Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

When will Joey and Annie start the big promo?

Maybe I should check when any insider shares can be dumped so I can load up.

Doesn't look like dillution. Nice close today. Bitcoin still don't know what direction will be taken.

Not convinced. Last update was 2/9, let's wait for the next update to be sure. Below average volume and given the market conditions, could be cautious retail or some shorting by MMS. Market cap and share structures here are highly favorable imo.

Scumbags diluting!

Even half a bone would be awesome!!

I hope Annie and Joey runs this to $1.00.

Well the uplist is now history and the financials are audited. Share structures and low market cap. I can only go by what's disclosed. So far I see a CEO intent on developing a burgeoning business. I'll adjust if actions defer from present. As a shareholder I'm pleased.

Don't bet the house on it. ANASTASIA SHISHOVA is the wife of Joseph Wade Mezey and they have run many scams for years.

Should be good here. Like any OTC there are risks but the good here far outweighs the past history. CEO IMO doing a very good job!

Even I have to admit that on face value it looks good.

But the history here is horrendous.

Let them play their games. Zero debt, revenues, growth, low share structures and market cap, and now uplist. All good here..

Great news? PPS in trouble.

The top MM's are known to liquidate large blocks. High volume today.

JANE...we excel at executing large trades with minimal market impact.

CDEL, GTSM not a good sign either.

We shall see.

Due to the OTCQB listing, now Level 2 quotes for all:

https://www.otcmarkets.com/stock/GYST/quote#level-2

Nice!

$GYST

$GYST Graystone Company Announces Up-listing to OTCQB Venture Market

https://www.prnewswire.com/news-releases/graystone-company-announces-up-listing-to-otcqb-venture-market-301479689.html

FORT LAUDERDALE, Fla., Feb. 10, 2022 /PRNewswire/ -- Graystone Company, Inc. (OTCQB: GYST), is pleased to announce that it has obtained approval for trading on the OTCQB, that is operated by the OTC Markets Group. The Company's Class A Common Stock has officially commenced trading on the OTCQB under the ticker symbol "GYST". Investors can find quotes for the Company's common stock on www.otcmarkets.com.

"We are excited about Graystone's official upgrade to the OTCQB Venture Market," said Anastasia Shishova, President of The Graystone Company. "It is a significant milestone and a logical progression for the Company towards our goal to make 2022 a transformational year for our business. Additionally, this elevates Graystone's profile within the investment community and signifies a part of our long-term strategy to introduce the Company to a broader audience. We would like to thank our shareholders for their ongoing support as we execute on our ten-year plan to expand and grow our bitcoin mining business within the streamlined market standards established by OTCQB."

The OTCQB is recognized by the Securities and Exchange Commission (SEC) as an established public market providing data that investors need to analyze, value and trade securities. Being part of an established financial marketplace will assist in diversifying our shareholder base with increased liquidity and brand visibility while maintaining a high level of transparent trading, annual verification, continuous regulation and provide a strong baseline of transparency to inform and engage investors. The requirements and standards for OTCQB can be found at https://www.otcmarkets.com/corporate-services/get-started/otcqb.

Graystone's listing on OTCQB enhances the availability of such information to the general public and ultimately provides greater transparency for our investors, since all companies listed on OTCQB must have audited financials, must be current in their reporting and undergo an annual verification and management certification process. As one of the few bitcoin mining companies listed on the OTCQB, we strongly believe this differentiates from our competitors and further validates our efforts to influence the industry as whole by raising the bar and bringing transparency and legitimacy to the exponentially growing blockchain and crypto market for the benefit of our shareholders.

OTCQB now.....nice.

Hawk

Uplist approved! Congrats corporate!

OTC is Wild West and everyone who invest in OTC should know that >> very high risk meets extremely high rewards.

Time will tell if GYST can surprise.

It has been done many times over the years.

But you don't want to claim, that a group of pushers is really able to bring rising power into the stock... imo not!

So when bit coin starts moving up the team will show up? ![]()

Have you seen Bitcoin raising? Nope! GYST could release 100 news a week, without a raising Bitcoin GYST won't raise. Understand?

7 recent P/R's and nothing!

Five P/R's in two weeks and nothing?

What a POS!

Will they show up now?

Record revenues?

Graystone Company Announces Record Revenue For January; January Revenue Exceeds Total Revenue For FY 2021

FORT LAUDERDALE, Fla., Feb. 3, 2022 /PRNewswire/ -- Graystone Company, Inc. (OTC: GYST), is pleased to provide its preliminary unaudited financial results for the month ending January 31, 2022.

Preliminary results for our total unaudited revenues have increased to approximately $185,000 for January, consisting of (1) cryptocurrency mining, (2) sales of mining equipment and (3) realized gain on sales of digital currencies. The beginning of 2022 has been very productive for the company and financial results for the first month of the new year have already exceeded our revenues for our entire Fiscal Year of 2021.

"It has been an amazing journey since we launched our bitcoin mining operations in September 2021 and expanded to include equipment sales in October 2021. In terms of revenues, January of 2022 was GYST's best month to date. With the steady growth of our company, we are committed to expand our bitcoin mining operations and are actively exploring opportunities on the Metaverse platforms. We are constantly seeking strategic partners, creative business solutions and additional revenue sources that are complementary to GYST's core business plan. With our on-going strategic initiatives, the Company is very well positioned for the rest of 2022 and beyond," said Anastasia Shishova, CEO of The Graystone Company.

https://finance.yahoo.com/news/graystone-company-announces-record-revenue-130000536.html

$GYST

This one should have a forward split soon. They support their shareholders.

No one is able to push a stock price by posting in discussion boards. The same applies also to the other way around. My posting are for information only.

No one is buying Bitcoins as well. GYST price will move after a BTC price move. As long BTC is bottomed, GYST will be too.

Nice post but no one is buying!

The Graystone Company, Inc. (OTCMKTS: $GYST) ESG Advantages

The Graystone Company, The Graystone Company (OTCMKTS:GYST)

As 2022 catapults into its second month of business, all things environment, sustainability, and green (ESG) are hot topics for investors seeking attractive businesses with potential.

The Graystone Company, Inc. (OTCMKTS: GYST) is a Bitcoin mining company, that through its actions shows it is aware of these trends. This makes it one of the few BTC miners that ESG investors will consider.

GYST has made sustainability a large part of its vision, and is putting its plans into action in three significant ways:

GYST’s Sustainable Practices

Acquisition of 50 Antminer S19j Pro (100TH) machines. These new machines greatly increase environmental appeal because they are said to be the top-of-the-line, coolest running, and most energy efficient mining computer on the market.

2. GYST uses 3rd party data center to host its equipment. This “co-location” receives its power from a nuclear power plant. Thus, the Company’s operations will be derived from a clean, zero-emissions energy source.

3. Last, yet certainly not least, the Company announced its tree-planting program. Initially, they volunteered to plant 1,000 trees through donation and a partnership with the National Forest Foundation. In addition to this, Graystone (OTCMKTS:GYST) plans to plant one tree for each terrahash it mines and moving forward. GYST has already contributed 2,100 trees, thereby removing over 4.5 tons of air pollutants to date.

While this is pretty “cool”, it is simultaneously red “hot” from an investment standpoint.

Celebrity Investor and Shark Tank Star Kevin O’Leary Agrees

After a recent trip to the Middle East with the goal of seeking new ways to invest in Bitcoin, Kevin O’Leary, aka Mr. Wonderful, discovered excitement in the concept of sustainable Bitcoin mining investments. When a big name makes an announcement like this, many will hear about it and want to be a few of the first passengers on the Sustainable Mining Ship.

The expectation is that sustainable crypto mining stocks will experience a surge in value. Particularly, Graystone (OTCMKTS:GYST) is a company to pay close attention to as the race to compete in the cryptocurrency industry heats up.

https://www.drpjournal.com/the-graystone-company-inc-otcmkts-gyst-esg-advantages/

Remind the known group that this has great news and to hurry up! ![]()

So where are the buyers?

Very decent share structures and market cap here. An early growth play.

https://www.otcmarkets.com/stock/GYST/security

Slowly front loading before the pump?

Got in 2 days ago on $GYST. Growth , decent share structures and reasonable market cap.

Tons of great news, but no one is buying?

I don't understand.

$GYST Graystone Company Continues Expansion of Its Bitcoin Mining Operation; Increases Total Order To 50 S19j Pros

https://www.prnewswire.com/news-releases/graystone-company-continues-expansion-of-its-bitcoin-mining-operation-increases-total-order-to-50-s19j-pros-301468998.html

FORT LAUDERDALE, Fla., Jan. 27, 2022 /PRNewswire/ -- Graystone Company, Inc. (OTC: GYST) is pleased to announce updates about our continued expansion of its bitcoin mining operations. We have just secured the purchase of 9 additional machines. This brings the total number of units on order to 50. The units will begin to be installed in the coming weeks.

We started mining on September 15, 2021, we can't be more proud of the results. Since then, we have grown each month by thoroughly planning each equipment acquisition tranche. We are focused on being patient and growing our revenues and profits slow and steady for the long-term benefits of the company and its shareholders and building a strong foundation that can support our future expansion plans. We are currently planning on acquiring 8-20 machines per month for the next 6 months and then increasing our purchases to 20-30 machines per month. Executing on this plan will allow the company to be mining with up to 300 machines by the end of 2022. Additionally, our revenue will begin to increase as our mining hash-power increases as the new machines are being installed.

We are also excited to announce that we are planning to dedicate some of the equipment and space we have acquired to subleasing to 3rd party clients. This business model is attractive due to extremely high demand and profitability, and we see it as a great opportunity that can't be missed, because it will provide supplemental revenue in addition to mining BTC for ourselves. We are passionate about the emerging bitcoin mining industry, and we strongly believe in our vision we have for the future of our company, it is rewarding as we accomplish each milestone along our journey towards the building of this future.

WHERE ARE THE TROOPS?

Graystone Company, Inc. (OTCMKTS: GYST) Hashrate To Increase Six-Fold

The Graystone Company, Inc. (OTCMKTS: GYST) is a bitcoin mining company that has increased its computing power dramatically in a few short months making it a stock crypto investors are watching closely as the sector rallies.

Bitcoin is in the spotlight after its recent price drop, but if new investors in this post meme stock world learned anything it’s “buy the dip”. The old buy low, sell high mantra certainly applies to GYST, who experienced a price drop in January like every other crypto play.

Prior to last week, the stock was on as steady an uptrend as you will find in a company with GYST’s market cap. After hitting a low of $0.015 on Monday, the stock has rallied and sits just above 2 cents.

If the rally in bitcoin continues, GYST may follow in tandem and march back toward its 7 cent high.

WHY GYST?

GYST has proven success in its short time as a miner, since entering the market last Spring as an equipment seller and initiating its own mining operations this past September; the company has dramatically increased its revenue and looks poised to continue its growth trajectory in 2022.

GYST announced sales in the final three months of 2021 of $176,926. The company’s assets grew to $412,445. A massive improvement over the goose egg the company reported in its previous quarter and helped shareholder equity rise to $365,954 from ($1,140).

This revenue growth will continue if the company continues to boost its bitcoin production capacity.

GYST’s HASHRATE

From this past September to November the company’s terrahash rate doubled from 1,100 terrahash per second (TH/s) to 2,100 TH/s. After a recent acquisition, this capacity is set to increase again to 6,200 TH/s.

For the uninitiated, Bitcoin mining company value is based on hashrate which is essentially the computing power that company possesses. The company’s goal is to reach 1 million TH/s or, as it’s marked in the crypto community, 1,000 PH/s by 2024. For perspective, companies like Bit Digital, Inc. (Nasdaq: BTBT), CleanSpark Inc. (Nasdaq: CLSK), BIT Mining, LTD (NYSE: BTCM) and Greenidge (Nasdaq: GREE) currently have hashrates at or near GYST’s goal.

At GYST’s current hashrate growth curve, the company will hit its goal well before 2024.

If the stock can reach prices similar to BTBT, CLSK, BTCM and GREE by then, early GYST investors would feel like early bitcoin investors did near the end of 2021.

VOLATILITY IN BITCOIN

Bitcoin is of course volatile, but JP Morgan analysts projected last October that Bitcoin could eventually reach a valuation of $146,000, according to The Wall Street Journal.

Despite its recent dip, we have been here before with bitcoin, as its price recovers analyst predictions may yet prevail like Ark Invest’s Cathie Wood, for example, who believes the price could rise by another $500,000 as institutions increase their allocations to the digital currency to 5% of their portfolio’s value.

Remember, there are a few underlying facts that differentiate bitcoin other than its first-mover adoption rate:

–Only 21 million bitcoins will ever be produced.

–Over 90% have been mined already (18.9 million).

–Bitcoin mining supply is estimated to be exhausted by 2040.

The scarcity alone combined with institutional adoption should support value in the cryptocurrency.

GYST’s INFRASTRUCTURE

GYST is building infrastructure, Bitcoin mining power potential and expanding hosting equipment.

–The Company has added 4,100 TH/s by acquiring 41 S19j Pro machines. Installation is expected to begin the end of this month. They are expected to be initially placed at third-party data-centers or farms. GYST will host, provide power and maintain the equipment.

–GYST plans to mine only Bitcoin and all of its mining operations will be conducted through wholly owned subsidiary, Graystone Mining.

–GYST’s current operations consist of 2,100 TH/s leased from Supply Bit, LLC. They are on a three-year lease, equal to the useful life of the equipment. The costs are approximately $3,600 per month plus a 15% management fee, the Company says.

TAKEAWAY

GYST has started its bitcoin mining operations with a bang. Already set to increase its computing power 6 fold from its September start; the company is on pace to reach its 1,000,000 TH/s goal well before the stated deadline of 2024.

With Bitcoin and thereby public companies in the bitcoin business rebounding, now is an opportune time to put GYST on your Watch List.

$GYST

And imo 99% of the OTC stocks are scam, but you can make profits with all of them if you know how it works and if you can read a chart even of a scam stock.

Please let it move to the correct category! Thanks

That is still ONLY your opinion! So imo it matters!

But it is still a scam. So does it matter?

If you want to do something useful regarding your role as GYST board admin, please let move the board from category "Cannabis" to "Cryptocurrency Industry". That would reflect better company's new business model.

Thanks in advance!

$GYST

OK. Waiting for the usual ones to show up.

|

Followers

|

352

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

48039

|

|

Created

|

08/04/11

|

Type

|

Free

|

| Moderators | |||

The Company has entered into an Acquisition Agreement (the “AA”), appended as Exhibit1hereto with Direct Capital Investment Group, Inc. (“DCIG”) a Delaware corporation resulting in a change in control of the company from Anastasia Shishova (“Shishova”) to James Anderson (“Andersen”) the sole shareholder of DCIG who acquired a controlling interest in the Company pursuant to the AA. (the “Acquisition”) Details of the Acquisition are disclosed in Exhibit 1.

Previously, on June 1, 2023 pursuant to a Securities Purchase Agreement (the “DMI SPA”) appended as Exhibit 2 hereto, in which details of the DMI SPA are disclosed, DCIG purchased all of the then outstanding stock of Direct Mortgage Investors, Inc. (“DMI”), a Delaware corporation wholly owned by Anderson which owns and operates a mortgage origination company licensed in 17 states in the U.S. mid-Atlantic area whose website can be found at www.MTG101.com. As a result of the DCIG/DMI acquisition, the Company will focus exclusively on operating and expanding the mortgage lending business and will cease all its existing business operations.

For the year ended December DMI had (unaudited) revenues of $6,324,163 of and a loss of $1,669,892. For the period commencing January 1, 2023 and ending May 26, 2023 had (unaudited) revenue of $1,827,307 and a loss of $20,583.

In conjunction with the Acquisition, current Company CEO and Sole Director Anastasia Shishova appointed Anderson to be President, CEO and Director of the Company and Glen Gomez, an experienced mortgage professional as a Director of the Company and resigned her officer and director positions with the Company, effective immediately. Mr. Anderson's extensive mortgage expertise and proven DMI track record make him the ideal candidate to guide the Company going forward.

Exhibits

1 Direct Capital Acquisition Agreement

2 Direct Capital Securities Purchases Agreement

Safe Harbor Statement

The information furnished in Form 1-U is not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section, and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

This Current Report on Form 1-U contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties, including those described under the section entitled “Risk Factors” in our Offering Statement on Form 1-A dated July 23, 2018, filed with the Securities and Exchange Commission (“SEC”), as such factors may be updated from time to time in our periodic filings and prospectus supplements filed with the SEC, which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in our filings with the SEC. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

| 2 |

|

|

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| THE GRAYSTONE COMPANY, INC. | ||

|

|

| ||

| Date: June 26, 2023 | By: | /s/ James Anderson |

|

|

| Name: | James Anderson |

|

|

| Title: | CEO |

|

|

|

|

|

|

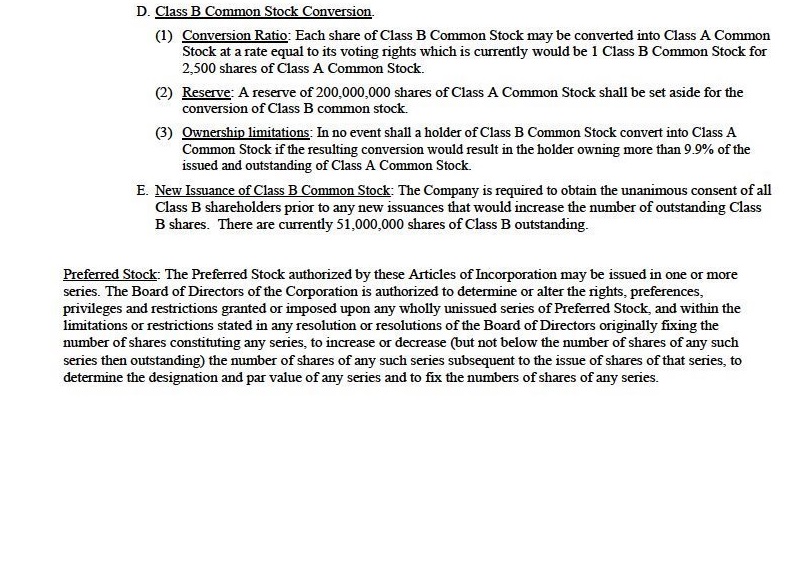

Read the Acquisition agreement and understand it. Pay close attention to the Class B shares which convert into 2500 free trading shares ewach!

https://www.otcmarkets.com/filing/html?id=16750502&guid=zzD-keOSEzifJth

The math here does not add up.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |