Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

This is basically a dormant shell. So no.

Do you have a target price for the stock for the next three months?

Nothing since June 17, 2023. I am surprised that they are Pink Current as there have been no filings sine the 1 U in June.

Someone buying one share at a time lol

Do people know this stock is a scam. RS so many times.

Looks like it died.

This company has and is still run by the Joseph Wade Mezey clan. They are very well known scammers going back many years to when Joey got a cease and desist from California and got disbarred in New York.

Check out some of the related companies to see. The same names keep popping up.

CGLD, EMBR, NHMD, SIGO, VTXB ARE JUST SOME.

Also one should read the history of this and related companies. Almost like scam of the month club.

.002-.007 in a week? That's is very highly buyers

Why scam warning BuT pps keep rising??? Doesn't make sense to me! Please explain!

Wrong company!

150 S. Pine Island Road, Suite 300, Plantation, Fl 33324

Direct Mortgage Investors, Inc. NMLS# 1559635

Plantation, FL

https://plus.preapp1003.com/Roland-Collymore

There are some more peeps involved into that business:

https://mtg101.com/lender-list/

A one person company? Another scam like the debt consolidation company run by Anastasia's husband Joseph Wade Mezey who got disbarred?

Direct Mortgage Investors, Inc. NMLS# 1559635

Plantation, FL

https://plus.preapp1003.com/Roland-Collymore

STATE OF CALIFORNIA

BUSINESS, TRANSPORTATION AND HOUSING AGENCY

DEPARTMENT OF CORPORATIONS

TO: Joseph Wade Mezey

Mezey & Associates, Inc.

405A Arenoso

San Clemente, CA 92672

Jeffrey Campos

Campos Chartered Law Firm

210 N. University Drive, 9th Floor

Coral Springs, FL 33071

The Consumer Protection Law Center

dba Consumer Law Center, LLC

210 N. University Drive, Suite 901

Coral Springs, FL 33071

AMENDED DESIST AND REFRAIN ORDER

(For violations of section 12200 of the Financial Code)

https://dfpi.ca.gov/wp-content/uploads/sites/337/2012/03/Mezey_adr.pdf

State of New York

Supreme Court, Appellate Division

Third Judicial Department

Decided and Entered: July 1, 2010 D-31-10

___________________________________

In the Matter of JOSEPH W.

MEZEY, an Attorney.

COMMITTEE ON PROFESSIONAL MEMORANDUM AND ORDER

STANDARDS,

Petitioner;

JOSEPH W. MEZEY,

Respondent.

(Attorney Registration No. 4047841)

___________________________________

Calendar Date: March 29, 2010

Before: Spain, J.P., Rose, Lahtinen, Malone Jr. and

Kavanagh, JJ.

ORDERED that respondent is disbarred, and his name is

stricken from the roll of attorneys and counselors-at-law of the

State of New York, effective immediately; and it is further

ORDERED that respondent is hereby directed to make monetary

restitution pursuant to Judiciary Law § 90 (6-a) as follows:

$5,925 to Stephen L. Talve; $14,328 to Keith Anderson; $8,970 to

Roger Cottle; $6,090 to Shane DeCremer; $8,761.85 to Randall Cox;

$7,600 to David Smith; $4,500 to Patricia Thompson; $6,450 to

Lynne Sherman; and $5,600 to Patrice Nowiszewski and Daniel

Nowiszewski;

https://decisions.courts.state.ny.us/ad3/decisions/2010/d-31-10%20mezey.pdf

Just as I thought!

Quest Workspaces Plantation

150 South Pine Island Road, 300, Plantation, FL 33324

https://liquidspace.com/us/fl/plantation/vanessa-vegas-plantation

That scam fell apart. New scam.

In one time they were mining bitcoin, what happened to that?

Check on their Twitter page they have bitcoin logo

In one time they were mining bitcoin, what happened to that?

There are some updates on X

https://twitter.com/TheGraystoneco

I think it’s on their main website: https://www.thegraystoneco.com

Can someone post a link to to either Direct Capital or Direct Mortgage website.

OMG! Another incestouous reverse merger.

Anastasia is Joseph Wade Mezey's wife.

As part of this transaction, Anastasia Shishova resigned from her position as an officer and director of Direct Capital on June 1, 2023, paving the way for a new era of growth and opportunity within the organization.

Direct Capital, through its subsidiary Direct Mortgage, has exhibited remarkable performance in the mortgage industry. In 2022, the company generated revenues totaling $6,324,163. During the same year, they facilitated approximately 450 loans, securing approximately $152 million in funded mortgages.

Powerhour!

Let's go!

$GYST

Is this the way to a new 24 months-high?

Last high in that timeframe was on March 29, 2021 at 0.0989$

$GYST

Looks like the sky is the limit! At the moment + 100% - very low volumes.

If someone want to get in bigger she is exploding imo!

$GYST

This stock is flying because of Merger Completion News!

$GYST

$GYST market cap only around 1 million US$ & Pink Current!

Sounds like strong growth:

Direct Capital, through its subsidiary Direct Mortgage, has exhibited remarkable performance in the mortgage industry. In 2022, the company generated revenues totaling $6,324,163. During the same year, they facilitated approximately 450 loans, securing approximately $152 million in funded mortgages.

The momentum continued into 2023, with Direct Capital achieving outstanding results. From January through August 2023, they oversaw the funding of 353 mortgages, with a total value of $119 million. This noteworthy performance in the first eight months of 2023 puts Direct Capital on pace to surpass its already impressive 2022 numbers.

Market is liking that news: +50%

With James Anderson we have a very prominent leader in this company just now!

https://www.ftadviser.com/investments/2023/05/15/baillie-gifford-s-james-anderson-joins-investment-manager/

The Graystone Company Announces Completion of Acquisition of Direct Capital via Reverse Merger

Plantation, FL -- September 11, 2023 -- InvestorsHub NewsWire -- The Graystone Company (OTC: GYST) is pleased to announce the successful completion of its acquisition of Direct Capital, a leading mortgage banker and broker, through a reverse merger transaction. The reverse merger transaction was finalized on June 1, 2023, resulting in a significant change of control within the company.

As part of this transaction, Anastasia Shishova resigned from her position as an officer and director of Direct Capital on June 1, 2023, paving the way for a new era of growth and opportunity within the organization.

Direct Capital, through its subsidiary Direct Mortgage, has exhibited remarkable performance in the mortgage industry. In 2022, the company generated revenues totaling $6,324,163. During the same year, they facilitated approximately 450 loans, securing approximately $152 million in funded mortgages.

The momentum continued into 2023, with Direct Capital achieving outstanding results. From January through August 2023, they oversaw the funding of 353 mortgages, with a total value of $119 million. This noteworthy performance in the first eight months of 2023 puts Direct Capital on pace to surpass its already impressive 2022 numbers.

The acquisition of Direct Capital by The Graystone Company marks a significant step forward in our commitment to providing exceptional financial services and expanding our footprint within the mortgage industry. With a strong foundation and a team of dedicated professionals, we are excited about the growth opportunities this merger brings and look forward to providing enhanced services to our clients.

About The Graystone Company, Inc.

The Graystone Company (OTC: GYST) is a dynamic and forward-thinking financial services company dedicated to delivering top-tier mortgage services and investment solutions to our clients. We are committed to innovation, growth, and excellence in the financial sector.

You are posting on this board

I post as a Mod calling out this scam.

It's hard to believe that this stock is still trading and even harder to comprehend there are people still posting on this board.

It is nothing but a proven scam.

Prtomoting a virtual office? Just minutes from Wade's wife Anastasia's UPS Store mailbox?

SMH

150 S. Pine Island Road, Suite 300, Plantation, Fl 33324

https://questworkspaces.com/plantation?utm_source=Google-Business&utm_medium=Listing&utm_campaign=Plantation

401 East Las Olas Blvd

Suite 401-321

Fort Lauderdale, FL 33301

The UPS Store Downtown Fort Lauderdale on Las Olas Blvd.

https://locations.theupsstore.com/fl/fort-lauderdale/401-e-las-olas-blvd

https://mtg101.com/

...was down a long time and now it is up again!

$GYST

SCAM WARNING

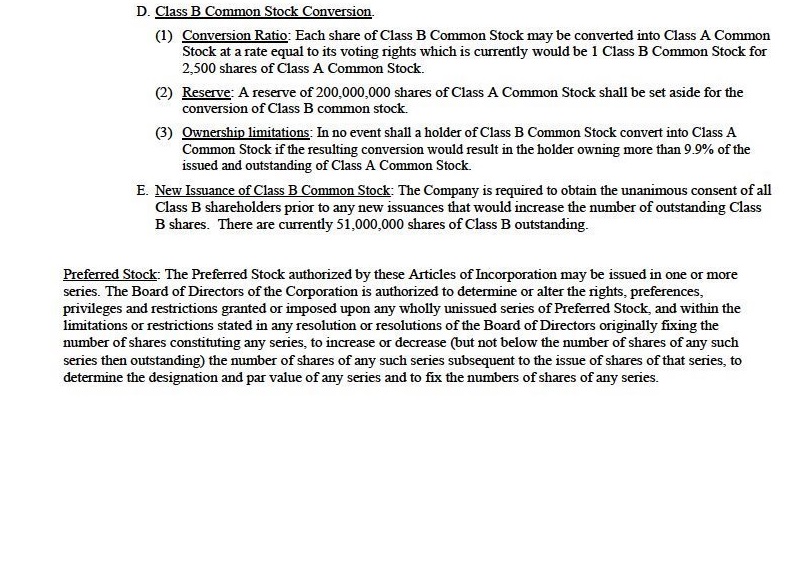

There are currently 51,000,000 shares of Class B outstanding.

Conversion Ratio: Each share of Class B Common Stock may be converted into Class A Common Stock at a rate equal to its voting rights which is currently would be 1 Class B Common Stock for 2,500 shares of Class A Common Stock.

Converted that would be 127 billion shares!

The mortgage company reported revenue of $6,324,163 and a loss of $1,669,892.

tem 9. Other Events

The Company has entered into an Acquisition Agreement (the “AA”), appended as Exhibit1hereto with Direct Capital Investment Group, Inc. (“DCIG”) a Delaware corporation resulting in a change in control of the company from Anastasia Shishova (“Shishova”) to James Anderson (“Andersen”) the sole shareholder of DCIG who acquired a controlling interest in the Company pursuant to the AA. (the “Acquisition”) Details of the Acquisition are disclosed in Exhibit 1.

Previously, on June 1, 2023 pursuant to a Securities Purchase Agreement (the “DMI SPA”) appended as Exhibit 2 hereto, in which details of the DMI SPA are disclosed, DCIG purchased all of the then outstanding stock of Direct Mortgage Investors, Inc. (“DMI”), a Delaware corporation wholly owned by Anderson which owns and operates a mortgage origination company licensed in 17 states in the U.S. mid-Atlantic area whose website can be found at www.MTG101.com. As a result of the DCIG/DMI acquisition, the Company will focus exclusively on operating and expanding the mortgage lending business and will cease all its existing business operations.

For the year ended December DMI had (unaudited) revenues of $6,324,163 of and a loss of $1,669,892. For the period commencing January 1, 2023 and ending May 26, 2023 had (unaudited) revenue of $1,827,307 and a loss of $20,583.

In conjunction with the Acquisition, current Company CEO and Sole Director Anastasia Shishova appointed Anderson to be President, CEO and Director of the Company and Glen Gomez, an experienced mortgage professional as a Director of the Company and resigned her officer and director positions with the Company, effective immediately. Mr. Anderson's extensive mortgage expertise and proven DMI track record make him the ideal candidate to guide the Company going forward.

Mortage company website is suspended.

https://www.mtg101.com/cgi-sys/suspendedpage.cgi

Website in the filings is unsafe.

www.MTG101.com.

The acquisition deal was only announced, but still not closed si far...

What deal?

Can you help me out please

I guess market is waiting for a closed deal. Still only an agreement with DMI. Not closed yet.

$GYST

Why there is no buying and selling today??

Why there is no buying and selling today??

Watch out for major dilution here. This stinks of a typical Joseph Wade Mezey playbook scam.

GYST will owe Anastasia Shishova $5 million. (Joeseph Wades wife!}

There are currently 51,000,000 shares of Class B outstanding.

Conversion Ratio: Each share of Class B Common Stock may be converted into Class A Common Stock at a rate equal to its voting rights which is currently would be 1 Class B Common Stock for 2,500 shares of Class A Common Stock.

DMI's homepage is not looking too bad!

https://www.dmifinancialservices.com/

Just saying:

$GYST marketcap is about 350.000 US$

DMI revenues are about 6.300.000 US$

The loss in 1st Q only was 20.000US$

IMO Expected DMI revenues for 2023 about 8 mln US$

That could get really interesting here again!!!

|

Followers

|

350

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

48039

|

|

Created

|

08/04/11

|

Type

|

Free

|

| Moderators | |||

The Company has entered into an Acquisition Agreement (the “AA”), appended as Exhibit1hereto with Direct Capital Investment Group, Inc. (“DCIG”) a Delaware corporation resulting in a change in control of the company from Anastasia Shishova (“Shishova”) to James Anderson (“Andersen”) the sole shareholder of DCIG who acquired a controlling interest in the Company pursuant to the AA. (the “Acquisition”) Details of the Acquisition are disclosed in Exhibit 1.

Previously, on June 1, 2023 pursuant to a Securities Purchase Agreement (the “DMI SPA”) appended as Exhibit 2 hereto, in which details of the DMI SPA are disclosed, DCIG purchased all of the then outstanding stock of Direct Mortgage Investors, Inc. (“DMI”), a Delaware corporation wholly owned by Anderson which owns and operates a mortgage origination company licensed in 17 states in the U.S. mid-Atlantic area whose website can be found at www.MTG101.com. As a result of the DCIG/DMI acquisition, the Company will focus exclusively on operating and expanding the mortgage lending business and will cease all its existing business operations.

For the year ended December DMI had (unaudited) revenues of $6,324,163 of and a loss of $1,669,892. For the period commencing January 1, 2023 and ending May 26, 2023 had (unaudited) revenue of $1,827,307 and a loss of $20,583.

In conjunction with the Acquisition, current Company CEO and Sole Director Anastasia Shishova appointed Anderson to be President, CEO and Director of the Company and Glen Gomez, an experienced mortgage professional as a Director of the Company and resigned her officer and director positions with the Company, effective immediately. Mr. Anderson's extensive mortgage expertise and proven DMI track record make him the ideal candidate to guide the Company going forward.

Exhibits

1 Direct Capital Acquisition Agreement

2 Direct Capital Securities Purchases Agreement

Safe Harbor Statement

The information furnished in Form 1-U is not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section, and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

This Current Report on Form 1-U contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, including those described under the section entitled “Risk Factors” in our Offering Statement on Form 1-A dated July 23, 2018, filed with the Securities and Exchange Commission (“SEC”), as such factors may be updated from time to time in our periodic filings and prospectus supplements filed with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in our filings with the SEC. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

| 2 |

|

|

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| THE GRAYSTONE COMPANY, INC. | ||

|

|

| ||

| Date: June 26, 2023 | By: | /s/ James Anderson |

|

|

| Name: | James Anderson |

|

|

| Title: | CEO |

|

|

|

|

|

|

Read the Acquisition agreement and understand it. Pay close attention to the Class B shares which convert into 2500 free trading shares ewach!

https://www.otcmarkets.com/filing/html?id=16750502&guid=zzD-keOSEzifJth

The math here does not add up.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |