Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

General Electric (GE) Wins HA Gas Turbine Contract in Malaysia

https://finance.yahoo.com/news/general-electric-ge-wins-gas-123312812.html

General Electric Company’s GE unit GE Power recently clinched an order for its state-of-the-art HA — one of the most efficient fleet of gas turbines in the world. Notably, the company entered into a deal with engineering, procurement, and construction consortium of Posco Engineering & Construction Co. Ltd. to deliver power generation equipment at Pulau Indah power plant, located in Selangor, Malaysia.

For the 1,200 MW power plant, General Electric will be responsible for offering two blocks of 600 megawatts, each blocks consisting of an advanced 9HA.01 gas turbine, a W88 generator, an STF-D650 steam turbine and a Once Through Heat Recovery Steam Generator. In addition to the power generation equipment, the deal involves a 21-year services agreement.

General Electric’s advanced HA gas turbine technology will bring greater flexibility and efficiency to the plant’s operations for producing efficient and low-cost energy in Selangor. Apart from helping the power plant in catering to the growing requirements of reliable electricity, the HA technology will help it in lowering the consumption of natural gas and emissions. Notably, the plant’s commercial operations are expected to commence in 2024.

Separately, General Electric’s Healthcare unit introduced StarGuide, an advanced SPECT/CT system. The system is developed to facilitate clinicians to improve patient outcomes in several medical specialties, including bone procedures and others.

GE Sells Lightbulb Business for About $250 Million

General Electric Co. is getting out of the business of making lightbulbs, selling a unit that defined the company for nearly a century and was its last direct link to consumers.

GE said it would sell its lighting business to Savant Systems Inc., a seller of home automation technology. Terms of the deal weren't disclosed but the transaction valued the unit at around $250 million, according to a person familiar with the matter.

GE had been looking to sell the business for several years. The conglomerate once made refrigerators, microwaves and bulbs but has exited those consumer businesses as part of a yearslong restructuring. It has shifted its focus to making heavy equipment, like power turbines, aircraft engines and hospital machines.

GE Lighting will remain based in Cleveland, and its more than 700 employees will transfer to Savant, which will also get a long-term license for the GE brand. GE no longer discloses revenue for the lighting business, which it slimmed down over the years.

The unit traces its roots back to GE's founding 130 years ago when Thomas Edison invented the first viable incandescent lamp. In 1935, the first Major League Baseball night game was played under GE lights. A GE engineer invented the LED light in 1962.

For decades, GE's home appliances and lightbulbs formed a link between American consumers and one of the country's oldest and largest industrial companies. The company's popular TV ad campaigns promised to "Bring good things to life," but the growth and profitability of the consumer businesses waned.

GE got out of making television sets and small appliances like toasters under former Chief Executive Officer Jack Welch. His successor Jeff Immelt continued the shift, exiting the NBCUniversal media business and in 2016 selling the large appliances business to Haier Group. GE gave the Chinese buyer the right to continue to use its brand on stoves, fridges and other appliances for several decades as part of the deal. Thousands of workers and a sprawling factory complex in Louisville, Ky., were transferred in that deal.

More recently, the company has been selling off industrial units -- such as its locomotive, oil equipment and biopharma units. It has used the proceeds to pare down its debts after a plunge in profits at its power and financial services divisions prompted the company to slash its cash dividend to a token penny a share and overhaul its board and executive ranks. It has also shrunk GE's scope -- leaving the company with about 205,000 employees at the start of 2020.

CEO Larry Culp, who took over in 2018, had depended on GE's thriving aviation division in order to turn around the company, but the coronavirus pandemic has crippled the airline industry. GE has cut thousands of jobs in its aviation business and warned a restructuring of its large power unit could take years.

GE had previously shed its Current business, which sold commercial lighting systems, along with parts of its overseas lighting operations. GE's traditional bulb rivals have also scaled back in the last decade, and many of the buyers have been Chinese firms.

GE spent years trying to sell the lighting business, a largely commoditized and low-margin division, before striking the deal to sell its Current business in 2018. The company had spoken to Chinese suitors about the lighting business, but pivoted as the Trump administration increased scrutiny of the security risks of selling to Chinese companies, the person familiar with the matter said.

The transaction is expected to close quickly, possibly within a month, due to it being structured in a way that will limit antitrust clearance required, this person said.

Savant, founded in 2005, is based in Hyannis, Mass. The company specializes in so-called smart home systems that control features such as lighting, entertainment, temperature and security settings all in one place.

https://ih.advfn.com/stock-market/NYSE/general-electric-GE/stock-news/82543907/ge-sells-lightbulb-business-for-about-250-million

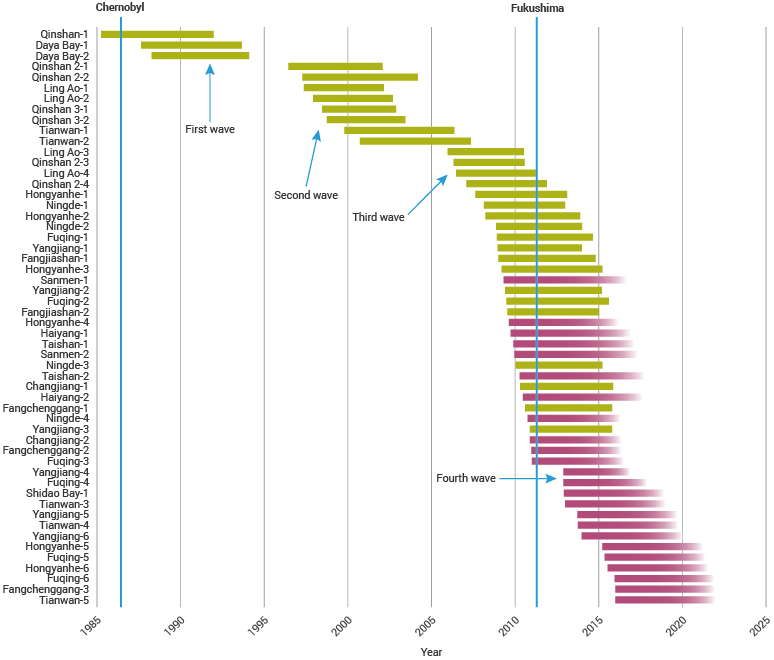

Nuclear Power in China

https://world-nuclear.org/information-library/country-profiles/countries-a-f/china-nuclear-power.aspx

China nuclear power plant construction milestone

190815_GE Plunges Most in 11 Years as Madoff Accuser Slams Accounting

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=TVIX&x=28&y=13&time=3&startdate=1%2F4%2F1999&enddate=2%2F6%2F2012&freq=7&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=3&maval=20&uf=4&lf=4&lf2=256&lf3=1024&type=4&style=330&size=2&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=11

General Electric Co. tumbled the most since 2008 after a prominent financial examiner working with a short seller accused the company of “accounting fraud.” GE Chief Executive Officer Larry Culp called the claims “market manipulation -- pure and simple.”

Harry Markopolos, who had raised concerns over investment manager Bernie Madoff before his fraud was exposed, said GE will need to increase its insurance reserves immediately by $18.5 billion in cash -- plus an additional noncash charge of $10.5 billion when new accounting rules take effect. GE is also hiding a loss of more than $9 billion on its holdings in Baker Hughes, an oilfield services company, Markopolos said.

Madoff Whistleblower Harry Markopolos

Harry Markopolos

“These impending losses will destroy GE’s balance sheet, debt ratios and likely also violate debt covenants,” Markopolos said in a report Thursday. “GE’s cash situation is far worse than disclosed in their 2018” annual report to regulators.

GE dismissed the claims as “meritless” without providing a point-by-point rebuttal. That wasn’t enough to stem the share plunge at a company long criticized for its murky finances. Culp, who took the helm in October, has vowed to improve transparency while also seeking to fix the power-equipment unit and halt a slide that erased more than $200 billion from GE’s market value in the two-year period ending Dec. 31.

“The short report accurately depicts a GE culture that historically hid losses and deceived investors,” Scott Davis, an analyst at Melius Research, said in a note to clients. “GE has no credibility at all in responding to the report today as inaccurate. The truth is GE is using a set of assumptions, the short report uses another. We don’t know where the truth lies.”

GE Left Itself Open to Markopolos Critique: Brooke Sutherland

The shares plummeted 11% to $8.01 at the close in New York, the biggest drop since April 2008. The slide had triggered a trading restriction on short-sellers that takes effect when a decline exceeds 10%. GE had climbed 24% this year through Wednesday, following a 57% plunge in 2018.

https://www.bloomberg.com/news/articles/2019-08-15/ge-drops-as-madoff-whistle-blower-levels-accounting-accusations?srnd=premium

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=GE&x=49&y=12&time=3&startdate=1%2F4%2F1999&enddate=2%2F6%2F2012&freq=7&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=3&maval=20&uf=4&lf=4&lf2=256&lf3=1024&type=4&style=330&size=2&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=11

GE Brings New Leadership to Revamp Ailing Power Business

Leadership shuffle

In mid-November 2018, General Electric’s (GE) newly appointed CEO Larry Culp announced a leadership shuffle to help turn around the company’s ailing Power business. The leadership shuffle includes bringing back former GE executive John Rice from retirement to be the chair of the newly structured gas power business. Prior to his re-recruitment, Rice had served the company for 39 years before retiring in December 2017 as vice chair. During this period, he led several divisions of GE including energy and transportation.

Restructuring plans

For the last few years, General Electric has been evaluating sales and spin-off options to optimize its business. In June, the company announced a massive restructuring plan. Under the restructuring plan, General Electric decided to divest and split off certain assets to focus on only three sectors—aviation, renewable energy, and power.

According to the restructuring plan, General Electric intends to exit the oil and gas business, divest its lighting division, and spin off its Healthcare segment into a standalone company. On November 13, General Electric announced that it entered a series of agreements with Baker Hughes (BHGE). The agreements include a stake sale in Baker Hughes that would raise almost $4 billion for General Electric.

On November 16, General Electric announced that its lending arm, GE Capital, had sold $1.5 billion worth of its healthcare equipment finance portfolio to TIAA Bank. The company announced that it would sell up to 49.9% of its Healthcare business and then spin-off the unit as a standalone company.

For the Transportation segment, General Electric has entered into an agreement with Wabtec. According to the agreement, General Electric will receive a $2.9 billion up-front cash payment. General Electric’s shareholders will own 50.1% in the combined company.

General Electric intends to completely divest its lighting division, which generated ~$1 billion in revenues in 2017. The segment’s revenues fell 18% YoY to $385 million in the third quarter. As part of General Electric’s strategy, the company sold its energy efficiency business unit, Current, to private equity firm American Industrial Partners.

https://marketrealist.com/2018/12/ges-lighting-and-transportation-businesses-struggle

South Korea's KEPCO loses preferred bidder status for UK nuclear project

https://www.reuters.com/article/us-britain-nuclear/south-koreas-kepco-loses-preferred-bidder-status-for-uk-nuclear-project-idUSKBN1KL1YB

South Korea’s Korea Electric Power Corp (KEPCO) (015760.KS) no longer has preferred bidder status to buy Toshiba’s (6502.T) NuGen nuclear project in Britain, Toshiba said on Tuesday.

“Toshiba continues to consider additional options including the sale of its shares in NuGen to KEPCO, and we are carefully monitoring the situation, in consultation with stakeholders including the UK government,” a spokesperson for Toshiba said in an email to Reuters.

The project in Moorside, north-west England, was expected to provide around 7 percent of Britain’s electricity when built, but has faced setbacks after Toshiba’s nuclear arm Westinghouse went bankrupt last year.

Following the Westinghouse bankruptcy, NuGen joint venture partner Engie (ENGIE.PA) pulled out of the project, leaving the Japanese firm searching for new investors.

KEPCO was chosen as preferred bidder last year but delays in concluding the deal have led to a review of operations at NuGen and of the roles of its 60 direct employees plus around 40 contractors.

Britain needs to invest in new capacity to replace aging coal and nuclear reactors that are due to close in the 2020s, but large new plants have struggled to get off the ground due to high costs and weak electricity prices.

Cracks in nuclear reactor will hit EDF Energy with £120m bill

https://www.theguardian.com/environment/2018/may/06/cracks-nuclear-reactor-threaten-uk-energy-policy-hunsterston

Problems at Hunterston B in Scotland trigger doubts over six other 1970s and 80s plants

The six month closure of one of Britain’s oldest nuclear reactors will burn a £120m hole in the revenues of owner EDF Energy and has raised questions over the reliability of the country’s ageing nuclear fleet.

EDF said this week that it was taking reactor 3 of Hunterston B in Scotland offline for half a year, after inspections found more cracks than expected in the graphite bricks at the reactor’s core.

The plant is one of seven Advanced Gas-Cooling Reactors (AGRS) switched on during the 1970s and 80s, several of which have seen their lifetimes extended into the 2020s.

EDF maintains that the prospect of more old reactors having a sustained outage is highly unlikely, but experts said it would pose a significant challenge to power supplies if they did.

Peter Atherton, an analyst at the consultancy Cornwall Insight, said: “Let’s say worst-case scenario they found a big graphite core problem and Hunterston never comes back on.

“That would be a big hole in the plan [for electricity supplies]. The gas-fired power stations, we’ve probably got enough of them, but it would be pretty tight. It would also be a knock-back to carbon targets. You could build more windfarms, but that would take time.”

The Hunterston outage is the longest yet over the graphite issue, which EDF calls a “unique challenge”, and company presentations concede the cracking “will probably limit the lifetime for the current generation of AGRs”.

The graphite core is used to moderate the neutrons in a nuclear reaction, but over time the irradiation degrades the graphite, ultimately leading to cracks. These cause a series of knock-on effects that can impair control of the nuclear reaction.

The UK nuclear regulator points out that the total number of cracks is well below specified safety limits. It has also welcomed more frequent inspections such as those that led EDF to take the Hunterston reactor offline.

Experts estimate the 40% cut in the power station’s output – it normally supplies enough electricity for 1.8m homes – will cost the French state-owned firm £100m-120m in lost revenue.

That is small compared with the impact of temporary safety closures at EDF’s French plants, which led profits to fall 16% last year, but it is still a blow the company could do without as it ramps up construction of the £20bn Hinkley Point C nuclear power station in Somerset.

EDF will not be the only energy company affected by the outage. Deepa Venkateswaran, an analyst at Bernstein bank, said she thought it would also hurt the price British Gas’s parent company, Centrica, would fetch for its stake in the plants. Centrica recently said it hoped to sell its 20% share by 2020.

Brian Cowell, EDF’s generation managing director, said he was very confident the Hunterston reactor would come back online in mid-November.

So far, significant cracks have only been found at reactors three and four at Hunterston B.

Hinkley Point B, which came online in the same year as Hunterston, is offline to carry out checks for cracks, which will be completed in three to four weeks.

“The one that will be worrying them is Hinkley [Point B],” said John Large, a nuclear consultant who has advised the UK government.

Hinkley Point has not only become an industry showcase for why new nuclear reactors should be built in the UK, but the old power station is providing electricity for the 3,500-strong workforce constructing the new plant.

Nuclear provides about a fifth of UK electricity, but experts said this week that it would slump to 10% by 2027, as the old plants are retired.

BMI Research said it did not expect Hinkley Point C to come online by 2025 as planned, given recent warnings of further delays to EDF’s Flamanville plant in France, which uses the same reactor design.

China looking to buy stake in UK nuclear plants

https://www.theguardian.com/environment/2018/jul/08/china-interested-majority-stake-uk-nuclear-power-stations-reports

The Chinese government has emerged as a potential buyer of a multibillion-pound stake in Britain’s nuclear power plants.

The talks will reignite debate about China’s involvement in the UK nuclear power industry. Two years ago, the government paused approval for the £18bn Hinkley Point C project because of security concerns over China’s stake.

China General Nuclear Power Group (CGN), a state-run corporation, is said to be interested in buying a major stake in eight power stations, including Sizewell in Suffolk and Dungeness in Kent.

The power stations are operated by EDF Energy, a subsidiary of the French company EDF, but earlier this year, the British Gas owner, Centrica, put its 20% stake up for sale. The Sunday Times suggested CGN hoped to acquire a 49% stake, which indicates EDF could be looking to offload some of its shareholding.

The proposed deal would be a headache for Theresa May, who is concerned about giving China greater access to critical infrastructure projects and has initiated a new national security test for foreign takeovers.

CGN is becoming an increasingly important player in Britain’s atomic plans, and is working with EDF Energy on plans to develop a new nuclear power station at Bradwell-on-Sea in Essex.

The sale could attract interest from pension and insurance funds, but analysts say the pool of bidders is small because the reactors have a limited shelf live.

Paul Dorfman, a senior researcher at University College London’s Energy Institute, said Britain was an outlier in its openness to Chinese investment.

“It’s entirely credible [that China would be allowed to buy the stake] in the context of what the British government is doing,” he said. “There is no other OECD country that would allow China to own any of its critical infrastructure, let alone its nuclear infrastructure.”

Dorfman said EDF, with €33bn (£29bn) of debt, was eager to raise funds from asset sales. “EDF is in financial difficulties and has been for some time. It’s looking to sell off whatever it can sell off. It’s worried about debt, its credit rating … plus its waste and decommissioning liabilities,” he said.

The eight nuclear power stations, which used to be grouped under British Energy, generate 8.9 gigawatts of electricity and supply about 20% of Britain’s electricity needs. They were bought by EDF for £12.5bn in 2008. The following year, Centrica took a 20% stake, which it values at £1.7bn.

General Electric and EDF will work together to build European Pressurised Water reactors at a planned 9,900-megawatt nuclear plant in Jaitapur, India.

India is building nuclear power stations to meet the growing energy demands of its increasingly urban population and to shift away from environmentally-damaging coal-fired electricity.

The six European Pressurised Water reactors will be for a 9,900 mw nuclear power project at Jaitapur, south of Mumbai in the state of Maharashtra, GE and EDF said in a joint statement released on Tuesday.

India plans to have nuclear power generation capacity of 22,480 mw by 2031 through projects including Jaitapur, where construction has not yet started, junior minister for atomic energy Jitendra Singh told lawmakers in April.

EDF will be responsible for engineering integration of the entire project, while GE Power will design the critical part of the plant and supply its main components, the companies said.

GE will also provide operational support services and a training programme to meet the needs of the state-run Nuclear Power Corp. of India Ltd, the plant’s owner and operator.

https://www.reuters.com/article/us-usa-court-immigration/u-s-top-court-upholds-trump-travel-ban-targeting-muslim-majority-nations-idUSKBN1JM1U9

GE to Spin Off Health-Care Business in Latest Revamp

General Electric plans to spin off its health-care business and unload its ownership in oil-services company Baker Hughes, people familiar with the matter said, betting that the once-sprawling conglomerate can reverse a painful slump by further shrinking.

The final plan, expected to be presented to investors on Tuesday, focuses GE around its power, aviation and renewable-energy businesses, the people said. These units, which accounted for more than half of GE’s $122 billion in revenue last year, mostly sell turbines to power plants and engines to jet makers.

GE Hitachi touts development of smaller, cheaper nuclear reactor

https://seekingalpha.com/news/3347387-ge-hitachi-touts-development-smaller-cheaper-nuclear-reactor

GE Hitachi (NYSE:GE) must innovate to remain viable as the economics of nuclear power plants often wrap the construction of new facilities in red tape, a top official said this week at the 2018 State Energy Conference of North Carolina.

Executive VP Jon Ball says GE Hitachi is developing a reactor called the BWRX-300 that is far smaller than traditional reactors - ~15.5K cm vs. some other reactors that can stand as large as 161K cm - and cost-competitive at ~$700M.

GE Hitachi has targeted production at $2,000/kw, a number where federal estimates show nuclear is extremely competitive with renewable technologies; the company says it thus far has reduced the costs of BWRX-300 production to $2,250/kw.

“Hitting this [2,000/kw] target is relevant, and if new nuclear is going to have a future going forward, these are the kind of price targets that we’re going to have to hit," Ball tells the Wilmington Star News.

Brookfield Business Partners to buy Westinghouse for $4.6 billion

The Brookfield group of companies is among the world’s largest investors in stable, long-lived assets such as utilities, real estate, energy and infrastructure.

https://ca.reuters.com/article/businessNews/idCAKBN1ET1MQ-OCABS

A subsidiary of Canada’s Brookfield Asset Management Inc BAMa.TO BAM.N plans to acquire Westinghouse Electric Co LLC, the bankrupt nuclear services company owned by Toshiba Corp 6502.T, for $4.6 billion.

Brookfield Business Partners LP BBU.N BBU_u.TO said in a statement on Thursday that it and institutional partners would use $1 billion of equity and $3 billion of long-term debt financing to buy the Pittsburgh-based business, its first investment in nuclear power.

The buyers are also assuming Westinghouse’s underfunded pension plan.

New York-listed shares of Brookfield Business Partners were up 3.4 percent in afternoon trading.

The deal is expected to close in the third quarter but will require approval from regulators and the U.S. Bankruptcy Court.

Westinghouse has said it is aiming to exit bankruptcy as soon as March, which would allow Toshiba to book tax benefits in the current fiscal year.

Schneider said he was surprised that Brookfield acquired Westinghouse, given that the company has no other nuclear businesses.

Westinghouse is one the world’s leading suppliers of nuclear fuel, and it provides some form of service to 80 percent of the world’s 450 commercial reactors, according to court records.

Those two business lines generated combined cash flow of $403 million on revenue of about $3.1 billion in Westinghouse’s 2015 financial year, according to court records.

However, the company suffered after it agreed to build two plants in the U.S. Southeast on fixed-price contracts. The project went billions of dollars over budget, and Westinghouse filed for bankruptcy in March to escape the contracts.

Construction of new nuclear power plants globally has dropped to the lowest level in a decade following renewed safety concerns after the Fukushima disaster in Japan in 2011.

One of Westinghouse’s unfinished U.S. projects, known as Vogtle in Georgia, will continue with Southern Co SO.N replacing the company as the project manager. A South Carolina project known as V.C. Summer was abandoned in July.

The lead utility behind the V.C. Summer project, Scana Corp SCG.N, agreed on Wednesday to a $7.9 billion takeover bid from Dominion Energy Inc D.N.

Westinghouse has joined a consortium bidding to provide nuclear power in Saudi Arabia, one of the biggest new markets in the world. Bringing Westinghouse out of bankruptcy could help close a proposed deal for six of the company’s new AP1000 reactors in India.

Dominion Energy to buy Scana, assume failed nuclear project costs

Dominion Energy Inc (D.N) said on Wednesday it would buy Scana Corp (SCG.N) in an all-stock deal worth about $7.9 billion, offering the utility a way to appease customers and investors angered by the cost of a failed nuclear project.

Richmond, Virginia-based Dominion will pay Scana’s customers $1.3 billion, averaging about $1,000 for each customer, and has promised to cut bills by 5 percent to appease users who have been overcharged for years as Scana funded the nuclear project.

Shares of Dominion, which will also assume Scana’s debt of $6.7 billion, were down 4 percent in after-market trading.

Dominion’s $55.35 per share offer represents a premium of 42.4 percent to Scana’s Tuesday close. South Carolina-based Scana’s shares were trading well below the offer price at $47.89, suggesting some investors were skeptical of the deal.

Scana, which owns the South Carolina Electric & Gas Co (SCE&G), has been under pressure since it scrapped the V.C. Summer nuclear project in July after spending about $9 billion on it with state-owned utility Santee Cooper.

The company received a subpoena in October from the Securities and Exchange Commission related to an investigation of the nuclear project.

Scana was funding some of the project’s costs from SCE&G, a move that angered customers and led to the utility rolling back electricity rates for residential users.

https://www.reuters.com/article/us-scana-m-a-dominion-inc/dominion-energy-to-buy-scana-assume-failed-nuclear-project-costs-idUSKBN1ES0XK

S. Korea to invest in safety, decommissioning research

http://www.businesskorea.co.kr/english/news/industry/20114-nuclear-power-rd-direction-rd-investment-nuclear-power-sector-be-oriented-phase

According to the plan, a total of 203.6 billion won (US$183 million) will be invested for R&D in the nuclear industry next year and approximately one-third of the investment will be spent on nuclear power plant safety, security and decommissioning technology. For reference, 60 billion won (US$54 million) has been invested in these fields this year.

The government is going to increase the utility of its nuclear technology by combining it with sectors such as medical and biotech. In this context, the technology will be utilized for marine nuclear system development, neutron radiographic testing and so on while radiological technology is going to be applied to the environment industry, material development, etc. 64.3 billion won (US$57 million) will be invested to this end.

The government also focuses on the export of the technological elements including nuclear power plant fuels and software for nuclear power plant analysis, too. At the same time, the ministry will support the preparation of future energy sources like nuclear fusion and provides more support for the Hanaro research reactor. In this regard, technical support will be provided for the production of ITER procurement items such as vacuum vessels and thermal shields, and high-performance plasma operation technologies shall be developed by the use of the Korea Superconducting Tokamak Advanced Research (KSTAR).

Toshiba has completed the early payment of $3.225 billion, reflecting the remaining outstanding amount of its $3.68 billion parent company guarantee obligation to the owners of the Vogtle nuclear construction project in the USA. The company is negotiating the settlement of the full guaranteed amount due to the owners of the VC Summer project.

http://www.world-nuclear-news.org/C-Vogtle-owners-receive-full-payment-from-Toshiba-1412175.html

Toshiba looks to sell Westinghouse

and Seeks $5.4 Billion in Stock Sale to Avoid Delisting

https://www.bloomberg.com/news/articles/2017-11-19/toshiba-approves-5-4-billion-cash-injection-to-avoid-delisting

Toshiba Corp. plans to raise 600 billion yen ($5.4 billion) by selling new shares and will explore divestment of its Westinghouse-related assets in a bid to avoid being delisted from the Tokyo Stock Exchange.

Toshiba’s board approved the transaction on Sunday and expects it to close in early December, the Tokyo-based company said in a statement. It will sell 2.28 billion new shares at 262.8 yen apiece, about 10 percent less than Friday’s closing price, it said in a separate statement in Japanese. Toshiba shares fell 5.8 percent in Tokyo trading.

If the transactions are successful, Toshiba expects the consolidated negative 750 billion yen on its balance sheet will be erased by the end of the fiscal year in March. About 60 funds, including Effissimo Capital Management Pte and David Einhorn’s Greenlight Capital, are planning to make investments, it said.

Toshiba is struggling to recover from multibillion-dollar losses in the Westinghouse nuclear operations in the U.S. The company has agreed to sell its memory-chip unit to raise funds, but feared the deal wouldn’t be completed by the end of March as it needs to clear competition laws in different countries. Toshiba needs to reverse its negative shareholders equity by the end of its fiscal year to avoid violating the TSE’s listing requirements.

“Eliminating excessive debt and bolstering capital can certainly be seen in a positive light,” said Masahiko Ishino, an analyst at Tokai Tokyo Securities. “But dilution is still something to be reckoned with.”

Toshiba is selling its memory chip unit to a consortium led by Bain Capital. The sale has been complicated by legal action from Western Digital Corp., which has argued it should have veto rights because of its partnership with Toshiba. The U.S. company has filed for arbitration to resolve the dispute, a process that may drag out and complicate the closing.

Toshiba Share Sale Opens Door to Einhorn, Loeb, Other Activists

Private equity firms Blackstone Group LP and Apollo Global Management LLC have teamed up to bid on Toshiba’s Westinghouse unit and others are considering offers, people familiar with the situation said in September. The nuclear unit, which was contracted to build two power projects in the U.S. that were both billions of dollars over budget and years behind schedule, filed for bankruptcy in March.

Selling its holding in the nuclear-power business Westinghouse, and any liability for claims, will let Toshiba “significantly reduce” resources required to rehabilitate that unit, funds that can be focused on new businesses, the company said in the statement Sunday.

How to Make Enemies and Lose Influence in the Chips Business

Toshiba aims to use the capital it gains from the share sale for a full payment of so-called "parent-company guarantees" related to its Westinghouse unit, according to the statement. If Toshiba settles obligations to Westinghouse creditors, it will then be able to request reimbursement from the U.S.-based reactor-maker. Toshiba will then sell the claims against Westinghouse and focus on rebuilding its remaining business units.

GE shares plunge 7% for biggest decline since housing recession after turnaround plan unveiled

General Electric announces it will cut its dividend in half as part of a broader corporate restructuring.

It plans a renewed focus on health care, aviation and energy.

CEO John Flannery (Took over the job in Augest) apologizes on investor day for the company's performance and says GE would be "more focused."

The shares dropped 7.2 percent for their worst single-day decline since April 2009.

https://www.cnbc.com/2017/11/13/ge-announces-broad-restructuring-to-keep-health-care-aviation-and-energy-units.html

Washington tells India Westinghouse could be sold by year end

http://ca.reuters.com/article/businessNews/idCAKBN19N0Y1-OCABS

The U.S. administration has told India that Westinghouse Electric Co will emerge from bankruptcy and be sold by the year end, industry and diplomatic sources have said, raising the prospect of a Washington-supported sale or bailout for the nuclear firm.

India, like other nuclear nations, has been closely watching the fate of Japanese-owned Westinghouse, which filed for Chapter 11 in March after an estimated $13 billion of cost overruns at two U.S. projects, casting a shadow over the nuclear industry.

There has been debate over potential U.S. support for the reactor maker since owner Toshiba (6502.T: Quote), the laptop-to-chips conglomerate, announced the blow-out at Westinghouse last year.

Some form of U.S. backing or involvement, industry experts say, could avoid a Chinese or Russian buyer unpalatable to Washington, which would prefer to keep Westinghouse's advanced nuclear technology out of the hands of its foreign rivals.

US industry on tenterhooks over Westinghouse

28 April 2017

The "30-day window which ends imminently" on the fate of Westinghouse's US nuclear power plant projects is "critical" to the national interest and to the interest of the industry as a whole, Dan Lipman of the Nuclear Energy Institute (NEI) has told the World Nuclear Fuel Cycle (WNFC) conference in Toronto, Canada. Westinghouse said it would no longer spend money on the Summer and Vogtle projects, but reached an agreement with the utilities involved to allow them to pay costs during a 30-day interim period.

Westinghouse filed petitions for reorganisation under Chapter 11 of the US Bankruptcy Code in the US Bankruptcy Court for the Southern District of New York on 29 March, to enable strategic restructuring amid financial and construction challenges in its US AP1000 projects. Pittsburg, USA-headquartered Westinghouse is majority owned by Japanese electronics corporation Toshiba.

Toshiba, which bought Westinghouse in 2006, warned in December last year that it might have to write off "several billion" dollars because of Westinghouse's purchase in 2015 of US construction firm CB&I Stone & Webster (S&W). Upon closing of that transaction, Westinghouse assumed full responsibility for all AP1000 projects and the nuclear integrated services business. Westinghouse is constructing eight AP1000 pressurized water reactors (PWRs) - four in the USA (two each at Vogtle and VC Summer) and four in China (two each at Sanmen and Haiyang) - with S&W as its consortium partner.

Lipman, who is vice-president at the NEI's Suppliers, New Reactors and International Programs department, said utilities associated with VC Summer 2 and 3 and Vogtle 3 and 4 had agreed to finance construction activities for a period of 30 days.

"That takes us to the end of this week, at which time a decision needs to be taken, at the very least on Vogtle and Summer," Lipman said on 25 April. "After bankruptcy declared by Westinghouse, the principals, Toshiba, Southern, Westinghouse, and Scana were going to decide really the future of the projects all the while the utilities continue to pay for construction of the stations.

"NEI's position is very, very clear. We've articulated this to the US government. We've articulated it to the Japanese government. And I'm articulating it now. We want these projects to be completed. We think it's critical in the national interest, in other words the US interest, but we think it's critical in the interests of our industry. We need to have these projects done. And we also expect Westinghouse and Toshiba to stand behind their responsibilities to the employees of Westinghouse, both past and current."

Stephen Byrne, COO at South Carolina Electric & Gas Company (SCE&G), said yesterday the interim agreement to continue construction at Summer 2 and 3 that was due to expire today, is likely to be extended by 60 days. Byrne told analysts during a conference call on SCE&G's financial results for the first quarter of 2017 that he believed an extension to the agreement could be agreed to the end of June.

Vote of confidence

Lipman told delegates at WNFC: "I happened to be in Pittsburgh the week of the bankruptcy - and I was told by some old colleagues that there were three different syndicates in Pittsburgh with financing ready as soon as bankruptcy was announced. And I think it was a real vote of confidence that within a day after bankruptcy about $1 billion of financing was made available for Westinghouse.

"So, in the operating plant side of the business, which is of most interest - certainly of keen interest - for many of you here who rely on Westinghouse for fabrication and storage and other services, that part of the business is open for business as usual. But it's a very important situation. It's one that's critical."

Westinghouse Electric Company designed PWRs based on US submarine power plants. Its technology supplies about half of the USA's nuclear electricity - 65 US units are PWRs - and undergirds France's PWRs, and in turn, China's. Its technology is the basis for half of the world's operating nuclear plants.

The company was bought by the UK's BNFL in 1999 from US CBS Corporation for $1.1 billion, with ASEA Brown Boveri being added the following year. This amalgamation included Combustion Engineering whose designs have flowed to South Korea and now the United Arab Emirates. BNFL then sold Westinghouse in 2006 to Toshiba and The Shaw Group. Toshiba then sold 10% to KazAtomProm in 2007, and in 2013 it bought Shaw's 20% share so ending up with 87%.

Toshiba, which said that it bought Westinghouse in 2006 as "a global leader in the nuclear industry", itself has had a major role in Japan's nuclear design and construction.

The 1100 MWe-class Westinghouse AP1000 received final design certification from the US Nuclear Regulatory Commission (NRC) in December 2005. This was the culmination of a 1300 man-year and $440 million design and testing program. Westinghouse then applied for UK generic design assessment and this process was completed recently.

However, in 2008, the NRC accepted an application from Westinghouse to amend the AP1000 design, and this review was completed with revised design certification at the end of 2011. This included assessment "to ensure it could withstand damage from an aircraft impact without significant release of radioactive materials". This design change increased costs substantially.

Westinghouse and The Shaw Group signed engineering, procurement and construction (EPC) contracts for both the Vogtle and VC Summer projects in 2008. S&W was Shaw's nuclear construction business. Combined construction and operating licences (COLs) for both projects were issued early in 2012 and construction started in March 2013. These were the first new reactors to be licensed for construction in the USA since 1978, and were - apart from the four being built in China - essentially 'first-of-a-kind'. Westinghouse said that the design changes called for by the NRC added $1.5 billion to each project.

US loan guarantees totalling $6.5 billion were issued to Georgia Power and Oglethorpe Power in 2014 for Vogtle, while a further $1.8 billion in loan guarantees were issued to three subsidiaries of the Municipal Electric Authority of Georgia in June 2015.

The Shaw Group was bought by Chicago Bridge & Iron in 2013. Then in 2015, to resolve contract disputes on the two projects, Westinghouse bought S&W, the nuclear construction and integrated services business of CB&I, for $229 million after CB&I had incurred major losses on it. S&W as the contract successor to The Shaw Group was already engaged with building the four reactors.

Toshiba in February said that the cost blowout to complete these US AP1000 projects was now $6.1 billion. Of that, $3.7 billion is for underestimated direct and indirect labour costs, and $1.8 billion related to increased equipment prices and procurement costs.

Chapter 11

Westinghouse listed assets of $4.3 billion and liabilities of $9.4 billion among about 35,000 creditors in the Chapter 11 filing at the end of March. Toshiba said it anticipated a new entity - to be founded by Westinghouse - would take a leading role in bringing Westinghouse out of bankruptcy, and that its own control of Westinghouse had ended. Interim debtor-in-possession financing of $800 million was provided by parent company Toshiba and a New York private equity company - Apollo Capital Management.

Westinghouse's largest creditors were US construction company Fluor Enterprises - which was brought into the US projects in 2015 to take over construction management and is owed almost $194 million, and Chicago Bridge & Iron, which is owed $145 million in connection with the acquisition of the S&W construction business in late 2015.

Toshiba now says Westinghouse overpaid for the company and that information material to the acquisition - specifically cost overruns, delays and the impact these would have on S&W's bottom line - were not disclosed properly or accounted for.

Beyond supplying the technology as reactor vendor, it had taken over the construction functions in 2015 by purchasing S&W. This led to the $6.1 billion write-down by Toshiba for cost overruns on the four US reactors. Toshiba said it would not provide additional funding without collateral, hence the development of the debtor in possession financing, under which Westinghouse is funding continuing operations.

The owners of the Vogtle and VC Summer plants have agreed to pay costs to continue construction themselves for 30 days while a final arrangement on future plant work is developed. They have said that Westinghouse is being very cooperative within its obvious constraints.

Earlier this month, Westinghouse said that about $1.5 billion was required to complete construction of both Summer units, and apparently $2.5 billion for both Vogtle units. The latest total cost estimates are about 50% over the original budgets.

Westinghouse's nuclear fuel business had revenue of $1.48 billion in fiscal 2015 (to end-March 2016), while its operating plant business had revenue of $1.65 billion in the same period, while the new nuclear plant services business lost money.

Westinghouse's shares are split between Toshiba (87%), KazAtomProm (10%) and IHI Corporation (3%). KazAtomProm, Kazakhstan's state-run uranium producer, is entitled to sell its 10% equity holding in Westinghouse pursuant to put option agreements that can be exercised on or after 1 October, Toshiba has said.

Researched and written

by World Nuclear News

http://www.world-nuclear-news.org/C-US-industry-on-tenterhooks-over-Westinghouse-NEI-28041702ST.html

Westinghouse Electric, a unit of Japanese conglomerate Toshiba, filed for bankruptcy on Wednesday, hit by billions of dollars of cost overruns at four nuclear reactors under construction in the U.S. Southeast.

http://www.cnbc.com/2017/03/29/huge-nuclear-cost-overruns-push-toshibas-westinghouse-into-bankruptcy.html

Toshiba Flags Hit of 'Billions of Dollars' on U.S. Nuclear Acquisition

http://fortune.com/2016/12/28/toshiba-nuclear-power-charges-billions/

Toshiba Corp (tosbf, -13.03%) said it may have to book several billion dollars in charges related to a U.S. nuclear power plant construction company acquisition, sending its stock tumbling 12% and rekindling concerns about its accounting acumen.

The Japanese group said cost overruns at U.S. power projects handled by the CB&I Stone & Webster Inc business it acquired last December from Chicago Bridge & Iron Company NV (CB&I) would be much greater than initially expected, potentially requiring a huge writedown.

Toshiba 's announcement came as its Westinghouse Electric Company subsidiary is engaged in a legal and accounting row with CB&I, which has argued in court that it expected a relatively small payment from Westinghouse of only $161 million when the deal closed on the understanding that the latter was taking on a challenged business.

Toshiba 's latest writedown would be another slap in the face for a sprawling conglomerate hoping to recover from a $1.3-billion accounting scandal, as well as a writedown of more than $2 billion for its nuclear business in the last financial year.

"This will come as an additional shock to Toshiba 's institutional investors that may further undermine confidence in company management, as well as significantly weakening its international nuclear credentials," said Tom O'Sullivan, founder of energy consultancy Mathyos Japan.

O'Sullivan noted the acquisition in December 2015 coincided with the finalizing of a record fine by Japanese regulators for accounting irregularities at Toshiba , indicating that corporate governance controls were extremely weak.

Toshiba Chief Executive Satoshi Tsunakawa, who only took the helm in June after his predecessor embarked on a series of restructuring steps to clean up Toshiba 's books, said the conglomerate would look at some kind of strategy to boost capital.

"We would have needed to boost our capital base anyway because our shareholders' equity ratio is low," he told a news conference.

As of end-September, Toshiba had shareholders' equity of 363 billion yen, or just 7.5 percent of assets, which could fall close to zero if the company is forced to log significant losses.

Asked if Toshiba 's liabilities would exceed its assets, Chief Financial Officer Masayoshi Hirata said the company had not yet completed its estimation of the charge.

It would finalize that by mid-February, he said, adding that the conglomerate would explain the situation to its main banks and seek their support. Toshiba 's main lenders are Sumitomo Mitsui Financial Group Inc (smfnf, -0.66%) and Mizuho Financial Group (mzhof, -1.57%).

Toshiba has positioned its nuclear and semiconductors businesses as key pillars of growth while seeking to scale down less profitable consumer electronics units such as personal computers and TVs.

But Toshiba could revise the positioning of its nuclear business if need be, said Tsunakawa, who has been credited with having shaped a medical equipment unit into a major earnings driver. The unit was sold to Canon Inc this year.

Tsunakawa added that asset sales or a potential listing of its cash-cow flash memory chips division were options that could be considered.

Deal of Discord

The deal between CB&I and Toshiba 's Westinghouse division has been fraught with disagreement since at least July.

Clashing over who should shoulder potential liabilities related to cost overruns and over calculations for net working capital for the unit, CB&I sued Toshiba 's Westinghouse division after Westinghouse said it was owed more than $2 billion.

Delaware's Chancery Court earlier this month dismissed the CB&I lawsuit, which accused Westinghouse of making claims in bad faith by seeking to use an arbitration process on net working capital of the nuclear construction business to eliminate liabilities it should have inherited by closing the deal.

CB&I has since launched a legal appeal that is pending. A Westinghouse spokeswoman reiterated on Tuesday that the company expected the issue to be decided by an independent third-party auditor pursuant to the terms of the deal with CB&I.

"Both the (CB&I legal) appeal and the independent auditor process are expected to be determined in 2017. CB&I will continue to defend its position vigorously in both processes," a CB&I spokeswoman said.

CB&I received no upfront payment for the sale of the nuclear construction business, but stood to receive earnouts based on the progress of the completion of two U.S. projects by Stone & Webster: a nuclear power plant in Georgia for Southern Co and two reactors in South Carolina for SCANA Corp (scu).

CB&I and Westinghouse were consortium partners building those reactors prior to their deal for Stone & Webster, which was meant to resolve disagreements over each contractor's responsibilities over the projects.

As of Sept. 30, CB&I had incurred an after-tax goodwill impairment charge in 2016, as a result of the sale of its nuclear operations to Westinghouse, of $904 million. In 2015, it incurred another $1.1 billion after-tax impairment charge.

Shares in Toshiba , which remains on the Tokyo bourse's watch list due to concerns about internal controls, finished 12 percent lower, giving it a market value of around $14.2 billion. CB&I shares were flat in afternoon trading in New York on Tuesday at $34.19.

Prior to Tuesday, Toshiba had forecast a full-year net profit of about 145 billion yen this financial year, a turnaround from a loss of 460 billion yen, thanks to strong demand for flash memory chips from Chinese smartphone makers.

Masahiko Ishino, an analyst at Tokai Tokyo Research Center, said the focus may soon shift to whether Toshiba will divest some of its businesses if the latest loss wipes out its shareholders' equity.

"There will be a lot of companies that want to buy Toshiba 's businesses," Ishino said. "It is possible that its NAND flash memory business would attract various buyout offers as there are few players in the market," he said.

Video from

https://www.bloomberg.com/news/articles/2016-12-27/toshiba-finds-u-s-nuclear-renaissance-a-nightmare-for-costs

Toshiba Corp. plunged by the most on record as the once heralded U.S. nuclear renaissance turns into a nightmare for the Japanese company.

The shares fell by 20 percent, the most since 1974, according to available data, to close at 312 yen in Tokyo, following a 12 percent drop Tuesday. Toshiba said it may have to write down billions related to an acquisition made by U.S. unit Westinghouse Electric that was geared toward completing the newest generation of reactors at two U.S. facilities. The projects, overseen by utilities Southern Co. and Scana Corp., are years behind schedule and billions of dollars over budget.

Southern’s nuclear expansion in Georgia and Scana’s in South Carolina were once viewed as part of a rebirth of the U.S. atomic power industry, which hadn’t seen a new reactor licensed in three decades. However, stumbles with those projects, the nuclear disaster in Fukushima and a flood of cheap natural gas that lowered U.S. power prices made new reactors increasingly expensive and risky.

“This is another reminder of how hard it is to predict how much new projects are going to cost,” Kit Konolige, a utilities analyst for Bloomberg Intelligence, said by phone. “That just makes it a higher hurdle for any new nuclear U.S. construction project. ”

Westinghouse’s purchase of contractor CB&I Stone & Webster Inc. resulted in a settlement with the utilities regarding legal disputes over construction delays and cost overruns. However, Westinghouse and CB&I have squabbled in court over how expensive the delays will be and who should pay for them.

CB&I is appealing a court ruling that dismissed a lawsuit over a $2 billion accounting dispute with Westinghouse. CB&I continues to “vigorously defend” its position and is also moving forward on a process with an independent auditor, spokesman Gentry Brann said in an e-mailed statement. Westinghouse declined to comment.

The cost to insure Toshiba’s bonds traded as high as 440 basis points, up 295 basis points from yesterday, according to a credit trader, who asked not to be identified. That puts the contracts on track for a record jump, based on figures going back to 2004, from data provider CMA.

Won Approval

Toshiba’s rating was cut to BB from BBB- at the Japanese firm Rating and Investment Information Inc., which said the conglomerate is on watch for further downgrade. The writedown would drag the Toshiba’s financial bases down to a “serious condition,” the ratings company said.

Last week, Southern won approval from Georgia regulators to raise the capital costs of Units 3 and 4 at its Plant Vogtle by $1.3 billion to $5.68 billion. The action came after Southern agreed to resolve its dispute with Westinghouse and CB&I by paying $350 million. The parties also agreed that the units would be finished in 2019 and 2020, more than three years behind schedule.

Southern’s settlement with Westinghouse and CB&I provides “strong financial protections for customers by assigning significant construction risks to the contractor,” spokesman Jacob Hawkins said in an e-mail statement. The company will hold the contractor accountable for achieving the in-service target dates, he said.

“We continue to monitor the financial position of Toshiba, who is the guarantor for Westinghouse under our engineering, procurement and construction contract,” Hawkins added.

Revised Schedule

In South Carolina, regulators agreed in November to raise Scana’s costs of its project by $831 million with the company’s share of the total expense now at $7.7 billion due to delays. The utility had also reached a settlement with Westinghouse and CB&I that led to a revised completion schedule for its reactors at V.C. Summer to 2019 and 2020.

“Westinghouse has communicated that they are still working to finalize their evaluation,” said Ginny Jones, a spokeswoman for Scana.“We will maintain contact with them and expect to learn more over the next few weeks,” Jones said in an e-mail statement.

Toshiba underestimated costs of projects in the U.S., Mamoru Hatazawa, the company’s executive officer in charge of the nuclear business, told a briefing in Tokyo. While Toshiba is evaluating the exact reasons, much of the miscalculation centered on the local cost of labor and the amount of materials needed, Hatazawa said.

Exelon details plans to close Clinton and Quad Cities nuclear plants

Exelon said June 2, 2016, that it will move ahead with plans to shutter the Clinton and Quad Cities nuclear plants, blaming the lack of progress on Illinois energy legislation.

Exelon said Thursday it would move ahead with plans to shutter the Clinton and Quad Cities nuclear plants, blaming the lack of progress on Illinois energy legislation, but said its decision could be reversed.

The company, the parent of Chicago-area utilities provider ComEd, said the Clinton Power Station would close June 1, 2017, and the Quad Cities Generating Station in Cordova would close June 1, 2018. The plants have lost a combined $800 million in the past seven years, despite being "two of the best-performing plants," the company said in a statement.

The move comes after the Illinois General Assembly adjourned earlier this week without acting on legislation known as the Next Generation Energy Plan, which Exelon said would help save the nuclear plants. Consumer advocates are concerned the legislation would put consumers on the hook for fixing what ails Exelon's nuclear facilities.

Exelon said it expects the plant closings to have a significant economic impact on the regions in which they operate. Both plants support roughly 4,200 direct and indirect jobs, including 700 workers at Clinton and 800 workers at Quad Cities and produce more than $1.2 billion in economic activity annually, the company said. Exelon cited a state report that the plant closings could boost wholesale energy costs in the region by $439 million to $645 million annually.

Exelon said its proposal would raise consumer's bills by about 25 cents per month while ensuring stability and improving Illinois' energy markets. But critics have charged that consumers would see their bills climb an average of $3 per month

http://www.chicagotribune.com/business/ct-exelon-closing-nuke-plants-0603-biz-2-20160602-story.html

EXC D ETR FE AEE XEL NRG NEE

China Nuclear Power Push

China wants to shift from customer to competitor in the global nuclear industry as it seeks to roll out its first advanced reactor for export, a move that adds new competition for already struggling global firms.

China General Nuclear Power Group, hosted dozens of business executives from Kenya, Russia, Indonesia and elsewhere, at its Daya Bay nuclear-power station to promote the Hualong One for export.

http://www.pressreader.com/belgium/the-wall-street-journal-europe/20160224/282020441365372/TextView

GE to sell appliances business to China's Haier for $5.4 billion

General Electric Co said it would sell its appliance business to China's Haier Group for $5.4 billion in cash, another step in its push to sell its non-core assets and project itself as a technology company.

The deal comes weeks after GE walked away from a deal to sell the business to Sweden's Electrolux for $3.3 billion, following months of opposition from U.S. antitrust regulators.

GE said the deal values the appliance business at 10 times last 12 months earnings before interest, taxes, depreciation, and amortization (EBITDA). Whirlpool Corp is valued at 7.7 times.

GE shares fell 2.3 percent in premarket trading.

http://www.reuters.com/article/ge-ma-qingdao-haier-idUSL3N14Z2ZQ

CGN to build floating reactor

China General Nuclear (CGN) expects to complete construction of a demonstration small modular offshore multi-purpose reactor by 2020, the company announced yesterday.

CGN said development of its ACPR50S reactor design had recently been approved by China's National Development and Reform Commission as part of the 13th Five-Year Plan for innovative energy technologies.

The company said it is currently carrying out preliminary design work for a demonstration ACPR50S project. Construction of the first floating reactor is expected to start next year, it said, with electricity generation to begin in 2020.

The 200 MWt (60 MWe) reactor has been developed for the supply of electricity, heat and desalination and could be used on islands or in coastal areas, or for offshore oil and gas exploration, according to CGN.

The Chinese company said it is also working on the ACPR100 small reactor for use on land. This reactor will have an output of some 450 MWt (140 MWe) and would be suitable for providing power to large-scale industrial parks or to remote mountainous areas.

CGN said the development of small-scale offshore and onshore nuclear power reactors will complement its large-scale plants and provide more diverse energy options.

Last October, Lloyd's Register of the UK announced it had signed a framework agreement with the Nuclear Power Institute of China - a subsidiary of China National Nuclear Corporation (CNNC) - to support the design and development of a floating nuclear power plant utilizing a small modular reactor. That plant would be based on a marine version of CNNC's ACP100 SMR design, known as the ACP100S. This 100 MWe design with passive safety features has been under development since 2010 and its preliminary design was completed in 2014.

The only floating nuclear power plant today is the Akademik Lomonosov, under construction in Russia, where two 35 MWe reactors similar to those used to propel ships are being mounted on a barge to be moored at a harbour. The Baltiysky Zavod in St Petersburg is on schedule to deliver the first floating nuclear power plant to its customer, Russian nuclear power plant operator Rosenergoatom, in September 2016. It could start operating in Chukotka as early as in 2017.

Floating plants offer various advantages: construction in a factory or shipyard should bring efficiencies; siting is simplified; environmental impact is extremely low; and decommissioning can take place at a specialised facility. However, the offshore environment brings important considerations, such as access for personnel and equipment and the need to ensure radioactive materials never enter the sea.

http://www.world-nuclear-news.org/NN-CGN-to-build-floating-reactor-1301164.html

The California High-Speed Rail Authority board Tuesday awarded a three-year contract valued at $444.3 million for design and construction of the third segment of the rail line in the San Joaquin Valley.

Tuesday’s 6-0 vote by the rail agency’s directors authorizes CEO Jeff Morales to negotiate and finalize a contract with California Rail Builders for a 22-mile stretch of the bullet-train route from the Tulare-Kern county line to Poplar Avenue in Shafter, northwest of Bakersfield. California Rail Builders submitted the lowest-cost bid among four proposals by firms competing for the job.

California Rail Builders is led by Ferrovial Agroman US Corp., an American subsidiary of Spain’s Ferrovial S.A., and augmented by Eurostudios, a Spanish engineering company, and Othon Inc., a Houston engineering and environmental consulting firm. Ferrovial has extensive experience in infrastructure construction in the United States and around the world, including work on high-speed rail lines in Spain, Turkey, Algeria and Columbia.

The California Rail Builders/Ferrovial Agroman bid came in at $347.5 million, well below engineers’ estimates of $400 million to $500 million. The rest of the contract value comes from an estimated $107 million to cover the costs of protecting or relocating utilities owned by Pacific Gas & Electric Co., AT&T and Level 3 Communications.

The contract covers construction of the route up to the railbed in both at-grade and elevated areas, as well as relocating four miles of existing freight tracks, crossings for waterways and wildlife, and some road overpasses to carry traffic over the new line.

Once a contract is executed, it will extend work being done by construction teams that have contracts for nearly 100 miles of rail line in the San Joaquin Valley, stretching from Avenue 17 northeast of Madera to the Tulare-Kern county line.

The first contract, for just under $1 billion, was awarded in mid-2013 to Tutor Perini/Zachry/Parsons for a 29-mile segment from Madera to the south edge of Fresno. The second contract, for about $1.4 billion, was awarded a year ago to Dragados/Flatiron, a joint venture of two construction firms, and covers about 65 miles from American Avenue south of Fresno to the Tulare-Kern county line.

Construction will start later this year on the second contract south of Fresno. Work is under way on the Fresno-Madera segment, but is running well behind the original schedule. Scott Jarvis, the rail authority’s chief engineer, said delays in buying or acquiring the land needed for the railroad right of way has meant slow progress.

http://www.fresnobee.com/news/local/high-speed-rail/article54370025.html

General Electric Will Move Headquarters to Boston

GE has been headquartered in Fairfield, Conn.

The conglomerate has been weighing a move out of Connecticut since the summer, when lawmakers passed a budget that included $1.2 billion in tax increases despite protests from some of the state's biggest corporations. In earlier 2015 comments, Immelt claimed GE's state taxes had increased five times since 2011.

At last tally, GE employed about 5,700 people in the state of Connecticut, with about 800 people in its Fairfield headquarters.

GE already has a number of businesses with offices in the Boston area, including life sciences, jet engines and a new lighting business called Current headquartered in Boston.

http://www.cnbc.com/2016/01/13/general-electric-to-select-boston-as-new-global-headquarters-report.html

General Electric Co. is cutting up to 6,500 jobs in Europe after buying a big chunk of French engineering company Alstom, but sticking to pledges to create a net 1,000 jobs in France.

The French government, facing chronic 10 percent unemployment and a struggling industrial sector, had been concerned that the $17 billion Alstom takeover deal in 2014 would cause layoffs. To ease those concerns, GE promised to create jobs instead of destroying them.

In fact, it's doing both. GE France spokesman Laurent Wormser said that 756 of the 6,500 job losses in Europe will hit its French operations, primarily administrative jobs in the Paris region.

But they will be replaced with jobs in other sectors of the French operations, which employ 14,000 people, he said.

http://www.foxnews.com/world/2016/01/13/ge-cutting-thousands-european-jobs-after-takeover-deal.html

India closing in on Westinghouse deal to build six nuclear reactors

India expects to seal a contract with Westinghouse Electric Co LLC to build six nuclear reactors in the first half of next year, a senior government official said, in a sign its $150 billion dollar nuclear power program is getting off the ground.

The proposed power plant in Prime Minister Narendra Modi's home state of Gujarat will accelerate India's plans to build roughly 60 reactors, which would make it the world's second-biggest nuclear energy market after China.

India wants to dramatically increase its nuclear capacity to 63,000 megawatts (MW) by 2032, from 5,780 MW, as part of a broader push to move away from fossil fuels, cut greenhouse gas emissions and avoid the dangerous effects of climate change.

The United States signed a pact with India in 2008, opening the way for nuclear commerce that had previously been stymied due to New Delhi's nuclear weapons program and shunning of the global Non-Proliferation Treaty (NPT).

But hopes that reactor makers would get billions of dollars of new business evaporated after India adopted a law in 2010 giving the state-run operator Nuclear Power Corp of India Ltd (NPCIL) the right to seek damages from suppliers in the event of an accident.

A deal with Westinghouse could also put pressure on General Electric Co (GE.N), whose nuclear energy venture with Hitachi (6501.T) was offered a site six years ago to build reactors.

GE has still not decided whether it would move ahead with the plan, the official said, adding that India was keen for a decision from the company soon.

Later this week, India is expected to offer Russia a site in its southern state of Andhra Pradesh to build six reactors, on top of the six it is already expected to build in neighboring Tamil Nadu, Indian and Russian officials have said. Separately, India expects Japan, which supplies components used in most reactors, to ratify an agreement some time in the second quarter of 2016 to support its nuclear program, another senior Indian government source said. "There are no more technical hurdles in the development of nuclear energy for peaceful purposes," the source said. French nuclear company Areva (AREVA.PA), which uses Japanese components, also has a deal to build six reactors in India, although restructuring within that company was likely to delay construction until 2017, the first official said.

http://in.reuters.com/article/us-india-nuclear-idINKBN0U619N20151224

Bangladesh signs $12.65 billion deal with Russia for nuclear power plants

Bangladesh's state-run Atomic Energy Commission signed a deal with Russia on Friday to set up two nuclear power plants, each with 1,200 megawatt capacity, an investment totaling $12.65 billion, a government official said.

Work will begin early next year at Ruppur in Iswardi, 160 km (100 miles) from Dhaka, said Kamrul Islam Bhyian, spokesman for the ministry of science and technology.

"Russia will finance up to 90 percent of the total cost as credit with an interest rate of Libor plus 1.75 percent," Bhyian told Reuters.

Bangladesh will clear the total loan within 28 years with a 10-year grace period.

http://www.reuters.com/article/us-bangladesh-russia-power-idUSKBN0U80TF20151225

Toshiba Plans to Cut 7,800 Jobs as It Warns of Huge Loss

The Japanese company, whose financial struggles were laid bare this year in a $1.2 billion accounting scandal, said it would eliminate 7,800 jobs, mostly in its slumping consumer electronics division. That brings the number of job cuts announced this year to more than 10,000 total, or roughly 5 percent of its workforce.

Toshiba is seeking to offload whole divisions as well as employees. It said Monday it would look for a buyer for its health care arm, which makes products like medical scanners for hospitals. It already wants to offload all or part of its personal computer business as well as its U.S.-based nuclear power plant subsidiary, Westinghouse.

http://www.afr.com/technology/toshiba-plans-to-cut-7800-jobs-as-it-warns-of-huge-loss-20151221-glsxxx

Google ups ante, nearly doubles bet on renewable energy

The long-term commitments announced Thursday cover up to 842 megawatts of power that will flow from six different wind and solar power projects scheduled to be finished within the next two years in the U.S., Chile and Sweden. Google isn't disclosing how much it expects to pay for the power.

Some of the deals were signed several weeks ago, but Google timed its announcement to coincide with the U.N. conference in Paris that is exploring ways to reduce the volume of carbon emissions widely believed to be changing the Earth's climate.

"It's an opportune time to make a strong statement," said Gary Demasi, Google's director of data center energy.

Google has now signed contracts covering 2 gigawatts of renewable energy, putting the company closer to its goal of having 3.6 gigawatts lined up by 2025. The 2 gigawatts currently under contract is enough to supply 2 million European homes annually, based on Google's estimate that the renewable energy projects will generate an average of about 7.4 billion kilowatt hours of power.

The Mountain View, California, company has pledged to have all of its 14 data centers worldwide running on renewable energy as part of its quest to minimize the pollution caused by the rising demand for its Internet search engine, YouTube video service, Gmail, digital maps and other services.

Google, part of a recently formed company called Alphabet Inc., still has a long way to reach that goal. By its latest estimates, renewable energy accounts for 37 percent of the power needed to run its data centers.

Apple, Facebook and other technology companies also have been investing heavily in renewable energy in an effort to reduce the pollution caused by the popularity of their products. All of Apple's data centers, offices and stores in the U.S. already run on renewable energy, but the company is still trying to obtain cleaner power for the overseas factories that make its iPhones, iPads and other devices.

Besides signing long-term contracts with renewable energy providers, Google also has invested about $2.5 billion in companies and projects trying to produce more wind, solar and geothermal power.

http://www.miamiherald.com/news/business/technology/article47694915.html

Westinghouse, again, looks for the next generation of nuclear reactors

Westinghouse Electric Co.’s CEO Danny Roderick in January challenged his employees to come up with the next big thing in nuclear energy — the next generation reactor.

It had been a very long time since such words were uttered at the Cranberry-based nuclear company.

“His charter was to take a clean sheet approach and come up with the most economic [option],” said Cindy Pezze, chief technology officer. The central question was: “How can we get to a more economic future for nuclear?”

No new nuclear reactor has been built in the U.S. on time and on budget, and the overruns haven’t been trivial. That track record, along with cheap and plentiful natural gas and a lack of environmental policy that incentivizes low carbon generation, has held back the nuclear renaissance predicted a decade ago.

Even operating nuclear plants with capital costs far behind them are having trouble competing. A handful are headed for premature retirement.

For that reason, economics and scale are top priorities.

“I think that the industry in total — that includes the vendors, the government — is looking at this saying, ‘We have to figure out a way of doing this more efficiently than we have done in the past,’” Ms. Pezze said. “Everyone is talking about [how] we need to have some change.”

The Westinghouse team wasn’t given a budget or a cost target for the new reactor design and Ms. Pezze declined to speculate.

“We've been down this road before,” she said. “I won't give you a number at this point.”

The timeline, she expects, will be rather lengthy.

The company’s first step was to whittle down the possibilities. There are six types of Generation IV reactors being researched today. Westinghouse chose the lead-cooled fast neutron reactor concept, which submerges the nuclear core in molten lead and operates at extremely high temperatures.

In most of the nuclear reactors now operating, the nuclear core is placed in a pool of water. That prevents radiation from escaping into the air, but as the nuclear reaction heats up the water, cooler water must be constantly pumped in.

Lead offers a more static solution. It absorbs radiation and doesn’t boil until it reaches 3,182 degrees Fahrenheit. Those properties mean a lead-cooled reactor would need fewer pumps, thinner walls and have fewer “uncomfortable byproducts,” shaving off a portion of capital and operating expenses. The whole operation would be smaller, Ms. Pezze said.

DOE seeks new ideas for reactors

Last month, Westinghouse submitted its proposal to the Department of Energy, which had solicited ideas about advanced nuclear reactors that could be built by 2035. The agency plans to award $80 million to two teams over the next five years, but that depends on Congress’ approval going forward. In the meantime, the department is getting ready to announce the winners of a much smaller opportunity.

Westinghouse hasn’t said yet who else it has enlisted to be part of its team, only that there are more than a dozen entities and that they include universities, national labs and vendors.

A spokesman for the agency said the response has been strong with more than a dozen teams vying for funding. The winners — there will be two, and each will be awarded $6 million — are expected to be announced before the end of the year.

By nuclear standards, that’s a drop in the bucket.

“At one time, there was a fair amount of investment going on in Generation IV,” said Larry Foulke, adjunct professor at the University of Pittsburgh’s Swanson School of Engineering.

An international consortium, Gen IV, sprung up in 2000 to guide research and collaboration in advanced reactor activities.

“A number of nations were working together on these reactors,” he said. “But as with most research activities where you’re studying reactors on paper and not making them,” investment dwindles.

“Generation IV reactors are suffering from a lack of funding worldwide,” he said.

Europe and Russia are pulling ahead.

Russia is due to start construction on a demonstration lead-cooled reactor next year, and European groups are working on three reactor designs.

The investment needed to start from scratch and get to that demonstration stage is staggering. It’s not something Westinghouse can do alone, Ms. Pezze said.

The last time the company tried at its hand at getting DOE funding for a new reactors design was in 2012, when the agency snubbed its pitch for funding for a small modular reactor. The following year, the DOE again passed over Westinghouse for a small modular reactor award and last year, citing unfavorable market conditions, the company pulled back on its program.

Some 35 years ago, Westinghouse was at the forefront of a new reactor design — the liquid metal fast breeder reactor, which would have used sodium as a coolant, was designed to produce more fuel than it uses to generate electricity.

The first of its kind reactor was to have been built at on the banks of Clinch River in Tennessee. The project received hefty government funding, nearly $1 billion, and had more than 600 Westinghouse employees devoted to it.

Then, in 1977, President Jimmy Carter decided to kill the project. He didn’t want reprocessed fuel crisscrossing the country, worrying it might get into the wrong hands.

But, according to newspaper reports from that time, the industry and Congress were slow to get the message. Federal funding continued to flow for several years and the majority of equipment was either delivered to the site or on order before the effort was finally canceled in 1983.

http://powersource.post-gazette.com/powersource/companies/2015/12/01/Westinghouse-again-looks-for-the-next-generation-of-nuclear-reactors/

Here’s Why Sunedison Inc (SUNE), TerraForm Power Inc (TERP) Stocks Are Up Today

Positive commentary by Oppenheimer Research helps resurrect SunEdison Inc. and TerraForm Power Inc stock prices today

TerraForm Power Inc. (NASDAQ:TERP), one of SunEdison’s two yieldco vehicles, has struggled in recent months as troubles at the parent company continue to take a toll on the subsidiary. SunEdison, the fastest growing solar energy developer, went public with TerraForm Power in July 2014 in hopes that dropping down projects to the subsidiary would allow it to generate cash flow and lower financing costs for its future projects.

While going through a challenging period, SunEdison’s board of directors recently reshuffled some top management positions. On November 23, SunEdison announced its chief financial officer, Brian Wuebbels, will replace Carlos Domenech to assume the additional role of CEO for both yieldcos. Chairman Emmanuel Hernandez, was moved to the role of executive chairman, as part of the management shuffle. Mr. Hernandez believes the reorganization will improve the “effectiveness of our structure to focus on the organic development opportunities that lie ahead in order to deliver value for shareholders.”