Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Nobody cares, the pinnacle of indifference.

I've made money investing with Knudson. With CBTC not PCLI.

And with all the great experience the company has not had a profitable year.

But the lease arrangements for the facilities he owns pays Paul a great annual income! LOL

Net Income -216,594

https://www.otcmarkets.com/otcapi/company/financial-report/396088/content

The rest of it

41 years as the

Manager of construction related companies, with 26 years performing

bookkeeping and accounting services for these companies; and (iv) for

four and one-half years, he has served as CFO for two publicly-held

companies, and as CFO, represented these companies while they were

going through their auditing process in preparation of completing “Reg. A

Tier 2” offerings, where his duties included providing company

bookkeeping, coordinating with outside accountants, securities attorneys

and auditors of these companies

Check out this bullshit!

Mr. Knudson’s qualifications for preparing

financial statements include, among other general business experience: (i)

taking bookkeeping classes in high school; (ii) a two year college

Bachelor of Arts degree in Business Administration;

Probably because this is a scam? They have mined a pitiful amount of coins since inception. Their miners are outdated and not profitable.

This is a self enrichment scam. All one has to do is read the financials. Paul is paying himself rent to base the miners! LOL

https://www.otcmarkets.com/otcapi/company/financial-report/385289/content

Gross Profit -182.34 Jul - Sept 23

How much does an Antminer T17 make?

Profitability

Period /day /year

Income $3.82 $1,375.13

Electricity -$3.70 -$1,330.56

Profit $0.12 $44.57

Period /day /month /year

Income $4.64 $139.16 $1,669.98

Electricity -$6.34 -$190.08 -$2,280.96

Profit -$1.70 -$50.92 -$610.98

Term

Day

Income

$7.27

Electricity

$9.24

Profit

$-1.97

Why isn't this moving up with bitcoin?

$CBTC I was there when it run to .0369. Things maybe different now, but CBTC can really run, with very low float that we like.

Accumulating this lotto play as well. ;)

I would love if one of these crypto/BTC plays could be T $ NP during this cycle

$CBTC Previously ran to .0395 on Feb 22, 2021 https://schrts.co/FseXuGgT

Bitcoin is getting hot again! It's possible that we see a big run by CBTC!

Very low float! https://www.otcmarkets.com/stock/CBTC/security

$CBTC Yeah well, that'll be excellent!

$CBTC It's time to rise! Bitcoin is up!

Bitcoin 48k own two million shares ride on top with me.

Third eye

Apparently you are everywhere on different boards I have no shares in this company but when a stock is declared dead and worthless and the broker sends all your shares to the DTCC then they should have total accountability of every electronic share and compare them to the original certificates on file at the DTCC they then should know exactly which broker had all the naked short positions that’s what I see happening on the expert market between the NSCC and the broker and the shorts

It would be something if CBTC ran up over $.10. It would be even more something if it went over $1🫲🤑🫱

This thing looking like it wants to break .0050 and move straight up fast. I hope it dips before then so I can get more.

Patiently waiting.

All one has to do is read the financials. Bit coin mining is comical at best. Bitcoin held - intangible asset 1,492.64. Plus with only a small number of miners even at 100% they will produce about $15,000 per year based on the manufactures estimates. Paul paying himself is the issue as he owns all the properties. (Storage units!)

Leased facilities: Wonka #5 and Wonka #6. Each unit’s lease rate is $345/month as storage units to reserve the space

and allocation of electrical power capacity. Lease rate increases to $4,855/month NNN when the primary power is

extended to the unit by either party. As of January 1, 2020, Company obtained the right, but not the obligation, to lease

Wonka #3 and Wonka #4 by assuming each unit’s lease from The Pines Townhomes LLC at rate of $345/month as

storage units to reserve the space and allocation of electrical power capacity

OTC Markets Group Inc.

OTC Pink Basic Disclosure Guidelines (v4.0 January 1, 2023) Page 13 of 17

.

The Pines Townhomes LLC, a privately held company owned by XTRA’s CEO/Director Paul Knudson, is re-purposing a self-storage facility located in Ontario, OR, USA into a data center with 7MW of electrical capacity in phase one and an additional 8MW in phase 2. XTRA Bitcoin Inc. has acquired 5-year leases on building space known as Wonka #5 and Wonka #6. Each lease consists of six storage units combined into a 900 square foot unit and the right to access 1.25MW electricity primary on site. XTRA is obligated to pay all costs to install the high-voltage primary, transformers, metering and secondary distribution electrical systems from utility interconnect onsite to their equipment. XTRA also has a performance based option to acquire access to an additional 7.5MW electricity for expansion at this site. Facility is inside a security fenced property. XTRA is in the development process of raising capital to install the electrical system and to purchase energy-efficient ASIC miners. Development is on hold as XTRA has opportunity to acquire other facilities with a lower

electricity cost.

XTRA Bitcoin Inc. – CBTC acquired 70% of RINK facility, phase 1 electrical capacity lease located in Manitoba, Canada from Xtra Crypto Mining, Inc., a privately held corporation owned by XTRA’s CEO/Director Paul Knudson. RINK is capableof hosting 37 T17s miners. XTRA is obligated to pay 70% of NNN expenses and $490.00 monthly rent. XTRA, also,acquired option on 70% of an additional 1.5 MW future electrical capacity upgrade. RINK acquisition was financed by Xtra Crypto Mining, Inc.

XTRA Bitcoin Inc had previously arranged a 6-month hosting contract for their miners with a 3rd Party provider in

Manitoba, Canada to work around the Covid-19 travel and access restrictions that are delaying completion of RINK

facility. Mining began on December 20, 2020. Hosting continued thru October 1, 2021 when parties agreed to terminate

the contract due to the failure of 90% of the ASIC miners. XTRA’s remaining operable T17 miners have been received at the RINK facility but have not been reactivated due to deteriorating mining economics. All miners have been written off asa n impaired loss.

Argentina to accept Bitcoin to settle contracts..... it is starting

CBTC lets get this thing moving up !!!!!!!

cbtc another 3.93% up ,,,,, let it run

CBTC 5% ,, 8% what ever it takes as long as it keeps going up all positive GLTA

Hearing things about a group on the West Coast coming into this & this stock becoming a darling in 2024.

Paul owns the storage units that allegedly hold the miners. The company address is his home. He pays himself monthly rent on the units and is also paying back "loans" he gave to the company.

Read the lease and loan sections of the filings Here is an excerpt.

.To guarantee the 5-year leases for Wonka #5 and #6 XTRA was obligated to prepay the first and last years’ lease in

the amount of $116,520 and a security deposit of $8,480 for each facility. $75,431 resulted from prepayments and

security deposits paid in cash. $87,285 of the lease prepayment for each lease was made by the transfer of minority

interests in an investment held in a related party. These investments were considered to be potentially impaired

F-14

though accepted as consideration for the lease prepayment and was therefore written off as a loss on asset

impairment. As a result, the Company had a total of $250,000 in lease deposits, incurred a loss of 174,569 and reports lease deposits as follows on September 30, 2023, and 2022:

That's what I gathered off the 10q. Was wondering if there was another side to this. Thanks.

There is no valid reason to buy.

Bitcoin held - intangible asset 2023 $1,492.64, 2022 $1,014.79

Net Income -$52,813.23 Jul - Sept 2023

No motive here except to get a fair and objective answer. Given their income/balance and share structures, I don't see a revenue scaling here, or serious attempt to develop the business. So, aside from the rise in Bitcoin, why buy here?

Tia

Well, the last time BTC was hovering at 40,000 this stock was around .005

March - May 2022.

I think there still a lot of skittish traders out there.

BUY BUY BUY It’s going over a penny 🪲PENNY LANE

XTRA Bitcoin Inc (PK)

0.0028

-0.0006 (-17.65%)

WOOHOOOOOO CBTC💫 🐷weeeeeeeeeeeeeeee

I should have been cleared with my post/ Anyway, back to reality.

We went over a half a penny yesterday I bought this at $.0014 Monday. I started the pump,😂🤣😂hurry up and get in. We’re going over a penny.

WOOHOOOOOOOOOO BUYING Any dips

cbtc seems to go with the price of bitcoin. will watch to see if support holds.

.01 ? Keep pumping those bogus price target maybe one day one will hit !

.0025 -25% what happened? Pump and dump

Oops missed that. Ty.

Please read the filings! That is dollars! SMH

Bitcoin held - intangible asset 2023 $1,492.64, 2022 $1,014.79

Net Income -$52,813.23 Jul - Sept 2023

https://www.otcmarkets.com/otcapi/company/financial-report/385289/content

|

Followers

|

521

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

55245

|

|

Created

|

01/26/11

|

Type

|

Free

|

| Moderators | |||

https://www.otcmarkets.com/stock/TCEL/security

Warning! This company may not be making material information publicly available

Buying or selling this security on the basis of material nonpublic material information is prohibited under Section 10(b) of the Securities Exchange Act of 1934 and Rules 10b-5 and 10b5-1 thereunder. Violators may be subject to civil and criminal penalties.

Per the website, this is all in the planning stage! They claim to need $10 million!

https://secureservercdn.net/50.62.174.113/p3y.c81.myftpupload.com/wp-content/uploads/2019/07/XTRA_Presentation_0711_site-1.pdf

Progress Report

FRUITLAND, ID / ACCESSWIRE / August 22, 2019 / XTRA Bitcoin Inc. (OTC PINK:TCEL) XTRA’s management is assembling the documentation requested by FINRA in response to our corporate action notification regarding merger and name change. Complying with the FINRA requests is the required first step towards bringing our filings current. After FINRA, bringing filings current on OTC to remove the STOP sign is a prerequisite condition to obtaining funding. Management is confident that the FINRA requested documentation and audited financials can be provided in the next 30 to 60 days and has therefore opened financing discussions with several investors and leased additional electrical capacity to bring our project from 2.5MW to 10MW.

https://www.otcmarkets.com/stock/TCEL/news/story?e&id=1421717

FRUITLAND, ID / ACCESSWIRE / August 6, 2019 / Progress report update for $TCEL and $XTRA (OTC PINK:TCEL).

Situation: OTC Markets will not accept filings to bring current (remove STOP sign) until Name Change Notification has been processed by FINRA.

Status: Today, XTRA Bitcoin Inc submitted the Issuer Company Related Action Notification to FINRA with documentation of all actions taken to date by Therapy Cells, Inc (TCEL), including the new Directors and Officers, Plan of Merger with XTRA Bitcoin Inc and Articles of Correction that canceled R/S, Articles of Amendment re Name Change from Therapy Cells, Inc. to XTRA Bitcoin Inc, Updated principal address, Change of Registered Agent, etc, along with a Trading Symbol change request. When reviewed and distributed by FINRA, XTRA Bitcoin Inc is ready to bring filings current to remove STOP sign.

https://www.otcmarkets.com/stock/TCEL/news/story?e&id=1410966

Name Change, Merger Complete, Cancel Reverse Split, Officer Change, Twitter

CHEYENNE, WY / ACCESSWIRE / July 15, 2019 / Great news shareholders of $TCEL and $XTRA.

MERGER COMPLETE!

THERAPY CELLS, INC. (OTC PINK: TCEL) has successfully merged with XTRA Bitcoin Inc. Therapy Cells Inc is the surviving entity and has changed its name to XTRA Bitcoin Inc

REGISTERED in WYOMING as XTRA Bitcoin Inc.

https://www.otcmarkets.com/stock/TCEL/news/story?e&id=1394921

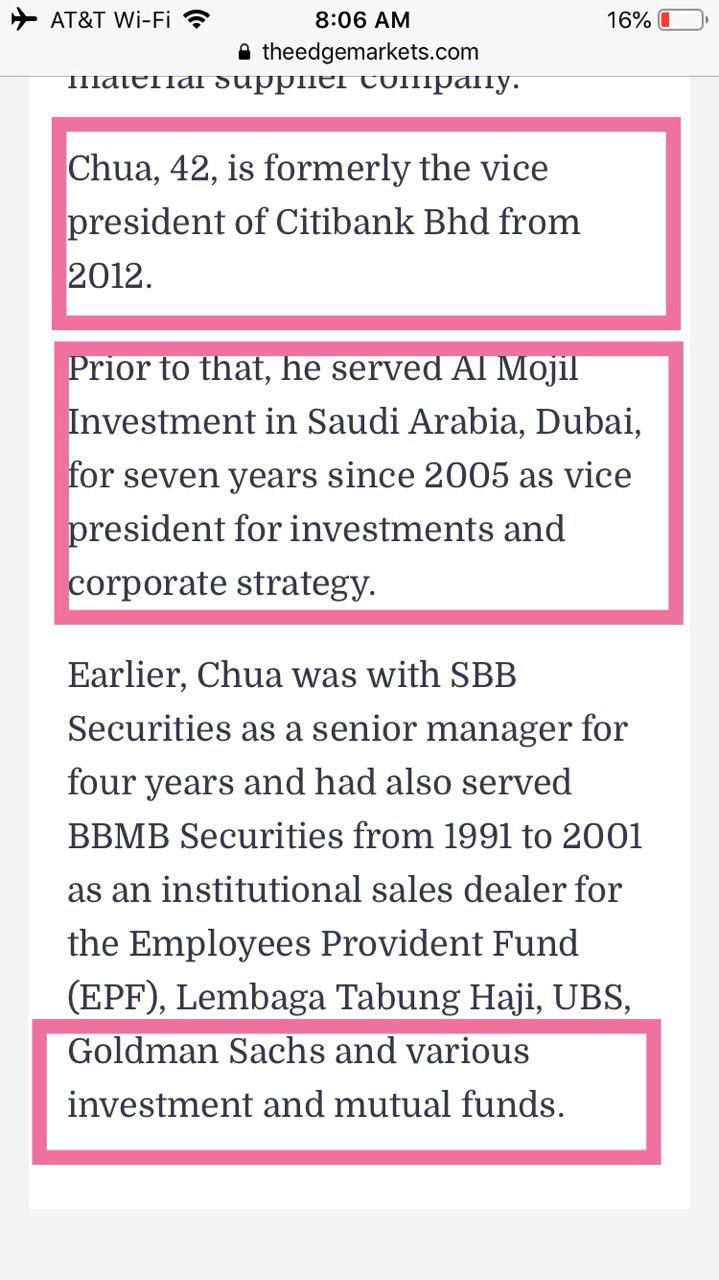

David Chua Newest Member of $TCEL

https://www.nst.com.my/node/259501/amp

https://www.theedgemarkets.com/article/changes-are-afoot-ipmuda

https://www.pressreader.com/malaysia/the-star-malaysia-starbiz/20130405/281496453748799

XTRA’s 2.5MW mining facility is adjacent to a utility substation with 7.5MW available for expansion.

https://secureservercdn.net/50.62.174.113/p3y.c81.myftpupload.com/wp-content/uploads/2019/07/XTRA_Presentation_0711_site-1.pdf

As for costs,,,,,,,,,,,,,,,,,,

Between 60 and 80 percent of bitcoin mining revenue goes straight back into paying for electricity.

https://www.vox.com/2019/6/18/18642645/bitcoin-energy-price-renewable-china

It will take years.

Idaho is a perfect choice for a Cryptocurrency Host Provider for a range of reasons. First, you will find that according to Forbes and the New York Times, it makes a great location because there is such a low risk of natural disasters.

And the average cost for one coin is $3,289

Copyright © 2019 Cryptalker

https://cryptalker.com/bitcoin-states/#Idaho

PLUS

Check out what the company has to say.

https://www.otcmarkets.com/stock/TCEL/news

https://xtrabitcoin.com/

Investor presentation

XTRA’s 2.5MW mining facility is adjacent to a utility substation with 7.5MW available for expansion. They claim to have only 2.5 MW based on their information.

XTRA will manage the installation of the electrical high voltage

infrastructure, transformers, distribution systems, sourcing and acquisition of miners, cooling equipment, filters, racks, internet, and security, and their installations. Obviously the site is not up yet.

Total Investment - Mine Development $10,000,000 for 10 MW. More proof that they are not up and running.

https://secureservercdn.net/50.62.174.113/p3y.c81.myftpupload.com/wp-content/uploads/2019/07/XTRA_Presentation_0711_site-1.pdf

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |