Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Just an email I received as a reminder…last I heard appx. 30% of shareholders have not responded. Not asking for opinions, debates or arguments, just passing some info along...

So far no large black cars with super tinted windows are parked in front of my house...

“If you are still interested in this dividend and following up on the email below as time is running out, please email the document and your April and May statements so we can process

please scan and email

Thanks Sam and Gemma”

1 hour in & TSOI

Therapeutic Solutions International Inc (PK) 0.0008 0.00 (0.00%)

Volume: -

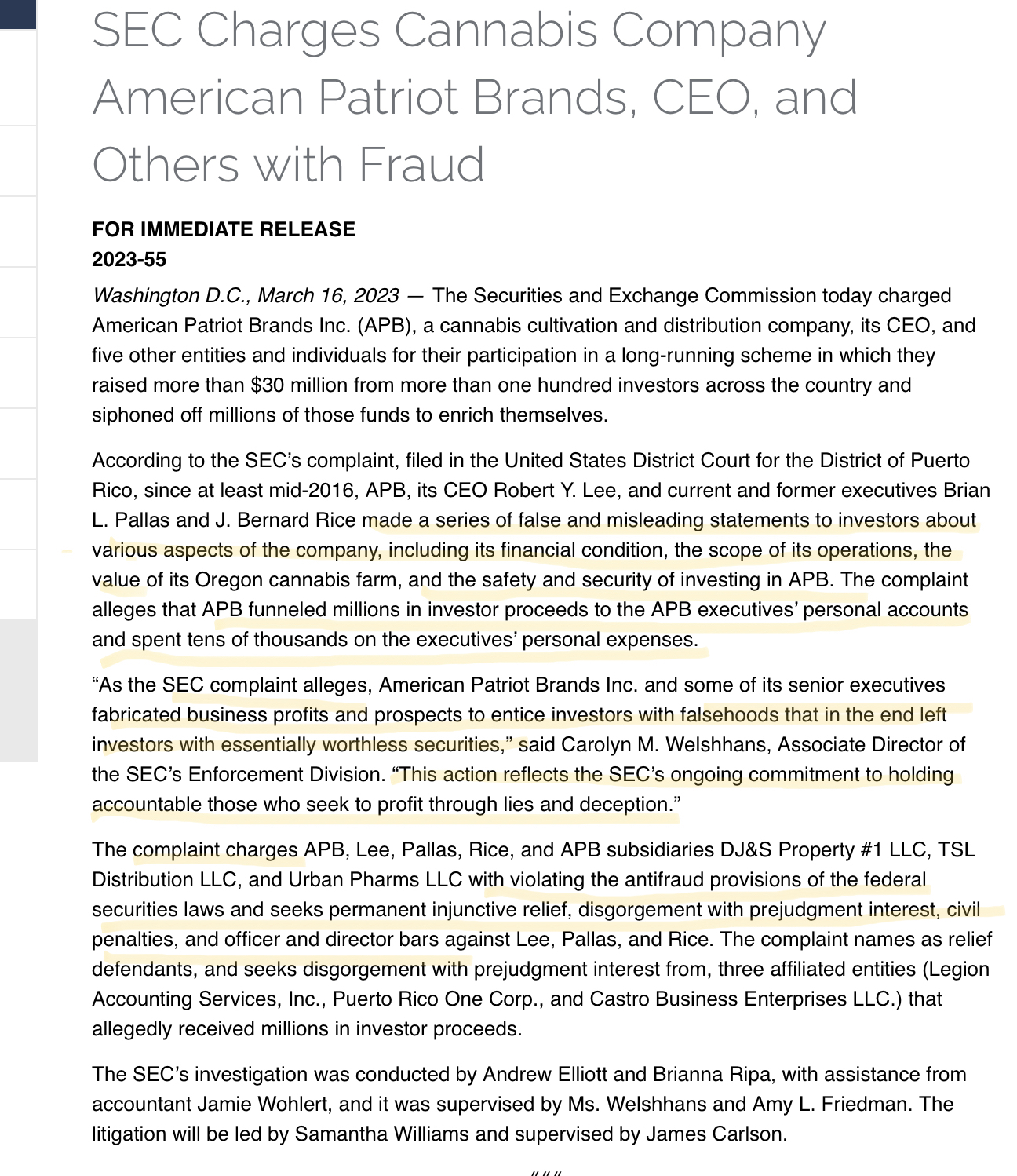

Wonder if... as I try to search for the related companies below

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=175130129

Outstanding Shares 5,057,149,981 08/20/2024

As of August 19, 2024, 4,884,095,275 shares of the registrant’s common stock, par value of $0.001 per shares, were outstanding.

BAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHHAHAHAHAHAHAHAHAHAHHAHA

You are Dixon's puppets, all your posts are boilerplate and pretty bad ones. . .

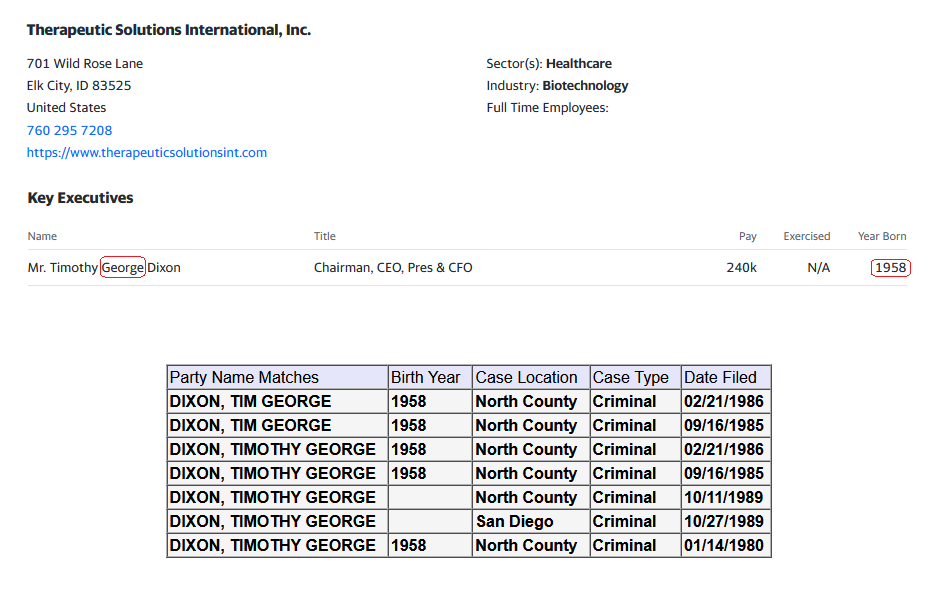

On 10-19-2020 the share price was .0078. Today the share price is .0008.

Let's see that 3billion float go to .02 TSOI

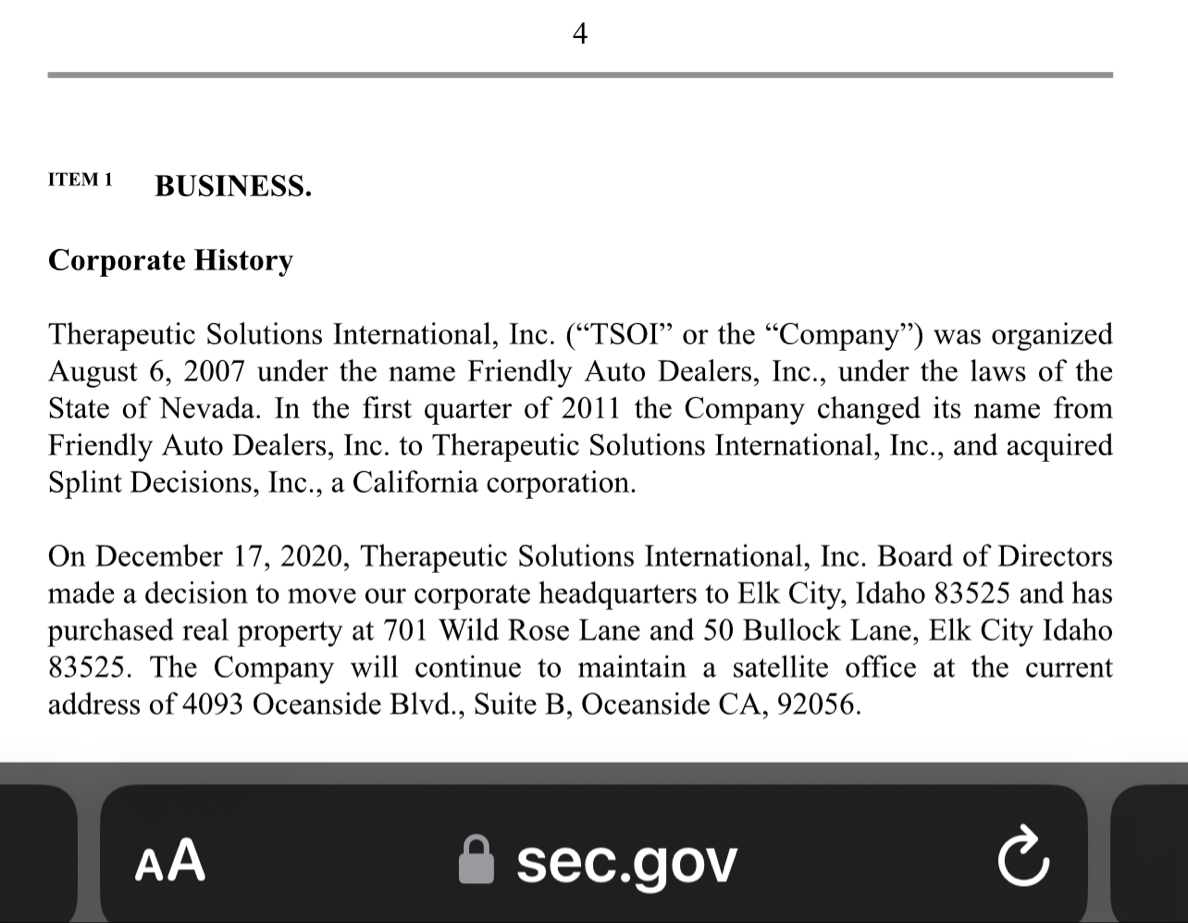

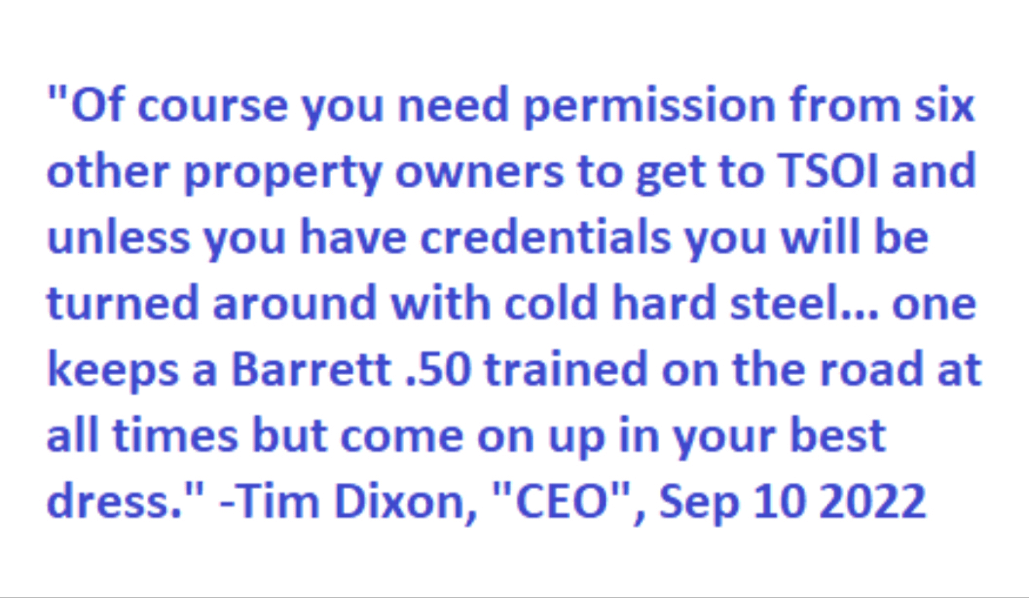

Where did you come up with a $500,000.00 price tag for the TSOI Idaho property? Just another clerical error? Just think 10-19-2020 was almost 4 years ago! Google the address below for confirmation! Just imagine if they had an address in the Cayman Islands like so many other publicly traded companies do? I wonder why they haven’t gone down?

701 Wild Rose Ln, Elk City, ID 83525 is currently not for sale. The vacant lot last sold on 2020-10-19 for $160000, with a recorded lot size of 12.5 acres.

Dixon bought the no man's land Idaho property with $500k of shareholders' money. Not for TSOI but for something illegal that he is getting money from. He had a bunker built there and people live in it. It's all over for the scum bag psychopath Dixon. They are gonna take him down in a BIG way and it will make the News…

Did everyone get off suspension today? 😂😂

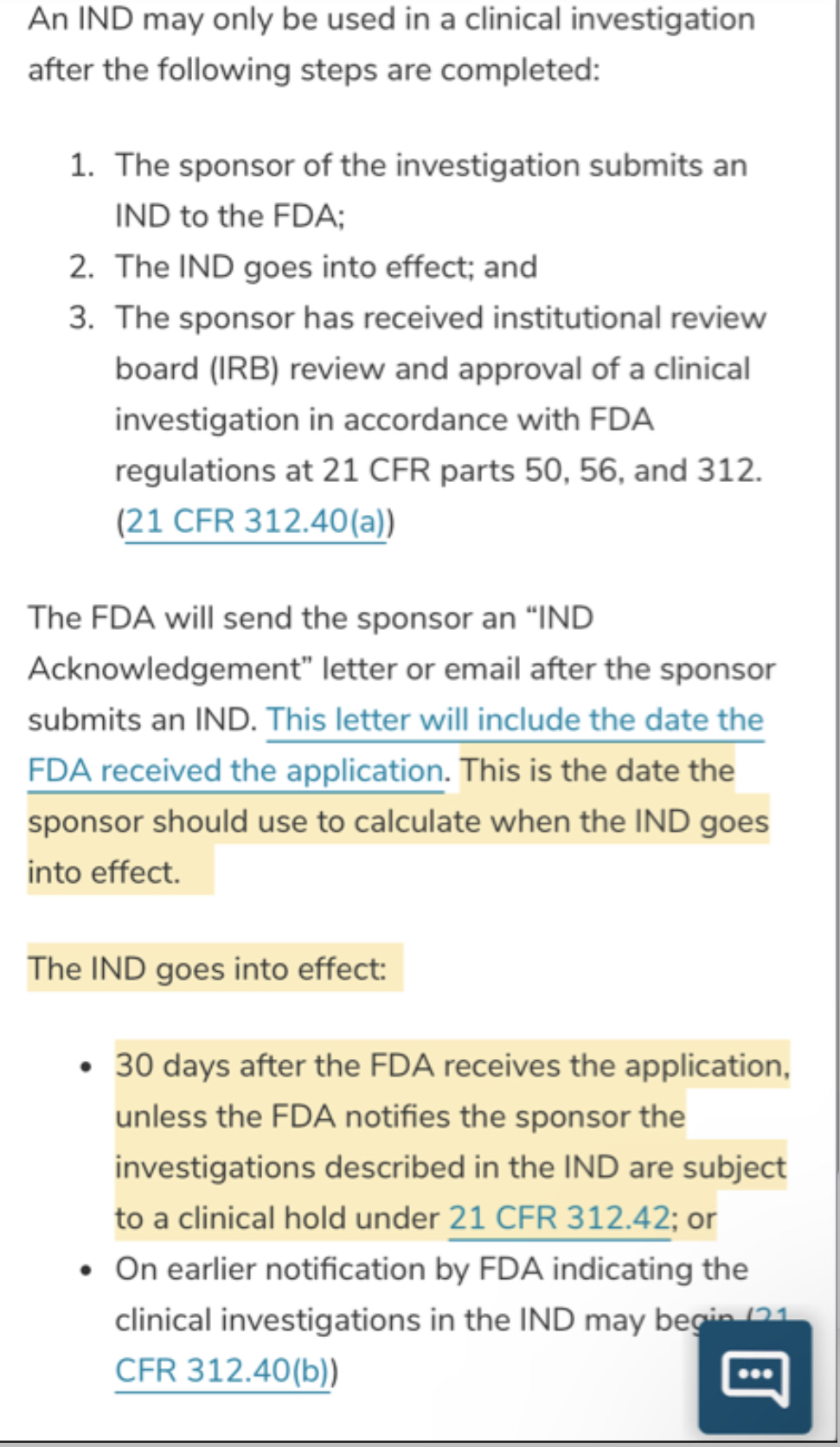

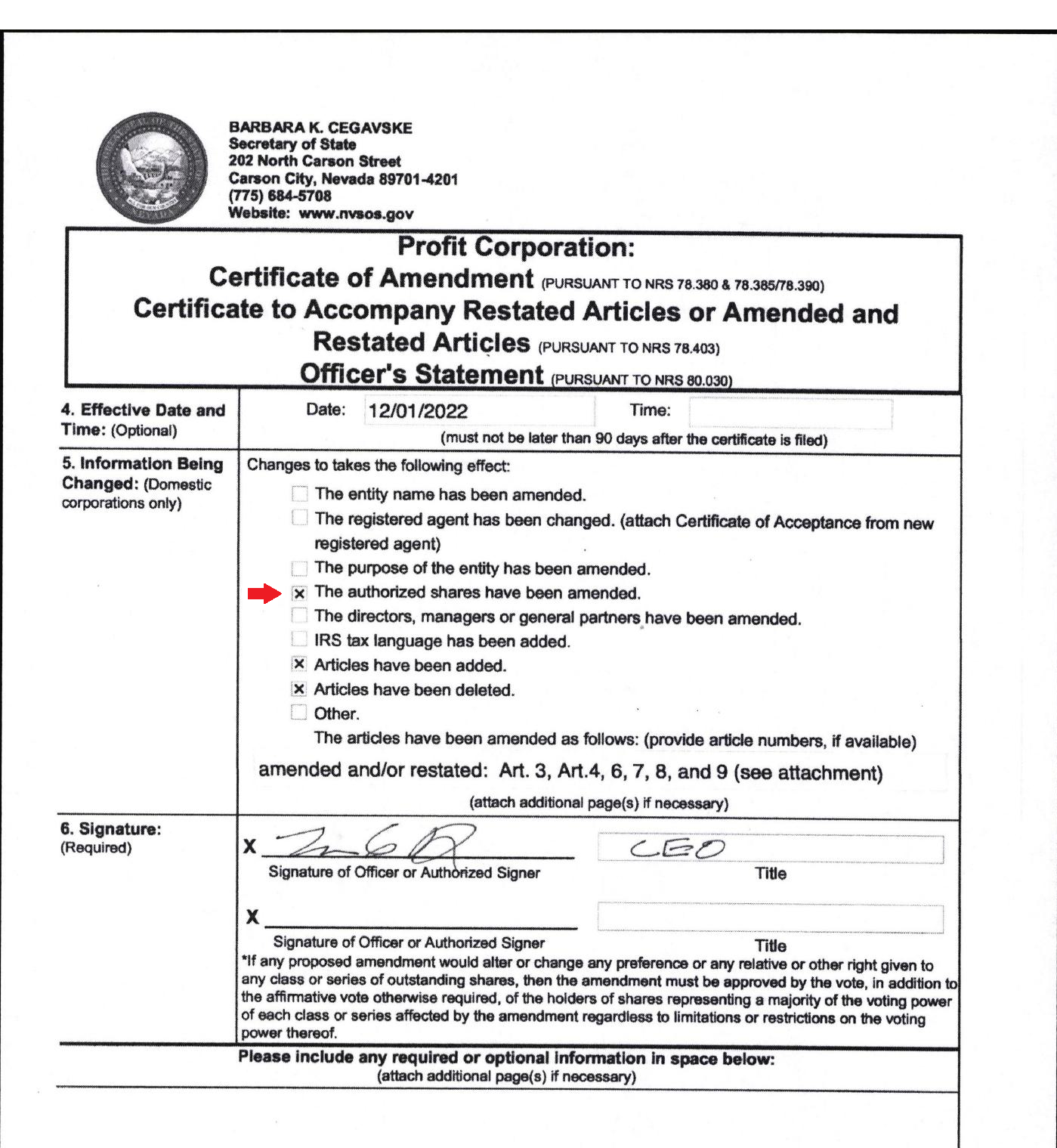

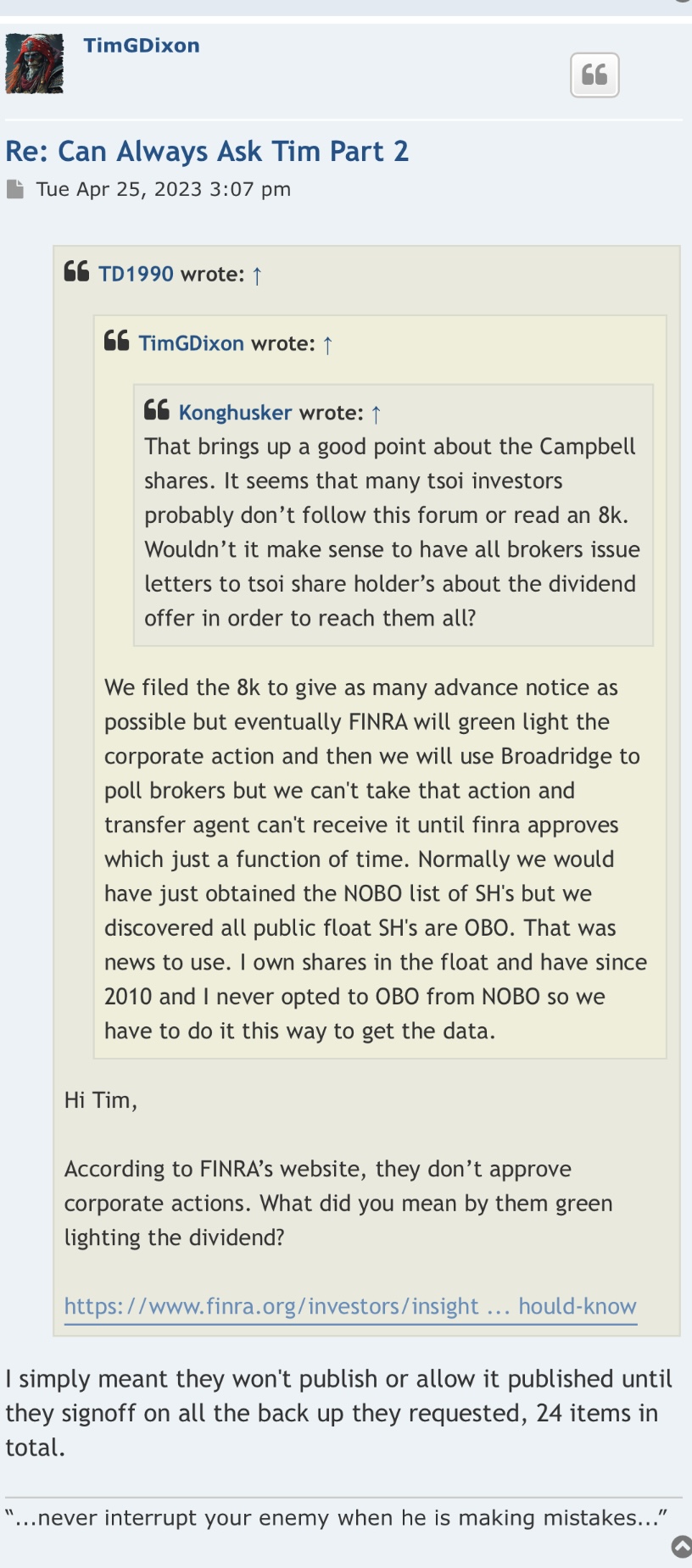

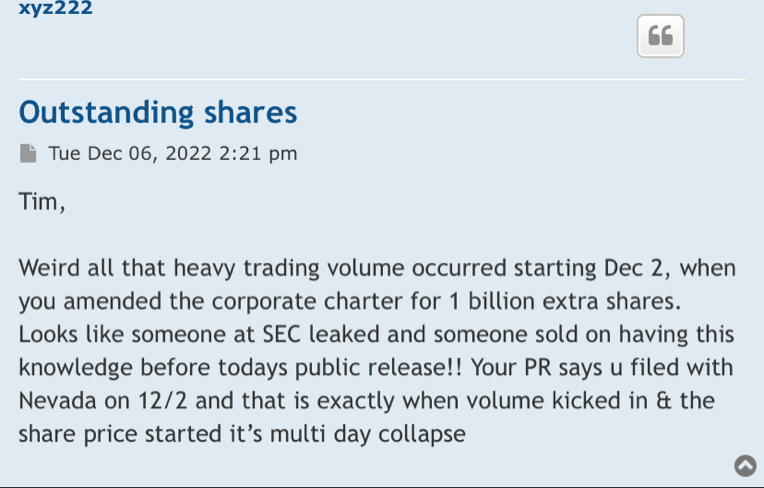

imho this is why there has been no increase in the SS just recently, check the dates of both filing / last SS update

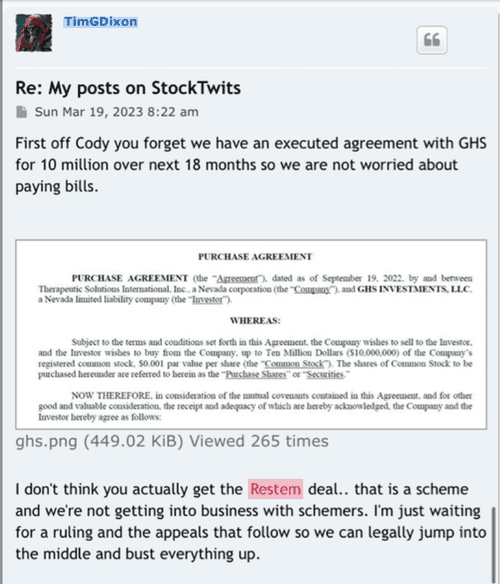

https://www.sec.gov/newsroom/speeches-statements/uyeda-statement-ghs-investments

Now w/

Conclusion

In enforcing the federal securities laws, the Commission has an obligation to express its views prospectively, ex ante, to provide fair notice to persons of the conduct that will run afoul of the law. The Commission has failed to do so in this action against GHS.

Anyone with the ability to read can see just by scrolling down that is a completely false statement. FACTS are this is a loser of a company and stock. Lie upon lie, more lies , more lies to cover up lies. All brought to you by that shady ass CEO Timmy boy Dixon.

What will the next TSOI news be?

-OS exceeds 6 billion?

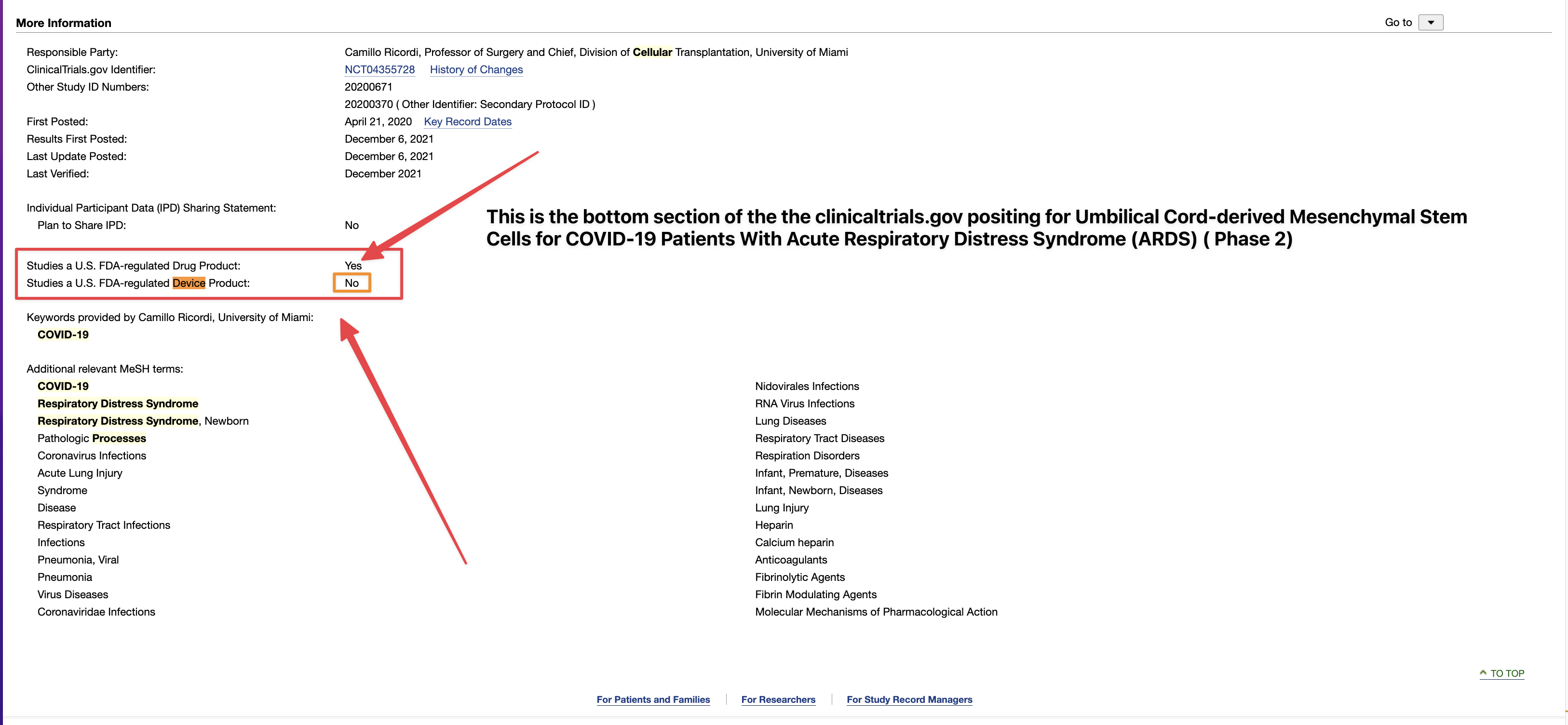

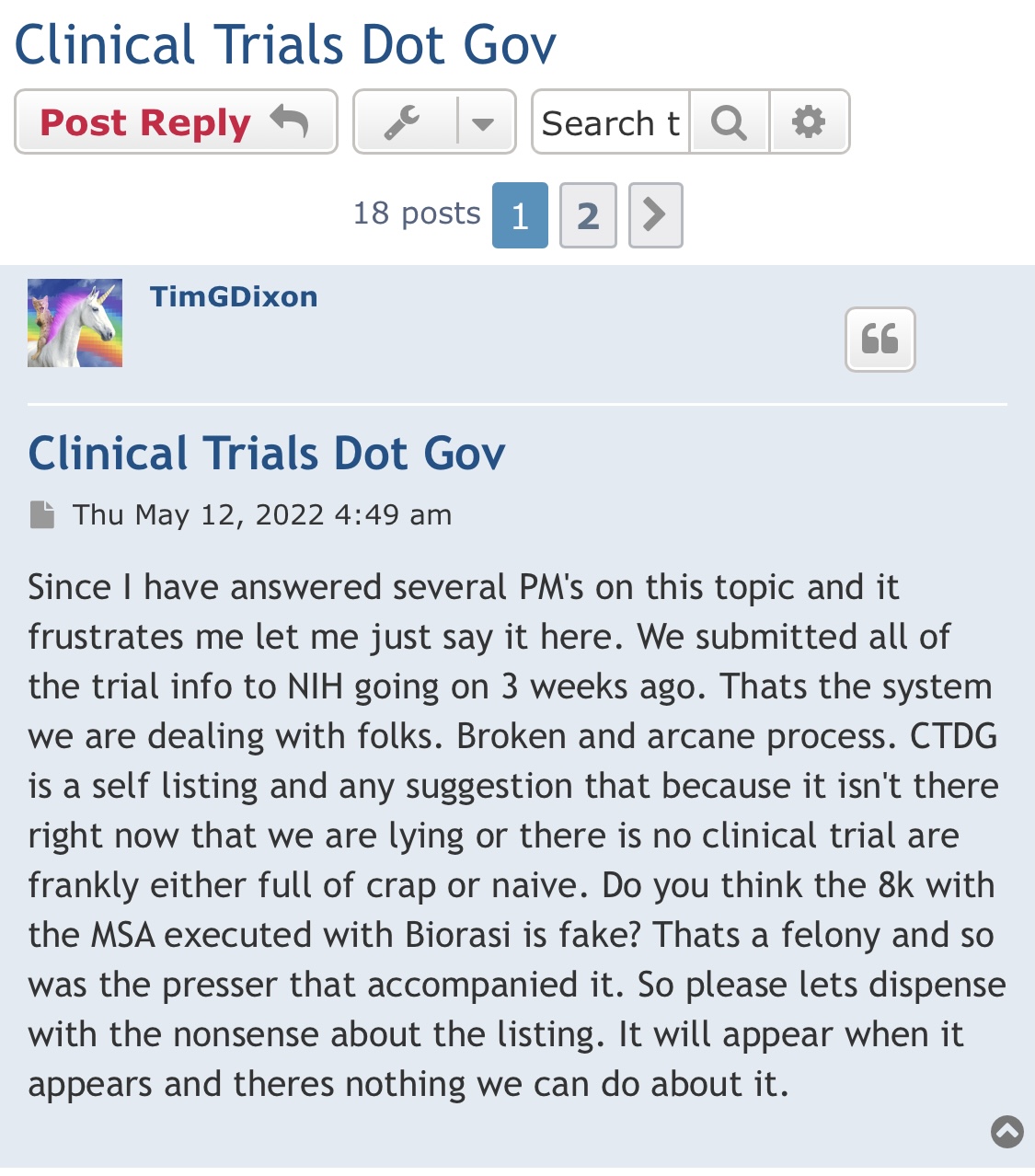

-registered P1 clinical trial?

-QM sales break 50K in sales for the year?

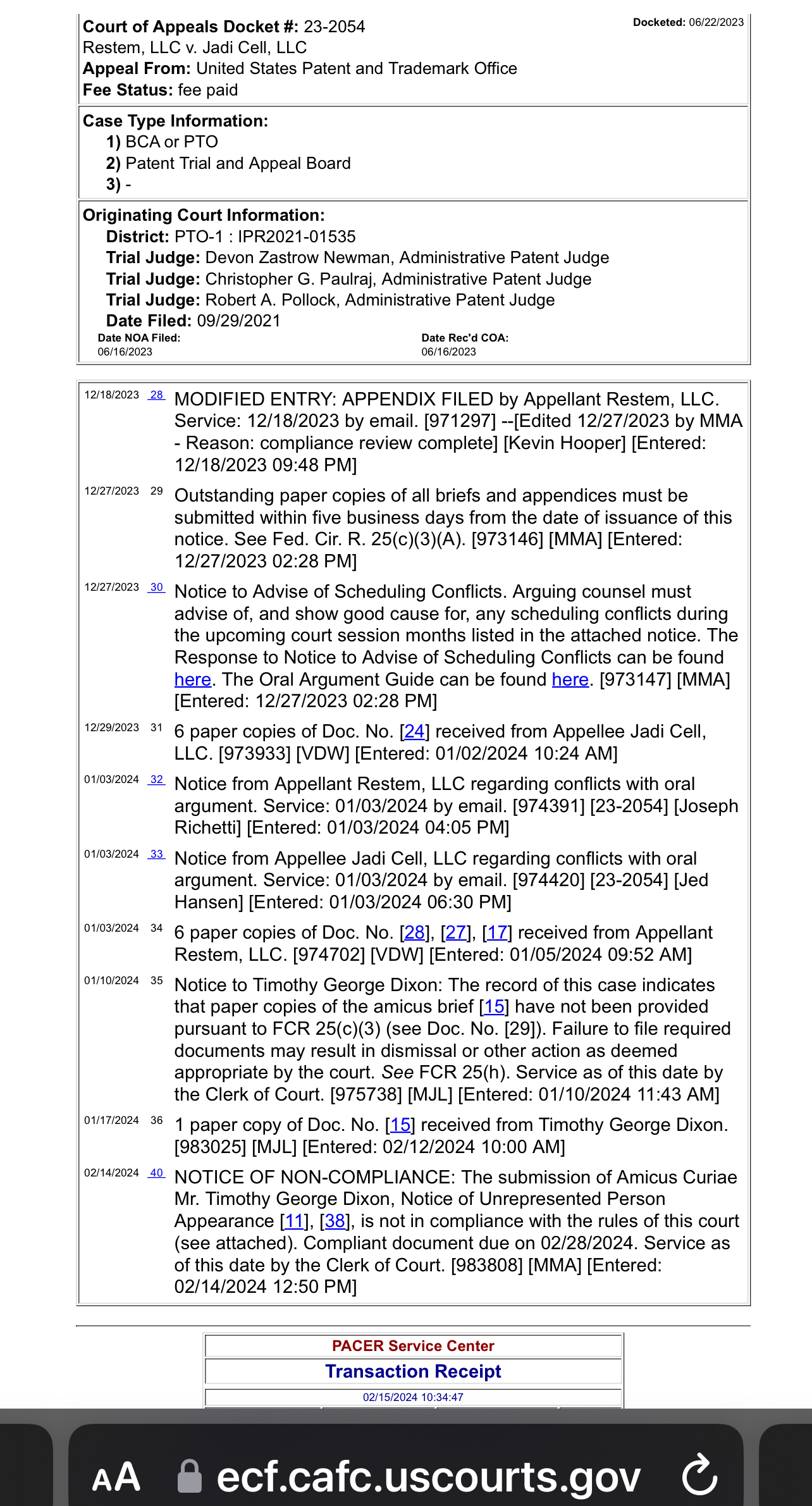

-Dixon finally sues U of M so it can finish this failure off?

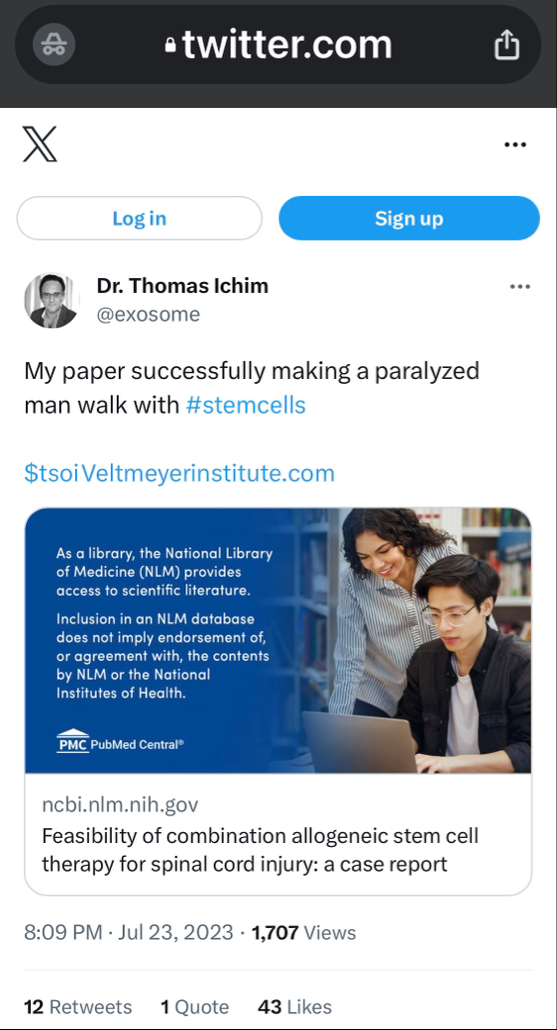

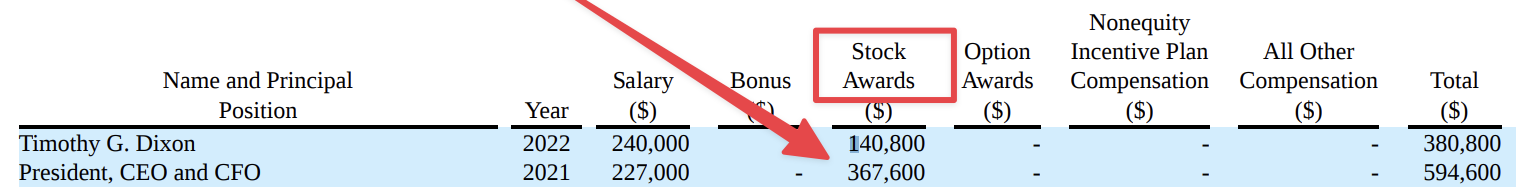

-Dixon and Ichim award themselves another couple of hundred million shares?

-An update on the tattoo gun or any one of those hundreds of other press released that went no where?

Will TSOI ever have any news worth mentioning again? Will it be true...?

Many know I have my own questions with this company but I have to agree, you created an account months ago but decided now was a good time to make your first post? Sorry but you don’t seem credible at all. What made you wait? What’s different now than it was when you created your account? Is this company on the verge of something big and that’s why you’re coming forward with this information? Seems extremely sus!

Tsoi great company were almost home buy it while it's cheap

...lol, how would you know...you've been here for 4 days...

WHY did you say this? I am just contributing! Please elaborate a little more about TSOI being “legit”!

“I also think company may be legit. e.g. who would go through all the trouble and science for a few dollars, and they could get sued themselves.”

All you do is ask why why why. You have nothing to contribute.

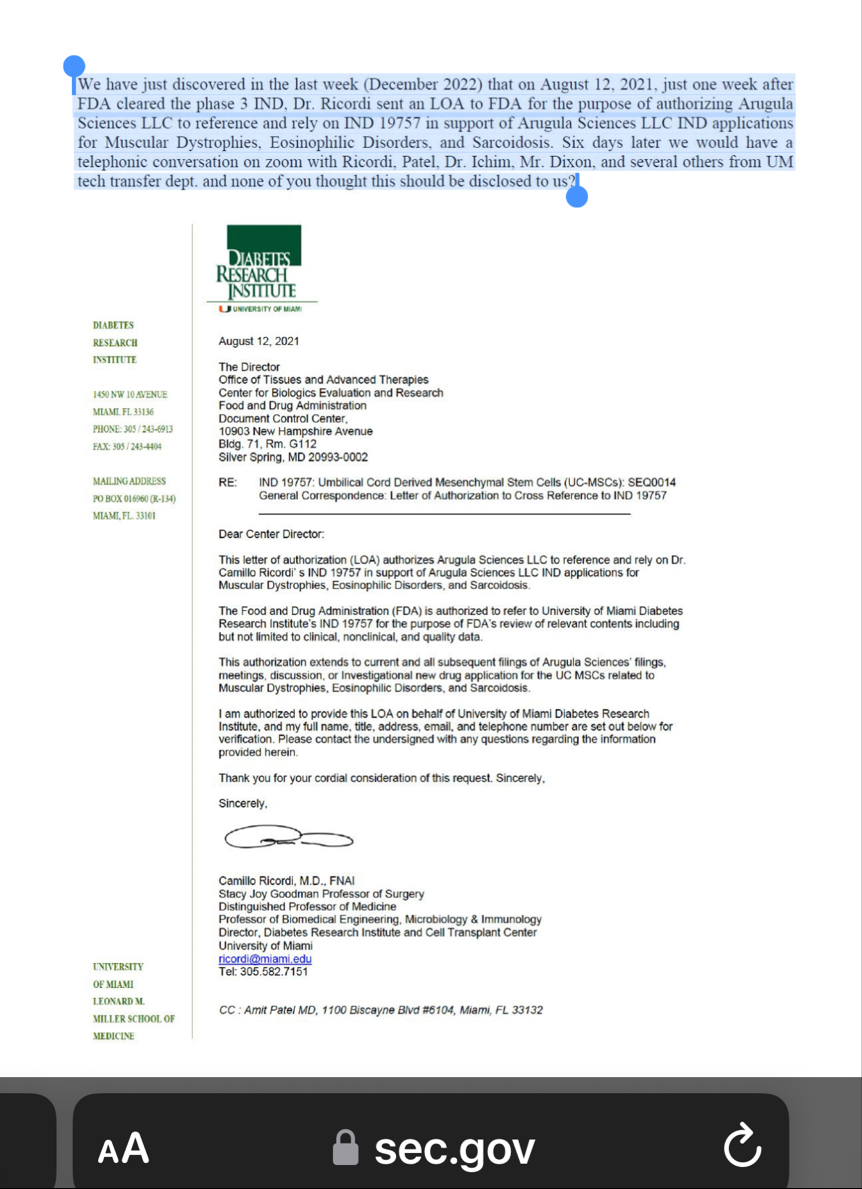

If this TSOI news you have provided was so important why was there such a delay in posting it until today? You have a 2 month old account and this is your very first post ever and now you want to discuss what “supposedly” happened 3 years ago with TSOI CEO Tim Dixon and Dr. Camillo Ricardo? Was this confession tape recorded? Or was it word of mouth from some undercover informant? It seems so suspicious! How can we truly verify on this board that you are a former employee of the University Of Miami, Miller School of Medicine? I bet there are numerous other posters on this board that are also former employees of the University Of Miami, Miller School of Medicine and disagree with what you’re stating!

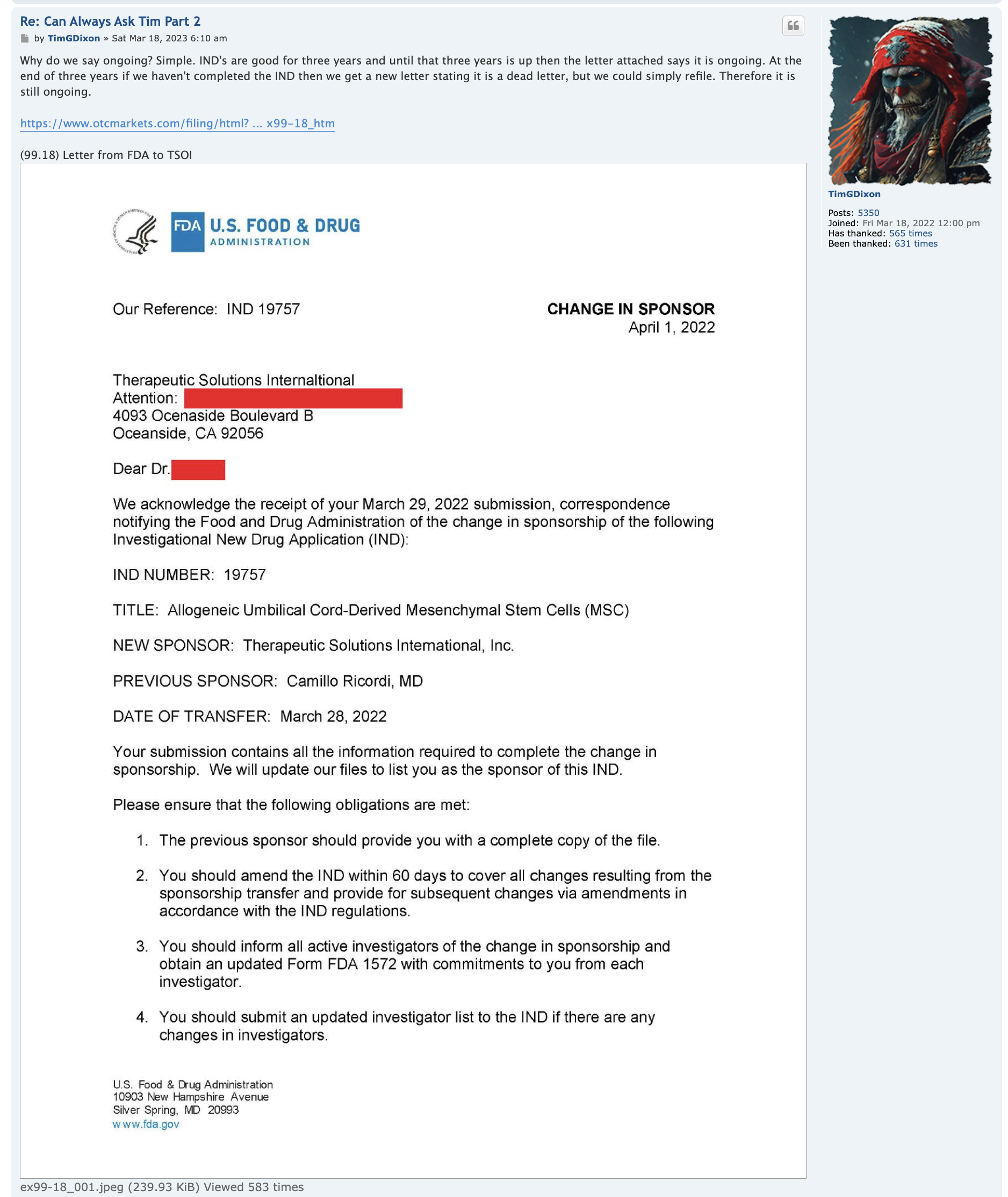

I'm a former employee of the University Of Miami, Miller School of Medicine, and worked with the renowned Dr. Camillo Ricordi. I feel it's important to get the truth out about what happened 3 years ago with this Obstinate ignorant narcissist Schizophrenic Tim Dixon, as shareholders are owners of the Company and have every right for truth and justice!

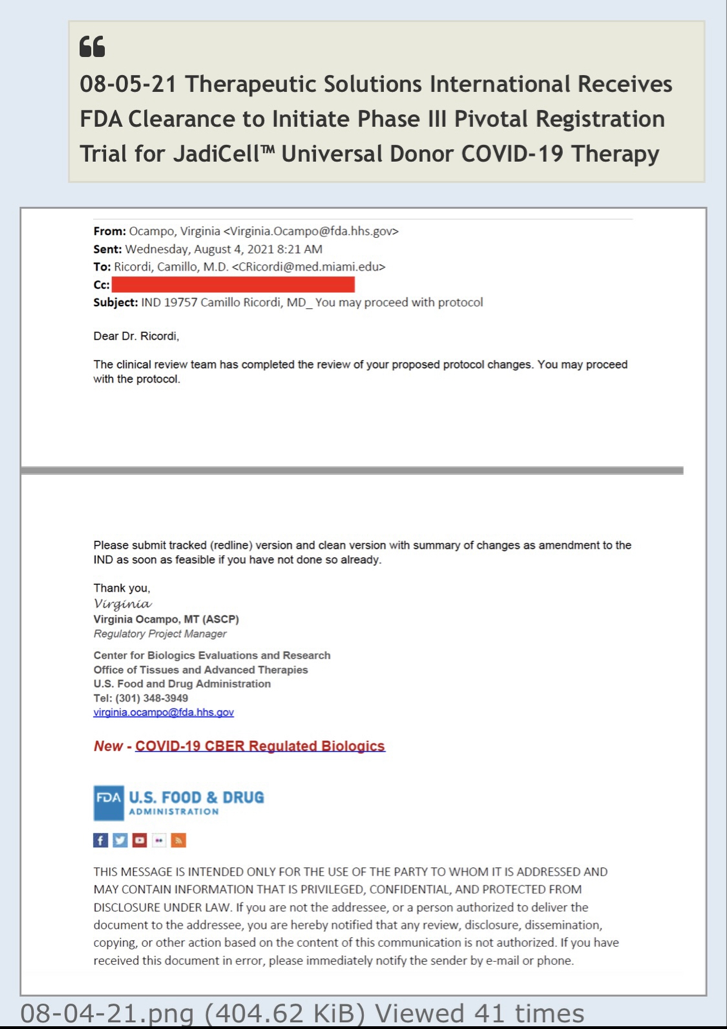

Everything was ready to run smoothly into Phase 3 but Tim Dixon took it upon himself to disgrace DR Ricordi by not listening and disagreeing with the master professional in the field of Medicine and Stem Cells. Tim told DR Ricordi that he was ignorant regarding the FDA process.

The DR wants to barf every time the name Tim Dixon is brought up! He despises the guy.

There is a condition some people have called "self sabotage" which is 100% of Dixons makeup.

He has alienated everybody that he has worked with in the past and now there will be a court-appointed receiver taking the reins after an investigation of the Idaho property. Stay tuned…

Better volume the last couple of days and no OTCN dumping.....PR?

It's amazing how the .0007's get reloaded on the bid

if TSOI stops diluting pps will keep moving up

I need to ask you. Why don`t you ask? Again. You have all questions and no answers.

Aren`t there many on stocktwits?

And why wouldn’t you do it for any other TSOI shareholders? Why wouldn’t they be interested in what you supposedly wrote CEO Tim Dixon about? There really would be no need to hide from it because it is about simply requesting to have a shareholders meeting! Now I need to ask you about what you wrote earlier today and is listed below:

“The company is supposedly suing it`s own shareholders for saying mean things about the company. If you read yahoo mbs you will see that happens every 2 seconds.”

But when you go to the TSOI yahoo mbs, the 3 NEWEST POSTS are one from yesterday, one that is a week old and another that is 2 weeks old and none of those posts have anything to do with how TSOI is supposedly suing it`s own shareholders for saying mean things about the company! In reality the most recent post that brings the subject up is almost 6 weeks old! I recommend anyone interested should go and see it for themselves! You see as of 5:45 EST the last post on that board was written yesterday and simply talks about if anyone still cares anymore! I wonder if it’s time for the sailboat captain draped in gold tinsel to make his entrance and bring it up? Time will tell…

I would, but, as you say you are not concerned about it, so why bother?

Um this is not me in any way. But good try tractor. https://stocktwits.com/LetsCHere/message/586518548

Wondering if, the possible consequences of as some have already been shown to be less than.... When a client is not truthful with their attorneys, several consequences can arise, and these consequences can significantly impact both the legal representation and the overall outcome of the case. Here are some common outcomes:

Compromised Legal Strategy: Attorneys rely on accurate and complete information to develop effective legal strategies. If a client is dishonest, the attorney might make decisions based on false or incomplete information, which can lead to a poorly executed strategy and potentially unfavorable outcomes.

Legal Risks: Providing false information can increase legal risks. For instance, if a client lies under oath or provides misleading information in legal documents, they could face charges of perjury or other legal consequences.

Damaged Trust: The attorney-client relationship is based on trust. If an attorney discovers that a client has been dishonest, it can damage or destroy that trust. This can affect the attorney's ability to advocate effectively and could lead to a breakdown in communication.

Ethical Issues: Attorneys have ethical obligations to the court and to the legal system. If a client’s dishonesty comes to light, it can place the attorney in a difficult position, as they are bound by rules of professional conduct that require honesty and integrity. The attorney may be compelled to withdraw from the case or report the dishonesty, depending on the circumstances.

Adverse Outcomes: The lack of honesty can directly impact the outcome of a case. For example, if critical facts are withheld or misrepresented, it can weaken the client's position, lead to sanctions, or result in a less favorable judgment.

Withdrawal of Representation: If an attorney discovers that a client has been deceitful and it affects the representation, the attorney may seek to withdraw from the case. This can create additional delays and complications, as the client would need to find new legal representation.

In summary, honesty and transparency are crucial in the attorney-client relationship to ensure effective legal representation and to avoid negative consequences that can arise from deceit.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=175066730&txt2find=MAGAnify

When a plaintiff files a frivolous lawsuit, which is a case that lacks any legal basis or is filed for the purpose of harassment or delay, the court has several options to address the situation. Here’s what a judge or court can do in response to a frivolous suit:

Dismiss the Lawsuit: The court can dismiss the lawsuit if it determines that the claims are entirely without merit. This is often done through a motion to dismiss, which may be filed by the defendant.

Sanctions: The court may impose sanctions on the plaintiff for bringing a frivolous suit. Sanctions can include financial penalties, such as requiring the plaintiff to pay the defendant’s legal fees and court costs. Sanctions are intended to discourage the filing of frivolous or abusive lawsuits.

Rule 11 Sanctions (Federal Court): In federal court, Rule 11 of the Federal Rules of Civil Procedure allows the court to impose sanctions if a party submits pleadings, motions, or other papers that are not well-grounded in fact or law. Sanctions under Rule 11 can include fines or orders to pay the opposing party’s legal costs.

Contempt of Court: In extreme cases, if a plaintiff's behavior is particularly egregious or obstructive, the court might hold the plaintiff in contempt of court. This can result in additional penalties, including fines or other measures.

Referral to Disciplinary Authorities: If the frivolous suit is filed by an attorney, the court might refer the matter to the appropriate bar association or disciplinary authority for investigation and possible disciplinary action against the attorney.

Warning or Admonishment: The court may issue a warning or admonishment to the plaintiff or their attorney, cautioning them against filing such suits in the future. This can sometimes be part of the court’s order when dismissing a case or imposing sanctions.

Restrict Future Filings: In some cases, particularly where a plaintiff has a history of filing frivolous lawsuits, the court might impose restrictions on the plaintiff’s ability to file future lawsuits without permission. This is more common in cases involving vexatious litigants.

By taking these actions, the court aims to prevent misuse of the legal system and to ensure that legal resources are used efficiently and appropriately.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=175107526

All you are going to get, "why" questions, whenever you ask a question. You'll never actually get an direct answer to any specific question about this company's past deeds.

You'll get farther if you nail one foot to the floor and walk for days.

Misdirection is the only answer.

IMO, this is best just flipped every time there is another dip and sold on the pop.

GLTU

Because because because the irrefutable can't be refuted

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=175107526

Because I am not the one concerned about it! If you sent emails to TSOI twice requesting a conference call with shareholders, those emails would still be in your “sent” email history so feel free to post them here on this board showing the dates on them for our own reading purposes! Again, it should only take about 30 seconds! Why not do TSOI Facebook forum knowing you already stated you do Stockwits, Yahoo, and Ihub message boards? You seem very unhappy with everything that is going on with TSOI so adding some disgruntled posts to the TSOI Facebook page, it should help your cause for holding accountability to TSOI? Go sail away with that golden idea…

I have a better idea. I don`t do facebook. Why don`t YOU ask him since I already did twice and got nowhere. As you say, "it will only take 30 seconds of your time". Let me know how you make out. Thanks in advance and good luck with TSOI for all of us.

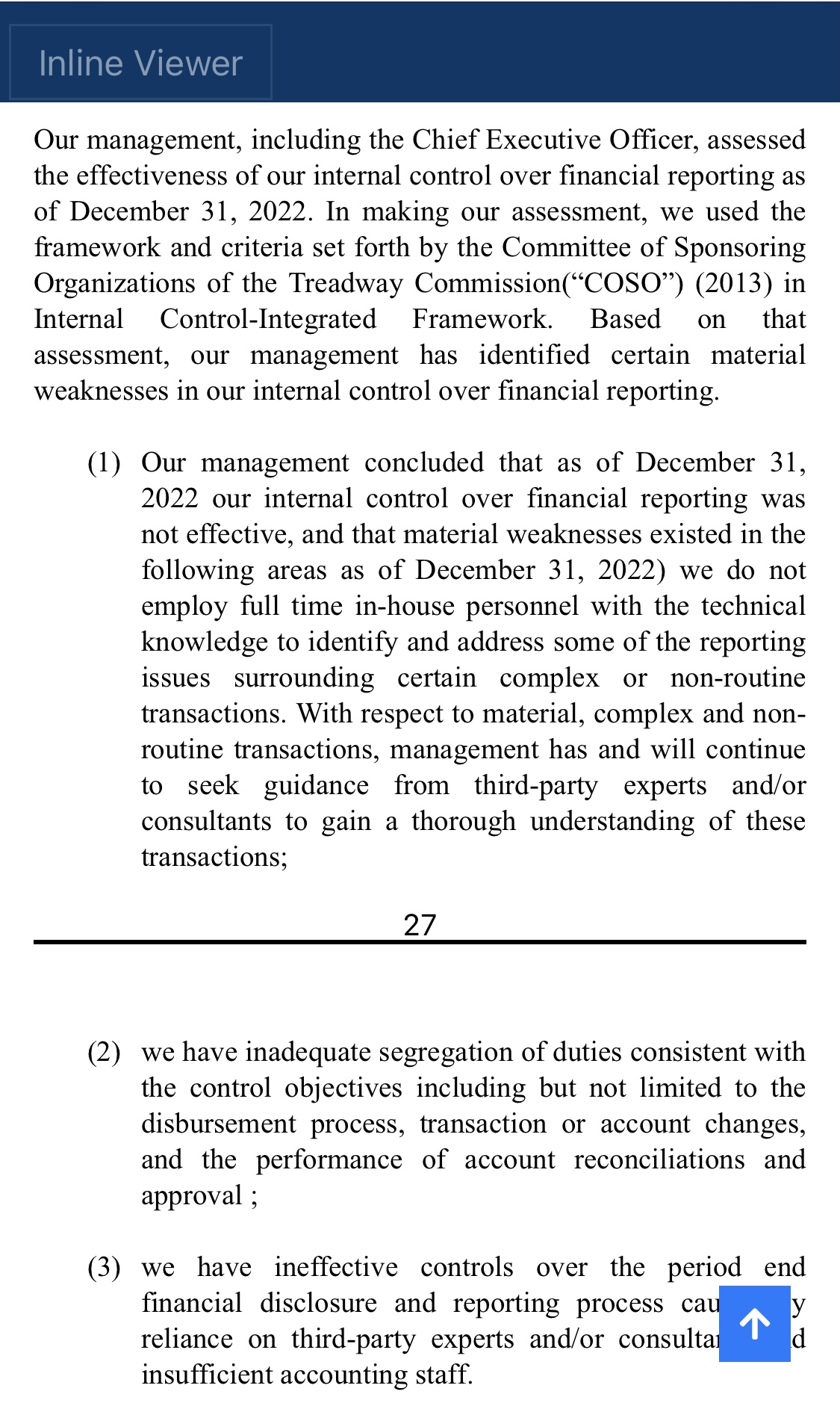

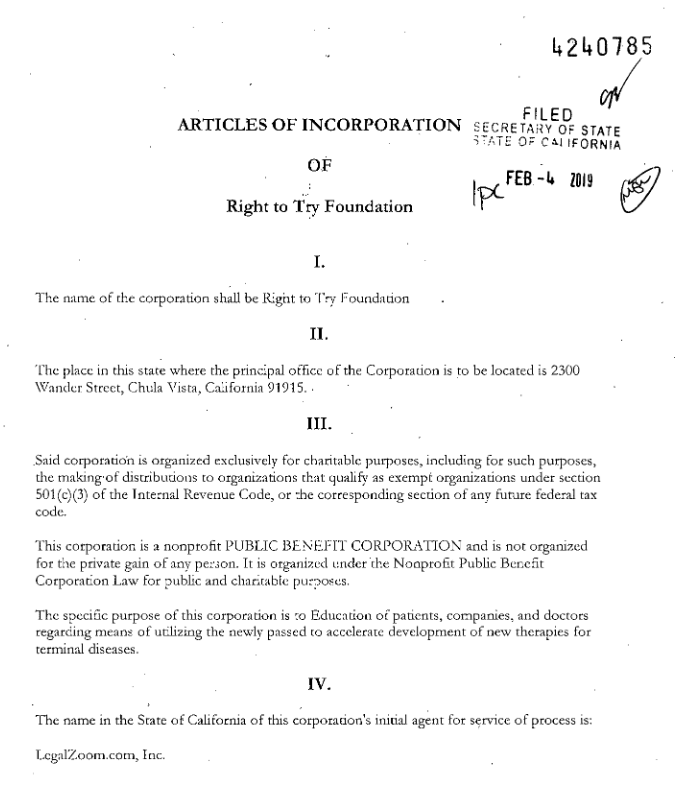

Offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline

The elimination of monetary liability against our directors and officers under the Company’s Articles of Incorporation and Nevada law, and the existence of indemnification rights to our directors, officers and employees, may result in substantial expenditures by the Company.

Article 6 of our Articles of Incorporation exculpates our directors and officers from certain monetary liabilities. Article 7 of our Articles of Incorporation provides that we shall indemnify all directors (and all persons serving at our request as a director or officer of another corporation) to the fullest extent permitted by Nevada law.

Further pursuant to Article 7, the expenses of the indemnified person incurred in defending a civil suit or proceeding must be paid by us as incurred and in advance of the final disposition of the action, suit, or proceeding under receipt of an undertaking by or on behalf of the indemnified person to repay the amount if it is ultimately determined by a court of competent jurisdiction that he or she is not entitled to be indemnified by us.

The foregoing indemnification obligations could result in us incurring substantial expenditures, which we may be unable to recoup. These provisions and resultant costs may also discourage us from bringing a lawsuit against directors and officers for breaches of their fiduciary duties even though such actions, if successful, might otherwise benefit us and our stockholders.

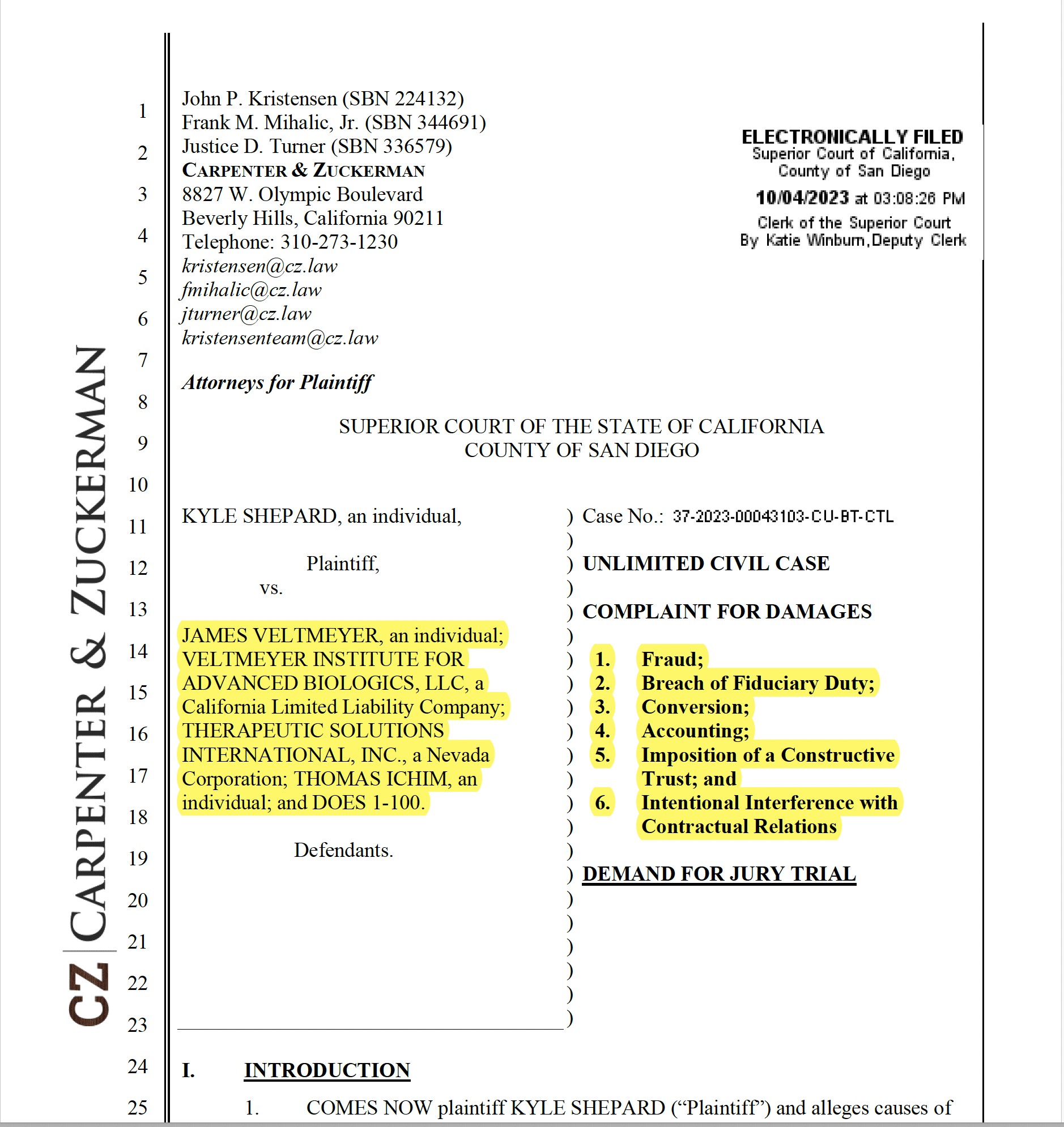

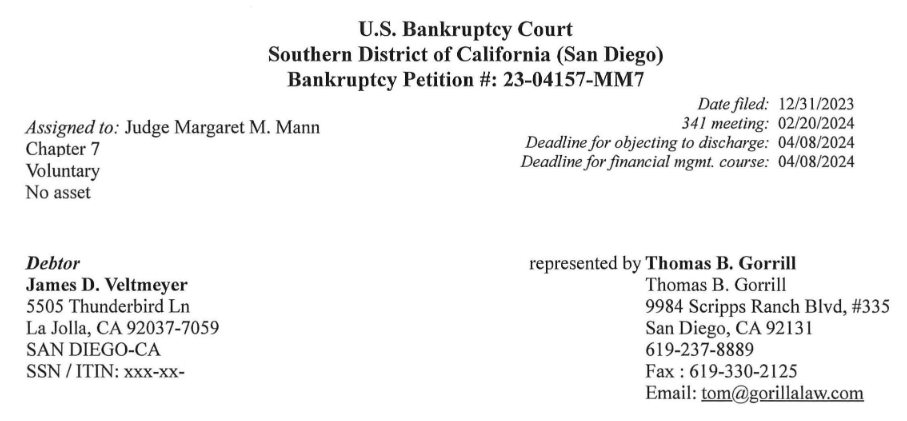

ITEM 3 LEGAL PROCEEDINGS.

From time to time, claims are made against us in the ordinary course of business, which could result in litigation. Claims and associated litigation are subject to inherent uncertainties and unfavorable outcomes could occur, such as monetary damages, fines, penalties, or injunctions prohibiting us from selling one or more products or engaging in other activities. The occurrence of an unfavorable outcome in any specific period could have a material adverse effect on our results of operations for that period or future periods.

-29-

However, as of the date of this report, management believes the outcome of currently identified potential claims and lawsuits will not have a material adverse effect on our financial condition or results of operations.

Currently identified

Cost of goods sold decreased $42,672, from $79,440 to $36,768, for the years ended December 31, 2022 and 2023, respectively. This decrease was mainly due to lower net sales of the Company’s nutraceutical line of products in 2023 vs 2022.

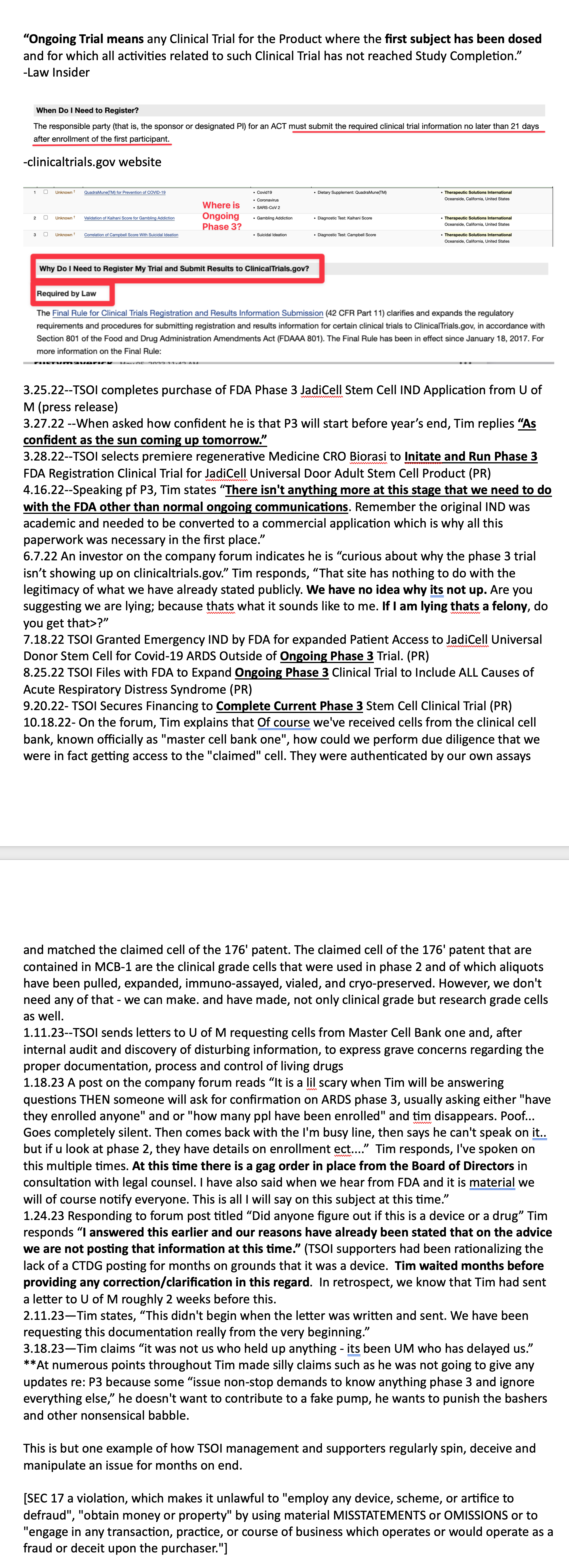

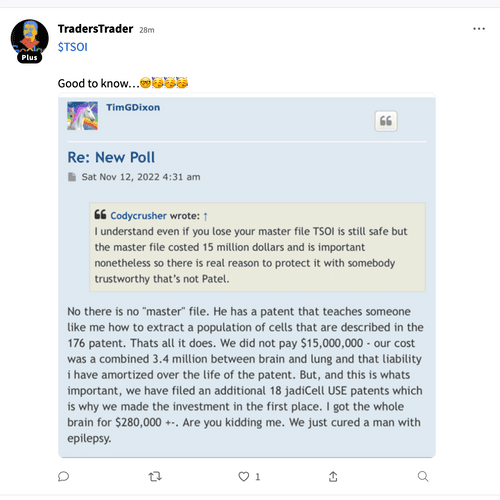

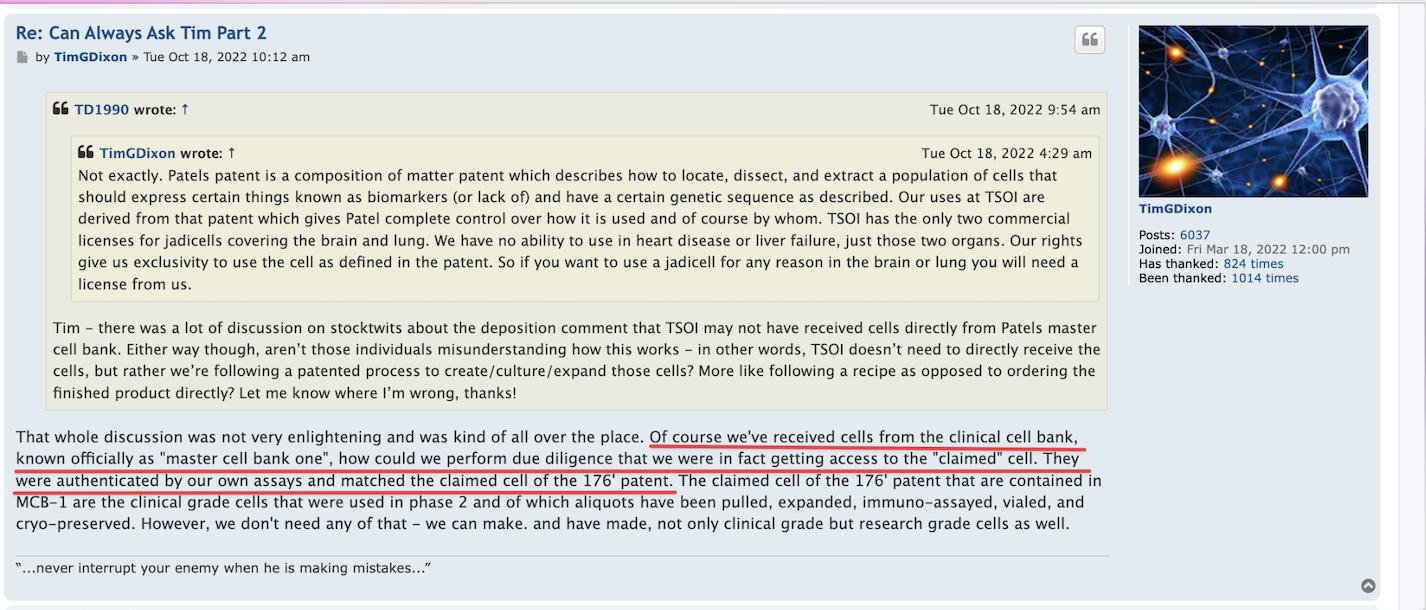

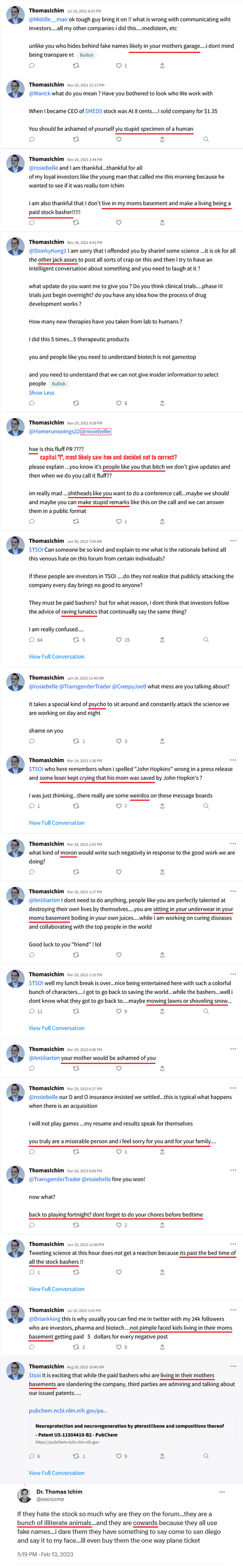

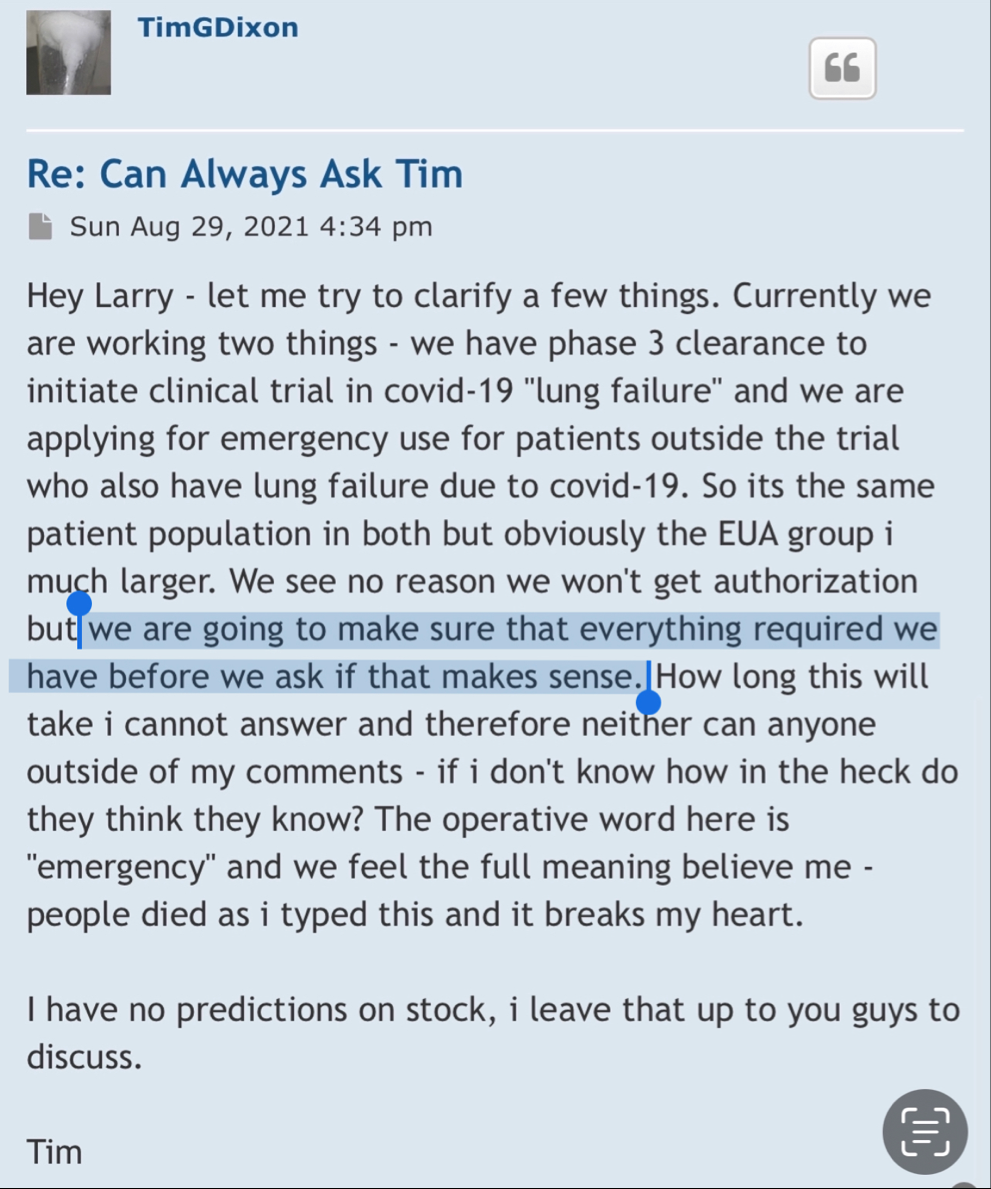

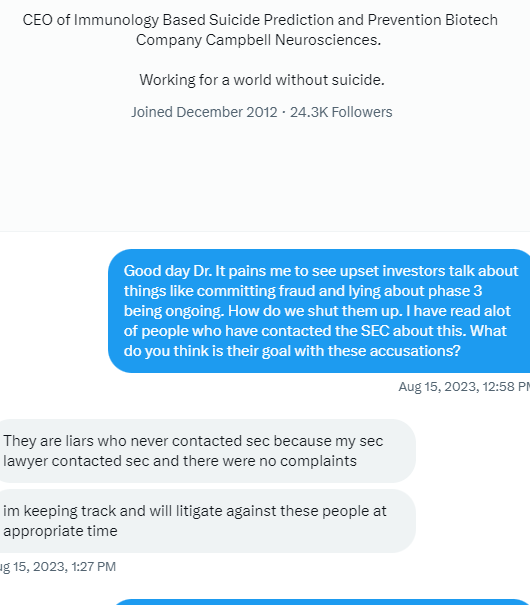

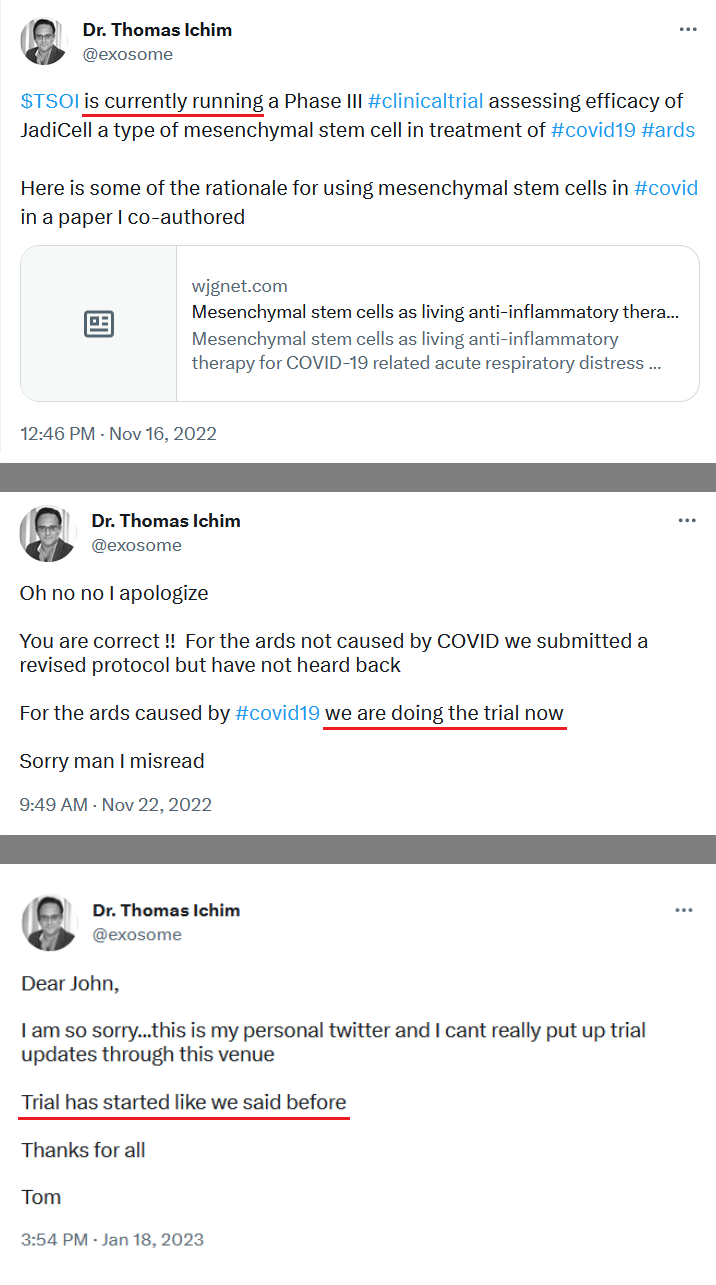

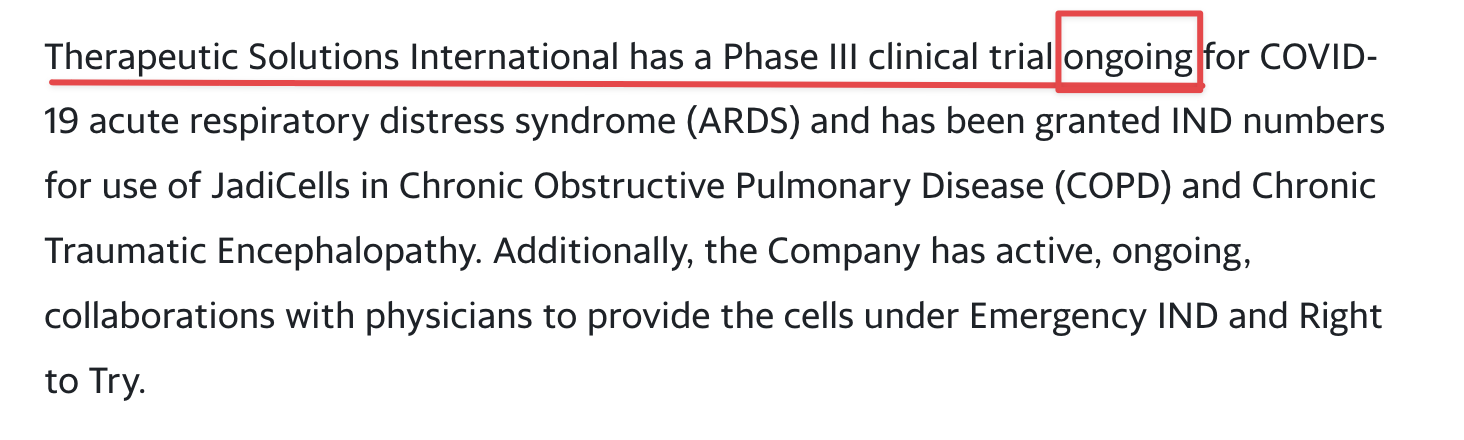

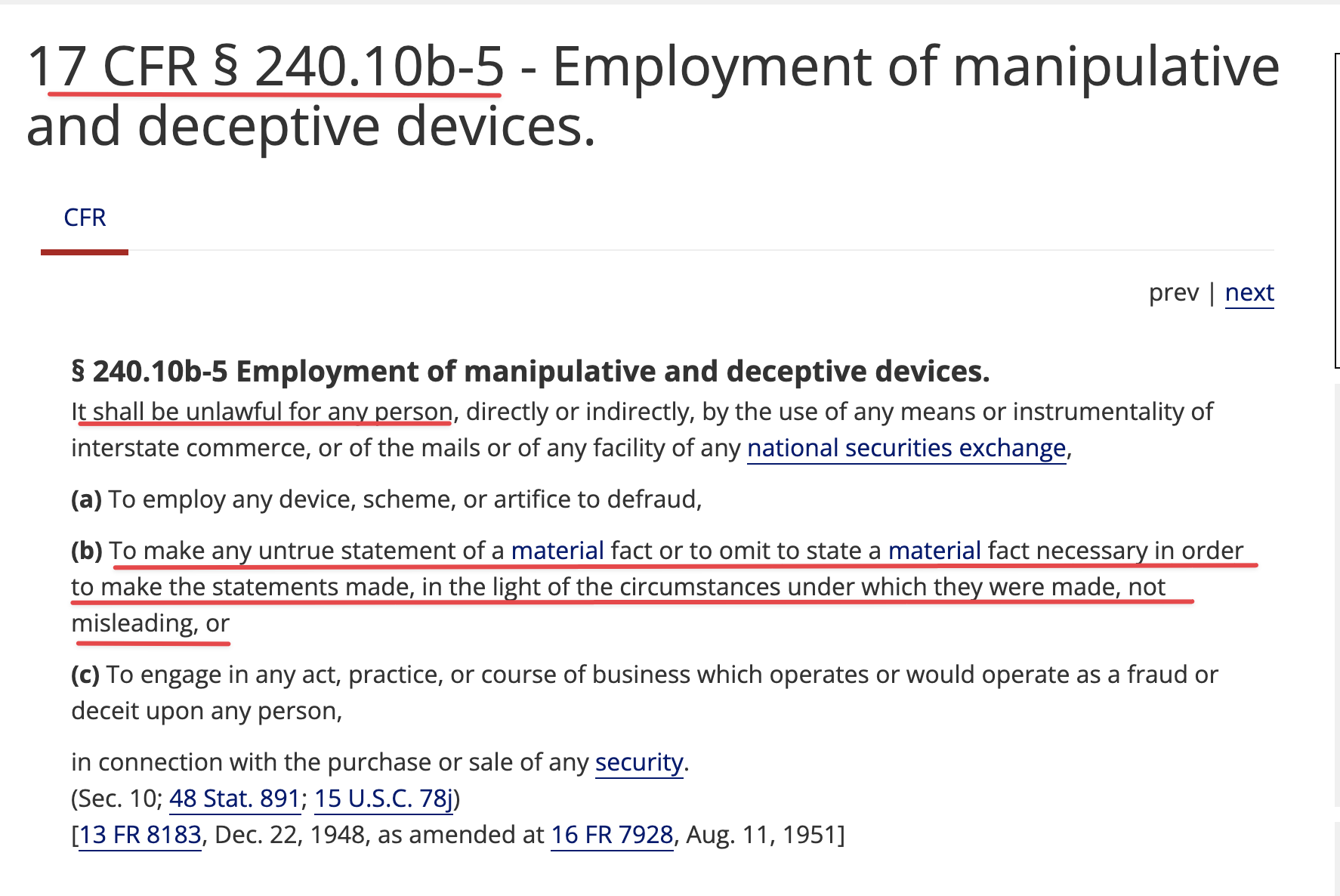

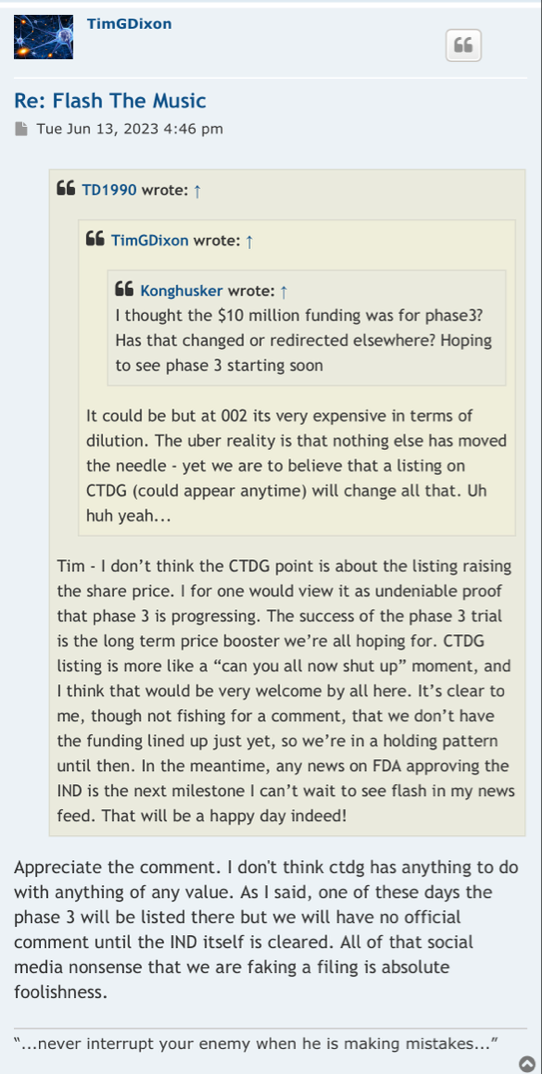

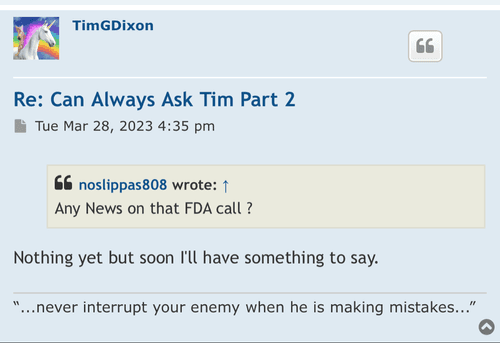

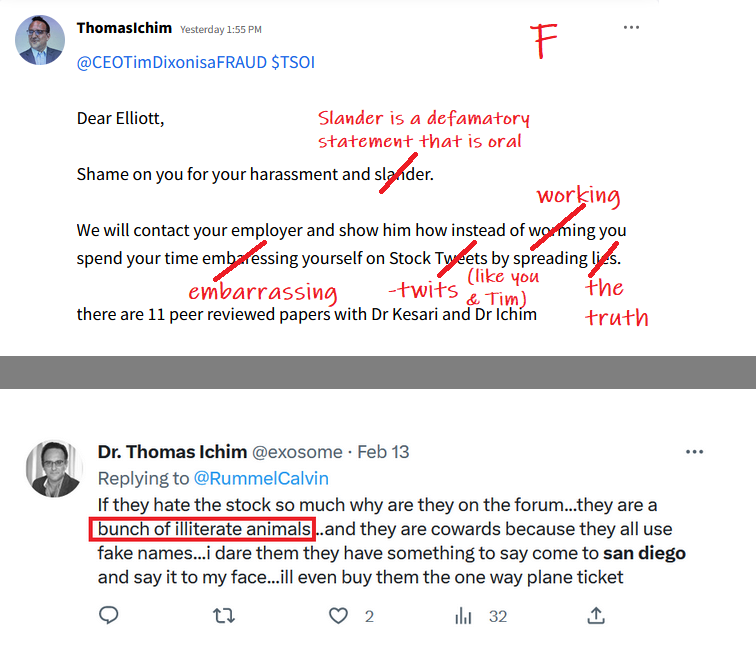

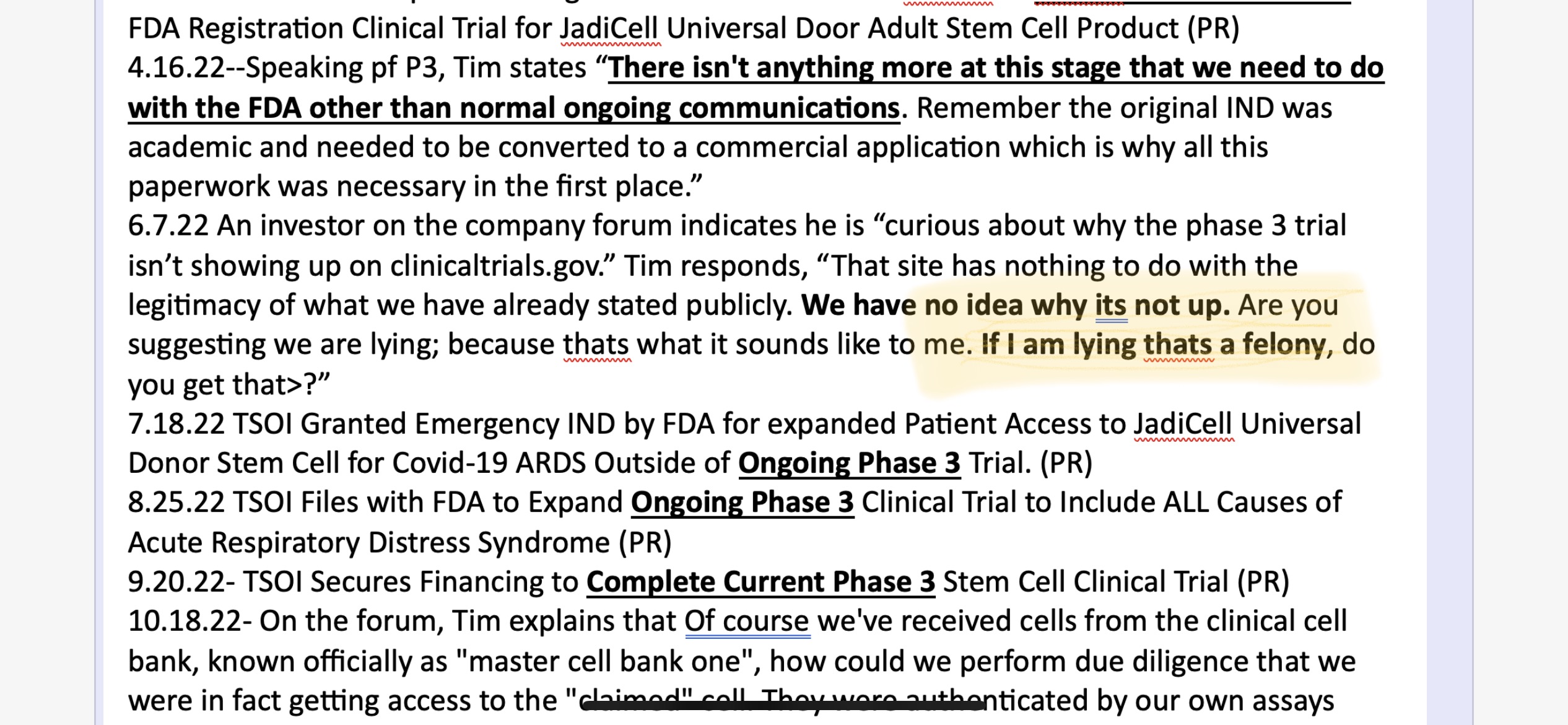

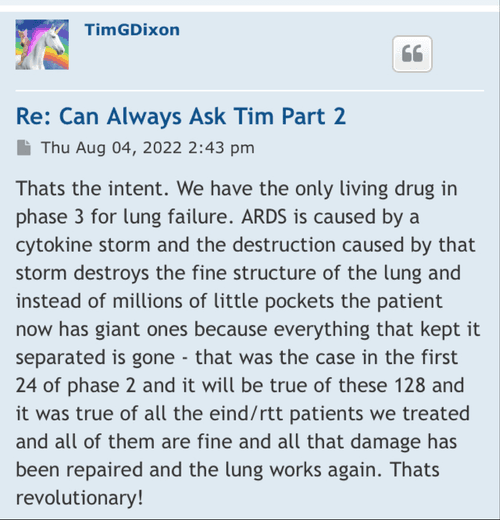

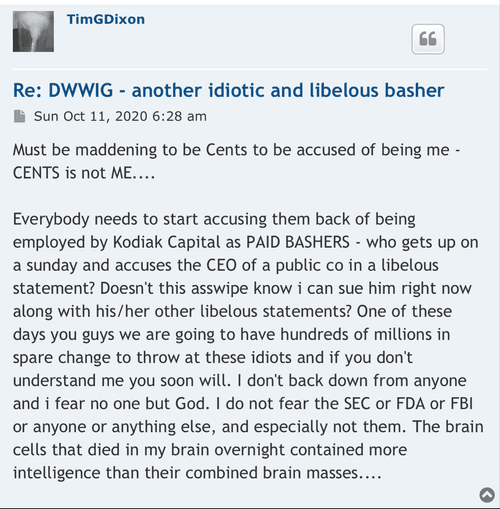

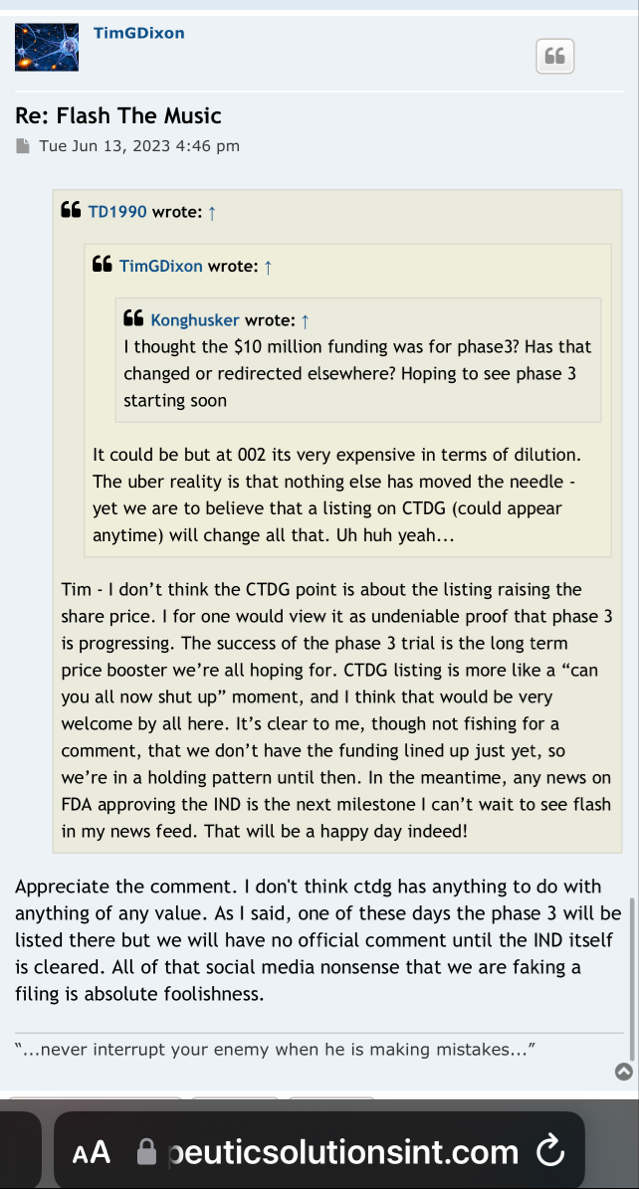

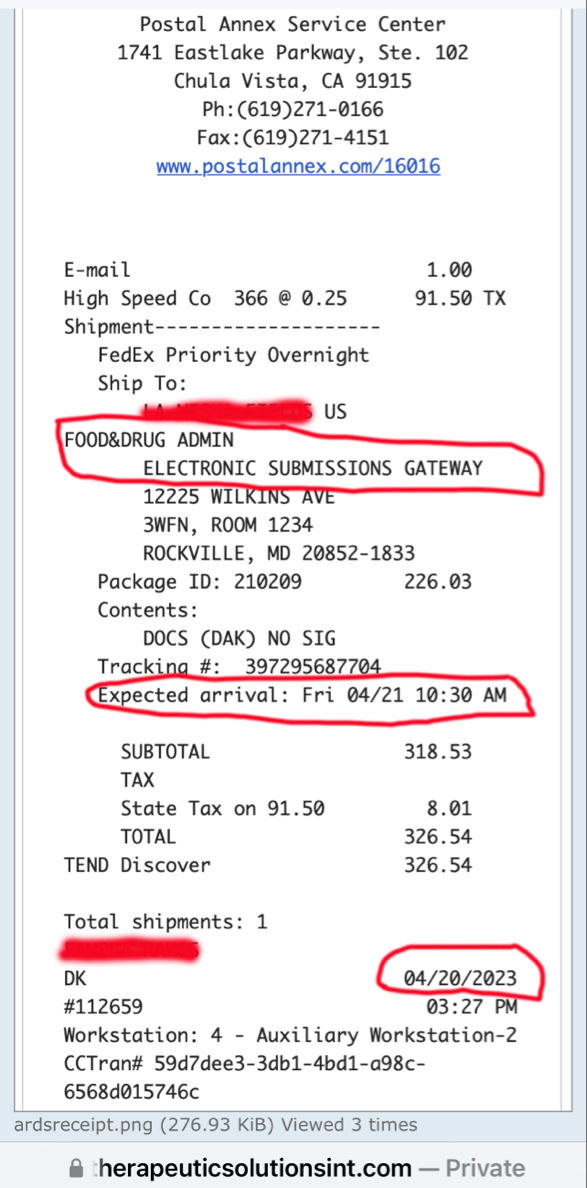

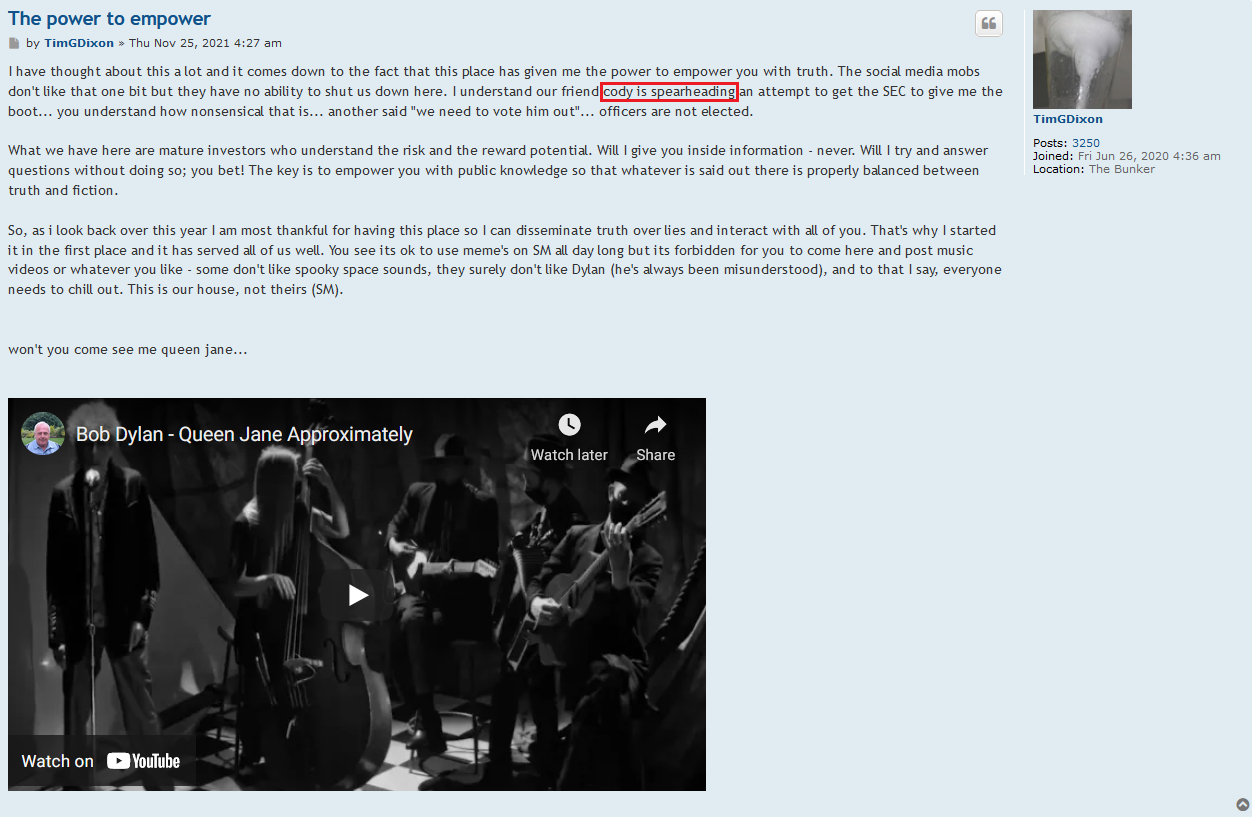

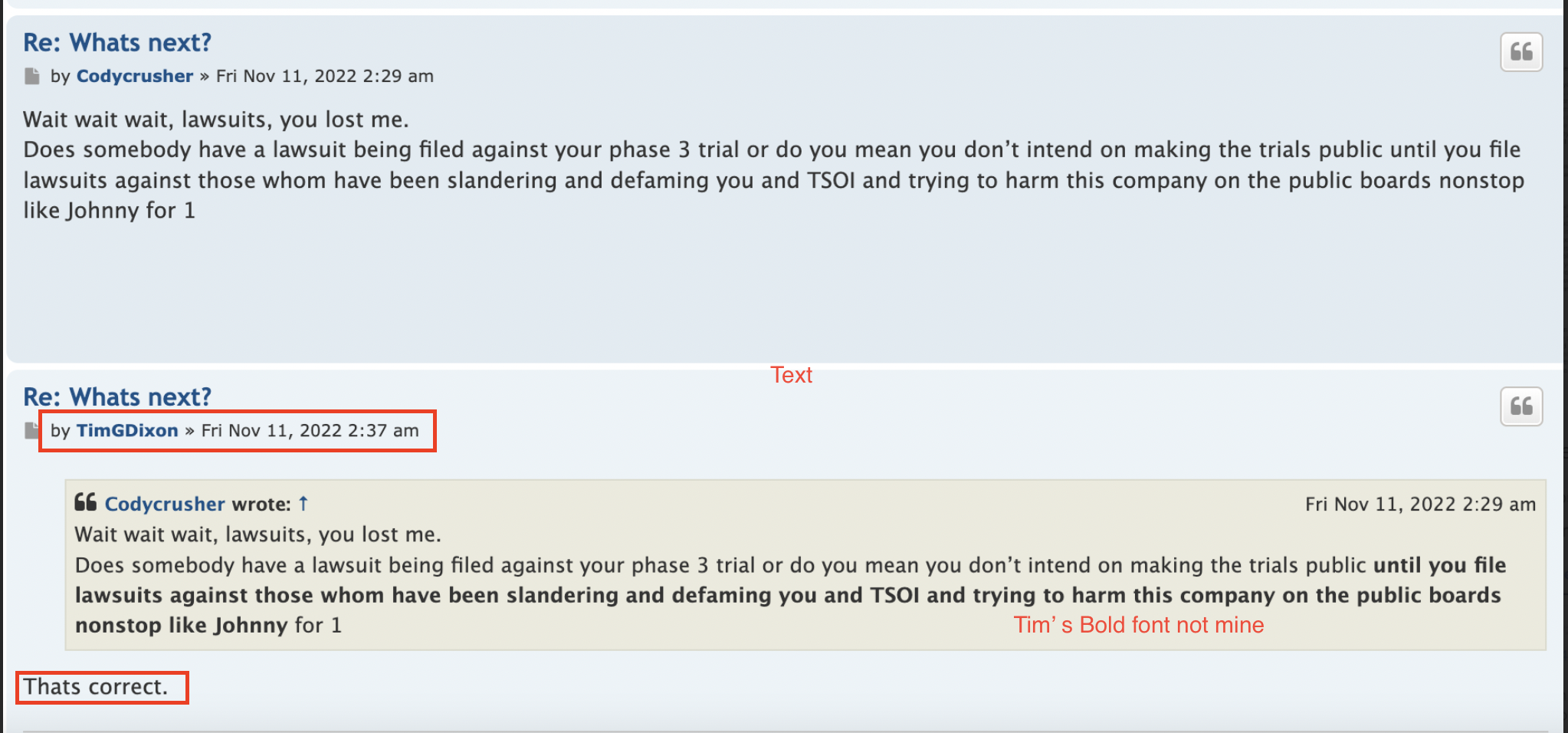

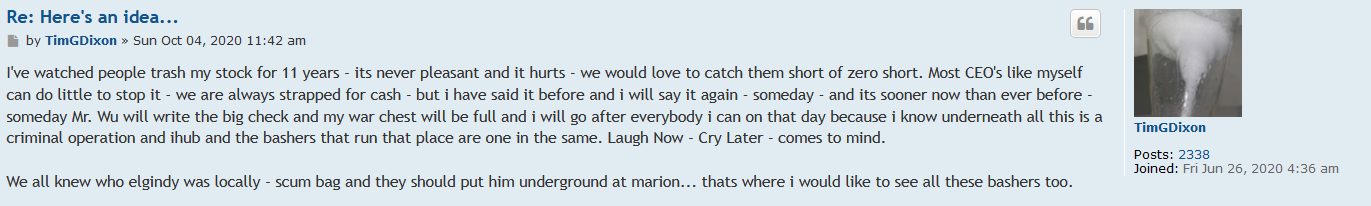

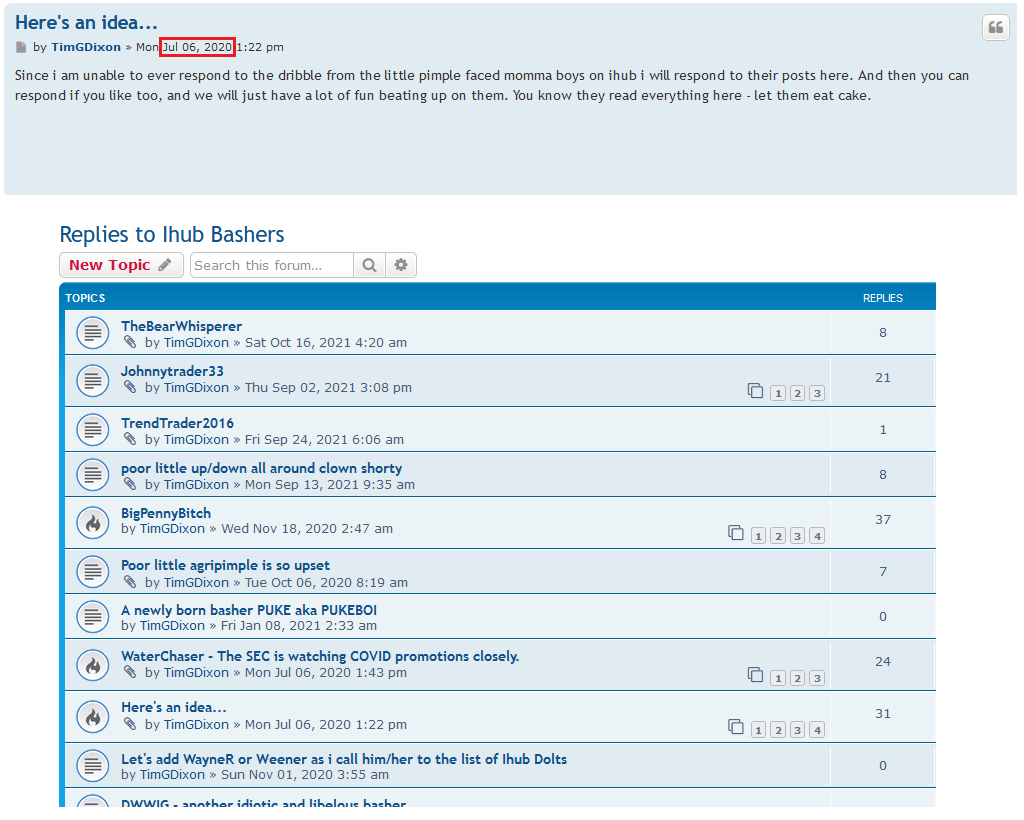

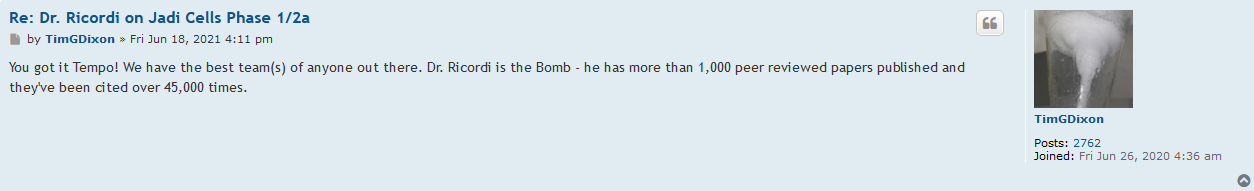

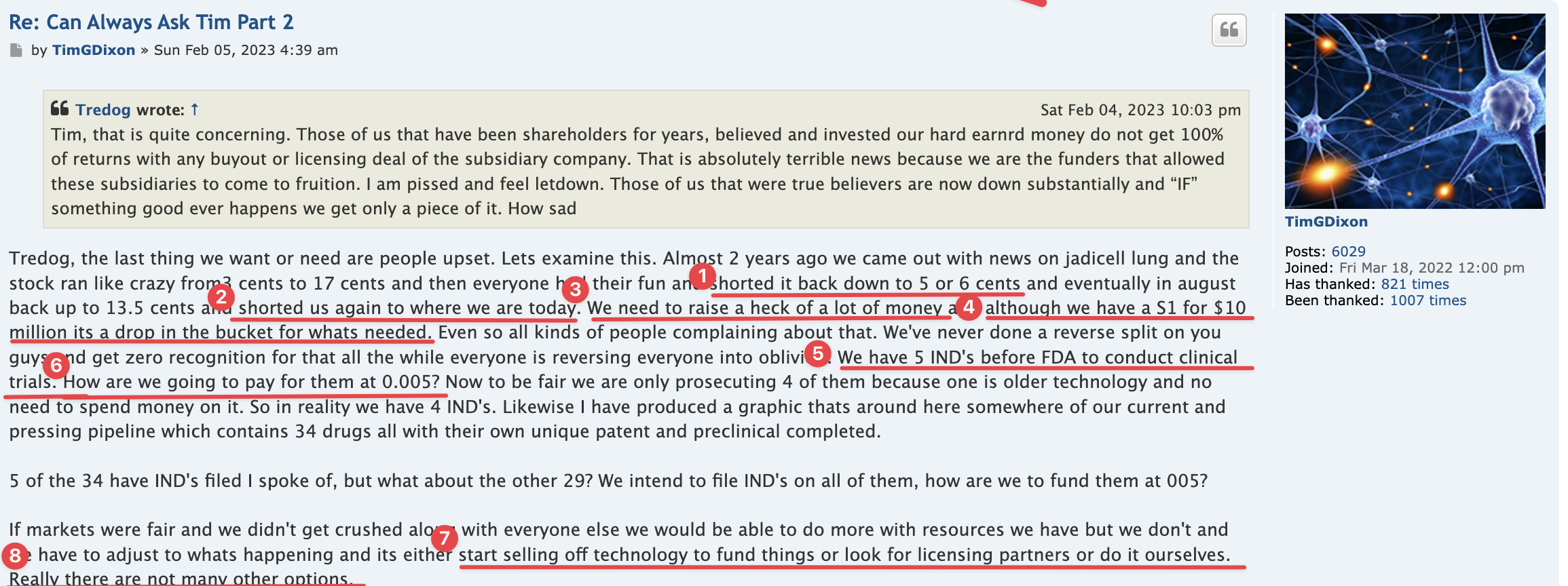

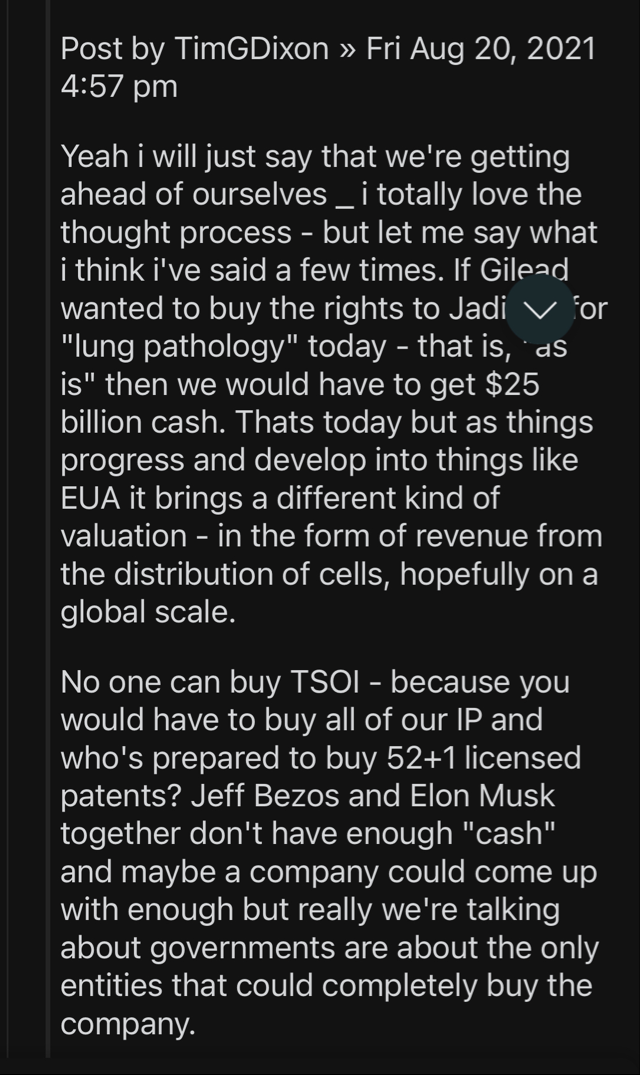

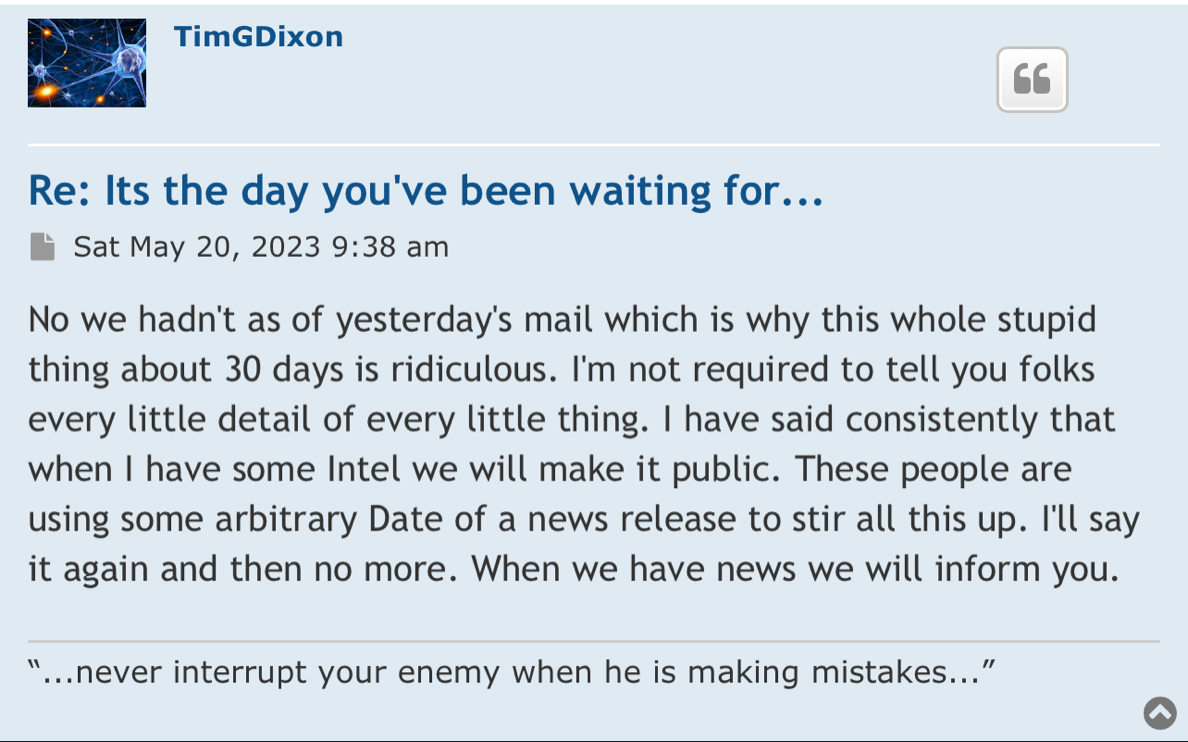

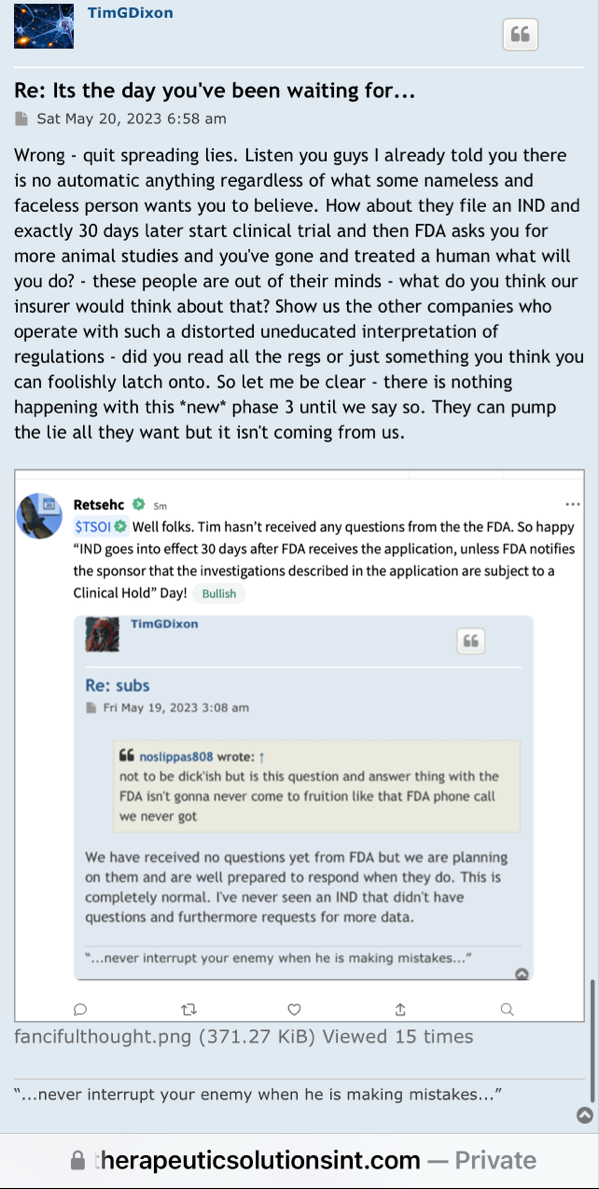

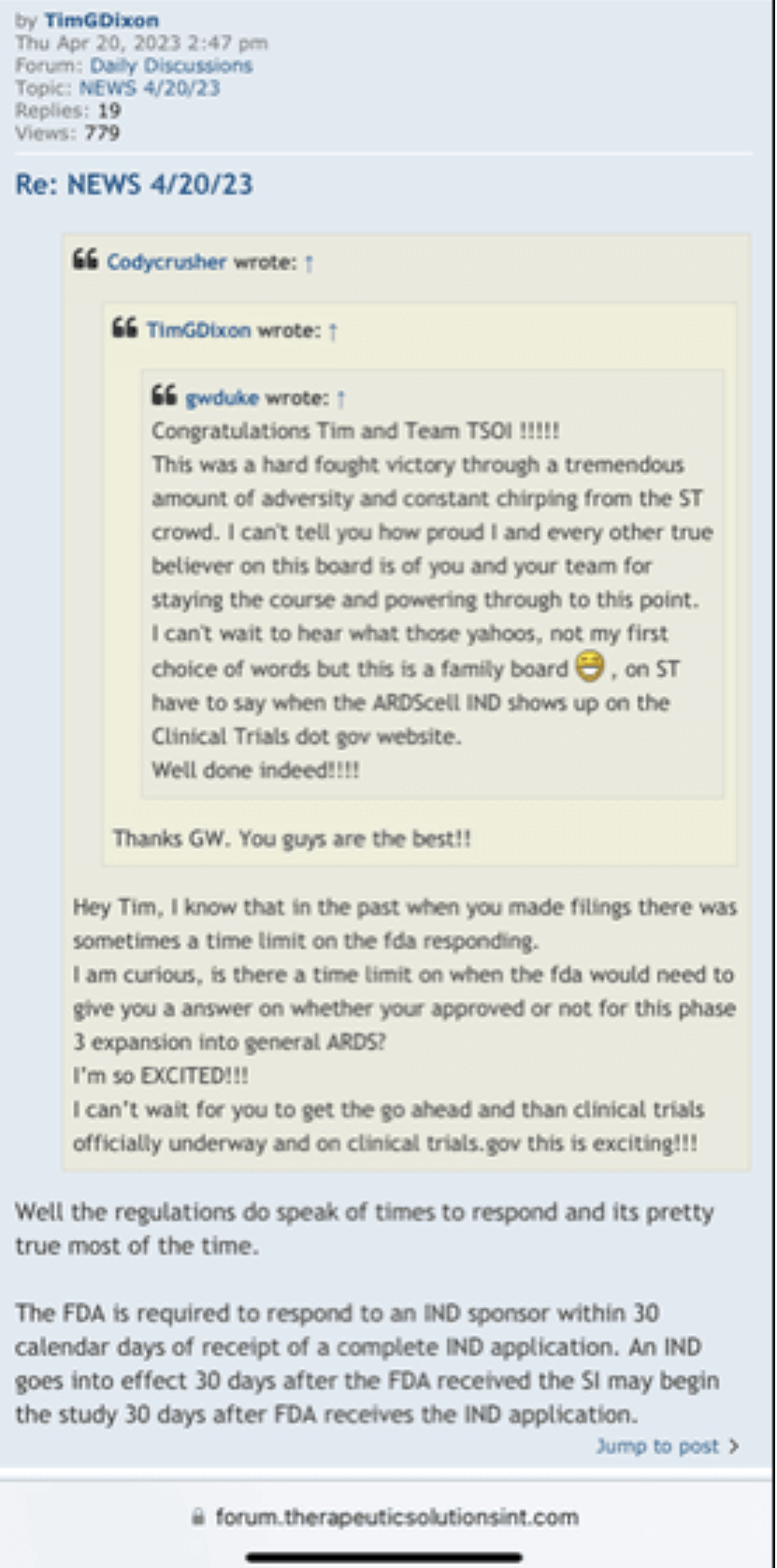

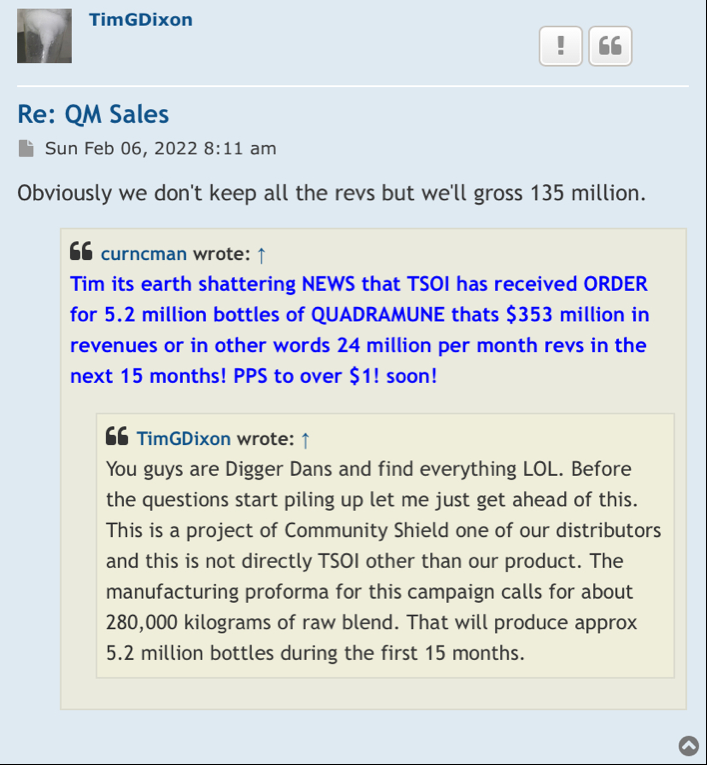

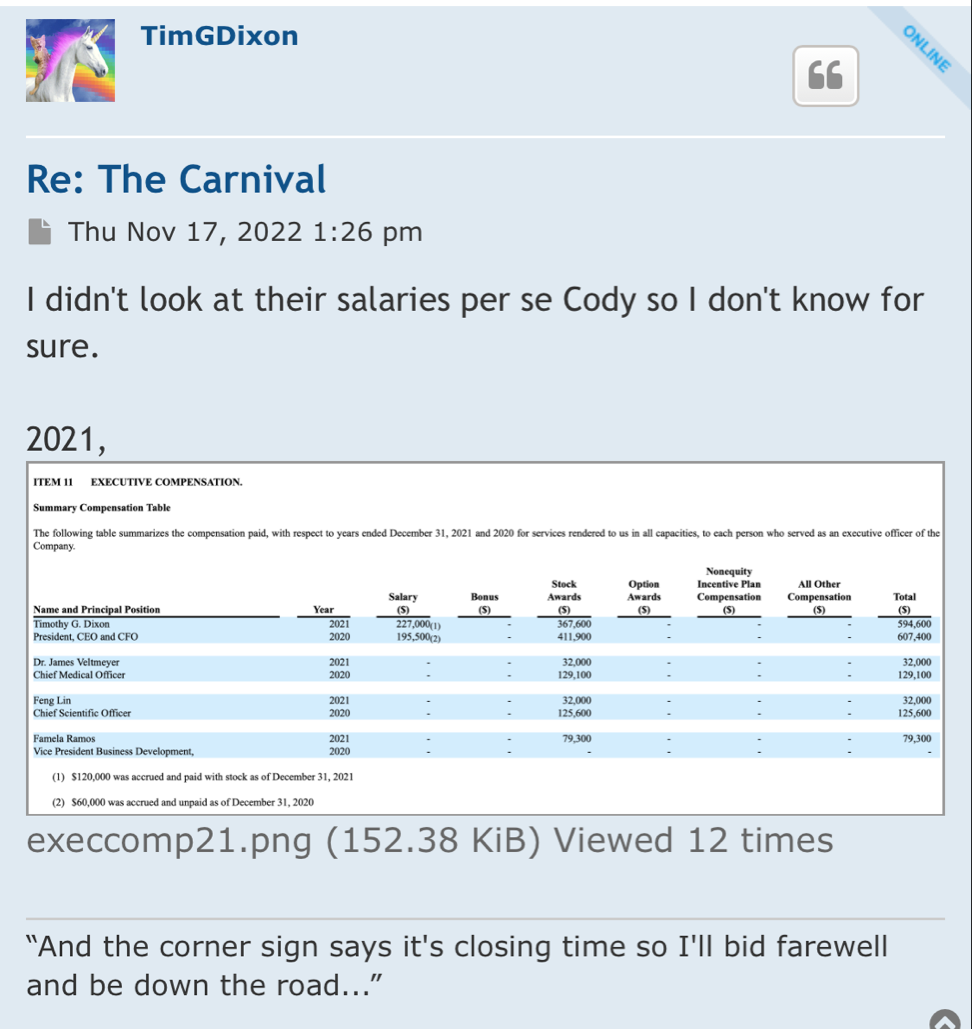

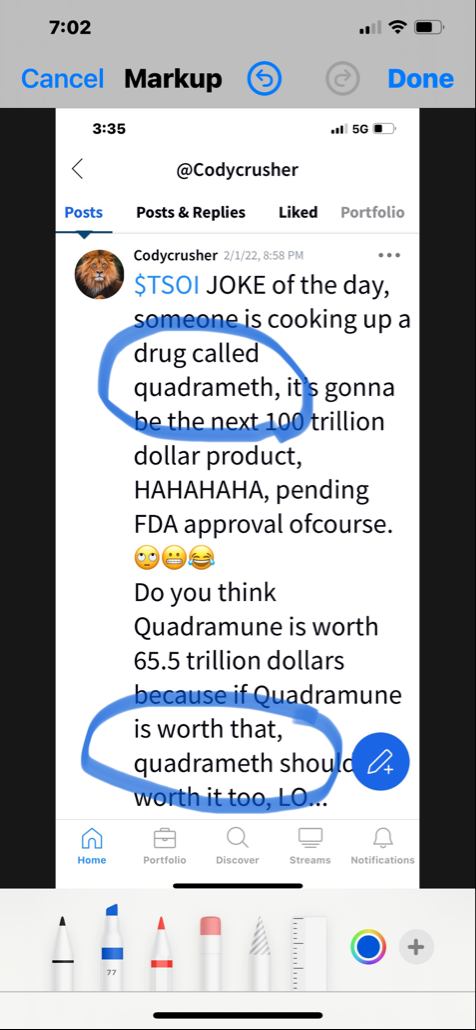

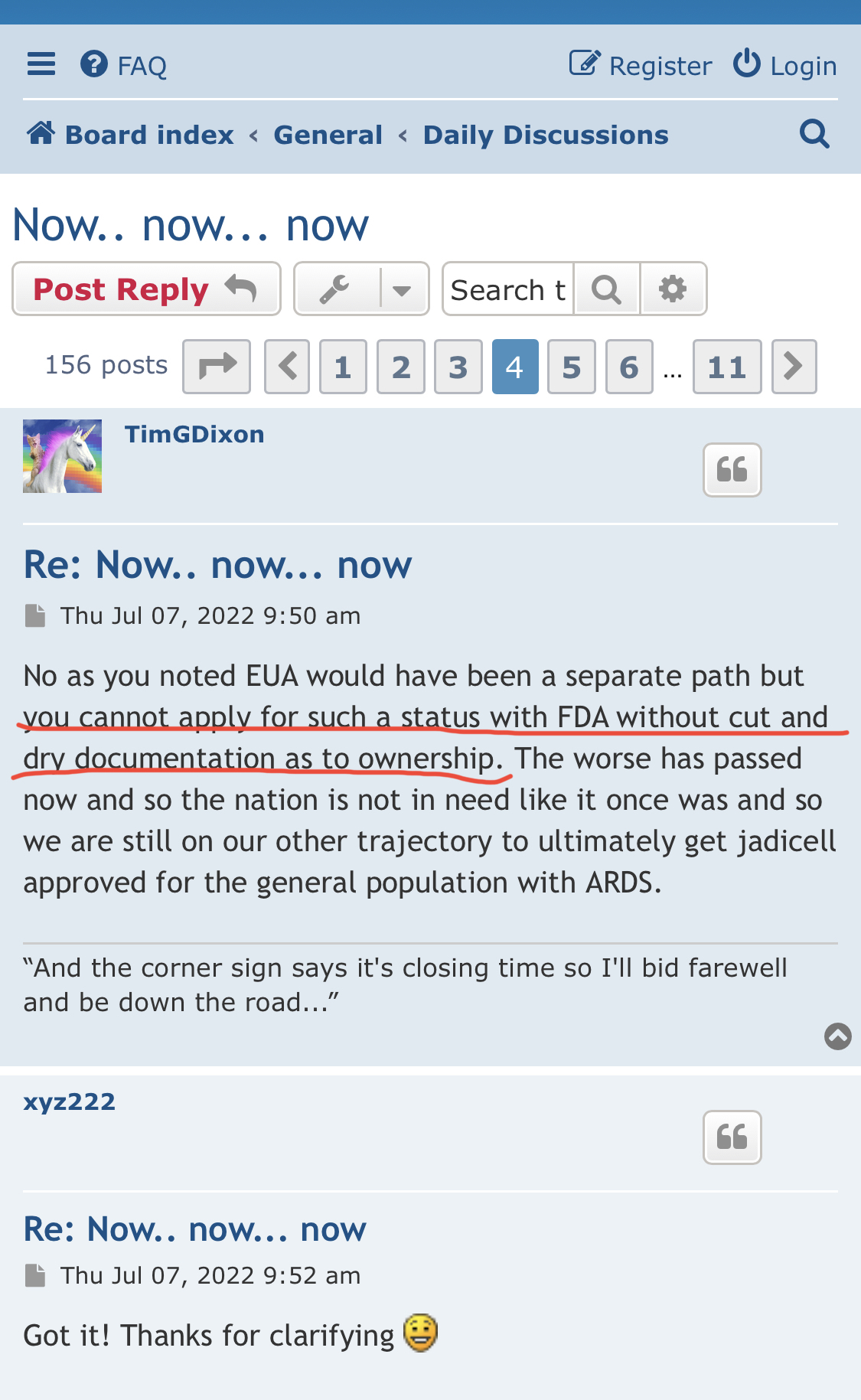

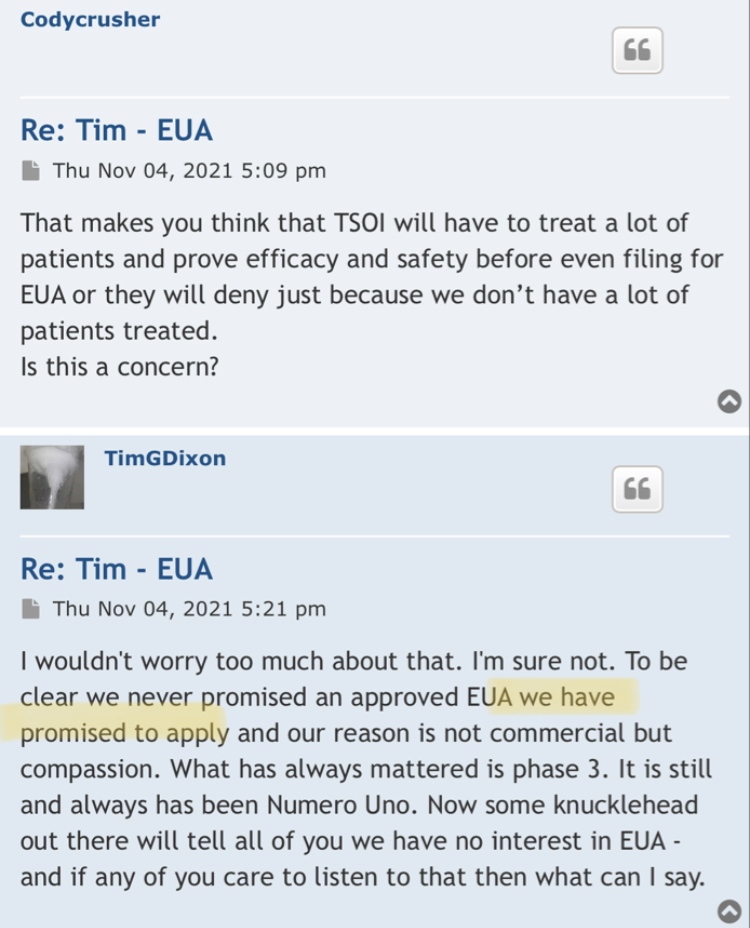

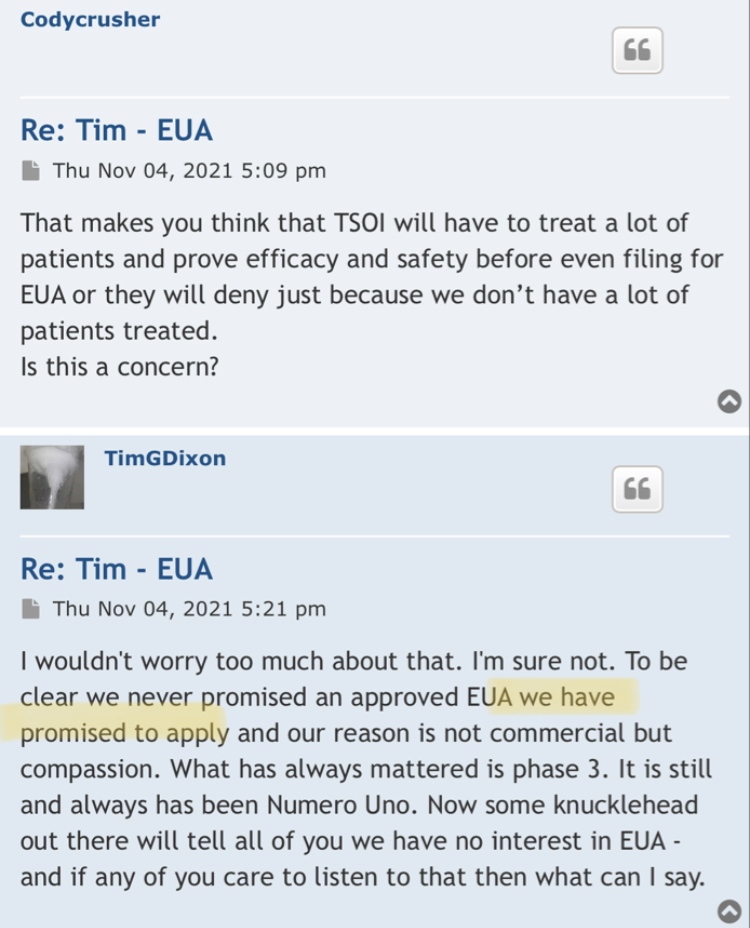

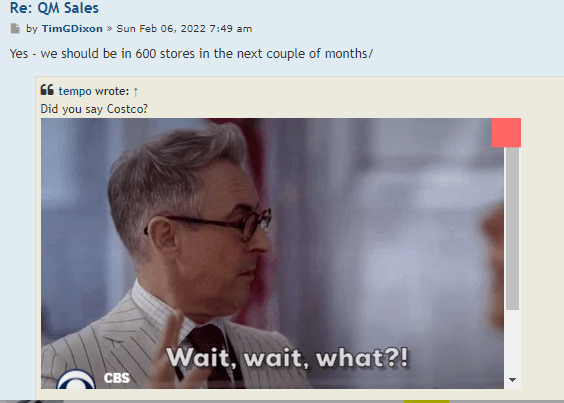

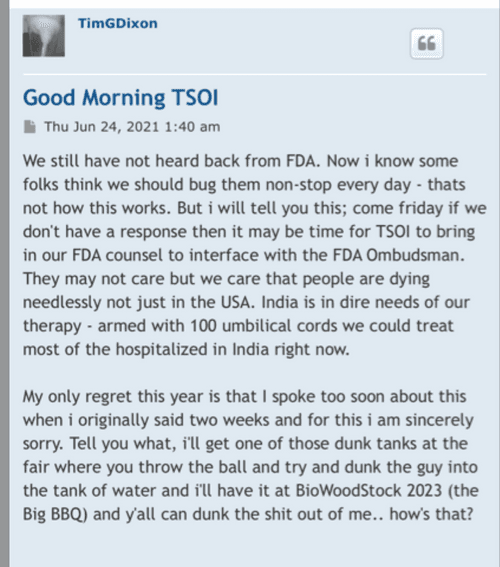

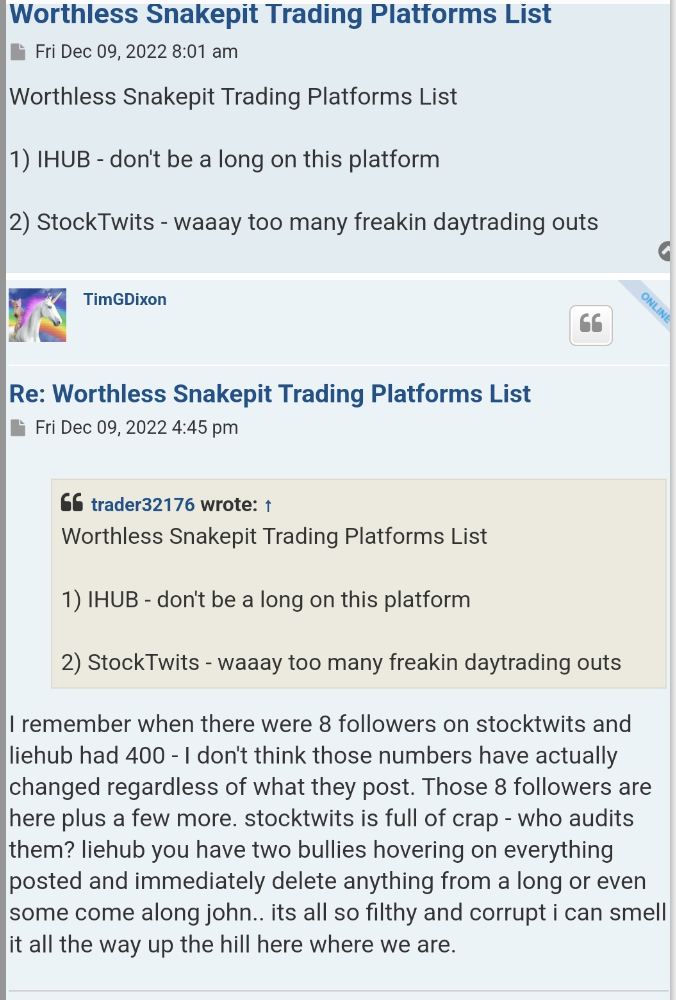

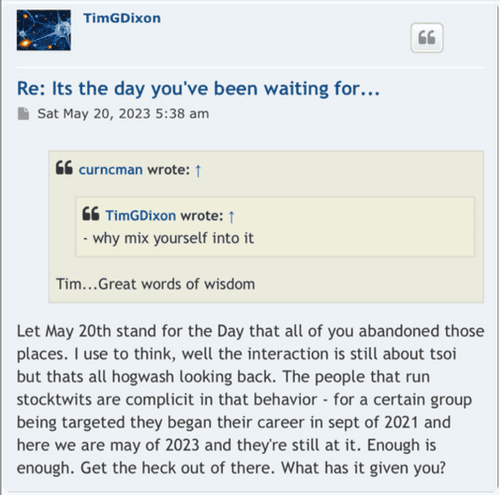

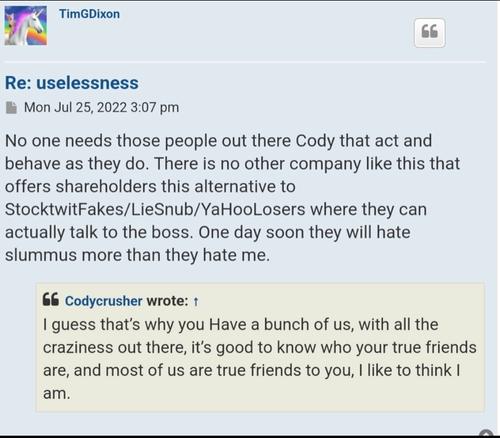

$Dixon’s own words w/ quotes & $screenshots no other commentary needed

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=175066730&txt2find=MAGAnify

That’s funny stuff! I would have thought the TSOI attorneys were the ones suing specific posters for defamation statements all while they are working on healing and medicine! I don’t think the damages of those defamation statements will be “cheap” if you know what I mean! As you mentioned about yahoo mbs, does anyone sound familiar who posted “But his patents!!! LOLOLOLOL!! But I got a baseball cap!”? Right! Captain Koolaid himself! That knucklehead has been defaming TSOI since the fall of 2021 and is why he holds the top position on the DOE’s list in the defamation case! It’s hard imagine that ANYONE would complain about the TSOI massive dilution, the secret lab and Idaho property, many major red flags for TSOI, and that the CEO is shady as can be and he didn’t trust this so called pretend scientist who walks around in a lab coat but it’s best to sell his TSOI at that time but will buy back at .03! Isn’t that truly remarkable? He was willing to buy back at .03 all while promoting the idea to the board that the share price has no bottom! The dude really needs to go on a boat ride imo! Do us all a favor and post on the TSOI Facebook page about your desire to do a conference call with the shareholders! It should only take about 30 seconds out of your day! At least you are making the idea public and immediately available to the viewing audience! Enjoy…

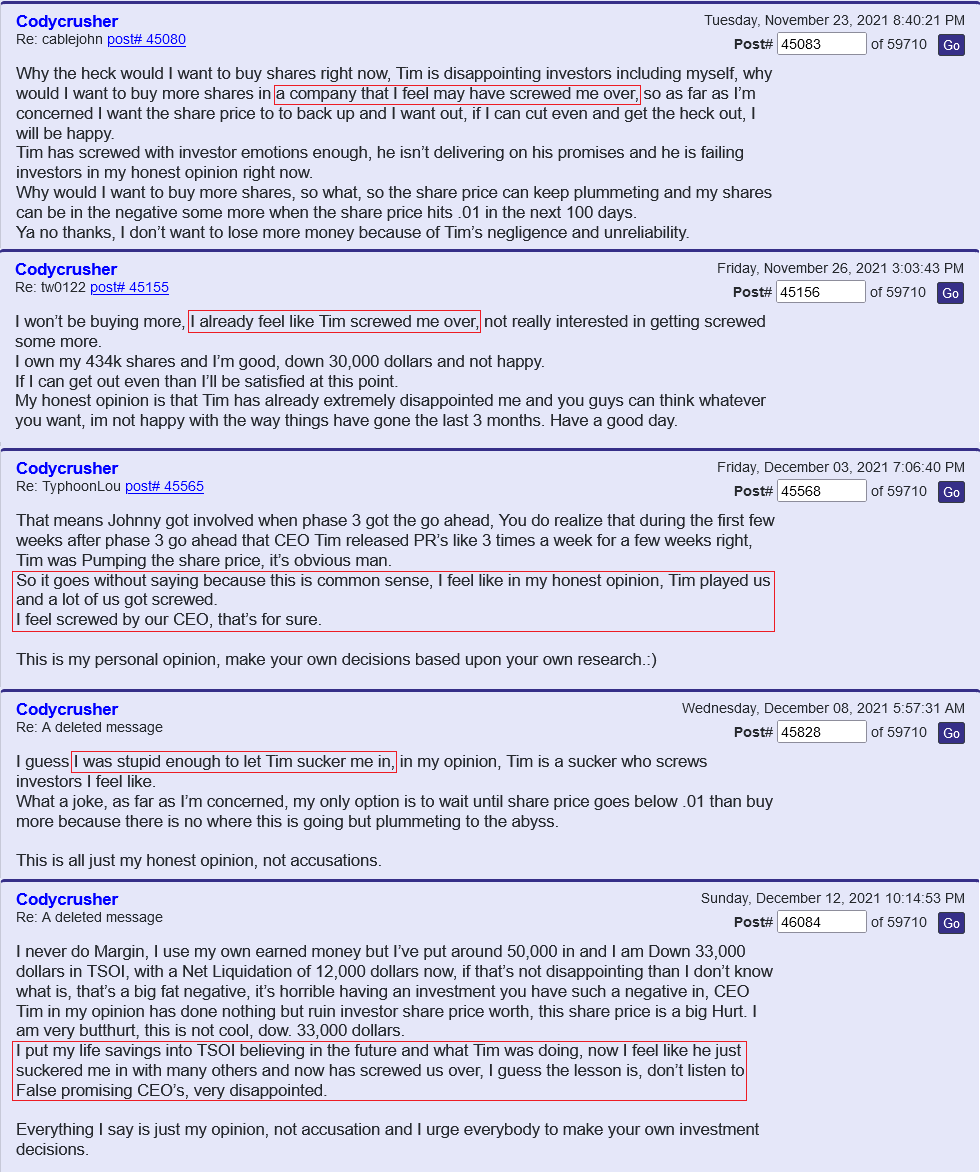

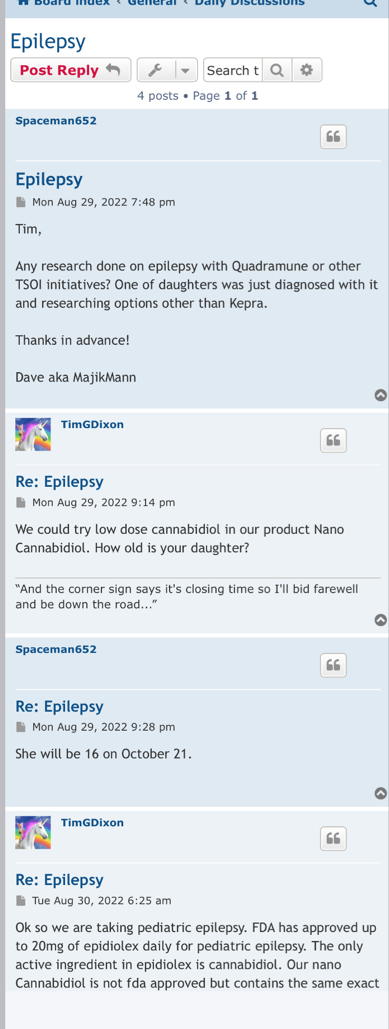

Had shares for years. Am entitled to divvy. Why do I question if company is legit? The company is supposedly suing it`s own shareholders for saying mean things about the company. If you read yahoo mbs you will see that happens every 2 seconds! I would have really thought the company would be working on the science of healing. The way to shut the naysayers up is to produce! Talk is cheap.

As for the naysayers who slam the company...No doubt they lost money and are upset. So what. The company has not produced yet. They do say all these glamorous thing that would leave one to think they will be rich, but it has been years of talk. I`ve emailed Tim about this and suggested he have a conference call more than once. Never heard back. I think that is why investors have doubts, plus shares have gone from a dime to .0007 cents.

No idea what that even means? "funny you already know the answer"

So what`s the answer? Wolfman?

Welcome aboard are new IHub poster as of today! I believe you would have had to been a current TSOI shareholder as of a certain date a while back to even be eligible for the Campbell Neuroscience divvy? And if you weren’t, it would not apply to you. If you are questioning if the divvy’s are legit, does that mean you don’t believe TSOI is legit? I personally wouldn’t be investing into a company that I didn’t think was legitimate. You have stated that you “also think the company may be legit” which makes me question if you’re on the fence and currently undecided about becoming a shareholder. Remember, current non shareholders of TSOI would definitely not be entitled to the Campbell Neuroscience divvy’s! I am sure you can understand that…. Also I question how you even would have been notified of the divvy’s if you weren’t already a TSOI shareholder at a certain time? Contact your broker if there is any confusion…

The dividends are legit. I put in the paperwork to the transfer agent New Horizon Transfer and received back a statement of my ownership of the shares. They are not at my brokerage account, but I guess are held by the transfer agent.

Question. Anyone who has this stock. Are you going to opt for divvy in Campell Neuroscience? Reason why I`m asking is when you apply they ask you " Note If you elect into the stock option of this event it will require the disclosure of your name, address, email address, phone number and tax ID number to the issuer and their transfer agent. Additionally, the new shares issued from this event cannot be held in your account.

I was wondering if they were using this as a tool to get your info so they can find out who said bad things about them on stocktwits, yahoo etc. I`ve had my doubts if it is legit, e.g. the lawsuit about posters speaking ill of company. What president or ceo would even care. Don`t they have regular work to do instead of trolling market boards? I also think company may be legit. e.g. who would go through all the trouble and science for a few dollars, and they could get sued themselves. Comments?

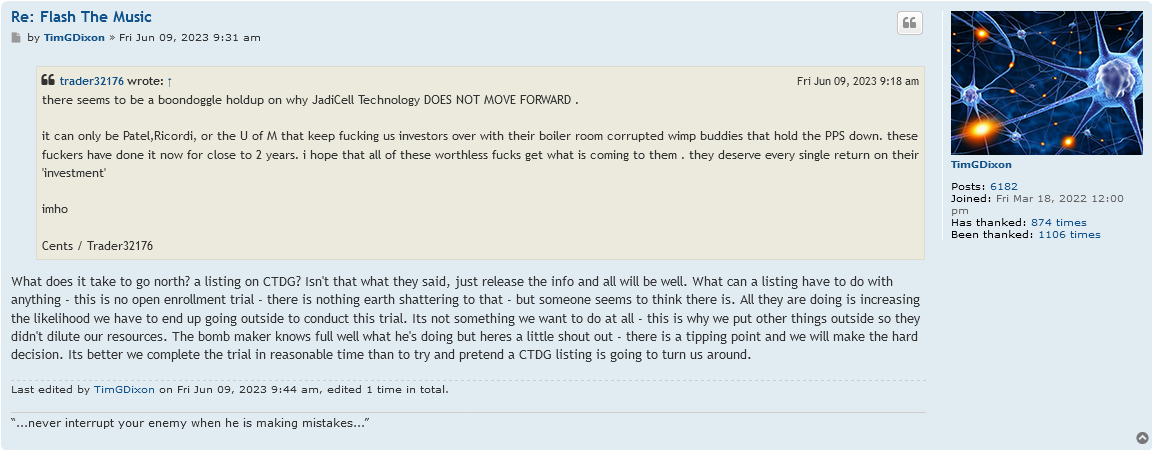

hopefully TSOI can hold off on the diluting, and come out with some JadiCells NEWS

Stay tuned almost here

That’s like asking why anyone would buy back into a SCAM at .03? Even one with dilution, I mean the massive dilution that was coming? Scroll through the posting history here last week because obviously SCAMS MUST BE GREAT INVESTMENTS! It can’t get any clearer! People have to think TSOI must have a great future and be a fan of Tim’s koolaid…

how are they great? I mean scroll down and read the lies. How is that great? Come on you gotta sell it man.

Show us this greatness cause the facts are this is a complete SCAM.

Sure dies down when there's no shares being dumped.

Complaining on the board does nothing. If you think you got a case consult an attorney. Better call Saul lol

pure facts ya know the ones us abused shareholders post about and get slandered by the CEO......

https://stocktwits.com/rustymaverick/message/586180544

|

Followers

|

526

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

65516

|

|

Created

|

10/04/08

|

Type

|

Free

|

| Moderators BigBadWolf johnnytrader33 JMC$ Yooperman Hogwarts | |||

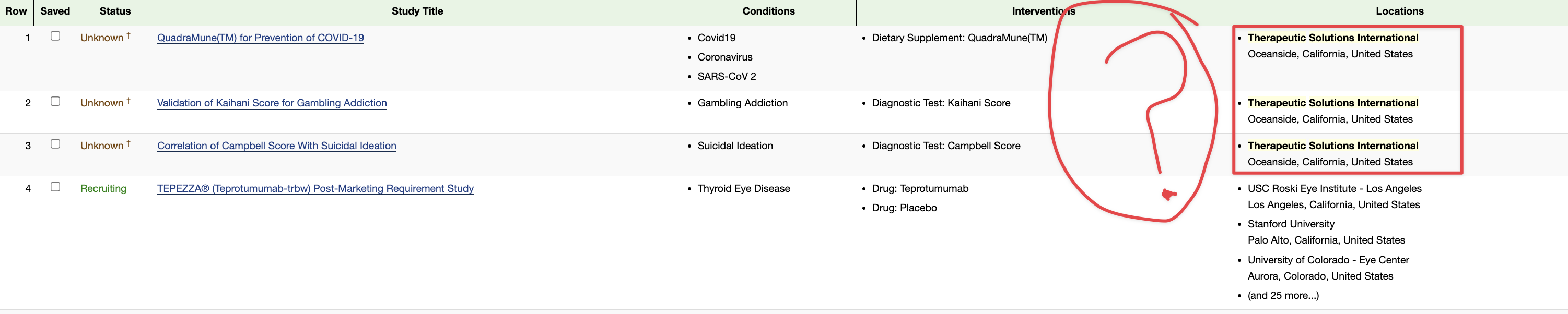

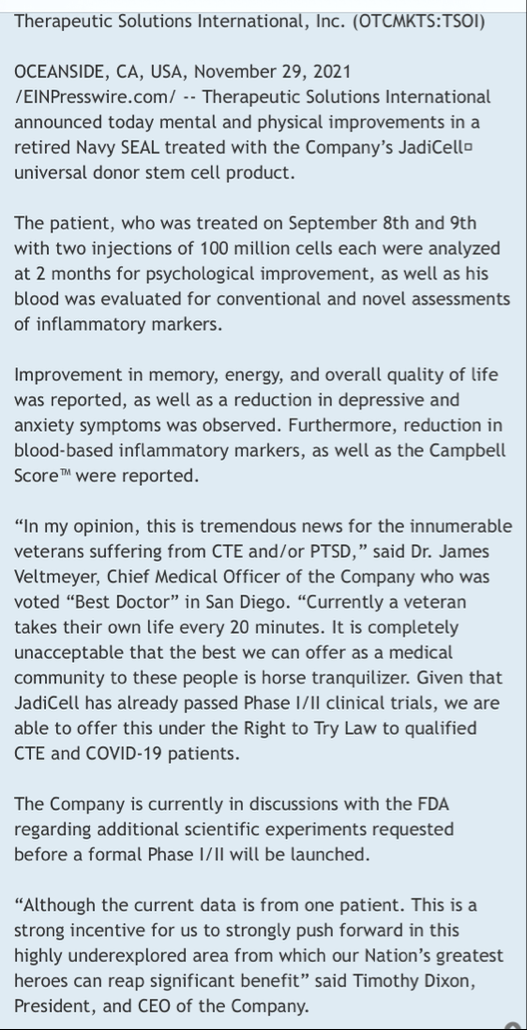

Preclinical Data Suggests QuadraMune™ Prevents Stress-Induced Suppression of Neurogenesis More Effectively than Prozac

OCEANSIDE, Calif., Dec. 9, 2020 /PRNewswire/ -- Therapeutics Solution International, Inc., (OTC Markets: TSOI), announced today new data suggesting the possibility that QuadraMune™ may mediate neuroprotective activity through preserving the ability of regenerative brain cells to proliferate subsequent to psychological stress.

The experiments, which involved exposing mice to established stressors, demonstrated that specific areas of the brain associated with production of new brain cells are damaged by stress. In agreement with previously published research, administration of fluoxetine (Prozac™) protected the brain from stress-induced damage. Surprisingly, QuadraMune™ administration appeared superior to Prozac™ at stimulating proliferation of new brain cells.

"QuadraMune™ which is currently in a clinical trial for prevention of COVD-191, has also been demonstrated to possess anti-inflammatory activity in other clinical trials, suppressing cytokines such as IL-62, which are known to be involved in depression3 and suicide4" said Kalina O'Connor, Director of Campbell Neurosciences and co-inventor on the patent. "Given major depressive disorder causes a significant risk for suicide, we are highly interested in exploring the use of QuadraMune™ for preventing suicide."

"Although much enthusiasm has been generated over the planned distribution of the COVID vaccine, at present little is being done to address mental health issues that are being exacerbated by the current pandemic" said Dr. James Veltmeyer, co-inventor of the patent, and Chief Medical Officer of the Company. "If current results are reproducible, the possibility that a nutraceutical would concurrently boost immunity while preserving mental health is highly enticing."

"It has not escaped us that COVID-19 is associated with increased inflammatory cytokines in the blood of patients, cytokines that also predispose to depression" said Famela Ramos, Vice President of Business Development for the Company. "It may be that the recent increase in suicides and suicide attempts is related biologically to activities of the coronavirus. It will be interesting to examine whether QuadraMune™ may modify putative negative mental effects of the virus."

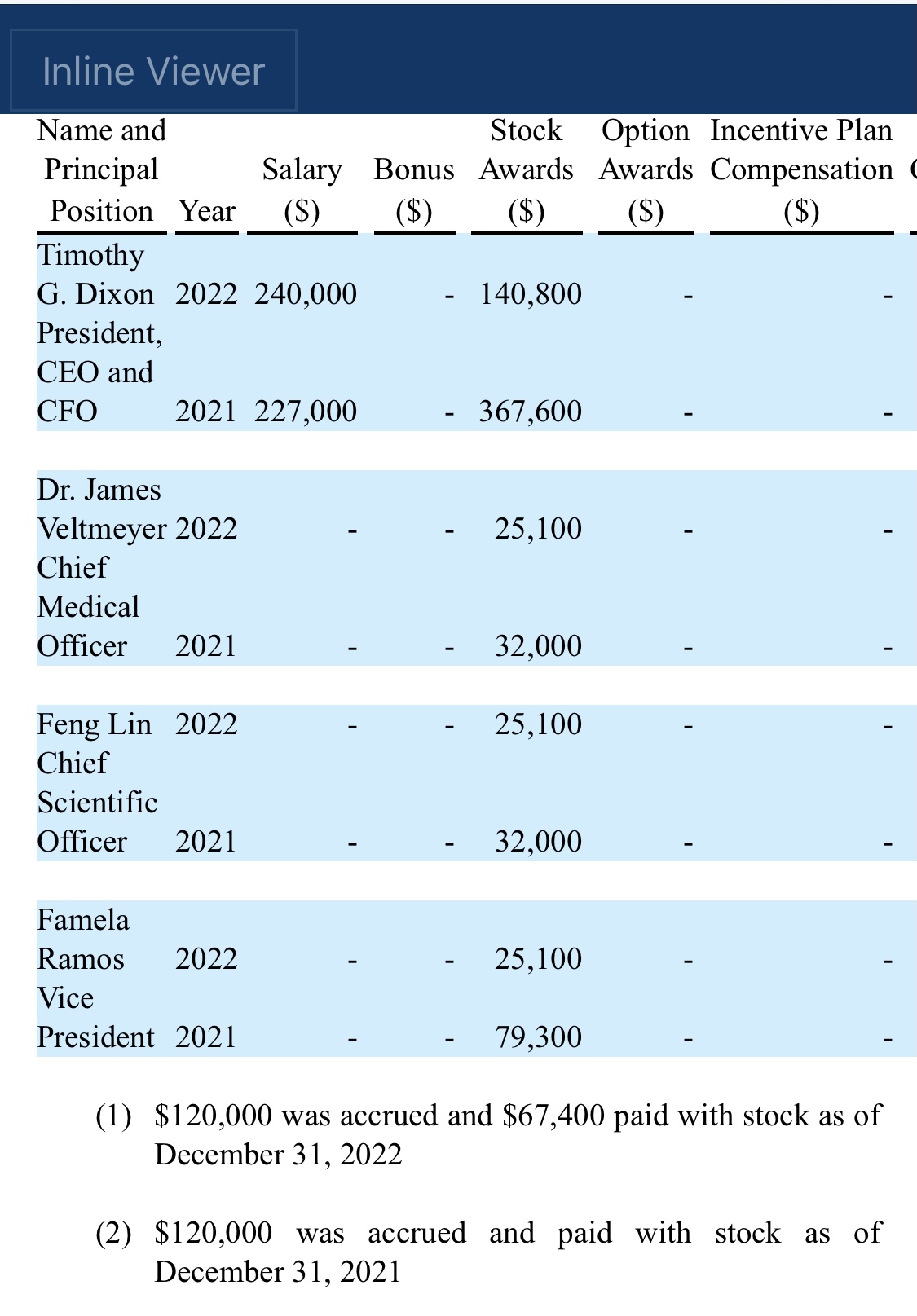

"An estimated 17.3 million adults in the United States had at least one major depressive episode. This number represented 7.1% of all U.S. adults" stated Timothy Dixon, President and CEO of the Company. "We believe the Mission of our Company is not just providing a return on investment to our shareholders, but also increasing the quality of life for Americans. We are extremely pleased to report this unexpected finding with significant potential implications to advancing non-toxic means of helping patients with this terrible condition."

1 QuadraMune(TM) for Prevention of COVID-19 - Full Text View - ClinicalTrials.gov

2 Therapeutic Solutions International Announces Positive Preclinical and Clinical Evaluation of Nutritional Supplement QuadraMune™, Designed to Protect Against COVID-19 | BioSpace

3 Ting et al. Role of Interleukin-6 in Depressive Disorder. Int J Mol Sci. 2020 Mar 22;21(6):2194.

4 O'Donovan et al. Suicidal ideation is associated with elevated inflammation in patients with major depressive disorder. Depress Anxiety. 2013 Apr;30(4):307-14.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |