Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

hmmm, are they trying to come back? ra agent resignation today? cant get any worse lol

what a piece of fkn trash! name change than tells me i cant sell for weeks than i sell , order goes through than reverses and delists! nice company scumbags!

XDSC: Company Dissolved. Shares Cancelled. Transfer Books Closed.

FINRA deleted symbol:

https://otce.finra.org/otce/dailyList?viewType=Deletions

MRAL: effective Nov. 11,2019 Mr. Amazing Loans Corp., MRAL, will change to XXXX Dormant Shell Corporation. XDSC:

https://otce.finra.org/otce/dailyList?viewType=Symbol%2FName%20Changes

5000-1 RS Then 1-5000 FS

https://www.otcmarkets.com/filing/html?id=13310363&guid=3g_3UaPFhu3iHth

Another scam to watch...Caught up when MRAL came tied into INCB?

Paul seems like a real dirtbag and I'm going to watch what he does with his shell?

.20 now?

IMO

$MRAL: NEWS.. 5yr-$20Million Revolving Debt Facility

Currently at $0.225/sh

***************************************************************

Press Release: Mr. Amazing Loans Corporation Subsidiary Obtains $20 Million Debt Facility from Investment Evolution Coin Ltd.

8:51 AM ET 6/8/18 | Dow Jones

3:43 PM ET 6/7/18

Symbol Last % Chg

MRAL

0.23 0.00%

Real time quote.

Mr. Amazing Loans Corporation Subsidiary Obtains $20 Million Debt Facility from Investment Evolution Coin Ltd.

LAS VEGAS, June 08, 2018 (GLOBE NEWSWIRE) -- Mr. Amazing Loans Corporation ("Mr. Amazing Loans") (OTCQB:MRAL) today announced that its wholly owned subsidiary, MRAL Blockchain, LLC, has obtained a $20 million debt facility from Singapore company, Investment Evolution Coin Ltd. ("IEC Ltd"). IEC Ltd is currently 100% owned by certain Mr. Amazing Loans' stockholders, including Paul Mathieson, Mr. Amazing Loans' President, Chief Executive Officer, Chief Financial Officer and sole director who is IEC Ltd's majority stockholder. The $20 million debt facility is structured as a 5-year revolving line of credit, with an interest rate of 12% per annum. The debt facility is due for repayment on June 7, 2023. In addition, in connection with the debt facility, IEC Ltd purchased 360,000 shares of Mr. Amazing Loans' Series H preferred stock, for an aggregate purchase price of $360,000.

About Mr. Amazing Loans Corporation

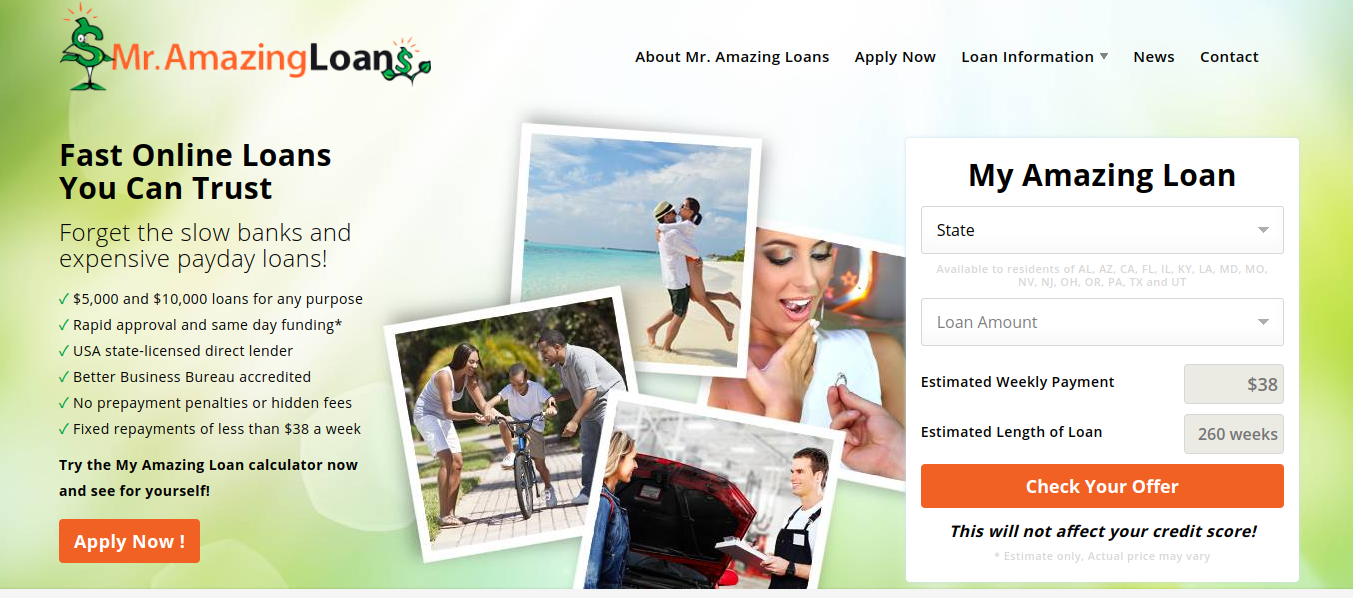

Mr. Amazing Loans is a Securities and Exchange Commission ("SEC") reporting fintech company that provides online $5,000 and $10,000 unsecured consumer loans under the brand name "Mr. Amazing Loans" via its website and online application portal. Mr. Amazing Loans is a direct lender with state licenses and/or certificates of authority in 20 U.S. states and all loans are originated, processed and serviced out of our centralized Las Vegas, NV head office. For more information about Mr. Amazing Loans, please visit https://ir.mramazingloans.com.

Forward-Looking Statements

This press release contains forward-looking statements. All statements other than statements of historical facts included in this press release are forward-looking statements. In some cases, forward-looking statements can be identified by words such as "believe," "expect," "anticipate," "plan," "potential," "continue" or similar expressions. Such forward-looking statements include risks and uncertainties, and there are important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors, risks and uncertainties are discussed in Mr. Amazing Loans' filings with the SEC. Investors should not place any undue reliance on forward-looking statements since they involve known and unknown, uncertainties and other factors which are, in some cases, beyond Mr. Amazing Loans' control which could, and likely will, materially affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects Mr. Amazing Loans' current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to operations, results of operations, growth strategy and liquidity. Mr. Amazing Loans assumes no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

The contents of the websites referenced herein are not incorporated into this press release.

Contact:

Paul Mathieson

Mr. Amazing Loans Corporation

Chairman/CEO and Founder

MRAL@mramazingloans.com

> Dow Jones Newswires

June 08, 2018 08:51 ET (12:51 GMT)

So now what's up here? Rentry?

Last day to qualify for Investment Evolution Coin[Crypto]shares - 1:1 entitlement by holding MRAL shares on 30 April 2018.

https://www.otcmarkets.com/stock/MRAL/news/IEG-Holdings-Announces-Distribution-by-CEO-of-Investment-Evolution-Coin-Ltd-Shares-to-IEG-Holdings-Shareholders-and-Hold?id=186115

IEG Holdings Corp., IEGH, changed to Mr. Amazing Loans Corp., MRAL:

http://otce.finra.org/DLSymbolNameChanges

This isn't correct..they are just moving crypto business to Investment Evolution Coin Ltd in Singapore. Anyone holding IEGH on 30 April will get 1:1 free in the new IEC.

So much for the IEGH crypto business. Guess its on to PLan B now for them.

whatever that is.

What a knee slapper!

This company isn't making any operational money in the loans business, in fact they are losing their shirts.

Spending an average of about $300,000.00 month on wages and corporate financing costs is killing this ticker.

Shares aren't worth the paper they are printed on.

More like an investment REVOLUTION instead of evolution.

IEGH Projected to Reach $5.3M in Revenue in FY2019 by Equity Research Firm

- Company, exploring economics of cryptocurrency loans and an initial coin offering (ICO), has formed a 100 percent-owned subsidiary, Investment Evolution Crypto, LLC

- ACF Equity Research sees IEGH revenue reaching $8.2 million in FY2020 with positive EBITDA

IEG Holdings Corp. (OTCQB: IEGH) is a Las Vegas-based fintech provider of $5,000 and $10,000 unsecured, five-year consumer loans under the brand name ‘Mr. Amazing Loans’ on its website (www.MrAmazingLoans.com). It is licensed and/or holds certificates of authority to originate direct consumer loans in 20 states. The company provides loans through its online application portal to residents of those states. All loans are originated, processed and serviced out of the company’s centralized head office in Las Vegas. The company was launched in 2010.

ACF Equity Research projects the revenue of IEGH reaching $5.328 million in FY2019 and $8.227 million in FY2020, with positive EBITDA in both years (http://nnw.fm/1dPMY). That projection is based on ACF Equity Research liking the no-debt position of IEGH, its free cash flow, its business model, and its 80 percent repeat business loan book. It also sees value in the company’s exploration of cryptocurrency loans and the formation of its new 100 percent-owned subsidiary, Investment Evolution Crypto, LLC. IEGH is said to be looking into launching an initial coin offering (ICO), the report said.

For more information, visit the company’s website at www.InvestmentEvolution.com

IEGH Announced as Latest Addition to SeeThruEquity’s Blockchain Research and Advisory Platform

Consumer loan provider IEG Holdings Corp. (OTCQB: IEGH) was this morning named the newest member of SeeThruEquity’s blockchain research and advisory platform. This update comes on the heels of IEGH’s January news release unveiling its plans to launch a new, gold metal-backed, SEC-registered cryptocurrency in tandem with its Investment Evolution Crypto, LLC subsidiary. “We are very excited to have joined SeeThruEquity’s blockchain platform which we believe will provide the market with much needed information and awareness of this new space,” Paul Mathieson, CEO of IEG Holdings, stated in the news release. “We look forward to working with SeeThruEquity as we believe them to be a key player in the blockchain/cryptocurrencies research and advisory space.”

To view the full press release, visit http://nnw.fm/W3UPt

About IEG Holdings Corporation

IEG Holdings Corporation provides online $5,000 and $10,000 unsecured consumer loans under the brand name, “Mr. Amazing Loans,” via its website, www.MrAmazingLoans.com. In addition, IEG Holdings announced on December 22, 2017 that it has formed Investment Evolution Crypto, LLC, a wholly owned subsidiary of IEG Holdings (“Crypto”). Crypto will explore the legalities and economic risks and benefits of entering into a joint venture with Investment Evolution Corporation, a wholly owned subsidiary of IEG Holdings (“IEC”), to accept repayment of customer loans in the form of crypto/blockchain currencies such as Bitcoin, provide the crypto equivalent of $5,000 and $10,000 loans to customers, and also potentially create and issue an IEC cryptocurrency. Crypto has not begun operations and is in the development planning stages to explore these business opportunities in this time of changing technology. For more information, visit the company’s website at www.InvestmentEvolution.com

IEGH Signs Intellectsoft for Cryptocurrency Blockchain Development Services; Discloses Potential Philippines Cryptocurrency Remittance Strategy

IEG Holdings Corp. (OTCQB: IEGH) this morning announced that Investment Evolution Crypto LLC, its wholly owned subsidiary, has outsourced Intellectsoft LLC to offer blockchain development services including functional and business requirement analysis; technical and market research; and a development plan for the development of IEG Holdings’ cryptocurrency. IEGH also revealed that its subsidiary is planning to penetrate the Filipino USD 28 billion Overseas Foreign Workers (“OFWs”) remittance market, by developing and launching a cryptocurrency targeting both the Australian and US based Philippines OFWs. Per the update, its subsidiary is in the initial stages of these plans, and it will investigate the economic and legal risks as well as their merits, before putting the plans in action. “We believe potentially combining the exciting new blockchain technology with a leading sophisticated online consumer finance system, individual US state lending licenses and exposure to the Philippines $28 billion OFW remittance sector is a very exciting proposition. We aim for IEGH to leverage off its existing fintech business credentials, specifically its extensive experience in online consumer loans, to potentially be a key player in the crypto/blockchain sector,” IEG Holdings chairman and CEO Paul Mathieson stated in the news release.

To view the full press release, visit http://nnw.fm/B1sWG

About IEG Holdings Corporation

IEG Holdings Corporation provides online $5,000 and $10,000 unsecured consumer loans under the brand name, “Mr. Amazing Loans,” via its website, www.MrAmazingLoans.com. In addition, IEG Holdings announced on December 22, 2017 that it has formed Investment Evolution Crypto, LLC, a wholly owned subsidiary of IEG Holdings (“Crypto”). Crypto will explore the legalities and economic risks and benefits of entering into a joint venture with Investment Evolution Corporation, a wholly owned subsidiary of IEG Holdings (“IEC”), to accept repayment of customer loans in the form of crypto/blockchain currencies such as Bitcoin, provide the crypto equivalent of $5,000 and $10,000 loans to customers, and also potentially create and issue an IEC cryptocurrency. Crypto has not begun operations and is in the development planning stages to explore these business opportunities in this time of changing technology. For more information, visit the company’s website at www.InvestmentEvolution.com.

News :: IEG Holdings Corp. (IEGH)

https://ir.investmentevolution.com/news/detail/307

IEGH Aims to Back Cryptocurrency Technologies with Gold

- IEG Holdings Corp. provides small personal online loans of up to $10,000

- IEGH subsidiary Mr. Amazing Loans offers rates up to 13-times lower than typical APR

- IEG Holdings Corp. intends to create metal-backed cryptocurrency

Based in Las Vegas, IEG Holdings Corp. (OTCQB: IEGH) provides small online personal loans in over 20 states within the U.S. This publicly traded company is a global leader in consumer financing, providing these loans through a state-licenced operating subsidiary known as Investment Evolution Corporation under the consumer brand Mr. Amazing Loans. As a leading fintech brand, Mr. Amazing Loans specializes in dedicated loan amounts of $5,000 and $10,000. This is offered directly to consumers through access to an easy-to-use website.

Customers are assured of no hidden or additional fees and are able to receive same-day processing. There is no prepayment penalty, and loans have fixed repayment and interest rates for their duration. Contrary to the typical annual percentage rate (APR), which can range from 391 percent to 521 percent, as stated by the Centre for Responsible Learning, Mr. Amazing Loans offers rates of 29.9 percent or less that are designed to fit into the budgets of consumers.

A 100 percent-owned subsidiary, Investment Evolution Crypto, LLC has been tasked with the exploration of business opportunities within the blockchain/cryptocurrency industry. This company is set to explore the economic risk and legalities associated with a joint business venture with Mr. Amazing Loans (http://nnw.fm/gZhT1).

With over 22 years in the finance industry, Paul Mathieson, IEG Holdings’ CEO and chairman, has experience in funds management, lending, investment banking and stock market research. Mathieson has been a member of the IEGH board of directors since 2012 and a member of its subsidiary’s board since 2009. Mathieson founded IEG Holdings Limited in Sydney, Australia, having launched Mr. Amazing Loans there in 2005 and then in the United States via IEGC in 2010. He was awarded Ernst & Young’s 2007 Australian Young Entrepreneur of the Year (Eastern Region). Mathieson has been joined on the IEGH management team by Carla Cholewinski, who currently serves as chief operating officer with over 37 years of experience in the finance industry, including credit union management, debt securitization, banking, underwriting, regulatory oversight and banking.

For consumers to be eligible for a loan from Mr. Amazing Loan, they must have a minimum gross annual income of $40,000, a minimum credit score of 600 and steady employment history. The loans are originated, processed and serviced out of the company’s Las Vegas corporate offices, which eliminates IEGH’s need to have a physical establishment in each of the states in which it is licenced to conduct business. IEGH’s six-and-a-half-year track record of originating, underwriting and servicing personal loans to underbanked consumers has made it adept within the consumer finance industry, achieving a meaningful return on its loan portfolio (http://nnw.fm/Zu9nV).

On January 29, 2018, it was announced that the consumer loan provider IEG Holdings was exploring the possibility of creating a cryptocurrency to be backed by gold metal and registered with the SEC as a security. Investment Evolution Crypto, LLC announced its intention to create its own gold metal-backed cryptocurrency that could be used when offering loans and accepting loan repayments. Although Crypto is currently in the development planning stages and exploring the opportunities presented by cryptocurrency and blockchain technologies, the company has already commenced negotiations to purchase a bona-fide gold project with established gold resources in the ground and prospecting licences on record (http://nnw.fm/Tk4iy).

Investment Evolution Crypto is in the process of developing plans to explore the above-mentioned blockchain/cryptocurrency opportunities, with efforts made toward evaluating the legal and associated economic risks. Unlike other digital currencies such as bitcoin, either, Ripple, and Litecoin, IEG Holdings’ cryptocurrency is expected to be backed by gold and registered with the Securities and Exchange Commission (SEC).

In a news release (http://nnw.fm/Ozj1y), Mathieson stated, “We believe potentially combining the exciting new blockchain technology with the hard asset of gold metal, expected SEC registration, a leading sophisticated online consumer finance system and individual U.S. state lending licences is a very exciting proposition. In addition, we believe the future leaders of the crypto/blockchain sector will be companies that are materially compliant with all of the existing and future related U.S. government legislation. We aim for IEGH to leverage off its existing fintech business credentials, specifically its experience on online consumer loans, to potentially be a key player in the crypto/blockchain sector.”

Although it is one of IEGH’s main goals to create its own gold metal-backed cryptocurrency, it will in addition explore the acceptance of established digital currencies, such as bitcoin, for the repayment of consumer loans. This promises to be a year of substantial growth for the company, with plans for further expansion that could see it grow to include up to 25 states by the end of the year.

For more information, visit the company’s website at www.InvestmentEvolution.com

IEGH Aims to Create Exclusive Gold Metal-backed Cryptocurrency

Consumer loan provider IEG Holdings (OTCQB: IEGH) intends to create its own gold metal-backed cryptocurrency for consumer loans and consumer loan repayments. A recent article discussing the company’s anticipated endeavor reads: “On January 10, 2018, consumer loan provider IEG Holdings Corp. (OTCQB: IEGH) announced that its wholly owned subsidiary, Investment Evolution Crypto, LLC, is negotiating to purchase a gold project with prospecting licenses and known gold resources. The corporation plans to use a gold resource for the creation of its own gold metal-backed cryptocurrency, with a view to offering loans and accepting loan repayments through blockchain technology. Investment Evolution Crypto has not started mineral operations as yet, but it is currently developing plans to explore these crypto/blockchain opportunities. These efforts will include an evaluation of the legalities and associated economic risks.”

To view the full article, visit http://nnw.fm/pZWh7

About IEG Holdings Corporation

IEG Holdings Corporation provides online $5,000 and $10,000 unsecured consumer loans under the brand name, “Mr. Amazing Loans,” via its website, www.MrAmazingLoans.com. In addition, IEG Holdings announced on December 22, 2017 that it has formed Investment Evolution Crypto, LLC, a wholly owned subsidiary of IEG Holdings (“Crypto”). Crypto will explore the legalities and economic risks and benefits of entering into a joint venture with Investment Evolution Corporation, a wholly owned subsidiary of IEG Holdings (“IEC”), to accept repayment of customer loans in the form of crypto/blockchain currencies such as Bitcoin, provide the crypto equivalent of $5,000 and $10,000 loans to customers, and also potentially create and issue an IEC cryptocurrency. Crypto has not begun operations and is in the development planning stages to explore these business opportunities in this time of changing technology. For more information about IEG Holdings, visit www.InvestmentEvolution.com.

Really pumped then exhaled

Is anyone long on this? I think it will spike soon.

Why has it just stayed flat the last few sessions?

No movement what so ever.

Waiting for take - off. Tightly held - good news needed.

How are we doing folks?

IEGH Aims to be Key Player in the Cryptocurrency/Blockchain Sector

- IEG Holdings plans to create its own gold metal-backed cryptocurrency for consumer loans and consumer loan repayments

- The company’s loans offer interest rates that are significantly lower than payday lenders

- Adoption of blockchain technology offers substantial growth potential

On January 10, 2018, consumer loan provider IEG Holdings Corp. (OTCQB: IEGH) announced that its wholly owned subsidiary, Investment Evolution Crypto, LLC, is negotiating to purchase a gold project with prospecting licenses and known gold resources. The corporation plans to use a gold resource for the creation of its own gold metal-backed cryptocurrency, with a view to offering loans and accepting loan repayments through blockchain technology. Investment Evolution Crypto has not started mineral operations as yet, but it is currently developing plans to explore these crypto/blockchain opportunities. These efforts will include an evaluation of the legalities and associated economic risks.

Unlike other digital currencies like bitcoin, ether, Ripple and Litecoin, IEG Holdings’ cryptocurrency will be backed by gold and registered with the Securities Exchange Commission (SEC) as a security.

In a news release, the company’s chairman and CEO, Paul Mathieson, had this to say about the venture: “We believe potentially combining the exciting new blockchain technology with the hard asset of gold metal, expected SEC registration, a leading sophisticated online consumer finance system and individual U.S. state lending licenses is a very exciting proposition. In addition, we believe the future leaders of the crypto/blockchain sector will be companies that are materially compliant with all the existing and future related U.S. government legislation. We aim for IEGH to leverage off its existing fintech business credentials, specifically its extensive experience in online consumer loans, to potentially be a key player in the crypto/blockchain sector.”

IEG Holdings, based in Las Vegas, is a global leader in consumer finance and provides small-sized online personal loans to consumers in the United States. Through its operating subsidiary, Investment Evolution Corporation, the company offers loans under the brand “Mr. Amazing Loans.” Mr. Amazing Loans is a fintech company that specializes in providing loan amounts of $5,000 to $10,000 to consumers through a professional, user-friendly website. IEG Holdings’ loans are unsecured consumer loans with a five-year maturity period and interest rates that are significantly lower than payday lenders.

Through Mr. Amazing Loans, consumer loans receive same-day processing, with no prepayment penalty and no hidden or additional fees. Repayment interest rates are fixed at an annual percentage rate (APR) of 29.9 percent or less for the life of the loan.

According to the Center for Responsible Lending, typical payday lenders charge interest rates ranging from 391 percent to 521 percent APR on loans from $100 to $1,000 (http://nnw.fm/iH8Y8). Terms presented by Mr. Amazing Loans offer low fixed repayments which fit into consumer budgets in an effort to ensure that they strengthen their financial positions. Loans may be approved on the same day of application, and funds are deposited directly into approved consumers’ bank accounts.

IEG Holdings is licensed and/or holds certificates of authority to originate loans in 20 states, including Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Louisiana, Maryland, Missouri, Nevada, New Jersey, New Mexico, Ohio, Oregon, Pennsylvania, Texas, Utah, Virginia and Wisconsin. All loans are processed and serviced through the company’s corporate offices in Las Vegas, which eliminates the need for physical offices in each state where the company is licensed to conduct business.

While IEG Holdings’ primary goal is to create its own gold metal-backed cryptocurrency, it will explore the acceptance of established digital currencies, like bitcoin, for consumer loan repayment. With its foray into the rapidly growing blockchain space, 2018 promises to be a year of substantial growth for the company.

For more information, visit the company’s website at www.InvestmentEvolution.com

Are folks buying LC instead of IEGH to get in on the offer?

IEGH Intends to Create Cryptocurrency Backed by Gold Metal

Consumer loan provider IEG Holdings (OTCQB: IEGH) is exploring the possibility of creating a cryptocurrency to be backed by gold metal and registered with the SEC as a security. A recent article discussing the company reads: “Consumer loan provider IEG Holdings Corp. (OTCQB: IEGH), through wholly owned subsidiary Investment Evolution Crypto, LLC. (“Crypto”), recently announced its intention to create its own gold metal-backed cryptocurrency that could potentially be utilized when offering loans and accepting loan repayments. While Crypto is in the development planning stages and exploring the opportunities presented by crypto/blockchain technologies, the company is already negotiating to purchase a bona fide gold project with established gold metal in the ground and prospecting licenses on record.”

To view the full article, visit http://nnw.fm/kDc26

About IEG Holdings Corporation

IEG Holdings Corporation provides online $5,000 and $10,000 unsecured consumer loans under the brand name, “Mr. Amazing Loans,” via its website, www.mramazingloans.com. In addition, IEG Holdings announced on December 22, 2017 that it has formed Investment Evolution Crypto, LLC, a wholly owned subsidiary of IEG Holdings (“Crypto”). Crypto will explore the legalities and economic risks and benefits of entering into a joint venture with Investment Evolution Corporation, a wholly owned subsidiary of IEG Holdings (“IEC”), to accept repayment of customer loans in the form of crypto/blockchain currencies such as Bitcoin, provide the crypto equivalent of $5,000 and $10,000 loans to customers, and also potentially create and issue an IEC cryptocurrency. Crypto has not begun operations and is in the development planning stages to explore these business opportunities in this time of changing technology. For more information about IEG Holdings, visit www.InvestmentEvolution.com.

Need to get some footing here!

IEGH Exploring Creation of Gold Metal-backed Cryptocurrency

- Negotiations underway to purchase a verified gold project with prospecting licenses

- IEGH’s cryptocurrency to be backed by gold metal, registered with SEC as a security

- Volatility of cryptocurrency could potentially be stabilized with precious metal backing

Consumer loan provider IEG Holdings Corp. (OTCQB: IEGH), through wholly owned subsidiary Investment Evolution Crypto, LLC. (“Crypto”), recently announced its intention to create its own gold metal-backed cryptocurrency that could potentially be utilized when offering loans and accepting loan repayments. While Crypto is in the development planning stages and exploring the opportunities presented by crypto/blockchain technologies, the company is already negotiating to purchase a bona fide gold project with established gold metal in the ground and prospecting licenses on record.

In a news release announcing the company’s venture (http://nnw.fm/y3TXj), Paul Mathieson, IEG Holdings chairman and CEO, said, “We believe potentially combining the exciting new blockchain technology with the hard asset of gold metal, expected SEC registration, a leading sophisticated online consumer finance system and individual US state lending licenses is a very exciting proposition… In addition, we believe the future leaders of the crypto/blockchain sector will be companies that are materially compliant with all the existing and future related US government legislation. We aim for IEGH to leverage off its existing fintech business credentials, specifically its extensive experience in online consumer loans, to potentially be a key player in the crypto/blockchain sector.”

This attention to detail and meeting regulatory necessities is the backbone of IEGH’s success as a publicly traded, global leader in consumer finance (http://nnw.fm/08dOt). The company provides small online personal loans of $5,000 to $10,000 in the United States via a state-licensed operating subsidiary, Investment Evolution Corporation, under the consumer brand ‘Mr. Amazing Loans’.

The company originates, processes, and services consumer loans from its centralized Las Vegas headquarters. Loans are offered in 20 states via its online platform and distribution network. IEGH is a licensed direct lender with state licenses and/or certificates of authority to lend in each state and offers all loans within the prevailing statutory rates. The difference for consumers seeking a personal loan under Mr. Amazing Loans’ terms is the ability to repay the loan with low, fixed repayment schedules that fit into their lifestyle and budget. Since inception, the company has provided over $16 million in consumer loans – a cumulative loan volume increase of 192 percent from January 2015 to the end of 2017 (http://nnw.fm/N1DtP).

The coming year includes some exciting business opportunities for IEG Holdings, its subsidiaries and investors. Exploration of the legalities, economic risks and benefits of accepting repayment of customer loans in the form of leading crypto/blockchain currencies such as bitcoin, and also possibly creating and issuing a precious metal-backed cryptocurrency, are seen as prime targets for 2018.

For more information, visit the company’s website at www.InvestmentEvolution.com

IEGH Pushes for Negotiations Related to LendingClub Offer

Consumer loan provider IEG Holdings Corp. (OTCQB: IEGH) this morning issued a news release urging LendingClub Corporation (NYSE: LC) to enter negotiations related to the former’s tender offer to acquire approximately 4.99 percent of LendingClub’s outstanding shares. The offer, which is scheduled to expire on Thursday, February 22, 2018, comes as IEGH has identified what it believes to be “major risks and problems” with LendingClub’s business model and management strategy. IEGH believes that by altering this model to a balance sheet lender model, LendingClub would be able to generate significantly higher margins, provide substantially higher long duration cash flow, build increased goodwill with customers and enable increased customer refinancing. IEGH also highlights blockchain technology as a means of increasing LendingClub’s cash flow security and transparency. IEGH’s tender offer calls for the exchange of 13 shares of IEGH common stock for each share of LendingClub common stock, up to an aggregate of 20,701,999 LendingClub shares.

To view the full press release, visit http://nnw.fm/yY4pw

About IEG Holdings Corporation

IEG Holdings Corporation provides online $5,000 and $10,000 unsecured consumer loans under the brand name, “Mr. Amazing Loans,” via its website, www.mramazingloans.com. In addition, IEG Holdings announced on December 22, 2017 that it has formed Investment Evolution Crypto, LLC, a wholly owned subsidiary of IEG Holdings (“Crypto”). Crypto will explore the legalities and economic risks and benefits of entering into a joint venture with Investment Evolution Corporation, a wholly owned subsidiary of IEG Holdings (“IEC”), to accept repayment of customer loans in the form of crypto/blockchain currencies such as Bitcoin, provide the crypto equivalent of $5,000 and $10,000 loans to customers, and also potentially create and issue an IEC cryptocurrency. Crypto has not begun operations and is in the development planning stages to explore these business opportunities in this time of changing technology. For more information about IEG Holdings, visit www.investmentevolution.com

IEG Holdings Urges LendingClub Board to Enter into Negotiations with IEG Holdings and to also Explore Opportunities in the Crypto/Blockchain Sector

Jan 23, 2018

OTC Disclosure & News Service

-

IEG Holdings Urges LendingClub Board to Enter into Negotiations with IEG Holdings and to also Explore Opportunities in the Crypto/Blockchain Sector

LAS VEGAS, NV--(Marketwired - January 23, 2018) - IEG Holdings Corporation (OTCQB: IEGH) ("IEG Holdings") has commenced a tender offer to exchange 13 shares of IEG Holdings' common stock for each share of LendingClub Corporation ("LendingClub") common stock, up to an aggregate of 20,701,999 shares of LendingClub common stock, representing approximately 4.99% of LendingClub's outstanding shares as of October 31, 2017, validly tendered and not properly withdrawn in the offer. The offer is scheduled to expire at 5:00 p.m., Eastern time, on Thursday, February 22, 2018, unless the offer is extended or earlier terminated.

IEG Holdings urges LendingClub to enter into negotiations with IEG Holdings, rather than simply dismissing the tender offer. IEG Holdings also encourages LendingClub to explore opportunities in the crypto/blockchain sector, as IEG Holdings believes LendingClub's use of blockchain technology may increase cash flow security, transparency and customer loan risk analysis with an open ledger. IEG Holdings believes that the LendingClub board of directors should be held accountable by its shareholders for continuing to pursue a flawed, slim margin "broker" business model and ignoring blockchain technology.

Based on the closing prices of IEG Holdings' and LendingClub's common stock on January 22, 2018, the aggregate market value of 13 shares of IEG Holdings offered in the offer is approximately 12.1% MORE than the value of one LendingClub share.

Market Price

Per Share Total Value

(as of January 22, 2018)

1 Share of LendingClub Common Stock $ 4.06 $ 4.06

13 Shares of IEG Holdings Common Stock $ 0.35 $ 4.55

AMOUNT YOU MAY POTENTIALLY GAIN: $ 0.49 per Share

IEG Holdings has identified what it believes to be a number of major risks and problems with the LendingClub business and management:

Flawed, slim-margin, loss-making business model

Weak underwriting standards

Lack of company-owned state lending licenses

Unsustainable funding sources

Lack of leadership and excessive cost structure

Poor stock market performance and zero dividends to shareholders

IEG Holdings' Reasons for the Offer

IEG Holdings believes that changing LendingClub's business model to a balance sheet lender model would enable the company to generate significantly higher gross margins, provide significantly higher long duration cash flow from customers, build increased customer goodwill with customers and enable increased customer refinancing. The longer duration cash flow would provide more flexibility in reducing lending volumes during periods when underwriting risk levels are rising, as the company would be less dependent on brokering new loan deals every day to provide revenue. Becoming a balance sheet lender rather than a broker of loans would also remove the inherent potential conflict of interest and hazard of providing loans as a broker with potential lax underwriting standards due to the company and employees not taking the full risk of loan repayment. The addition of individual state licenses also is likely to reduce the regulatory risk of being operationally dependent on third parties for lending licenses. LendingClub could initially utilize its existing cash at bank to conduct balance sheet lending and then utilize customer principal and interest repayments, seeking additional debt or equity funding for additional growth of its loan book.

In reaching its decision to approve the offer and the acquisition of LendingClub shares, Paul Mathieson, IEG Holdings' sole director, consulted with IEG Holdings' senior management team and considered a number of factors, including the following material factors which Mr. Mathieson viewed as supporting his decision to approve the offer and the acquisition:

IEG Holdings intends to encourage LendingClub to undertake substantial costs cuts by terminating excess employees, achieving substantial cuts in advertising/marketing costs and other significant cost cutting measures;

IEG Holdings intends to encourage LendingClub to transform its broker business model with low gross margins and high volumes to focus on high gross margin unsecured loans to near prime clients with strong underwriting, company owned individual state licenses and retention of loans on its balance sheet to secure long duration cash flow from longer term loans;

IEG Holdings intends to encourage Lending Club to explore opportunities in the crypto/blockchain sector; and

The acquisition of LendingClub shares would substantially increase shareholder equity for IEG Holdings' stockholders.

Consummation of the offer is conditioned upon satisfaction of certain customary conditions. Shares that are tendered pursuant to a notice of guaranteed delivery but not actually delivered to the depository and exchange agent for the tender offer, Computershare Trust Company, N.A., prior to the expiration time of the offer will not be deemed to be validly tendered into the offer unless and until such shares underlying such notices of guaranteed delivery are delivered.

Complete terms and conditions of the offer are set forth in the Letter of Transmittal and other related materials and in the registration statement on Form S-4, which were filed by IEG Holdings with the Securities and Exchange Commission (the "SEC") on January 5, 2018.

Copies of the Letter of Transmittal and other related materials are available free of charge from Okapi Partners LLC, the information agent for the offer. LendingClub stockholders who have questions regarding the tender offer should contact the information agent at info@okapipartners.com or (855) 208-8903 (toll-free). Computershare Trust Company, N.A. is acting as depository for the tender offer.

Additional Information

This press release is provided for informational purposes only and does not constitute an offer to purchase or the solicitation of an offer to sell any securities. IEG Holdings has filed with the SEC a Registration Statement on Form S-4 and a Tender Offer Statement on Schedule TO containing a letter of transmittal and other documents relating to the tender offer. IEG Holdings or LendingClub will mail these documents without charge to LendingClub common stockholders. Investors and stockholders should read those filings carefully as they contain important information about the tender offer. These documents, as well as IEG Holdings' other public filings with the SEC, may be obtained without charge at the SEC's website at www.sec.gov and at IEG Holdings' website at www.investmentevolution.com. The information contained on the SEC's and IEG Holdings' websites is not incorporated by reference in this press release and should not be considered to be a part of this press release. The letter of transmittal and related materials may also be obtained without charge by contacting Okapi Partners LLC, the information agent for the offer, at info@okapipartners.com or (855) 208-8903 (toll-free).

About IEG Holdings Corporation

IEG Holdings Corporation is an SEC reporting fintech company that provides online $5,000 and $10,000 unsecured consumer loans under the brand name, "Mr. Amazing Loans", via its website and online application portal at www.mramazingloans.com. IEG Holdings currently offers $5,000 and $10,000 unsecured consumer loans that mature in five years. IEG Holdings is a direct lender with state licenses and/or certificates of authority in 20 states -- Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Louisiana, Maryland, Missouri, Nevada, New Jersey, New Mexico, Ohio, Oregon, Pennsylvania, Texas, Utah, Virginia and Wisconsin. IEG Holdings provides loans to residents of these states through our online application portal, with all loans originated, processed and serviced out of our centralized Las Vegas head office.

IEG Holdings has formed Investment Evolution Crypto, LLC, a wholly owned subsidiary of IEG Holdings ("Crypto"). Crypto will explore the legalities and economic risks and benefits of entering into a joint venture with Investment Evolution Corporation, a wholly owned subsidiary of IEG Holdings ("IEC"), to accept repayment of customer loans in the form of crypto/blockchain currencies such as Bitcoin and provide the crypto equivalent of $5,000 and $10,000 loans to customers. IEG Holdings also plans to utilize a gold resource to investigate creating, through Crypto, its own gold metal-backed and Securities and Exchange Commission registered crypto/blockchain currency, and potentially offer loans and accept loan repayments in its own crypto/blockchain currency. Prior to launching these plans, Crypto will investigate the legalities and economic risks and benefits of its plans. Crypto has not begun operations and is in the development planning stages to explore these business opportunities in this time of changing technology. For more information about IEG Holdings, visit www.investmentevolution.com.

Forward-Looking Statements

This press release contains forward-looking statements. All statements other than statements of historical facts included in this press release are forward-looking statements. In some cases, forward-looking statements can be identified by words such as "believe," "expect," "anticipate," "plan," "potential," "continue" or similar expressions. Such forward-looking statements include risks and uncertainties, and there are important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors, risks and uncertainties are discussed in IEG Holdings' filings with the SEC. Investors should not place any undue reliance on forward-looking statements since they involve known and unknown, uncertainties and other factors which are, in some cases, beyond IEG Holdings' control which could, and likely will, materially affect actual results, levels of activity, performance or achievements. Any forward-looking statement reflects IEG Holdings' current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to operations, results of operations, growth strategy and liquidity. IEG Holdings assumes no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

The contents of IEG Holdings' website referenced herein are not incorporated into this press release.

Contact:

Paul Mathieson

IEG Holdings Corporation

Chairman/CEO and Founder

info@investmentevolution.com

IEGH is Lending to the Under-Banked in 20 US States

- Offering consumer loans in 20 states

- Robust underwriting standards

- Successful track record in the industry

Despite living in the country with the world’s most sophisticated financial system, 16 million American adults are ‘unbanked’, according to the latest ‘Report on the Economic Well-Being of U.S. Households’ issued by the Board of Governors of the Federal Reserve System (http://nnw.fm/29Obr). Unbanked consumers are those without “a checking, savings, or money market account.” In addition, another 43 million or so are ‘under-banked’, defined as having a deposit account but also using at least one alternative financial service in the prior year. Yet prick the people who fall into these two market segments and, like their better-banked brethren, they will bleed, being no different. That similarity extends to their need for certain banking services, such as the personal loans offered by IEG Holdings Corp. (OTCQB: IEGH). The Nevada-based company offers loan products, under the label ‘Mr. Amazing Loans’, to residents of 20 states.

Who hasn’t needed, at some point, a personal loan for an emergency or to finance some venture? Yet banks are notoriously finicky. As Bob Hope once observed, “A bank is a place that will lend you money if you can prove you don’t need it.” Moreover, non-bank lenders charge usurious rates. The typical payday loan has rates ranging from 391 percent to 521 percent annual percentage rate (APR) on loans ranging from $100 to $1,000, according to the Center for Responsible Lending.

Conversely, the rates offered by Mr. Amazing Loans are affordable and designed with low, fixed repayments to fit into consumer budgets, with the added goal of helping clients reach a stronger financial position. The company offers $5,000 and $10,000 personal loans over a five-year term at rates ranging from 12.0 percent to 29.9 percent APR in 20 states, including Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Louisiana, Maryland, Missouri, Nevada, New Jersey, New Mexico, Ohio, Oregon, Pennsylvania, Texas, Utah, Virginia and Wisconsin.

Thoughtful underwriting standards separate gold from the straw. To be eligible, a consumer must, among other criteria, have a minimum gross annual income of $40,000, a minimum credit score of 600 and a steady employment history. Loans are originated, processed and serviced out of the company’s Las Vegas corporate offices, which eliminates the need for IEGH to have a brick-and-mortar office in each state where it is licensed to conduct business. Consumers are able to receive same-day processing and are assured of no hidden or additional fees, no prepayment penalties and reasonable interest rates.

IEGH has a 6 1/2-year track record of originating, underwriting and servicing personal loans to under-banked consumers. It has become adept, through that experience and knowledge in the consumer finance industry, at achieving a meaningful return on its loan portfolio. In addition, the company has the clout to attract capital markets financing, as it has signaled with recent private placements of common and preferred stock. IEGH has two wholly-owned subsidiaries, IEC, its U.S. operating entity that holds all its state licenses, leases, employee contracts and other operating and administrative assets, and IEC SPV, a bankruptcy remote special purpose entity that holds the U.S. loans. The company recently introduced a third subsidiary, Investment Evolution Crypto, LLC.

Paul Mathieson, IEG Holdings chairman and chief executive officer, has over 22 years’ experience in lending, funds management, stock market research and investment banking. Mathieson founded IEG Holdings Limited in Sydney, Australia, launching the Mr. Amazing Loans business in that country in 2005 and then in the United States via IEGC in 2010. He was awarded Ernst & Young’s 2007 Australian Young Entrepreneur of the Year (Eastern Region). Mathieson is joined by Carla Cholewinski, who serves as chief operating officer with over 37 years of experience in the finance industry, including banking, credit union management, regulatory oversight, debt securitization and underwriting.

For more information, visit the company’s website at www.InvestmentEvolution.com

IEGH Views Current Tender Offer as Solid Short-term Investment for Shareholders

IEG Holdings (OTCQB: IEGH), a provider of unsecured consumer loans, recently announced a tender offer to exchange 13 shares of the company’s common stock for each share of common stock of LendingClub Corp. (NYSE: LC). An article discussing the offer reads: “IEG Holdings Corporation (OTCQB: IEGH) recently announced (http://nnw.fm/4dXAB) that it has begun a tender offer for 4.99 percent of the common shares of LendingClub Corporation (NYSE: LC). The offer, set to expire on February 22, 2018, is for up to an aggregate of 20,701,999 common shares. The transaction calls for the exchange of 13 shares of IEG Holdings common stock for each share of LendingClub. … IEGH believes that the offer is a solid short-term investment for its shareholders.”

To view the full article, visit http://nnw.fm/Ux3j4

About IEG Holdings Corporation

IEG Holdings Corporation provides online $5,000 and $10,000 unsecured consumer loans under the brand name, “Mr. Amazing Loans,” via its website, www.MrAmazingLoans.com. In addition, IEG Holdings announced on December 22, 2017 that it has formed Investment Evolution Crypto, LLC, a wholly owned subsidiary of IEG Holdings (“Crypto”). Crypto will explore the legalities and economic risks and benefits of entering into a joint venture with Investment Evolution Corporation, a wholly owned subsidiary of IEG Holdings (“IEC”), to accept repayment of customer loans in the form of crypto/blockchain currencies such as Bitcoin, provide the crypto equivalent of $5,000 and $10,000 loans to customers, and also potentially create and issue an IEC cryptocurrency. Crypto has not begun operations and is in the development planning stages to explore these business opportunities in this time of changing technology. For more information about IEG Holdings, visit www.InvestmentEvolution.com

GobalSmallCaps Research Report out on IEGH

http://globalsmallcaps.com/2018/01/22/2899/

IEG Holdings Corp. is a Las Vegas, Nevada-based holding company that has a core focus of offering online unsecured consumer loans up to $10,000 through its Mr. Amazing Loans subsidiary. The lender is licensed to operate across 20 U.S. states.

The company recently announced plans to create its own IEGH cryptocurrency and blockchain technology.

IEG Holdings Corp. is currently negotiating the purchase of a gold mining project with feasibility reports supporting strong gold deposits. The company will back its own cryptocurrency up with the gold from this mining project.

The holding company recently launched a tender offer for up to 4.99% of LendingClub Corp., a peer-to-peer, crowdfunding platform for individuals.

The company continues to post strong earnings growth on an annual basis. Total revenues have more than tripled since full year 2014.

IEG Holdings Corp. continues to position for long-term growth within consumer loans, cryptocurrency, and other financial services holdings

50 ema support and 100 ema new resistance...but I think we make a run on the 200ema soon

it seems this is at a turning point soon. I may reenter next week

This is a good company. About to go in the black soon...plus they have 2 mil in sales last year and a float of 2.8 mil. Oh did I mention over 3% dividend? Bought them for a trade, but honestly I think I will keep a piece for a while. Price target 4$

With all the back loading on the drop this will go back over 1$ soon imo.

Fidelity wouldn't fill be at .41...even when it was lower today...so I slapped and added more at .43...price target 4$

IEGH is “One to Watch”

- State-licensed online unsecured consumer loan company

- Attractive alternative to expensive payday lenders

- Cumulative loan volume increased to more than $16 million end of 2017

- Since January 2015, cumulative loan volume has increased by 192%

IEG Holdings Corp. (OTCQB: IEGH) is a publicly traded, global leader in consumer finance providing small-sized online personal loans in the United States via a state-licensed operating subsidiary, Investment Evolution Corporation, under the consumer brand “Mr. Amazing Loans.” Based in Las Vegas, the company originates consumer loans in 20 states: Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Louisiana, Maryland, Missouri, Nevada, New Jersey, New Mexico, Ohio, Oregon, Pennsylvania, Texas, Utah, Virginia and Wisconsin via its online platform and distribution network. IEGH is a licensed direct lender with state licenses and/or certificates of authority to lend in each state and offers all loans within the prevailing statutory rates.

Mr. Amazing Loans is a leading FinTech company specializing in dedicated loan amounts of $5,000 to $10,000 offered directly to consumers through an easy-to-use website known for its professional interaction with applicants. All loans are originated, processed and serviced out of the company’s Las Vegas corporate offices, eliminating the need for physical locations in each state where IEGH is licensed to conduct business. The company’s loans are unsecured consumer loans that mature in five years at interest rates significantly less than those of payday lenders. Consumers are able to receive same-day processing and are assured of no hidden or additional fees, no prepayment penalty, with repayment and interest rates fixed at 29.9% or less Annual Percentage Rate (APR) for the life of the loan.

The Center for Responsible Lending states the typical payday loan has rates ranging from 391% to 521% APR on loans that typically range from $100 to $1,000. Conversely, Mr. Amazing Loans’s terms are designed with low fixed repayments to fit into consumer budgets with the added goal of helping clients reach a stronger financial position. Loan funds are deposited directly into an approved consumer’s checking account and may be approved the same day after necessary application documentation is received.

IEG Holdings has also incorporated Investment Evolution Crypto, LLC., a 100 percent owned subsidiary, and tasked the new company with exploring business opportunities in the cryptocurrency/blockchain industry. Specifically, the subsidiary company will explore the legalities and economic risks of entering into a joint venture with IEGH’s other 100 percent owned subsidiary company, Investment Evolution Corporation dba Mr. Amazing Loans. Among the questions to be answered during this development planning stage are whether Mr. Amazing Loans should accept repayment of customer loans in the form of leading crypto/blockchain currencies such as Bitcoin, provide the equivalent of USD $5,000 and $10,000 loans to consumers in cryptocurrencies, and potentially create and issue an Investment Evolution cryptocurrency.

Paul Mathieson, IEG Holdings’ chairman and Chief Executive Officer, has over 19 years of finance industry experience in lending, funds management, stock market research and investment banking. He has been a member of the board of directors at IEGH since 2012 and of its subsidiary since 2009. Mathieson founded IEG Holdings Limited in Sydney, Australia, launching the Amazing Loans business in that country in 2005 and then in the United States via IEGC in 2010. He was awarded Ernst & Young’s 2007 Australian Young Entrepreneur of the Year (Eastern Region). Mathieson is joined by Carla Cholewinski, who serves as chief operating officer with over 37 years of experience in the finance industry including banking, credit union management, regulatory oversight, debt securitization and underwriting.

For more information, visit the company’s website at www.InvestmentEvolution.com

VERT back loading on the bid

Did I miss something? Why is IEGH trading at .56 if the tender offer is 13X -$7.3 equiv (cheaper to buy LC ($4.35) no?)

I'm looking at the float to be 5.4m Due for a good bounce tomorrow! Looking forward to a green friday.

Gonna grab some of this prolly, Blockchain and Gold is that what we have here?

In here...lets get crackin...the giant volume spike is a good start. This looks attractive to people wanting to get into the blockchain, but not into just buying random coins from people on the web. Also Crypto lending is big $$$ easy double here!

ASCM set to start loading at .55 if it gets there. Not selling.

IEGH Commences Tender Offer for 4.99% of the Common Shares of LendingClub Corporation (NYSE: LC)

- Offer to expire on February 22, 2018, and represents 4.99 percent of outstanding common shares as of October 31, 2017

- Transaction calls for exchange of 13 shares of IEG Holdings common stock for each share of LendingClub, up to an aggregate of 20.7 million shares

- IEGH sees tender offer as a solid short-term investment for its own shareholders

IEG Holdings Corporation (OTCQB: IEGH) recently announced (http://nnw.fm/4dXAB) that it has begun a tender offer for 4.99 percent of the common shares of LendingClub Corporation (NYSE: LC). The offer, set to expire on February 22, 2018, is for up to an aggregate of 20,701,999 common shares. The transaction calls for the exchange of 13 shares of IEG Holdings common stock for each share of LendingClub.

IEGH believes that the offer is a solid short-term investment for its shareholders. In connection with the offer, IEG Holdings prepared a Letter of Transmittal and submitted a form S-4 with the SEC.

Las Vegas-based IEG Holdings provides $5,000 and $10,000 unsecured consumer loans under the brand name ‘Mr. Amazing Loans’ through its website, www.MrAmazingLoans.com. It is licensed and/or holds certificates of authority to originate direct consumer loans in 20 states. The company provides loans through its online application portal to residents of those states, with all loans originated, processed and serviced out of its centralized Las Vegas head office.

ACF Equity Research, on January 4, 2018, estimated that IEG Holdings revenues in 2018 will reach $2,911,000, compared to $2,135,046 actual in 2016 (http://nnw.fm/v5Tsk). The research report noted that ACF also estimates a high 80 percent repeat loan business for the company.

LendingClub (http://nnw.fm/lYN8d) offers loans of up to $40,000 for consumers, as well as small business loans of up to $300,000. It is an online marketplace connecting borrowers and investors. It began operations in 2007.

For more information, visit the company’s website at www.InvestmentEvolution.com

Finding nice support in .60 range IEGH

IEGH consolidating in this range then will pop to $1.50-$2.00 and find new trading range above $1.00-$1.25.

Love this stock

Obviously, IEGH is a Pump and dump from $0.2! Going back soon!!!

|

Followers

|

11

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

300

|

|

Created

|

11/23/12

|

Type

|

Free

|

| Moderators | |||

NEW YORK, NY / ACCESSWIRE / December 29, 2017 / SeeThruEquity, a leading independent equity research and corporate access firm focused on smallcap and microcap public companies, today announced it has issued an update on IEG Holdings Corporation (OTCQB: IEGH).

The report is available here: IEGH December 2017 Update Note.

IEG Holdings Corporation (OTCQB: IEGH) provides online unsecured consumer loans under the brand name "Mr. Amazing Loans" via its website, www.mramazingloans.com, in 20 US states. The company offers $5,000 and $10,000 personal loans over a five-year term at rates ranging from 19.9% to 29.9% APR. IEG Holdings plans future expansion to a total of 25 US states, which would cover 240mn people and represent approximately 75% of the US population.

Since 2013, IEGH has obtained additional state lending licenses, and they are licensed and originating direct consumer loans in 20 states including: Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Louisiana, Maryland, Missouri, Nevada, New Jersey, New Mexico, Ohio, Oregon, Pennsylvania, Texas, Utah, Virginia, and Wisconsin. The Company was founded in 2010 and is headquartered in Las Vegas, Nevada.

Highlights from the note include:

IEGH to enter Crypto / Blockchain space with new entity

On December 22, 2017, IEGH Chairman and CEO Paul Mathieson announced that IEGH would enter the cryptocurrency space with the incorporation of a new entity, Investment Evolution Crypto, LLC. The new entity is a 100% wholly-owned subsidiary that will explore the practicality and legality of working with Mr. Amazing Loans to accept payment for customer loans by way of leading Crypto / Blockchain currencies such as Bitcoin, provide the cryptocurrency equivalent of $5,000 and $10,000 loans, and potentially issue its own cryptocurrency. The decision to enter the cryptocurrency space is a rational one for IEGH, which already has an existing business issuing $5,000 and $10,000 consumer loans through online channels, and the company may be able to leverage the growing interest in cryptocurrency to grow its business and raise new capital that could be deployed to grow its loan book.

IEGH releases 3Q17 results

IEGH released 3Q17 results on November 8, 2017, with the filing of its 10-Q with the SEC. During 3Q17 IEGH increased its advertising spend and maintained its quarterly dividend of $0.005 per common share. Revenues, primarily consisting of interest revenue, were $407,370, down from $413,941 in 2Q17 and 557,551 in 3Q16. As of September 30, 2017, IEGH had 1,546 loans outstanding with an unpaid principal balance of $5.92mn. Operating expenses during the quarter declined to $1.48mn from $1.54mn in the year-ago period. The company increased advertising expenses during the quarter, which is expected to help increase loan originations in future periods. IEGH also resumed payments to CEO Paul Mathieson, at an annual salary of $1.2mn, and reduced rent and other operating expenses. We estimate the company is now operating at an annualized expense rate of slightly under $6mn and have assumed the company will manage the business for growth rather than targeting breakeven in the short run. Net loss in 3Q17 was ($1.7mn), including a legal settlement of $0.6mn. For the quarter, EPS came in at a loss of ($0.13) versus ($0.10) in the year-ago period.

Price target moves to $2.00

We are updating our price target for IEGH to $2.00 per share following recent results and a new share count assumption following recent financing activities. IEGH is a high risk, high potential reward company in the consumer finance sector.

OTC Disclosure & News Service

-

LAS VEGAS, NV--(Marketwired - December 22, 2017) - IEG Holdings Corporation (OTCQB: IEGH) announced today that it has incorporated a 100% owned subsidiary company named Investment Evolution Crypto, LLC. The subsidiary company will explore the legalities and economic risks and benefits of entering into a joint venture with IEGH's other 100% owned subsidiary company Investment Evolution Corporation dba Mr. Amazing Loans to accept repayment of customer loans in the form of leading Crypto/Blockchain currencies such as Bitcoin, provide the crypto equivalent of USD $5,000 and $10,000 loans to customers, and also potentially create and issue an Investment Evolution cryptocurrency. Investment Evolution Crypto has not begun operations and is in the development planning stages to explore these business opportunities in this time of changing technology.

Paul Mathieson, IEG Holdings' Chairman and Chief Executive Officer, said, "I am pleased to announce the launch of a potential new vertically integrated business channel in the exciting new Crypto/Blockchain sector."

Investment Evolution Corporation provides unsecured online consumer loans under the brand name "Mr. Amazing Loans" via our website and online application portal at www.mramazingloans.com. We started our business and opened our first office in Las Vegas, Nevada in 2010. We currently offer $5,000 and $10,000 unsecured consumer loans that mature in five years. The Company is a direct lender with state licenses and/or certificates of authority in 20 states - Alabama, Arizona, California, Florida, Georgia, Illinois, Kentucky, Louisiana, Maryland, Missouri, Nevada, New Jersey, New Mexico, Ohio, Oregon, Pennsylvania, Texas, Utah, Virginia and Wisconsin. We provide loans to residents of these states through our online application portal, with all loans originated, processed and serviced out of our centralized Las Vegas head office, which eliminates the need for physical offices in all of these states.

Make sure you are first to receive timely information on IEG Holdings when it hits the newswire by signing up for IEG Holdings' email news alert system at http://www.investmentevolution.com/alerts.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |