Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Buy. Dusty, but did not "bite the dust."

oh well another one hits the dust. too bad . thanks for the update.

VCRTQ Revoked by the SEC today. EOM

VCRTQ SEC Suspension for Financials / Filings delinquencies:

http://www.sec.gov/litigation/suspensions/2016/34-76963.pdf

Order:

http://www.sec.gov/litigation/suspensions/2016/34-76963-o.pdf

Admin Proceeding:

http://www.sec.gov/litigation/admin/2016/34-76964.pdf

VCRTQ .001 hit starting here.

http://stockcharts.com/h-sc/ui?s=VCRTQ&p=D&yr=0&mn=6&dy=0&id=p87945325060

VCRTQ has literally under 130k shares to 003 here now!

VCRTQ .001 couple million shares to .003 seen this one move before to .0058.

http://stockcharts.com/h-sc/ui?s=VCRTQ&p=D&yr=0&mn=6&dy=0&id=p20051281069

Agree. Nice to see multiple buys this afternoon on VCRTQ

More green coming next week won't take much.

VCRTQ in the Green!

I think when traders realize 17.5M top volume and it can move to .0058 they will get some.

VCRTQ getting some hits now.

Kinda ridiculous when it moves so easy and some are in these trip 0s that take 500M up to move a tick.

VCRTQ L2: 25k @ 0008, 10k @ 001, 50k @ 0012, 699k @ 0016 and then 003

100k buy @.0008 and look how thin it is here nothing to .003 October will be a good month.

Unfortunately so many do.

Why buy those bloated share structure trips when this one moves easily.

VCRTQ under 600k to 003.

The .0009s would go with any buy above 50k I bet.

Just needs a few hits.

VCRTQ slow to start but moves easily with 17.5 max historical volume low floater.

Looks like 580k to 003 which at these levels isn't all that much money.

Won't take much to get to .0025 L2 is so thin and low floater.

VCRTQ very thin to 003 again.

VCRTQ is very oversold and moves easily with the small float check this chart 17.5M high volume where do you find this in a sub penny stock. It was just .0058 in August on 17M volume.

http://stockcharts.com/h-sc/ui?s=VCRTQ&p=D&yr=0&mn=6&dy=0&id=p06733221262

Look at VCRTQ chart went to .0058 on 15M volume the share structure is minimal moves on air it's time is coming soon.

http://stockcharts.com/h-sc/ui?s=VCRTQ&p=D&yr=0&mn=6&dy=0&id=p92365953034

Yes. Look at HWICQ the past week from the middle triple 0's and in 7 days has moved to the 0045 level this morning on very little volume. VCRTQ is a similar type play/low share structure.

are you guys serious....?

VCRTQ a gem waiting to be discovered moves so easy. Somebody hit the .0007 bid trying to get cheapies.

VCRTQ will be discovered at some point it moves so easily. Once we got out of trips more will take notice.

Agree. This is just a tad higher than where it was at when it took off the 0058 which would be a nice rise from here.

And very tempting at .0008 since it went to .0058 recently.

http://stockcharts.com/h-sc/ui?s=VCRTQ&p=D&yr=0&mn=6&dy=0&id=p59874137549

True. Everyday there are a few Q plays that run hard on no news. It's only a matter of time before VCRTQ does again.

Holding here once traders realize how easy it moves they will be back. Why buy a heavily loaded float that takes huge volume to move a tick when this one moves on air.

http://stockcharts.com/h-sc/ui?s=VCRTQ&p=D&yr=0&mn=6&dy=0&id=p88677107348

Still holding. VCRTQ will bounce again and the very low float is in our favor.

Agree. A 28% gain will get us a few looks.

Maybe scanners will come up tonight and get some curious traders out there that are looking for an easy moving stock.

Over 1000% a month ago to 0058 from the 0005 level in a 2 day period.

Imagine if we had some real volume.

+28%, not a bad day.

That's true it could come pretty soon.

Correct. People always need to see a gain on a play and then they buy in. Strange way to do it as people should be buying down here and not when it is up 300%

Amazingly thin a few ask hits attracts a lot here.

VCRTQ just 630k shares to 003 now.

|

Followers

|

15

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1166

|

|

Created

|

10/19/08

|

Type

|

Free

|

| Moderators | |||

Diagnostics that enable inexpensive, accurate, and early identification of disease states in at-risk populations prior to costly treatments for advanced disease or resulting from inaccurate identification are garnering increased attention in the current health care reform environment. These populations are significant:

Vicor's diagnostics are being developed to address those needs easily, accurately, and inexpensively. Vicor's PD2i Analyzer™ has FDA 510(k) marketing clearance to both measure heart rate variability (HRV) for physician-determined use and be used specifically in cardiovascular disease testing. Physicians who have purchased the PD2i Analyzer™ are largely using it to test their diabetic patients for autonomic nervous system (ANS) dysfunction, also known as diabetic autonomic neuropathy or DAN. Cardiologists are using it to test their cardiovascular disease patients to risk stratify them for cardiac death resulting from arrhythmia or congestive heart failure. Current procedural terminology (CPT) codes enable physicians using the PD2i Analyzer™ to measure HRV to be reimbursed by insurance carriers, creating a recurring source of revenue from test analysis for Vicor.

↓

Vicor's PD2i® Nonlinear Algorithm - A Revolutionary New Vital Sign

Vicor's point correlation dimension (PD2i®) nonlinear algorithm is at the heart of Vicor Technologies' PD2i Analyzer™, which is sometimes referred to as the PD2i CA™ (Cardiac Analyzer), and PD2i VS™.

Decoding The Interaction of Brain and Heart

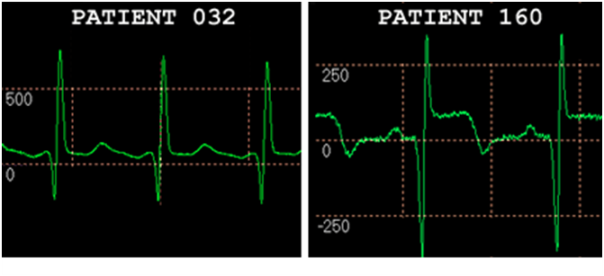

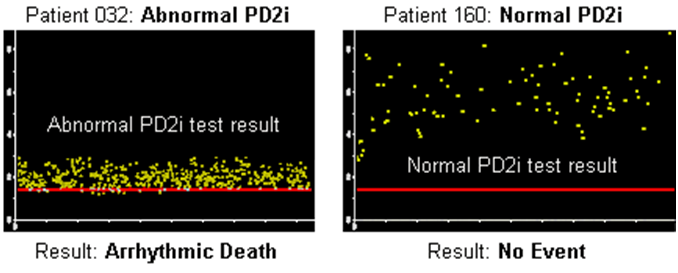

We know intuitively that the brain influences the heart. Vicor has taken this understanding a step further. Through years of research and experimentation, Vicor Technologies' Chief Scientist Dr. James Skinner was able to determine that while cardiac arrest occurs in the heart, it is initiated by the brain. Dr. Skinner developed the PD2i® nonlinear algorithm, which examines a sequence of heartbeats to detect the subtle tell-tale patterns that reveal whether the brain's interaction with the heart is healthy or is putting the patient at high risk of cardiac death. Conventional diagnostics, which only evaluate the heart, are of limited use in predicting cardiac death. Further, current guidelines for implantable cardioverter defibrillators (ICDs) are inadequate and lead to implantations in many people who don't need them. Studies show that, at present, 20 ICDs must be implanted to save a single life. Of even greater concern, nearly 80 percent of those who do die from cardiac death would not even qualify for implantation under current criteria. Clearly, a more accurately predictive diagnostic is greatly needed. Vicor's PD2i® test may be that diagnostic.A case in point: Both patients below meet current implantation guidelines. But which one will die without an ICD?

The ECG for Patient 032 (above left) is normal according to current interpretations. Conversely, the ECG for Patient 160 (above right) is grossly abnormal by current interpretations. Relying on the above tracings, a physician might well recommend "watchful waiting" for Patient 032 and an ICD for Patient 160. In contrast, the PD2i® test is able to correctly indicate Patient 032′s imminent cardiac death and Patient 160′s lack of risk:

Further, the PD2i® would predict that Patient 032 was in need of an ICD, and Patient 160 required no intervention. In summary, the PD2i® nonlinear algorithm, as shown by these examples, should reduce both false positives and false negatives, indications for who does and who does not need an ICD.

Unprecedented Predictive Potential

Published clinical trial data shows the PD2i® nonlinear algorithm is a highly accurate predictor of cardiac death, with a sensitivity approaching 100 percent and a specificity of approximately 86 percent. All that is required to conduct the analysis is an ECG of a thousand heartbeats (requiring less than 20 minutes). The PD2i® typically uses recordings made at rest and does not require stress-testing or any active participation from the patient. The PD2i® test is relatively impervious to data non-stationarities and artifacts, setting it apart from other measures, and its sensitivity is unparalleled.

Current Implementations of the PD2i® Nonlinear Algorithm

Vicor received FDA 510 (k) marketing clearance for the PD2i Analyzer™, on December 29, 2008. The PD2i Analyzer™ measures heart rate variability (HRV) in patients at rest, and in response to paced respiration and controlled exercise, and is expected to be capable of identifying autonomic nervous system (ANS) dysfunction earlier than conventional means. During 2010, Vicor Technologies expects to launch two additional diagnostics: the PD2i CA™ , which identifies cardiovascular disease patients at risk of cardiac death resulting from arrhythmia or pump failure, and the PD2i VS™, which facilitates triage of seriously injured combat and civilian trauma victims.

An Advance Over Conventional Diagnostics

Vicor's PD2i CA™ -based diagnostics offer serveral potential advantages over other measures. They:

Learn Even More About Vicors PD2i® Technology by calling Vicor at 877.528.7324!

Vicor Technologies, Inc. Company Information & Financials

Contact Information:

Vicor Technologies, Inc.

2200 Corporae Blvd., N.W.

Suite 401

Boca Raton, Florida 33431

561.995.7313 (Local Telephone)

877.528.7324 (Toll-Free)

http://www.vicortech.com

info@victortech.com

Vicor Technologies, Inc. (OTCBB: VCRT) creates innovative, non-invasive diagnostics based on its patented PD2i® nonlinear algorithm, a new vital sign which accurately determines the likelihood of pathological events in specific populations.

| Reporting Status | U.S. Reporting: SEC Filer |

| Audited Financials | Audited |

| Latest Report | Not Available |

| Regulatory Agency | Not Available |

| CIK | 0001335104 |

| Fiscal Year End | 12/31 |

| OTC Market Tier | OTCQB |

| SIC - Industry Classification | 3841 - Surgical and medical instruments |

| Business Status | Development Stage Company a/o Mar 31, 2007 |

| Incorporated In: | DE, USA |

| Year of Inc. | 2005 |

| Employees | Not Available |

| James E. Skinner | Interim Chairman & CEO |

| Richard M. Cohen | COO, VP, Business Development |

| Jerry M. Anchin | Vice President, Director, Prod. Dev. |

| Thomas J. Bohan J. Bohannon | Chief Accounting Officer |

| Market Value | $0.625 Million | a/o Feb 08, 2012 |

| Shares Outstanding | 56.8 Million | a/o Sep 30, 2011 |

| Float | Currently Unknown | |

| Authorized Shares | Currently Unknown | |

| Par Value | 0.0001 |

| Shareholders of Record | 622 | a/o Mar 31, 2011 |

| Ex. Date | Record Date | Pay Date |

|---|

| Short Interest | 722,280 (-31.54%) Jan 31, 2012 |

| Significant Failures to Deliver | No |

| Corporate Stock Transfer, Inc. |

Safe Harbor Statement. The above press release(s) include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 27E of the Securities Act of 1934. Non-historical facts and/or statements contained in the above release(s) may constitute "forward-looking" statements. We caution investors that forward-looking statements prove inherently uncertain. Actual performance and results may differ materially from that projected or suggested herein due to certain risks and uncertainties including, without limitation, ability to obtain financing and regulatory and shareholder approvals for anticipated actions. We base any forward-looking statements on management's current expectations, which fall subject to certain factors, risks, and uncertainties that may cause actual results, events, and performance to differ materially from those referred to or implied by such statements. Moreover, actual results may differ materially from the anticipated results, depending on a variety of factors including, e.g., the following: (1) continued maintenance of favorable license arrangements; (2) success of market research identifying new product opportunities; (3) successful introduction of new products; (4) continued product innovation; (5) sales and earnings growth; (6) ability to attract and retain key personnel; and (7) general economic conditions affecting consumer spending. We caution readers not to place undue reliance on any forward-looking statements, which statements refer only to our current vantage point. We do not intend to update any of the forward-looking statements after the date of this release; thus, we shall not conform the above statements to actual results or to changes in expectations, except as the law might require.

Moderators' Position Statement and Disclaimer. This iHub Information Box, forum, and board (collectively, "Board") contains information acquired from various sources (both on and offline), which information the moderators of this Board adjusted for formatting into the Board, and presented for investors to review and analyze for themselves. No licensed brokers or investment professionals created, reviewed, revised, or approved any of the information on this Board. Each investor must complete (and finds his or her self responsible) for their own due diligence regarding the security/stock associated with this Board. Accordingly, each investor takes full responsibility for the performance and possession of any shares one purchased or might purchase. The moderator and assistant moderator(s) on this board are admittedly - and in the interest of full disclosure - rank amateurs. We therefore post only our rank amateur opinions and ideals, which is not necessarily the verified truth. We accordingly do NOT vouch for, confirm, deny, affirm, guaranty the accuracy of, or endorse any information on the Board, and we thus advise great discretion in believing or relying upon anything we post. Thus, place any reliance on what we write at YOUR own peril. YOU are the only person responsible for your opinions, conclusions, expectations, understandings, losses, gains, and/or claims pertaining in any way to the security/stock associated with this Board.

CONSIDER YOURSELF DULY NOTICED AND WARNED!

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |