Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Tencent Holdings $TCEHY - The most important stock in China plunged more than -10%

By: Jason Goepfert | December 22, 2023

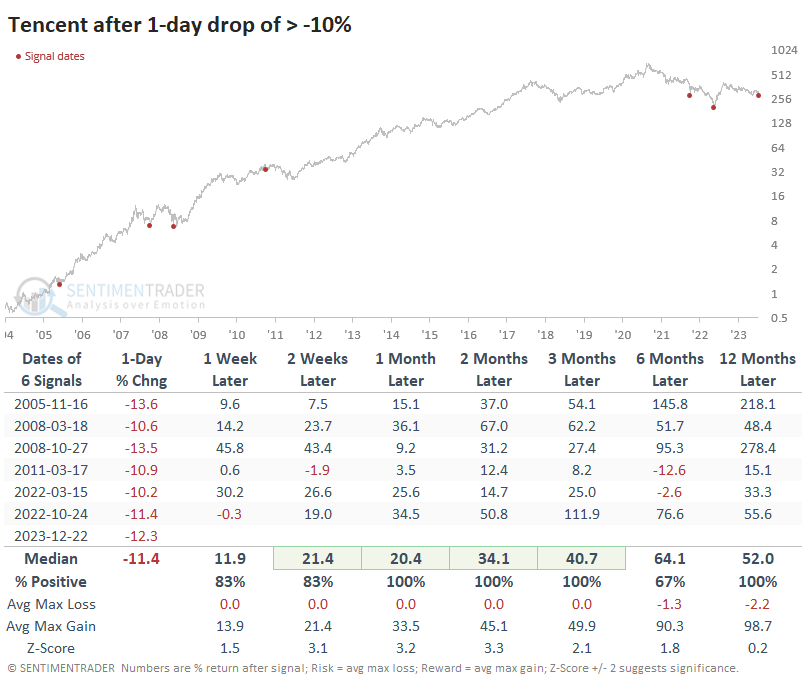

• The most important stock in China plunged more than -10%.

That's one of the most remarkable moves ever for an 800-lb gorilla kind of stock.

Picking bottoms in Chinese tech has been nothing but a knee-hammer kind of thing for investors, but Tencent's reaction history is notable. $TCEHY

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent (TCEHY) turns to ByteDance in gaming showdown with NetEase

By: Investing | December 18, 2023

HONG KONG (Reuters) - Tencent Holdings (OTC:TCEHY) is relying on one-time bitter rival ByteDance to promote its most important video game release in years, in a sign of warming relations as well as intensifying competition as China's gaming industry returns to growth.

Tencent released on Friday mobile party game "DreamStar" that it hopes to challenge "Eggy Party", a similar offering from NetEase (NASDAQ:NTES) which has become a surprise hit this year with 100 million monthly active users.

Analysts expect DreamStar to earn up to 6 billion yuan ($842 million) in its first year, while they forecast Eggy Party, which owes much of its success to advertising on ByteDance platforms, to earn 8 billion yuan for NetEase this year.

In a battle to defend its status as China's biggest gaming firm,Tencent has chosen to promote Dreamstar on ByteDance's popular advertising platforms despite the two's rancorous history in barring one another from their platforms.

About 38% of Tencent ads for DreamStar were put on ByteDance's online ad service Pangolin in the last 30 days, making it the top ad service Tencent has spent on for the game, according to data tracking firm DataEye.

Its decision to rely heavily on Pangolin is remarkable considering that Tencent has its own ad network and various promotion channels within its product ecosystem.

Tencent has put only 12% of DreamStar ads on its own ad network Youlianghui, according to DataEye.

The advertising layout is part of Tencent's plans for a 1.4 billion yuan investment to build out DreamStar's ecosystem to ensure its success.

That strategy has also seen Tencent begin to let video game live-streamers to stream on ByteDance platforms.

Zhang Daxian, China's top live-streamer who became famous through playing Tencent's "Honor of Kings" game, started his channel on a ByteDance platform earlier this month and previewed DreamStar, a scenario unthinkable to many fans just a year ago.

For years, Tencent and ByteDance were locked in a series of lawsuits against each other. In 2021, ByteDance sued Tencent for restricting users from sharing content from Douyin - TikTok's sister app in China - on Tencent's apps, citing anti-monopoly law.

In the same year, Tencent sued ByteDance for featuring footage of Honor of Kings on a ByteDance platform, citing copyright infringement.

The apparent thaw in their relationship comes as ByteDance recently decided to wind down its gaming business to focus on its core platform operations, marking a retreat from its competition with Tencent and NetEase in gaming.

China's video games market returned to growth this year as domestic revenue rose 13% to 303 billion yuan, putting Beijing's eight-month industry crackdown two years ago in the rear-view mirror.

($1 = 7.1255 Chinese yuan renminbi)

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent launches party game 'DreamStar', analysts say poses a threat to NetEase

By: Investing | December 14, 2023

HONG KONG (Reuters) - Chinese tech giant Tencent Holdings (OTC:TCEHY) on Friday launched "DreamStar", a new party game that has been widely anticipated by users and pegged by analysts to pose a threat to domestic arch rival NetEase (NASDAQ:NTES).

"DreamStar", in which gamers play as cartoon characters to race in an obstacle course, is seen as Tencent's move to take on NetEase' massively popular game "Egg Party", a surprise hit which has helped lift NetEase shares by more than 40% this year.

JPMorgan analysts said in a note on Thursday that the launch of "DreamStar" could impact NetEase revenue by 2% to 3%. The bank also trimmed its forecast for NetEase revenue for the next two quarters by 4% and 5% respectively.

"Egg Party" is forecast to be on track to earn an annual revenue between 7 billion yuan and 8 billion yuan ($980 million and $1.1 billion) this year, according to a Goldman Sachs note.

As Tencent's answer to "Egg Party", Goldman expects "DreamStar" to earn between 5 billion and 6 billion yuan in its first year.

NetEase's market capitalisation reached $67 billion on Friday, a day after surpassing food delivery giant Meituan to become China's fourth-biggest internet company.

Tencent remains China's biggest internet company. It is the world's biggest video games provider and it operates China's leading social network app WeChat.

Tencent has been in search for new hit gaming titles as competition from other game developers like NetEase and miHoYo, producer of "Genshin Impact", intensifies. Tencent unveiled its most ambitious console title, "Last Sentinel", this month.

($1 = 7.1252 yuan)

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent's Business Is Thriving And It Has Taken Precautions Against The U.S. Chip Export Curbs

By: Markets & Mayhem | November 21, 2023

Tencent Holdings Limited (OTC: TCEHY) posted impressive third quarter results last week. The world's largest video game company and operator of the WeChat messaging platform showed that the gaming segment rebounded from China’s tech regulatory crackdown, along with shining advertising sales. Earlier this month, Tencent revealed it made a deal with Meta Platforms (NASDAQ: META) to sell its VR headsets. This move will allow Meta to return to China and face Apple Inc (NASDAQ: AAPL) whose new mixed-reality headset Vision Pro should go on sale early next year.

Tencent’s Third Quarter Highlights

Tencent posted a revenue of 154.6 billion yuan which equates to about $21.4 billion, in line with estimates. This is Tencent’s third consecutive quarter of revenue growth.

Domestic games revenue rose 5%, driven by titles such as "Lost Ark" and "Valorant", which Tencent launched in July and for the first time in China.

Online advertising business reported revenue rose 20% on the back of strong demand for advertising in its video content. Over the recent quarter, e-commerce companies have "become a much bigger contributor to Tencent’s ad revenue. Tencent also noted that these companies tend to advertise in the second half of the year.

Tencent’s second-largest segment, financial technology business, also reported a 16% rise as wealth management services and online transactions improved.

Although third quarter margin continued to improve as it got closer to 50% with Tencent eliminating unprofitable business segments, net profit declined 9% to 36.1 billion yuan.

A Deal With Meta

As Wall Street reported earlier in the month, Meta signed a deal with Tencent to sell a new low-cost version of its virtual-reality (VR) headset in China as of late next year. This move marks Meta's return to a market where its platforms Facebook and Instagram are blocked. Besides returning to China after 14 years, Meta gets to compete with TikTok-owner Bytedance, which makes the VR headset Pico. Wall Street Jounral reported that Meta is planning to use lenses in the headset that are cheaper than those in the Quest 3 for the Chinese market...

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent’s Record Buybacks Are Not Enough to End $43 Billion Rout

By: Markets & Mayhem | October 17, 2023

Tencent Holdings Ltd. has returned about $24 billion to shareholders via buybacks and dividends this year. But even that won’t convince investors that it’s due for a turnaround following a $42 billion market value wipeout.

Shares of the Chinese gaming company have fallen more than 27% since its January high, trailing the Hang Seng Tech Index despite it buying back more shares than any other firm in Hong Kong this year. Investors remain cautious that broad global selling of Chinese assets and a sputtering economy will remain key pressure points.

“That the stock has underperformed is really emblematic of the investor disillusionment with China,” said Vey-Sern Ling, managing director at Union Bancaire Privee. “Tencent stock can start outperforming only when investor confidence in China returns.”

In total, Tencent has spent $4 billion in buybacks and another $20 billion across cash dividends and distributed shares in food-delivery firm Meituan, according to Bloomberg calculations.

Shares of the company gained as much as 1.1% on Tuesday as Apple Inc.’s Tim Cook showed up at a Tencent gaming tournament in China, endorsing one of the biggest earners on the app store. It ended the Hong Kong session up 0.3%.

There are clear reasons why investors are concerned. Tencent’s fintech and business services segment, which accounts for about one-third of total revenue, likely grew at a slower pace last quarter as offline payment volumes were hit by slower retail sales, according to HSBC Holdings Plc’s Charlene Liu. The bank also trimmed its 2023 games revenue growth forecast given contribution from new launches may take longer to ramp up.

Still, optimism is slowly building among some analysts as Tencent shifts its business mix toward higher-margin segments such as mini-games and video accounts, while reducing exposure to its less profitable video-streaming business. The recent boost in share buybacks may also provide some price support even as its biggest shareholder trims its stake, according to Morgan Stanley.

Tencent’s forward earnings forecast is at a historic high and the company’s shares remain the most recommended in Asia. The stock has 67 buy recommendations and zero sell ratings, according to data compiled by Bloomberg...

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent unveils Hunyuan foundation AI model for enterprises as public debut of internet giant's chatbot remains on hold

By: South China Morning Post | September 7, 2023

Chinese video gaming and social media giant Tencent Holdings has launched its foundation artificial intelligence (AI) model called Hunyuan, as the country's most valuable company bets on its vast ecosystem to help drive the adoption of more ChatGPT-like services across the mainland.

Hunyuan, a large language model (LLM) that has more than 100 billion parameters and been pre-trained with over 2 trillion tokens, is now available for enterprises in China to test and build apps via the company's cloud-computing arm Tencent Cloud, according to a Thursday announcement by Tencent vice-president Jiang Jie at the main forum of the company's 2023 Global Digital Ecosystem Summit in Shenzhen.

A foundation model is a deep-learning algorithm, trained on mountains of raw data from the internet, that can be adapted to accomplish tasks in various AI applications. An early example of a foundation AI model is the LLM GPT-3 used by ChatGPT creator OpenAI.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

Tencent's Hunyuan provides a range of functions, including image creation, copywriting and text recognition, that can be applied in multiple industries such as finance, social media, e-commerce and video gaming...

* * *

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent Stock (TCEHY): Bear vs. Bull

By: Motley Fool | August 22, 2023

• The Chinese tech giant remains a divisive investment.

Tencent (TCEHY -1.17%) posted its second-quarter report on Aug. 16. The Chinese tech giant's revenue rose 11% year over year to 149.2 billion yuan ($20.6 billion) but missed analysts' estimates by 2.5 billion yuan. Its net profit grew 41% to 26.2 billion yuan ($3.6 billion), but also missed the consensus forecast by 7.3 billion yuan. Tencent's stock dipped slightly after the report, but it remains up 3% for the year.

Let's review the key numbers and see if the bulls or bears are likely to gain the upper hand in the period ahead.

The key numbers

During the second quarter, Tencent generated 50% of its revenue from its value-added services (VAS) business, which collects fees from its video games, social media apps, and streaming media platforms. Nearly 33% of its revenue came from its fintech and business services division, which houses its WeChat Pay digital payments platform, Tencent Cloud platform, and other enterprise-oriented services. The remaining 17% came from its online advertising business, which sells ads across all of its websites, apps, and streaming services. Here's how its three core businesses fared over the past year...

* * *

Read Full Story »»»

DiscoverGold

DiscoverGold

Will Tencent Holdings (TCEHY) Regain Favor Among Investors?

By: Barchart | August 1, 2023

After plunging to a 6-year low in October 2022, Tencent Holdings Ltd (TCEHY) rallied to a 17-month high in January. However, the stock has since moved sideways as the company has fallen out of favor with Chinese investors.

According to Bloomberg data, onshore investors have sold Tencent Holding shares on a net basis for two months in a row (June-July) for the first time since 2021. Investors unloaded $375 million of Tencent shares in July through trading links between the Hong Kong, Shenzhen, and Shanghai exchanges.

Tencent Holdings, China’s most valuable company, has been weighed down by concerns about its outlook and selling by its largest shareholder. Beijing Eastern Smart Rock Asset Management said, despite the company still making money, it’s not a good time to buy Tencent Holdings, given that selling by its largest shareholder is weighing on the stock. Also, “Mainland investors all agree Tencent is cheap, but the price moves of 2022 have just proven that things can go quite extreme in the Hong Kong market.”

The upside momentum in Tencent Holdings has been hampered since June when Prosus NV, Tencent’s largest shareholder, announced that it was offloading its stake in the company. Chinese investors, who have supported Tencent holdings since it was listed in Hong Kong twenty years ago, have pulled back on their support for the stock. Since June, shares of Tencent Holdings are up by +15%, underperforming the Hang Seng Tech Index, which is up by +28%. Forsyth Barr Asia Ltd said investors may have moved out of Tencent to buy some higher beta names amid the recent risk-on sentiment in the China market.

The next test for Tencent Holdings will be its Q2 earnings report due in the middle of this month. There are signs that the company’s outlook is improving. Tencent is expected to report a +14% y/y increase in Q2 revenue due in part to solid gaming revenue growth. Analysts also remain optimistic about Tencent Holdings's prospects, as Bloomberg data shows that analysts have 70 buy ratings on the stock and just one sell rating.

Although most analysts remain upbeat on Tencent Holdings, some are cautioning that it may take time for the stock to recover. JPMorgan Chase said that while the company should deliver a “solid quarter,” it may take time for share prices to recover, given the weak sentiment. Also, Bloomberg Intelligence said, “While second-quarter numbers look to be in the bag for most Chinese Internet companies, including Tencent, we think expectations are still too high and see a risk China’s Internet companies could disappoint into the fourth quarter.”

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent acquires Key parent company Visual Arts

By: Gematsu | July 27, 2023

Tencent has acquired Visual Arts, the parent company of AIR, Clannad, and Kanon developer Key, the companies announced.

Additionally, current Visual Arts CEO Takahiro Baba will step down and Genki Tenkumo (Okano Tohya) will become the new CEO.

“Visual Arts will remain Visual Arts, and the staff will continue to do the things it wants to do,” the company said in a statement.

According to Visual Arts, the acquisition will allow it to grow further and become a more global intellectual property owner.

Read Full Story »»»

DiscoverGold

DiscoverGold

Alibaba, Tencent shares rise as investors bet China's tech crackdown is over

By: Investing.com | July 9, 2023

HONG KONG (Reuters) -Alibaba Group and Tencent shares rose in Hong Kong on Monday after China's $984 million fine against the Jack Ma-founded Ant Group appeared to signal the end of a regulatory crackdown on the country's technology sector.

Following the penalty on Friday, the Alibaba (NYSE:BABA) affiliate announced a share buyback that values the fintech a 75% discount to the valuation touted in an abandoned initial public offering (IPO) plan, but is seen as providing liquidity and certainty to investors.

The abrupt shelving of Ant's IPO in late 2020 had heralded the start of a wide-ranging clampdown by Beijing on industries ranging from technology to education, as regulators sought to assert their authority over what they deemed to be excesses and bad practices emerging from years of runaway growth.

The scrutiny left decades-old firms and startups alike operating in a new, uncertain environment and wiped billions off share prices, ensnaring companies from online retail giant Alibaba to gaming company Tencent and food delivery group Meituan.

Besides Ant, the Chinese authorities also announced on Friday they had fined Tencent's online payment platform Tenpay nearly 3 billion yuan ($414.88 million) for committing violations in areas such as customer data management.

The People's Bank of China (PBOC) said on Friday that most of the prominent problems for platform companies' financial businesses had been rectified and regulators would now shift their focus from focusing on specific companies to overall regulation of the industry.

Alibaba's Hong Kong-listed shares were up nearly 4% by 0230 GMT on Monday, outpacing a 1.3% gain for the broader market, while Tencent's shares were up 1%.

"Their share prices have strongly rebounded today mainly driven by the expectation that regulatory pressure from mainland government will ease," said Dickie Wong, Kingston Securities executive director.

ANT GROUP VALUATION SLASHED

Alibaba, which spun off Ant 11 years ago and has a 33% stake, said on Sunday it was considering whether to participate in the buyback.

Alibaba's U.S.-listed shares rose 8% on Friday after the penalty, one of the largest-ever fines for an internet company in China, was delivered.

Ant and its subsidiaries had violated laws and regulations in areas including corporate governance, financial consumer protection, payment and settlement business, as well as anti-money laundering obligations, the PBOC said.

Ant said on Saturday it proposed to all of its shareholders to repurchase up to 7.6% of its equity interest at a price that represents a group valuation of about $78.5 billion.

That compared to the $315 billion valuation in 2020 for what was set to be the world's largest IPO, had it not been derailed at the last minute by Chinese regulators.

The finalisation of Ant's penalty is seen as paving the way for the firm to secure a financial holding company licence, lift its growth rate and eventually revive its plans for a stock market listing.

However, analysts are questioning whether Ant will press ahead with a listing in the near future.

"According to the company, the reason for the buyback is providing liquidity to existing investors and attracting and retaining talented individuals through employee incentives," said Oshadhi Kumarasiri, a LightStream Research analyst who publishes on Smartkarma.

"Ant could have achieved both these objectives through an IPO....This means IPO is essentially put on hold."

($1 = 7.2310 Chinese yuan renminbi)

Read Full Story »»»

DiscoverGold

DiscoverGold

Meta Platforms makes progress in talks with Tencent to sell Quest VR headset in China - WSJ

By: Investing.com | July 3, 2023

Meta Platforms (NASDAQ:META) has reportedly made progress with Tencent (OTC:TCEHY) on a virtual reality (VR) headset partnership, according to the Wall Street Journal.

The company held discussions with several Chinese tech companies after CEO Mark Zuckerberg questioned his firm’s China stance, asking if Apple (NASDAQ:AAPL) can sell iPhones in China, and Tesla (NASDAQ:TSLA) can sell cars, why can’t Meta sell its devices in one of the world’s largest markets?

Still, the company’s China push has hit multiple challenges, in part because Chinese executives worry that Zuckerberg isn’t seen as friendly to China.

Tencent (HK:0700) had its own concerns when it comes to partnering with Meta before Chairman Pony Ma decided to proceed with the negotiation. One of the challenges mentioned in the WSJ article is how Meta would roll out content in China, the people said.

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent jumps on ChatGPT bandwagon by rolling out LLM for corporate clients, including state media

By: South China Morning Post | June 20, 2023

Chinese social media and gaming giant Tencent Holdings has launched its industry-oriented large language model (LLM) service aimed at a wide array of traditional sectors from finance to media, making it the latest of China's Big Tech firms to join the ChatGPT-frenzy.

The Shenzhen-based company's cloud arm launched its LLM as a model-as-a-service [MaaS] solution at a technical event held on Monday in Beijing, according to a post published to its official WeChat account.

LLMs are deep language learning models that respond to textual user prompts in a human-like fashion, and provide the technology underpinning for ChatGPT, the chat bot developed by Microsoft-backed start-up OpenAI.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

Tencent Cloud's LLM solutions will cater to industries ranging from finance, media, travel to education, with clients including China's state media China Media Group, the Shanghai University, and Fujian Big Data Group among others, according to the WeChat post.

Together with clients, the company has launched over 50 LLM-enabled industrial solutions covering over 10 industries, Tang Daosheng said at the event, a senior executive vice-president at Tencent and chief executive of its cloud and smart industries group.

"Tencent will keep opening its ecosystem to provide quality [LLM] services for corporate clients," said Tang, who added that the company will assist its clients in training multimodels and speed up exploration of applying LLMs in more industrial scenarios.

Tencent's foray into the local LLM arena will pit it against rivals including Baidu and Alibaba Group Holding, which are both looking to roll out their respective LLM applications for wider adoption among many businesses. Alibaba owns the Post.

ChatGPT's success has goaded global tech firms into an artificial intelligence (AI) arms race, with Chinese Big Tech firms falling over themselves to develop rival services.

Baidu was among the first domestic firms to launch a competitor service called Ernie Bot in March, with a promise to embed the AI chatbot into its existing services, including search.

At the March launch event, the Chinese search engine giant said that more than 650 companies have signed up to embed Ernie Bot into their services.

Alibaba's cloud business, meanwhile, has also started baking its ChatGPT-like artificial intelligence (AI) into a range of service offerings, including meeting assistant Tingwu and Slack-like office collaboration platform DingTalk.

Other than the industrial LLM service launched on Monday, Tencent is also working on a foundational AI model dubbed Hunyuan, which is yet to be released. Tencent founder and CEO Pony Ma Huateng, said earlier that his company was in no rush to launch unfinished products.

"[AI] is a once-in-a-century opportunity like the invention of electricity during the industrial revolution," Ma said at the company's latest earnings call in May.

"In the grand scheme of things, introducing the light bulb a month earlier wasn't that important. The key [for us now] is to build a solid foundation of algorithms, computing power, data and more importantly, use cases."

Read Full Story »»»

DiscoverGold

DiscoverGold

What Makes Tencent Holding Ltd. (TCEHY) a New Strong Buy Stock

By: Zacks Equity Research | June 8, 2023

Tencent Holding Ltd. (TCEHY) appears an attractive pick, as it has been recently upgraded to a Zacks Rank #1 (Strong Buy). This upgrade is essentially a reflection of an upward trend in earnings estimates -- one of the most powerful forces impacting stock prices.

The sole determinant of the Zacks rating is a company's changing earnings picture. The Zacks Consensus Estimate -- the consensus of EPS estimates from the sell-side analysts covering the stock -- for the current and following years is tracked by the system.

Since a changing earnings picture is a powerful factor influencing near-term stock price movements, the Zacks rating system is very useful for individual investors. They may find it difficult to make decisions based on rating upgrades by Wall Street analysts, as these are mostly driven by subjective factors that are hard to see and measure in real time.

Therefore, the Zacks rating upgrade for Tencent Holding Ltd. basically reflects positivity about its earnings outlook that could translate into buying pressure and an increase in its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company's future earnings potential, as reflected in earnings estimate revisions, and the near-term price movement of its stock are proven to be strongly correlated. That's partly because of the influence of institutional investors that use earnings and earnings estimates for calculating the fair value of a company's shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their transaction of large amounts of shares then leads to price movement for the stock.

For Tencent Holding Ltd. rising earnings estimates and the consequent rating upgrade fundamentally mean an improvement in the company's underlying business. And investors' appreciation of this improving business trend should push the stock higher.

Harnessing the Power of Earnings Estimate Revisions

Empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, so it could be truly rewarding if such revisions are tracked for making an investment decision. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here >>>>.

Earnings Estimate Revisions for Tencent Holding Ltd.

For the fiscal year ending December 2023, this company is expected to earn $2.13 per share, which is a change of 21% from the year-ago reported number.

Analysts have been steadily raising their estimates for Tencent Holding Ltd. Over the past three months, the Zacks Consensus Estimate for the company has increased 9%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of 'buy' and 'sell' ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a 'Strong Buy' rating and the next 15% get a 'Buy' rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of Tencent Holding Ltd. to a Zacks Rank #1 positions it in the top 5% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent’s Sales Rebound Though Concerns Persist on China Outlook

By: Zheping Huang | May 18, 2023

Tencent Holdings Ltd. posted its fastest pace of revenue growth in more than a year but earnings missed estimates, reflecting an uneven internet sector recovery during China’s post-pandemic reopening.

China’s most valuable company grew online advertising by 17% as a gradual resumption of marketing fuels the business for sector leaders including Baidu Inc. Yet analysts had projected a sharper bounceback as the world’s No. 2 economy let down years of Covid Zero barriers. Tencent’s shares slid as much as 3.9% in Hong Kong.

Investors remain cautious after a year during which Tencent and its peers barely grew after regulatory crackdowns and Covid restrictions choked off the consumer and corporate spending. Mainstay internet businesses like advertising and gaming are only now emerging from their historic trough, while big tech firms have been forced to push aggressive cost cuts to endure an uncertain macroeconomic environment.

To revitalize the business, Tencent aims to integrate artificial intelligence capabilities across its suite of products from WeChat to online media, calling the technology a “growth multiplier.” ChatGPT, now a global phenomenon, triggered a race among Chinese tech firms to catch up. But the Shenzhen-based firm appears to lag behind rivals like Alibaba Group Holding Ltd. and Baidu, both of which have announced ChatGPT-style platforms and triggered a frenzy among investors.

President Martin Lau joined a number of technology executives — including OpenAI’s Sam Altman — in publicly welcoming regulation of the burgeoning space, in China or elsewhere. The company has been careful to stress its compliance with Beijing’s guidelines since gaming crackdowns of past years threatened to sap its business.

“We’re making good progress, and if you look into the different components, the model building is progressing well,” Lau told analysts on a conference call. It’s using “high-quality public data, as well as high-quality public data within our ecosystem.”

Revenue rose 11% to almost 150 billion yuan ($21.4 billion) for the three months ended March, exceeding the 146.29 billion yuan average forecast. But the net income of 25.8 billion yuan fell short of projections.

Tencent and peers like Alibaba, JD.com Inc., and Baidu are watched for clues to the health of Chinese business sentiment and consumption. JD.com’s revenue barely rose during the March quarter, but the more advertising-dependent search leader Baidu returned to double-digit growth. WeChat operator Tencent itself had only just resumed expanding revenue in the December quarter after months of decline.

Investors have flip-flopped on Chinese tech stocks this year, first buying into the belief that Beijing would rally the giant sector to boost the world’s No. 2 economy in 2023. But cheerleading by officials didn’t translate into concrete policy and signs have since grown that the country’s nascent economic recovery may already be petering out.

Tencent faces more specific challenges as well. It has yet to find its next big gaming success in China after Honor of Kings and Peacekeeper Elite cemented its lead in the pre-Covid era. The company aims to fill its long-empty pipeline in 2023 with hits like Valorant after Beijing’s censors resumed licensing approvals last year. Such new launches will test a rapidly saturating domestic market, where younger players are increasingly drawn to up-and-comers like anime specialist Mihoyo.

“Investors care more about geopolitics and China macro than stock specifics now,” said Vey-Sern Ling, managing director at Union Bancaire Privée...

* * *

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent CEO: "During the first quarter of 2023, we achieved solid revenue growth

By: The Transcript | May 17, 2023

• Tencent CEO: "During the first quarter of 2023, we achieved solid revenue growth as our payment volumes benefitted from, and facilitated, domestic consumption recovery, our games revenue improved, and our advertising revenue sustained rapid growth"

Read Full Story »»»

DiscoverGold

DiscoverGold

Is Tencent (TCEHY) Stock a Buy?

By: Motley Fool | April 20, 2023

This giant is still not done yet in its quest to build its empire.

The last two years have been awful for Tencent Holdings Limited (TCEHY -2.37%). Once a darling, the tech conglomerate's stock price almost halved from its peak of around $90 per share.

With its stock price much cheaper today, should investors take a bite of this leading Chinese tech company? Let's explore this further in the article.

Tencent's recent performance has been disappointing.

Tencent has arguably had one of the best long-term track records for growth. Since its initial public offering (IPO) in 2004, revenue and net profit have grown by an annualized rate of 44%.

Its flawless performance, however, fell short lately as it delivered its first-ever annual decline in revenue. Net profit for the year performed worse, down by 17% year over year. The weaker performance was across the board, except for the fintech and business services segment, which reported a slight revenue increase. The regulatory crackdown on online learning and internet industries in China, and the ongoing negative impact of COVID-19 were some of the main drivers behind its weak performance.

It did not help that one of the central themes from Tencent throughout 2022 was about improving efficiency and controlling costs. In a way, it signaled to investors that the company would unlikely resume the kind of growth it had experienced in the first 16 years since its IPO.

Don't get me wrong. There is nothing wrong with a company improving its cost structure and efficiency. On the contrary, such a move was necessary during a challenging environment. But for Tencent's diehard fans, it might be disheartening to think that the company's hyper-growth days might be over.

Tencent's long-term growth prospects remain attractive

Let's face it. No company can continue to grow at 44% forever. And at its size -- $80 billion annual revenue -- Tencent is already a giant, so it's natural that its growth slows down over time.

Still, there are good reasons to believe that the company can continue to grow -- albeit slower -- by leveraging its twin engine of the franchise business and external investments.

The former relies on its social media networking services (mainly WeChat and QQ) and 1.3 billion monthly active users (MAU). As the dominant messaging service in China, Tencent can leverage its user base to offer an ever-expanding catalog of services to improve monetization. It already provides services like payments, gaming, online video, e-commerce, and music and is well-positioned to add new products over time.

On top of that, Tencent can rely on its capital allocation skills to divert unused cash into external investments. JD.com, Pinduoduo, Meituan, and Sea Limited are examples of Tencent's successful past investments. The beauty of this strategy is that Tencent has the flexibility to invest anywhere globally that it sees fit and in any company -- both listed and private -- across multiple industries. Think of it as Berkshire Hathaway but for technology companies.

With its twin engine for growth, Tencent has plenty of opportunities to allocate capital to grow shareholder value in the coming years.

So is Tencent stock a buy?

Tencent faces short-term headwinds from the Chinese government crackdown and the generally weak external economy. However, the tech behemoth should resume its upward trajectory in the longer term by growing its internal businesses and investment portfolio.

On balance, I'm cautiously optimistic about the company's prospects over the next few years. And with the stock trading at a reasonable price-to-earnings (PE) ratio of 16, I don't think it's too irrational for long-term investors to buy stock in the company.

Still, investors should expect a volatile ride ahead.

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent $TCEHY - Metaverse update over a year later:

By: Markets & Mayhem | March 30, 2023

• Metaverse update over a year later:

- Tencent $TCEHY is disbanding its "extended reality" department

- The "Sandbox" say only $78K of sales in Feb compared to $63M in Nov of 2021

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent says focus on cost-cutting, core business after first revenue fall

By: Josh Ye | March 22, 2023

HONG KONG (Reuters) -Tencent Holdings on Thursday said it would restrict its focus to its core business, while maintinaing cost-cutting and improving efficiencies, as it reported its first drop in annual revenue to date.

The world's largest video game company and operator of the WeChat messaging platform posted revenue of 554.55 billion yuan ($81 billion) for 2022, down 1% from a year earlier, after China's economic slowdown due to the pandemic and a long-running regulatory crackdown dented profits.

Analysts on average had expected 555.15 billion yuan, according to Refinitiv.

Profit attributable to equity holders fell 16% to 188.24 billion yuan for the year versus a consensus estimate of 114.19 billion yuan.

Tencent Chair and CEO Pony Ma told reporters on a call the company would focus this year on getting more out of existing core businesses, rather than on "trying to do everything" and on operating in "red ocean markets", where competition is intense.

"We hope that our entire business management team and technology will be more focused," he said. "I think this is very important because we can see that focus and making breakthroughs are very key to overall development."

The business outlook is uncertain in the world's largest gaming market after two years of regulatory crackdowns, but sector participants are hopeful of a recovery as regulators have resumed granting publishing licences since late last year after a months-long freeze.

Unlike in most other countries, video games need approval from regulators before release in China.

The crackdown has changed the operating environment for China's tech giants as regulators have tightened scrutiny over monopolistic behaviour and companies' handling of user information.

Martin Lau, president of the company, told a later call with analysts that regulations are being normalised and support for platform companies should improve this year.

"[Chinese president Xi Jinping recently] mentioned supporting platform companies to show competence, creating employment, driving consumption and international competition," he said, "The premier also highlighted the private sector would have a significant potential in the China economy."

ADVERTISING BUSINESS PICKS UP

Helping to offset the losses in domestic gaming and fintech, Tencent's online advertising business showed a surprisingly strong recovery in the fourth quarter, with revenue for the segment rising 15%, and contributing to a 1% rise in the group's revenue overall for the quarter ended December.

China's city lockdowns intensified in the weeks to early December when the country abruptly ended its zero-COVID policy, unleashing a wave of infections, which heavily disrupted the economy and caused many deaths.

Charlie Chai, an analyst with 86Research, said Tencent's performance as a whole was "lukewarm", but the advertising segment "shrugged off the COVID challenge and delivered industry-beating growth".

During the media call, Lau also spoke about the company's forays into generative artificial intelligence, which has seen a surge in global interest, driven by the popularity of Microsoft-backed startup OpenAI's chatbot ChatGPT.

Reuters reported last month that Tencent was working on a ChatGPT-like chatbot named the "HunyuanAide" that will incorporate Tencent's Hunyuan AI model.

Lau said the company was rapidly advancing its proprietary foundation model Hunyuan and planned to gradually roll out its own AI foundation models.

Tencent's chief strategy officer James Mitchell said that Tencent was ready to bear the large cost associated with training AI models even though it is focused on cost-cutting in other areas.

The United States in October announced export controls on high-end computer chips to China to try to contain AI development in the country, but Mitchell said Tencent has enough chips ready to develop its AI models.

($1 = 6.8887 Chinese yuan)

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent Holdings Looks To Maintain Its Upside Momentum

By: Barchart | March 21, 2023

Since tumbling to a 6-year low in October, shares of China’s Tencent Holdings (TCTZF) have more than doubled to a 1-year high. Tencent Holdings has rallied on anticipation of future sales streams and optimism that the Chinese government will keep its promise of supporting the private sector. As a result, Tencent Holdings is up more than +8% this quarter, even as peers Alibaba Group Holding (BABA) and JD.com (JD) remain in the red.

According to analysts’ estimates, Wednesday’s quarterly earnings report for Tencent Holdings is expected to show Q4 revenue growth rose +0.2% after two quarters of contraction. Revenue growth is then expected to accelerate 6.7% in Q1 as the Chinese economy reopened from Covid lockdowns. Since the start of this year, analysts have raised their price target for Tencent Holding by +17%, citing a resumption of new game approvals, recovery in consumption, and the growing popularity of its WeChat video feed.

The increasing popularity of Tencent Holdings TikTok styled WeChat video feed is expected to boost ad sales and revenue for the company. Last year, the number of views of the WeChat video feed tripled, and executives forecast 1 billion yuan ($135 million) of ad sales through the feature in Q4. Analysts also expect that the post-Covid recovery in China will boost consumer and corporation spending on entertainment and advertising.

An easing of China’s regulatory crackdown on online video games is also helping to push shares of Tencent Holdings higher. The company’s new blockbuster video games Valorant and Pokemon Unite are in the pipeline after Tencent received approval from China’s regulators for new video games in December. On Monday, China’s online gaming regulator approved 27 more games, a positive factor for the online gaming industry. The optimism over the new games has boosted earnings estimates for Tencent Holdings. According to Bloomberg data, forward earnings estimates have risen by more than +5% this year, while analysts’ targets suggest a +29% increase in the company’s stock price over the next 12 months.

Some analysts are concerned that China may once again tighten scrutiny of major internet companies should the economy return to its pre-Covid pace of growth. Also, Chinese regulators last month said they are studying measures to curb addiction among Chinese youths of watching short videos. However, CMB International Capital said, “there are still a lot of bright spots that may bring upside surprises” for Tencent Holdings. “Also, the company could resume share buybacks after earnings.”

Read Full Story »»»

DiscoverGold

DiscoverGold

Metaverse layoffs continue to mount as Tencent dismisses 300 employees

By: Jordan Finneseth | February 17, 2023

The metaverse continues to challenge even its most committed companies as Tencent, the tech firm behind the WeChat social media platform and China’s largest company by market cap, is reevaluating the approach to its metaverse offering and scrapping plans to launch virtual reality hardware.

According to a report from Reuters, the Chinese tech giant’s metaverse unit is now in cost-cutting mode amid worsening economic conditions and the broader struggles of the cryptocurrency ecosystem.

Tencent launched its “extended reality” XR unit in June as part of an ambitious plans to build virtual reality software and hardware, hiring 300 people to make it a reality.

The firm developed a concept for a ring-shaped handheld game controller, but issues with profitability – with internal forecasts predicting the XR project wouldn’t make money until 2027 – and the large investment required to produce a competitive product hampered its progress and prompted Tencent to alter its strategy.

A lack of promising games and non-gaming applications was also cited by one source as a reason for the shift in focus. "Under the company's new strategy as a whole, it no longer quite fit in," the source said.

All sources quoted in the Reuters story declined to be named as the information is confidential.

Tencent also had to walk away from plans to acquire gaming phone maker Black Shark, which was intended to beef up its hardware push and add 1,000 people to the unit, due to the shift in strategy and increasing regulatory scrutiny that would have required a lengthy review process.

On Thursday, Tencent confirmed that it would be making some personnel adjustments and notified the 300 staff members of the XR unit that they have been given two months to find new internal or external opportunities. The company pushed back against rumors that it was disbanding the XR unit entirely, saying that it was making adjustments to some business teams as its development plans for hardware had changed.

With this development, Tencent joins Microsoft and Facebook among the ranks of large firms that have recently shifted their metaverse strategy in the wake of economic struggles. Last Friday, Microsoft announced that it would be shutting down a team that was formed only four months ago to help customers use the metaverse in an industrial setting.

Facebook’s parent company Meta has also had to reduce its labor force as part of a cost-cutting initiative, announcing back in November that it would be laying off 13% of its workforce, or more than 11,000 employees. All sectors of the company will be affected by the layoffs, including Reality Labs, the unit responsible for developing augmented reality (AR), virtual reality (VR), and prototypes in emerging technologies such as mixed reality and brain-computer interfaces.

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent scraps plans for VR hardware as metaverse bet falters - sources

By: Investing.com | February 17, 2023

HONG KONG (Reuters) -Tencent Holdings is abandoning plans to venture into virtual reality hardware, as a sobering economic outlook prompts the Chinese tech giant to cut costs and headcount at its metaverse unit, three sources familiar with the matter said. The world's largest video game publisher had ambitious plans to build both virtual reality software and hardware at an "extended reality" XR unit it launched in June last year, for which it hired nearly 300 people. It had come up with a concept for a ring-like hand-held game controller, but difficulties in achieving quick profitability and the large investment needed to produce a competitive product were among factors that prompted a shift away from that strategy, two of the sources said. One of the sources said the XR project was not expected to become profitable until 2027, according to an internal forecast. The second source said the unit also had a lack of promising games and non-gaming applications.

The sources declined to be named as the information is confidential. "Under the company's new strategy as a whole, it no longer quite fit in," the first source said. Earlier in the year, Tencent had also planned to buy gaming phone maker Black Shark, which it believed had supply chain and inventory experience that could beef up its hardware push and add 1,000 people to the unit.

However, it eventually walked away from that deal due to Tencent's shift in strategy, as well as mounting regulatory scrutiny and an expected lengthy review process, one of the sources who had direct knowledge of the matter said.

The sources said that Tencent had advised most of the unit's staff to seek other opportunities, confirming a Thursday report from Chinese tech news outlet 36Kr.

Tencent declined to comment on the Black Shark deal and whether Beijing's scrutiny had soured the deal. Regarding the status of the XR unit, the company referred to a statement to Reuters on Thursday that said it was making adjustments to some business teams as development plans for hardware had changed.

The company also said on Thursday that it was not disbanding the XR unit.

Tencent shares slipped as much as 2.5% after Reuters' report.

METAVERSE INTEREST

The launch of the XR unit came amid swelling global interest in the metaverse concept of virtual worlds and had marked a rare foray into hardware for Tencent, which is mostly known for software that includes a suite of games and social media applications.

It also entered into a race against Western peers such as Meta Platforms and Microsoft (NASDAQ:MSFT), which are building their own metaverses and have their own virtual reality hardware projects.

One of the sources said that Tencent had dabbled in virtual reality about seven years ago for a short while, and its interest in the area had been revived in 2021 after learning of new breakthroughs in pancake lenses and more powerful displays. Strong sales of Meta's Quest headset was also a driver, the person added.

But last year marked one of the toughest years for Tencent since its founding in 1998, with revenue battered by a regulatory crackdown and headwinds from measures to stop the spread of COVID-19.

Underlining such strains, its founder Pony Ma in December displayed a rare show of frustration at a year-end meeting when he lambasted senior managers for not working hard enough and said the company needed to focus on short video for future growth.

Several tech companies include Meta and Google (NASDAQ:GOOGL) have announced layoffs as they seek to trim costs amid rising fears of a global recession.

Pico, a virtual reality (VR) headset manufacturer owned by TikTok's Chinese developer ByteDance, said on Friday it was laying off a small number of people, after local media reported the start of hundreds of redundancies earlier this week. A source familiar with the matter said 200 staff were affected.

Read Full Story »»»

DiscoverGold

DiscoverGold

The price target for Tencent (TCEHY) has been raised to $330.00

By: Best Stocks | January 6, 2023

According to a research, note emailed to investors on Thursday, stock analysts at Mizuho raised Tencent’s (OTCMKTS: TCEHY) price target from $300 to $330.00. The note was included in a research package that was distributed to investors.

TCEHY has been the focus of research in various supplementary papers that have been published. KGI Securities downgraded their recommendation for Tencent from “outperform” to “neutral” in a research note published on October 24. On Friday, October 28, Barclays presented a research report in which they said they had decreased their target price for Tencent from $44.00 to $31.00. This information was included in the report. The share has been assigned four unique ratings, including two hold ratings, two buy recommendations, and one sell rating, all provided by equity research experts. Bloomberg.com’s rating for the stock is “Hold” at the moment, and the website anticipates its price will reach $180.50 shortly.

When trading started on Thursday, the share price of TCEHY was established at $45.99 per share. During its 52-week trading range, the price of Tencent’s stock ranged from a low of $24.75 to a high of $63. The company’s market capitalization is $440.34 billion, the price-to-earnings ratio of the stock is 16.54, and the company has a beta of 0.29. The moving average for the company over the past 50 days is currently sitting at $36.98, and the moving average over the past 200 days is currently sitting at $38.23.

On November 16, Tencent (OTCMKTS: TCEHY) released its most recent quarterly financial report results. The quarterly earnings per share (EPS) for the information technology company came in at $0.37, which was identical to the estimate made by the market as a whole, which was $0.37. The sales for the company for the quarter came in at $19.73 billion, which is significantly lower than the forecast that was made by analysts, which was $20.32 billion. Tencent had a return on equity of 8.93%, and the net margin for the company was 32.16%. According to analysts who follow stocks and shares, Tencent is expected to generate earnings of $1.29 per share during the current fiscal year.

As an investment holding company, Tencent Holdings Limited conducts business in Mainland China and several other countries, where it provides value-added services (VAS) and online advertising. The company can be broken down into the following categories, in descending order: other, fintech and business services, online advertising, and value-added services. In addition to its offerings in the areas of FinTech, cloud computing, and online advertising, it also provides services for online social networks, online games, and online advertising.

Read Full Story »»»

DiscoverGold

DiscoverGold

$TCEHY Profits at industrial firms in China fell in the first 11 months of the year, as production slowed and factory-gate prices declined in the wake of Covid disruptions, reported Bloomberg. https://www.benzinga.com/markets/asia/22/12/30210214/tesla-production-reports-lead-to-carnage-for-chinese-ev-stocks-as-hang-seng-tech-majors-hold-it-toge

Tencent Buys Back 1.1M Shrs for $350M

By: AAStocks | December 15, 2022

TENCENT (00700.HK) -0.800 (-0.252%) Short selling $1.00B; Ratio 12.557% 's statement disclosed that, on 15 December, it repurchased 1.1 million shares on the Stock Exchange, at $316.2-326.2 per share, involving approximately $350 million.

TENCENT has repurchased 81.1986 million shares YTD, representing 0.84476% of the company's issued shares.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio Stock Gets Jolt on Tencent Self-Driving Tech Partnership

By: Schaeffer's Investment Research | November 29, 2022

• Tencent and Nio will partner to create self-driving technology

• The deal will help Nio capitalize on interest surrounding so-called new energy cars

Chinese electric vehicle (EV) giant Nio Inc - ADR (NYSE:NIO) announced earlier that it would partner with tech name Tencent -- also based in China -- to create self-driving and high-definition mapping technology. The partnership will allow Nio to capitalize on the interest surrounding "new energy cars" in Beijing and give Tencent an opportunity to broaden its already wide-reach into China's tech businesses.

NIO is rising after the news, last seen up 3.9% at $10.51. The U.S.-listed equity took most of yesterday's China-based headwinds, actually trading higher at one point before settling with a slight loss. The equity still has plenty of technical obstacles to overcome, however, including its 30-day moving average. Year-to-date, NIO has lost 68%.

When we last checked in on NIO, the stock was surging on upbeat third-quarter delivery numbers. since its mid-November earnings report, however, several analysts have slashed their price targets. The 12-month consensus price target now sits at $20.29, which is still roughly double Nio stock's current perch.

Short-term options traders, meanwhile, have rarely been more call-biased. This is per NIO's Schaeffer's put/call open interest ratio of 0.30, which stands higher than 1% of readings from the past year. Plus, the top six open interest positions on NIO are all puts.

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent: "Revenues decreased by 2% to RMB140.1B for the third quarter of 2022 on a YoY basis...

By: The Transcript | November 16, 2022

• Tencent: "Revenues decreased by 2% to RMB140.1B for the third quarter of 2022 on a YoY basis...Revenues from Online Advertising decreased by 5% to RMB21.5B for Q3 2022 on a YoY basis"

Read Full Story »»»

DiscoverGold

DiscoverGold

*TENCENT Starts New Round of Layoffs: Reuters

By: Markets & Mayhem | November 15, 2022

• *TENCENT STARTS NEW ROUND OF LAYOFFS: REUTERS

*TENCENT LAYOFFS FOCUS ON VIDEO STREAMING , GAMING , CLOUD OPS: RTRS $TCEHY

Read Full Story »»»

DiscoverGold

DiscoverGold

Chinese stocks are in free fall today: TCEHY down 15.31%

By: Markets & Mayhem | October 24, 2022

• Chinese stocks are in free fall today:

$BABA down 14.38%

$JD down 15.04%

$BIDU down 15.13%

$TCEHY down 15.31%

$PDD down 28.59%

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent has invested in close to 700 companies in its ~24 years of existence:

By: The Transcript | October 21, 2022

• Tencent has invested in close to 700 companies in its ~24 years of existence:

Read Full Story »»»

DiscoverGold

DiscoverGold

What the eclipse of Tencent by a liquor company says about Xi’s China

By: Financial Times | October 17, 2022

• Kweichow Moutai has overtaken the tech group in market capitalisation thanks to the whims of one man

What would it say about US innovation and President Joe Biden’s stewardship of the economy if America’s largest beer company, Anheuser-Busch InBev, had a bigger market capitalisation than Apple? Nothing good, probably, and indeed the very thought is a ridiculous one. Apple’s $2.2tn market cap is almost 28 times larger than AB InBev’s $80bn.

But that is exactly what happened recently in China, where Xi Jinping is about to embark on a third term as Communist party leader, military commander-in-chief and state president. Late last month China’s most famous liquor maker, Kweichow Moutai, overtook Tencent as the country’s most valuable company.

How can this be? Tencent is one of the most innovative and successful technology companies in the world’s second-largest economy. It developed the country’s most popular instant messaging and social media app, WeChat, and its WePay online payments platform is second only to Alibaba’s Alipay. Kweichow Moutai, which brews a strong-smelling, 76 to 106-proof grain liquor, sells hangovers.

Politics is how, or at least Chinese Communist party politics as transformed by Xi over the past decade. Xi’s third term will officially begin on Sunday, October 23, almost two years from the day on which an impolitic speech by Alibaba’s founder, Jack Ma, triggered Beijing’s ongoing regulatory crackdown on the technology sector.

Speaking on October 24, 2020, Jack Ma castigated China’s state-owned banking sector for its conservatism and sloth at a financial forum in Shanghai. Ma was correct in his criticism of the banking sector’s traditional neglect of the small and medium-sized enterprises.

“Jack always understood that in markets dominated by large corporations and state-owned enterprises, technology could be the great equaliser for SMEs,” Brian Wong, a former senior Alibaba executive, writes in a forthcoming book on the company. “His real mission was spreading opportunity beyond traditional elite circles?.?.?.?[by] developing a platform for neglected entrepreneurs to thrive, compete and spread prosperity on a far more equitable basis than China had experienced before.”

Unfortunately for his shareholders, Ma was not preaching to the converted. Other forum VIPs included vice-president Wang Qishan, the architect of Xi’s anti-corruption campaign and a former state bank boss, as well as a number of senior financial regulators. Ma appeared to forget that Xi and Wang do not appreciate lesser mortals speaking truth to power. Within a fortnight the initial public offering of Ma’s online finance group, Ant, was cancelled by Chinese regulators.

Ant’s $37bn IPO would have been the world’s largest. Since the speech, the price of Alibaba’s Hong Kong-traded shares has fallen more than 75 per cent. While Tencent’s HK$2.37tn ($301bn) market cap is at least neck-and-neck with Kweichow Moutai’s HK$2.38tn, Alibaba’s — HK$1.56tn — is nowhere close.

* * *

In his book, Wong documents his former boss’s passion — and talent — for disruption. Revealing anecdotes include the time in 2011 that Alibaba broke China’s postal system. He writes that, on its famous November 11 or “Singles’ Day” sales festival that year, “it took [China Post] months to finish delivering all the packages ordered that day”.

When the same thing happened a year later, Ma decided he would have to develop an in-house delivery arm. The result was Cainiao, which means “rookie” in Chinese, and a revolution in China’s logistics industry.

A factory in coastal Guangdong province, Wong writes, can now ship a mobile phone to a customer 1,500 miles inland in three days for just Rmb15 ($2.08). He adds that “a similar package shipped using the UPS three-day service from Boston to Reno, covering roughly the same distance, will cost more than 10 times that amount”.

On October 16, Xi told the party congress that “we will encourage entrepreneurship, move faster to help Chinese companies become world-class outfits and support the development of micro, small and medium-sized enterprises”.

“Been there, was doing just that” Tencent and Alibaba executives might reply. As for Kweichow Moutai, it too might soon discover that its fortunes ultimately hinge on one man’s whims. Since overtaking Tencent as China’s most valuable company, the price of its Shanghai-traded shares has fallen around 8 per cent — partly on rumours that Xi might ban alcohol at party and government

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent shifts focus to majority deals, overseas gaming assets for growth-sources

By: Reuters | October 1, 2022

• Tencent is resetting its M&A strategy to put more focus on buying majority stakes mainly in overseas gaming companies, as the tech giant eyes global expansion to offset slowing growth at home in China, people with

HONG KONG (Reuters) – Tencent is resetting its M&A strategy to put more focus on buying majority stakes mainly in overseas gaming companies, as the tech giant eyes global expansion to offset slowing growth at home in China, people with direct knowledge of the matter said.

Tencent Holding Ltd has for years invested in hundreds of up-and-coming businesses, mainly in the onshore market. It has typically acquired minority stakes and stayed invested as a passive financial investor.

However, it is now aggressively seeking to own majority or even controlling stakes in overseas targets, notably in gaming assets in Europe, the four people with direct knowledge of the matter told Reuters.

The shift comes as the world’s number one gaming firm by revenue is counting on global markets for its future growth, which requires a strong portfolio of chart-topping games, the sources aid.

Tencent’s new strategy indicates how China’s tech titans are looking to emerge from the regulatory shadows after two years of crackdown and uncertainty that weighed on their sales at home and triggered a massive selloff in their stocks.

Apart from the core gaming sector, Tencent is also looking to snap up global assets, in particular in Europe, related to the so-called metaverse, said one of the sources and another source with direct knowledge of the matter.

The people declined to be identified as the information was private.

Tencent told Reuters the company had been investing abroad for a long time – “long before any new regulations” in China. It looks for “innovative companies with talented management teams” and gives them room to grow independently, the company added, without elaborating.

Tencent’s pursuit for bigger stakes in gaming firms comes as other tech giants such as Microsoft, Sony and Amazon are snapping up gaming assets and related intellectual properties, said three of the sources.

Tencent’s chief strategy officer, James Mitchell, said on a post-earnings call in August the company would remain active in acquiring new game studios overseas.

“In terms of the game business, our strategy is … to focus on developing our capabilities especially in the international market,” he said. “We will continue to be very active in terms of acquiring new game studios outside China.”

Pursuit of bigger stakes

Tencent’s growing focus on overseas assets and markets is in sharp contrast to its much slower dealmaking pace at home since the regulatory clampdowns intensified, and the divestment of a clutch of domestic portfolio companies.

From 2015 to 2020, the owner of China’s number one messaging app WeChat 150 investments at home totalling $75 billion, compared to 102 deals worth $33 billion in overseas markets, according to Refinitiv data.

Tencent in August reported its first ever quarterly top-line fall, partially hurt by a lack of game approvals in China and regulations that limit playing time. Revenue from online games decreased both at home and abroad by 1%.

Its Hong Kong-listed shares have sunk some 60% in the last two years.

Against that backdrop, Tencent has barely made investments in China this year versus 27 deals worth $3 billion offshore, Refinitiv data show. It has been reducing its portfolio partly to placate regulators and also to book some hefty profits, sources have told Reuters.

“We believe Tencent will continue to make reasonable investments to acquire quality gaming content and talents and deepen partnerships with top-tier studios worldwide in order to step up its investments and presence in overseas markets,” said Citi analysts in a report in early September.

Tencent’s pursuit of bigger stakes in its existing gaming portfolio or new targets would give the company a bigger say in such firms’ businesses and also help it secure the intellectual property rights of popular games, said the four sources.

Also, with Beijing strictly restricting game approvals at home and still suspending approvals for games of foreign IPs, Tencent is forced to move towards gaining control of foreign game companies and their IPs, said the four sources.

Tencent in September raised its stake in Ubisoft in a deal that made the Chinese firm the single biggest shareholder of the top French games developer, with a stake of 11% which can be further increased to as much as 17%.

Regional hub

The Ubisoft deal comes just after deep-pocketed Tencent in June acquired Copenhagen-based Sybo Games, the developer of hit mobile game Subway Surfer, and in August took a 16.25% stake in Japan’s “Elden Ring” developer FromSoftware.

Last year, Tencent said it would take over British videogame developer Sumo in a $1.3 billion deal – one of its largest foreign transactions since the regulatory crackdown in late 2020.

In Europe, except for its purchase of majority stake in “Clash of Clans” mobile game maker Supercell for $8.6 billion in 2016, Tencent has for years mostly cut minority deals including its purchase of 9% of British gaming firm Frontier Developments.

Elsewhere, Tencent also seeks to increase its investment in and make deeper forays into Southeast Asia as it sees the region – home to 650 million people – as having potential to replicate the success of China’s internet boom, said two of the sources.

China’s largest social network firm already has a regional hub for Southeast Asia in Singapore that houses its international game publishing business.

Since last year, the company has repeatedly emphasized that it is aiming to have half of its gaming revenue coming from outside China, from about 25% now. In doing so, it in December launched a new publishing brand called Level Infinite in Singapore.

Read Full Story »»»

DiscoverGold

DiscoverGold

Alibaba and Tencent hold some of China's biggest cash balances

By: Ayesha Tariq | September 9, 2022

• Chinese companies hold some of the biggest cash balances of the country

$TCEHY $BABA $JD $BIDU $PDD

Read Full Story »»»

DiscoverGold

DiscoverGold

Tencent Divestment Concerns Add to China Pressure

By: Bloomberg | September 2, 2022

In a world awash in technology stocks for sale, the last thing bulls want to see is more big sellers hitting the market. In China, that appears to be just what’s happening.

Investors are fretting that Tencent Holdings Ltd. will add to pressure on the market if it moves ahead with a reported plan to offload 100 billion yuan ($14.5 billion) from its equity portfolio. While the company denied the report, that was little comfort to stockholders, who pushed down the share prices of Tencent investees such as Pinduoduo Inc. and KE Holdings Inc.

A divestment would follow similar moves under consideration by Baidu Inc. and Alibaba Group Holding Ltd. as the internet giants seek to assuage regulators concerned about their sway over the industry. And it would just deepen the gloom around Chinese tech stocks still reeling from Beijing’s regulatory clampdown. The Nasdaq Golden Dragon Index of US-listed Chinese stocks has plunged 64% from its 2021 record.

“The current market environment is not favorable and may substantially exacerbate the negative impacts on the share prices of the targeted companies being off-loaded,” said Redmond Wong, Saxo Capital Markets strategist.

Investors are now paying attention to what is next. Alibaba -- which arguably faced the worst of the regulatory crackdown -- holds a stake in at least six US-listed stocks, including XPeng Inc. and Weibo Corp., according to exchange filings. Baidu owns a controlling stake in iQiyi Inc., while e-commerce giant JD.com Inc. is a shareholder of its peer Vipshop Holdings Ltd., Bloomberg data shows.

China’s tech titans have plenty of incentive to pare their stakes in listed companies. Besides appeasing regulators, reducing their holdings also slims balance sheets and gives firms the ability to invest those funds into more profitable operations...

Read Full Story »»»

DiscoverGold

DiscoverGold

$TCEHY reported 2Q rev and adj net income largely in line with expectations

By: Gary Black | August 17, 2022

• $TCEHY reported 2Q rev and adj net income largely in line with expectations.

- Total revs -3% to ¥134B (in line)

- Online adv -18% YoY (vs -29% est decline)

- Mobile games inline

- Fintech/ business service inline

- Adj net income -17% YoY to ¥28.1B vs ¥24.4B E

Conf call 8am

Read Full Story »»»

DiscoverGold

DiscoverGold

Marketmind: Tencent’s Q2 results take center stage in Asia

By: Reuters | August 16, 2022

• A look at the day ahead in Asian markets from Jamie McGeever

Earnings from China’s Tencent, an interest rate decision from New Zealand, and a clutch of Japanese economic indicators will give Asian markets a local steer on Wednesday, following another solid rise on Wall Street and notable decline in oil prices.

Tencent’s second-quarter results come a day after Reuters exclusively reported that the tech giant plans to sell all or a bulk of its $24 billion stake in food delivery firm Meituan.

This would placate domestic regulators but also bring a timely cash injection – Tencent’s second-quarter profit is forecast to slide 27%, per analyst estimates on Refinitiv, thanks to a slowing economy and tightened video-game rule.

Tencent’s shares edged up 0.9% on Tuesday, while Meituan’s slumped 9%, their biggest fall in five months.

On the macro front, the Reserve Bank of New Zealand is expected to raise its cash rate by 50 basis points for the fourth meeting in a row. All 23 economists in a Reuters poll forecast the rise to 3.00%, which would mark the most aggressive tightening since 1999.

RBNZ rate decision: https://tmsnrt.rs/3ApCqVH

Meanwhile, figures from Japan are expected to show a recovery in machine orders and a narrowing trade deficit. The Tankan manufacturing and services indexes for August will also be released.

Tuesday marked another 3% fall in oil prices and solid rise on Wall Street. Brent crude is now lower than it was before Russia’s Feb. 24 invasion of Ukraine, and the S&P 500 has rebounded almost 20% from its June low.

Later on Wednesday investors also have a clutch of U.S. and European macro releases to digest, including: UK inflation, euro zone GDP and employment, and U.S. retail sales.

Read Full Story »»»

DiscoverGold

DiscoverGold

Here's Why Investors Are Avoiding Tencent Stock

By: Motley Fool | August 13, 2022

• Tencent is facing multiple headwinds in the near term.

Once a bedrock of stability and growth, Tencent Holdings Limited (TCEHY -1.52%) stock has lost its appeal among investors. From their peak in early 2021, Tencent's shares have dropped by more than 55%. The stock lost over 30% of its value this year alone.

Confused (and frustrated) investors -- especially foreign investors -- want to know what caused the share price to plummet. Though we cannot pinpoint the exact reason, we can certainly make some educated guesses. Here are some of mine.

Tencent's recent financial performance has been disappointing

It is not without reason that Tencent has been a favorite among investors for many years. From its IPO in 2004 to 2021, the company grew its top and bottom lines by a compound annual growth rate (CAGR) of 44%. This impressive performance generated enormous returns for early investors who held on to the stock.

Lately, Tencent seems to have lost its Midas touch. In the fourth quarter of 2021, revenue growth slowed to 8% year over year while profit fell 25% on a non-IFRS basis. The tech specialist followed that with another weak performance in the first quarter of 2022: Revenue came in flat while profit plunged 24%.

Tencent's recent performance was affected by the slowdown in gaming revenue growth and the decline in advertising income. The latter was severely impacted due to lower advertising income from online education and internet service industries amid the Chinese government crackdown. Moreover, the online advertising industry's regulatory changes further affected advertising revenue.

To address these challenges, Chairman and CEO Ma Huateng said that Tencent "has implemented cost control initiatives and rationalized certain non-core businesses, which would enable us to achieve a more optimized cost structure going forward."

I like that the management team is addressing its challenges head-on. Yet its decision also signaled that this downturn could last a while. At best, Tencent's good old days of high growth rates might take some time to resume. At worst, they might never...

* * *

Read Full Story »»»

DiscoverGold

DiscoverGold

Exclusive-Tencent seeks bigger stake in ‘Assassin’s Creed’ maker Ubisoft -sources

By: Reuters | August 4, 2022

• Tencent Holdings Ltd plans to raise its stake in French video game group Ubisoft Entertainment SA as the Chinese gaming giant pivots to the global gaming market, four sources with direct knowledge of the matter

HONG KONG (Reuters) -Tencent Holdings Ltd plans to raise its stake in French video game group Ubisoft Entertainment SA as the Chinese gaming giant pivots to the global gaming market, four sources with direct knowledge of the matter told Reuters.

China’s largest social network and gaming firm, which bought a 5% stake in Ubisoft in 2018, has reached out to the French firm’s founding Guillemot family and expressed interest in increasing its stake in the firm, the sources said.

It is not clear how much more Tencent wants to own in Ubisoft, valued at $5.3 billion, but Tencent aims to become the single largest shareholder of the French company with an additional stake purchase, two of the sources said, speaking on condition of anonymity.

Tencent is hoping to buy a part of the additional stake in Ubisoft, the maker of the blockbuster “Assassin’s Creed” video game franchise, from the Guillemot family, which owns 15% of the firm, three of the sources said.

Tencent could offer up to 100 euros ($101.84) per share to acquire the additional stake, two of the sources with knowledge of the internal discussions, said. It paid 66 euros per share for the 5% stake in 2018.

Details of the deal are not yet finalised and are subject to change, the sources said.

Ubisoft shares surged 16% after the Reuters report in their biggest daily rise since 2010.

Shares in Guillemot Corp SA, the holding company in which the Guillemot family owns the majority shareholding, were trading up more than 7%.

Tencent will also seek to acquire shares from public shareholders of Ubisoft, two of the sources said, in a bid to boost its ownership and become the single-largest shareholder.

About 80% of the French firm’s shares are owned by public shareholders, according to its latest annual report.

All the sources declined to be named as they are not authorised to speak to the media.

Tencent and Ubisoft declined to comment.

Representatives of the Guillemot family could not be immediately reached for comment.