Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

More news and why is Tyson breaking away from the pack.........

http://www.fool.com/investing/general/2013/08/10/tyson-has-a-beef-with-industrys-doping-problem.aspx

Starboard Seeks Group to Form Rival Smithfield Bid........

http://www.bloomberg.com/video/starboard-seeks-group-to-form-rival-smithfield-bid-SKsHqe4yQWS7CiYL8rAqEQ.html?cmpid=yhoo

Tyson takes lead with Zilmax ban.....

http://www.reuters.com/article/2013/08/09/livestock-tyson-idUSL1N0GA01220130809?feedType=RSS&feedName=rbssHealthcareNews&rpc=43

Excitement in another protein producer of beef,pork,chicken,packaged meat........

WILL TSN BREAK $30.00 TODAY??AND OPTION,OPTION,OPTION.

After hour trading before opening:$29.72 Up $1.21

A Stock blazing the trails today and for years to come??WOWWW....easy $$$ as protein prices are going through the roof...

PS-Wish TSN suppliers can participate in this price boom too.

MRL revisited.............

http://www.ecpa.eu/files/webinars/residues/player.html

Logistic for testing individual animal is a HUGE TASK,even for the APHIS of the USDA,before the tighter spec of MRL.

Story of Antibiotics for piggy............

http://www.npr.org/blogs/thesalt/2013/07/11/200870193/are-antibiotics-on-the-farm-risky-business

Politics over pork...............

http://www.c-span.org/flvPop.aspx?id=10737440394

Black swan: protectionism.

China buying SFD for $4.6 Billiont that would mark the biggest Chinese takeover of an American company..............

http://finance.yahoo.com/q;_ylt=AuUaS3PkTUf3bdGnWCBZfONvNu8C;_ylu=X3oDMTEwMHFwZDJuBHBvcwM0BHNlYwN5ZmlRdW90ZXNUYWJsZQRzbGsDc2Zk?s=SFD

TSN 2014 $30 Call option went from $0.40 to $0.50-$0.60 today!

http://finance.yahoo.com/q?s=TSN150117C00030000

I believe adding a chaser, 2015 $30.00 TSN call option,can be a good calculated bet/HEDGE.

PS-Any company controls physical protein,should offer ROI topping PHYSICAL GOLD,and CB(cental banks) policies are NOT WORKING!

I believe the company is trying......

Transitioning from a 100%(inclusive of hardware) service revenue centric model to a more balanced progressive model,with WFCF royalty centric model pushing the way,and eventually 50/50(revenue?). The management team is superb but the current macro pictures are full of crosswinds and headwinds,against the company's plan to grow and diversify its business,thru further leveraging its platform,resulting a higher profit margin and more.Last Q,the SG&A was above $600K vs $480K a year prior,with little change in revenue.The consolidation in the service revenue sector seems continuing,maintaining market share with no price increase,e.g. S&A,its biggest offering, is the rule of the day and has been going on for too many years in my view.

The new program being talked about,may not kick in for another few Q,at the earliest. Until then,the challenge: grow the company with cost control and reduced head count,in an environment where costs are going up everywhere.The management had been in similar challenges between 2006-2009,and it knows what to do when headwinds becomes a gale storm again.Bottom line: I believe 25% revenue growth may not materialize until 2015/2016,my hope was 2014/2015.

You should call the company and ask that one. Leann and I talked a couple times. They are very passionate about what they do and are very receptive to questions.

Thank you...that was interesting. I am curious if there is an Identifying feature to IMI ear tags. For instance the cattle down the street have Yellow tags that you can see while driving by. I notice that same color tags on a picture on IMI's web site so

I just say there IMI verified to my family but don't really know.

At any rate, enjoyed the conference call and bought a few more shares today in my IRA. I appreciate the honesty of this company.

Cheers

Here is a little overview of that 800,000 number. It is an estimation of all beef producers in USA. http://m.beefboard.org/news/files/factsheets/The-Cattle-Industry-Who-We-Are.pdf

WFCF is about the only option for verification compliance. Anyone starting in this business would be years behind.

Hey Grease...Thank goodness John sounded upbeat on the call.

In regards to the new USDA rules and the 800,000 producers referred to on the call. Would that mean the ones that sign up for source verified would need tags for each one of there cattle?

Whats your feel for it? Folks seemed pretty excited on the call.

(its happygolky from yahoo BTW) Cooperpee = Coopers my Jack Russell and he used to like to pee on every bush until I got him fixed.

Hope all is well

$48- a-share value for Smithfield following a breakup??.........

http://www.bloomberg.com/news/2013-03-21/smithfield-seen-unlocking-23-gain-with-breakup-real-m-a.html?cmpid=yhoo

Or

TOP $$$$$$$$$$ for its business subsidiary that controls the supply(piggy) and Wall Streets demanded the company to be broken up NOW!

PS-I got a bad feeling about the price of pork going forward;got to go and stuff my stomach with the non-kosher meat,before it is out of my price range again,like lamb/beef/.............life is tough if you are on other side of Wall Streets(vs Main Streets).....How to fight back: buy TSN $30.0 Jan 2014 call options for $0.40?? I smell $$$$(3 baggers),50% chance a winner.Please use $ you can effort to loose.

Fast Food CEO: "Healthy Food 'Not Our Personality,'...."

http://www.huffingtonpost.com/2013/03/16/fast-food-healthy-food-hardees-carls-jr_n_2891489.html

PS-Can you effort to be different(vs. owning socially responsible companies only) and what is your return? Who ever can make money has my wallet's vote!

Kathleen Merrigan:"Know Your Farmer, Know Your Food"......

http://news.yahoo.com/usdas-no-2-official-quits-she-promoted-local-151625085.html;_ylt=ArD6aCpshyNWISglsr6nP0fzWed_;_ylu=X3oDMTVxdmlxdjMxBGNjb2RlA2dtcHRvcDEwMDBwb29sd2lraXVwcmVzdARtaXQDQXJ0aWNsZSBNaXhlZCBMaXN0IE5ld3MgZm9yIFlvdSB3aXRoIE1vcmUgTGluawRwa2cDMWU5ODA0ZWYtODY3OS0zMzMyLTkwNWUtNjNjNzZiZWY4ZjVhBHBvcwMyBHNlYwNuZXdzX2Zvcl95b3UEdmVyAzhhMWIxOGMxLThkODMtMTFlMi1iN2JmLWI2OGE5YmY2MzNjMw--;_ylg=X3oDMTJtNm0wcG9nBGludGwDdXMEbGFuZwNlbi11cwRwc3RhaWQDMmM0NzkwY2EtNjE0OS0zMTI5LTljYWQtMmRmNWNmNGM3MGJmBHBzdGNhdAN1LXMEcHQDc3RvcnlwYWdl;_ylv=3

ps-Centalization and power in the hands of big food suppliers.... time to buy AT THE MONEY Call otions of TSN and EASY MONEY for 2013? 66% chance,I believe.

From Wendy's point of view.......

"And by far, the protein we're most concerned with is the cost of the beef. That, we see really for the next couple of years, there's such a significant imbalance of global demand versus the supply in North America, which is all we buy, and we're only buying fresh beef. That we think we're just going to face an inflationary environment .......... Occasionally and last year, we saw a little bit of relief, but I think that comes from extraneous factors, pink slime and other issues. So I think fundamentally, we're on a path where the timeframe to improve the supply fundamentals in this country are going to take several years. So I think we're looking at cost inflation of 3% to 4%, which equates to really think of it as a negative 1 point on our restaurant margin that we have to offset..." Steven Hare,CFO of Wendy's

http://seekingalpha.com/article/1274161-the-wendy-s-company-presents-at-ubs-global-consumer-conference-mar-14-2013-09-40-am?page=6

ps-Those who control supply have the upper hand!

It appears there is light at the end of the tunnel

“The weather pattern is more favorable than last year, when warm, dry weather from March to August wilted crops,” Paul Pastelok, an AccuWeather senior meteorologist, said in a telephone interview. “We expect ample moisture during most of the growing season from southern Texas to New York.”

http://www.bloomberg.com/news/2013-03-13/dust-bowl-drought-seen-ending-as-rain-aids-u-s-midwest-planting.html

Excerpts from the CEO......

"So a majority of our customers, our retail customers, while very interested in Where Food Comes From quite frankly are much more worried about whether or not they are actually going to have beef in their cases in the coming months and over the next year.."

http://www.sec.gov/Archives/edgar/data/1360565/000138713113000709/ex99_2.htm

ps-More changes are at work and repositioning to a higher ground is at play...as John stated: there are winners and losers.And I believe pressure is on again!

New COOL over the Old COOL.........

http://www.reuters.com/article/2013/03/08/usa-meat-usa-labeling-idUSL1N0C0HWP20130308?feedType=RSS&feedName=nonCyclicalConsumerGoodsSector&rpc=43[img][/img]

ps-Another broken record and still playing?Not cool.

JBS..........

World:

http://www.jbssa.com/CompanySites/default.aspx

USA:

https://www.fiveriverscattle.com/about/about_history.aspx

Other protein:

"Chicken will be the big driver of global sales growth in coming years, according to JBS. Large swaths of the developing world are becoming richer and consuming more meat, but their populations often don't eat beef or pork for religious or other reasons. Chicken therefore is likely to grow exponentially, Mr. Batista said. After a string of recent acquisitions, JBS says it is now the largest poultry producer in the world."

http://online.wsj.com/article/SB10001424127887324048904578318490389155334.html

ps-As protein cost goes up,along side of shrinking volume,consolidation of packers and companies in the meat industry coming? Or hedge fund taking over control of the meat industry inevitable?Heinz takeover is a warning shot to all players! Challenge for smaller value-added players: shrinking volume.

Listen to the webcast.......

My concern:

John expressed WFCF(beef) customers are facing a likely supply shortage in 2013 and its impact on everyone?????

ps-Power in the hands of packers who owns/inventory cattle?JBS a better business model?

Years of drought are reshaping the U.S. beef industry......

http://www.google.com/hostednews/ap/article/ALeqM5hZW9u13sIMxwwM4dZGHJzkXh_axQ?docId=97397e3ebd93488293da5e2d50453156

Japan Plans to Relax Restrictions on U.S. Beef Imports on Feb. 1

http://www.bloomberg.com/news/2013-01-22/japan-plans-to-relax-restrictions-on-u-s-beef-imports-on-feb-1.html?cmpid=yhoo

ps-Part of cost saving as Japan go broke??

Have a great New Year!

ps- You are right on the price call,down to $1.00.

WFCF: Integrated Management Information, Inc., changed to

Where Food Comes From, Inc.

Ticker remains WFCF.

http://www.otcbb.com/asp/dailylist_detail.asp?d=11/30/2012&mkt_ctg=NON-OTCBB

Agreed.I was hoping the net income is above $350K,thus maintaining the momentum. The "issue" is the $680K SG&A,which is $200K higher than my expectation.Again,we had been here before in 2010/2011,and the question to ask "Is this delta for future growth or bloated overhead??" I believe it is for the growth and,if not,ICS most likely need a "step-father(60% only) to son talk" soon to reign in cost.

WFCF $1.54.. I don't know what I'm missing here but this stock seems very expensive..

Integrated Management Information (IMI Global) Reports Continued Profitable Growth for Third Quarter and Nine-Month Period

Net income attributable to IMI Global in the third quarter was $63,600, or less than one cent per share, versus net income of $204,000, or $0.01 per share, in the same quarter last year. It was the Company's 11th straight profitable quarter. The lower year over year net income was due to slightly lower gross margins combined with increased investments in growth initiatives.

CASTLE ROCK, CO -- (Marketwire) -- 11/05/12 -- Integrated Management Information, Inc. (d.b.a. IMI Global, Inc.) (OTCQB: WFCF)

Third quarter revenue up 24% to a record $1.5 million from $1.3 million

Nine-month revenue up 24% to a record $4.0 million from $3.2 million

Where Food Comes From® program continues to grow with legendary steakhouse Delmonico's New York the latest to adopt Company's flagship brand

Integrated Management Information, Inc. (d.b.a. IMI Global, Inc.) (OTCQB: WFCF), a leading provider of verification and Internet solutions for the agricultural/livestock industry under the Where Food Comes From® brand, today announced record revenue and continued profitability for its third quarter and nine-month period ended September 30, 2012.

"In addition to extending our track record of profitable growth and further strengthening our balance sheet in the third quarter, we are pleased to report continued success with our Where Food Comes From labeling program, which added Delmonico's as a flagship steakhouse customer during the period," said John Saunders, chairman and CEO of IMI Global. "Although a higher expense base impacted our bottom line in the third quarter, we are confident that the investments we are making in ICS and various marketing programs are strengthening our foundation and better positioning the Company for long-term, profitable growth."

In February of 2012 IMI Global acquired controlling interest in International Certification Services, Inc. (ICS), a leading provider of organic and sustainable certification services to agricultural operations and the food industry. The acquisition strengthened IMI Global's solutions portfolio and is expected to contribute to continued year-over-year revenue growth. The Company will continue to evaluate opportunities to acquire complementary businesses.

Third Quarter Results

Revenue in the third quarter increased 24% to a record $1,545,200 from revenue of $1,250,100 in the third quarter a year ago. It was the Company's 11th consecutive quarter of year-over-year revenue growth. Verification services revenue increased 39% to $1,237,200 from $892,400 in the third quarter last year. This increase was attributable to the addition of revenue from ICS' organic and gluten free services. Age and source verification revenue declined 18% in the third quarter due to uncertainty surrounding Japanese export market requirements, but was partially offset by a 15% increase in revenue from the Company's Non-Hormone Treated Cattle (NHTC) and Verified Natural Beef (VNB) programs. Hardware revenue consisting primarily of cattle identification tags decreased 19% in the third quarter, to $268,800 from $331,000 in the same quarter last year, due to lower age and source verification activity. Other revenue, primarily consisting of fees from the Where Food Comes From labeling program, grew 47% to $39,200 from $26,700 year over year.

Gross profit in the third quarter increased to $802,900 from $671,100 in the same quarter last year. As a percent of revenue, third quarter gross margin declined to 52% from 54% year over year.

Selling, general and administrative expense in the third quarter increased 49% year over year to $686,500 from $460,400. This increase was attributable to expenses associated with the Company's ICS subsidiary, increased investments in promoting the Where Food Comes From program, and increased headcount to support various marketing initiatives.

Net income attributable to IMI Global in the third quarter was $63,600, or less than one cent per share, versus net income of $204,000, or $0.01 per share, in the same quarter last year. It was the Company's 11th straight profitable quarter. The lower year over year net income was due to slightly lower gross margins combined with increased investments in growth initiatives.

Nine-Month Results

Revenue for the first nine months of 2012 increased 24% to a record $3,971,600 from $3,197,400 in the same period last year. Verification revenue through nine months grew by 30% to $3,255,300 from $2,512,700 in the same period last year due primarily to the addition of ICS services revenue. Hardware revenue declined 4% to $626,000 from $654,000 a year ago. Revenue from Where Food Comes From and other sources grew nearly three-fold to $90,400 from $30,700 year over year.

Gross profit through nine months grew to $2,129,800, or 54% of revenue, from gross profit of $1,800,400, or 56% of revenue, in the same period last year.

Selling, general and administrative expense increased 44% for the year-to-date period to $1,755,900 from $1,220,800, due primarily to investments in the Where Food Comes From program and ICS, as well as to increased headcount to support various marketing initiatives.

Net income attributable to IMI Global through the first nine months of 2012, inclusive of an income tax benefit of $363,000, was $730,200, or $0.04 per basic and $0.03 per diluted share, versus net income of $558,300, or $0.03 per basic and diluted share, in the same period a year ago.

Balance Sheet Highlights

Cash and cash equivalents and short-term investments at September 30, 2012, totaled $1.4 million, up from $1.3 million at 2011 year-end despite the Company having paid $215,000 in cash associated with its acquisition of ICS and having paid down approximately $67,000 in long-term debt year to date.

About IMI Global

Where Food Comes From, Inc. (d.b.a. IMI Global) is America's leading provider of third-party identification, verification and traceability solutions for the livestock and agricultural industries. The Company supports more than 6,000 ranchers, farmers, feed yards, meatpackers, food retailers and restaurants with a wide range of solutions, including its USVerified™ brand -- the industry standard for USDA Process Verified (PVP) programs -- which annually verifies marketing claims for approximately one half of all U.S. beef exports; Where Food Comes From®, a unique retail and restaurant labeling program that connects consumers directly to the source of the food they purchase; and various organic and gluten free certification solutions through its International Certification Services (ICS) subsidiary. Go to www.IMIGlobal.com and www.wherefoodcomesfrom.com for additional information.

CAUTIONARY STATEMENT

This news release contains "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, based on current expectations, estimates and projections that are subject to risk. Forward-looking statements are inherently uncertain, and actual events could differ materially from the Company's predictions. Important factors that could cause actual events to vary from predictions include those discussed in our SEC filings. Specifically, statements in this news release about revenue and profitability growth, ICS' revenue and profitability, the Company's ability to achieve continued success, generate positive financial results, and maintain a strong balance sheet; growth potential; leadership; potential acquisitions; and the demand for, and impact and efficacy of, the Company's and its subsidiaries' products and services on the marketplace are forward-looking statements that are subject to a variety of factors, including availability of capital, personnel and other resources; competition; governmental regulation of the agricultural industry; the market for beef and other commodities; and other factors. Financial results for the third quarter and nine-month period are not necessarily indicative of future results. Readers should not place undue reliance on these forward-looking statements. The Company assumes no obligation to update its forward-looking statements to reflect new information or developments. For a more extensive discussion of the Company's business, please refer to the Company's SEC filings at www.sec.gov.

Integrated Management Information, Inc.

Statements of Operations

Three Months Ended Nine Months Ended

September 30, September 30,

2012 2011 2012 2011

----------- ----------- ----------- -----------

Revenues

Service revenues $ 1,237,215 $ 892,360 $ 3,255,266 $ 2,512,652

Product sales 268,750 331,004 625,986 653,999

Other revenues 39,196 26,707 90,375 30,712

----------- ----------- ----------- -----------

Total revenues 1,545,161 1,250,071 3,971,627 3,197,363

Costs of revenues

Labor and other costs

of services 543,362 329,969 1,387,499 920,594

Costs of products 198,862 248,959 454,279 476,355

----------- ----------- ----------- -----------

Total costs of

revenue 742,224 578,928 1,841,778 1,396,949

----------- ----------- ----------- -----------

Gross profit 802,937 671,143 2,129,849 1,800,414

Selling, general and

administrative expenses 686,538 460,357 1,755,873 1,220,839

----------- ----------- ----------- -----------

Income from operations 116,399 210,786 373,976 579,575

Other expense (income):

Interest expense 6,068 7,046 19,761 22,496

Gain on sale of

marketable securities (9,581) - (12,155) -

Other income, net (556) (210) (3,909) (1,238)

----------- ----------- ----------- -----------

Income before income

taxes 120,468 203,950 370,279 558,317

Income tax expense

(benefit) 46,500 - (362,972) -

----------- ----------- ----------- -----------

Net income 73,968 203,950 733,251 558,317

Net income attributable

to non-controlling

interest (10,336) - (3,063) -

----------- ----------- ----------- -----------

Net income attributable

to Integrated

Management Information,

Inc. $ 63,632 $ 203,950 $ 730,188 $ 558,317

=========== =========== =========== ===========

Net income per share:

Basic $ - $ 0.01 $ 0.04 $ 0.03

=========== =========== =========== ===========

Diluted $ - $ 0.01 $ 0.03 $ 0.03

=========== =========== =========== ===========

Weighted average common

shares outstanding:

Basic 21,063,153 20,643,862 20,843,311 20,667,409

=========== =========== =========== ===========

Diluted 21,798,484 20,838,047 21,571,396 20,896,852

=========== =========== =========== ===========

Integrated Management Information, Inc.

Balance Sheets

September 30, December 31,

2012 2011

------------- -------------

ASSETS

Current Assets:

Cash and cash equivalents $ 1,349,740 $ 969,020

Accounts receivable, net 468,831 226,760

Investment in marketable securities 19,853 283,511

Prepaid expenses and other current assets 43,677 36,776

Deferred tax assets 242,944 224,350

------------- -------------

Total current assets 2,125,045 1,740,417

Property and equipment, net 117,188 57,354

Intangible assets, net 331,336 9,205

Goodwill 377,581 -

Long-term deferred tax assets 376,481 -

------------- -------------

Total assets $ 3,327,631 $ 1,806,976

============= =============

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable $ 245,645 $ 148,384

Accrued expenses and other current

liabilities 97,191 42,960

Customer deposits 28,533 -

Deferred revenue 161,517 -

Short-term debt and current portion of notes

payable 20,823 25,644

Current portion of capital lease obligations 6,975 -

------------- -------------

Total current liabilities 560,684 216,988

Capital lease obligations, net of current

portion 15,990 -

Notes payable and other long-term debt 164,068 176,201

Notes payable, related party 200,000 250,000

------------- -------------

Total liabilities $ 940,742 $ 643,189

------------- -------------

Stockholders' equity:

Common stock 21,677 21,049

Additional paid-in capital 3,615,708 3,416,343

Treasury stock (111,284) (109,014)

Accumulated other comprehensive loss 250 (6,693)

Accumulated deficit (1,427,710) (2,157,898)

------------- -------------

Total stockholders' equity 2,098,641 1,163,787

Non-controlling interest 288,248 -

------------- -------------

Total equity 2,386,889 1,163,787

------------- -------------

Total liabilities and stockholders' equity $ 3,327,631 $ 1,806,976

============= =============

Company Contacts:

John Saunders

Chief Executive Officer

303-895-3002

Jay Pfeiffer

Pfeiffer High Investor Relations, Inc.

303-393-7044

Source: Integrated Management Information (IMI Global)

"Wall Street has come to perceive that while currencies and debt markets may not be as lucrative as they once were, arable land and fresh water will possess value going forward. It would be nice to think that buying local and organic will solve the problem—and yes, my family frequents the local green market. But the global food crisis can only be solved if we get the bankers out of the system and begin to regulate the $648 trillion global-derivatives business that has made food into a speculative buy." From the author of the book "Bet the Farm"

http://harpers.org/blog/2012/10/bet-the-farm-six-questions-for-frederick-kaufman/

WFCF will release its 2012 third quarter financial results before the market opens on Monday, November 5, 2012, and conduct a conference call and webcast the same day at 9:30 a.m. Mountain Time (11:30 a.m. Eastern time).

The call-in numbers for the conference call:

Domestic Toll Free: 1-877-941-9205

International: 1-480-629-9771

Conference Code: 4573683

http://finance.yahoo.com/news/integrated-management-information-imi-global-110000779.html

""..Welcome to the "recovery" in which there is no inflation, unless you dare to eat, and where cash flow grow on Magic Money Trees (MMT), reaching everywhere but where it is supposed to. Oh, and where the government creates wealth. Lots and lots of wealth....""

http://www.zerohedge.com/news/2012-10-25/iconic-ny-steakhouse-gallaghers-which-survived-great-depression-closing

ps-As Americans eat less and less quality meat,the US meat export to the world's riches just keep on getting better: A replay of the Irish famine in "high-end protein," a new normal for the down-and-out Americans!!

Anticipation is building up 4 weeks before ER.....

My wild guess(odds) for this "Dynamo":

55%:

North of $2.5 pps with $500k net income*;

35%:

South of $1.5 pps with $300k net income;

10%:

South of $1.00 pps with $100k net income.

Or

A 25% BIG CHANCE becoming a "margin-able stock**" before the end of the year!!!

Notes:

* 100% wholesome,no "fillers".

** Most stocks that are $3.00 and more pps.

Is the stock "fiscal cliff" ready??

http://video.cnbc.com/gallery/?video=3000121899&play=1

Downside w/over the fiscal cliff:

I believe "Market for the US premium protein makers and participants" would not be impacted as much as the bond market,if the 70% chance fallen into the financial abyss(whirlpool of a $7.7T deduction) becomes a reality!! Vary little if any at all.

Upside w/over the fiscal cliff:

Dollar debases 10% per year,US high-end protein: like beef export, adds 3%(total US supply in lb) more per year,from 10% to 13%,in 2013,or 25%+ increases in dollar term!

Not over the fiscal cliff:

The "wealth effect on equities" should bolsters "high-end protein demand" throughout the world!! a 10% increase per year in the price of premium beef!!

or

The US consumption of beef would likely to continue to drop at the rate of 2 lb(boneless) per year per capita in a for see-able future!! Or for the average Americans: good cuts of beef would becomes a "Holiday-only treat!!".

Private labeling by Heinens through WFCF "Our Own Meats Program"........

http://wherefoodcomesfrom.com/heinens/h_Beef.html

US organic market and players overview........

http://www.cnbc.com/id/49185619?__source=yahoo|headline|quote|text|&par=yahoo

a bit more:

http://www.foodengineeringmag.com/ext/resources/Issues/October2012/Top100/FE-Top-100-Companies.pdf

Also,

Almost forgot to mention what I learned at the IMI Global presentation:

Tom Heinen is listed as a member of the board of IMI Global.

ps-This dynamo just added another set of wings!

Thank you for that update Grease.

Attended LD Micro conference and saw IMI Global's presentation in the early afternoon on Thursday. At the presentation given by the CEO John Saunders,I say there were about 40 participants,and it lasted for about half hour;it then continued with a follow-up Q/A session,attended by about 10 "diehard" participants. Interest shown in the company and at the PR presentation by investors, I say is good and more "newbie seeds" have been planted for the near and medium term.

Another highlight and attention getter: serving of Delmonico dry aged prime steak samples with WFCF label: the participants loved it and IMI Global definitely had the votes of the "stomachs," a brilliant PR move!

ps-This is the first "roadshow," and a great sign that the company started and aggressively "let the words out".

A glimpse of future demand of sustainable beef......

http://www.bloomberg.com/news/2012-09-25/mcdonald-s-wants-to-know-whether-its-beef-is-sustainable.html

ps-IMI Global's "Verified Green," the next revenue stream??

New customer under WhereFoodComesFrom

http://wherefoodcomesfrom.com/newmexicobeef/

7 weeks before the next ER,the stock broke an all-time-new-high!!

I believe the stock is on its way to the $100.00 million MC!! When you have a great product line,NO BS and a FAIR management,it just that simple for you,the investor,to make $$$$$$$$$$$$$$$$$!! For the newbies, a multi-bagger is in the making,75% chance likely within 2-3 years!!

Integrated Management Information (IMI Global) Reports Second Quarter and Six-Month Revenue and Net Income*

Integrated Mgmt Inf (QB) (USOTC:WFCF)

Today : Wednesday 1 August 2012

Integrated Management Information, Inc. (d.b.a. IMI Global, Inc.) (OTCQB: WFCF) (OTCBB: WFCF)

Q2 revenue up 24% to a record $1.4 million from $1.1 million

Q2 net income* increases to $304,300 from $276,900

6-month revenue up 25% to a record $2.4 million from $1.9 million

6-month net income* increases to $666,400 from $354,400

Integrated Management Information, Inc. (d.b.a. IMI Global, Inc.) (OTCQB: WFCF) (OTCBB: WFCF), a leading provider of verification and Internet solutions for the agricultural/livestock industry under the Where Food Comes From® brand, today announced record revenue and net income for its second quarter and six-month period ended June 30, 2012.

"We continue to generate positive financial results and maintain a strong balance sheet, and are looking forward to continued success in the second half of the year," said John Saunders, chairman and CEO of IMI Global. "Our consistent growth is a testament to the strength of our broad solutions portfolio and the hard work and commitment of employees and contractors at all levels of our organization. In addition to our solid financial performance, our second quarter was highlighted by the addition of the Company's first regional restaurant chain -- Anderson's Frozen Custard in western New York -- to our Where Food Comes From program. We now have anchor customers in both the restaurant and grocery segments and are focused on adding new, quality customers in both areas. Also of note in the second quarter, we changed our stock symbol to WFCF to better reflect our Where Food Comes From brand strategy and to raise awareness of Company in the investment community."

In February of 2012 IMI Global acquired controlling interest in International Certification Services, Inc. (ICS), a leading provider of organic and sustainable certification services to agricultural operations and the food industry. On an unaudited basis, ICS was profitable on revenue of approximately $1.0 million in 2011. The acquisition strengthened IMI Global's solutions portfolio and is expected to accelerate the Company's revenue growth. The Company will continue to evaluate opportunities to acquire complementary businesses.

Second Quarter Results

Second quarter revenue increased 24% to a record $1,397,200 from revenue of $1,125,500 in the second quarter a year ago. It was the Company's 10th consecutive quarter of year-over-year revenue growth. Revenue from verification services, which includes the Company's industry leading USVerified™ solutions, increased 25% to $1,172,200 from $938,300 in the second quarter last year. Hardware revenue consisting primarily of cattle identification tags increased 8% in the second quarter to $200,300 from $186,000 in the same quarter last year. Other revenue, primarily consisting of fees from the Where Food Comes From labeling program, grew to $24,700 in the second quarter from $1,100 in the same quarter last year.

Gross margin in the second quarter increased to $756,000 from $677,200 in the same quarter last year. As a percent of revenue, second quarter gross margin declined to 54% from 60% year over year.

Selling, general and administrative expense in the second quarter increased 48% year over year to $581,400 from $393,500 due to increased investments in promoting the Where Food Comes From program as well as costs associated with the Company's acquisition of controlling interest in ICS in the first quarter of 2012.

IMI Global recognized a second quarter income tax benefit of $127,400 related to the release of the valuation allowance on its deferred tax assets. Net income attributable to IMI Global in the second quarter was $304,300, or $0.01 per share, versus net income of $276,900, or $0.01 per share, in the same quarter last year.

Six-Month Results

Revenue for the six-month period ended June 30, 2012, increased 25% to a record $2,426,500 from $1,947,300 in the same period last year based on strong market demand for the Company's core verification solutions as well as a growing contribution to revenue from Where Food Comes From and ICS.

Verification revenue grew by 25% to $2,018,100 from $1,620,300 in the same period last year. Hardware revenue grew 11% to $357,200 from $323,000 a year ago. And revenue from Where Food Comes From and other sources increased dramatically to $51,200 from $4,000.

Gross margin through six months grew to 1,326,900, or 55% of revenue, from gross margin of $1,129,300, or 58% of revenue, in the same period of 2011.

Selling, general and administrative expense increased 41% for the year-to-date period to $1,069,500 from $760,500, primarily as a result of increased advertising, marketing and consulting costs associated with promoting Where Food Comes From.

Net income through six months, inclusive of an income tax benefit of $409,500, was $666,400, or $0.03 per share, versus net income of $354,400, or $0.02 per share, in the same period a year ago.

Balance Sheet Highlights

Cash and cash equivalents and short-term investments at June 30, 2012, totaled $1.2 million, down only slightly from $1.3 million at 2011 year-end despite the Company having paid $215,000 in cash associated with the ICS transaction and having paid down $50,000 in long-term debt.

*References to net income in the text of this news release refer to net income attributable to IMI Global stockholders, which includes significant income tax benefits for the 2012 second quarter and six-month period.

About IMI Global

Integrated Management Information, Inc. (d.b.a. IMI Global) is America's leading provider of third-party identification, verification and traceability solutions for the livestock and agricultural industries. The Company supports more than 6,000 ranchers, feed yards, meatpackers, food retailers and restaurants with a wide range of solutions, including its USVerified™ brand -- the industry standard for USDA Process Verified (PVP) programs -- which annually verifies marketing claims for approximately one half of all U.S. beef exports; and Where Food Comes From®, a unique retail and restaurant labeling program that connects consumers directly to the source of the food they purchase. Go to www.IMIGlobal.com and www.wherefoodcomesfrom.com for additional information.

CAUTIONARY STATEMENT

This news release contains "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, based on current expectations, estimates and projections that are subject to risk. Forward-looking statements are inherently uncertain, and actual events could differ materially from the Company's predictions. Important factors that could cause actual events to vary from predictions include those discussed in our SEC filings. Specifically, statements in this news release about revenue and profitability growth, expected acceleration of revenue growth, ICS' revenue and profitability, the Company's ability to achieve continued success, generate positive financial results, maintain a strong balance sheet, and build shareholder value; growth potential; leadership; potential acquisitions; and the demand for, and impact and efficacy of, the Company's and its subsidiaries' products and services on the marketplace are forward-looking statements that are subject to a variety of factors, including availability of capital, personnel and other resources; competition; governmental regulation of the agricultural industry; the market for beef and other commodities; and other factors. Financial results for the second quarter and six-month period are not necessarily indicative of future results. Readers should not place undue reliance on these forward-looking statements. The Company assumes no obligation to update its forward-looking statements to reflect new information or developments. For a more extensive discussion of the Company's business, please refer to the Company's SEC filings at www.sec.gov.

Integrated Management Information, Inc.

Statements of Operations

Three Months Ended Six Months Ended

June 30, June 30,

2012 2011 2012 2011

----------- ----------- ----------- -----------

Revenues

Service revenues $ 1,172,224 $ 938,315 $ 2,018,051 $ 1,620,291

Product sales 200,282 186,024 357,236 322,996

Other revenues 24,676 1,133 51,179 4,004

----------- ----------- ----------- -----------

Total revenues 1,397,182 1,125,472 2,426,466 1,947,291

Costs of revenues

Labor and other costs of

services 488,684 313,691 844,137 590,625

Costs of products 152,545 134,583 255,417 227,396

----------- ----------- ----------- -----------

Total costs of revenue 641,229 448,274 1,099,554 818,021

----------- ----------- ----------- -----------

Gross profit 755,953 677,198 1,326,912 1,129,270

Selling, general and

administrative expenses 581,369 393,475 1,069,506 760,482

----------- ----------- ----------- -----------

Income from operations 174,584 283,723 257,406 368,788

Other expense (income):

Interest expense 5,821 7,244 13,693 15,449

Gain on sale of marketable

securities (2,574) - (2,574) -

Other income, net (691) (465) (3,353) (1,028)

----------- ----------- ----------- -----------

Income before income taxes 172,028 276,944 249,640 354,367

Income tax benefit (127,382) - (409,472) -

----------- ----------- ----------- -----------

Net income 299,410 276,944 659,112 354,367

Net loss attributable to

non-controlling interest 4,842 - 7,273 -

----------- ----------- ----------- -----------

Net income attributable to

Integrated Management

Information, Inc. $ 304,252 $ 276,944 $ 666,385 $ 354,367

=========== =========== =========== ===========

Net income per share:

Basic $ 0.01 $ 0.01 $ 0.03 $ 0.02

=========== =========== =========== ===========

Diluted $ 0.01 $ 0.01 $ 0.03 $ 0.02

=========== =========== =========== ===========

Weighted average common

shares outstanding:

Basic 20,854,725 20,716,923 20,732,182 20,740,515

=========== =========== =========== ===========

Diluted 21,549,014 21,078,226 21,361,420 20,988,471

=========== =========== =========== ===========

Integrated Management Information, Inc.

Balance Sheets

June 30, December 31,

2012 2011

------------- -------------

ASSETS

Current Assets:

Cash and cash equivalents $ 907,399 $ 969,020

Accounts receivable, net 395,062 226,760

Investment in marketable securities 292,368 283,511

Prepaid expenses and other current assets 35,713 36,776

Deferred tax assets 232,350 224,350

------------- -------------

Total current assets 1,862,892 1,740,417

Property and equipment, net 117,193 57,354

Intangible assets, net 715,468 9,205

Long-term deferred tax assets 422,981 -

------------- -------------

Total assets $ 3,118,534 $ 1,806,976

============= =============

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable $ 170,006 $ 148,384

Accrued expenses and other current

liabilities 35,139 42,960

Customer deposits 40,885 -

Deferred revenue 213,191 -

Short-term debt and current portion of notes

payable 23,058 25,644

Current portion of capital lease obligations 8,424 -

------------- -------------

Total current liabilities 490,703 216,988

Capital lease obligations, net of current

portion 16,987 -

Notes payable and other long-term debt 166,101 176,201

Notes payable, related party 200,000 250,000

Other long-term liabilities 775 -

------------- -------------

Total liabilities $ 874,566 $ 643,189

------------- -------------

Stockholders' equity:

Common stock 21,422 21,049

Additional paid-in capital 3,550,530 3,416,343

Treasury stock (111,284) (109,014)

Accumulated other comprehensive loss (3,099) (6,693)

Accumulated deficit (1,491,513) (2,157,898)

------------- -------------

Total stockholders' equity 1,966,056 1,163,787

Non-controlling interest 277,912 -

------------- -------------

Total equity 2,243,968 1,163,787

------------- -------------

Total liabilities and stockholders' equity $ 3,118,534 $ 1,806,976

============= =============

Company Contacts:

John Saunders

Chief Executive Officer

303-895-3002

Jay Pfeiffer

Pfeiffer High Investor Relations, Inc.

303-393-7044

More tailwind: 48%(millennial) vs 29%(baby boomers) favor organic food

http://www.bloomberg.com/video/trouble-in-aisle-five-bih4~TLWSbeaAGgnbVztGg.html

Another tailwind is brewing: Animal Rights Legislation S. 3239

http://www.freeslo.com/news/national/item/618-alert-egg-prices-to-quadruple?

ps- More boots on the ground.Is this why IMI acquired ICS(60% interest)????

A trophy catch again this week:

BS Five Rivers Cattle Feeding - Kuner Feedlot

Producer #: 120514010449

State: CO

Supplier Type: USV Plus Feedyard

This location is approved for:

NHTC - (Initial Approval: 6/21/2012)

Source and Age - (Initial Approval: 6/21/2012)

2011

JBS Five Rivers - Gilcrest Feedyard

Producer #: 110908092819

State: CO

Supplier Type: Finishing Yard

NHTC - (Initial Approval: 9/29/2011)

Source and Age - (Initial Approval: 9/29/2011)

ps- This dynamo(Pacman) just keep on moving(gobble up)!!

Integrated Management Information (IMI Global) to Change Stock Ticker Symbol to "WFCF" to Better Reflect Its Where Food Comes...

Integrated Management Information, Inc. (IMI Global) (OTCBB: INMG), a leading provider of verification and Internet solutions for the agricultural/livestock industry under the Where Food Comes From® brand, today announced that its common stock will trade under the new symbol "WFCF" beginning at the opening of the market on Friday, June 29, 2012.

The new symbol -- an acronym for Where Food Comes From -- will better reflect the Company's core solution.

"Our Where Food Comes From program continues to gain momentum as a unique way of connecting consumers to the source of the food they purchase," said John Saunders, CEO of IMI Global. "As a result, and in response to increased investor interest in IMI Global, we are changing the symbol to better reflect our brand strategy and to raise awareness in the investment community."

INMG - With technical all up-trending I could see this catch on to many other screeners and radars not to mention the PR's that come out. Real company with solid technicals and shockingly solid fundamentals also. They have possitive earning per share and an increase in assets in their financial statements.

INMG Technicals

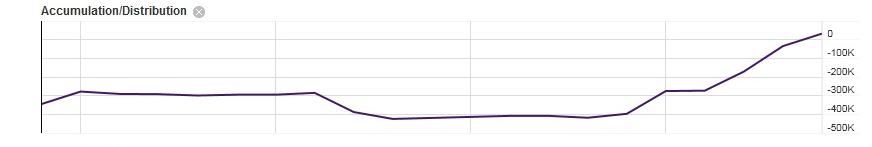

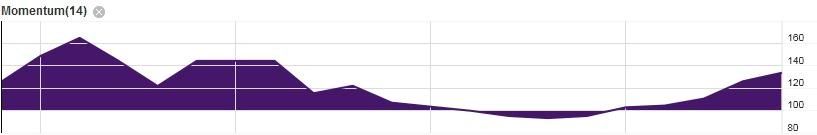

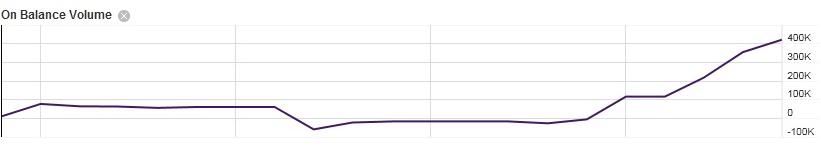

Includes: 1 month chart, 1 month accumulation/distribution, 1 month momentum, and 1 month on balance volume.

Charts created by and formulated by Scottrade.com

For those that don't know, the two main types of financial analysis on equities such as stock are fundamental and technical. Most people pick one, I use both. Bellow you will find technicals for INMG.

1) Chart: Chart shows up-trending PPS, clear and most basic sign of technical growth

2) Accumulation/Distribution: Using a formula (Acc/Dist = ((Close – Low) – (High – Close)) / (High – Low) * Period's volume) Accumulation (buying) is also up-trending

3) Momentum: Tracks acceleration of price and/or volume. Up-trending spike is seen

4) On Balance Volume: Technical indicator of cumulative volume based on price. Once again, up-trending Formula shown bellow (Source:Wikipedia)

I will post both technicals and fundamentals within the coming hours

|

Followers

|

29

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

241

|

|

Created

|

10/11/08

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |