whole number.

On the date of the actions taken and approved by the written consent by the Majority Stockholders, there were issued and outstanding (i) 8,379,641,409 shares of Common Stock, (ii) 3,586,245 shares of Series A Preferred Stock, (iii) 7,890,529 shares of Series B Preferred Stock, (iv) 10,000 shares of Series C Preferred Stock, and (v) 9 shares of Series D Convertible Preferred Stock (collectively, the “Preferred Stock”). Each share of Common Stock, Series A Preferred Stock and Series B Preferred Stock is entitled to one vote. Each share of Series C Preferred Stock has the voting equivalency of one million (1,000,000) shares of Common Stock which means the 10,000 issued and outstanding shares of Series C Preferred Stock have the voting equivalency to 10 billion shares of Common Stock. All of the issued and outstanding shares of Series C Preferred Stock is held by Troy A. Lyndon, the Company’s Chief Executive Officer, President and Chairman. The shares of Series D Convertible Preferred Stock have no voting rights, however, each share of Series D Convertible Preferred Stock is immediately convertible into one million (1,000,000) shares of the Company’s Common Stock."

Ways of a Market Maker: Market Maker Speaks Out

I was an OTC MM for about 10 years ending in the late 80's. Since then I have been strictly an investor. Since I have not been that up to date in MM rules I will only make statements that I feel fairly confident are still accurate regarding these activities. By and large most MM don't have a clue nor do they care to learn, about the fundamentals of the stocks they trade.

They just try to make orderly markets. When dealing with BB stocks it is very easy for a MM to get trapped into being short in dealing in a fast moving market. Reason being; most of the MM's in this stock are what are called "wholesalers" this means they don't have retail brokers "working" the stocks.

So they have to rely on what's known as the "call" from larger retail houses. If a "Big" retail firm like an E-trade calls up a market maker to purchase say 5,000 shares of a stock, they expect to get an "execution" from that market maker. If he turns them down, or only gives a partial then the "Big" firm will go to another MM.

If this second MM "fills the order" then that "Big" firm has a moral obligation to continue to give future "business" in that stock to that MM who performed (his life blood). This will go on until he "fails" to perform and so on.

Contrary to popular opinion the "Big" firms Do NOT neccessarily go to the "Low Offer" to fill a buy order (Or high bid for a sell). They "Go" to who they think will perform to fill the order and expect that MM to "match" the "low offer" in the case of a buy (bid in the case of a sell). Even though this MM might in fact be the "high bid" and not really want to sell any more.

As a wholesaler he must perform or he will get a reputation as a "non-performer" with the "Big" houses and will cease getting "calls" which means he will soon go out of business. I mentioned above that this activity is very significant to BB stocks. I say this because most of the trades in these BB stocks are "unsolicited" and are done through discount houses.

With the above groundwork laid, let me try to explain how market makers get short even if they like the Company; Lets say that a stock (shell) has been lying quietly at $.25 bid $.50 offered. A limit order comes into one of the MM's to Buy at $.50 for a thousand shares. Prior to this trade that MM may be "flat" (neither long or short any shares). He fills the order and is now short 1,000 shares. He may raise his bid hoping to find a seller to "flatten" out his position. But before he realizes it a wave of buyers have come in and cleared out all the $.50 offers. Now the stock is $.50 bid .75 offered. Here comes that "Big" firm he just sold the 1,000 shares to at .50 with another bid for 1000 at .75. He makes this print. Now he is short 2,000 at an average of .625. The market keeps moving and now its .75 bid 1.00 offered. Now he has to make a decision.

Just like investors, MM Hate to take a loss. So 9 times out of 10 he will now sell 2000 at 1.00 making him short 4000 but with an average .81. At this time he would love to see a seller at .75 so he can cover his short and make a few bucks.

But instead the market keeps moving up. Now it is 1.00 to 1.25 and here comes the buyer again at 1.25. He doesn't want to lose the call so now he needs to sell 4,000 at 1.25 to keep his break even point above the bid. Now he is short 8,000. Market moves up to 1.25 bid 1.50 offer here comes the buyer now he feels he must sell 8000 here because "stocks don't go up forever".

Now he is short 16,000. And so on and so on. If the stock keeps moving up, before he realizes it he could be short 50k or 100k shares (depending how big his bank is). _________________________

Finally the market closes for the day and on paper he may look all right in that his "break even" price may be around the closing price. But now he has to figure out how to entice sellers so he can cover this short. It is important to note that if this happened to one MM it has probably happened to most all of them.

Some ways MM's entice sellers; Run the stock up with a "tight spread" in a fast market, then "open" up the spread to slow down the buying interest. After it has "cooled off" for a little while lower the offer below the last trade right after a small piece trades on the offer then tighten the spread so that the sellers feel they can take a "quick profit" by "hitting the bid" on the tight spread.

Once the selling starts the MM's will walk it down quickly by only making small prints on the way down with the tight spread. Another way is by running the stock up in the morning, averaging up their short then use the above technique to walk it down in the afternoon.

Hopefully after doing this for several days, it will demoralize the buyers. The volume will dry up and the sellers will materialize thinking that the game is over.

Contrary to popular opinion, MM usually Do Not Cover in Fast moving markets either Up or Down if they are short. They Short More. They usually try to cover after the frenzy is out of the market. There are many other techniques they use but the above are the most popular.

This technique works about 9 times out of 10 particularly in a BB market. However that is because 9 out of 10 BB stocks are BS. Remember what I said above. Most MM's don't have a clue as to the value of a Company until they get trapped. If the Company has solid fundementals and a bright future. Then the stock will do very well. And the activity that caused the situation will prove to even help the future stock activity because it created an audience."

posted by Lowman http://investorshub.advfn.com/boards/read_msg.aspx?message_id=15625415

MARKET MAKERS SHAKEDOWN: A MUST READ!!!!!!!!

More and more investors are winning the game nowadays despite all bashers that float through the Internet that has become part of the game. Floor traders of market makers often watch CNBC, news wires and bulletin boards in order to follow the market during trading session. OTC BB market makers (MMs) don't use fundamental and technical analysis. However, what they do realize is a lot of dumb money does use this newest niche charting or TA (Technical Analysis) to run a stock either up or down. To the MMs this is like taking candy from a baby. Simply they will paint the tape and use whatever tactic to affect the charting bands. Thus the public and dumb money they will have eating out of their hands. Effectively the MMs can show a strong stock growing weak by manipulating the close price in order to generate selling volume, delaying trading time to manipulate trading activities, or even stalling the ask without honoring orders to hold a stock price.

MMs follow a simple code of business when making a market in a atock especially an OTC BB / PS. That is the level that stocks will seek that yields the most volume. Now this is very important because they make money on the volume buying at the bid and selling at the ask. In other words, by making the market they are buying low and selling high. Now smart money adheres to that rule, so do all the market makers. They could careless whether the

stock is at $22 or at $0.0002. All they care about is the action thus being able to sell stock at the offer (The high) and buy stock at the bid (The low). To increase their profitability, they make the spread as great as possible on as many shares as they can especially if the volume falls off.

When they have mostly all "buy" orders, that's not the price that's going to yield the most volume. They need both buy and sells to get the maximum action. Remember, MMs play the volume. If the volume decreases and there are mostly Buys that become a one way volume, Buy volume. So what they do is let the stock run up to a price where it runs out of steam. They fill all the buy orders there that they can and then comes the pullback one way or another naturally or induced. During the pull back they can buy tons of shares and flip them to those averaging down or trying to catch the bounce. At some price, the stock will be relatively stable and yield the most volume. Now that is the average price you will see.

The average price is the point where a stock seeks a level where MMs can profit on the most volume. So during the day that is the price that MMs and momentum/day traders want to see the stock at. Why? Because they know the public and dumb money was chasing the price thing up. Most of the time, the MMs love a flurry of Market Orders which is a dead sign of an artificial run or momentum. Merely it is money in the bank for them. Most get hung in a momentum or day trade or by the tactics of Market makers, who are in the business to screw the public every chance they get. They are merely making the market liquid is their reasoning.

The market makers have created an added complication to the OTCBB's /PS chaos of the already volatile intra-day price movements created by dumb money, momentum and day-traders. MMs can not relate to long-term holders in the OTC BB / PS. That makes absolutely no sense what so ever. They feel a large percentage of trades in the OTC BB / PS market consist of short-term or day-trades, MMs merely view the barrage of buy and sell orders as relatively neutral to the market. How they figure it is when the average dumb money buys shares in a company, the MMs feel or rather know with some certainty it is very likely that dumb money will want to sell back those shares relatively quick on the slightest drop.

Now somewhat comfortable with this logic the MMs merely short sells into the buying and attempts to take the stock down in an effort to "shake out" the weak. Since it is tough to know for sure whether a move is the beginning of a trend, or a routine shake out, this type of deception works quite well for the MMs. What the long-termers do to a stock is surprise the MMs because instead of falling, the shorting has no effect and the price goes up. Now that puts the MM at selling low through shorting and thus having to buy high in order to cover.

Boy, when this happens, the MMs are not very happy campers. The investors and traders aren't supposed to be doing that to them. Now it becomes time to pull out every trick and tactic in the book in order to attempt to get a Bear Raid at every dollar/cent mark or percent from where the stock started. Could be a fraction of a penny in smaller priced securities. What MMs do is give you a chance to make a small amount of money for your momentum and day trading style by shorting it at these levels and trying to get a bear raid each time. Each failure is compounding the MMs short position so they let it go to the next level. Now come more deliberate tactics MMs use to coerce Bear Raid or panic selling.

Once the MM is caught short and the strength of the buy is overpowering the MM will want to cover his short position. So the MMs call up one of his friendly MMs and says some like "the weather is sure rough today." The MM along with the other "friendly MM initiates a down tick about the same time. Now this can also be done with a certain amount of shares such as an infamous 100 shares flag. This down tick gives the illusion of weakness designed to hopefully begin the bear raid of selling. The fickle, fearful, day trader, momentum and short term begin to sell out allowing the MM to cover his short position at lower prices. They will move it down quickly to get it to a price of least financial damage. Problem they have is long-term investors in the OTC BB / PS. They start accumulating and buying comes flying in when they take it too far thus the MMs took it to the point of volume again and not only investors the other MMs step in the make money on the spread.

Alas the poor MM does not get to cover. Now comes various tactics like stalling, boxing, or even locking the Bid and Ask for a while. Of course, MMs aggressively deny any sort of collusion designed to fix quotes or spreads.

MMs have a vast resource of tactics and it would take probably more than a lifetime to figure them all out.

So how do investors somehow manage to overcome the obvious deception in OTCBB arena? One answer is indirection trading style by going long which the MMs do not expect. In the war between investors and public companies on the OTC BB / PS vs the MMs, if the MMs have all the advantages due to position or other factors, direct confrontation such as momentum or day trading hitting the stock is a definite death sentence.

However, an indirect approach tends to weaken the path of least resistance before slowly overcoming it. The most effective way is long-term investors slowly accumulating and holding thus drawing the MMs out of its defenses making them as naked as their short position. This is war so this slow accumulation and holding for the long term easily achieves the desired effect to force MMs to cover and knock off the tactics or bury themselves deeper.

The MMs when caught will especially use every trick and tactic in the book to get a Bear Raid thus playing on the individual fear of most people. The MMs feel they have information and position

advantages over the investors as long as the holding of the stock is in weak hands or short term holders. Since they are OTC BB MMs who believe all OTCBB companies are not worth investing and management is ineffective regardless what is happening within the company. Furthermore, MMs know they are in the position to impose a great deal of influence in OTC BB stocks trading when it suits

their needs.

This inherent power of position enables the MMs to move the markets at any time up or down. As a result, the only way to draw them out of their favorable position is going long. Now this does not mean just any company but to effectively nail the MMs, Longs must find the great company on the floor and accumulate long before the MM tactics and games begin.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=62830080 (posted by SJJNAMARTIN)

SEC Announces Roundtable on Microcap Securities

FOR IMMEDIATE RELEASE 2011-186

Washington, D.C., Sept. 19, 2011 — The Securities and Exchange Commission today announced that it will host a public roundtable next month to discuss the unique regulatory issues surrounding the execution, clearance, and settlement of microcap securities.

The roundtable is being sponsored by the SEC’s Microcap Fraud Working Group, a joint initiative of the Division of Enforcement and Office of Compliance Inspections and Examinations. The Working Group is the Commission’s primary resource for issues relating to market participants and trading practices concerning securities primarily quoted on the OTC Bulletin Board (OTCBB) or OTC Quote (previously Pink Sheets).

The event will take place on October 17 from 1 p.m. to 5 p.m. at the SEC’s Washington D.C. headquarters. It will feature in-depth discussions of key regulatory issues including Anti-Money Laundering monitoring, compliance challenges, and potential changes to the regulatory framework. Panelists will include representatives from The Deposit Trust Company, broker-dealers, the Financial Industry Regulatory Authority and others.

The roundtable is part of an ongoing SEC effort to focus on the particular challenges facing issuers and regulated entities within the changing business and regulatory climates. The purpose of the roundtable is to enable Commission staff to gather ideas and request input for regulatory measures surrounding the execution, clearance and settlement of low-priced securities.

The event is open to the public with seating available on a first-come, first-served basis. The roundtable also will be webcast live on the SEC website and archived for later viewing. For more information about the roundtable, contact the Division of Enforcement at 202-551-6607.

http://www.sec.gov/news/press/2011/2011-186.htm

Besides crooked CEOs, do they have any familiars besides MMs that help them defraud their trusting investors ?

To: MaxShockeR

I need to know more about the possible negative relationships that may exist between CEOs, and their Investor Relations people.

What exactly is a MM, in all possibilities ?

CEOs charged with conspiring to manipulate stock prices

* One defendant enters plea agreement -- lawyer

By Jonathan Stempel

NEW YORK, June 30 (Reuters) - Three chief executives and two stock promoters were criminally charged with engaging in fraudulent penny stock schemes, after a probe that involved undercover FBI agents, federal investigators said on Thursday.

The U.S. Department of Justice said the executives charged include Donald Klein, 40, of KCM Holdings Corp (KCMH.PK); Douglas Newton, 66, of Real American Capital Corp (RLABD.PK); and Thomas Schroepfer, 54, of Smokefree Innotec Inc (SFIO.PK).

Also charged were Charles Fuentes, 66, accused of promoting Smokefree stock; and Brian Gibson, 63, accused of promoting stock of Xtreme Motorsports International Inc (XTMM.PK).

Each defendant was charged with conspiracy to defraud the investing public and faces a maximum of five years in prison plus fines.

The U.S. Securities and Exchange Commission also filed civil fraud charges against the defendants. The charges were brought in the U.S. District Court for the Southern District of Florida.

Investigators said the defendants manipulated the shares of thinly-traded companies that traded on the Pink Sheets.

Most of the schemes involved kickbacks to a purportedly corrupt pension fund or a broker who agreed to buy shares, while Gibson's scheme involved the alleged creation of a fake website to tout Xtreme stock, the SEC said.

According to the SEC, one example of FBI involvement was when an agent, posing as a corrupt pension fund trustee, met with Newton and agreed to buy Real American stock in exchange for a 30 percent kickback.

A day later, the FBI wired funds to Real American's Billy Martin's USA affiliate, which then issued a check to a bogus consulting firm set up to conceal the kickback, the SEC said.

"Investors deserve better than secret investment strategies based on kickbacks and bribes," SEC enforcement chief Robert Khuzami said in a statement. "These CEOs got more than they bargained for but exactly what they deserved."

Jeffrey Cox, a lawyer for Klein, said his client entered a plea agreement in his criminal case. The other defendants' lawyers were not immediately available to comment on their behalf. (Reporting by Jonathan Stempel, editing by Gerald E. McCormick)

I miss Doc Rock. He was a good guy.

How Penny Stock Pumps Use Buyins.Net To Squeeze Short Sellers, Fail & Encourage Us To Short Sell More oops!

Posted by Timothy Sykes on Wed 3rd of Nov, 2010 03:00:58 PM Watch these 20 free video trading lessons and Apply for my Trading Challenge

ShareShare The event of the year

UPDATE: This post was all written a few weeks before the Coastal Pacific Mining Corp (CPMCF) paid pump, but that didn’t stop this latest pump from employing the EXACT same strategy as pumps of the past…absolute morons…I won’t debate “the science” behind BuyIns.net as they’d inevitably claim they have sophisticated software/algorithms to detect how many shares are short on any one of “their clients”, but their word means about as little to me as DoublingStocks.com which claim computer geeks pick the stocks but when you read and LOL at the hard-to-read disclaimer, you see their “picks” are actually just paid pumps…which is why I focus on the disclaimer used by BuyIn.net “clients”, read the CPMCF press release which looks to have been paid by a promoter or shareholder, not CPMCF:

A third party has paid $1,667 per month to purchase data to be provided in six monthly reports. CPMCF has not approved the statements made in this release.

Also interesting to note is that BuyIns.net has gone up in price from $995 per month to $1,667 per month and the promoters, shareholders and companies gladly pay because they think it will squeeze short sellers…the irony is that anytime I or any other short seller with any intelligence greater than the Neanderthals who run these companies/promotions see a “SqueezeTrigger” press release, it doesn’t scare us, read the title, IT ENCOURAGES US TO SHORT SELL MORE!

Just about every company that has ever issued these SqueezeTrrigger press releases or their shareholders or promoters issue press releases, whatever, has dropped 90%+ in the next few months, making these a GREAT short selling indicator. If I could, I would short the heck out of BuyIns.net, the company and their revenue and any of the owners’ mortgages because they are promoting a service that works in the exact opposite way their clientele expects….truly one of the best jokes in recent memory, thanks BuyIns.net for providing the punchline!

This past weekend, doing some research on behalf of some PennyStocking Silver subscribers, I was casually looking at some recent press releases of the blatant pump CrowdGather Inc (CRWG) (still not convinced, see the evidence with their $200,000 promotional pumping mailer and their $300,000 pumping mailer too) and saw this beauty of a PR “BUYINS.NET Updates CrowdGather SqueezeTrigger Report”

The article said blah blah blah, which has been purposely deleted as anything said is nullified by the disclaimer “CRWG has paid $995 per month to purchase data to be provided in six monthly reports.”

As of the date of this blog post, I have been only somewhat right about CRWG as its tanked roughly 40% from $1.75ish to $1ish since I’ve been exposing them as a pump (the CEO refuses to debate me despite my many offers, which is ironic given that his company and shareholders have have paid for exposure with tens of thousands, even hundreds of thousands of dollars and shares to other media outlets and yet my little media outlet has greater viewers than all of them…actually I still don’t know if Michael Arrington of TechCrunch was paid to feature CRWG or if it was just harmless penny stock ignorance there) and hasn’t dropped the 90%+ I was expecting…so far.

But when I read this press release, my confidence in Crowdgather’s demise has grown as I thought back to similar press releases from similar paid-for pumps like Mesa Energy Holdings, Inc. (MSEH) and NXT Nutritionals Holdings Inc (NXTH) both of whose CEOs publicly attacked me (MSEH put me in an SEC filing while NXTH’s CEO blamed his stock’s drop from $3 to $2 on short sellers like me, slurring my name on Huffington Post)

Remember MSEH’s CEO even talked about the hiring of BuyIns.Net with The Dallas Morning News, saying “When Sykes’ blog posting went up in late March, Mesa’s advisers suggested it hire an Internet firm, Buyins.net, to spotlight the short sellers’ positions in Mesa shares. Buyins.net, which cost Mesa $995 a month, found the number of Mesa shares in “short” positions – meaning the trader bets the shares will fall – rose tenfold in just a month. The reports show that if shares of Mesa continued to rise, the short sellers would get “squeezed” out of their positions.

…evidenced nicely by press releases aimed at publicly blaming and squeezing short sellers like THIS and THIS, despite the stock’s rather perfect drop was caused entirely, if not mostly, by company insiders selling more than 6 million shares as the CEO played dumb.

Now that the SEC is investigating Mesa Energy, I wonder just how dumb the CEO Randy Griffin is “playing”.

And NXTH had a similar BuyIns.Net press release entitled “BUYINS.NET: NXT Nutritionals (NXTH) Has Been On BUYINS.NET Naked Short List For 13 Consecutive Trading Days.” apparently trying to blame/scare short sellers…look at their longterm chart and see if it worked:

The reality is that no matter what the pump does, whether hiring Buyins.net or bribing or taking advantage of penny stock ignorant media outlets, they can’t escape the fact that they’re a blatant pump and will end under 5-10-20 cents/share within a few weeks/months.

Nice try Sanjay/Crowdgather; I look forward to short selling your carcass of a stock even more now

Share this post:

Related Posts

Who Hires Buyins.Net Besides Blatant Pumps? [6 EXAMPLES] Who Hires Buyins.Net Besides Blatant Pumps? [6 EXAMPLES] Catching SEC-Busted Stansberry Research In 4 Blatant Lies & Why Porter Stansberry Is The Real Life Hyman Roth Dear Michael Arrington & TechCrunch, Please Don’t Feature Penny Stock Pump & Dumps Tags: Basics, Buyins.net, CPMCF, CRWG, Manipulation, Misinformation, MSEH, NXTH, Stock Promoters

**ADVISORY WARNING** Penson Under Investigation

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=64619230 (posted by SJJNAMARTIN)

Motivations of a Pumper

Another good read, basically the opposite of the original from Vantillian (by Doctor Rockzo)

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=64571816

Motivations of a "BASHER" (by Vantillian)

interesting read

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=64571728

8 WAYS TO RECOGNIZE A POTENTIAL PUMP & DUMP

Interesting article on PumpandDumps.com just passing it on: (posted by $toney)

Pump & dumps are illegal stock hypes, usually within the penny or microcap market, performed to artificially raise the trading volume and often the price of a stock ("pumping") through a campaign of hype which may include misinformation and/or misrepresentation. This enables insiders or other large shareholders to sell their stock ("dumping"). Dupes purchase the stock and unwittingly create a façade of legitimacy. This can entice even more people to believe the hype and buy even more shares. Once the schemers have sold their shares, the pumping ends, and the share price plummets.

Pump & dumps are indicated by...

1. SPAM EMAIL

A legitimate company will never send you spam email. First of all, spam is illegal. Secondly, all the information that they would need to get out to the public is disseminated though press releases. If they need to make themselves aware to the public, they do it through a number of legitimate campaigns such as advertising, technology fairs and the like.

2. STOCK TOUTS

Sometimes emails received are from a free subscription based touting service. Sign-ups are how these touts get around spam laws. However, the intent is the same: to con you out of your money. These touts are paid by the people intending to dump their stock on you and usually say so in the fine print of their promotions. While their names are constantly changing currently subscriptions are available to StocksGoneWild.com, EpicStockPicks.com and countless others. These sites often tout the same stock and there is a good reason for that. Touts usually own many touting sites and promote under various names in order to give the perception of a wide following for the particular stock they are touting.

MoneyTV with Donald Baillargeon is another touting service paid for by insiders wishing to promote their stock under the perception of a TV interview show. The fact is that these insiders pay to be on this "show" and just about the only place you'll see the interview is on MoneyTV's own website. The insiders will usually disseminate a press release bragging about how they were interviewed on MoneyTV in an effort towards self-importance.

3. THE BACKGROUND OF THE OFFICERS

There's an old saying, "Once a crook, always a crook", and that's why it's always a good idea to see who is running the show at the company. Verify his resume. Most companies at one time, will offer up the qualifications of the President, CEO or other officers. Check his past involvement with public companies and the past performance of that stock. Chances are that if he's been involved with past pump and dumps or other schemes, you're now looking at one that is heading in that direction. Also, it is a good idea to look into court records of the individual(s) involved and their previous companies and see if anyone has been involved in civil or criminal proceedings, especially for fraud.

4. MESSAGE BOARD CONTENT

Yes, forums such as investorshub.com, siliconinvestor.com or the Yahoo Finance Message Boards usually contain contributions from child-like posters who are there for no other reason than to try and convince themselves that they made a good investment. But you can often find the touts or Investor Relations guy posting anonymously trying to keep the pom poms shaking and keeping the naysayers in check. They know that people who are apt to follow spam email or stock touts probably consider these message boards to be research so they want to bluster about their great investment and brag about all the money they are supposedly making. These are the guys who call anybody negative or questioning the company a "paid basher" (there is no such thing) or the ones who claim they have done their "DD" ( due diligence) when there is really none to be done. When you ask what DD they did, they will be vague with their answer or give a non-answer, with a "Because I said so" kind of response. They are also the ones who offer up lame excuses for down days such as naked short selling (does not occur in the penny stock market) or MM (market maker) manipulation. They are also the ones who make bold and baseless predictions like, "This is an easy ten-bagger" (stock price will increase by a multiple of ten).

5. CLAIMS OF BREAKTHROUGHS

Beware if the company claims to be an industry leader (do you really think a penny stock can be a leader in anything except possibly scams?) or has made a breakthrough discovery. A company with legitimate breakthrough technology is unlikely to be promoting itself on the penny stock market and will most likely have funding available to it within a variety of partnerships with major companies. These same companies will not likely be interested in dealing with a penny stock company.

6. PRICE AND VOLUME UPSWING ON NO NEWS

If a stock's trading volume and price per share, show a recent and sudden increase, there is a good chance that the stock is being set up for a pump and dump. Especially if it has been involved in one in the past.

7. FINANCIALS (or lack thereof)

A legitimate company will always make recent financials available, even if it is a penny stock that is not required to file financials with the SEC. And if there are financials are they fabricated? Would a billion dollar company be found within a penny stock?

8. ISSUED AND OUTSTANDING

If nobody will tell you how many shares are out on the street or if that number is disproportionate to the stock price (a billion shares of a stock trading @ one tenth of a penny for example, stay away. Chances are a reverse split is coming and you will be left with only a few shares worth a fraction of what you spent.

hey if u have stuff to add i would be happy to add u as a mod.. if you would like!

i added a link to this board in my ibox on my board and ill quote some of your post sometimes.

also it would be good to put a list of Ceo names to warn others to stay away, i have 5 & 2 IR firms but im sure there is a lot more thats out there.

BTW keep up the good work

FOR IMMEDIATE RELEASE SEC Suspends 17 Companies in Proactive Effort to Combat Microcap Stock Fraud

http://www.sec.gov/news/press/2011/2011-120.htm

2011-120

Excerpts From Internet Promotional Campaigns

Calypso Wireless Inc.

Emerging Healthcare Solutions Inc.

Montvale Technologies Inc.

Washington, D.C., June 7, 2011 — The Securities and Exchange Commission today suspended trading in 17 microcap stocks because of questions about the adequacy and accuracy of publicly available information about the companies, which trade in the over-the-counter (OTC) market.

The trading suspensions spring from a joint effort by SEC regional offices in Los Angeles, Miami, New York, and Philadelphia; its Office of Market Intelligence; and its new Microcap Fraud Working Group, which uses a coordinated, proactive approach to detecting and deterring fraud involving microcap securities. The trading suspensions follow a similar suspension last week against Uniontown Energy Inc. (UTOG), based in Henderson, Nev., and Vancouver, Canada.

--------------------------------------------------------------------------------

Additional Materials

Trading Suspension

Order

--------------------------------------------------------------------------------

“They may be called ‘penny stocks,’ but victims of microcap fraud can suffer devastating losses,” said Robert Khuzami, Director of the SEC’s Division of Enforcement. “The SEC’s new Microcap Fraud Working Group is targeting the insiders and promoters, as well as the transfer agents, attorneys, auditors, broker-dealers, and other “gatekeepers” who flourish in the shadows of this less-than-transparent market.”

George Canellos, Director of the SEC’s New York Regional Office, added, “The investing public does not have accurate or adequate information about these securities to use in making informed investment decisions. Nonetheless, stock-touting websites, twitter users, and often anonymous individuals posting to Internet message boards have hyped many of these companies, and these promotional campaigns have been followed by spikes in share price and trading volume.”

The 17 companies and their ticker symbols are:

American Pacific Rim Commerce Group (APRM), based in Citra, Fla.

Anywhere MD, Inc. (ANWM), based in Altascadero, Calif.

Calypso Wireless Inc. (CLYW), based in Houston.

Cascadia Investments, Inc. (CDIV), based in Tacoma, Wash.

CytoGenix Inc. (CYGX), based in Houston.

Emerging Healthcare Solutions Inc. (EHSI), based in Houston.

Evolution Solar Corp. (EVSO), based in The Woodlands, Texas.

Global Resource Corp. (GBRC), based in Morrisville, N.C.

Go Solar USA Inc. (GSLO), based in New Orleans.

Kore Nutrition Inc. (KORE), based in Henderson, Nev.

Laidlaw Energy Group Inc. (LLEG), based in New York City.

Mind Technologies Inc. (METK), based in Cardiff, Calif.

Montvale Technologies Inc. (IVVI), based in Montvale, N.J.

MSGI Security Solutions Inc. (MSGI), based in New York City.

Prime Star Group Inc. (PSGI), based in Las Vegas, Nev.

Solar Park Initiatives Inc. (SOPV), based in Ponte Verde Beach, Fla.

United States Oil & Gas Corp. (USOG), based in Austin, Texas.

Some examples of the promotions are as follows:

Calypso Wireless Inc. has not filed periodic reports since February 2008, when it filed a report for the period ending Sept. 30, 2007. Despite that, the company’s share price rose from 4 cents on Sept. 21, 2010 to an intra-day high of 17 cents on Sept. 24, 2010. Over the same period, trading volume jumped to nearly six million shares, up from 376,000 shares. On Sept. 24, 2010, a stock-promoting website encouraged investors to continue buying Calypso Wireless shares (PINK: CLYW, CLYW message board), stating, in part, “Over the week, CLYW stock has been running wild … This CLYW stock rush happened just like that, on no company’s news and on old, well known SEC filings, done for the investment community.”

Shares in Kore Nutrition Inc. began to spike on Aug. 31, 2010, following the release of a company-paid research report setting a target price of $10.50. Moreover, on Sept. 1 and 8, 2010, the company issued press releases announcing new distribution agreements to market its energy drinks. The research report and distribution agreement claims were reiterated on numerous stock-promotion websites, touting Kore Nutrition as a “winner.” Kore Nutrition’s quarterly report for the period ending Sept. 30, 2010, filed with the SEC on Nov. 15, 2010, made no mention of the announced distribution agreements.

Montvale Technologies Inc. announced the dissolution of the company on Feb. 12, 2010, and last filed financial statements with the SEC for the third quarter of 2009. The company’s shares have nonetheless continued to trade, and to be promoted. On Dec. 22, 2010, a website recommended a “closer look” at Montvale Technologies, claiming it “has the potential to do very well in the short term.” That day, the share price rose 75 percent from 12 cents to 20 cents, and trading volume soared 500 percent over the prior day.

The Microcap Fraud Working Group is a joint initiative of the SEC’s Division of Enforcement and Office of Compliance Inspections and Examinations. The Working Group is pursuing a strategic approach to combating microcap fraud by focusing on recidivists and insiders, and on the attorneys, auditors, broker-dealers, transfer agents and other gatekeepers that facilitate a large volume of the fraud in this sector. The Working Group is comprised of staff from the SEC’s headquarters in Washington D.C., each of its 11 regional offices, and from the Office of Market Intelligence, Division of Corporation Finance, Division of Risk, Strategy, and Financial Innovation, Office of General Counsel, Division of Trading and Markets, and the Division of Investment Management.

For additional information about trading suspensions, including answers to frequently asked questions, read the SEC’s Investor Bulletin on Trading Suspensions available at www.sec.gov/investor.shtml as well as on www.Investor.gov.

# # #

For more information about this enforcement action, contact:

Michael Paley

Assistant Regional Director, SEC’s New York Regional Office

(212) 336-0145

Elisha L. Frank

Assistant Regional Director, SEC’s Miami Regional Office

305) 982-6392

http://www.sec.gov/news/press/2011/2011-120.htm

SEC Approves Amendments to Establish Regulation

NMS-Principled Rules in Market for OTC Equity

Securities

http://www.finra.org/web/groups/industry/@ip/@reg/@notice/documents/notices/p122114.pdf

SEC Charges Johnson & Johnson With Foreign Bribery

J&J to Pay $70 Million to Settle Cases Brought by SEC and Criminal Authorities

FOR IMMEDIATE RELEASE

2011-87

Washington, D.C., April 7, 2011 – The Securities and Exchange Commission today charged Johnson and Johnson (J&J) with violating the Foreign Corrupt Practices Act (FCPA) by bribing public doctors in several European countries and paying kickbacks to Iraq to illegally obtain business.

The SEC alleges that since at least 1998, subsidiaries of the New Brunswick, N.J.-based pharmaceutical, consumer product, and medical device company paid bribes to public doctors in Greece who selected J&J surgical implants, public doctors and hospital administrators in Poland who awarded contracts to J&J, and public doctors in Romania to prescribe J&J pharmaceutical products. J&J subsidiaries also paid kickbacks to Iraq to obtain 19 contracts under the United Nations Oil for Food Program.

Additional Materials

* SEC Complaint

* Litigation Release No. 21922

J&J agreed to settle the SEC’s charges by paying more than $48.6 million in disgorgement and prejudgment interest. J&J also agreed to pay a $21.4 million fine to settle parallel criminal charges announced by the U.S. Department of Justice (DOJ) today. A resolution of a related investigation by the United Kingdom Serious Fraud Office is anticipated.

“The message in this and the SEC’s other FCPA cases is plain – any competitive advantage gained through corruption is a mirage,” said Robert Khuzami, Director of the SEC's Division of Enforcement. “J&J chose profit margins over compliance with the law by acquiring a private company for the purpose of paying bribes, and using sham contracts, off-shore companies, and slush funds to cover its tracks.”

Cheryl J. Scarboro, Chief of the SEC Enforcement Division’s Foreign Corrupt Practices Act Unit, added, “Bribes to public doctors can have a detrimental effect on the public health care systems that potentially pay more for products procured through greed and corruption.”

According to the SEC’s complaint filed in federal court in the District of Columbia, public doctors and administrators in Greece, Poland, and Romania who ordered or prescribed J&J products were rewarded in a variety of ways, including with cash and inappropriate travel. J&J subsidiaries, employees and agents used slush funds, sham civil contracts with doctors, and off-shore companies in the Isle of Man to carry out the bribery.

Without admitting or denying the SEC’s allegations, J&J has consented to the entry of a court order permanently enjoining it from future violations of Sections 30A, 13(b)(2)(A), and 13(b)(2)(B) of the Securities Exchange Act of 1934; ordering it to pay $38,227,826 in disgorgement and $10,438,490 in prejudgment interest; and ordering it to comply with certain undertakings regarding its FCPA compliance program. J&J voluntarily disclosed some of the violations by its employees and conducted a thorough internal investigation to determine the scope of the bribery and other violations, including proactive investigations in more than a dozen countries by both its internal auditors and outside counsel. J&J’s internal investigation and its ongoing compliance programs were essential in gathering facts regarding the full extent of J&J’s FCPA violations.

Kelly G. Kilroy and Tracy L. Price of the Enforcement Division’s FCPA Unit and Brent S. Mitchell and Reid A. Muoio conducted the SEC’s investigation. The SEC acknowledges the assistance of the U.S. Department of Justice, Fraud Section; Federal Bureau of Investigation; Serious Fraud Office in the United Kingdom; and 5th Investigation Department of the Regional Prosecutor’s Office in Radom, Poland. The SEC's investigation is continuing.

# # #

For more information about this enforcement action, contact:

Cheryl J. Scarboro

Chief, Foreign Corrupt Practices Act Unit, Division of Enforcement

202-551-4403

http://www.sec.gov/news/press/2011/2011-87.htm

SEC Charges India-Based Affiliates of PWC for Role in Satyam Accounting Fraud

FOR IMMEDIATE RELEASE

2011-82

Washington, D.C., April 5, 2011 – The Securities and Exchange Commission today sanctioned five India-based affiliates of PricewaterhouseCoopers (PwC) that formerly served as independent auditors of Satyam Computer Services Limited for repeatedly conducting deficient audits of the company’s financial statements and enabling a massive accounting fraud to go undetected for several years.

The SEC found that the audit failures by the PW India affiliates – Lovelock & Lewes, Price Waterhouse Bangalore, Price Waterhouse & Co. Bangalore, Price Waterhouse Calcutta, and Price Waterhouse & Co. Calcutta – were not limited to Satyam, but rather indicative of a much larger quality control failure throughout PW India.

Additional Materials

* SEC Order Against PW India Affiliates

The PW India affiliates agreed to settle the SEC’s charges and pay a $6 million penalty, the largest ever by a foreign-based accounting firm in an SEC enforcement action.

In addition, the PW India affiliates agreed to refrain from accepting any new U.S.-based clients for a period of six months, establish training programs for its officers and employees on securities laws and accounting principles; institute new pre-opinion review controls; revise its audit policies and procedures; and appoint an independent monitor to ensure these measures are implemented.

In a related settlement today, Satyam agreed to settle fraud charges, pay a $10 million penalty, and undertake a series of internal reforms. Since the fraud came to light, the India government seized control of the company by dissolving its board of directors and appointing new government-nominated directors, among other things. Additionally, India authorities filed criminal charges against several former officials as well as two lead engagement partners from PW India.

"PW India violated its most fundamental duty as a public watchdog by failing to comply with some of the most elementary auditing standards and procedures in conducting the Sataym audits. The result of this failure was very harmful to Satyam shareholders, employees and vendors," said Robert Khuzami, Director of the SEC's Division of Enforcement.

Cheryl Scarboro, Chief of the SEC’s Foreign Corrupt Practices Act Unit, added, “PW India failed to conduct even the most fundamental audit procedures. Audit firms worldwide must take seriously their critical gate-keeping duties whenever they perform audit engagements for SEC-registered issuers and their affiliates, and conduct proper audits that exercise professional skepticism and care.”

The SEC’s order instituting administrative proceedings against the firms finds that PW India staff failed to conduct procedures to confirm Satyam’s cash and cash equivalent balances or its accounts receivables. Specifically, the order finds that PW India’s “failure to properly execute third-party confirmation procedures resulted in the fraud at Satyam going undetected” for years. PW India’s failures in auditing Satyam “were indicative of a quality control failure throughout PW India” because PW India staff “routinely relinquished control of the delivery and receipt of cash confirmations entirely to their audit clients and rarely, if ever, questioned the integrity of the confirmation responses they received from the client by following up with the banks.”

After the fraud at Satyam came to light, PW India replaced virtually all senior management responsible for audit matters. The affiliates suspended its Satyam audit engagement partners from all work and removed from client service all senior audit professionals on the former Satyam audit team.

In addition to the $6 million penalty and previously listed reforms, the PW India affiliates have consented to a censure, as well as the entry of a cease-and-desist order finding that they violated Section 10A(a) of the Exchange Act and were a cause of Satyam’s violations of Sections 13(a) and 13(b)(2)(A) of the Exchange Act and relevant Rules thereunder.

PCAOB Proceeding

In a related proceeding, the PW India affiliates also reached a settlement with the Public Company Accounting Oversight Board (PCAOB) in which the PW India firms have been censured and agreed to extensive undertakings substantially similar to those set forth in the SEC administrative order. Additionally, Lovelock & Lewes and Price Waterhouse Bangalore have agreed to pay the PCAOB a $1.5 million penalty for their violations of PCAOB rules and standards in relation to the Satyam audit engagement.

The Commission acknowledges the assistance of the PCAOB. The SEC’s investigation is continuing.

# # #

For more information about this enforcement action, contact:

Cheryl J. Scarboro

Chief, FCPA Unit of the SEC Division of Enforcement

202-551-4403

http://www.sec.gov/news/press/2011/2011-82.htm

SEC Charges Satyam Computer Services With Financial Fraud

FOR IMMEDIATE RELEASE

2011-81

Washington, D.C., April 5, 2011 – The Securities and Exchange Commission today charged India-based Satyam Computer Services Limited with fraudulently overstating the company’s revenue, income and cash balances by more than $1 billion over five years.

The SEC’s complaint, filed in U.S. District Court in Washington, D.C., alleges that former senior officials at Satyam – an information technology services company based in Hyderabad, India – used false invoices and forged bank statements to inflate the company’s cash balances and make it appear far more profitable to investors. Although Satyam’s shares primarily traded on the Indian markets, its American depository shares traded on the New York Stock Exchange.

Additional Materials

* SEC Complaint

* Litigation Release No. 21915

According to the SEC’s complaint, shortly after the fraud came to light in January 2009, the India government seized control of the company by dissolving Satyam’s board of directors and appointing new government-nominated directors; removed former top managers of the company; and oversaw a bidding process to select a new controlling shareholder in Satyam. In addition, India authorities filed criminal charges against several former officials.

In addition to the actions taken by the India authorities, Satyam, whose new leadership cooperated with the SEC’s investigation, has agreed to pay a $10 million penalty to settle the SEC’s charges, require specific training of officers and employees concerning securities laws and accounting principles, and improve its internal audit functions. Satyam also agreed to hire an independent consultant to evaluate the internal controls the company is putting in place.

In a related settlement, the SEC sanctioned Satyam’s former independent auditors for violations of federal securities laws and improper professional conduct while auditing the company’s financial statements from 2005 through January 2009.

“The actions of Indian and U.S. authorities have transformed Satyam into a new company with new management, directors and investors and state-of-the art controls, resulted in criminal charges against seven former executives and given harmed shareholders the chance to recoup losses,” said Robert Khuzami, Director of the SEC’s Division of Enforcement. “This comprehensive and thoughtful response underscores the ability of regulators across the globe to respond to cross-border misconduct in a coordinated manner.”

Cheryl Scarboro, Chief of the SEC’s Foreign Corrupt Practices Act Unit, added, “The fact that Satyam’s former top officers were able to maintain a fraud of this scale represents a company-wide failure of extreme proportions that cut across a wide array of functions from customer invoicing to cash management.”

According to the SEC’s complaint, Satyam’s former senior managers engineered a scheme that created more than 6,000 phony invoices to be used in Satyam’s general ledger and financial statements. Satyam employees created bogus bank statements to reflect payment of the sham invoices. This resulted in more than $1 billion in fictitious cash and cash-related balances, representing half the company’s total assets.

The SEC alleges that when the fraud was finally revealed, Satyam’s then-Chairman, B. Ramalinga Raju, declared that maintaining Satyam’s inflated revenues and profits “was like riding a tiger, not knowing how to get off without being eaten.”

Raju and other former senior and mid-level Satyam executives, as well as two lead engagement partners from Satyam’s former external audit firm, are defendants in a criminal trial now underway in India.

Without admitting or denying the allegations in the SEC’s complaint, Satyam agreed to a permanent injunction against future violations of the periodic reporting provisions of Sections 10(b), 13(a), 13(b)(2)(A) and 13(b)(2)(B) of the Securities Exchange Act of 1934 and Rules 10b-5, 12b-20 13a-1 and 13a-16. As previously mentioned, the settlement also requires Satyam to pay a $10 million penalty, to hire an independent consultant and to comply with certain undertakings. In bringing this settled enforcement action, the SEC balanced the scope and severity of Satyam’s misconduct and harm to holders of Satyam’s American Depository Shares against the unique and significant remediation efforts made after the fraud became public in 2009.

The SEC’s investigation is continuing.

# # #

For more information about this enforcement action, contact:

Cheryl J. Scarboro

Chief, FCPA Unit of the SEC Division of Enforcement

202-551-4403