Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Ghost town will be revived

larrybaz: LOL! EOM

Dale, I actually posted that message in March of last year. I recommend renaming this board the Ghost Town Board.

larrybaz: This is 2014, not 2013.

AXXU bought a few at .28

Company has increasing revs and has scraped up an MJ angle that hasn't been pumped dry by the Maryjane-1200%-in-1/2-day crew. Yet.

SS is decent and a bit of exposure to this news should do the trick:

http://www.axxessunlimited.com/index.php

Another little Scooby snack here:

http://finance.yahoo.com/news/axxess-unlimited-reports-date-2013-133000981.html

CHCI - ($1.78 + $.61) - Check out the guidance:

RESTON, Va., March 26, 2013 (GLOBE NEWSWIRE) -- Comstock Holding Companies, Inc. (CHCI) ("Comstock" or the "Company"), a home building and multi-faceted real estate development and services company in the Washington, D.C. metropolitan area, announced a net loss for its fourth quarter ended December 31, 2012 of ($2.0) million or ($0.10) per basic and diluted share on total revenue of $2.6 million as compared to a net loss for its fourth quarter ended December 31, 2011 of ($2.7) million or ($0.14) per basic and diluted share on total revenue of $6.1 million. For the year ended December 31, 2012, the Company reported a net loss of ($5.7) million or ($0.28) per basic and diluted share on total revenue of $14.3 million as compared to a net income of $1.1 million or $0.05 per basic and diluted share on total revenue of $21.9 million for year ended December 31, 2011. The 2012 results include impairment charges of $2.4 million on the Company's one remaining legacy project, the Eclipse, while results for 2011 include a one-time gain on legal settlement of $9.4 million. During 2012, the Company also reported a gain of $6.5 million within net income from discontinued operations as a result of the $19.35 million sale of the Cascades apartment project in the first quarter.

2013 Outlook

"For the first time in a number of years there is clear and convincing evidence that the housing market has rebounded and will continue to improve," said Christopher Clemente, Comstock's Chairman and CEO. "The inventory of existing homes on the market has dropped to levels not seen in decades, while the number of days on market has dropped to pre-recession levels. Further, historically low interest rates are contributing to the affordability of new homes, while residential rental rates continue to climb. Although the results we reported for 2012 are disappointing, our primary focus during 2012 was securing and positioning new projects to generate positive results in 2013 and beyond. Based upon our early sales success at our recently opened new communities, 2013 is off to a great start, with unit sales and revenue in the first quarter of 2013 expected to approximate the revenue levels for all of 2012."

"Based on the increased demand for new homes in the D.C. market, and our scheduled openings of additional communities, we anticipate 2013 homebuilding revenue and home settlements to be exponentially higher than in 2012," continued Clemente. "As a result, we are projecting a return to profitability for 2013. Furthermore, we believe the rebounding housing market in the D.C. area will provide an opportunity for additional growth beyond this year. Accordingly, we anticipate generating additional growth in home settlements and revenue with the goal of reaching 250-300 settlements and $125M - $150M of revenue by 2015."

The Company's forecasted homebuilding revenues and settlements for 2013 is as follows (revenue in thousands):

Actual Forecast

12/31/12 Q1-2013 FY-2013

Homebuilding Revenue $11,633 $10,000 - $12,000 $55,000 - $64,000

Home Settlements 45 18 - 22 105 - 125

Sales Backlog (Period end) 9 31 n/a

Backlog Revenue (Period end) $5,400 $16,100 n/a

As of the date of this press release, the Company has settled 12 homes in the first quarter of 2013 realizing $5.4 million in revenue. The total value of settled homes combined with the value of current backlog is approximately $21.5 million, representing an increase of year-to-date homebuilding revenue of more than 80% as compared to the homebuilding revenue generated in all of 2012.

Notable Events

• Subsequent to year end, the Company raised approximately $6.9 million of equity capital through a newly formed subsidiary, Comstock Investors VII, L.C. ("Investors VII'). The proceeds of the private placement are primarily being used to acquire and capitalize new residential development projects specifically: The Townes at Shady Grove Metro and The Boulevard at Shady Grove Metro in Rockville, Maryland, The Hampshires community in Washington, D.C. and Falls Grove in Manassas, Virginia. Accredited investors participating in Investors VII included unrelated third parties as well as members of the Company's management team and certain members of the Board of Directors of the Company. The terms of the offering include a preferred return equal to a maximum of 20% per annum on capital account balances with no prepayment penalty.

2012 Highlights

• Gross new order revenue for the year ended December 31, 2012 increased $4.4 million to $18.9 million on 57 homes as compared to $14.5 million on 50 homes for the year ended December 31, 2011. Net new order revenue for the year ended December 31, 2012 increased $2.3 million to $16.4 million on 51 homes as compared to $14.1 million on 48 homes for the year ended December 31, 2011. The average gross new order revenue per unit for the year ended December 31, 2012 increased by $42 to $332, as compared to $290 for the year ended December 31, 2011.

• During 2012, the Company continued to monetize existing inventory at the Penderbrook Square condominium project, where it settled 37 units reducing remaining inventory to 2 units (out of a total of 424 units) at year-end and at the Eclipse condominium project where it settled 8 units reducing remaining inventory to 19 (out of a total of 465 units). Subsequently, as of the date of this press release, the Company sold and settled all remaining units at the Penderbrook Square condominium project and reduced the inventory of remaining units at the Eclipse condominium project to 19 at year-end 2012.

• The Company announced plans to develop its latest Transit-Oriented residential community located adjacent to the Shady Grove Metro Station in Rockville, Maryland, the terminus of Metro's "Red Line". The community will include 36 upscale townhomes, 3 single-family homes, and 117 luxury apartments. The Company acquired the land on December 27, 2012 and is preparing to commence land development in spring-2013. The Company plans to commence sales of the townhomes mid-2013 with first deliveries expected in late-2013. Leasing of the apartments will commence in early-2014.

• The Company announced plans to develop its latest Prince William County, Virginia residential community located in Manassas, Virginia near the Virginia Railway Express Station. The community, to be known as Falls Grove, will include 110 townhomes and 19 single-family homes. The Company is preparing to commence land development in spring-2013 and plans to commence sales of the townhomes, priced from the high $200's, in mid-2013 with first deliveries expected in late-2013. Sales are expected to commence on the single-family homes in late 2013 or early 2014.

• In early 2012, the Company closed on the sale of its 103-unit Cascades Apartment project for $19.35 million, recognizing a gain of $6.5 million from the sale. The Cascades apartment project represented the Company's first "merchant-build" rental apartment project sale.

• During the third quarter of 2012, the Company formed Comstock Eastgate, L.C., a joint venture of Comstock Holding Companies, Inc. and BridgeCom Development I, LLC, to develop and construct Eastgate One, a 66-unit subdivision situated within the 400-unit Eastgate master-planned community located in Loudoun County. Construction on the first building containing six units, two of which are model homes, commenced in December 2012, with sales commencing in the 1st quarter of 2013. As of the date of this press release, the Company had received 15 new orders (sales contracts) for units within the Eastgate community. Settlements of homes at Eastgate began in the first quarter of 2013.

• Based on the improving market conditions, and increasing revenue potential associated with its new communities, the Company recently entered into an affiliated business arrangement with Stewart Title Insurance Company promoting the sale of title and real estate settlement services. This ancillary business venture, named Superior Title Services, LC ("STS"), is anticipated to generate additional revenue for the Company in 2013.

About Comstock Holding Companies, Inc.

Comstock is a home building and multi-faceted real estate development and services company that builds a wide range of housing products under its Comstock Homes brand through its wholly owned subsidiary, Comstock Homes of Washington, LC. Our track record of developing numerous successful new home communities and more than 5,500 homes, together with our substantial experience in building a diverse range of products including apartments, single-family homes, townhouses, mid-rise condominiums, high-rise condominiums and mixed-use (residential and commercial) developments has positioned Comstock as a leading residential developer and homebuilder in the Washington, D.C. metropolitan area. Comstock Holding Companies, Inc. is a publicly traded company, trading on NASDAQ under the symbol: CHCI. For more information about Comstock or its new home communities, please visit www.comstockhomes.com

Cautionary Statement Regarding Forward-Looking Statements

This release contains "forward-looking" statements that are made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that may cause actual future results to differ materially from those projected or contemplated in the forward-looking statements including incurring substantial indebtedness with respect to projects, the diversion of management's attention and other negative consequences. Additional information concerning these and other important risks and uncertainties can be found under the heading "Risk Factors" in the Company's most recent Form 10-K, as filed with the Securities and Exchange Commission. Comstock specifically disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

COMSTOCK HOLDING COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except per share data)

December 31,

2012 December 31,

2011

ASSETS

Cash and cash equivalents $ 3,539 $ 5,639

Restricted cash 3,203 3,082

Trade receivables 1,611 2,228

Real estate held for development and sale 27,781 21,212

Operating real estate, net — 12,095

Property, plant and equipment, net 222 105

Other assets 2,343 2,018

TOTAL ASSETS $ 38,699 $ 46,379

LIABILITIES AND SHAREHOLDERS' EQUITY

LIABILITIES

Accounts payable and accrued liabilities $ 4,691 $ 3,987

Notes payable - secured by real estate held for development and sale, net of discount 19,492 10,541

Notes payable - secured by operating real estate — 9,957

Notes payable - due to affiliates, unsecured 5,041 5,008

Notes payable - unsecured 3,096 4,309

Income taxes payable — 33

TOTAL LIABILITIES 32,320 33,835

Commitments and contingencies (Note 15) — —

SHAREHOLDERS' EQUITY

Class A common stock, $0.01 par value, 77,266,500 shares authorized, 17,627,826 and 17,944,503 issued and outstanding, respectively 176 179

Class B common stock, $0.01 par value, 2,733,500 shares authorized, 2,733,500 issued and outstanding 27 27

Additional paid-in capital 170,070 168,620

Treasury stock, at cost (391,400 shares Class A common stock) (2,480) (2,439)

Accumulated deficit (162,349) (156,684)

TOTAL COMSTOCK HOLDING COMPANIES, INC. EQUITY 5,444 9,703

Non-controlling interests 935 2,841

TOTAL EQUITY 6,379 12,544

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $ 38,699 $ 46,379

COMSTOCK HOLDING COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except per share data)

Twelve Months Ended December 31,

2012 2011

Revenues

Revenue - homebuilding $ 11,633 $ 14,062

Revenue - other 2,669 7,871

Total revenue 14,302 21,933

Expenses

Cost of sales - homebuilding 9,692 12,160

Cost of sales - other 3,484 7,434

Impairments and write-offs 2,358 —

Selling, general and administrative 8,658 7,399

Interest, real estate taxes and indirect costs related to inactive projects 2,135 2,739

Operating loss (12,025) (7,799)

Gain on troubled debt restructuring — (219)

Gain on legal settlement, net — (9,434)

Other income, net (18) (304)

(Loss) income before income tax benefit (expense) (12,007) 2,158

Income taxes benefit (expense) 2,484 (33)

Net (loss) income from continuing operations (9,523) 2,125

Discontinued operations:

Loss from discontinued operations (98) (527)

Gain on sale of the real estate from discontinued operations 6,466 —

Income tax expense from discontinued operations (2,484) —

Net income (loss) from discontinued operations 3,884 (527)

Net (loss) income (5,639) 1,598

Less: Net loss from continuing operations attributable to non-controlling interests (77) —

Less: Net income from discontinued operations attributable to non-controlling interests 103 491

Net (loss) income attributable to Comstock Holding Companies, Inc. $ (5,665) $ 1,107

Basic (loss) income per share:

Continuing operations $ (0.47) $ 0.10

Discontinued operations 0.19 (0.05)

Net (loss) income per share $ (0.28) $ 0.05

Diluted (loss) income per share:

Continuing operations $ (0.47) $ 0.10

Discontinued operations 0.19 (0.05)

Net (loss) income per share $ (0.28) $ 0.05

Basic weighted average shares outstanding 19,970 20,287

Diluted weighted average shares outstanding 19,970 20,720

Net (loss) income attributable to Comstock Holding Companies, Inc.:

(Loss) income from continuing operations $ (9,446) $ 2,125

Income (loss) from discontinuing operations 3,781 (1,018)

Net (loss) income $ (5,665) $ 1,107

COMSTOCK HOLDING COMPANIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands, except per share data)

Twelve Months Ended December 31,

2012 2011

Cash flows from operating activities:

Net (loss) income $ (5,639) $ 1,598

Adjustment to reconcile net (loss) income to net cash (used in) provided by operating activities

Amortization of loan discount and deferred financing fees 1,283 1,444

Depreciation expense 122 196

Provision for bad debt 60 1

Impairments and write-offs 2,358 —

Amortization of stock compensation 1,447 932

Loss (gain) on extinguishment of notes payable 73 (219)

Gain on trade payable settlements — (161)

Gain on sale of operating real estate, net (6,466) —

Loss on disposal of property, plant and equipment 1 —

Changes in operating assets and liabilities:

Restricted cash (121) 19

Trade receivables 569 (1,837)

Real estate held for development and sale (8,984) 10,292

Other assets (433) (678)

Accrued interest (495) 752

Accounts payable and accrued liabilities 217 364

Income taxes payable (33) 33

Net cash (used in) provided by operating activities (16,041) 12,736

Cash flows from investing activities:

Investment in Cascades Apartments -- operating real estate, net — (9,764)

Purchase of property, plant and equipment (158) (78)

Proceeds from sale of Cascades Apartments -- operating real estate, net 19,075 —

Net cash provided by (used in) investing activities 18,917 (9,842)

Cash flows from financing activities:

Proceeds from notes payable 24,986 38,908

Payments on notes payable (27,512) (38,436)

Loan financing costs (518) (1,548)

Proceeds from SunBridge warrant issuance — 996

Distribution to non-controlling interest holders (2,944) —

Contribution from non-controlling interest holders 1,012 2,350

Net cash (used in) provided by financing activities (4,976) 2,270

Net (decrease) increase in cash and cash equivalents (2,100) 5,164

Cash and cash equivalents, beginning of period 5,639 475

Cash and cash equivalents, end of period $ 3,539 $ 5,639

Supplemental disclosures:

Interest paid, net of interest capitalized $ 1,226 $ 522

Reduction in proceeds from sale of Cascades Apartments and increase in other assets related to amount placed in escrow upon settlement of Cascades Apartments sale $ 275 $ —

Increase in class A common stock par value in connection with issuance of stock compensation $ — $ 8

Increase in additional paid in capital in connection with SunBridge warrant $ — $ 996

Increase in treasury stock and accrued liabilities for net-settlement of stock compensation $ 41 $ —

.

.

Contact:.

.

Joe Squeri

Chief Financial Officer

703.230.1229

.... .

.

@yahoofinance on Twitter, become a fan on Facebook ..

. .

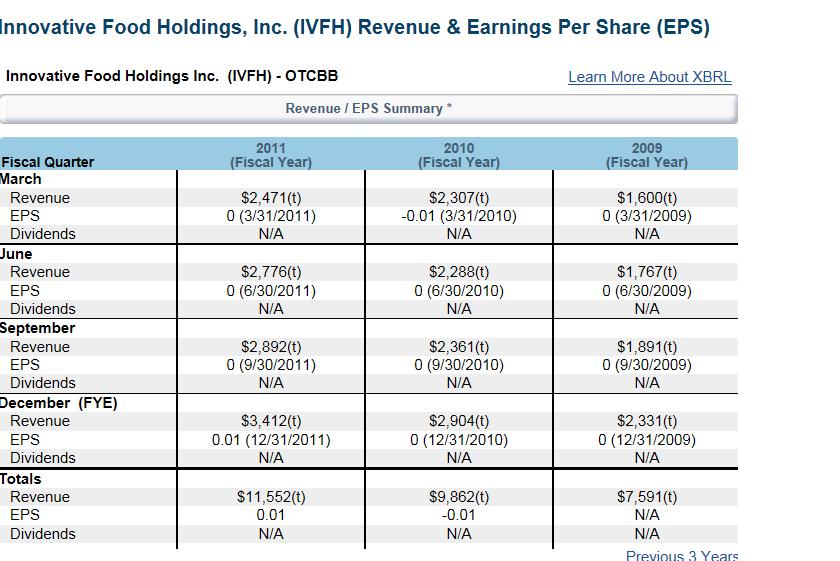

IVFH Value Micro Cap?

Compare the 3yr Chart with the 3 year earnings!

A very long consolidation period, with constant revenue increases!

Earnings Look Good!!!.

http://www.nasdaq.com/symbol/ivfh/revenue-eps

Three Year Weekly Chart

Koz: You say, "all animals process INFORMATION but only humans process MEANING." Obviously U never owned a parrot.

This is what it is coming to: http://www.wbaltv.com/news/29485601/detail.html

Johnny Mullet rides again! Quick on the draw with scissors?

This is weird: http://www.dailymail.co.uk/news/article-2046968/Four-arrested-Amish-Amish-religious-attacks-renegade-cult-Ohio-community.html

Pat Buchanan said to do this decades ago: http://news.yahoo.com/china-us-currency-bill-repercussions-090135830.html

This would be entirely the wrong time to pass such a bill. China has a big inflation problem. In the U.S., price inflation is hurting the poor and much of the middle class, and making goods from China more expensive would exacerbate the problem.

No, this problem should have been addressed during Bush I's or Clinton's Administrations.

Dogs skinned alive in China to make fake UGGS:

This is beyond the pale. Not suitable for sensitive types.

But I really feel the word should get around, this is so

gruesome and hideous. They have been using dogs for fake

fur products for years. I wish they'd skin the skinners alive!

http://www.dailymail.co.uk/news/article-2045016/Raccoon-dogs-skinned-alive-make-cheap-copies-Ugg-boots.html

Drone attacks in Yemen: I agree with Dr. Paul:

http://www.dailymail.co.uk/news/article-2044404/Ron-Paul-attacks-unconstitutional-Obama-Anwar-al-Awlaki-death.html

What is the difference between al-Awlaki and, say, a serial killer who has left the U.S. and is living in Venezuela, say. Would we send in a drone to kill him? I think not.

Well I guess Rick Perry isn't all bad: http://www.dailymail.co.uk/news/article-2044279/Rick-Perry-says-U-S-send-military-kill-Mexican-drug-cartels-brutality-rises.html

I agree 100 percent. Those carters are a threat to the security of the U.S. but few people seem to realize it.

You cannot trust the U.S. Census: http://news.yahoo.com/census-hispanics-fuel-us-white-population-growth-173449405.html

Those instructions invalidated the category of "race". How interesting. Does that mean that Hispanics cannot claim racial discrimination under the Equal Opportunity Act because Hispanic is not a "race"?

octbargains: Axelrod

http://news.yahoo.com/axelrod-obama-faces-titanic-struggle-173328948.html

Looks like he plans on campaigning for Obama, instead of Obama campaigning for himself! Actually Axerod's intended audience might be the Democratic donors. He painting a bleak picture of Romney and Perry. I'm betting that Obama does not run. Think Mrs. C.

Are we going to be shrimp on the barbie?

http://www.dailymail.co.uk/sciencetech/article-2042428/Earth-cross-hairs-huge-solar-storm-caused-sunspot-1302.html

Republican presidential race. Weird but interesting. There was a candidates' debate the other evening with a field of about 8 or 9 candidates: Bob Johnson, Herman Cain, Newt Gingrich, Rick Santorum, Michelle Bachmann, Ron Paul, Rick Perry and Mitt Romney.

It was more entertainment than substance, imo, because everything that was said has been said before. But now this:

http://www.newsmax.com/InsideCover/NYPost-HugePressure-Christie-toRun/2011/09/24/id/412149?s=al&promo_code=D1EC-1

Apparently, there are big money types who think that Perry or Romney (the only 2 serious candidates) cannot deliver the goods.

On the Democratic side, it looks as though Obama's candidacy will be uncontested, but there are Hillary sounds creeping into the air.

I hope 2012 is the year of the winter Olympics! I'm sick of the Presidential race already, 13 months before the election!!!

This coming week could be (??) really dramatic....we'll see.

Lot's of wild and crazy speculation of "something big" happening that may(?) have some merit.

Stay tuned...

WTC Building 7...September 11, 2001

If it looks like a Cutter Charge, sounds like a Cutter Charge then it probably is a Cutter Charge.

otcbargains: Today's market The real carnage is in the oil and gas sector. Metals too. FCX at $32 and change is starting to tempt me. The yield is 3 percent.

Believe it or not, I'm making money in one positin--SKF--reverse index EFT--financials.

Looks like another big day for the market. Maybe we need to bail out some more foreign banks.

otcbargains: re: Howard Buffett

Didn't know that. VERY interesting. His opposition to the Marshall Plan sounds exactly like a position Ron Paul would have taken if he were around then.

Buffett's dad was the Ron Paul of his day

byPhilip Klein Senior Editorial Writer

Follow on Twitter:@PhilipAKlein

In recent days, the Buffett name has become synonymous with support for higher taxes, but a long time ago, it was associated with fierce opposition to federal taxation and big government.

Warren Buffett may be a committed liberal Democrat, but his father, Howard Buffett, was a four-term Republican member of Congress (1943-49 and 51-53), a John Bircher who fought FDR and warned that the expansion of government was eroding individual liberty.

“Today’s situation is the result of an alarming and devious governmental intervention in the economic affairs of the nation for objectives not contemplated by the men who wrote the Constitution,” Buffett lamented in a lecture excerpted in the December 1956 issue of the libertarian journal The Freeman. “Historically, in America the producer was protected by government in the enjoyment of the fruits of his labors. That protection of his property explains the glorious material progress already recounted.”

In the lecture, Buffett went on to observe that, “The last 40 years have seen a gigantic expansion of political power over economic affairs by the federal government. This change is linked by many scholars to the passage of the income tax law in 1913.”

Buffett first ran for Congress in 1942 as a Republican sacrificial lamb in Nebraska’s second district when FDR was a popular wartime leader, Warren Buffett biographer Roger Lowenstein recounts. “I am fully aware of the odds against a Republican candidate today,” Howard said in his stump speech. “He fights against the most powerful Tammany political machine the world has ever known. The ruthless gang, under cover of war, is making plans to fasten the chains of political servitude around America’s neck.”

He won a surprise victory, and during his time in Congress and in articles and speeches in the decades that followed, Buffett laid out a political philosophy that closely resembles Rep. Ron Paul, R-Tex, today. The elder Buffett was for limited government at home, non-interventionism abroad, and a gold standard. Along these lines, he was a campaign director for the conservative non-interventionist Robert Taft in the 1952 GOP nomination battle against the establishment candidate, Dwight D. Eisenhower.

According to Lowenstein, “Unshakably ethical, Howard refused offers of junkets and even turned down a part of his pay. During his first term, when congressional salary was raised from $10,000 to $12,500, Howard left the extra money in the Capitol disbursement office, insisting that he had been elected at the lower salary.” His wife said he considered only one issue when deciding whether or not to vote for a bill: “Will this add to, or subtract from, human liberty?”

He attacked the Truman doctrine on the floor of Congress, declaring, "Even if it were desirable, America is not strong enough to police the world by military force. If that attempt is made, the blessings of liberty will be replaced by coercion and tyranny at home. Our Christian ideals cannot be exported to other lands by dollars and guns."

In a 1948 article promoting the gold standard (PDF), Buffett explained his opposition to the Marshall Plan, making what today would be considered a “crony capitalism” critique.

“There are businesses that are being enriched by national defense spending and foreign handouts,” said Buffett. “These firms, because of the money they can spend on propaganda, may be the most dangerous of all. If the Marshall Plan meant $100 million worth of profitable business for your firm, wouldn't you Invest a few thousands or so to successfully propagandize for the Marshall Plan? And if you were a foreign government, getting billions, perhaps you could persuade your prospective suppliers here to lend a hand in putting that deal through Congress.”

Buffett also wrote an article opposing the draft in a 1962 issue of the New Individualist, his piece squeezed in between contributions from legendary free market economist Milton Friedman and libertarian intellectual Murray Rothbard. (Rothbard had high praise for Buffett).

In the article, Buffett acknowledged that, “the bitter truth is this: that for 30 years we have been marched towards collectivism despite occasional repulses by conservative forces.” He didn’t spare his own party from criticism. “Since the ’thirties the Republican Party has had no coherent or recognizable political faith,” he wrote. “When out of power it has occasionally brilliantly resisted the collectivist drive. But mostly it has collaborated with the Democrats in diminishing individual freedom, calling such action bi-partisan.”

Warren Buffett admired his father, but drifted apart from him ideologically as he came of age. “Perhaps to spare his father anguish,” Lowenstein noted, “Warren didn’t change parties or publicly acknowledge the switch until Howard’s death.”

otcbargains: Very nice!

Just some song lyrics.

otcbargains: I don't know what that means, but I enjoyed reading it!

We live inside society, our presence is unknown

We plot and we manipulate you to which way to go

Illumination comes across the world to bring an end

Intimidating silent force that puts us in command

Bobwins: Greece and Germany

I agree with you 100 percent. Germany will put up with the bailouts for so long and then say "so long"!

It would be nice to know which big European banks will be in trouble if (when?) Greece defaults. I think there are a couple of French banks that will be on the hook.

At the micro level, holding units of money markets worries me. I've encouraged my family to move their money market account money at banks into their checking account or to a savings account. That might be paranoid, but you never know.

At Fidelity I asked them to switch my IRA money market to FDIC insured banks accounts. Must to my dismay, I discovered the banks they are using are Wells Fargo and BOA, the two banks I already use!

bbotcs

not will but when and what will they call it.

German voters have had it. They don't want to support spoiled Greek public servants and citizens who don't pay taxes. Even if she wants to, I don't think Germany can come to the rescue too many more times. They are just trying to delay things until the world economy comes back but I think with all the money printing, that could take awhile. Took many years for the credit bubble to inflate and with all the government intervention, it will take years for it to deflate. In the meantime, there won't be any economic revolution to spike tax revs and get the Greeks back on solid footing. Their main revs come from tourism. Unless they convince the Chinese that they should come to Greece and visit the birthplace of Western democracies, they are not going to get more tourists in this economic climate.

I'm reactivating this board so to speak? Anyone interested in economic events? Will Greece default?

kozuh: MED is up over a dollar today. Good earnings report yesterday. http://finance.yahoo.com/news/Medifast-Inc-Earnings-Net-wscheats-1104274211.html?x=0&.v=1

otcbargains: Singing? Hmm. Forgot that. We'll Koz definitely cannot sing because he's a fat lady, ummm, I mean curvy lady.

Iron Maiden has three Lead guitar players. Value Maiden on tour again. World Slavery tour 2011.

Koz is beating the skins just like Nicko.

I'll play Adrians parts.

You can play Daves

and Rogue will play Janicks.

Who is singing?

I don't think Rogue can post here now that it is premium.

The band needs to get back together. otcbargains, roguedolphin and I will fight over who plays lead guitar. Koz definitely is on drums.

Thank you Rosterman. We'll check it out.

Trained Fish ... ???

koz: I give U two thumbs up for that one, Koz! Trouble in Bahrain today. Bought a little bit of HERO. Their stats look awful. The news is that they are buying the assets of another drilling that has gone bellyup.

bbotcs, I finally did it ... !!!!

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=59876276

koz: I love it! I wish U would post that over on Tornado Alley. It would get up the noses of those chuckleheads. If they don't like what U post, they ban U after about 2 or 3 days. It probably is KSuave's favorite sandbox.

Don't mess with Texas ... !!!!

The arraignment judge asked: "Why did you shoot the robber 6 times?"

The Texan replied under oath: "Because, when I pulled the trigger the

7th time, it only went ... click."

koz: Excellent one! Mr. Mubarak is in a state of de-nial.

koz: Excellent one! Mr. Mubarak is in a state of de-nial.

The Egyptians are angry with Mubarak ...

they think he is involved in some kind of ...

... PYRAMID SCHEME ... !!!!!!!!!!!

PS: I'm sorry; the Devil made me do it ... .

Value Microcaps Free-For-All...

...so much for "freedom"....

...SIGH.

koz: I think Florida has replaced California as the State with the most nuts!

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |