Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Hope you got some 0.02s in PSPW. Their subsidiary signed a 1.4 billion dollar deal in March 2017. Just waiting for the official announcement.

RECENT SIGNING (AS OF 3/9/2017) CEREMONY BETWEEN SEVERAL HUGE CHINESE GLOBAL INVESTMENT HOLDING COMPANIES AND SHALA ENERGY PLC (PSPWs WHOLLY OWNED 2nd TIER SUBDISUARY) FOR A 1.27 BILLION EURO HYDRO DAM RENEWABLE ENERGY PROJECT IN ALBANIA

Link to the Signing Ceremony on 3/9/2017

Wolfgang Heinl (BOD Technical Adviser For PSPW and General Manager of each PLC)

Juljana Sokoli (Shala Energy PLC Office Manager her name was misspelled in the 3/9/2017 article)

http://www.hndongdian.com/m/show.asp?showid=43 (They Sign Multi-Billion Deals all the time)

ENGLISH TRANSLATION USING GOOGLE TEXT TRANSLATOR

My company and Albania Shala Energy PLC signed the "Albanian water power plant project agreement"

Source: Published: 2017-3-14 Views: 578 times

0003.jpg

March 9, 2017, the United States Eastern Point Global Holdings Group Greater China CEO, Hong Kong East Point Group Co., Ltd. Executive Director, Hunan East Point Global Investment Holdings Development Co., Ltd. Mr. Tang Zhaoyi in the Economic Commission and Albania Shala Energy PLC Successfully signed the "Albanian Hydroelectric Power Station Project Agreement".

Strait cross-strait industrial economic cooperation committee Wang Xinya director, Zhao Qiaoling deputy director, deputy director of Zhibi on behalf of the Chinese witnessed the signing ceremony.

Albanian Water Conservancy Power Station Project Representative: President and CEO of An Lihua Shahe Energy Partners - Jon, Associate General Manager of Ariel Shahe Energy - Yanling, An Lihua Shahe Energy Partner - Norman Gross, Man - Greg, Albanian Hydro Power Station Project Owner, Albanian Shahe Energy General Manager and Shahe Irish Legal Person - Wolfgang Heinl, Albanian Shahe Energy Member - Juliana Sokoli, Berbatie Group Chief Financial Officer - Eric attended the signing ceremony. Mr. Tang Zhaoyi, Chairman of the Board, and Wolfgang Heinl, President of Shala Energy PLC of Albania, have conducted various evaluations of the Albanian hydroelectric power station project to learn more about the development of the Albanian hydropower project. The construction potential of the Albanian hydropower project is significant Agree with.

05.jpg

Hunan East Point Global Investment Development Co., Ltd. for the People's Republic of China outside the project to accelerate the expansion of investment, the implementation of international priority strategy. Investment orders grew steadily, the Albanian hydroelectric power station project is the East Point Global Holdings Group in Albania's first signing of the project, to further develop the China-Africa market has laid a good foundation.

547799414724323211_ copy .jpg

Wolfgang Heinl said that the Albanian hydroelectric power station project will play a significant role in the development of Albania's electricity and hope that the Albanian hydroelectric power station project will start on schedule and complete the construction task as soon as possible.

The total investment in the Albanian hydroelectric power station project is about 1.27 billion euros. The project will work with China Water Resources and Hydropower Engineering Bureau Co., Ltd. to ensure the smooth completion of construction tasks.

Wolfgang Heinl expressed his appreciation for the good momentum of the construction of the Albanian water conservancy project and shared the views and feelings of visiting China.

125938233082558137_ copy .jpg

Wolfgang Heinl expressed his appreciation for the good momentum of the construction of the Albanian water conservancy project and shared the views and feelings of visiting China.

02.jpg

Greg said that Albania is an important part of the "all the way along the way," the construction of Albania hydropower station project potential, can increase the Albanian hydropower 20%, will produce many jobs to promote regional economic development.

Albania is one of the most abundant hydropower resources in Europe. Power generation is mainly dependent on water resources, but only one third of the current water resources are being used and are affected by climate.

Albania power plant total installed capacity of 1628 megawatts, the annual power generation of about 50 billion degrees. The main power station is Feierze hydropower station, Keman hydropower station, cutting Udayi hydropower station, Wuerze hydropower station, Skopu hydropower station.

In 2013, Albania's domestic electricity generation increased significantly, the import electricity and thus declined, the grid loss rate declined, but the loss increased slightly.

This company is dead in the water!!! Good thing they did not build the projects or they would have lost 500 million instead of the bankruptcy! Ohh well! GLTA who lost money here.

You tell them you want to write it off as a loss and they will take it off your hands. I had some old stocks that were de-listed for years and you had to call up and give the shares to the broker for the write off. You can also write it off as worthless too.

I feel pretty good for 2016. That hedge bet PSPW paid off and I have made my money back that I lost here but it lacks volume significant volume to sell. Hoping this time the Falak Holding Group billionaires backing this company fund the hydro dam projects for $250 million for a 127 MW project. They raised $3 billion in credit in 2013 but the electrical transmission lines were not ready and they let the money expire. If they secure that again and give it to PSPW look out. They own almost majority in PSPW. So if they construct the Shala Energy hydro dam project this will be a $4-5 stock overnight. Managements goal has always been to up list to the NASDAQ. Voluntary reporting pink sheet that can uplist when its ready. Watch it for the day it happens and buy then and make 4-6 times your money. Bet like $30k and pull out your $120k and be even on the day that it hits. Might gap up to 50 cents. It finally started an uptrend and went up to 13 to 20 cents from the 1s and 2s when i recommended it. It breaks 21 cents its going to 35 cents.

The delay with that was two fold. Albania took 2 extra years to construct the electrical transmission lines that were needed before the projects in the area could start. So all of the projects took an extra 2-3 years. This year its going to forward now that the lines are finished and will be energized in June 2016. There was free loafers stealing the electricty (general public) and KESH that is the governmental authority went bankrupt because of the electricity loss and over payments to companies generating electricity.

you need to write them a letter and they should do it

well phantom I had my brokerage wipe them off paid minimum charge for couple 100thou shares. Taking loss this year. Your brokerage should be able to do this for you. and of course everyone one including every ceo of this comp was fooled. by who you say ??

I owned over 2 million shares of the stock and it still comes up on my statement. I called the brokerage firm and they said, quite simply you cannot declare a loss on this security until the bankruptcy procedure is over. That could take up to 10 years before a company is officially bankrupt, some people i know were able to take the loss, it all depends who your brokerage company is. I thought i would be a millionaire off this stock and i dragged some close friends into it also, feel like such an idiot

i think the best was when "someone "??? posted as a lawyer from jersey and was going to sue all the bashers, claiming it was them who were destroying the company. that was a good one

This was never a hold forever POS. But there were profits to be made along the way. I just watch this board for old times sake. I enjoy keeping up with the banter. There used to be a lot of entertainment on this board.As I'm sure you remember cytrxman.

thios stock is never coming back I certainly dont want to be reminded of the spanking that took place. Learned one lesson, never invest in comp when you hear 6-8 months stock is going to go ballistic.

Rat just call your broker and have them take them out. shouldnt charge you anything, shares are worthless and you will get the tax writeoff

Thank you for your straightforward and simple advice. I appreciate it!

http://www.fool.com/taxes/2000/taxes000630.htm

Consider selling the junk for pennies to a friend or distant relative. (In-laws qualify, as does anyone other than your spouse, siblings [either whole or half-blood], ancestors, or lineal descendants.)

You then have a closed transaction, and the loss is certain and deductible in the year of sale. If the stock ever comes back and is worth something, at least the money stays with friends or family. Here's how you might do it:

Get the actual stock certificates from your broker.

Formally sell the shares to the purchaser, with a check for payment and a bill of sale.

Sign over the stock certificate (on its back) to the purchaser. Have the signatures verified by your banker and/or a local stockbroker.

Send the certificate to the stock transfer agent. Explain that the shares have been sold, and ask them to cancel the old shares and issue a new certificate to the new owner.

Bingo! For a pittance, your friend or relative has just bought a placemat or birdcage liner... but you have a capital loss. You have a stock sale, a closed transaction, and an indisputable loss. No financial statement review and analysis. No subjective decisions regarding any potential future turnaround by the company. No second-guessing from the IRS. Sweet.

For more information on worthless securities, check out IRS Publication 550. But remember that even Publication 550 doesn't address the complex issue of exactly when a stock becomes worthless in the eyes of the IRS. So, if you are holding some questionable stock, consider selling the junk and being done with it.

How can I determine when my 46,500 shares of NSOL/USFF are deemed zero value in order to claim the loss on my taxes? I have researched several boards and it appears the last posted value was Feb 5, 2014. And their bankruptcy was reported this past fall. Any suggestions? Thanx!

RS & Shkreli stories have erie similarities

Seems Drinkwater and Co should be looking over their shoulders

Appears agents are digging into lawyer buffeted schemes.

phantom of course he is to blame. no one else

Was USFF a Scam lead by Rob Schwartz

Phantom X raised the question of whether USFF was a scam and whether shareholders should pursue some form of legal action. Rather than state an opinion or provide a recommendation, I thought I would respond by providing some informational ‘dots’ which shareholders can connect as you see fit and raise some questions to which shareholders may want answers. This post is not intended to be an all inclusive list of informational dots or questions; this is just some of the information available from public sources.

If, after reviewing this post, there are shareholders who are interested in more information regarding USFF, including non-public information, retain an attorney and have that attorney contact me.

Consider the USFF SEC filing, made on August 21, 2012, regarding a Stock Purchase Agreement (SPA) with G & A Capital and available online at [url]www.sec.gov/Archives/edgar/data/1116112/000139834412002707/fp0005402_8k.htm:

***

Item 1.01 Entry into a Material Definitive Agreement

On 10 June 2011, the board of directors ratified a Stock Purchase Agreement entered into between G&A Capital Development, LLC and Nuclear Solutions, Inc. on 12 May 2011. Under the terms of the Stock Purchase Agreement, G&A Capital paid Six Hundred Sixty-Two Thousand Five Hundred Forty Dollars And Thirty Seven Cents (US $662,540.37) for One Hundred Sixty-Four Million Four Hundred Two Thousand Seventy-Six (164,402,076) common shares.

To facilitate the transaction contemplated by the Stock Purchase Agreement, the board modified the corporate Articles of Incorporation and Bylaws, including the following resolution:

RESOLVED, that the corporation will have authority to issue Eight Hundred Fifty Million (850,000,000) shares of stock in the aggregate. These shares will be divided into two classes. The number of authorized common shares in the Articles of Incorporation is changed to 800,000,000 (Eight Hundred Million) shares authorized with a par value of $.0001, and the number of preferred shares is changed to 50,000,000 (Fifty Million) shares authorized with a par value of $.001

Under the terms of the Stock Purchase Agreement, the $662,540.37 was placed in escrow and used to retire in excess of 75% of the outstanding corporate debt.

***

The ‘facts’ in the last sentence of this filing are inconsistent with ‘facts’ in other USFF SEC filings and other public information: there never was a lump sum of $662,540.37, there never was an escrow and 75% of the USFF corporate debt was NOT retired.

The assertion that USFF conducted a transaction with G & A Capital Development contradicts the records of the NJ Secretary of State; there is no evidence that G&A Capital Development ever existed as a NJ limited liability company. Visit https://www.njportal.com/DOR/businessrecords/EntityDocs/BusinessStatCopies.aspx and conduct a business name search for a New Jersey LLC named “G & A Capital Development”; the search will return no records.

An edited version of the G & A Stock Purchase Agreement (SPA) was filed with the SEC in 2013 and is available online at http://www.sec.gov/Archives/edgar/data/1116112/000114420413042758/v351020_ex10-1.htm.

Examine the language in paragraph 1 and the dates of the ‘investments’ listed in attachment 1 to the SPA. If Attachment 1 is accurate, there could never have been a lump sum of $662,540.37 to put into escrow in May 2011 when the SPA was executed unless the $90,000 from March 10, 2010 and the $155,000 from April 13, 2010 was held, unused for over a year until the SPA was signed in May 2011.

Note that paragraph 1 of the SPA identifies an ‘Escrow Agreement’ which is purportedly attached to the SPA as Attachment 2. There is no Attachment 2 to the copy of the SPA USFF filed with the SEC, perhaps because, like G & A Capital itself, Attachment 2 never existed and there never was an escrow of any funds.

Note that paragraph 2(f) of the SPA calls for issuance of a warrant to purchase additional shares for an aggregate price of $2,000,000. While paragraph 2(f) recites that a form of warrant was included as Attachment 3 to the SPA, the copy of the SPA USFF filed with the SEC does not include an Attachment 3, perhaps because, like G & A Capital itself and Attachment 2 (the Escrow Agreement), Attachment 3 never existed.

This raises at least three questions:

1. What due diligence did USFF officers and directors conduct regarding G & A Capital Development?

2. Did Bagot sign and implement an incomplete agreement in May 2011?

3. Did Drinkwater, Bagot and Chady approve an incomplete agreement in June 2011?

Applying simple math to the provisions of paragraph 2(f) of the SPA establishes a share price of $0.004 per share ($2,000,000 to purchase 496,277,915 shares of stock). Using this valuation, 300,851,000 shares should cost $1,212,429, yet in multiple SEC filings, USFF asserts that G & A Capital obtained 300,851,000 shares by exercising a ‘cashless warrant’.

Note that paragraph 4.4 of the SPA omits the address for notices to G & A Capital Development, LLC. The address included in the actual SPA but intentionally deleted from the copy of the SPA filed with the SEC, was:

G & A Capital

One Miss America Way

Atlantic City, NJ 08401

That address is the address of the Atlantic City Convention Center and a phone call to the convention center will reveal that G & A never had an office there. Perhaps the address was intentionally omitted to avoid revealing a material fact that might raise questions about the existence of G & A Capital and the validity of the SPA.

Enquiring minds may want to look at corporate governance, specifically how the board that approved the G & A Capital SPA was ‘elected’ and maintained in power, supposedly acting as fiduciaries for you as a shareholder. Before you review the following, ask yourself:

• Do you recall ever receiving a notice of a USFF annual meeting?

• Did you ever attend a USFF annual meeting?

• Do you recall ever being asked to send, or actually sending, your proxy to vote in the board elections conducted at a USFF annual meeting?

Now consider one sentence regarding annual meetings and board elections that is repeated verbatim in multiple USFF SEC filings: “Each director is elected at our annual meeting of shareholders and holds office until the next annual meeting of shareholders, or until his successor is elected and qualified.”

(http://www.sec.gov/Archives/edgar/data/1116112/000114420413042758/v351020_10k.htm), at page F-20 of the 2010 10K;

(http://www.sec.gov/Archives/edgar/data/1116112/000114420413047620/v353019_10k.htm, at page 20 of the 2011 10K ;

(http://www.sec.gov/Archives/edgar/data/1116112/000114420413067721/v362810_10k.htm) at page 35 of the 2012 10K;

(http://www.sec.gov/Archives/edgar/data/1116112/000114420414009810/v368506_10-12g.htm) at page 10 of the Form 10 filed in 2014.

This statement regarding annual meetings and board elections was certified by Bagot in all of the 10Ks and Form 10s; Chady certified the statement in the 2010, 2011 and 2012 10Ks. One of the 10K certifications can be seen for Bagot at http://www.sec.gov/Archives/edgar/data/1116112/000114420413042758/v351020_ex31-1.htm and for Chady at http://www.sec.gov/Archives/edgar/data/1116112/000114420413042758/v351020_ex31-2.htm.

As you will see, the certification language includes, in part, that:

“(2) Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this annual report;”

This raises at least two questions:

1. If there was no annual meeting and no board election in 2010, 2011, 2012, 2013 and 2013, is certifying that an election was conducted at an annual meeting in each of those years an untrue statement of a material fact?

2. Is it possible that the CEO (Bagot) and the CFO (Chady) did not know that there was no annual meeting and no board election in 2010, 2011, 2012, 2013 or 2014?

Review the articles of incorporation and bylaws USFF filed with the SEC at http://www.sec.gov/Archives/edgar/data/1116112/000114420413042758/v351020_ex3-1.htm and http://www.sec.gov/Archives/edgar/data/1116112/000114420413042758/v351020_ex3-2.htm, respectively and then ask yourself at least two questions:

1. Is there any provision in the articles of incorporation or bylaws that provides an exemption from the requirement for an annual meeting and an election of directors?

2. If the board had a secret agreement to forego annual meetings and board elections, would failure to inform shareholders of that fact in SEC filings be an omission of a material fact that should have been disclosed in order to ensure that a filing was not misleading?

Look again at the G & A SPA; that transaction was proposed by Schwartz and approved by Drinkwater, Bagot and Chady. G & A obtained a total of 465,253,076 shares of USFF stock, 164,402,076 shares of stock from the SPA itself and another 300,851,000 shares from the ‘cashless warrant’.

If your brain did not explode the first time you tried, pause here and take another shot at reconciling a cashless warrant for 300,851,000 shares with paragraph 2(f) of the SPA setting a share price of $0.004 ($2,000,000 for 496,277,915 shares).

Tracing the stock is important, for now just consider what the SEC filings show: 190,432,576 shares – over 40% - of the G & A shares went to parties involved in proposing and approving the transaction. After the G & A SPA was approved by Drinkwater, Bagot and Chady, Drinkwater received 76,050,000 shares, Bagot received 33,000,000 shares, Chady received 10,000,000 shares and Reyna & Associates, a company controlled by Rob Schwartz, received 71,382,576 shares. See, for example, pages 5, 39 and 40 of the USFF 2012 10K at http://www.sec.gov/Archives/edgar/data/1116112/000114420413067721/v362810_10k.htm.

Enquiring minds may want to identify the source of the funds described in Attachment 1 of the SPA and ask at least three questions –

1. What was the source of the $662,540.37 referenced in the SPA?

2. How much of the alleged $662,540.37 from the SPA was provided by Schwartz, Drinkwater, Bagot or Chady?

3. How often does an investor put money into a company so that stock can be issued to a third party?

Enquiring minds may also want to dig a little deeper to examine shareholder lists and track stock holdings and transfers, with a special focus on shareholder last names and family affiliations.

Phantom X said “I think we were all scammed” and that Rob Schwartz was the ringleader. If by “scammed” Phantom X meant being victimized by a scheme to make money by dishonest means, perhaps shareholders should consider conducting some basic background checking. This could include

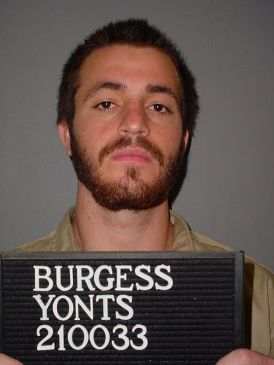

1. Reviewing a February 21, 2014 article on Rob Schwartz available at http://www.nj.com/gloucester-county/index.ssf/2014/02/washington_township_man_gets_5_years_probation_for_stealing_in-laws_mortgage_money.html . Here is a portion of that article:

Schwartz — an entrepreneur who studied financial management at Drexel University — pleaded guilty in October [2013] to theft by deception. He admitted to stealing funds meant to pay the mortgage on the Gloucester Township home his sister-in-law, Karen Giosa, shares with her husband, Frank Giosa and their two children.

Frank Giosa said Schwartz took $175,000 from him and his wife in 2007, having agreed to use it to pay the mortgage. After some time, he stopped making the payments. But he didn’t tell the Giosas, Frank said.

“We didn’t know what was going on until we got a foreclosure notice,” he explained after Friday’s sentencing. That foreclosure notice came in 2009.

2. Scrutinizing the timing of Rob Schwartz’ ‘resignation’ from the USFF executive committee in August 2012 (http://www.sec.gov/Archives/edgar/data/1116112/000139834412002954/fp0005501_8k.htm) and his indictment for theft by deception in October 2012 (http://www.nj.com/gloucester-county/index.ssf/2012/10/gloucester_county_indicts_30_s.html).

3. Reviewing Civil Action No. 09-CI-00931, Franklin Circuit Court, Commonwealth of Kentucky; the end result is that a USFF investor obtained a $728,677.60 judgment against Schwartz for breach of contract relating to a USFF investment.

4. Investigating the facts behind the ‘settlement’ with Larry Harris referenced in SEC filings.

5. Examining the filings made in the USFF Chapter 7 bankruptcy, pending in the US Bankruptcy Court in the Eastern District of New Jersey, Case Number 14-35701-GMB – US.

So there is no misunderstanding, I have no intention of engaging in an endless debate on this forum regarding anything and will not communicate with people who keep their identity hidden behind a forum pseudonym.

On the other hand, if a shareholder or a group of shareholders decide to investigate USFF, retain an attorney and have that attorney contact me; I am prepared to share what I have with your attorney.

Thanks brother, I appreciate the tip and will keep an eye on it. Good luck to you also

It sucks for everybody shareholders and management. Harry blew his own money and time as well. Everyone did. It was my biggest lost and just bad timing for oil and gas plays. I did bet heavy on a hedge in case Oil and Gas did fail and I still have once chance for a heavy hit on a hydro dam project in Albania.

Check it out as I have done extensive DD on this one. 3Power Energy (PSPW) which is currently dormant but they did commence operations of a subsiduary which commenced operations after 3 years of silence. These guys are the same guys who own the Dubai Sports Center, the Falak Holding Group, multi billionaires.

Bet $3k-$10k and sit on it. If they construct the dams the stock price will be an instant $4-$8 a share and make a a couple hundred multibagger. Good luck PhantomX!

It just sucks dude, I thought Robert was a friend and I feel like I was betrayed. Promises were made that were never fulfilled and the frustration just spilled over to an argument that I know I will probably regret. I had close friends of mine who also bought the stock and lots of it and I feel as though I let them down. May be he is not to blame, I dont know but someone should have to take responsibility

Forget this man its dead. Waste of time and its still in bankruptcy!!!! Everybody lost money because of oil and gas investments in general were hyped by Wall street and the news media due to $100/barrel oil. We will never see that again for 10 to 20 years. Market condition do not support these projects currently and with Iran oil coming on line its even going lower as the economic battle between Saudi and Iran takes place. Oil goes up and bust all the time, 1980s, 1990s, 2010s, and yes probably 2020s. The world is awash of oil. All oil and gas projects failed in the last 3 years look at the price of oil. This project would have failed too even if they got the financing it probably would have been foreclosed on too. Projections were something like $55 a barrel. We are not there now.

If you want a stock to potentially make your money back I found one in Dubai a Holding Company of IPOs that is at 3.6 cents. GEQU check it out if you have time. I speculate that it will be 25 to 35 cents by the end of this year. Institutional buying started on Friday with an uplist to OTCQB. This stock is in the top 0.1% on OTCQB and most read and watched. $400k cash flow today which was an increase from the $50k to $120k it was 3 weeks earlier. These are my opinions and Goodluck!

Can I Deduct a Stock Loss Due to a Bankruptcy?

by John Csiszar, Demand Media

Stock in bankrupt companies is usually deemed worthless.

If a company goes into bankruptcy, the stock can drop dramatically and often stops trading on the stock exchange. Generally, you have to sell a stock to claim a capital loss, so a bankrupt stock can cause problems. The Internal Revenue Service recognizes this difficulty and allows you to deduct stock losses due to bankruptcy. However, you must carefully document the stock's worthless status. Most brokerage firms also provide assistance in unloading bankrupt stocks.

Form 8949

Form 8949 is a worksheet you have to use when filing capital gains or losses with your taxes. The information you enter on Form 8949 ultimately gets entered on Schedule D and transferred to your Form 1040. To deduct a stock loss due to bankruptcy, enter the information regarding the stock on line 1 of Part 1 or line 3 of Part II, as you would with any other stock sale. Under the sales price column, enter "worthless." For tax purposes, you should enter the last trading day of the year as the sale date for a worthless security, according to Bankrate.com. Check the box indicating that this transaction was not included on Form 1099-B, which lists all regular stock transactions.

Documentation

In the event of an audit, the IRS will want to know how you arrived at a valuation of "worthless" for your security. Bankrate.com suggests that you keep documentation of when the stock became worthless and how you made that determination. Anything that demonstrates the impossibility of that stock providing any return to investors will suffice. Examples include canceled stock certificates, evidence that the stock no longer trades on any stock market or the non-existence of the company should suffice. Some firms will allow you to sell worthless stock for penny in exchange for signing a "tax loss" letter. Since the letter shows that you have relinquished all interest in a stock, it is an easy way to document your loss. Obviously, if you do sell your stock lot for a penny, you should enter the actual price on your tax forms, rather than writing "worthless."

Capital Losses

Once you have documented your loss, you can deduct your stock loss just like any other losing stock sale. Using Form 8949 and Schedule D, offset your gains and losses to determine your net capital gain or loss. If you show a net capital loss, the IRS allows you to offset an additional $3,000 of income. If you have a significant loss, you can carry that loss forward into future years, offsetting capital gains and $3,000 of income per year until your total loss is depleted.

New Shares

While most bankrupt stock ends up worthless, it's possible that you will get new shares of stock when a company emerges from bankruptcy. While this is a rare occurrence, it's possible that the stock you thought was worthless when a company declared bankruptcy will actually find new life when the newly reorganized company comes out of bankruptcy. In this case, your stock will not be worthless. However, you can still sell it and deduct the loss if it sells below your original purchase price.

Oil and Gas projects all around failed. Get use to the idea! If they built those plants we would be in the same situation. Look around even HIIT failed too! All the new companies failed majority of them in the last 3 years. USA Synthetic Corporation the biggest of them all failed as well. Pacific Ethanol is holding on by a thread and will probably fail as well.

I think we were all scammed and i think robert schwartz was the ring leader, I lost quite a bit of money on this stock by listenting to what robert was saying, i also had lots of friends who lost money on this stock for the same reasons. I dont think we should allow them to get away with this, i think we should stART A CLASS ACTION LAWSUIT against all the characters that were involved in this. If anyone agrees i am sure we can find an attorney to take this case on. Send me a private reply and we can discuss this further if anyone thinks we were screwed and we have a shot of recovering funds, since the bankruptcy was never completed, only filed i cannot even right off the losses against my tax returns, looking forward to hearing from someone or many i hope

yes mlm you were correct. I have learned a big lesson. wonder how doc explained that loss. it is a shame. ceo that was fired was not problem we all no who the prob was. it was a fun expensive life learning experience

nobody left, and not much more to say about this brazen scam.......

BTW, wonder how Brent Yonts is doing????....it's one thing for penny stock operators to do their thing, but another for a politician to be an accessory to the deceit on his constituents....hope those curtains were worth it!!!

http://www.lrc.ky.gov/legislator/h015.htm

Just checking to see if anyone ever looks at this board? LOL!

if anyone here remembers Elgindy, the rumor is he committed suicide recently:

http://www.sandiegoreader.com/news/2015/jul/25/ticker-anthony-elgindy-dead/#

hate to say I told you so........but I did!!!

(the general "you", being nobody in particular......)

RIP NSOL! Was a lotta fun back in the day...

So we can write this off for 2014 taxes, right?

seems Harry has a new job. If you have LinkedIn you will find him.

What part of bankrupt don't you understand...We are done!!!

Wow maybe thier is hope thats a good g move

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): December 23, 2014

U.S. FUEL CORPORATION

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

Nevada 000-31959 88-0433815

(STATE OR OTHER JURISDICTION OF

INCORPORATION OR ORGANIZATION)

(COMMISSION FILE NO.)

(IRS EMPLOYEE

IDENTIFICATION NO.)

277 White Horse Pike, Ste.200, Atco, N.J., 08004

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

(856) 753 - 1046

(ISSUER TELEPHONE NUMBER)

Copies to:

Hunter Taubman Weiss LLP

130 w. 42nd Street, Suite 1050

New York, NY 10036

Tel: 212-732-7184

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Item 1.03 Bankruptcy or Receivership

On December 23, 2014 (the "Petition Date"), US Fuel Corporation (the “Company”) filed a voluntary petition for relief (the "Chapter 7 Petition") in the United States Bankruptcy Court, District of New Jersey (the "Bankruptcy Court") seeking relief under the provisions of Chapter 7 of Title 11 of the United States Code (the "Bankruptcy Code"). The matter has been assigned Case No. 14-35701.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

US FUEL COPORATION

Date: December 29, 2014 By: /s/ Stanley Drinkwater

Stanley Drinkwater

Chairman of the Board

(Authorized Signatory)

Hey Joe,

Let us know how your lawsuit is going.

The only person that can help you is Fred Frisco if he is still around. Or maybe this is Fred!

Adam filed a whistle blower case to get 1.7 million cash in back wages. His case is before an ALJ.... Adams used WestPiont creds to get FINRA to hold up approving us from trading. Global is a problem, I have read an internal independent legal analysis, (which I think the will release soon) that convinced me there are no merits to Global's case. But its Adam's case that is holding things up.

I investigated his background back when FFI paid him 20K to raise money. I told the company then he was a fraud, but the Kentucky folks loved. Then I warned ES about Adams when I saw that got onto the board. Remember the RB posts he made... Jus take a look, this guy was West Grad then went Hastings law school in SF CA. But he has done nothing in business, except hook with veteran's org and wiggle into a few Gov sponsered veterans work program. He has no real credentials, I mean he was working USFF and alleges we owe him 1.7 millions dollars.

I'm digging out all my case investigation work and sending to the ALJ, maybe the court will take a second look at Adam's credibility. If any of you know anything about him, share it. WE ARE NSOL< USFF SURVIVORS... we can't let this guy bring us down. help me..thanks

So is it HIS demand for $$$ that is causing the current problem or is it the Global mess?

That's Paul Adams.. sorry, Im so pissed.

Now Paul brown lives in his mother's bedroom and continues to perpetuate his frauds ad blackmail. I warned RS about Adams, but the Kentucky folks wanted him and Luck. I hope they finally understand their stupidndty.

I got to the bottom, remember Paul Adams. FFI paid him20k to get funding, but he was a fraud he never got a single investor and his resume was BS, he raised a nickel for any company. Herda tried to get the money back, but couldn't get support from FFI or NSOL board, lead to Herda leaving, THen Paul Adams snaked his way into USFF with Mr. Luck. it was the Kentucky folks who Paul;s Adams BS, Now Paul is the one stopped the FINRA process demanding 2 million dollars cash in back wages. Un friggin believable.

His whistle blower complaint is absolutely a farce, but he uses his WestPiont badge for creditability. But he is a liar and I can prove it. All shareholders should contact the ALJ handling Adams compliant and express our outrage. Paul Adam is a fraud and he is responsible for our losses.

As you can see the court order on 9/11/14, dismissed all causes of action against USFF. Unfortunately without prejudice, which allowed Global to refile 4 times before manufacturing a cause of action that has survived so far. But it Paul Adams whistleblower complaint that has killed us. NSOL should have listened to Herda years ago and slammed Paul Adams.

We have to act. I will

JOECraig,,,, PLEASE DELETE MY POSTS. They are inappropriate and don't help the company.. I was just pissed at Global, but I know RS did everything he could to settle the matter.

But this just my thoughts. I also know how hard RS worked to get the company back on the boards and he probably did everything he could to try and resolve the issue. He had every incentive to resolve it .....

That's way I think we shareholders should go after Global. They are the cause

Between RS and Drinkwater they probably own or control about 400million shares. You think they could have come up with enough shares 6 months ago to settle the lawsuit. But again knowing how RS treated my contract, I can only imagine what he did to Global and now Global has no reason to settle. I think Global is willing to spend the money and go to trial just out of vengeance because they have nothing to gain,,,,

I haven't seen USFF's answer to the Complaint and or if they made a cross complaint. The point is that Global,s allegations of wrongdoing have survived and according to Dave, it sounds like the company can't resolve the complaint with any motions, they have to defend it or settle it. IMO, the company should have settled tis matter 6 months ago, but greedy people thought they didn't need to protect shareholders. Now they lost too. Id say Drinkwater gave some bad advice and he should have been the 1st to step with shares to settle. The problem is Global may right! But until n independent attorney reviews all the case documents, we don't know if a class action is even viable. We may have a better case against Drinkwater

However, based on my person business experience with RS, I tend to believe there are merits to Global’s Complaint and we would only discover that the demise of the company was caused by management. But I don’t know the facts. I do know that FINRA believes the company acted inappropriately to the extent they won’t allow the company enter the public market.

I AM DEFINITELY IN ON THAT!!!!!

The only way to save us is a shareholder class action against Global, if its BS like RS says. Need a few hundred shareholder to pony up a few bucks each.

Hey Joe. If you don't realize I am not defending anyone. The phone number works. Maybe you should wake up. And the microscope was already shoved up their ass in the form 10 or don't you remember that.

As for me this is my last post. I wish all a great future.

|

Followers

|

93

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

30354

|

|

Created

|

01/20/05

|

Type

|

Free

|

| Moderators | |||

U.S. FUEL CORPORATION

| U.S. Fuel Corporation 277 White Horse Pike Suite: 200 Atco, N.J. 08004 Investor Relations: 856.753.1046 Info@USFuelCorporation.com |

US Fuel a publicly traded company, OTC ticker symbol- USFF is developing its first plants, 2000 barrel per day (bpd) in Muhlenberg County Kentucky or Henderson Kentucky. The Company has invested over $900,000 in the projects to date, and is seeking $200 million to achieve commercial operation of the first plant.

US Fuel anticipates funding to be in three tranches, $963,000 to complete Development, $6.56 million to complete the Front End Engineering and Design, and $337.93 million to complete construction. We estimate a plant could begin commercial operations as soon as twenty four months after the first funding.

The Fischer–Tropsch process is a collection of chemical reactions that converts synthesis gas (syngas) a mixture of carbon monoxide and hydrogen into liquid hydrocarbons. US Fuel will produce syngas from natural gas and a Fischer-Tropsch technology to produce diesel fuel, naphtha.

The high quality diesel fuel produced through the Fischer–Tropsch (FT) process contains near zero Sulfur and can be used directly in today’s diesel-powered vehicles. Laboratory testing indicates that F-T diesel provides superior vehicle performance and delivers dramatic across-the-board reductions in all major criteria pollutants such as SOx, NOx, and hydrocarbon (HC) emissions and reduces the most harmful pollutant, PM 10 (10 micron particulates) by 34%.

These fuels are compatible with the current petroleum distribution infrastructure and do not require new or modified pipelines, storage tanks, or retail stations.

US Fuels’ strategy of locating small plants next to interstate pipelines will maximize returns by lowering feed stock prices and reducing transportation costs. The smaller size will significantly reduce the time to permit each plant so shorten the construction period, and make the projects easier to finance.

Critical News

http://usfuelcorporation.com/?page_id=2043

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |