Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

That would be a good thing for the bag holders.

$GYST is following Bitcoin as predicted...

Looking at another month of a failure!

The only problem is that this is not a bitcoin company.

How long before Joe and Annie change course again?

Where is the big run for this great company? ![]()

No worries! Only important is that Bitcoin find its way up sustainable again!

$GYST

Just checked. Ugh. Somebody dumped.

Glta

I'm doing great here. I don't know why anyone is complaining. Bitcoin is only going up as the dollar crash looms. I think we'll see a big pop in the coming days/weeks.

Better some would invest real money into $GYST

Sky rocket will follow Bitcoin as already predicted.

Patience pays off here!

$GYST

Very low volume scam is pathetic. They must have forgotten how to run a P&D.

... still cheap... turnaround in da making...

$GYST

GO BITCOIN!

Bitcoin

46,918.30USD

+36.70 (0.08%)today

Companies developing a nice growth business. At current pace and rise in Bitcoin, we could see substantially higher numbers in subsequent quarters. Building it right IMO. Increase revenues and reducing liabilities. Bitcoin going to go parabolic as commodities continue to rise and Petro dollar u.s. currency wanes.

https://seekingalpha.com/pr/18695369-graystone-company-announces-1st-quarter-2022-financial-results-revenue-exceeded-fy-2021

Totally agreed.

Crypto winter seems to be over!

$GYST will follow soon, imho.

Adding here is a no brainer...

$GYST

Bitcoin is moving back up!

Revenues are increasing.

We will move soon!

Pure bullshit losers Joey and Annie!

Here's another link that specializes on OTC. You'll see a large number above current outstanding. Believe this is more accurate given naked shorts.

https://otcshortreport.com/company/GYST

37,000 shares out of 175 million is meaningless.

As for the Higher tier. We shall see if it helps.

Unfortunately it's a part of he OTC dynamics. Current short is at 37%. You'll find that at the bottom of the link. Corporate did uplist, with a new higher level of audited financials required as well.

https://www.otcmarkets.com/stock/GYST/security

Some good points except the shorting part.

Also one big factor is Annie and Joey have a long history of running scams.

We shall see.

I assume various factors. Over all markets, Bitcoin weakness, retail selling, and mm shorting, part or all could be factors in play. Corporate uplisted and are generating revenues, reduced or zero debt, and exhibiting growth. They have a higher transparency of accounting now required. There's a lot of progress here and a lot of potential growth. Given an improvement on the political landscape, rise in Bitcoin, and further corporate progress, it might have a substantial and sustained upside. Time will tell.

Why is the PPS so low?

The update on shares posted yesterday, show no additional shares brought to market. Dillution isn't in play. Either retail or naked. In this market, appearances are not always accurate. Corporate is not selling Fwiw.

https://www.otcmarkets.com/stock/GYST/security

Such a POS even the known promoters are avoiding it!

Wow! Down 30% already.

GLTY!

Joe and Annie forgot how to pump a scam? LOL

Great! Start a mega run!

Anastasia Shishova, CEO of The Graystone Company and wife of Joseph Wade Mezey the disbarred attorney who has been scamming since at least 2008.

https://dfpi.ca.gov/wp-content/uploads/sites/337/2012/03/Mezey_adr.pdf

and

https://decisions.courts.state.ny.us/ad3/decisions/2010/d-31-10%20mezey.pdf

Graystone Company Announces Record Revenue For January; January

Revenue Exceeds Total Revenue For FY 2021

News Link: https://www.otcmarkets.com/otcapi/company/dns/news/document/57406/content

Fort Lauderdale, FL – February 3, 2022 – Graystone Company, Inc. (OTC: GYST), is pleased to provide its preliminary unaudited financial results for the month ending January 31, 2022.

Preliminary results for our total unaudited revenues have increased to approximately $185,000 for January, consisting of (1) cryptocurrency mining, (2) sales of mining equipment and (3) realized gain on sales of digital currencies. The beginning of 2022 has been very productive for the company and financial results for the first month of the new year have already exceeded our revenues for our entire Fiscal Year of 2021.

“It has been an amazing journey since we launched our bitcoin mining operations in September 2021 and expanded to include equipment sales in October 2021. In terms of revenues, January of 2022 was GYST's best month to date. With the steady growth of our company, we are committed to expand our bitcoin mining operations and are actively exploring opportunities on the Metaverse platforms. We are constantly seeking strategic partners, creative business solutions and additional revenue sources that are complementary to GYST’s core business plan. With our on-going strategic initiatives, the Company is very well positioned for the rest of 2022 and beyond," said Anastasia Shishova, CEO of The Graystone Company

Hey losers. Get here and promote this one! LOL!

Boy need the chest waders here.

F'en clowns!

Assholes can't run a pump and dump anymore LOL

When will Joey and Annie start the big promo?

Maybe I should check when any insider shares can be dumped so I can load up.

Doesn't look like dillution. Nice close today. Bitcoin still don't know what direction will be taken.

Not convinced. Last update was 2/9, let's wait for the next update to be sure. Below average volume and given the market conditions, could be cautious retail or some shorting by MMS. Market cap and share structures here are highly favorable imo.

|

Followers

|

352

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

48039

|

|

Created

|

08/04/11

|

Type

|

Free

|

| Moderators | |||

The Company has entered into an Acquisition Agreement (the “AA”), appended as Exhibit1hereto with Direct Capital Investment Group, Inc. (“DCIG”) a Delaware corporation resulting in a change in control of the company from Anastasia Shishova (“Shishova”) to James Anderson (“Andersen”) the sole shareholder of DCIG who acquired a controlling interest in the Company pursuant to the AA. (the “Acquisition”) Details of the Acquisition are disclosed in Exhibit 1.

Previously, on June 1, 2023 pursuant to a Securities Purchase Agreement (the “DMI SPA”) appended as Exhibit 2 hereto, in which details of the DMI SPA are disclosed, DCIG purchased all of the then outstanding stock of Direct Mortgage Investors, Inc. (“DMI”), a Delaware corporation wholly owned by Anderson which owns and operates a mortgage origination company licensed in 17 states in the U.S. mid-Atlantic area whose website can be found at www.MTG101.com. As a result of the DCIG/DMI acquisition, the Company will focus exclusively on operating and expanding the mortgage lending business and will cease all its existing business operations.

For the year ended December DMI had (unaudited) revenues of $6,324,163 of and a loss of $1,669,892. For the period commencing January 1, 2023 and ending May 26, 2023 had (unaudited) revenue of $1,827,307 and a loss of $20,583.

In conjunction with the Acquisition, current Company CEO and Sole Director Anastasia Shishova appointed Anderson to be President, CEO and Director of the Company and Glen Gomez, an experienced mortgage professional as a Director of the Company and resigned her officer and director positions with the Company, effective immediately. Mr. Anderson's extensive mortgage expertise and proven DMI track record make him the ideal candidate to guide the Company going forward.

Exhibits

1 Direct Capital Acquisition Agreement

2 Direct Capital Securities Purchases Agreement

Safe Harbor Statement

The information furnished in Form 1-U is not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section, and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

This Current Report on Form 1-U contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, including those described under the section entitled “Risk Factors” in our Offering Statement on Form 1-A dated July 23, 2018, filed with the Securities and Exchange Commission (“SEC”), as such factors may be updated from time to time in our periodic filings and prospectus supplements filed with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in our filings with the SEC. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

| 2 |

|

|

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| THE GRAYSTONE COMPANY, INC. | ||

|

|

| ||

| Date: June 26, 2023 | By: | /s/ James Anderson |

|

|

| Name: | James Anderson |

|

|

| Title: | CEO |

|

|

|

|

|

|

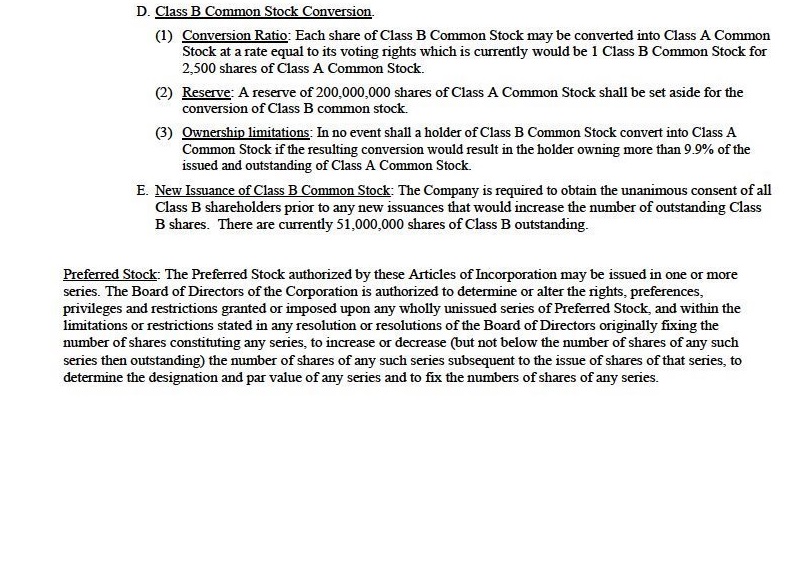

Read the Acquisition agreement and understand it. Pay close attention to the Class B shares which convert into 2500 free trading shares ewach!

https://www.otcmarkets.com/filing/html?id=16750502&guid=zzD-keOSEzifJth

The math here does not add up.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |