Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

…. Maybe clean this up a bit and sell as a shell?

…. Maybe clean this up a bit and sell as a shell?

Someone blew $30 today haha

Someone blew $30 today haha

Perhaps Trump can put in a good word for us with the new Mexican president lol

+ 90,000% whoop whoop … we’re going to the moon!!!

I put 2 million on at .0005 if anyone is interested!

Have not done anything in years. So I doubt it.

…. Any chance these guys file in Mexican court soon?

AlphaRidge tried and they fought it off

The short answer is a stockholder can file with the District court in the State where the company was incorporated.

Below is a good read.

The issue since the updated rule Rule 15c2-11 is to become compliant and file a Form 211 with FINRA. With clean shells available, it would not be worth the time, money and effort,

https://law.justia.com/codes/nevada/2010/title7/chapter78/nrs78-347.html

OTC on15c2-11

https://www.otcmarkets.com/learn/15c2-11-resource-center

How does a custodian come in here and take this?

Just saw some volume that’s all.

This is a dark, defunct, Expert Market shell that has not filed since 2012. They would need 12 years of filings. Not happening!

There is no proof of them filing with the Mexican courts either.

https://www.otcmarkets.com/stock/UNDR/disclosure

No idea but hopefully filings or news shows up

We go back many years!

NICE CHATTING WITH YOU

NICE CHATTING WITH YOU

The same to you!

HAPPY NEW YEAR & ALL 2024

WHAT A YR , SOME LIKE IT HOT

Still no proof of documents filed in the Mexican courts.

CEO does not get anything unless he gets the funds from the judgment and neither do we.

I believe Herbert is still actively working on it so definitely not counting on him winning, after all these years, but sure hope he pulls a rabbit out of the hat!!

ceo took us bad

Yep …. Old dependable mick!

Looks like they are trying to get all the records. Still waiting to see if they have the Mexican courts approval. Otherwise it is meaningless.

Exhibit A

DEFINITIONS

The following Definitions apply to each Request set forth herein and are deemed

incorporated in each Request.

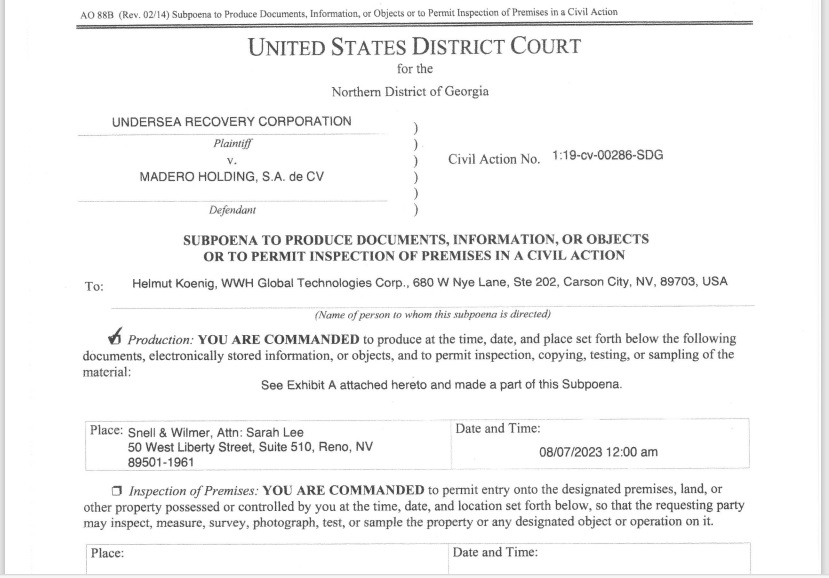

1. “Action” means UnderSea Recovery Corporation v. Madero Holding, S.A. de C.V.,

Civil Action No. 1:19-cv-00286-SDG, filed before the United States District Court for the

Northern District of Georgia Atlanta Division.

2. “Agreement” means any contract, arrangement, or understanding, formal or

informal, oral or written, between You and UnderSea or a Third Party.

3. “All Documents” means every Document, whether an original or copy, as defined

herein.

4. “AVIS” means AVIS Global Energy, AVIS Global Energy UK Group, AVIS

Global Green Energy Group, AVIS Global Energy Ltd, AVIS Energy Mexico SA, AVIS Tech

Mexico SA CV, AVIS Energy Venezuela SAS, AVIS Simmtronics Tech Corp., AVIS Vortex

PLC, AVIS Atom Threads PLC, AVIS Fintech PLC, AVIS Global Group PLC, and any

subsidiaries, affiliates, branches, divisions, controlling persons, officers, directors, employees,

representatives, agents, including any attorneys, accountants, investment advisors or bankers and

any other person acting or purporting to act on Avis’s behalf.

5. “Communicate” or “Communication” means every manner or means of

disclosure, transfer, or exchange of information whether oral, written, visual, face-to-face, by

telephone, telecopier, mail, personal delivery, electronically stored, including letters, memoranda,

electronic mail, invoices, interviews, discussions, text messages, messages secured via Internetconnected application, or otherwise.

Case 1:19-cv-00286-SDG Document 59 Filed 07/19/23 Page 1 of 13

2

6. “Company” means Madero Holding, S.A. de C.V. or Madero.

7. “Date” shall mean the exact day, month, and year. If the exact date is unknown,

“Date” shall mean the best available approximation.

8. “Describe” means to identify the date, sender or author of the requested

information, including the full name, present or last known address, and as applicable, the present

or last known name of employment, Person or Persons involved, a complete and detailed

description and explanation of the facts, circumstances, context, analysis and any other

information relating to the subject matter of the Request.

9. “Document” is used in the broadest possible sense permitted under the Federal

Rules of Civil Procedure and means, without limitation, any object (including but not limited to

any paper, film, videotape, computer storage media, computer file, or any other print, graphic or

data medium) in or on which any information or any representation of any information is

contained, stored, recorded or embodied. “Information” includes, but is not limited to text,

numbers and images. This definition includes copies or duplicates of documents

contemporaneously or subsequently created that have any non-conforming notes or other

markings. Without limiting the generality of the foregoing, the term “Document” includes, but

is not limited to, correspondence, memoranda, notes, emails, records, letters, envelopes,

telegrams, messages, studies, analyses, contracts, agreements, working papers, summaries,

statistical statements, financial statements, financial statements or work papers, accounts,

analytical records, reports and/or summaries of investigations, trade letters, press releases,

comparisons, books, calendars, diaries, articles, magazines, newspapers, booklets, brochures,

pamphlets, circulars, bulletins, notices, drawings, diagrams, instructions, notes or minutes of

meetings, or other communications of any type, including inter- and intra-office communications,

Case 1:19-cv-00286-SDG Document 59 Filed 07/19/23 Page 2 of 13

3

questionnaires, surveys, charts, graphs, phonograph recordings, films, tapes, disks, data cells,

drums, print-outs, all other data compilations from which information can be obtained (translated,

if necessary, into usable form), and any preliminary versions, drafts or revisions of any of the

foregoing.

10. “Identify” shall mean to state the Person or Persons’ (a) full name; (b) present or

last known address; and (c) telephone number. Where the Person is an individual, “Identify”

shall also include the individual’s (1) last known position or business affiliation; (2) job title; (3)

employment address and telephone number. Where the Person is an entity, “Identify” shall also

include (1) the legal form of such entity or organization and (2) the identity of the entity’s chief

executive officer and management team.

11. “Including” shall mean “including, without limitation” and “including but not

limited to.”

12. “Judgment” means the Final Order and Judgment executed on June 3, 2021 by

United States District Court Judge Steven D. Grimberg in favor of Plaintiff/Judgment Creditor

UnderSea Recovery Corporation against Defendant/Judgment Debtor Madero Holding, S.A. de

C.V., in the amount of $15,952,780.20.

13. “Madero” means Madero Holding, S.A. de C.V. and any of its subsidiaries,

affiliates, predecessors, branches, divisions, controlling persons, officers, directors, employees,

representatives, agents, including any attorneys, accountants, investment advisors or bankers and

any other person acting or purporting to act on Madero’s behalf.

14. “Memorandum of Agreement” means the contract dated February 8, 2013, and

entered into between Undersea and Madero under which Madero agreed to deliver to UnderSea

bonds issued by the Central Bank of Venezuela bearing the ISIN code USP97475AP55, in the

Case 1:19-cv-00286-SDG Document 59 Filed 07/19/23 Page 3 of 13

4

face amount of $10,000,000 in United States currency.

15. “Person” means both the singular and the plural, and means any individual,

partnership, joint venture, corporation, proprietorship, firm, association, group, or any other

organization or entity.

16. “Present” means the date on which this request was served.

17. “Ramon Madero” means Ramon Agustin Madero Davila.

18. “Relating to” means concerning, discussing, containing, constituting, showing or

relating or referring to in any way, directly or indirectly, and when used with reference to

documents is meant to include, among other documents, documents underlying, supporting, now

or previously attached or appended to, or used in the preparation of any document called for by

each document Request.

19. “Relevant Period” means January 1, 2012–Present.

20. “Third Party” means any Person except Plaintiff, Defendant, or any Person that

is a party to this Action.

21. “UnderSea” means UnderSea Recovery Corporation.

22. “Worldwide Holdings” means Worldwide Holdings Ltd., WWH Global

Technologies Corp., and any subsidiaries, affiliates, related holding companies, branches,

divisions, controlling persons, officers, directors, employees, representatives, agents, including

any attorneys, accountants, investment advisors or bankers and any other person acting or

purporting to act on Worldwide Holdings’ behalf.

23. “You” or “Your” means Helmut Koenig, and any employees, representatives,

agents, including any attorneys, accountants, investment advisors or bankers and any other person

acting or purporting to act on Your behalf.

Case 1:19-cv-00286-SDG Document 59 Filed 07/19/23 Page 4 of 13

5

24. The terms “and” and “or” as used herein mean “and,” “or,” and “and/or” in such

a way as to include any Documents that might otherwise not be responsive under an alternative

interpretation.

25. The singular includes the plural, and vice versa.

INSTRUCTIONS

The following Instructions apply to each Request set forth herein and are deemed

incorporated in each Request.

1. In answering these Requests, You must provide all information that is available

to You, that can be located through reasonable inquiry, is in Your access or control, including

in Your actual or constructive possession.

2. If You are unable to answer a Request in whole or in part, You should respond

to the extent possible and state the reason for which you are unable to respond to the full Request.

3. If You object to the Request or otherwise decline to respond to information

requested in any part of the Request, You must state the basis for Your objection and respond

to the parts of the Request to which You do not object.

4. Responsive Documents shall be produced in image format, with searchable text

load files that are compatible with Concordance and IPRO. The images shall be single-page,

300 DPI, Group IV .tiff images. For each individual document based on an electric file, the load

file shall, to the extent practicable, contain the corresponding text that was extracted from the

electronic file, not generated as an OCR file from the .tiff image(s). In the case of e-mail, the

load file shall also include, to the extent practicable, header information including: (1) the

individual to whom the communication was directed (“To”); (2) the author of the e-mail

communication (“From”); (3) who was copied (“cc”) and/or blind copied (“bcc”) on such eCase 1:19-cv-00286-SDG Document 59 Filed 07/19/23 Page 5 of 13

6

mail; (4) the subject line of the e-mail (“Re” or “Subject”); and (5) the date and time sent. For

each document, the load file shall also contain: (1) the beginning Bates number (referring to the

first page of the document); (2) the ending Bates number (referring to the last page of the

document); and in the case of e-mails with attachments; (3) the beginning attachment range

number(s); and (4) the ending attachment range number(s), where the “attachment range”

records the relationship of e-mails to their attachments. The attachment range should be

recorded from the first page of the first document in the attachment range to the last page of the

last document in the attachment range. In addition, all documents whose native format is that

of a Microsoft Excel file (or other electronic spreadsheet file) shall be produced with a singlepage placeholder (Group IV .tiff image) indicating that the file is a spreadsheet and shall be

produced in native format, including the logical formulae within the cells of the spreadsheets.

5. If You withhold response to Request on a claim of privilege, You must provide

the following information:

a. The basis for Your claim of privilege.

b. The name of any attorney involved.

c. The nature and subject matter of the information withheld.

d. The name and contact information of the Person having possession,

control, or knowledge of the information withheld.

e. The name of the Document and the subject matter of the Document.

6. Unless otherwise specified, these Requests refer to the Relevant Period.

7. These Requests are continuing and all Documents or information coming into

Your possession, custody, or control which would have been produced had they been available

earlier shall be produced forthwith.

Case 1:19-cv-00286-SDG Document 59 Filed 07/19/23 Page 6 of 13

7

REQUESTS

Request for Production No. 1

All Documents and Communications relating to Your role at Avis.

Request for Production No. 2

All Documents and Communications relating to Your role at Worldwide Holdings.

Request for Production No. 3

All Documents and Communications relating to the relationship between Avis and

Worldwide Holdings.

Request for Production No. 4

All Documents and Communications relating to the relationship between Avis and the

Company.

Request for Production No. 5

All Documents and Communications relating to the relationship between Worldwide

Holdings and the Company.

Request for Production No. 6

All Documents and Communications relating to this Action.

Request for Production No. 7

All Documents and Communications relating to the Judgment.

Request for Production No. 8

All Documents and Communications relating to Your relationship with the Company.

Request for Production No. 9

All Documents and Communications relating to Your relationship with Ramon Madero.

Case 1:19-cv-00286-SDG Document 59 Filed 07/19/23 Page 7 of 13

8

Request for Production No. 10

All Documents and Communications between You and the Company about the Action and

the Judgment.

Request for Production No. 11

All Documents and Communications between You and Ramon Madero about the Action

and the Judgment.

Request for Production No. 12

All Documents and Communications relating to the September 25, 2015 letter between

You and Ramon Madero regarding transfer of $500 million in BCV notes to Avis Global Energy

Fund.

Request for Production No. 13

All Documents and Communications relating to compensation paid to Avis directors,

officers, and shareholders, including one-time payments, dividends, lump sum payments, or

performance-based or incentive payments, including payments You received, during the Relevant

Period, and continuing until satisfaction of the Judgment.

Request for Production No. 14

All Documents and Communications relating to Avis’ formation and operating documents,

including without limitation, articles of incorporation or organization, shareholders and Board of

Directors meeting minutes, votes, bylaws, issuance of stock certificates, and maintaining proper

accounting and shareholder records.

Request for Production No. 15

All Documents and Communications relating to any bank account, investment account,

checking account, savings account, money market account, and/or brokerage account in which

Case 1:19-cv-00286-SDG Document 59 Filed 07/19/23 Page 8 of 13

9

Avis has any financial or ownership interest.

Request for Production No. 16

All Documents and Communications relating to each of Avis’ monthly or other periodic

financial statements during the Relevant Period, and continuing until satisfaction of the Judgment.

Request for Production No. 17

All Documents and Communications relating to Avis’ accounts receivable during the

Relevant Period, and continuing until satisfaction of the Judgment.

Request for Production No. 18

All Documents and Communications relating to Avis’ payments, repayments, loans, other

debts, or transfers made to officers, directors, shareholders, parents, subsidiary corporations, or

other entities during the Relevant Period, and continuing until satisfaction of the Judgment.

Request for Production No. 19

All Documents and Communications relating to Avis’ assets, including assets held

domestically and abroad. For each asset held, produce All Documents and Communications

relating to the (a) name of the asset; (b) type of asset; (c) value of the asset; and (d) location of the

asset.

Request for Production No. 20

All Documents and Communications relating to Avis’ transfer of assets to the Company or

to Ramon Madero during the Relevant Period, and continuing until satisfaction of the Judgment.

Request for Production No. 21

All Documents and Communications relating to the Company’s or Ramon Madero’s

transfer of assets to Avis during the Relevant Period, and continuing until satisfaction of the

Judgment.

Case 1:19-cv-00286-SDG Document 59 Filed 07/19/23 Page 9 of 13

10

Request for Production No. 22

All Documents and Communications relating to Avis’ creditors, including but not limited

to, the following: (a) the name of each creditor; (b) the name of the parties to each loan agreement,

credit agreement, or any other agreement under which the creditor provided resources to You or

to Avis; (c) the amount loaned; (d) the present value of the loan; (e) the terms of each loan

agreement, including all exhibits relating to the agreement; (f) negotiations relating to each

agreement; (g) delayed or missed payments; (h) default on any agreement; (i) claims, threatened

claims, or complaints made by Avis’ creditors.

Request for Production No. 23

All Documents and Communications relating to Avis’ audit reports.

Request for Production No. 24

All Documents and Communications relating to Avis’ financial forecasts, including but

not limited to, growth assessments and short and long-term financial performance that were

prepared during the Relevant Period, and continuing until satisfaction of the Judgment.

Request for Production No. 25

All Documents and Communications between You and Third Parties regarding any bonds

or other assets owned by Avis, the Company, Worldwide Holdings, or any Third Parties or any

bonds or assets held by Avis, the Company, Worldwide Holdings, or any Third Parties for the

benefit of Madero.

Request for Production No. 26

All Documents and Communications relating to Agreements between You and Third

Parties relating to the Action, that were in effect during the Relevant Period, and continuing until

satisfaction of the Judgment.

Case 1:19-cv-00286-SDG Document 59 Filed 07/19/23 Page 10 of 13

11

Request for Production No. 27

All Documents and Communications between You and the Company or Ramon Madero

for any bonds or other assets owned by You, the Company, Ramon Madero, or any Third Parties,

or any bonds or assets held by You, the Company, Ramon Madero, or any Third Parties for the

benefit of the Company or Ramon Madero.

Request for Production No. 28

All Documents and Communications relating to consideration the Company gave

UnderSea in exchange for an interest in Pedro Bank Shipwreck Exploration and Excavation LLC

(“Pedro”) and a warrant for 17% of UnderSea’s common stock, as stated in the Memorandum of

Agreement.

Request for Production No. 29

All Documents and Communications relating to the Memorandum of Agreement.

Request For Production No. 30

All Documents and Communications relating to any Agreements between You and

UnderSea entered into or effective during the Relevant Period, and continuing until satisfaction

of the Judgment.

Request for Production No. 31

All Documents and Communications sufficient to show any tax returns filed by Avis

during the Relevant Period, and continuing until satisfaction of the Judgment.

Request for Production No. 32

All Documents and Communications sufficient to show any tax returns filed by

Worldwide Holdings during the Relevant Period, and continuing until satisfaction of the

judgment.

Case 1:19-cv-00286-SDG Document 59 Filed 07/19/23 Page 11 of 13

12

Request for Production No. 33

All Documents and Communications relating to Third Party complaints, claims,

threatened or pending lawsuits, prior lawsuits, and judgments against You, Avis, or Worldwide

Holdings during the Relevant Period, and continuing until satisfaction of the Judgment.

Request for Production No. 34

All Documents and Communications sufficient to show the transfer of bonds or other

assets by the Company to Avis, including Documents and Communications showing justification

for the transfer.

Request for Production No. 35

All Documents and Communications relating to the $2.3 billion deposit of capital reserves

into the “BCV Portfolio Account” as detailed in Avis’ 2017 audited financial statements.

Request for Production No. 36

All Documents and Communications relating to the following bonds: ISIN

USP97475AP55 CUSIP P97475AP5; ISIN USP97475AN08 CUSIP P97475AN0; ISIN

US922646AS37 CUSIP 922646AS3; and ISIN USP17625AE71 CUSIP P17625AE7.

Request for Production No. 37

All Documents and Communications relating to current and past business relationships,

including any joint ventures, between Worldwide Holdings and Avis, including but not limited

to, any shared operational components of Worldwide Holdings’ and Avis’ operations such as the

leadership, contracted services, legal, finance, human resources, or any other operational

component.

Case 1:19-cv-00286-SDG Document 59 Filed 07/19/23 Page 12 of 13

13

Request for Production No. 38

All Documents and Communications relating to the current business location(s) and

operational status of Simmtronics Technology USA.

Request for Production No. 39

All Documents and Communications relating to the current business location(s) and

operational status of WWH Global Technologies Corp.

Request for Production No. 40

All Documents and Communications relating to Worldwide Holdings’ board of directors

and the team members identified on Worldwide Holdings’ website, including but not limited to,

whether members of the board of directors or team members have a business relationship with

Avis.

Request for Production No. 41

All Documents and Communications relating to the business relationship between Limex

Finance and Investments, LLC and Avis.

Request for Production No. 42

All Documents and Communications sufficient to show the change in name, entity type,

or any other organizational change relating to the change from Avis Simmtronics Tech

Corporation to WWH Global Technologies Corporation.

I saw that the pacer was updated a couple months ago stating: "NOTICE Of Filing Exhibit to Subpoena by UnderSea Recovery Corporation" on July19. Looks like they are still fighting to get their money! Does anyone have an account so we can read the PDF and find out what the filing says?

it had lot of potential

WE NEED SOME HELP $undr

WE NEED SOME HELP $undr

UNDR

UnderSea Recovery Corporation (CE)

0.0003

0.00 (0.00%)

Volume: -

Ok then! I have put 5 milly on the ask at .001 if you really want to back that up!!

Not soon enough. Website is now owned by a Chinese company.

Raw Whois Data

Domain Name: UNDERSEARECOVERY.COM

Registry Domain ID: 2769699558_DOMAIN_COM-VRSN

Registrar WHOIS Server: whois.gname.com

Registrar URL: www.gname.com

Updated Date: 2023-04-04T16:34:08Z

Creation Date: 2023-04-01T18:04:38Z

Registrar Registration Expiration Date: 2024-04-01T18:04:38Z

Registrar: Gname 025 inc

Registrar IANA ID: 3994

Reseller:

Registrar Abuse Contact Email: email@gname.com

Registrar Abuse Contact Phone: +65.31581931

Domain Status: clientTransferProhibited https://icann.org/epp#clientTransferProhibited

Registry Registrant ID: Redacted for privacy

Registrant Name: Redacted for privacy

Registrant Organization: Redacted for privacy

Registrant Street: Redacted for privacy

Registrant City: Redacted for privacy

Registrant State/Province: HUNAN

Registrant Postal Code: Redacted for privacy

Registrant Country: CN

Registrant Phone: Redacted for privacy

Registrant Fax: Redacted for privacy

Registrant Email: https://rdap.gname.com/extra/contact?type=registrant&domain=UNDERSEARECOVERY.COM

Admin Name: Redacted for privacy

Admin Organization: Redacted for privacy

Admin Street: Redacted for privacy

Admin City: Redacted for privacy

Admin State/Province: Redacted for privacy

Admin Postal Code: Redacted for privacy

Admin Country: Redacted for privacy

Admin Phone: Redacted for privacy

Admin Fax: Redacted for privacy

Admin Email: https://rdap.gname.com/extra/contact?type=admin&domain=UNDERSEARECOVERY.COM

Tech Name: Redacted for privacy

Tech Organization: Redacted for privacy

Tech Street: Redacted for privacy

Tech City: Redacted for privacy

Tech State/Province: Redacted for privacy

Tech Postal Code: Redacted for privacy

Tech Country: Redacted for privacy

Tech Phone: Redacted for privacy

Tech Fax: Redacted for privacy

Tech Email: https://rdap.gname.com/extra/contact?type=technical&domain=UNDERSEARECOVERY.COM

Name Server: A.SHARE-DNS.COM

Name Server: B.SHARE-DNS.NET

DNSSEC: unsigned

URL of the ICANN Whois Inaccuracy Complaint Form: https://www.icann.org/wicf/

>>> Last update of whois database: 2023-04-04T16:34:08Z <<<

For more information on Whois status codes, please visit https://icann.org/epp

Hey Emily...and finding's?

When will deletion come? Website broken?

https://www.otcmarkets.com/stock/UNDR/quote

http://www.undersearecovery.com/

OH YES MY FRIEND

UNDR

UnderSea Recovery Corporation (CE)

0.0003

0.00 (0.00%)

Volume:

No more playing Mick?

I will help if you promise to help me bury this thing!

|

Followers

|

190

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

23461

|

|

Created

|

12/28/04

|

Type

|

Free

|

| Moderators | |||

| Emily1212 post# 21052 courtesy of Emily |  0.000 0.000 | |

| Post # of 21063 | | |

2409 Chastain Dr.

Atlanta, GA 30342

| PER IHUB MGMT |

02-07-2021

DISCLAIMER: ONLY FOR MICK

https://investorshub.advfn.com/boards/profilea.aspx?user=1012

*The Board Monitor and herewithin , are not licensed brokers and assume NO responsibility for actions,

investments,decisions, or messages posted on this forum.

CONTENT ON THIS FORUM SHOULD NOT BE CONSIDERED ADVISORY NOR SOLICITATION

AUTHORS MAY HAVE BUYS OR SELLS WITH THE COMPANIES MENTIONED IN TRADING POSTERS SHOULD DUE DILIGENT BUYING OR SELLING.

ALL POSTING SHOULD BE CONSIDERED FOR INFORMATION ONLY. WE DO NOT RECOMMEND ANYONE BUY OR SELL ANY SECURITIES POSTED HEREWITHIN.

ANY trade entered into risks the possibility of losing the funds invested.

• There are no guarantees when buying or selling any security.Any

SURFKAST'S REMINDER

Warning! This security is eligible for Unsolicited Quotes Only

This stock is not eligible for proprietary broker-dealer quotations. All quotes in this stock reflect unsolicited customer orders. Unsolicited-Only stocks have a higher risk of wider spreads, increased volatility, and price dislocations. Investors may have difficulty selling this stock. An initial review by a broker-dealer under SEC Rule15c2-11 is required for brokers to publish competing quotes and provide continuous market making.Warning! This security is traded on the Expert Market

The Expert MarketSM serves broker-dealer pricing and investor best execution needs. Quotations in Expert Market securities are restricted from public viewing. OTC Markets Group may designate securities for quoting on the Expert Market when it is not able to confirm that the company is making current information publicly available under SEC Rule 15c2-11, or when the security is otherwise restricted from public quoting. See additional information about the Expert Market here.

| Volume: | - |

| Day Range: | |

| Last Trade Time: |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |