Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I can’t explain but to call Trep and STTN a scam is a stretch! This “scam” has been around for A LONG TIME! This “scam” did a few rounds with the IRS, fought, settled, paid and came out the other side. This “scam” has had PLENTY of opportunity to dilute and HASN'T! Trep is also making rev’s. So yes I’m frustrated as a Shareholder but to call it a “scam” is a stretch

How do you explain how they purchased two supposed million dollar revenue companies for a thousand dollars? This reaks of scam.

Makes sense to me, and seems logical. Of course this is all speculation, but seems logical. Might actually be a reason for the delayed uplisting and audited results. Especially when you balance the costs of being on the OTC and no dilution all these years. Makes sense.

Is TREP a take-over target…an essay:

The short answer is YES ! It’s said that the only reason to run an OTC company is to be able to use the markets to raise capital. They have never done so, nor do they show any signs of doing so. I can’t find a form 10 or a 1A or any other registration filed to execute a public or private offering. So we can rule that benefit out. The last several Qs have clearly shown that they do not need to raise capital with shares to continue to operate.

Running an OTC company is a hassle. Just to stay current with the SEC filings requires time and resources and detracts from the focus required to run the business. Shedding that burden would certainly be welcome.

What’s it worth: It currently has a tangible value of about $17M. That is about .33/share before adding for additions to the balance sheet from earnings in Q3. The debt is minimal at about $1.5M and doesn’t come due until 2023. (this is all in the filings BTW). To pay .40/share for Trucept Inc would not be to buy it. It would be to steal it!

Who would want it: Any equity firm or holding company that wanted to enhance their portfolio through the addition of a valuable and profitable company. Or any competitor in their peer group who wanted to expand their market share.

Who would benefit:

1. The acquiring company as mentioned above

2. TREP by shedding the burden of maintain an OTC company

3. The CEO and chairman who would each walk away with $2M using my .40/share example.

The last reason why I think this theory is viable is because management does essentially nothing to enhance visibility which would clearly drive the share price upward. Even the OTCQB certification seems to be dragging out.

This essay is just an extrapolation of my research and contains comments that may be purely coincidental. But it sure looks like TREP is low hanging fruit as a take-over target. You should always do your own research before investing.

I always welcome your well educated comments.

Good luck to all of us,

Willie

Just more old news about nothing. TREP is going places and its up.

in my opinion, the only variables are the timing of the announcements and the PPS.

A 2011 post detailing FACTS about BONAR.

He is a crook.

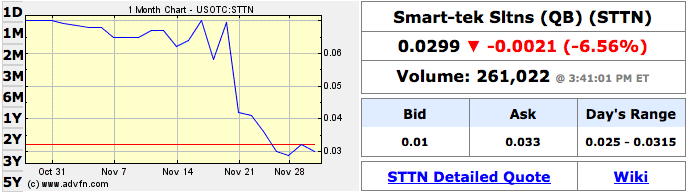

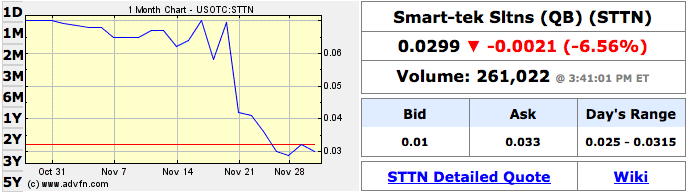

STTN some research inspired by the filing of the last 10Q on November 21, 2011

The stock started to plummet the day before the 10Q filing (maybe some insiders with advanced knowledge that the 10Q was going to be brutal decided they better start getting out early?)

-----

So what was in this 10Q?

Before we get to that a quick rundown on the events that have happened over the past few months:

-----

Starting shortly after the former Chief Executive Officer, Chief Financial Officer, Secretary and Treasurer and founder of the company, Perry Law, tendered his resignation from his last remaining position of Director effective immediately on June 3, 2011 things have taken a very bad turn for the worse.

-----

On June 9, 2011, Brian Bonar signed a toxic financing agreement with La Jolla which included a $500,000 debenture agreement and the right for La Jolla to purchase up to $5,000,000 worth of stock at 80% below the market price. To date this agreement has not been executed.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=7997447

On June 15, 2011, Brian Bonar issued himself 21,897,999 shares at no cost. According to the recently filed 10Q those shares were issued for $218,979 in compensation owed. On June 15, 2011, STTN closed at $.071/share making the actual value of those shares $1,554,757.93.

http://www.sec.gov/Archives/edgar/data/947011/000106299311002630/xslF345X03/form4a.xml

On June 17, 2011, Brian Bonar issued to his Director, Owen Naccarato, 3,000,000 shares at no cost for $225,000 in compensation owed.

http://www.sec.gov/Archives/edgar/data/947011/000106299311002672/xslF345X03/form4.xml

On July 29, 2011, Brian Bonar and Owen Naccarato met at the Rancho Bernardo Inn and used their 24,897,999 shares to elect themselves as the new Directors for the STTN shell.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8069037

On October 17, 2011, Brian Bonar brought his son, Colin Niven Bonar (aka C. Niven Bonar aka C N Bonar), into the picture by purchasing a group of companies which were all wholly owned subsidiaries of American Marine LLC, a company controlled by both Brian Bonar and C. Niven Bonar, for $50,000 and a $500,000 debt Note.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8194094

Solvis Medical Group consists of three revoked Nevada entities

Solvis Medical Inc and Solvis Medical Staffing Inc and Solvis Physical Therapy Inc all with Eric Gaer and Robert Dietrich listed as officers.

Former chairman of the Solvis Medical Group is Brian Bonar.

American Marine LLC is controlled by both Brian Bonar and C. Niven Bonar

http://www.corporationwiki.com/California/Escondido/american-marine-llc/47532519.aspx

Owen Naccarato (STTN Director) served as the legal counsel for the signed agreement between father and son.

C. Niven Bonar and Brian Bonar were previously linked with Dalrada Financial Corp (DFCO). Both C. Niven Bonar and Brian Bonar's daughter, Pauline Bonar, were initial shareholders in Dalrada Financial Corp back in 1999 while Brian Bonar was the CEO. Not so coincidentally Owen Naccarato was and still is the legal counsel for Bonar linked Delrada Financial Corp.

http://www.otcmarkets.com/stock/DFCO/company-info

The Bonar, Bonar, Naccarato connections don't end there.

The three can be linked to Allegiant Professional Business Services, Inc. (APRO)

Where daddy Bonar served as a Director and president, son Bonar served as the COO, and Naccarato once against served as legal counsel:

http://www.otcmarkets.com/stock/APRO/company-info

http://investing.businessweek.com/research/stocks/people/people.asp?ticker=APRO:US

APRO was (I used past tense because that company is basically dead now) a PEO company just like STTN is now.

APRO even uses the same address as STTN

11838 Bernardo Plaza Ct.

Suite 240

San Diego, CA 92128

Which is in shouting distance from American Marine LLC

11838 Bernardo Plaza Ct

Suite 210

San Diego, CA 92128

And is within walking distance from Dalada Financial Corp

11956 Bernardo Plaza Drive

#516

San Diego, CA 92128

John Capezzuto who works with Brian Bonar with APRO also worked with Brian Bonar with scam company Warning Management Services Inc. (WNMI) which was revoked by the SEC on May 22, 2009

http://www.sec.gov/litigation/admin/2009/34-59968.pdf

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=64388493

Legal counsel for scam company WNMI was Owen Naccarato.

Are you beginning to wonder if Brian Bonar always uses Owen Naccarato for a reason?

Here is a list of companies for which Owen Naccarato currently provides legal services:

http://www.otcmarkets.com/service-provider/Naccarato-&-Associates?id=2062&b=n&filterOn=3

Allegiant Professional Business Services, Inc. (APRO)

Com-Guard.com, Inc. (CGUD)

Dalrada Financial Corp. (DFCO)

Diverse Media Group, Inc. (DVME)

DPOLLUTION International Inc. (RMGX)

eMamba International Corp. (EMBA)

Family Room Entertainment Corp. (FMYR)

Genco Corp. (GNCC)

Global Digital Solutions, Inc. (GDSI)

Icon Media Holdings, Inc. (ICNM)

ITonis, Inc. (ITNS)

Lexico Resources International, Inc. (LXXI)

Markray Corp. (RVBR)

Quad Energy Corp (CDID)

Ree International, Inc. (REEI)

Smart-Tek Solutions, Inc. (STTN)

South Shore Resources, Inc. (SSHO)

TapSlide, Inc. (TSLI)

Velocity Energy Inc. (VCYE)

This link draws some interesting past connections between Corey Ribotsky and many companies that used Owen Naccarato as legal counsel

http://www.offshorealert.com/WorkArea/threadeddisc/print_thread.aspx?id=60&g=posts&t=37726

---------------------

I got side tracked though back to the 10Q

Then on November 21, 2011, the STTN 10Q for the 3rd quarter came out and it was ugly.

Cash on September 30, 2011 - $270,048

Cash on June 30, 2011 - $882,069

STTN lost $612,021 in cash during the 3rd quarter

Accounts payable and accrued liabilities on September 30, 2011 - $8,384,307

Accounts payable and accrued liabilities on June 30, 2011 - $3,256,689

STTN added $5,127,619 in accounts payable and accrued liabilities during the 3rd quarter

The accounts payable and accrued liabilities for the 2nd quarter was only $82,477

$5,127,619 is $2,129,070 more than STTN had in accounts payable and accrued liabilities for its entire existence from 1995 - through the 2nd quarter of 2011.

Why the $5,127,619 in accounts payable and accrued liabilities all in just a 3 month period? Who is all that money owed to?

Gross profit on September 30, 2011 (for 3rd quarter) - negative $155,177

Gross profit on June 30, 2011 (for 2nd quarter) - $1,685,183

STTN went from a profitable business to a company with a failing business. The cost of revenue for the 3rd quarter of 2011 was higher than the revenues themselves. They would have been better off not doing business in the 3rd quarter.

Subtract away the operation costs/expenses and

Overall operating loss on September 30, 2011 (for 3rd quarter) - $2,963,852

Overall operating loss on June 30, 2011 (for 2nd quarter) - $599,161

STTN's operating losses increased by $2,364,691.

During the 1st quarter of 2011 (the period ending March 31, 2011), STTN didn't have an operation loss. They had an operating gain of $363,354 after subtracting away all the costs of operations from the revenues for the quarter. It is obvious the direction that STTN is headed, and it is not good.

A further break down of the Selling, general and administrative expenses helps partially explain why STTN is headed down the toilet.

Salaries & Related Expense

1st quarter - $311,430

2nd quarter - $582,969

3rd quarter - $553,404

Consulting

1st quarter - $220,366

2nd quarter - $158,823

3rd quarter - $353,624

Commissions

1st quarter - $177,223

2nd quarter - $269,583

3rd quarter - $633,742

Outside Services

1st quarter - $31,688

2nd quarter - $62,403

3rd quarter - $211,287

Overall Selling, General, and Administrative Expenses

1st quarter - $1,272,515

2nd quarter - $1,685,183

3rd quarter - $1,997,439

Since revenues dropped by 28% from the 2nd quarter to the 3rd quarter why did commissions increase by 235% during that same stretch?

----------------

The most disturbing parts of the recent STTN filings:

#1) Brian Bonar paying himself $1,554,757.93 in shares for a $218,979 balance that was owed to him then writing off the payment in the books as a $218,979 stock expense.

#2) Brian Bonar issuing himself and his son a $500,000 debt Note for a group of revoked business entities.

#3) The $5,127,619 in accounts payable accrued during the 3rd quarter alone. Who is all that money owed to?

#4) STTN went from a positive balance sheet at the end of the 1st quarter to a failing business whose revenues cost more than what they make.

#5) The past connections and histories of the main players involved in STTN.

Gonna keep adding. Setting new highs!

I really hope the company responds with status of their 2020 promises to shareholders. If they do, you're right that this might be sustainable!

Back up to PE of 3. Watch out we may get discovered some day soon. Tangible book value still .33

Here's a shell wearing a yield sign that trades at twice our mkt cap:

https://www.otcmarkets.com/stock/APSI/profile

We are making progress on financial audits, which was delayed somewhat due to COVID and workplace restrictions. The second half of 2021 will be a very exciting time for our clients and our employees."

What we need is for the audits to be released. TREP is profitable.

TRANSLATION: hey folks, we need some BIGGER fools!

Calling all you Twitter Warriors. We need to increase the chatter on twitter. Even if you have only a handful of followers. Please help the warriors already on board beat the drum. Always start your tweet with $TREP.

Also if Norman tweets out the date of the earnings release, we need to pounce on that and spread it around.

Good Luck to all of us,

Willie

Looking forward to today's action, let's have a great end today!

Awesome! If we can get them to uplist and produce the audited results they promised last year it might help too.

IMPORTANT PLEASE READ:

Going forward and effective immediately myself and a predominant twitter warrior will be providing Norman Tipton directly with suggestions on how to better promote the financial success they are experiencing at Trucept Inc.

Those suggestions will include:

*Better use of their Twitter page to communicate with shareholders

*Various attempts to increase chatter on twitter

*Pursuit of an analyst to initiate coverage of the stock with a price target.

*Attempts to increase chatter on Stockwits and Reddit...and more

We appreciate any help or suggestions we can get. Norman strikes me as an old-school CEO focused on driving profits. However, he is also open to some new school ways of promoting their success. I can't tell him what to do, but I believe you will start to see enhanced visibility.

MY PERSONAL NOTES: I hold a long position in TREP, and believe it is the most undervalued stock on the OTC. Shells frankly trade at a higher Market Cap. I can't and won't make a prediction as to their continued success going forward. You should always do your own due diligence.

Good luck to all of us,

Willie

Of course it's a scam - BRIAN BONAR always runs scams...

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=155369241

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=71987571

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=164971555

Can someone explain how they were able to purchase afinida for a fair value of 3k dollars when they had a supposed 500k revenue? This thing reaks of a scam.

if the numbers tank, then a lot more games will be played with the notes.

Slow and steady. Everything is physics, fast up fast down. We need revenues to sustain.

Significant volume today between the bid/ask (i.e., "?Vol"). What are the thoughts on the board here regarding why? e.g., MM wanting to offload their shares to another MM that's willing to take a position on $trep? Just brainstorming, but really want folks thoughts here.

TREP vs BZWR: The comparison data

Both provide B to B services designed to help business be more profitable, efficient and productive. Very similar business models ! ! !

In the area of revenues TREP is the clear winner with last Q revs of $4.2M while BZWR reported $2.9M. BZWR was the winner in bottom line income with $1.2M vs TREP at $.65M

Regarding share structure, TREP has 33M floating shares and holding while BZWR has $105M and climbing.

TREP is the clear winner in valuations with a book value of $17M while BZWR comes in at a fraction of that with $1.4M.

The big difference is in market cap. At the time of this writing TREP would have to increase its share price by almost 10 times to equal BZWR's cap of $85M

I state again that we just need to be discovered.

Good luck to all of us,

Willie

The only thing with "longevity" is the shell - the business plans keep crashing and burning.

This is a scam.

I hear ya. But their longevity is starting to mean something now after all these years. They’re not just surviving but also growing with a responsible SS. Maybe not “excited” but definitely hopeful ![]()

Great, it's generating plenty of moves in the process!

Yeah it sure seems like we’re getting some visibility. Consistently improving fundamentals this past year might make this run very different

Over 30k was bought at .1675....Hold on tight, ...

This baby about to go over.30, why would you sell it now.....Unbelievable!!!

I hear ya, good luck on your next gamble.

I really hope it does for you guys but I'm happy just to get my 2 grand back. Bonar & Fong really stuck it to me in the early 2000's.

GLTA

Now watch it go on a crazy multi month run. That's usually how it works with these things. If you're 'lucky' enough to get out at break even on one of these long red holds, it generally means it's on it's way to make a lot more noise. Chart is screaming breakout here.

COUNTING THE PE UP..NOW 3 ! ! It still has to more than double to get to book value.

Whooooo! After 10 years holding the bag for this POS stock I was able to get out with a $20. profit. Winning!

$TREP starting to run and is very much under the radar, and it's sister company $DFCO is setting up to follow suit soon. IMO both are going to be in play here.

This company is worthless - no way it can be "undervalued" until delisted.

This company is so undervalued and who ever is selling today is going to find out here shortly how cheap they sold their shares.

Absolutely amazing that BONAR would go back into payroll services - someone got snookered...

Let's see if it can rise up, which would be a positive sign.

HERE'S WHY TREP WILL GET DISCOVERED:

If they simply continue to do what they have done over the past 2 Qs, for the next 2 Qs, they will report a net profit of about $2.6M over the 12 trailing months. With a market cap of just over $5M that is a PE OF 2 !

And it has to triple from current prices just to get to tangible book value. Let me put it this way...if they ceased operations, melted the company down and sold it for the sum of the parts we would all get about 33 cents per share.

If fundamentals ever mattered in the OTC and if TREP gets discovered this will EXPLODE !

I'm buying more in the morning.

Willie

I loaded today. This resembles BZWR in alot of ways. Low float. EXPLOSIVE revenues and earnings. Solid balance sheet. Can't find any boobie traps in it.

Would help to see some Twitter chatter on it tonight.

Good luck to all of us,

Willie

Maybe it's just me, but I think we should be doing better than this.

Afinida Announces 90% Growth In Payroll Processing RevenuePress Release | 08/10/2021

A subsidiary of Trucept Inc. (OTC Pink: TREP), Afinida, is one of the country’s fastest-growing full-service payroll solutions providers. The Company has expanded its physical presence to the Northeast to accommodate the ongoing growth of its payroll services division. Now operating in 47 states, Afinida’s professional services include turn-key payroll processing, cloud-based payroll software, direct deposit management, wage garnishments, W2 processing, and consulting services.

Julie Neill, Chief Operating Officer at Afinida, and a Trucept Board Member states: “We are pleased to announce that we are currently experiencing record increases in our payroll processing product line. Q1 saw revenue grow by over 18%, with Q2 producing a staggering 90% increase, year over year.” She went on to say: “The significant growth is directly attributed to the best-in-class, personalized service offered by Afinida.”

Unlike most payroll firms with a national footprint, Afinida prides itself on a unique, highly personalized customer experience, anchored by a dedicated Account Manager for every client. This gives Afinida one of the most responsive customer experience models in the payroll processing industry.

Afinida’s parent company, Trucept, offers professional services that help businesses navigate growth. The company’s professional services now encompass the following:

Marketing, technology, and Accessibility Act compliance services

Insurance offerings and third-party administrator (TPA) services

Payroll

Human resources and management

Employee benefits administration

Accounting support

Safety and risk management

Afinida Announces 90% Growth In Payroll Processing RevenuePress Release | 08/10/2021

A subsidiary of Trucept Inc. (OTC Pink: TREP), Afinida, is one of the country’s fastest-growing full-service payroll solutions providers. The Company has expanded its physical presence to the Northeast to accommodate the ongoing growth of its payroll services division. Now operating in 47 states, Afinida’s professional services include turn-key payroll processing, cloud-based payroll software, direct deposit management, wage garnishments, W2 processing, and consulting services.

Julie Neill, Chief Operating Officer at Afinida, and a Trucept Board Member states: “We are pleased to announce that we are currently experiencing record increases in our payroll processing product line. Q1 saw revenue grow by over 18%, with Q2 producing a staggering 90% increase, year over year.” She went on to say: “The significant growth is directly attributed to the best-in-class, personalized service offered by Afinida.”

Unlike most payroll firms with a national footprint, Afinida prides itself on a unique, highly personalized customer experience, anchored by a dedicated Account Manager for every client. This gives Afinida one of the most responsive customer experience models in the payroll processing industry.

Afinida’s parent company, Trucept, offers professional services that help businesses navigate growth. The company’s professional services now encompass the following:

Marketing, technology, and Accessibility Act compliance services

Insurance offerings and third-party administrator (TPA) services

Payroll

Human resources and management

Employee benefits administration

Accounting support

Safety and risk management

Think about the patience I've had and confidence in this thing.

A 2011 post detailing FACTS about BONAR.

He is a crook.

STTN some research inspired by the filing of the last 10Q on November 21, 2011

The stock started to plummet the day before the 10Q filing (maybe some insiders with advanced knowledge that the 10Q was going to be brutal decided they better start getting out early?)

-----

So what was in this 10Q?

Before we get to that a quick rundown on the events that have happened over the past few months:

-----

Starting shortly after the former Chief Executive Officer, Chief Financial Officer, Secretary and Treasurer and founder of the company, Perry Law, tendered his resignation from his last remaining position of Director effective immediately on June 3, 2011 things have taken a very bad turn for the worse.

-----

On June 9, 2011, Brian Bonar signed a toxic financing agreement with La Jolla which included a $500,000 debenture agreement and the right for La Jolla to purchase up to $5,000,000 worth of stock at 80% below the market price. To date this agreement has not been executed.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=7997447

On June 15, 2011, Brian Bonar issued himself 21,897,999 shares at no cost. According to the recently filed 10Q those shares were issued for $218,979 in compensation owed. On June 15, 2011, STTN closed at $.071/share making the actual value of those shares $1,554,757.93.

http://www.sec.gov/Archives/edgar/data/947011/000106299311002630/xslF345X03/form4a.xml

On June 17, 2011, Brian Bonar issued to his Director, Owen Naccarato, 3,000,000 shares at no cost for $225,000 in compensation owed.

http://www.sec.gov/Archives/edgar/data/947011/000106299311002672/xslF345X03/form4.xml

On July 29, 2011, Brian Bonar and Owen Naccarato met at the Rancho Bernardo Inn and used their 24,897,999 shares to elect themselves as the new Directors for the STTN shell.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8069037

On October 17, 2011, Brian Bonar brought his son, Colin Niven Bonar (aka C. Niven Bonar aka C N Bonar), into the picture by purchasing a group of companies which were all wholly owned subsidiaries of American Marine LLC, a company controlled by both Brian Bonar and C. Niven Bonar, for $50,000 and a $500,000 debt Note.

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=8194094

Solvis Medical Group consists of three revoked Nevada entities

Solvis Medical Inc and Solvis Medical Staffing Inc and Solvis Physical Therapy Inc all with Eric Gaer and Robert Dietrich listed as officers.

Former chairman of the Solvis Medical Group is Brian Bonar.

American Marine LLC is controlled by both Brian Bonar and C. Niven Bonar

http://www.corporationwiki.com/California/Escondido/american-marine-llc/47532519.aspx

Owen Naccarato (STTN Director) served as the legal counsel for the signed agreement between father and son.

C. Niven Bonar and Brian Bonar were previously linked with Dalrada Financial Corp (DFCO). Both C. Niven Bonar and Brian Bonar's daughter, Pauline Bonar, were initial shareholders in Dalrada Financial Corp back in 1999 while Brian Bonar was the CEO. Not so coincidentally Owen Naccarato was and still is the legal counsel for Bonar linked Delrada Financial Corp.

http://www.otcmarkets.com/stock/DFCO/company-info

The Bonar, Bonar, Naccarato connections don't end there.

The three can be linked to Allegiant Professional Business Services, Inc. (APRO)

Where daddy Bonar served as a Director and president, son Bonar served as the COO, and Naccarato once against served as legal counsel:

http://www.otcmarkets.com/stock/APRO/company-info

http://investing.businessweek.com/research/stocks/people/people.asp?ticker=APRO:US

APRO was (I used past tense because that company is basically dead now) a PEO company just like STTN is now.

APRO even uses the same address as STTN

11838 Bernardo Plaza Ct.

Suite 240

San Diego, CA 92128

Which is in shouting distance from American Marine LLC

11838 Bernardo Plaza Ct

Suite 210

San Diego, CA 92128

And is within walking distance from Dalada Financial Corp

11956 Bernardo Plaza Drive

#516

San Diego, CA 92128

John Capezzuto who works with Brian Bonar with APRO also worked with Brian Bonar with scam company Warning Management Services Inc. (WNMI) which was revoked by the SEC on May 22, 2009

http://www.sec.gov/litigation/admin/2009/34-59968.pdf

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=64388493

Legal counsel for scam company WNMI was Owen Naccarato.

Are you beginning to wonder if Brian Bonar always uses Owen Naccarato for a reason?

Here is a list of companies for which Owen Naccarato currently provides legal services:

http://www.otcmarkets.com/service-provider/Naccarato-&-Associates?id=2062&b=n&filterOn=3

Allegiant Professional Business Services, Inc. (APRO)

Com-Guard.com, Inc. (CGUD)

Dalrada Financial Corp. (DFCO)

Diverse Media Group, Inc. (DVME)

DPOLLUTION International Inc. (RMGX)

eMamba International Corp. (EMBA)

Family Room Entertainment Corp. (FMYR)

Genco Corp. (GNCC)

Global Digital Solutions, Inc. (GDSI)

Icon Media Holdings, Inc. (ICNM)

ITonis, Inc. (ITNS)

Lexico Resources International, Inc. (LXXI)

Markray Corp. (RVBR)

Quad Energy Corp (CDID)

Ree International, Inc. (REEI)

Smart-Tek Solutions, Inc. (STTN)

South Shore Resources, Inc. (SSHO)

TapSlide, Inc. (TSLI)

Velocity Energy Inc. (VCYE)

This link draws some interesting past connections between Corey Ribotsky and many companies that used Owen Naccarato as legal counsel

http://www.offshorealert.com/WorkArea/threadeddisc/print_thread.aspx?id=60&g=posts&t=37726

---------------------

I got side tracked though back to the 10Q

Then on November 21, 2011, the STTN 10Q for the 3rd quarter came out and it was ugly.

Cash on September 30, 2011 - $270,048

Cash on June 30, 2011 - $882,069

STTN lost $612,021 in cash during the 3rd quarter

Accounts payable and accrued liabilities on September 30, 2011 - $8,384,307

Accounts payable and accrued liabilities on June 30, 2011 - $3,256,689

STTN added $5,127,619 in accounts payable and accrued liabilities during the 3rd quarter

The accounts payable and accrued liabilities for the 2nd quarter was only $82,477

$5,127,619 is $2,129,070 more than STTN had in accounts payable and accrued liabilities for its entire existence from 1995 - through the 2nd quarter of 2011.

Why the $5,127,619 in accounts payable and accrued liabilities all in just a 3 month period? Who is all that money owed to?

Gross profit on September 30, 2011 (for 3rd quarter) - negative $155,177

Gross profit on June 30, 2011 (for 2nd quarter) - $1,685,183

STTN went from a profitable business to a company with a failing business. The cost of revenue for the 3rd quarter of 2011 was higher than the revenues themselves. They would have been better off not doing business in the 3rd quarter.

Subtract away the operation costs/expenses and

Overall operating loss on September 30, 2011 (for 3rd quarter) - $2,963,852

Overall operating loss on June 30, 2011 (for 2nd quarter) - $599,161

STTN's operating losses increased by $2,364,691.

During the 1st quarter of 2011 (the period ending March 31, 2011), STTN didn't have an operation loss. They had an operating gain of $363,354 after subtracting away all the costs of operations from the revenues for the quarter. It is obvious the direction that STTN is headed, and it is not good.

A further break down of the Selling, general and administrative expenses helps partially explain why STTN is headed down the toilet.

Salaries & Related Expense

1st quarter - $311,430

2nd quarter - $582,969

3rd quarter - $553,404

Consulting

1st quarter - $220,366

2nd quarter - $158,823

3rd quarter - $353,624

Commissions

1st quarter - $177,223

2nd quarter - $269,583

3rd quarter - $633,742

Outside Services

1st quarter - $31,688

2nd quarter - $62,403

3rd quarter - $211,287

Overall Selling, General, and Administrative Expenses

1st quarter - $1,272,515

2nd quarter - $1,685,183

3rd quarter - $1,997,439

Since revenues dropped by 28% from the 2nd quarter to the 3rd quarter why did commissions increase by 235% during that same stretch?

----------------

The most disturbing parts of the recent STTN filings:

#1) Brian Bonar paying himself $1,554,757.93 in shares for a $218,979 balance that was owed to him then writing off the payment in the books as a $218,979 stock expense.

#2) Brian Bonar issuing himself and his son a $500,000 debt Note for a group of revoked business entities.

#3) The $5,127,619 in accounts payable accrued during the 3rd quarter alone. Who is all that money owed to?

#4) STTN went from a positive balance sheet at the end of the 1st quarter to a failing business whose revenues cost more than what they make.

#5) The past connections and histories of the main players involved in STTN.

|

Followers

|

219

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

28891

|

|

Created

|

11/21/05

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |