Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

fooled - BREAKING: Fully Vaccinated Adults Account for Over 90% of COVID-Related Deaths!

Posted on February 25, 2023 by Constitutional Nobody

Key Points:

https://ussanews.com/2023/02/25/breaking-fully-vaccinated-adults-account-for-over-90-of-covid-related-deaths/

JESUS PRAYERS Needed Against - NWO = OWG KHZARIAN DEEPSTATE EVIL - THE ILLUMINATI AND ONE WORLD

GOVERNMENT WARMONGLERS NECON NAZIS =

DEPOPULATION AGAINST ALL HUMANITY -

WATCH

The Illuminati and One World Government

From Genesis to the Tower of Babel, to the

Egyptian Pharaohs, to Goat God's, to the World Bank, and the

FreeMasons, Secret Societies, Rosicrucians,

Rothschild bloodline, sexual perversions,

Marxism, Communism, Illuminati, Evil 666 -

https://www.bitchute.com/video/wzXLOeEAGm1d/

JESUS PRAYERS THANKS - SITUATION UPDATE GCR REPORT 2/20: JFK JR DECODE! HARRIS STARTS WW3?! EPSTEIN/CHASE BANK REVEAL! WOW!

WATCH

https://www.bitchute.com/video/IdhwLuCqaUg6/

https://www.bitchute.com/video/JrOIjbfGtLKs/

TRUMP LIFTS SPIRITS IN EAST PALESTINE, OHIO, WHILE BIDEN RESTS FROM

BANGING THE WAR DRUMS IN UKRAINE

WATCH

https://www.bitchute.com/video/YST1BSDWdsRw/

WATCH = NWO KHAZARIANS MAFIA MURDER OUR BROTHERS & SISTERS AND THE HUMANITY -

SECRET ISRAELI AND PFIZER CONTRACT EXPOSED BY STEVE KIRSCH AND STEW

PETERS

WATCH

https://www.bitchute.com/video/0eh6vANp9pOj/

Pp Watch - STEW PETERS: MARXISTS HIJACKED AMERICA, WHO IS RUNNING THE UNITED STATES - 2/20/23

WATCH

https://www.bitchute.com/video/wTE2J0hekgIK/

Evil eugenics MAID in Canada: Socialist left's massive genocide disguised as medical care

Mirror. Source

Evil Eugenics MAID In Canada: Socialist Left's MASSIVE Genocide Disguised As Medical Care https://odysee.com/@TimTruth:b/canada-maid-genocide:1

https://www.bitchute.com/video/K4zArax8Es6v/

Quote: "Evil Eugenics MAID In Canada: Socialist Left's MASSIVE Genocide Disguised As Medical Care Want more videos? Join https://GroupDiscover.com to find the best videos from across the free speech internet platforms like Odysee, Rumble, Bitchute & Brighteon all in one huge video repository. Add me on these great platforms: https://rokfin.com/timtruth https://odysee.com/@TimTruth:b/ https://rumble.com/timtruth https://bitchute.com/timtruth/ https://GroupDiscover.com Support links (thank you to all the supporters!): Easy to do one time tips via https://rokfin.com/timtruth or https://odysee.com/@TimTruth:b https://timtruth.substack.com/subscribe https://subscribestar.com/timtruth "

-

5G is a weapon system - Don't be fooled by the fake narrative https://tinyurl.com/tf38xs3d ~ The agenda - They are destroying human kind https://tinyurl.com/2p82r3j9 ~ 60GHz in schools - Lena Pu and Mark Steele https://tinyurl.com/2c67ep66 ~ 5G target acquiring weapon system - This is not for control but an extermination technology https://tinyurl.com/4hetn32u ~ UK Government hacked https://tinyurl.com/337zjb4s ~ Report #133: David Noakes on GcMAF cancer treatments, FDA/MHRA/Pharma corruption, & wrongful charges https://tinyurl.com/ev8kms8n ~ BitChute { noakes falconscafe https://tinyurl.com/2h7z47ve } ~ The disciples of Ra: The deception of "medicine", viruses & vaccines https://tinyurl.com/2p8uc7as ~ Viruses don't exist https://is.gd/E4li0z ~ If you don't know what causes what they call a virus you will never know unless you read the science https://tinyurl.com/yj8j9pd2 ~ Assembling the kill grid ~ Excerpt: Mark Steele https://tinyurl.com/4cethr4b ~ Prof. Francis Boyle "The British must not take these frankenshots"! Interview https://tinyurl.com/3cbrwts2 ~ The MAC phenomenon in people "vaccinated" from COVID-19 https://tinyurl.com/2p8xhjz3 ~ Video summary of La Quinta Columna that shows evidence of genocide based on injectable analysis https://tinyurl.com/43bdk4na

Illegal organ trafficking of homeless people in Texas? Same thing happened during Hurricane Katrina https://tinyurl.com/ym7uyt3e ~ Homeless vet killing society https://tinyurl.com/y2ycpn6m ~ NATO satanism, testimony, Kay Griggs: Colonel's wife tell-all, oppression, deception, secret society https://tinyurl.com/2p8ybsjv ~ Horus matrix at Normandy Omaha Beach Overlord D-Day 666 Cemetery satanic ritual sacrifice https://tinyurl.com/yckjeu8r ~ The cover up continues - Share this with all vaccinated, who have been lied to by their doctors https://tinyurl.com/3w65f9ny ~ Whistleblower: Hospitals killing for organs, "This is absolutely evil and a crime against humanity!" https://tinyurl.com/4mp7h8vy ~ The world must know #PureEvil #HellOnEarth https://tinyurl.com/2p93msb3 ~ Bombshell: Pfizer vaccine study's massive list of "Adverse events of interest" https://tinyurl.com/yc7tyu2r

Did he just say snake venom? - Dr Bryan Ardis talks to Right Now https://tinyurl.com/4chrmwy8 ~ World premiere: Watch the Water https://tinyurl.com/3ybuwhxv ~ Part 1/3 - Dr. Bryan Ardis reveals bombshell origins of COVID, mRNA vaccines and treatments https://tinyurl.com/38earx4a ~ Biological weapons; Is there a link between the water supply system and the pandemic? https://tinyurl.com/2p8pvuze ~ Professor Darrel Hamamoto on persecution and inquisition at UC Davis https://tinyurl.com/4wkcjcu3 ~ The China-NHS lateral flow test, massive fraud, for those that lost work.. or murdered on COVID ward https://tinyurl.com/2mbamwmf ~ COVID-19 test fraud, also carcinogenic https://tinyurl.com/2p99uwws ~ Your future The SPARS pandemic 2025 - 2028 https://is.gd/kCajO1

Snuff Hill https://tinyurl.com/573ufnvj ~ Blood Hill https://tinyurl.com/ymckkptu ~ Fitzwilliam military cult https://tinyurl.com/bdhz7529 ~ Troy River https://tinyurl.com/2p86hv66 ~ Tent City https://tinyurl.com/56hfw4kf ~ 18 Brickyard Troy Depot, Troy School, Cemetery, Discount Tire, satanic stalking, ritual sacrifice https://tinyurl.com/2jvdutm2 ~ Bohemian Grove Jr, Bridgewater Associates - CIA corporate front, CIA role in snuff and pornography https://tinyurl.com/2p8v8yr5 ~ Hebron Coven ~ Part 1 to 4 of 9 https://tinyurl.com/yw952bnn ~ Body Organs Of Over 18,000 Syrian Children Sold in Six Years https://tinyurl.com/djarv3w8 ~ I saw kids in cages outside a masonic lodge being loaded into trucks https://tinyurl.com/46uxrvs5 ~ Amazon USB key - Part 1 to 2 - CYM Adrenochrome https://tinyurl.com/yckfvnn2

The men on the moon https://tinyurl.com/42dh2ejv ~ Moon truth https://tinyurl.com/mrxx5sks ~ 7 rockets hit dome ! https://tinyurl.com/46rd63v5 ~ Who shot the moon landing, classroom bloopers https://tinyurl.com/mw7xwh39

Oil is abundant and cheap https://tinyurl.com/3e2nkbbm

MAGA Prayers To Father GOD Needed - THE WORLD VS. THE KHAZARIAN MAFIA -- JIM WILLIE

WATCH

https://www.bitchute.com/video/PSIN2glcoaju/

Watch MAGA Thanks - Pray To Get Father GOD'S Remedies Back To US - ROCKEFELLER INFLUENCED THE WORLD TO REMOVE ALL THE NATURAL

REMEDIES FROM PRACTICE FOR HIS BENEFIT

WATCH

https://www.bitchute.com/video/uD36QiNCxC8O/

China Says Ready To "Join Forces With Russia" To "Defend National Interests" As Putin Confirms Xi Visit

Tyler Durden's Photo

BY TYLER DURDEN

WEDNESDAY, FEB 22, 2023 - 10:00 AM

Despite all latest among Washington's repeat warnings to Beijing against strategic or military cooperation with Moscow, China is now pledging to "join forces" with "like-minded" partner Russia to defend national interests. The statement came by the close of the first day of the director of the Office of the Foreign Affairs Commission of the Communist Party of China’s Central Committee Wang Yi's trip to Moscow.

https://www.zerohedge.com/geopolitical/china-says-ready-join-forces-russia-defend-national-interests-putin-confirms-xi-visit

CH - TOXIC FUMES FROM OHIO MAY SERIOUSLY AFFECT EVERYONE EAST OF THE MISSISSIPPI RIVER 250 MILLION PEOPLE

WATCH

https://www.bitchute.com/video/hCb5IvRRkL7G/

$500 TRILLION LAWSUIT AGAINST THE FEDERAL GOVT AND OVER 140 MONOPOLISTS (REMOVED BY YOUTUBE IN 5HRS)

WATCH

https://www.bitchute.com/video/QFcfDjifRl6u/

Even the doctors fell for it

https://rumble.com/v2aenx2-more-than-130-canadian-doctors-have-died-suddenly-since-c19-killshots-began.html

5G – Microwave as a weapon Part 2 - Dr. Reiner Fuellmich and Barrie Trower https://rumble.com/v2a3th8-5g-microwave-as-a-weapon-part-2- dr.-reiner-fuellmich-and-barrie-trower.html | Towards The Light channel https://www.bitchute.com/cha…

https://www.bitchute.com/video/RaEZsuhWr2G0/

NWO Biden like a 3 year old -

RALLY Watch; TRUMP ANNOUNCES IMPRESSIVE LINEUP OF SPEAKERS FOR WYOMING RALLY

by Laura Ramirez May 26, 2022

https://www.rsbnetwork.com/news/trump-announces-impressive-lineup-of-speakers-for-wyoming-rally/

KEEP IDAHO IDAHO WITH AMMON BUNDY ON FRI. NIGHT LIVESTREAM

WATCH

https://www.bitchute.com/video/U913q3mr5Cge/

Ammon Bundy launches bid for Idaho governor

One America News Network

https://rumble.com/vuoas2-ammon-bundy-launches-bid-for-idaho-governor.html

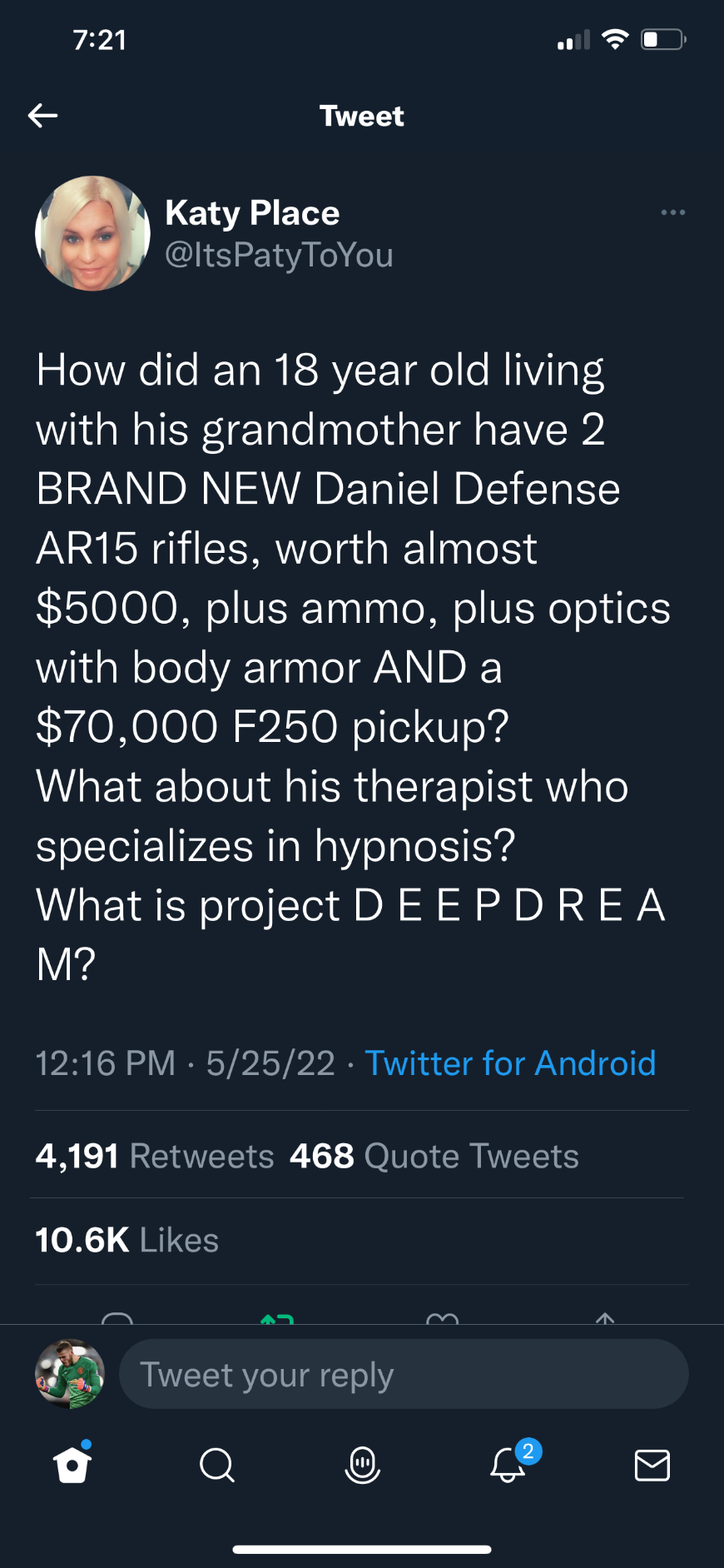

Spot On! Project DEEPDREAM

LEAKED: China's NWO Plan to Attack USA by November & Reason for Shanghai Lockdown (JR Nyquist Interview)

Man in America Published May 26, 2022

https://rumble.com/v166ro1-leaked-chinas-plan-to-attack-usa-by-november-and-reason-for-shanghai-lockdo.html

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=168980150

Top Airline Pilot Suffers Cardiac Arrest Between Flights Post Mandatory COVID Vaccination

https://resistthemainstream.org/top-airline-pilot-suffers-cardiac-arrest-between-flights-post-mandatory-covid-vaccination/?utm_source=telegram

God Bless America

Amen

$Prestdent Trump! We Don't Want $30,000 GOLD? Russia Says Certain Countries Will Have To Pay For Gas

Using Gold But This Is The Big Surprise

March 24, 2022

https://kingworldnews.com/30000-gold-russia-says-certain-countries-will-have-to-pay-for-oil-using-gold-but-this-is-the-big-surprise/

$PRESIDENT DONALD TRUMP RALLY LIVE IN COMMERCE, GA 3/26/22

by RSBN March 17, 2022

https://rsbnetwork.com/video/president-donald-trump-rally-live-in-commerce-ga-3-26-22/

Saturday, March 26, 2022: Join the RSBN team LIVE from Commerce, GA

for all day coverage of President Donald J. Trump’s SAVE AMERICA rally.

President Donald J. Trump, 45th President of the United States of

America, will hold a rally in Commerce, Georgia, on Saturday, March 26,

2022, at 7:00PM EST.

Saturday, March 26, 2022, at 7:00PM EST President Donald J. Trump, 45th

President of the United States of America, Delivers Remarks in support

of David Perdue Candidate for Governor, Herschel Walker Candidate for

U.S. Senate, and other endorsed candidates.

Venue: Banks County Dragway (Formally NHRA International Dragway) 500

East Ridgeway Road Commerce, GA 30529

Timeline of Events: 8:00AM – Parking and Line Opens 2:00PM – Doors Open

and Entertainment Begins 4:00PM – Pre-program Speakers Deliver Remarks

7:00PM – 45th President of the United States Donald J. Trump Delivers

Remarks

Point Roberts Safety; Are you in safe area or you don't want it; Things Are Escalating Very Quickly!

https://youtu.be/ggQzxPWCpgc

Trump: World Must Say in 'One Unified Voice >

https://www.newsmax.com/us/covid-19-pandemic-china-virus-wuhan/2021/06/05/id/1024053/?ns_mail_uid=d0c7f455-4f6a-4e46-8eca-551245fece55&ns_mail_job=DM226746_06062021&s=acs&dkt_nbr=010502hfu1zr

President Trump Speaks at the North Carolina Republican Party's State Convention

36,011 views•Streamedlive 4 hours ago

from da great one MR.PRESIDENT TRUMP 06-05-2021

Wow ! I guess I should have posted here 3 weeks ago when things started heading south in a hurry.

I'm not expecting a 2001 - 2003 or 2008 - 2009 style meltdown. Nobody's over leveraged. I'm fact we might get a nice bounce here. And not finish the year badly.

The proof we're not in a meltdown is that clearly there's been a rotation -- not all out selling -- into safer yield bearing stocks. And money has come out of high PE growth stocks.

If interest rates keep climbing, expect it to continue.

My minions say ..... THE HOUSE OF PAIN RULES !!!

Chris

haha such a nerd! It's cute.

So how do you like my "Minions diabolical laughter" siggy ? ![]()

Chris

Hi Tina ! wow $TZA -- you're really betting on a near term House of Pain.

I may have to join you in getting some. For now all I have is some $QID.

Chris

I think we should switch boards lol

been buying tza low $16's.

Is it just me or does anyone else think we're overdue for a "House of Pain" experience ?

Chris

CALEDONIA CALVF GOLD Miners Have A New Golden Cross Buy Bull Signal Stronger Again ![]() -

-

http://www.caledoniamining.com

CALEDONIA GOLD #1 SCOTTISH RIGHT WAY TO GO -

http://www.caledoniamining.com/pdfs/CALPres08142012.pdf

CALEDONIA GOLD Celtic Thunder -

Wall Street futures track global selloff on EU worries

http://finance.yahoo.com/news/stock-index-futures-signal-lower-084320477.html

Well at least this time officials are warning about a "fiscal cliff".

Chris

Going to be a few more imo

Another "Da Horror" day.

Oddly my 401K is still doing ok.

Chris

I hit that button yesterday. I'm in the OMG, da blood! Mode.

Is it too soon to say "Da Horror" ?

Chris

Looks like the DOW is still having trouble staying over 13,000.

same for NASDAQ 3000.

And S&P 500 1400.

Soooo its been 12 years since the NASDAQ peaked. And its still only about 60% of its Internet bubble high.

12 years of investments in the stock market averages going nowhere.

Chris

Wow, haters gonna hate chris. Just keep da love man.

Or have Tina spank you if you want Da Pain lol.

I attribute my success to getting a degree that including learning to design a new technology called microprocessors. I also took courses in this new field called software engineering. My "all nighters" in college did not involve drinking beer at frat parties.

I got a job programming computers. For the first 5 years my wife knew me, I was working overtime -- without pay since I was considered a salaried employee who was supposed to work as much as needed to get the job done.

10 years after I graduated I learned on my own about this new thing called the Internet and how to develop software that allows software on one computer to use it to exchange information with another.

My kids are doing well, and yes some of it part to mom & dad. But they both have degrees, went to relatively inexpensive state schools, so paying for college was manageable. By the way, I started saving for their educations when they were quite small, something apparently other baby boomers chose not to do. My sons took out some college loans, but they were for just for 1 year's worth of tuition so they have been easy to pay off.

Both of my kids are employed and hard working. One is a restaurant manager who works 50 hours/week. The other is a biochemist. Since they are just starting out, they get very little vacation or holidays off.

As for other kids who have huge college loans -- what did they get their degrees in ? Social sciences and partying ? Not too many job openings for that kind of education. Also -- I can tell you from experience, Federal and school sponsored student aid is pretty good. Any kid in need can probably get $5,000 per year from them. Add in a campus job for 10 hrs/week and you get another $3,000. Add in a summer job -- even at McDonalds, And you get another $3,000. Mom and dad pitch in the $5,000 they would have paid for food and clothing anyways and you're at $16,000 without ever taking advantage of the 18 years you had to save a penny for them. That doesn't cover all the costs but it makes the loans needed fairly manageable. And if parents/family had saved enough to cover $5,000/year, then they could afford to go to many places without borrowing any money at all.

So basically everything you said or assumed was wrong.

Chris

Ahhhh now I get it. If you worked for $2/hr that means that you are a bloated self important baby boomer who thinks that the world is still an oyster just waiting to be opened. You believe that your success was because of hard work and not because you grew up in an economy that was kept growing and expanding because of ever growing money supply thanks to the manipulation of the metals trade and a Federal Reserve which cranked out money like the Hasbro plant printing colored paper for Monopoly. How are your grandchildren and great-grandchildren fairing in this economy? I suppose if they're not doing so well you attribute it to laziness. Any of them 100K+ in debt for student loans yet?

Well that's a good way of looking at it!

Sorry for the tardy reply. Had family here for a week.

Upset I sold TZA too soon looks like it went over $20 again

Does to me as well. They have done lots of upgrades to their cell system.

The others atte tight floats and high volitility. I didn't play it right. I'm trying to getty back out with breakeven. Id should have no issues I think. Even a hundred loss is acceptable to me.

Hope you are having a good day!

- $FTR definitely looks interesting.

Chris

Its da pleasure today. Bought some cheap stocks the last 2 days. Hope it pans out well for me today or tomorrow. :)

Every summer when I was in college I had a 20 hr/week summer job that paid $2/hour.

I lived in a room at a frat house for $50/month, ate tuna fish sandwiches almost every day, except once a week I treated myself to McDonalds.

If the unemployment rate is really 25% in No. IL which I seriously doubt except in the inner city maybe, then my advice is for people to move away and find work someplace else.

Chris

I hope you never find yourself without money and a job simultaneously. Ever tried to move from Chicago to D.C. with no money? Ever had to file bankruptcy because you lost a job and couldn't find one again that covered your expenses for 9 months? Everything is not cut and dried. You know, right now N. IL seriously has a real unemployment rate of about 25%. Not that crap they print in the papers and it's been that way since about mid-2008. Have you ever gone to an interview where you were competing against 300 applicants for a restaurant management job and 75% of them have college degrees?

Yes I hear what it's like in the D.C. area. It's comparatively quite perky there at the heart of the Military Industrial Complex. The rest of the country doesn't look so pretty. Maybe you should get out more?

Everyone blames the Central Banks but if voters didn't keep electing officials who keep passing budgets with huge deficits, the central banks wouldn't be a problem.

Also I question the plight of the out of work restaurant manager. There are lots of restaurant manager jobs if you're willing to move. In DC they pay about $50,000 per year.

The stories about the elderly are sad though. But I think if you haven't prepared properly for your twilight years by the time your 68, you did something wwrong from age 30 to age 50.

Chris

Suicide by Central Bank from Athens to America and All Around

KRISTINA BRUCE · APRIL 5, 2012

http://cuttingthegordianknot.wordpress.com/2012/04/05/suicide-by-central-bank-from-athens-to-america-and-all-around/

This morning I woke to the story of a 77 year old retired Greek pharmacy owner whom had chosen to commit suicide near the Parliament building in Athens the day before. After devastating austerity measures, his pension decimated he had lost all hope of continuing. His suicide note read as follows,

“The Tsolakoglou government has annihilated all traces for my survival. And since I cannot find justice, I cannot find another means to react besides putting a decent end [to my life], before I start searching the garbage for food and become a burden for my child.”

The reference to Tsolakoglou apparently was meant to indicate that he likened the current goverment to that of the one run by the Greek collaborationists under Georgios Tsolakoglou during the Nazi German occupation of Greece during WWII.

Why is this important? Because it is happening right here in the U.S. now every single day. They just aren’t doing it in front of state capital buildings or on the steps of the halls of Congress…. yet.

Within minutes of posting this article a cousin of mine who still lives in my home state of West Virginia related to me that in February and March there had been 4 domestic case murder-suicides in the area. Incidences of husbands killing their wives and themselves over debt and foreclosure related issues. One of these cases involved a couple whom had been previously served an eviction notice by the Sheriff. They received a visit from the Sheriff’s department on a Sunday to make sure they would vacate the property the following day. “The sheriff says Robert Nusser told deputies he didn’t know where to go or what to do.” Afterward this 68 year old man called his daughter to tell her where ”some money was, just in case anything ever happened to them”. Nusser then called 911 on Monday, reported that there had been a murder-suicide at his home address and added “I did it”, then hung up. By the time the police arrived both he and his 64 year old wife were dead from single gunshots. He too left a note saying he didn’t want to be a burden to his 39 year old daughter.

These and many, many more tragic deaths never should have occurred but let us not allow their deaths to be in vain. Many have already forgotten and far more never even knew that those tremendous uprisings in North Africa last year were sparked by the suicide of Mohamed Bouazizi, a poor 26 year old Tunisian street vendor who had been so harassed by local police authorities that he could no longer make a living. The police took his vegetables and then tried to take his scales leaving him no way to support his widowed mother and six siblings. After trying to complain to the local police authorities and being rebuffed he eventually grabbed a gas can, ran into the middle of the street yelling “How do you expect me to make a living?”, doused himself in gasoline and lit himself on fire. Ten days later the uprising which ensued had topple the Tunisian government. The unrest of the young underclass of downtrodden soon spread to neighboring Algeria, Egypt and Libya, included their middle classes resulting in regime changes across the region.

What we must realize is that the cause of all these deaths, the suicides are but attempts to be released from the clutches of something these people felt powerless to fight. Every death comes back to the very same root cause, the banking system. Tunisa with $45 billion in debt and a growing trade deficit was doomed to be forever poor. Greece, it’s $349 billion of debt and austerity measures that now have people dumping their children on the streets, the country now without even aspirin in it’s pharmacies is truly lapsing into dismal despair. The U.S., it’s real estate market crash, the loss of $16.4 trillion in U.S. household wealth, $8 trillion in U.S. economic bailouts loaned to the banks and businesses by the Federal Reserve and now we have the Europeans announcing a $1 trillion “firewall” to prevent the collapse of their peripheral economies. Most believe the European like the American escapade can’t possibly be nearly enough. All these interventions by the Central Banks has now effectively put every man, woman and child in economic shackles.

Who pays for it? Of course we all do and the folks mentioned in this article are the ones currently paying the highest of prices. Their deaths are both public cries of injustice and the canary in the coal mine for those who have yet to be touched by this global Depression. I could bore you with statistics here for hours to back up that claim of global Depression but really there’s no need to. Anyone who takes their gaze away from that glowing flat disinformation screen hanging on the wall of their living room, gets up, walks away from the talking heads and makes it outside can do a 360° to actually see it. They might not recognize it because they don’t know what they’re looking at but the evidence is there.

Unfortunately sometimes it requires acts like these suicides to jolt people awake, see what is before them and to take action against the oppression that the banks now impose on humanity world wide. This transcends mere oppression and has created a state of perpetual debt slavery for all concerned. Even people who have a little bit of money don’t get a pass anymore. All are being effected if you are not part of the very elite upper 0.001% of the world who are the true movers and shakers. Forget about the 1% because if you’re pointing at them, a goodly percentage of them are doctors, dentists and small business owners that actually still work for a living like the other 99%. We really need to single out who the enemy is and it’s a far smaller percentage than what has been popularized by the Occupy Movement. People are now tied to mortgages where they owe far more than the value of their homes. Credit ratings have become determining factors as to whether you are deemed employable or not. Lose a home, incur so many medical bills you can’t pay, late too many times on your credit card bill or be forced to file bankruptcy and you can easily find yourself completely unable to find work in any company of any size which uses credit scores as a criteria to judge you. Many of the factors that can create a bad credit score today have absolutely nothing to do with people’s level of responsibility or integrity. It is just the fact that most people were unfortunate enough to buy into the idea that buying things on credit was an ok idea (hard to avoid that when every single message in the mass media and social structure tells you to do it), then later to also find out the shocking fact that there really is no such thing as job security and that the stock market is nothing more than a rigged ponzi scheme. You really can’t win anymore. All most people do is hope that they aren’t one of the folks who gets completely squashed in this economic downturn with no definable end in sight. Are you starting to notice that it’s really the banks that rule your life maybe even more so than a government which enacted 40,000 new laws for 2012?

They’re beating the hope out of people with the constant fear mongering in the press. Of course in the main stream media it’s a game. One day the stock markets are falling and the next day the jobs reports boost everything back to the previous level. It’s a form of passive aggressive psy-op to keep the masses confused and questioning their own good senses. It also has a tendency to make those who still have jobs just put their heads down and press their noses to the grindstone. I see folks on the edge, people living paycheck to pay check who now are scared to death that the whole ball of wax is going to unravel upon them. They’re just a pink slip away from complete and total loss of hope themselves. A few years back they were sure that everything would just work itself out as it always has seemed to during their lifetimes. After a few years of this economy though even the most dull have figured out that things are not only not getting any better but are decidedly getting worse.

I participate in an online political discussion group which predominately consists of people from my home town in WV, most still live there, some have moved away and there is a smattering of folks from other places around the state. I have found that some people of late are becoming increasingly agitated by and frantic over some of my economic posts such as this one from the other day. It’s an article from one of my favorite hedge fund managers and economists Dr. Marc Faber. He’s not particularly saying anything new in it. I’ve posted plenty of articles like this one on the forum over the last twenty months or so but apparently it’s finally hitting home with some folks. Now that the realization is sinking in it seems that to a lot of people the idea that the system is headed for an inevitable currency and market collapse globally is something that they just can’t emotionally handle. People who four years ago hadn’t a clue that anything was truly amiss are now suddenly finding their eyes being forced open to the light of day but it’s all gloomy and doomy as far as they can see over this new horizon. They are now either only seeing for the first time or are just finally willing to admit to themselves what has been apparent for quite some time, that they have been living in Mordoresque world for most if not all of their lives. What is being missed though is that as it is we are actually looking at a possible new beginning not necessarily THE END. There is no way to the light of the next day until this system does implode. It’s broken beyond repair. We can’t fix it. We must replace it. This mass awakening is our chance to make massive social and economic change.

I do understand why so many people seem to be completely paralyzed once the realization that all is not well starts to sink in. These folks see nothing but death and destruction ahead for themselves and do you know why? It’s because for many people the erosion of the family as a unit and destruction of the community as a cohesive group has left these folks with ZERO safety net. Many out there have no one to rely upon if and when things really go to shit even if it is only for a little while. I do understand that there are still families out there who will do whatever would be necessary to help their extended family and friends but some people aren’t even in a position to do it. People who are middle aged to seniors now have adult children who are barely living above poverty level in many cases as it is. I would imagine this is why the Greek fellow and the couple from Southern Ohio were so adamant about not burdening their children. Many people today are estranged from their own extended families for the most part and their relationships with their neighbors so superficial that they couldn’t ever ask them for assistance. Add to this the fact that hardly anyone is even a member of a church or civic organizations anymore which might have in earlier times lent a hand, today they’ve got nada and nowhere to go. If anything bad happens the best some can hope for is possibly a car if not it’s the possibility of a cardboard box. Those prospects aren’t so good considering that so many cities and townships in the U.S. have made it illegal to feed the homeless huh? When governments move to quell the most basic of human instincts like helping your fellow man you know you’re living in a bad, bad place.

My best friend has been out of work for 3 months since his last employer, a restaurant shut down after New Year’s. Oddly enough the same scenario occurred for him last year after New Year’s when the restaurant he was at prior also had to go out of business. At any rate, this guy who’s gone from a career restaurant manager for the better part of three decades has now been waiting tables for the past 3 years and understandably after three months without a paycheck is at the very end of his financial rope. With savings gone and a $167 a week in unemployment he could have been forced out of his home soon if it were not for the fact that by some miracle he managed to land another job this week. He has no family support and no children to rely upon. His only solace was knowing that if worse came to worse that he did have one person in the world who could and would be willing to help him if necessary. There are countless millions world wide who don’t even have that to fall back upon. Many, many people out here have no safety net and as this demise of the the global economy accelerates we’re going to see a lot more bodies giving up and piling up. People need to form better relationships with those around them. We can no longer survive as tiny islands unto ourselves. We have to relearn how to be the social creatures that humans are so that we can ALL move forward together.

So what’s the solution? First we have to come to the realization that our priorities are screwed up and have been since the mass media first figured out how to mass market. We have since the beginning of the industrial revolution been literally programmed to consume and those folks who make all the stuff they sell to us have designed their products with a limited lifespan so that we have to keep buying and buying frequently. It’s called planned obsolescence. That along with the banking system in general and even more so after the formation of the Federal Reserve Bank in 1913 have spurred on not one, not two but three major depressions and now promise to spark yet a Third World War in the span of time. It is after all how this economic system is set up and how it survives.

When did it become so important to protect the profits of private banks or even publicly held banks for that matter at the expense of humanity? How do most people not recognize that the priorities instilled in society today are completely dysfunctional? Yes we are a horribly neurotic population from one end of the globe to the other. We’ve been rendered half nuts by either the constant drone of commercial manipulation to consume more and more, pushed on by corporations which organize to ensure planned obsolescence is a part of almost every single product manufactured and then we’re all poked and prodded to believe that if we do not consume that we cannot possibly be happy. That’s our half of the world. The other half is made crazy by constant privation, war and the encroachment of the consumer economic/debt model being used on and against them.

We are led to believe it is all important to keep these banking institutions solvent even over the lives of people who more often than not had absolutely nothing to do with the actions of the banks which lead them to become insolvent (the publicly held banks like Chase, Bank of America, HSBC, ING, UBS, RBS etc) and then to not only bail them out but to create cash flow great enough to allow these institutions to pay multi-million dollar bonuses to their employees. The whole bailout scheme has allowed the privately held Federal Reserve to profit $88 BILLION last year alone! Here’s the thing………. you take the Federal Reserve out of the pictures and all the sudden you’ve got an extra $88 BILLION the US isn’t shelling out in interest to these loan shark hucksters. You let the banks that are insolvent fail. Put the creation of money back in the hands of Congress and the Treasury Department. This is the only Constitutionally legal way for money to be made in the first place, not by 500 bean counters at the Federal Reserve sitting there pounding out 1's and 0's on computers using two fingers like monkeys 24/7. Maybe the idea of a National Bank which makes loans directly to small businesses and consumers would make more sense? If we had that why would we possibly want to continue to shovel TRILLIONS of dollars into the pockets of the Central banksters, the middle men who add ZERO VALUE to the equation? The banks and especially the Federal Reserve have now become parasitic ticks that are bigger than the flea bitten dogs (us) they are continuing to suck dry!

We’ve got people killing themselves so that a few thousand people in the world can continue to grow fat, control more, and scoop up ever more real assets from the four corners of the Earth just to pay for debts that most people had nothing to do with. They now hold huge amounts of both private and commercial seized properties in the U.S. and are now especially in Europe squeezing sovereign nations for their payola by extracting things such as water rights, dam projects, forests, publicly held lands and landmarks and they aren’t going to stop taking it until the very last moment when the paper money scheme falls completely apart. That will be the point when all the dollars, Euros, Yen, Pesos and Lira world wide become virtually worthless. That’s why they’re grabbing those tangible assets now because they know the paper soon will hold no value. The way they plan it is that we all go broke and they hold the only stuff still of any value. The wealth now held by them in all that seized property AND THEN………… they get to start the whole game all over again.

We must abolish the Federal Reserve and quit feeding the illiquid banks world wide. If it can’t be done by putting someone in the White House who will take away the Fed’s power as President John F. Kennedy did with Executive Order 11110 in 1963 then it will have to be done by each individual state nullifying the debts owed . If you had never heard about E.O. 11110 before, you now know part of the reason why J.F.K. was killed. He took the power of money creation away from the Federal Reserve and put it back in the hands of the Treasury Department. The other way to end run the Fed would be for every state to nullify the personal income tax. You ask how can we do that and not have the entire government collapse? How would the government get it’s money to operate if we all stop paying taxes? Well the fact of the matter is that NONE of your tax money goes to the government to keep the light bill paid or the paychecks funded as it is. No, all of that money the IRS takes or you end up having to send goes to the Federal Reserve to pay the debts that we owe it. All money that is used to fund the government is newly created debt issued by the Federal Reserve. Are you starting to see how the cycle could be broken with a few simple steps? First we have to wipe the casino’s books clean. Tell the bad guys that the game is over, they’re not collecting any more money, take what they’ve made, go away quietly and they get to live.

It’s time to shut down the Federal Reserve, their global Central Banking System and the ponzi scheme that has become the stock markets world wide. We have to reset the clock otherwise the bailouts will not stop. The banks will continue to need more and more cash infused to keep them liquid going forward. That was evident even when they were telling us the $700 billion TARP program would do the trick. Here we are $8 TRILLION later and they still keep the presses going day and night. If they are not stopped we’re slated to go Zimbabwe style, inflate everything until there are so many zeros on a printed note you can’t count them without a calculator and like so many other countries in the past , eventually if they can hold it all together they end up just whack all the zeros off the bills and call it a $1 again even though the value has been decreased by multiple factors of 10 on the way down. This is why your gasoline, bread, milk, peanut butter and tuna fish now are costing you substantially more already. Don’t believe it’s gasoline supply problems or speculation alone that you are causing you to practically need financing just to fill up a tank. They’re lying to you, it’s the money supply. It’s the trillions of dollars sloshing around in the banks now leaking out into the real economy that is the problem.

Whether we choose to sit on our collective assess world wide, let the banks starve us out and steal every thing we own or we decide to take back our freedom, our liberty and our dignity it’s going to be a rough road. The former option will be far harder and confer no reward other than the perpetual opportunity to lick the boot pressing upon the throat of humanity. If we however choose to push that boot off and take back our natural rights we will have to seriously pull together as a species and help one another as the world goes through a period of tremendous change. If we don’t, they’ll have us at each other’s throats for what profit can be made of it. We live in exciting times, one guaranteed for the history books either way it goes.

I'm doing fine thanks. The markets aren't doing much so I can focus on getting my day job work done !

Chris

thank you chris, how you doing sir.

MIT researchers predict ‘global economic collapse’ by 2030

Well at least I'll get some soscial security money before then.

http://news.yahoo.com/blogs/sideshow/next-great-depression-mit-researchers-predict-global-economic-190352944.html

Chris

U.S. Stocks Drop On Weak Spanish Bond Sale

http://ih.advfn.com/p.php?pid=nmona&article=51903646

Chris

Hi realest, wow. I'm sorry for your loss. But I'm glad you're starting to get over it and get on with your life.

I don't think Tina not I are trading much. In retrospect buying $SBUX for $8 in March 2009 and holdingwould have been the smartest move.

I'm beginning to think the 3 years of superlow interest rates may be over. So an ETF or mutual fund that shorts treasuries might be a good place to put your money.

Chris

Don't be sad! I'm not special, how many were in my shoes, exactly the same situation yet still landed on the hard street. I am fortunate and blessed. I have all material things intact.

I can't imagine what life would be like if I were out of work, on the street, and lost a spouse. In my eyes heaven above corrected what was wrong and has rewarded us both for attempting to do the right things.

You're so beautiful for sharing that with us. I mean internally - well externally too but you know what I mean.

Jeez I'm crying sad and happy tears for you. Sad what you've been thru but happy that you're getting to be at a better place in life.

I will respond to your private message in the morning as the battery is flashing red on this phone.

Have a good night friend and so wonderful to see you back again.

xoxoxo

*wink* i'm back darlin. Like the song says though, you've got to go through hell before you get to heaven. I've met a new lady i've been talking with and going out. Real estate interest are doing well, regular job is making up for lost ground.

Financially, i'm better off than i've been in 10 years. Told my CPA i feel like the richest man in the world now. The financial burden from her illness was a killer on us and then everything else too... sheesh lol.

But i'm happy, despite all that stuff i've a real faith in god above. He did what we couldn't do to help one another. I couldn't help her pain and she couldn't work. I do miss her though, terribly sometimes.

Jesus that's really sad. You have been thru hell my friend. Sorry you've had such a rough time but I'm so glad you're back and some things are better now.

Chris is probably in bed and will most likely read this before any of us normal people wake up.

Can't wait to see you back in action again!

BOOYAHHH I'm back! And believe me i've been in the house of pain :(.

The last 2 years have seen my pay cut by 50%, almost lost a home to foreclosure, and 6 months ago my wife passed away.

The short story is pay is nearly returned to our happy time hi of 5 years ago. I've managed to save the home and it's all good there. Although i miss my wife terribly financially i'm better than we ever were the last 8 years. Leukemia was wicked on her, i really hope god had her victorian home waiting on her.

I've opened an E-trade account to get my feet wet again. You folks will start seeing much more of me again :)

I do hope you both have been doing well.

Realest!

The 10 Best Places to Retire

Washington DC mentioned. Someone forgot to tell the authors that despite the fact DC is small, the metro area is large - 6M people within 20 miles of downtown. The traffic -- because there's only one bridge between Maryland and Virgina on each side of the city -- makes both morning and afternoon rush hours THREE HOURS LONG !! Its the worst in America -- the rush hor traffic reports are really accident reports.

http://finance.yahoo.com/news/the-10-best-places-to-retire.html

Also -- its one of the most expensive places in the country to live. Not good for retirees.

I've been to Santa Fe -- most overrated city in America. Pittsburgh is a nice cheap place to live, but the area is ugly.

Winston-Salem ? Really ? Charlotte/Asheville maybe.

Chris

yeah. WE WANT TO MOVE !

lol

But for now, we just get to visit it on weekends.

And my slideshow wall paper has some nice pics on it.

Chris

oh how beautiful chris!

I'm so jealous!

I bet you're ecstatic :)

Million-dollar foreclosures rise as rich walk away

Maybe this is the sign of the bottom ?

http://finance.yahoo.com/news/million-dollar-foreclosures-rise-rich-105400917.html

Chris

wow central america ....

you always seem to be there. You must really love it.

Modern life is very stressful. Especially if you have to work at a grinding job and be a mom at the same time. It takes its toll. And its amazing how just a few months away can make you feel better.

I wish I could do that but at least I get a week off every now and then. Also my job is less stressful now. Mostly cuz our industry has slowed down and instead of being asked to do 3 persons' jobs, there are plenty of people looking for something to do. And I'm more than happy to let them do it !

So I get to come to work, help out, and go home. Its someones else problem to make sure everything is on schedule and stuff.

I get paid the same either way.

I'm also old enough where I can retire with a pension if I wanted. Unfortunately the penalty for retiring each year before age 60 is huge, so I'll probably stick it out for another 2 - 3 years.

My dream would be getting laid off in about 2 years. In addition to getting a pension, I'd get 26 weeks severance pay as a going away gift ! lol

Chris

Hey Zeph, it was the second house I was involved in buying this year, lol.

In June my son was looking for a place to rent with 2 othyer guys and my wife said at 4.5% interest rates, the mortgage payment is the same as the rent. So my wife did some shopping, found a place, and my son put up the down payment. My only role was to help qualify for the financing.

Our plan for the waterfront place is to move there in 2 -3 years when my wife and I don't have full time jobs west of DC. The rent from our current house will pay for the mortgage on the new place.

By the way -- its SHOCKING what houses are selling for, even specialty ones like waterfront, compared to what people thought they could get for them in 2008. Like 40% less. Of course the 2008 expectyations were insane, but I'm still surprised there wasn't a buyer for our place when it was listed for $100,000 more, or $50,000 more. In fact I'm not sure why 6 weeks after it was listed for its final price that we were the only serious offer. But I'm not complaining, lol.

Its very clear the housing pipeline is broken right now. You have baby boomers in their 60s wanting to sell but NO ONE is their 40s can come up with the down payment needed to get a loan for the remaining 80%.

Prices and interest rates have finally come down enough to restore the pipeline, but the sellers who thought the cap gains from their home sales would help finance their retirements are actually taking losses on their places.

Chris

Welcome to the stock market's House of Pain ! This board is really just about anything but will probably focus on the gloom & doom the markets will experience as a result of the on-going collapse of the housing and credit bubble. This board was started on April 2007 which was well in advance of those in control of Wall Street and Washington admitting the US economy had a problem. Many people outside the Wall Street mainstream, like Bill Fleckenstein and Mish Shedlock made it very clear that the US economy from 2002 - 2007 was an artificially enduced real estate and credit bubble that could not be sustained.

http://globaleconomicanalysis.blogspot.com/

January 10th Update:

The markets have had a nice 2 month rally off their November lows. But the averages seem to be thinking about rolling over after seeing the job report for December and continued reports of layoffs and earnings dissapointments. Like everyone else I traded in and out of stuff like consumer discretionaries (SBUX, DPZ) and gold (AUY). I'm back to 90% cash again. Like Bill Fleckenstein I see the market for the moment battleing between the effects of severe recession and huge stimulus. The only compelling argument for stocks is that many of them yield way better than treasuries right now. Economists predict another 3 million people could lose their jobs so that's another 3 million people who are probably not buying stocks. And with the Palm Beach crowd selling jewelry and furniture to raise cash take by Berine Madoff, that adds yet even more hestitation to put money into he equity markets, because hedge fund managers and financial advisers have proven yet again that they can't be trusted.

Where the selloffs of October and November were panic induced forced liquidation selling, the next delcine in the markets will be more from simple attrition as people need to sell stocks for college tuitions or retirement and less people buy stocks. Very much like the 1970s. Although deflation is the big fear to avoid right now, eventually all the stimulus will result in a weaker dollar. But between the time the deflation fear subsides and the inflation kicks in, the stock market should have an awesome rally.

October 17th Update:

So hedge funds and institutions proceeded to liquidate, dump & short on October 3rd for one of the worst weeks in stock market history. When losses, gains, and volatility gets compared ot the 1970s and 1930s, you know were in for trouble. The markets dove on the Monday after the bailout bill was passed. But that's not why the markets dropped. The markets dropped when the banks figured out how screwed they were by the collapse of Lehman Bros (LEH) and AIG. Their balance sheets must have included a lot of securities/obligations associated with LEH and AIG were not longer worth anything, massive selling errupted to fix their balance sheets. Kind of like the finacial equivalent of "The Emperor Has No Clothes" story.

On the plus side, EVERYONE now believes we are in a recession and it with be long and serious. Makes ya wonder what those expert analysts and economists were smoking. Some of them are still saying stuff like the economy will recover in the Spring of 09. What a joke. But most talking heads think it'll be late 09 or early 2010 before the economy starts to recover. I tend to agree with that and since the markets anticipate economic recovery 6 - 9 months in advance, the markets might be at their bottom next Spring.

The other good news is -- as predicted, the price of oil is dropping. And so is gasoline. Its already under $3/gallon and I'm guessing $2.50 will be the new norm. This will help consumer discretionary stocks like Starbucks and Domino's Pizza.

There are 2 keys to the economic recovery that I'm looking for. This first is the 3-month interbank lending LIBOR. Its 4.5% now and it should be about 2%. When it gets below 3% we'll know the banking system is thawing and it will lay the groundwork for economic recovery. The second thing I'm watching is the unsold home inventory. There's currently an 11 month supply of unsold home. When it start heading down to 8 months we'll know the economic recovery is underway.

As for price tarkets, the S&P500 typically trades at a PE of 12 during recession bottoms, and its somewhere around 14 now. I expect earnings to drop below current estimates, so its not unthinkable for the S&P500 to drop to 600 - 700 which is about 30% down from its current mid-900 level. It hit a panic selling low of 838, so if there's another massive liquidation selloff, we could see mid 700 quite easily.

I'm still hoping UVE doesn't bite the dust -- it's at 2.50 and yielding .40 per year ! I'm also considering China Mobile (CHL) . Its at 40, has a PE of 10 and yields almost 4%. Its down 60% just like the overall Chinese market.

Gold is being dumped like all other commodity plays so I'm out of that. The QIDs and QLD are just nuts -- moving 10%+ daily so I'm out of them too. I expect that when the gold dumping stops and people realize that they're actually losing money in money markets and treasuries, gold will head higher again.

September 21st Update:

It appears that my July predictions came true. In a big way. Fannie, Freddie, Mortgage Companies, Investment Banks could finally no longer hide their debts and perpetuate their lies. Not to mention all the talking heads who said commodities weren't in a bubble.

For the past 2 years cracks have been forming in our economic infrastructure. Last year the cracks became visible. This week the dam finally broke. The next thing that will happen is the water will come out of the dam, run down the valley, and wipe out the town that was foolishly built in the valley below the dam.

The government bailout of Wall Street and the housing bubble may cost the taxpayers as much as $700B near term. Where is that money coming from ? From higher taxes ? Not likely unless we want to turn our up coming recession into a depression. Will foreign governments keep lending us money ? Sure -- as long as the interest rate compensates them appropriately.

Governments ALWAYS print their way out of debt. We've only done so mildly because we a prosperous and hard working country. But this bailout amount added to our regular annual debt, and a slowing economy, will overwhelm us.

It will take 3 - 5 years to work of the debt and backlog of foreclosed properties. Maybe longer. But in the meantime, the dollar's buying power will decrease. Other countries will also devalue their currencies so that their products are priced competitively, and global commodites like gold and oil will increase in dollar terms. The price of oil is uncertain because supply will not be a problem in a slowing world economy (i.e lowering the price of oil ), but a weaker dollar will increase the price of oil making both factors a wash.

The price of the stock maket is also uncertain because stock prices should drop in a slowdown/recession but stocks with solid book values will rise in dollar terms. So the DOW should be ok, but the NASDAQ could be in trouble. Like I asked in July, who will be buying stocks ? Most of America's spare change will be going to pay off our debts.

Gold ETFs and QIDs and of course, cash equilavents seem like the best place to be.

July 2nd Update:

What a difference 8 weeks makes !! Oddly enough my market prediction from May 11th was correct. The markets are more-or-less back to their 52 week lows except this time, the price of oil, other commodity prices, and unemployment are sinking in.

I would never have guessed that oil would go for $140/barrel. It is definitely in the grips of "hot money/big money" speculation, no matter what anyone says.

We maybe be experiencing cost-of-living item inflation, but the real truth is that we're experience real asset DEFLATION such as real estate and the value of too many business with too much capacity chasing too few customers. Housing, autos, consumer discetionaries are all getting hammered.

I'm guessing, barring some event that disrupts supply lines (weather or political unrest) oil will drop because demand in the US and China will drop. I'm expecting this to start by the end of the summer. But I don't expect oil to go much below $110, if at all. ChrisJP Note: There's a good chance that oil completed its double top this week (7/18).

The other problem going on is that pesky banking system, which needs to raise capital to cover their losses. So some of them are most likely selling billions of dollars of stocks every day too. And they're in no position to loan money to help businesses who are having cash flow problems weather the down turn. So business that are losing money and are running out of money (i.e. GM & F ?) are in trouble.

So the big question is -- who is buying stocks ? Are baby boomers on the cusp of retirement ? Maybe. Are GenX'ers who just bought their McMansion dream homes. Probably not. Are GenY'ers who are still living at home with mommy and looking for work ? Nope. Are the rich buying stocks knowing full well they will under-perform for the next few years ? Probably not.

So hardly anyone is buying stocks.

I'm mostly in cash (i.e. money market) but I have some UVE for its 8% yield (and I'm praying no hurricanes hit Florida, lol) and I have 1000 QIDs and 300 DUG (which I bought too early). I maybe buy a gold ETF in August if I think the Fed plans to keep rates steady.

My plan is to avoid stocks and wait for a washout in the next few months. I'm also considering shorting (with QIDs and DUG) until Obama is elected and when the markets crash -- I'll sell my QIDs and DUG. I will consider nibbling in December to ride a possible January effect.

_______________________________________________________________________________________________________________________________________

Jan 10th note: The S&P500 is bouncing around in its new trading range of 800 - 950, but appears to be ready to drop below its 20 dEMA again.

From July: The S&P 500 hit a new low on July 15 and the trend of lower highs and lower lows is still in place. I still think there is at least one more leg down maybe in the fall. I''m also interested in seeing how the S&P 500 does against its 20 and 50 dEMas (currently at around 1270 and 1310)

Looks like Iwas right about one more leg down. I gotta admit, I had no idea how big a leg down that would be !

April 13th Update:

Well it looks like back in January we did hit bottom, until Bear Stearns imploded in March, lol. Since the markets are controlled by Wall Street, they tend to moved based on Wall Streets perception of how the banking industry is doing, as opposed to what it really should be doing which is trading based on the US economy. Right now, the banks think they are gonna pull through, so the markets are holding up. If they drop another credit crisis bomb, all bets are off. The fact that the S&P 500 keeps selling off at 1380 is disturbing.

I still think for the next 2 years we are going to experience something like the 1972 - 1974 recession and something like Japan experienced in the 1990s. I think the "experts" estimates for 4th quarter earnings are a joke, but what do I know.

As for gold & oil -- recessions are supposed make the prices of these commodities drop. But if the Fed keeps interest rates below the inflation rate (like was done in the 70s) , the dollar will continue to fall and gold & oil will go up in dollar terms. Over the past 5 - 6 years, gold tends to make its big move in August through March, and then do mothing for 5 months. So I'll be looking at gold again in August.

Solid consumer disretionaries seem to be rebounding, but who knows how long it wil last. I noticed the chart patterns of CROX and NTRI improving, and since they have 1) dropped 80% quickly from their highs last year and 2) appear to have low PEs (assuming their earnings more hold) I decided to take small positions in them. With my luck I will dump them for a loss sometime in the coming months. NTRI was just added to the S&P 600 small cap index. CROX was doing fine until Thursday April 10th when it fell below its 20 dEMA again. So the big question is will CROX test its lows of 15.40 ? (ANSWER: YES !) CROX does not report earnings for the quarter ending March 31st until May. But it warned on April 14th. I expect it to lower estimates again between now and July 31st.

Smith & Wesson 3-month Chart - Jan 10th note: SWHC seems to have hit a wall in the 2.80 area so I sold.

Nutrisystems 3-month Chart - Jan 10th Note: I didn't trust NTRI and I was right. Why pay $150/week for diet food when its easier to just not by food you can't afford anyways ? NTRI ALWAYS gets a boost in January becuase of increased New Years resolution sales.

CROX 3-month Chart - Jan 10th Note: CROX is a total POS but it made a nice dead cat bounce in Nov from .87 to 1.60.

ETFC 3-month Chart - Jan 10th Note: The 20 dEMA and 50 dEMA are getting closer. At the moment it seems to be following its 20 dEMA support line.

China Mobile (CHL) - Jan 10th Note: I bough CHL in the mid 40s and sold it in the low 50s for a quick gain. Its back below its 20 and 50 dEMA because of concerms again over the Chinese economy. 45 seems to be a key level for CHL

Starbucks 3-month Chart - Jan 10th note: Starbucks is still riding its 20 dEMA trendine. With gas at $1.50/gallon it seems to be a good buy if it holds its trendline.

Dominos 3-month Chart - Jan 10th note: Dominoes made a nice January effect move. It has a lot of debt but it too should be helped by lower gas prices..

Visa 3-month Chart - V could have some problems as unemployed people up to their eyeballs in credit card debt stop paying their bills. For some reason V LOVES 55. No clue why.

Huntsman Corp.

January 31st Update:

It appears the markets have bottomed for the near term, so rather than gloat over the gloom and doom of the credit and housing markets, this board will be discussing stocks that will benefit from the huge Fed rate cuts and from Americans getting stimulus checks.

Consumer discretionaries have been beaten to a pulp so I think they will rebound. Starbucks (SBUX), Brinker International (EAT), and so on. I'm not looking for much, just 20% - 30% over the next few months. ChrisJP Note: As I predicted, the 30% move happened and these stocks are back down near their lows again.

ULTRASHORT NASDAQ 100 (QID) CHART

GOLD ETF (IAU) CHART

OIL ETF

THE BIG LIE

The Federal Reserve tried to curb the explosive growth in the U.S. housing sector under Alan Greenspan's tenure, but each time it tried to raise long-term interest rates it failed, the former Fed chief said.

"In 2004 we tried to raise mortgage rates by moving the 10-year Treasury note up and we failed," Greenspan told CNBC, adding that the Fed failed again in 2005 and would have failed had it tried in 2002.

"We had no control, that I could see, which would have made any difference in the extent of the bubble that was emerging," he said. "And we concluded, as we did with respect to the stock market bubble in the 1990s, that … as I pointed out previously, every time we tried to tighten … we weren't trying to knock the stock market down. We were reacting to inflationary pressures.

Greenspan denied that the Fed inflated the economy under his leadership, saying that rate policy was reacting to price pressure.

http://www.cnbc.com/id/20817941

THE TRUTH COMES OUT

Two pieces of housing news from the government on Tuesday: (1) Construction of single-family homes plunged last month to the lowest level in more than 16 years. (2) The Federal Reserve unveiled a plan to police the mortgage lending industry.

It's difficult to avoid concluding that if (2) had occurred sooner, (1) might have been avoided.

Though long overdue, the Fed's proposal strikes a reasonable balance between protecting consumers and avoiding overregulation. It would require lenders to — imagine this — consider the ability of borrowers to repay their loans. And the plan would restrict some of the most abusive practices designed to keep borrowers trapped in loans with escalating and exorbitant interest rates.

But this new plan also poses one obvious question. If it is so worthwhile and logical today, why wasn't it several years ago as the tidal wave of abusive and ill-considered loans was just developing?

Acting now on mortgage lending — when foreclosures are soaring, the housing market is sinking, banks are writing off billions in losses and a credit crunch threatens the broader economy — is like the proverbial farmer closing the barn door after the animals get loose.

Had the Fed plan been in place long ago, it might not have prevented a subprime lending bubble from forming, but it might have made it smaller and less damaging.

http://news.yahoo.com/s/usatoday/20071219/cm_usatoday/fedfinallyshutsbarndoor;_ylt=AmoC6Wn4D03W3nRsfSJnzk2s0NUE

ChrisJP Note: Greenspan could have dampened the 1990s stock market bubble by simply requiring tighter margin restrictions. But he didn't.

DA HORROR!!!!

DA HORROR!!!!

For those who can't deal with market selloffs (courtesy of Tina Marie)

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |