Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Trash company peddling trash~ ! ENRON 2.0 ~! Over reports revenues by billion upon billions upon billions!

How long has this been going on? SEC turns a blind eye.

Disney share price DESCENDING TRIPLE BOTTOM BREAKDOWN today on 28-June-2024.

The price is getting closer to the level below which I plan to add more for long term.

Happy Weekend & GLTA

Are italians white or nonwhite in 2024?

Lawsuit coming in HOT

$DIS maybe it wakes up over the 21D.. maybe???

By: Options Mike | June 23, 2024

• $DIS maybe it wakes up over the 21D.. maybe???

Read Full Story »»»

DiscoverGold

DiscoverGold

Walt Disney $DIS is on the move!

By: TrendSpider | June 21, 2024

• The mouse is on the move! $DIS.

Read Full Story »»»

DiscoverGold

DiscoverGold

$DIS "BREAKING: Senior Vice President at The Walt Disney Company details discriminatory hiring practices: "Nobody else is going to tell you this, but they're not considering any white males for the job," says Michael Giordano, a Vice President of Business affairs, "there’s no way we’re hiring a white male.” Giordano reveals Disney uses "code words and buzzwords" to avoid legal action and even mentions a candidate being rejected for not looking black enough. Giordano also admits Disney gives bonuses to executives for practicing Diversity, Equity, and Inclusion (DEI), agreeing that "diversity helps with financial incentives." Giordano further claims he’s been denied promotions due to his race. "

$DISBREAKING: Senior Vice President at The Walt Disney Company details discriminatory hiring practices: "Nobody else is going to tell you this, but they're not considering any white males for the job," says Michael Giordano, a Vice President of Business affairs, "there’s no way we’re… pic.twitter.com/IMOsFOLKro

— James O'Keefe (@JamesOKeefeIII) June 20, 2024

Disney in a slow reversal as buyers like the potential for 2025.

Many will accumulate the $101-$102.50 area.

mb

RSI divergence spotted on that most recent low from Walt Disney

By: TrendSpider | June 17, 2024

• RSI divergence spotted on that most recent low from the mouse. $DIS

Read Full Story »»»

DiscoverGold

DiscoverGold

Based on the Chart, Disney share price still in the mode of Descending Triple Bottom Breakdown of 14-June-2024 at this time. C'est La Vie.

This too shall pass. And change (love) is in the air... I am optimistic in the long term.

In my case, I plan to add more should price fall to $97 or under. GLTA

Yep. Disney's Pixar is the darling of Hollywood and Wall Street this am after the $295 Million global record box office for an animated movie with the opening of Inside Out 2 this weekend.

Today Walt Disney Co. (DIS) is the best performer in the DJIA

By: Thom Hartle | June 17, 2024

• Today (8:32 CST), the best performer in the DJIA is Disney (Walt) Company. DIS.

Read Full Story »»»

DiscoverGold

DiscoverGold

Iger is just providing lip service at this point. Chapak started the bomb factory and Iger could give 2 shits. Sitting on shares in my iRA maybe I sell the call and collect a premium for holding this tarnished brand.

It's been sent countless times, everything they release bombs and that memo gets resent. It may legitimately be money laundering at this point.

Iger must have missed that memo…

Good to see this Marxist-Leninist crap rejected by the masses.

Based on the reaction to the latest Star Wars disaster, Disney now officially has killed its billion dollar franchise. Maybe Lucas will buy it back for a penny! Somehow the “gayest” StarWars doesn’t seem to be resonating with its fan base. Hmmmm I wonder why???

Based on my reading of the chart, Disney share price at this time is still in the process of bottoming.

The sideway consolidation hopefully leading to an upturn in price, in the market in an uncertain geopolitical environment.

Expecting for a positive signal. We shall see.

I have no concern for the long term.

GLTA

Really? Acolyte is bombing and it’s seems as if Disney cannot regain its mojo no matter what Iger says! Incompetent DEI hires is to blame for that!

Anybody working in management should go back and look at what Walt’s original vision was and try to recapture some of it by developing family friendly content without all the alphabet people getting butt hurt! Seriously Disney will be an empty shell of a company if it doesn’t make moves to right ship now. I say top to bottom management review. Throw out all equity nonsense and get back to making content that people want..

Looks like Disney is back to its old self again

By: TrendSpider | June 5, 2024

• Looks like Disney is back to its old self again.

Read Full Story »»»

DiscoverGold

DiscoverGold

It is not at all surprising that Nelson Pelz sold off his entire stake in DIS after DIS shareholders resoundingly rejected his slate of Directors and positions in the proxy battle he launched. Everyone expected that and knew it would bring the share price down as a result. It will recover in time.

Activist investor Nelson Peltz sells entire Disney stake after proxy battle loss

By: Yahoo | May 30, 2024

Activist investor Nelson Peltz has sold his entire Disney (DIS) stake, according to a source familiar with the matter.

Peltz sold his position at a price of around $120 a share, which yielded a return of about $1 billion, the source said.

The development, first reported by CNBC, comes after Disney successfully fended off Peltz in his quest to secure board seats at the company, officially ending a highly contested proxy battle that plagued the entertainment giant for months.

Peltz had been fighting to secure board seats for himself and former Disney CFO Jay Rasulo but was ultimately unsuccessful. At the company's annual shareholder meeting in early April, Disney said the current board would remain intact following a stockholder vote that gave the company's slate a win "by a substantial margin."

Disney did not immediately respond to Yahoo Finance's request for comment.

Peltz's hedge fund, Trian Fund Management, had owned $3 billion of common stock in Disney (including the shares owned by former Marvel Entertainment chair Ike Perlmutter). The activist renewed a push to shake up Disney's board last year as the stock price hit multiyear lows.

At the time of the shareholder meeting, Peltz said prior to the announcement of the results that regardless of the outcome of the vote, Trian would be watching the company's performance.

"The long-term track record still remains disappointing," he said at the time.

Disney shares are up about 12% since the start of the year but have fallen roughly 15% since the company defeated Peltz in its proxy fight.

Read Full Story »»»

DiscoverGold

DiscoverGold

Doing really well since then isn't it

No one should put money into this DISgusting filth!

Disney share price is still in the mode of SPREAD TRIPLE BOTTOM BREAKDOWN, since 7-May-2024.

If and when price goes under my entry level of $97.53, I will buy more. C'est La Vie, Mt. Blanc

Cheers & have fun.

PS: FYI, Disney share is only 9.8% of funds. I'm doing good with my magnificent 6 stocks plus other stocks.

The Tragic Kingdumb

Looks like DISNEY has become a sinking ship.

Now we can see the 90's coming dead ahead.

$DIS

mb

DIS "DIS"ERVES ZERO! Squash evil so our nation is no longer cursed.

The Prince of Darkness has, for some time now, taken over - especially in our Universities.

"Bye Bye Miss American Pie" all thanks to the sick pedo-commies in charge of everything.

Our nation is no longer blessed (again for some time!), Mystery Babylon (America) will be destroyed by our enemies.

"DIS"ervingly so....

clean the slate Lord Jesus!

Kiddie Groomers still paying the price, short it to $ZERO

Tuesday action was great.

Unfortunately I don't have time to check but part of the many stocks in my port.

Furthermore, I had this investment taken as one for the long term.

Now, half of my profits have disappeared already.

Disney share price now under the SPREAD TRIPLE BOTTOM BREAKDOWN mode since 7-May-2024.

This is the reality currently. And I will keep it still a long term commitment.

Should it continue in this mode, I intend to buy more, as well. C'est La Vie, Mt. Blanc!

Cheers & Better Luck To All

imo...sorry to pop your bubble but DIS has a gap at 82 that is getting ready to fill~

DIS

IHuser

Some are exiting and some are loading up while DIS sits under $107.

![]()

Walt Disney (DIS) Insider Trading Activity...

By: Barchart | May 10, 2024

• Walt Disney Insider Trading Activity

Board of Directors member James Gorman purchased 20,000 $DIS shares for a total investment of $2.1 million. James Gorman also happens to be the CEO of Morgan Stanley Wealth Management.

Read Full Story »»»

DiscoverGold

DiscoverGold

Great WB quote. And even with DIS shares down from its highs in recent years, there was an article out this week that pointed out if one would have invested $1,000 in Disney shares 20 years ago, that position would be worth $6,266 today.

PC: I agree with you.

Taking advantage for timely accumulation over time of promising stocks to by discerning long term investors. The challenge is that it requires patience and purpose. That's why Warren Buffet said the stock market is a mechanism/process where money is transferred from the impatient to the patient investor.

Cheers & GLTY

IF Peltz won things could of turned around

As long as same "woke" board and management this heads back to lows

Straight Down Sub 100 soon

Peltz winning was the hope that this would turn around ever since the vote

Recent DIS share price has provided a some very advantageous entry points for serious long term investors..

DISNEY buy low and just hold.

Easy investing.

DIS

Disney Surpasses Fiscal Q2 Earnings Expectations

By: James Hyerczyk | May 7, 2024

Key Points:

• Disney EPS of $1.21 beats estimates, revenue at $22.08B.

• Streaming loss narrows significantly, down to $18M.

• U.S. parks revenue up 7%, international sales jump 29%.

Disney Earnings Top Estimates

Disney has surpassed analyst expectations in its fiscal second-quarter earnings, significantly narrowing its streaming losses while maintaining steady overall revenue. This financial update underscores a notable improvement in Disney’s streaming operations and continued strength in its experiences segment.

Daily The Walt Disney Company

Earnings Overview

Disney’s earnings per share for the quarter stood at $1.21, adjusted, which exceeded the Wall Street expectations of $1.10. While total revenue reached $22.08 billion, aligning closely with projections of $22.11 billion, the highlight was the improved performance in streaming. Disney+, Hulu, and ESPN+ collectively reduced their losses dramatically to $18 million, compared from a substantial $659 million loss the previous year. This was largely due to Disney+ and Hulu turning a profit for the first time.

Streaming and Subscribers

The entertainment streaming segment, excluding ESPN+, saw a 13% revenue increase to $5.64 billion, with an operating income shift from a $587 million loss last year to a $47 million gain this quarter. This was attributed to a rise in Disney+ subscribers and a higher average revenue per user. Disney+ Core’s subscriber count rose to 117.6 million, while Hulu’s subscribers increased slightly to 50.2 million. However, ESPN+ experienced a decline in subscribers by 2%.

Parks and Experiences Growth

The U.S. parks and experiences sector witnessed a 7% revenue rise to $5.96 billion, while international sales surged 29% to $1.52 billion. This growth was driven by increased attendance and higher pricing at the Hong Kong Disneyland Resort, emphasizing Disney’s recovery in physical experience spaces post-pandemic.

Challenges in Traditional Media

Contrasting with the streaming success, Disney’s traditional TV business faced challenges, particularly with ESPN. Despite a revenue rise by 3% to $4.21 billion, operating income for ESPN dropped by 9% due to lower advertising revenue, declining cable subscribers, and increased costs linked to broadcasting the College Football Playoff.

Market Forecast

Looking forward, Disney’s strategic focus on streamlining its streaming operations and enhancing its experiences sector might provide a bullish outlook for the company’s stock in the short term. However, the ongoing struggles in its traditional TV business could temper this optimism unless significant adjustments are made.

Read Full Story »»»

DiscoverGold

DiscoverGold

Today Walt Disney Company (DIS) is the best performer in the DJIA

By: Thom Hartle | May 6, 2024

• Today (8:32 CST), the best performer in the DJIA is Disney (Walt) Company. DIS.

Read Full Story »»»

DiscoverGold

DiscoverGold

Unfortunately, the chart still remains in the mode of the HIGH POLE WARNING given on 5-April-2024 mode.

It's high time for a positive change but probably the naysayers have been successful for several weeks. Being optimistic I am expecting for positive news even though the chart is not yet reflecting it.

I hope DIS options traders betting bullishly on post-earnings reporting ahead of the event.

We shall see. GLTA

Disney (DIS) Stock Hoping For Another Post-Earnings Pop

By: Schaeffer's Investment Research | May 3, 2024

• Disney stock has scored a positive post-earnings reaction in four of its last eight reports

• DIS options traders are betting bullishly ahead of the event

Apple (AAPL) is propping up the Dow to end the week after the tech titan's blowout corporate report. The next blue-chip to step into the earnings confessional will be Walt Disney Co (NYSE:DIS), set for its quarterly report before the market opens on Tuesday, May 7. Ahead of the event, options traders are betting bullishly, perhaps hoping the stock's recent post-earnings history skews to the upside.

Walt Disney stock closed higher the session after earnings in four of its last eight quarters, but finished positive after its last three, including a 11.5% pop in February. The shares averaged a 6.5% swing, regardless of direction, after their last eight earnings events. This time around, the options market is pricing in a larger post-earnings move of 7.5%.

DIS was last seen trading at $113.79, up 1% on the day. The shares are up 26% in 2024, with their 7% quarterly drawdown finding historical support at the site of that post-earnings bull gap from February. Don't expect much unwinding of pessimism from the blue-chip next week, considering there's only one "sell" rating on the stock, and a slim 1.1% of its total available float is sold short.

Echoing this, at the International Securities Exchange (ISE), Cboe Volatility Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), DIS' 50-day call/put volume ratio of 2.30 sits higher than 93% of readings from the past year. But with the equity sporting a Schaeffer's Volatility Scorecard (SVS) of 16 out of 100 -- which indicates consistently realized lower volatility than its options have priced in -- a premium-selling strategy could be the move for the entertainment giant.

Read Full Story »»»

DiscoverGold

DiscoverGold

|

Followers

|

216

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

6290

|

|

Created

|

10/04/00

|

Type

|

Free

|

| Moderators DiscoverGold | |||

Outstanding Shares: 1.69B

Institute Own: 63%

Address: 500 S. Buena Vista St

BURBANK, CA 91521-0001

Website: http://thewaltdisneycompany.com

Full Description:

The Walt Disney Company, incorporated on July 28, 1995, together with its subsidiaries, is a diversified worldwide entertainment company.

The Company operates in five business segments: Media Networks, Parks and Resorts, Studio Entertainment, Consumer Products and Interactive.

The Company has a 63% effective ownership interest in Disneyland Paris, a 5,510-acre development located in Marne-la-Vallee, approximately 20 miles east of Paris,

France. The Company manages and has a 40% equity interest in Euro Disney S.C.A.

The Company owns a 48% interest in Hong Kong Disneyland Resort through Hongkong International Theme Parks Limited. On November 7, 2012,

the Company sold its 50% interest in ESPN STAR Sports (ESS). On November 7, 2012,

the Company sold its 50% equity interest in ESPN STAR Sports (ESS). On December 21, 2012, the Company acquired Lucasfilm Ltd. LLC.

Media Networks

The Media Networks segment includes international and domestic cable television networks, a domestic broadcast television network, television production operations,

domestic and international television distribution, domestic television stations, domestic broadcast radio networks and stations, and publishing and digital operations.

The Company’s cable networks include ESPN, Disney Channels Worldwide, ABC Family, and SOAPnet. The Company also operates the UTV/Bindass networks in India.

The cable networks group produces its own programs or acquires rights from third-parties to air programs on its networks.

ESPN is a multimedia, multinational sports entertainment company that operates eight 24-hour domestic television sports networks: ESPN, ESPN2, ESPNEWS,

ESPN Classic, ESPN Deportes (a Spanish language network), ESPNU (a network devoted to college sports), ESPN 3D, and the regionally focused Longhorn Network

(a network dedicated to The University of Texas athletics). Disney Channels Worldwide is a portfolio of over 100 entertainment channels and/

or channel feeds available in 35 languages and 167 countries/territories and includes Disney Channel, Disney Junior, Disney XD, Disney Cinemagic,

Hungama and Radio Disney. ABC Family is a United States television programming service that targets viewers in the 14-34 demographic.

ABC Family produces original live-action programming including the returning series The Secret Life of the American Teenager, Switched at Birth,

Melissa & Joey, as well as new original series Bunheads, Baby Daddy and the reality series Beverly Hills Nannies. SOAPnet offers same-day episodes of daytime dramas

and classic episodes of daytime dramas and primetime series. Programming includes daytime dramas such as Days of its Lives, General Hospital and The Young

and the Restless and classic episodes from series such as All My Children, One Life to Live, The O.C., One Tree Hill, Beverly Hills 90210,

The Gilmore Girls, Veronica Mars and Brothers & Sisters.

Parks and Resorts

The Company owns and operates the Walt Disney World Resort in Florida, the Disneyland Resort in California, Aulani, a Disney Resort & Spa in Hawaii,

the Disney Vacation Club, the Disney Cruise Line and Adventures by Disney. The Company manages and has effective ownership interests of 51% in

Disneyland Paris, 48% in Hong Kong Disneyland Resort and 43% in Shanghai Disney Resort. The Company also licenses the operations of the Tokyo Disney Resort in Japan.

The Company’s Walt Disney Imagineering unit designs and develops new theme park concepts and attractions as well as resort properties.

The Walt Disney World Resort is located 22 miles southwest of Orlando, Florida, on approximately 25,000 acres of owned land.

The resort includes theme parks (the Magic Kingdom, Epcot, Disney’s Hollywood Studios and Disney’s Animal Kingdom); hotels; vacation club properties;

a retail, dining and entertainment complex; a sports complex; conference centers; campgrounds; golf courses; water parks;

and other recreational facilities designed to attract visitors for an extended stay.

The Company owns 461 acres and has the rights under long-term lease for use of an additional 49 acres of land in Anaheim, California.

The Disneyland Resort includes two theme parks (Disneyland and Disney California Adventure), three hotels and Downtown Disney, a retail,

dining and entertainment complex designed to attract visitors for an extended stay. Tokyo Disney Resort is located on approximately 494 acres of land,

six miles east of downtown Tokyo, Japan. The resort includes two theme parks (Tokyo Disneyland and Tokyo DisneySea); three Disney-branded hotels;

six independently operated hotels; and a retail, dining and entertainment complex.

The Disney Vacation Club offers ownership interests in 11 resort facilities located at the Walt Disney World Resort; Disneyland Resort; Vero Beach, Florida;

Hilton Head Island, South Carolina; and Oahu, Hawaii. Disney Cruise Line, which operates out of ports in North America and Europe, is a vacation cruise line

that includes four ships: the Disney Magic, the Disney Wonder, the Disney Dream, and the Disney Fantasy. Adventures by Disney offers all-inclusive guided

vacation tour packages predominantly at non-Disney sites around the world. Walt Disney Imagineering provides master planning, real estate development,

attraction, entertainment and show design, engineering support, production support, project management and other development services, including

research and development for the Company’s operations.

Studio Entertainment

The Studio Entertainment segment produces and acquires live-action and animated motion pictures,

direct-to-video content, musical recordings and live stage plays. The Company distributes produced and acquired films

(including its film and television library) in the theatrical, home entertainment and television markets primarily under the Walt Disney Pictures, Pixar and Marvel banners.

The Company produces and distributes Indian movies worldwide through its UTV banner. The Company holds a 99% interest in UTV, film production studios

and film distributors in India, which produces and co-produces live-action and animated content. During fiscal year ended September 29, 2012 (fiscal 2012),

UTV releases included Rowdy Rathore and Barfi. The Company produces and distributes both live-action films and full-length animated films. In the domestic

market, the Company distributes home entertainment releases directly under each of its motion picture banners.

The Disney Music Group includes Walt Disney Records, Hollywood Records (including the Mammoth Records and Buena Vista Records labels), Lyric Street Records,

Buena Vista Concerts and Disney Music Publishing. Disney Theatrical Productions develops produces and licenses live entertainment events.

The Company has produced and licensed Broadway musicals around the world, including Beauty and the Beast, The Lion King, Elton John & Tim Rice’s Aida,

Mary Poppins (a coproduction with Cameron Mackintosh Ltd), Little Mermaid, Newsies, and TARZAN.

Consumer Products

The Consumer Products segment engages with among others licensees, publishers and retailers throughout the world who design, develop, publish,

promote and sell a range of products based on existing and new characters and other Company intellectual property through its Merchandise Licensing, Publishing

and Retail businesses. The Company’s merchandise licensing operations cover a diverse range of product categories, which include toys, apparel, home decor and f

urnishings, stationery, health and beauty, accessories, food, footwear, and consumer electronics. Disney Publishing Worldwide (DPW) creates, distributes,

licenses and publishes children’s books, magazines and digital products in multiple countries and languages based on

the Company’s Disney-, Pixar- and Marvel-branded franchises. The Company markets Disney- and Marvel-themed products through retail stores

operated under the Disney Store name and through Internet sites in North America (DisneyStore.com and Marvelstore.com),

Western Europe, and Japan. The Company owns and operates 216 stores in North America, 106 stores in Europe, and 47 stores in Japan.

Interactive

The Interactive Games business creates, develops, markets and distributes console and handheld, games worldwide, including 2012 titles,

such as Disney Universe and Brave. The Interactive Games business also produces online games, such as Disney’s Club Penguin and Disney Fairies Pixie Hollow,

interactive games for social networking websites such as Gardens of Time and Marvel Avengers Alliance, and games for smartphone platforms,

such as Where’s My Water and Where’s My Perry. Certain properties are also licensed to third-party video game publishers. Interactive Media develops,

publishes and distributes content for branded online services intended for kids and family entertainment through a portfolio of websites including Disney.com

and the Disney Family Network. Interactive Media also provides Website maintenance and design for other Company businesses.

Officers and Directors:

Executive Chairman of the Board, Chief Executive Officer: Robert A. Iger -

Mr. Robert A. Iger is Executive Chairman of the Board, Chief Executive Officer of Walt Disney Company. Prior to that time,

he served as President and Chief Executive Officer of the Company since 2005, having previously served as President and Chief Operating Officer since 2000

and as President of Walt Disney International and Chairman of the ABC Group from 1999 to 2000. From 1974 to 1998, Mr. Iger

held a series of increasingly responsible positions at ABC, Inc. and its predecessor Capital Cities/ABC, Inc., culminating in service as President of the

ABC Network Television Group from 1993 to 1994 and President and Chief Operating Officer of ABC, Inc. from 1994 to 1999.

He is a member of the Board of Directors of Apple, Inc., the Lincoln Center for the Performing Arts in New York City and the

National September 11 Memorial & Museum. Mr. Iger has been a Director of the Company since 2000. Mr. Iger contributes to the mix of experience

and qualifications the Board seeks to maintain primarily through his position as Chairman and Chief Executive Officer of the Company and his long

experience with the business of the Company. As Chairman and Chief Executive Officer and as a result of the experience he gained in 40 years at ABC and Disney,

Mr. Iger has an intimate knowledge of all aspects of the Company's business and close working relationships with all of the Company's senior executives.

Chief Financial Officer, Senior Executive Vice President, Treasureer: Christine M. McCarthy - Ms. Christine M. McCarthy is Chief Financial Officer,

Senior Executive Vice President, Treasurer of Walt Disney Company. She has been Executive Vice President - Corporate Finance and Real Estate since June 2005

and Treasurer since January 2000. Prior to her appointment as Executive Vice President, Corporate Finance and Real Estate,

Ms. McCarthy was Senior Vice President and Treasurer from January 2000 to June 2005. She is responsible for the company wide management

of a variety of functions including corporate finance, capital markets, financial risk management, pension and investments, risk management,

global cash management, and credit and collections, as well as the real estate organization, including facilities development, operations and portfolio management.

Prior to joining Disney, Ms. McCarthy was the Executive Vice President and Chief Financial Officer of Imperial Bancorp from 1997 to 1999. From 1981 to 1996,

she held various finance and planning positions at First Interstate Bancorp. In 1993, she was elected Executive Vice President in Finance.

Ms. McCarthy is a current Board member and former Chairman of the Finance Committee of Phoenix House of California, and is also a Governor of the UCLA Foundation

and a member of its Investment Committee. In 2002, she completed terms as the Treasurer and a Director of the Alumnae Association of Smith College,

and as a member of the Smith College Investment Committee. She also served as a Board member of the Los Angeles Philharmonic Association from 1998 to 2001.

In 2003 she became a Director of the Advisory Board of FM Global. Ms. McCarthy completed her Bachelor's Degree in Biology at Smith College,

where she received an award for excellence in botany, and later earned an MBA in Marketing and Finance from The Anderson School at UCLA.

Chief Operating Officer: Thomas O. Staggs - Mr. Thomas O. Staggs is Chief Operating Officer of Company. He was Chairman, Walt Disney Parks and

Resorts of The Walt Disney Company on January 1, 2010. Mr. Staggs was Chief Financial Officer, Senior Executive Vice President of The Walt Disney Company until January 1, 2010.

He joined Disney in 1990 as Manager of Strategic Planning and soon advanced through a series of positions of increased responsibility,

becoming Senior Vice President of Strategic Planning and Development in 1995 before becoming CFO and Executive Vice President in 1998. Born in Illinois,

he received a BS in business from University of Minnesota and an MBA from Stanford University. He worked in investment banking at Morgan Stanley & Co. before joining Disney.

Chief Human Resource Officer, Executive Vice President: Mary Jayne Parker - Ms. Mary Jayne Parker is Chief Human Resource Officer,

Executive Vice President of Walt Disney Company. She designated as an executive officer of the Company October 2, 2009.

Ms. Parker was previously Senior Vice President of Human Resources for Walt Disney Parks and Resorts from October 2005 to July 2007 and

Vice President Human Resources Administration for Walt Disney Parks and Resorts from March 2003 to October 2005. Previously,

Ms. Parker served as the Senior Vice President of Human Resources, Diversity and Inclusion for Walt Disney Parks and Resorts worldwide.

She also served as a member of the Walt Disney Parks and Resorts Executive Committee. Ms. Jayne began her Disney career in 1988,

developing the programs that became a part of the Disney Institute. Over the next 20 years, she took on positions of increasing responsibility,

including Manager and Director of Disney University, Director and Vice President of Organization Improvement and Vice President of Organization and Professional Development.

Prior to joining Disney, Jayne was a consultant with Wilson Learning Corporation, where she was responsible for designing and developing media-based programs and

management development seminars for education and assessment. During that time, products she developed were awarded first and second place by the

International Television & Video Association. Ms. Jayne is a member of the American Society for Training & Development (ASTD) and has held positions with the

ASTD Instructional Technology (IT) PPA Executive Committee. She has also assisted in the design of several ASTD National Conventions. In addition,

Ms. Jayne is a member of The Conference Board's Council for Division Leaders-Human Resources. Ms. Jayne holds degrees in communications and

education, a master's in instruction design and technology and an M.B.A., all from the University of Central Florida.

Senior Executive Vice President, General Counsel, Secretary: Alan N. Braveman: Mr. Alan N. Braverman is Senior Executive Vice President,

General Counsel and Secretary of Walt Disney Company. Mr. Braverman was named executive vice president and general counsel of

The Walt Disney Company in January, 2003. Mr. Braverman serves as the chief legal officer of the company and oversees its team of attorneys responsible for all aspects of

Disney's legal affairs around the world. Previously, Mr. Braverman was executive vice president and general counsel, ABC, Inc. and deputy general counsel,

The Walt Disney Company. In that capacity he oversaw the legal affairs of the ABC Broadcast Group, ESPN and Disney/ABC Cable, as well as labor relations.

In August 1996, prior to Disney's acquisition of ABC, Inc., Mr. Braverman was named senior vice president and general counsel, ABC, Inc. In October 1994,

he was promoted to vice president and general counsel. He joined ABC, Inc. in November 1993, as vice president and deputy general counsel. In his positions with ABC, Inc.

Mr. Braverman had broad responsibilities for the operation of the legal department, for government relations and for the Corporation's legal affairs.

Mr. Braverman joined Capital Cities/ABC, Inc. from the Washington, D.C. law firm of Wilmer, Cutler & Pickering, where he started in 1976. He became a partner in 1983,

specializing in complex commercial and administrative litigation.

Before joining Wilmer, Cutler & Pickering, Braverman was a law clerk to the

Honorable Thomas W. Pomeroy, Jr., Justice, Pennsylvania Supreme Court. Mr. Braverman received a B.A. degree from Brandeis University in 1969

and worked for two years as a Vista volunteer in Gary, Indiana. In 1975, he received a J.D. degree summa cum laude from Duquesne University in Pittsburgh,

where he was also editor-in-chief of the Law Review.

Senior Executive Vice President, Chief Strategy Officer: Kevin A. Mayer - Mr. Kevin A. Mayer is Senior Executive Vice President, Chief Strategy Officer of Walt Disney Company.

He previously was Partner and Head of the Global Media and Entertainment Practice of L.E.K. Consulting LLC, a consulting firm, from February 2002,

and Chairman and Chief Executive Officer of Clear Channel Interactive, a division of Clear Channel Worldwide, a media company, from September 2000 to December 2001.

Mr. Mayer rejoined Disney from L.E.K. Consulting LLC, where he was a partner and head of the Global Media and Entertainment practice.

Prior to L.E.K., Mr. Mayer held positions at interactive and Internet businesses.

As chairman and CEO of Clear Channel Interactive he managed all aspects of new media business, including content, sales, business and technology development,

and distribution. While at Clear Channel, Mr. Mayer launched local subscription ticketing services. He also served as president and CEO of Playboy.com, Inc.

where he established the overall strategy and financial plans for the interactive business. While at Disney, Mr. Mayer worked in both strategic planning and at Walt Disney Internet Group.

At the Internet group, he served as executive vice president and as such was responsible for the operations, business plans, creative direction and

distribution of Disney's popular Web sites, including ESPN.com and ABCNews.com. Mr. Mayer first joined Disney in 1993 as manager,

Strategic Planning where he spearheaded strategy and business development for all of Disney's interactive/Internet and television businesses worldwide.

Mr. Mayer received his M.B.A. from Harvard University in 1990, and holds a M.S.E.E. from San Diego State University and a B.S.M.E. from Massachusetts Institute of Technology.

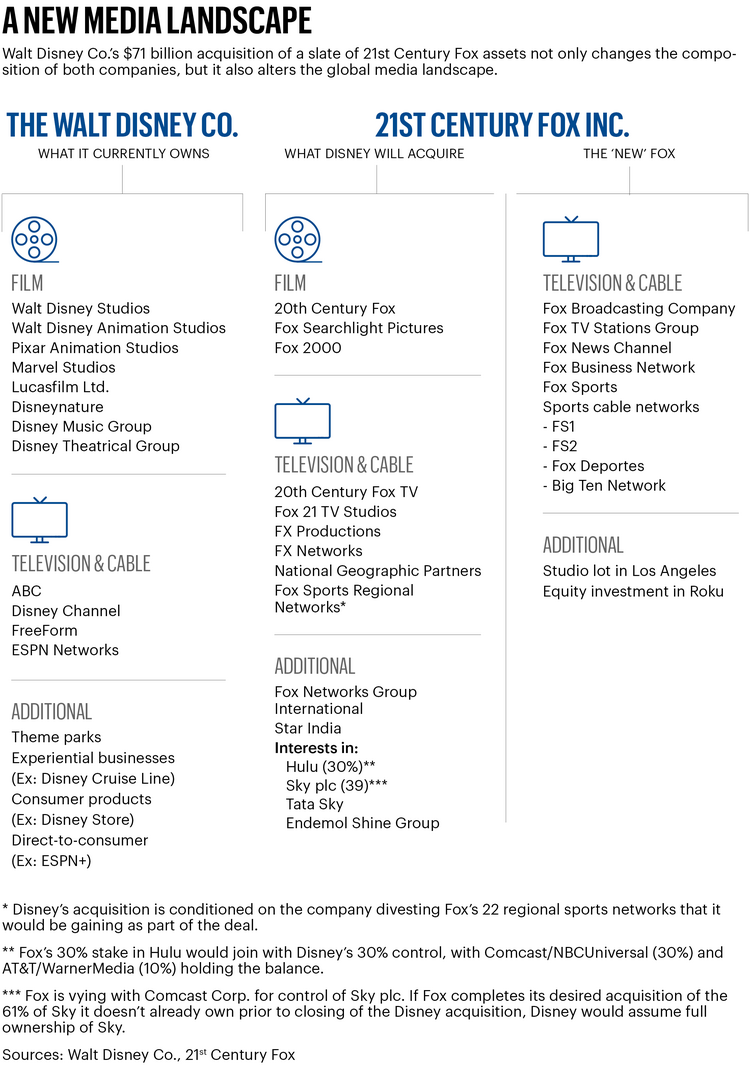

UPDATE; 07-31-2018

[-chart]media.bizj.us/view/img/10989085/fox-merger3*750xx.png[/chart]

[-chart]finviz.com/chart.ashx?t=DIS&ty=c&ta=1&p=d&s=l[/chart]

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |