Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

VRTA: Shareholders of Vestin Realty Mortgage I, Inc. (VRTA) will receive $4.01 for each share of VRTA stock in connection with the merger with Suncrest Holdings, LLC

FINRA deleted symbol:

https://otce.finra.org/otce/dailyList?viewType=Deletions

Wow...that's insane!!!!

I looked up trading history and see random days...all with 100 share trades. Must be market makers just creating allusion of volume. No retail investor will touch that stock at that price. LOL.

Look at the share count of VRTB...

I can understand squeezing out the shareholder theory. I am in a stock that had a float of 1.8M and they just did a 1:50 R/S to eliminate shareholders from the previous company (that managed the symbol).

I believe it is being done to slowly squeeze out the minority shareholders. In many states, if a shareholder has less than 1 share it is easier for the company to buy them out.

Frankly, I'm surprised Mr. Shustak has time to be CEO, given the SEC charges he's now fighting.

OMG....they have an O/S of 868,318 and they want to do a 1 - 100 reverse split? LOL. Why do they want the O/S to be 8,683? Unless they are figuring to dilute the heck out of it from now until then.

$VRTA Vestin Realty Mortgage I, Inc. Announces Proxy Voting Results of its 2021 Annual Meeting of Stockholders

Press Release | 10/20/2021

Vestin Realty Mortgage I, Inc. Announces Proxy Voting Results of its 2021 Annual Meeting of Stockholders

PR Newswire

LAS VEGAS, Oct. 20, 2021

LAS VEGAS, Oct. 20, 2021 /PRNewswire/ -- Vestin Realty Mortgage I, Inc. (OTC: VRTA) announced today the ballot of appointed proxies voting results from its 2021 Annual Meeting of Stockholders. Approximately 72.63 percent of shares were voted, or 630,671 shares of 868,318 total shares outstanding.

A total of 573,640 votes were cast in regard to item one, the election of Michael V. Shustek, who also serves as chief executive officer and president of VRTA, as a director, representing approximately 92.45 percent of all shares. Of those voting, 100 percent voted in favor of Shustek's appointment.

With regard to item two, an amendment to the company's charter's to effect a 1-for-100 reverse stock split of the common stock, $0.0001 par value per share, of the company, approximately 92.41 percent voted in favor of the amendment, while approximately 7.48 percent voted against it. Approximately 0.10 percent abstained.

A total of 619,854 votes were cast in regard to item three, an amendment to the company's bylaws to expand its investment policy to include investments in equity securities of publicly traded companies and unsecured debt investments in privately held companies. Approximately 92.55 percent voted in favor of the amendment, while approximately 7.34 percent voted against it and approximately 0.10 percent abstained.

About Vestin Realty Mortgage I, Inc.

Vestin Realty Mortgage I, Inc., formerly Vestin Fund I, LLC, invests in loans secured by real estate through deeds of trust or mortgages and as defined in our management agreement as mortgage assets. In addition, we invest in, acquire, manage, or sell real property and acquire entities involved in the ownership or management of real property, as well as securities. We commenced operations in June 2001. Vestin Realty Mortgage I, Inc. is traded on the OTC pink sheets under the symbol "VRTA" and headquartered in Las Vegas, Nevada. For additional information regarding Vestin Realty Mortgage I, please visit www.vestinrealtymortgage1.com.

This press release contains statements about the future expectations, beliefs, goals, plans or prospects of the management of Vestin Realty Mortgage II, Inc. These statements are based on current expectations, estimates, forecasts and projections and management assumptions about Vestin Realty Mortgage II, Inc. These statements constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Words such as "expects," "believes," "estimates," "anticipates," "targets," "goals," "projects," "intends," "plans, "seeks," and variations of such words and similar expressions are intended to identify such forward-looking statements which are not statements of historical fact. These forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to assess. Vestin Realty Mortgage II, Inc. has no obligation to update such forward-looking statements. Actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements.

Contacts

Julie Leber

Damon Elder

Spotlight Marketing Communications

Spotlight Marketing Communications

949.427.1391

949.427.1377

julie@spotlightmarcom.com

damon@spotlightmarcom.com

Cision View original content:https://www.prnewswire.com/news-releases/vestin-realty-mortgage-i-inc-announces-proxy-voting-results-of-its-2021-annual-meeting-of-stockholders-301404823.html

SOURCE Vestin Realty Mortgage I, Inc.

VRTA has Yield sign now

https://www.otcmarkets.com/stock/VRTA/disclosure

Let's see what the 3 day trading weekend brings us on Tuesday.

Good to see some action here after a long period of inactivity.

$VRTA: Smooth sailing to $19..... without even trying

Just take a quick peek at the L2.

See what I see ???????

Can you see a $SIGL kinda squeeze on this with how stupid short this is ?

You did see the run on $SIGL this week right ?

From 0.75 to $70 !!!!!!!

In THREE DAYS.

GO $VRTA

Interesting site.

Good info.

$VRTA: Just go about 20rows-down on this list.......

What do you see ????????

https://www.lowfloat.com/all/

Just one of the most lowest floats out there.

GO $VRTA

Interesting.

NITE only showing 100 shares on the Bid but 950 shares have been dumped on it at $3.00

Someone accumulating while the impatient ones are leaving.

I believe VRTA is only selling off a portion of themselves. The whole company is not up for grabs.

Parking REIT was 1/3 of their total asset base.

$VRTA: Bombe Asset Management LLC......... VC Firm

About us

Bombe is an alternative asset management fund investing in and optimizing transportation, infrastructure, and real estate assets. With over two decades of investing experience in similar assets, we are specialists in the parking sector.

Website

https://bombeltd.com/

Industries

Venture Capital & Private Equity

Company size

11-50 employees

Headquarters

Cincinnati, Ohio

Type

Privately Held

Founded

2018

Locations

Primary

250 E Fifth St.

Suite 2110

Cincinnati, Ohio 45202, US

$VRTA: Somebody getting ahead of whats coming in ........

That would make sense.

They basically gave the old VRTA their walking papers.

We are about to go CLEAN SLATE HERE !!!!!!!!!!

They are based outta Cincy.........

https://www.linkedin.com/in/stephanie-hogue-93b158?trk=org-employees_profile-result-card_result-card_full-click

GO $VRTA

What's up with that Huge Bid?

$VRTA: BOMBE Industrial Private EQUITY

I feel like we are about to get a SUPER CRAZY Reverse Merger in here

with these guys.

They got money to spare.

And our Share Structure with only 1Milly float....... is to DROOL OVER.

https://bombeltd.com/

Now at $3

GO $VRTA

LAS VEGAS, Jan. 14, 2021 /PRNewswire/ -- Vestin Realty Mortgage I, Inc. (OTC: VRTA) and Vestin Realty Mortgage II, Inc. (OTC: VRTB) announced today that, in combination with Michael V. Shustek and MVP Realty Advisors LLC, they have reached a definitive agreement wherein the collective parties will sell 1,549,324 shares of common stock of The Parking REIT at a price of $11.75 per share to Color Up LLC, a subsidiary of Bombe Asset Management LLC, which is a private equity firm that invests in real estate, transportation, infrastructure assets, and services.

In addition, the Vestin entities will contribute 175,000 common shares of The Parking REIT to settle three pending class action lawsuits brought against The Parking REIT and MVP Realty Advisors will surrender its claim to 400,000 shares of common stock due to it by The Parking REIT.

The completion of the transaction is expected to occur in the second quarter of the year and is subject to several closing conditions. Upon closing, Shustek will resign as a director and officer of The Parking REIT.

As of 9/30/20, the O/S is 937,861.

This is from their last quarterly financial release. OTC Markets has not been updated for a while.

As per the last PR about the proxy voting results the following statement was made....

The company also announced that it will continue to repurchase shares of its common stock. During the year the company has repurchased in excess of 15.2 percent of the outstanding shares.

$VRTA: Super low floatttttterrrrrrrrrrr....

Could go hard like $TZPC did earlier this week

Now $2

GO $VRTA

Q out, $1.51 net profit per share https://backend.otcmarkets.com/otcapi/company/financial-report/263431/content

In at $2 on Zalmy's call. Missed PCSO.

This could be $10 next week

$VRTA: 800k floater.......... could be something here.

Now at $2

GO $VRTA

What happened to your great pick here? Somebody predicted at 2 that this will be below 1 soon just based on your appearence. Oh I guess that was me.

Love this ticker

HOD close, she's gonna soar next week

Not far away from sub buck now.

HOD close, she's gonna soar next week.... my stock sense is tingling lol!

Soon as here will be a run up on the PPS!

It’s obvious to me investors are collecting shares!

Yeah they did, just took out all the impatient holders imo

Dang someone wanted shares!!! ![]()

Here come the bids... 15k bidding $1.40

Nice! Got my bids in and gonna sit on what I have, definitely headed for $20+!

UPDATED just now! VRTA is now MVP MORTGAGE http://mvpmortgage.com - Same CEO, same management, new acquisitions and positioning of companies.

Stop Sign removed, Shell Risk removed - we are Pink and OTCMarkets has updated with current information.

GLTA!

What a POS! Buyer beware. This is not a good buy. All things pointing to sell sell sell!

This keeps getting better! Huge news!

$VRTA Read the charts, read the filings, reach out to the CEO... if you can't do this then you don't belong here...

Pps targets... $2.40 (almost there), $3.5, $5, THEN $20ish

AABB AAPL ACB ACB AKER ALL ALPP AMRN ANY ARYC AVXL BBRW BLPH BRAV BUDT CAN CCL COOP COOP CYDY CZNI DCLT DECN DOW DUST ETEK FCEL FCX FMCC FNMA FONU GMGI IMO INKW INO JNUG KNOS LADR LKSD MITT NBDR NOW NRZ NSPX NWBO PCTL PNAT PRED PRTY PSTI PUMP PXYN RLBY RUN SECI SEE SKDI SMH SNDD SOLI SSL TGA TOPS TRON TTCM VRTA VRUS VSYM WEYL WHEN

$VRTA pps of $5+ BEFORE STOP is gone... then it's blue skies!

AABB AAPL ACB ACB AKER ALL ALPP AMRN ANY ARYC AVXL BBRW BLPH BRAV BUDT CAN CCL COOP COOP CYDY CZNI DCLT DECN DOW DUST ETEK FCEL FCX FMCC FNMA FONU GMGI IMO INKW INO JNUG KNOS LADR LKSD MITT NBDR NOW NRZ NSPX NWBO PCTL PNAT PRED PRTY PSTI PUMP PXYN RLBY RUN SECI SEE SKDI SMH SNDD SOLI SSL TGA TOPS TRON TTCM VRTA VRUS VSYM WEYL WHEN

You're reaching, like really out on a limb... have you come up with some real hard vented proof as to why we'll see .20? That seems very accurate... like Rain Man perfect... please, show me the numbers, screenshots of the filings where you see it, maybe some secret DD you're holding back... please, if you're out to help us and make the world a better place you must show... or do your morals conflict with your scruples?

Tymerz, I follow you on twitter and I see you in a lot of my plays, and yes, I back you up on your list, I been right there on those too, and this one is no different.

We break $2.40, $3.50, then $5 and it's blue skies backed by company performance... I like around $15 for an out but it should see $20+

AABB AAPL ACB ACB AKER ALL ALPP AMRN ANY ARYC AVXL BBRW BLPH BRAV BUDT CAN CCL COOP COOP CYDY CZNI DCLT DECN DOW DUST ETEK FCEL FCX FMCC FNMA FONU GMGI IMO INKW INO JNUG KNOS LADR LKSD MITT NBDR NOW NRZ NSPX NWBO PCTL PNAT PRED PRTY PSTI PUMP PXYN RLBY RUN SECI SEE SKDI SMH SNDD SOLI SSL TGA TOPS TRON TTCM VRTA VRUS VSYM WEYL WHEN

$VRTA S/S History shows one 1:4 r/s and that's the same day Vestin took over the shell

If you know charts, you know it was oversold and the bottom was just bought up

Avg pps for the last 5 years is right around $1.60 and I'm being generous on the low end.

There's only $2m in liabilities and over $28,000,000 in assets

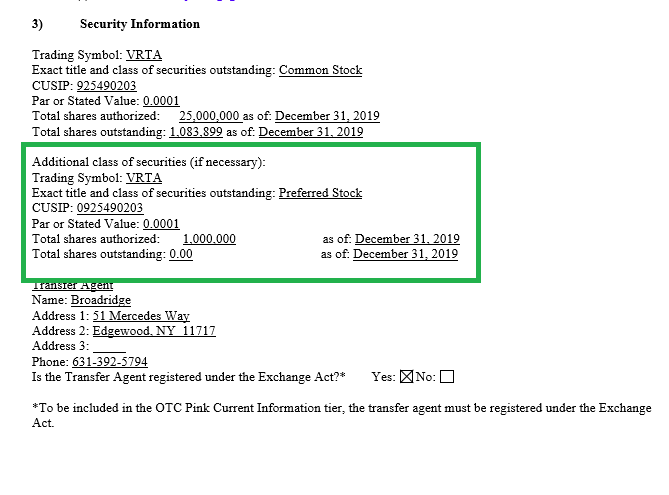

There are ZERO preferred shares issued and only 1.083m shares OUTSTANDING, not floating, that's OUTSTANDING and if you compare to the last TA update... it's gone down roughly 10%

No convertible shares issued as well.

Now, I want someone to tell me, backed by intelligence and not shit like has been posted, why this will go down and where the shares will come from to take it to .20.... the lowest pps in the history of VRTA trading is .40... and that was the day before the FIRST K was released...

Since it's traded almost 500% higher and that was just yesterday... green flags did go off and the real investors who recognize gems like this jumped all over it

This looks altered, don't think that's from the CEO at all. Shame on you

You might want to look where these stocks trade now. There is not one single DD argument or fact that you presented on these stocks that has come through or were even anything but completely fake. On every single stock. To pump up a stock with fake news and fake facts and what not is not difficult since there is enough sheeps out there who follow and don't know better. That's not impressing the least. It's the opposite. Misleading sheeps who don't know better is awful, I know you don't care. Of course it is nice if you are the frontloader like you always are like for example on HENC or ITOX or you name it. As far as I can see anything you posted on HENC was a total lie and made up that's why the stock is back at 02 right. If you don't get my point I can't help you.

Real traders wont touch this pos unless they enjoy losing tons of money

|

Followers

|

6

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

128

|

|

Created

|

04/13/12

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |