Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

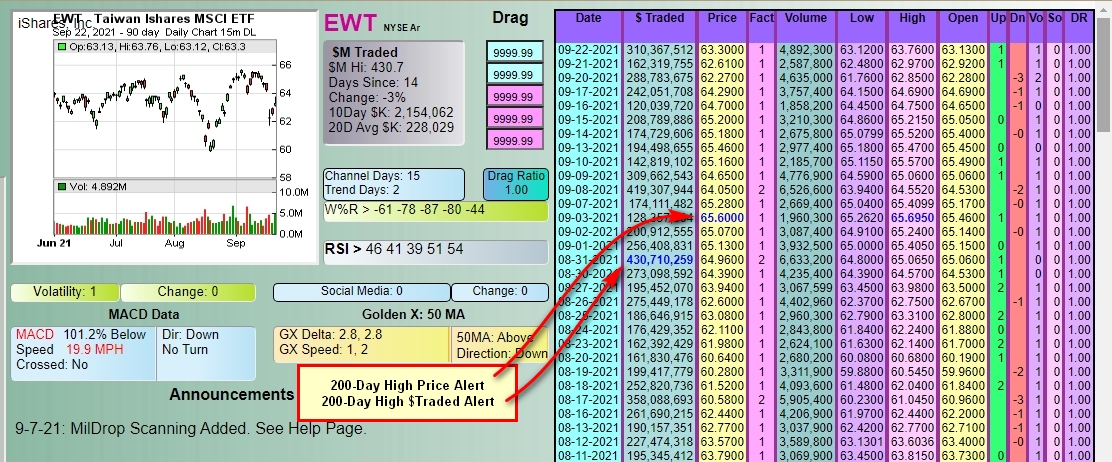

#DDAmanda Chart on: $EWT

You can scan for these before they run.

#DDAmanda Promo Code: dsh888

What the Fact (Factor) Column is:

The Factor is a proprietary indicator used for scanning in #DDAmanda.

It's defined as Today's $Traded divided by the average daily $Traded (20 day avg).

SO, if a stock has say a 10 Factor that day, it means she traded 10 Times the $ she normally trades.

That's significant, and many times indicates that a run in the stock is coming.

World Market Charts:

World Bank cuts global growth forecast on weak demand, commodity prices

The World Bank slashed its 2016 global growth forecast on Wednesday to 2.4 percent from the 2.9 percent estimated in January due to stubbornly low commodity prices, sluggish demand in advanced economies, weak trade and diminishing capital flows.

Commodity-exporting emerging market countries have struggled to adapt to lower prices for oil, metals, and other commodities, accounting for half of the downward revision, the multilateral lender said in its latest Global Economic Prospects report.

It expects these economies to grow at a meagre 0.4 percent pace this year, a downward revision of 1.2 percentage points from the January outlook.

Commodity-importing emerging market countries are faring better, but the benefits of lower energy and other goods have been slow to materialise, the World Bank said. It now expects growth in these countries will reach 5.8 percent, down a tenth of a percentage point from the January forecasts.

In the United States, a steep decline in energy sector investment and weaker exports will also shave eight tenths of a percentage point from the World Bank’s 2016 forecast, bringing growth to 1.9 percent.

The euro area saw a slight downgrade of its 2016 forecast to 1.6 percent, despite extraordinary monetary policy support and a boost from lower energy and commodity prices.

The downgraded World Bank forecast follows a similar move by the International Monetary Fund, which cut its growth forecasts two months ago.

Among major emerging market economies, the World Bank kept China’s growth forecast unchanged at 6.7 percent this year after 2015 growth of 6.9 percent. It expects China’s growth to slow further to 6.3 percent by 2018 as the world’s second-largest economy rebalances away from exports to a more consumer-driven growth model.

India’s robust economic expansion also is expected to hold steady at 7.6 percent, while Brazil and Russia are projected to remain in deeper recessions than forecast in January.

South Africa is forecast to grow at a 0.6 percent rate in 2016, 0.8 of a percentage point more slowly than the January forecast.

http://in.reuters.com/article/worldbank-growth-idINKCN0YT2V2

http://finance.yahoo.com/etf/lists/?mod_id=mediaquotesetf&tab=tab1&cat=%24FECA%24WS%24%24&ff=0C00004AZV&rcnt=50

Taiwan Stock Market is also a important market for business in international market.I really think this post got a lot of info from relevant resources.I also prefer http://www.sirfpaisa.com/index.php Best Stock Market for share market investors with Tips on Investment lessons, stock market advice, Stock Market Analysis and Much More! Thanks for sharing mate.Keep sharing more.

Taiwan Stock Market is also a important market for business in international market.I really think this post got a lot of info from relevant resources.I also prefer [url=http://www.sirfpaisa.com/index.php]Best Stock Market[/url] for share market investors with Tips on Investment lessons, stock market advice, Stock Market Analysis and Much More! Thanks for sharing mate.Keep sharing more.

It's going to be hard 5yr downtrend to break

I think over time GIGM can

Whats your target soon---I think GIGM can break into 2-3 area for a bit---then settle

Samsung to shed money-losing LCD TV business

South Korea's Samsung Electronics Co., the world's biggest maker of televisions, is shifting its focus toward new generation OLED display technology, and said it will spin off its loss-making LCD flat-screen business into an affiliate.

The outlook for liquid crystal display TVs has dimmed as shoppers in developed markets have traded in their bulky cathode-ray tube TVs for flat screens, and competition has intensified from low-cost Chinese manufacturers.

Together, Panasonic, Sony and Sharp expect to lose $17 billion this year, highlighting the savaging of Japan's electronics industry, and TV makers in particular, by foreign rivals such as Samsung, weak demand and a strong yen.

Samsung's LCD division had an operating loss of $666 million last year.

http://www.chicagotribune.com/business/breaking/chi-samsung-to-shed-moneylosing-lcd-tv-business-20120220,0,4488164.story

Cash went up to 1.70 a share

TAIPEI, Taiwan, Feb. 17, 2012 /PRNewswire-Asia/ -- GigaMedia Limited (NASDAQ: GIGM - News) ("GigaMedia") today announced that new management is seeking to sell certain of the company's assets in the first half of 2012. The planned disposals are intended to free up approximately US$30-US$40 million for investment in new strategic growth initiatives, in line with GigaMedia's turnaround plans.

The company's turnaround plans, driven by CEO John Stringer, are based on an explicit decision-making framework with clear objectives: effectively managing cash, maintaining the company's listing on NASDAQ, and executing a new strategic growth plan.

Part of efforts to better manage cash and increase focus, new Giga's disposal and asset optimization program targets investments made in certain game studios in Asia, as well as underperforming assets. Multiple publicly-listed game studios in GigaMedia's investment portfolio have grown in value. While past results are not a guarantee of future performance of these investments, based on current market values of GigaMedia's shareholdings management believes it has a reasonable expectation of generating cash proceeds of approximately US$30-US$40 million exclusively from sales of its interests in these publicly-listed game studios.

Additional details on new management's turnaround plans will be provided going forward, including on GigaMedia's fourth-quarter conference call, anticipated in the second half of March.

What is the good news for GIGM?

can't reply PM

GIGM next stop 1.95

AUO--and old one I use to follow

Taiwan seems to be breaking out!?

You think gigm has legs left or retraces?

GIGM coming back :)

Taiwan’s New Cabinet Takes Shape

Taipei, Feb. 1, 2012 (CENS)--Premier-designate Sean Chen announced yesterday (Jan. 31) the list of 47 members of his new Cabinet, which includes 16 new members, around a third of the total.

http://news.cens.com/cens/html/en/news/news_inner_39174.html

Premier-designate Sean Chen described his Cabinet picks Tuesday as an effort to put "talent in the right position."

http://focustaiwan.tw/ShowNews/WebNews_Detail.aspx?Type=aALL&ID=201201310048

New record: 32 PhD in New Cabinet

http://paper.wenweipo.com/2012/02/02/TW1202020002.htm

New Taiwan Legislative Yuan President, Wang Jin-pyng, Kuomintang

since 1 February 1999

http://paper.wenweipo.com/2012/02/02/TW1202020001.htm

http://en.wikipedia.org/wiki/Legislative_Yuan

PDF form

http://pdf.wenweipo.com/2012/02/02/a17-0202.pdf

Diabetes drug may cut pancreatic cancer risk

http://abclocal.go.com/wls/story?section=news/health&id=8526359

Download HK Chinese Characters

http://www.gov.hk/tc/about/helpdesk/softwarerequirement/hkscs.htm

Taiwan's China-friendly president wins re-election

http://www.foxnews.com/world/2012/01/14/taiwans-china-friendly-president-wins-re-election/

http://en.wikipedia.org/wiki/Republic_of_China_presidential_election,_2012

http://specials.mingpao.com/cfm/Main.cfm?SpecialsID=257

http://inews.mingpao.com/htm/INews/20120114/ab62113a.htm

http://www.chinapress.com.my/node/285386

Chen Shui-bian will continue

to live

http://www.worldjournal.com/printer_friendly/2617643

South Korean ex-president Roh dies in apparent suicide

Former South Korean President Roh Moo-hyun, embroiled in a broadening corruption scandal, jumped to his death while hiking in the mountains behind his rural southern home, his lawyer said. He was 62.

Roh had been hiking in the village of Bongha on Saturday morning when he threw himself off a mountainside rock, lawyer Moon Jae-in told reporters. In a suicide note left for his family, Roh called life "difficult" and apologized for making "too many people suffer," a TV report said.

Roh was rushed to a hospital in the nearby port city of Busan around 8:15 a.m. (2315 GMT) and died around 9:30 a.m. (0030 GMT) from head injuries, officials at Busan National University hospital said.

The lawyer confirmed that Roh left a "brief" suicide note for his family. Investigators have not seen the note, a Busan police official said. He did not give his name, citing department policy.

MBC television said the note asked that his body be cremated.

The apparent suicide — the first by a modern South Korean leader — shocked the nation.

President Lee Myung-bak said Saturday the news was "truly hard to believe" and called Roh's death "sad and tragic," presidential spokesman Lee Dong-kwan said.

Many gathered around TV monitors at Seoul's main train station watching broadcasts of the news.

"I'm heartbroken. I can't imagine how much pain he was in," said Park Kyung-hee, 46, in downtown Seoul.

Roh, a former human rights lawyer who served as president from 2003 to 2008, prided himself on being a "clean" politician in a country with a long history of corruption.

But he and his family have been ensnared in recent weeks in a burgeoning bribery scandal.

Last month, state prosecutors questioned Roh for some 13 hours about allegations that he accepted more than $6 million in bribes from a detained South Korean businessman while in office — accusations that deeply shamed him.

"I have no face to show to the people. I am sorry for disappointing you," an emotional-looking Roh said April 30 before undergoing questioning by prosecutors.

Roh acknowledged that his wife took $1 million from Park Yeon-cha, head of a local shoe manufacturer, but suggested it was not a bribe. He also said he was aware that Park gave another $5 million to a relative but said he thought it was an investment. Prosecutors suspect the $6 million eventually was conveyed to Roh.

Several of Roh's former aides and associates also have been investigated on suspicion of taking money from Park, who was indicted in December on separate bribery and tax evasion charges. Roh's elder brother was indicted in December for his alleged involvement in a separate bribery scandal.

Roh denied the allegations against him during questioning, prosecution spokesman Cho Eun-sok said.

Prosecutors expressed their condolences Saturday and said the investigation will be wrapped up soon, MBC reported.

Roh — a native of Gimhae, located 280 miles (450 kilometers) from Seoul — came from a poor farming family and never went to college. He studied law on his own, passing South Korea's difficult bar exam.

He built a reputation as a lawyer defending students accused of sedition under past military rule, and once was arrested, with his law license suspended, for supporting an outlawed labor protest.

Roh joined the National Assembly as an opposition liberal lawmaker in 1988.

His ascension to the presidency came after a surprise 2002 election win on a campaign pledge not to "kowtow" to the United States, a pledge that resonated with young voters.

He maintained predecessor President Kim Dae-jung's "sunshine policy" of offering North Korea aid as a way to facilitate reconciliation, holding a summit in Pyongyang with North Korean leader Kim Jong Il in 2007, the second such meeting between leaders of the wartime rivals.

In 2004, Roh called on the public to vote for candidates from his Uri Party in parliamentary elections, a violation of the president's political neutrality. The move prompted lawmaker to vote for his impeachment, making him the first South Korean president to be impeached. He was reinstated after two months of suspension, after a court ruled against the impeachment.

http://news.yahoo.com/s/ap/20090523/ap_on_re_as/as_skorea_ex_president

EWT more to come

Strait Talk for Taiwan, China

Taiwan's stock market is up 46% in 2009 on hopes for closer ties with China. But there's a danger investors are being too optimistic.

Taiwan's stock market, for some years Asia's ugly duckling, has been transformed by hopes for closer economic ties with mainland China. The Taiex is up 46% this year, including a recent surge since China Mobile's proposal to buy 12% of Far EasTone.

http://online.wsj.com/article/SB124289991457342863.html

Watching closely :)

http://finance.yahoo.com/news/Taiwan-Rallies-On-Improved-ibd-15095499.html?.v=1

*Thanks Moise

Taiwan's DRAM Merging Cannot Happen Fast Enough

Vivian Wai-yin Kwok, 03.06.09, 04:58 AM EST

Government plan to set up a new company to consolidate the country's struggling semiconductor industry may be too late for struggling producers.

Taiwan’s individual DRAM chip makers may go bankrupt before the government has time to implement its plan, disclosed this week, to promote consolidation in the ailing industry by setting up a new company in the second half of this year.

Shares of Taiwanese computer memory chip makers tumbled on Friday, with the largest, Powerchip Semiconductor, sliding by 28 New Taiwan cents (1 cent), or 6.85%, to 3.81 New Taiwan dollars (11 cents), and its major rival, Nanya Technology Corp., losing 37 New Taiwan cents (1 cent), or 5.8%, to 6.03 New Taiwan dollars (17 cents), at the close, a day after Taipei officials unveiled preliminary plans to restructure the industry. The broader Taiex weighted index picked up 16.43 points, or 0.35%, to 4,653.63.

Under the government’s blueprint, a new entity named Taiwan Memory Co. will be formed over the next six months to pull together Taiwan’s struggling computer memory chip makers. Taiwan Memory Co will merge the production capacities of various manufacturers, combine research teams, develop independent technology and expand brand marketing, so as to raise the sector’s competitiveness against South Korea's Samsung Electronics (other-otc: SSNLF - news - people ) and Hynix Semiconductor (other-otc: HXSCF - news - people ), the world’s top DRAM producers. The Taiwanese state will hold less than a 50% stake in Taiwan Memory Co., and the company will choose either Japan's Elpida Memory (other-otc: ELPDF - news - people ) or the United States’ Micron Technology (nyse: MU - news - people ) as a technology partner in the next three months.

No further details were disclosed Thursday. Goldman Sachs noted that Taiwan's focus is on rescuing the entire DRAM industry rather than supporting individual DRAM companies. "We believe hurdles that Taiwan DRAM companies are currently facing include a rising debt burden and technology dependency on foreign partners," the brokerage said in a research note released Friday, adding that “the government's aim is to address the latter hurdle."

Goldman Sachs estimated that it would take around 170 billion New Taiwan dollars ($4.9 billion) to convert the total capacity of Taiwan’s 12-inch DRAM wafer fabrication plants to 50-nanometer circuit-etching technology in order to be competitive with the cost leader, Samsung Electronics, which is gradually moving into 50 nm. “The balance sheets and cash flow positions of Taiwan’s DRAM companies’ have deteriorated significantly over a two-year downturn, preventing these companies from focusing on technology migrations,” the Goldman analysts wrote.

Because the government does not intend to inject capital into firms, the newly formed company is expected to use equity instead of cash to absorb their production facilities. DRAM producers with heavy debt loads may not be able to survive until or even beyond the consolidation.

Peter Yu, an analyst with BNP Paribas Securities Korea, predicted that Taiwan Memory Co. may face an operational nightmare merging different technology platforms across various facilities, based on the the history of the merger of Hyundai Electronics and LG Semicon, which formed Hynix Semiconductor in 1999. "The Hyundai-LG Semicon merger took almost four years to come up with a common technology platform and enjoy the post-merger synergy. It nearly went bankrupt during the lengthy process,” he said.

To reduce the cost of the restructuring, Morgan Stanley said, Taiwan Memory Co. quickly has to make an “either or” decision between Elpida Memory and Micron Technology as the foreign partner as Taiwan to help with research and development issues as it strives for critical mass. “Learning from the cheerless experience of the past 15 years with multiple technology sources (Mitsubishi, Toshiba, Infineon, Oki, Qimonda, Elpida, Hynix, Micron, etc), Taiwan only needs one globally competitive DRAM company. Given that the DRAM industry is ex-growth, we continue to believe the best exit/survival strategy for the Taiwan DRAM sector is a super merger,” the brokerage remarked.

http://www.forbes.com/2009/03/06/taiwan-dram-consolidation-markets-equity_merger.html

Puzzling Out A Japan-Taiwan Chip Alliance

Tina Wang, 01.21.09, 11:05 AM ET

The Taiwanese memory chip industry's attempts at consolidation have been a game of musical chairs, as troubled companies continue to flirt with foreign partners in a bid to get a government bailout. The latest news reports have Japan's Elpida Memory in merger talks with Taiwanese DRAM makers ProMOS Technologies, Rexchip and Powerchip Semiconductor. But, with disparate interests to be reconciled among so many parties, it will be an uphill climb to conclude a deal.

As chip makers cope with sagging prices that are the consequence of a supply glut, Elpida Memory said on Wednesday it is "discussing several possibilities" with a number of Taiwanese chip makers. Because they are currently losing money on every chip they fabricate, the Taiwanese companies are desperate to get a piece of the up to $3 billion in bailout funds that Taipei has indicated it would make available.

But a merger involving Elpida, ProMOS, Rexchip and Powerchip Semiconductor has less than 50% chance of happening, predicted Taipei-based Primasia Securities analyst Kenneth Lee. The Taiwanese government wants the island's chip makers to incorporate more foreign technology, whereas the Japanese government will lean on Elpida to keep its trade secrets close to the vest in order to retain a commercial advantage. Powerchip Semiconductor is least troubled of Taiwanese trio and may resist giving up its independence. A three-way deal among Elpida, Rexchip and ProMOS is more likely, but Elpida's majority ownership of Rexchip would give the combined entity a Japanese identity, which would concern Taipei, Lee added.

The Taiwanese government has already told ProMOS, the neediest of the chip makers, to come back with a revised plan for an alliance with Elpida that allows for more technology transfer. Since state aid will likely be dispensed through the National Development Fund rather than the country's Finance Ministry, Taipei is concerned to see that any deal shores up the strategic competitiveness of the domestic DRAM sector.

Speculation heightened last week that Micron Technology of the United States is eyeing Taiwanese partners Nanya Technology and Inotera Memories, also in hopes of getting assistance from Taipei. (See "Micron Wants Piece Of Taiwan Bailout Pie.")

"In the context of an industry that is used to investing billions of [U.S. dollars] in a single year, both [Nanya's and Inotera's] cash reserves amount to small change, in our view. The piggy bank is almost empty," UBS's Robert Lea wrote in a Jan. 20 research note. "We think the Taiwanese Government may play a central role in bailing out the industry in the coming months."

But a restructuring would dilute the value of existing shareholders' equity holdings, as chip makers focus on survival at all costs, the note added. Lee said he expected DRAM prices to rebound to a break-even level in the second half of 2009 or first half of 2010.

At the close of trading Wednesday in Taipei, ProMOS shares were up by 9 Taiwanese cents, or 6.3%, to 1.51 Taiwanese dollars (4 cents). Powerchip Semiconductor shares were up by 20 Taiwanese cents (1 cent), or 7.0%, to 3.07 Taiwanese dollars (9 cents). In Tokyo trading, Elpida Memory shares were up by 12 yen (13 cents), or 2.3%, to 545 yen ($6.06).

http://www.forbes.com/2009/01/21/elpida-taiwan-chip-markets-equity-cx_twdd_0121markets03_print.html

Taiwan's TMSC and Intel team up on Atom processor

Taiwan Semiconductor Manufacturing Co. and US computer chip maker Intel Corp. announced on Monday that they have forged an alliance that will allow TMSC to use Intel's tiny Atom microprocessors. Intel, the world's largest chip manufacturer, and TMSC described the agreement in a joint statement as "an important step in a long-term strategic technology cooperation between Intel and TSMC." "The compelling benefits of our Atom processor combined with the experience and technology of TSMC is another step in our long-term strategic relationship," Intel president and chief executive Paul Otellini said. Intel said the agreement with TMSC should "significantly broaden the market opportunities" for its Atom processor, which was unveiled last year and is used in a wide variety of electronic devices, from smartphones to netbooks. The Atom features 47 million transistors and is Intel's smallest processor. "We expect this collaboration will help proliferate the Atom processor ... and foster overall semiconductor growth," said Rick Tsai, president and chief executive of TSMC, which operates the world's largest dedicated semiconductor foundry. The agreement with TMSC is unusual for the Santa Clara, California-based Intel as it tends to tightly control everything from computer chip design to manufacturing. The alliance comes at a difficult time for the semiconductor industry and is aimed at expanding the use of the Atom in electronic devices. Market research firm Gartner expects worldwide semiconductor revenue to drop 24.1 percent this year to 194.5 billion dollars while another firm, IDC, has forecast that the semiconductor market will erode 22 percent this year. Gartner also reported on Monday that sales of personal computers are expected to decline by 11.9 percent to 257 million units in 2009, the steepest drop in the industry's history.

http://asia.news.yahoo.com/090302/afp/090302231753business.html

chips are inching up

Taiwan's Chen pleads not guilty in corruption case

Former Taiwanese President Chen Shui-bian pleaded not guilty to corruption charges Monday during a pre-trial hearing in Taipei.

Chen is accused of embezzlement and accepting bribes during his presidency, which ended in May. He was returned to jail after Monday's hearing until his next court date, now February 24.

He has been jailed since late December, when Taiwan's high court revoked an earlier decision to grant him bail.

Chen is accused of embezzling 600 million new Taiwan dollars ($18 million U.S.), taking bribes, laundering money and illegally removing classified documents from the president's office.

The 58-year-old former leader has denied any wrongdoing and insists the charges are politically motivated.

Thirteen others, including Chen's wife, son, daughter-in-law and brother-in-law have been indicted in the case. Prosecutors said Chen's son has a Swiss bank account with $22 million they believe to be illegal proceeds.

http://www.cnn.com/2009/WORLD/asiapcf/01/19/taiwan.china/index.html

Taiwan ex-leader urged to face justice after relatives plead guilty

TAIPEI (AFP) - Taiwan's former president Chen Shui-bian and his wife were urged Thursday to "stop lying" about the corruption charges they face after three of their relatives pleaded guilty to money laundering. Chen's son Chen Chih-chung, his daughter-in-law Huang Jui-chin and his brother-in-law Wu Chin-mao all entered guilty pleas Wednesday, in the latest development in a case that has gripped the island since Chen himself was arrested in November. The younger Chen and his wife also apologised to fellow Taiwanese for the disturbance the case has caused, and vowed to further cooperate with prosecutors. Legislator Chiu Yi-ying of the pro-independence Democratic Progressive Party (DPP) urged the former leader and his wife to "learn something" from their son and daughter-in-law. "Stop lying. It's time to honestly face justice," she said. The younger couple, who had previously promised prosecutors they would send 21 million US dollars back to Taiwan from their Swiss bank accounts, said they would repatriate another 17 million US dollars from abroad. They also agreed to tell prosecutors the whereabouts of cash and jewellry worth around 600 million Taiwan dollars (17.88 million US) that was being kept by the former first lady. Wednesday's twist was a blow to members of the party the former president once led. "It is especially embarrassing to the supporters," former DPP legislator Lin Cho-shui said, referring to those who believe their former leader is the subject of a witch hunt by his successor, Ma Ying-jeou of the China-friendly Kuomintang. On Monday, former president Chen insisted that he was innocent of taking bribes, as he appeared in court for a pre-trial hearing on charges he says are politically motivated. Chen, who left office in May after eight years, has been charged with embezzlement, taking bribes and money laundering, influence peddling and blackmail and faces life in prison if convicted on all counts. While some Taiwanese saw the move by the young Chen as an attempt to break ranks with his father, others interpreted it as just part of the family's legal defence strategy aimed at reducing any eventual punishment. The former leader has previously admitted that his wife Wu Shu-chen transferred 20 million US dollars abroad, but said the money was from past campaign funds and she had done so without his knowledge. Chen is already under investigation for allegedly embezzling 14.8 million Taiwan dollars (480,500 US) in special expenses from the government while he was president, and his wife is on trial for corruption and document forgery in the same case.

http://asia.news.yahoo.com/090122/afp/090122073726asiapacificnews.html

http://www.worldjournal.com/wj-tw-news.php?nt_seq_id=1837597

Former Taiwan leader insists he is innocent

TAIPEI (AFP) - Former Taiwan president Chen Shui-bian insisted Monday he was innocent of taking bribes, as he appeared in court for a pre-trial hearing on charges he says are politically motivated. The 58-year-old, out of office for less than a year, arrived at court in handcuffs under tight security, the latest development in a case that has electrified this island of 23 million people since his arrest in November. Chen and his family are alleged to have taken more than 10 million US dollars in bribes from an industry tycoon. "I'm not guilty," he told the court. "Saying that I took bribes, I would rather die." The former leader has admitted that his wife transferred 20 million US dollars abroad but said that money was from past campaign funds and that she had done so without his knowledge. He has also admitted submitting bogus expense forms while in office but said the money was used for "secret diplomatic missions" and not for personal benefit. He has been charged with embezzlement, taking bribes and money laundering, and faces life in prison. Eastern Television, a local network, reported prosecutors also want to charge him with influence peddling and blackmail. Chen was fiercely in favour of independence from China, which considers the island part of its territory, and says he is the victim of a witch-hunt by the current pro-China government that took power after him last year. No date has yet been set for the trial to begin. The former president and his wife, Wu Shu-chen, are accused of embezzling 104 million Taiwan dollars (3.15 million US) in public funds and accepting a bribe of about 12 million US dollars in a land purchase deal. Prosecutors also allege that Wu took a kickback of 2.7 million US dollars in a construction project. Their son and daughter-in-law have also been charged with money laundering. Taiwan's former intelligence chief Yeh Sheng-mao was jailed in December for covering up Chen's suspected money laundering activities abroad. Chen's family have agreed to turn over 21 million US dollars found in their Swiss bank accounts to the Taipei government. Before Monday's court session, Chen's lawyer Cheng Wen-lung called for the former president to receive a fair hearing. "This case is drawing much attention. We hope the former president will receive a fair trial, so that the truth behind the case will come out," he said. Taiwan's high court earlier this month rejected Chen's appeal against his detention, saying that if freed he "could destroy and tamper with the evidence and collude with other suspects or witnesses," or that he could flee. Chen, who pledged to clean up notoriously corrupt Taiwanese politics when he took power in 2000, left office in May after serving the maximum two four-year terms as president.

http://asia.news.yahoo.com/090119/afp/090119053544int.html

More stories from Chen's Book

Taiwan ex-president's son pleads guilty to money laundering

The son and daughter-in-law of former Taiwan president Chen Shui-bian pleaded guilty to money laundering on Wednesday in a case tied up with Chen's own corruption trial, the Central News Agency said. Chen was charged last month with graft, money laundering and misuse of public funds following a probe that embroiled his son, Chen Chih-chung, his son's wife and numerous former aides. "Chen Chih-chung and his wife, Huang Jui-ching, acted as the proxy and a nominal holder, respectively, of the former first family's controversial overseas bank accounts," the news agency said. The former president denies wrongdoing, calling the case against him a political plot. Prosecutors charged Chen Shui-bian with embezzling T$104 million ($3 million) from a special presidential office fund, accepting bribes of about $9 million related to a land procurement deal and taking another $2.73 million in kickbacks to help a contractor win its bid for a government project. The case is likely to affect public opinion of Taiwan's opposition Democratic Progressive Party (DPP), which backed the former president when he was in office from 2000-2008 and faces tough local elections at the end of the year against the ruling Nationalist Party. Chen Shui-bian left the DPP in August. His pursuit of independence for self-ruled Taiwan upset rival China as well as the United States. China has claimed sovereignty over Taiwan since 1949, when Mao Zedong's Communists won the Chinese civil war and Chiang Kai-shek's Nationalists fled to the island. Beijing has vowed to bring Taiwan under its rule, by force if necessary. Outside the courthouse, Chen Chih-chung publicly apologised. "I didn't differentiate clearly between laundering money and handling funds," Chen Chih-chung told reporters, standing next to his wife, who choked back tears. "If it could be done all over, we absolutely would not make the same kind of mistake again." A judge must accept the couple's statement before it counts as a formal plea, a court spokesman said. He declined to estimate a sentence in the case, which is expected to take years to complete.

http://asia.news.yahoo.com/090121/3/3v4bx.html

TAIPEI (AFP) - Three relatives of Taiwan's former president Chen Shui-bian on Wednesday pleaded guilty to charges of money laundering, as part of a massive corruption case in which the ex-leader has been implicated. Chen's son Chen Chih-chung, his daughter-in-law Huang Jui-chin and his brother-in-law Wu Chin-mao all entered guilty pleas, in the latest development in a case that has gripped the island since Chen himself was arrested in November. The former president, who left office in May after eight years, has been charged with embezzlement, taking bribes and money laundering, influence peddling and blackmail and faces life in prison. He says he is innocent. "I'm guilty," Wu told a Taipei judge, while the younger Chen and Huang nodded when asked if they were guilty. Prosecutors say the suspects may have laundered at least 820 million Taiwan dollars (24.4 million US). Chen and Huang, who had previously promised prosecutors they would send 21 million US dollars back to Taiwan from their Swiss bank accounts, said they would repatriate another 17 million US dollars from abroad. The young Chen also agreed to tell prosecutors the whereabouts of around 600 million Taiwan dollars being kept by his mother, and pleaded for a reduced sentence. The couple apologised for the political turbulence the case had caused. Chen Chih-chung bowed twice to show his remorse as he spoke to reporters after the hearing while his tearful wife looked on. "After some reflection, we decided to face justice," he said. "We were not aware of the difference between managing money and money laundering. We are sorry and we promise not to make the same mistake again. We hope we can be given another chance." The young Chen said his mother had promised to show up in court at a hearing scheduled for February 10-11. The wheelchair-bound Wu -- the first wife of a Taiwanese leader to be prosecuted -- collapsed at court in late 2006 at the start of her trial and has since been excused from all court sessions on health grounds. Former president Chen insisted two days ago that he was innocent of taking bribes, as he appeared in court for a pre-trial hearing on charges he says are politically motivated. He had previously admitted that his wife Wu Shu-chen transferred 20 million US dollars abroad, but said that money was from past campaign funds and that she had done so without his knowledge. Chen is already under investigation for allegedly embezzling 14.8 million Taiwan dollars (480,500 US) in special expenses from the government while he was president, and his wife is on trial for corruption and document forgery in the same case. Chen has admitted using false receipts to claim money from the state, but insisted those funds were used for "secret diplomatic missions" and not his personal benefit. Nevertheless, prosecutors found that at least 1.5 million Taiwan dollars had been spent on diamond rings and other luxury items for his wife. Chen was fiercely in favour of Taiwanese independence from China, which considers the island part of its territory, and says he is the victim of a witch hunt by the current pro-China government, which took power after he stepped down last year. No date has yet been set for his trial to begin.

Taiwan's graft-tainted ex-leader publishes prison diary

Former Taiwan president Chen Shui-bian, who has been in jail for more than two months awaiting trial on corruption charges, Monday published a prison diary proclaiming his innocence. Publication of the 246-page "Taiwan's Cross" coincided with Chen's first court appearance since his appeal for bail was refused earlier this month. In the book, as in court, Chen rejects the allegations of graft and money laundering and claims that the charges against him and his family are politically motivated. The diary includes an account of Chen's student days when, he says, he began his life-long campaign to defend Taiwan's sovereignty from mainland China. The diary's preface is written by Lee Hung-hsi, Chen's mentor at Taiwan University law school. "For those who have long supported Chen, reading the book will convince them that their support is correct... for those who have abandoned A-bian [Chen's nickname], this would be the chance to listen to his last defence," Lee wrote. During Monday's court appreance, Chen accused his successor, Ma Ying-jeou of the China-friendly Kuomintang, of conducting a witch-hunt against him. Chen left office in May, after serving the maximum two four-year terms, during which he and his Democratic Progressive Party frequently annoyed Beijing with their pro-independence stance. The DPP was defeated by the China-friendly Kuomintang in the March elections. Chen and his wife, Wu Shu-chen, are accused of embezzling 104 million Taiwan dollars (3.15 million US) in public funds and accepting a bribe of about 12 million US dollars in a land-purchase deal. At the end of Monday's hearing the judge ordered Chen to be sent back to his detention centre. A hearing set for Wednesday was postponed to February 24 after Chen's lawyers said they needed more time to prepare his defence. No date has yet been set for Chen's trial to begin.

http://www.nownews.com/2009/01/21/138-2398305.htm

TAIPEI, Dec 30 (Reuters) - Taiwan newspapers carried the following stories on Tuesday. Reuters has not verified these stories and does not vouch for their accuracy.

CHINA TIMES

-- The parliament gave an initial approval to lower year-end bonuses for workers of state-run enterprises.

-- The cabinet will lower the corporate income tax rate from 25 to 20 percent and reduce some personal income taxes, in efforts to help people during the economic downturn.

UNITED DAILY NEWS

-- A survey showed that most people would not buy durable goods in the next six months, impacting the housing and auto markets.

-- President Ma Ying-jeou said in an interview that there was no "medicine" that could immediately boost the economy and no way to know how long the global economic crisis would last.

LIBERTY TIMES

-- The Labour Affairs Council said it would review its loan interest rate for common workers, in response to criticism that the rate was higher than that for civil servants.

COMMERCIAL TIMES

-- Overseas Taiwanese remitted about T$600 billion ($18.2 billion) to the island between September and November this year, Taiwan central bank governor Perng Fai-nan told the legislature.

-- Netbooks from Acer (2353.TW) and Asustek (2357.TW) took six of the top 10 spots for best-selling laptop PCs on Amazon.com (AMZN.O) during the Christmas season.

ECONOMIC DAILY NEWS

-- Top contract chipmakers TSMC (2330.TW) and UMC (2303.TW) could see their utilisation rates fall to 50 percent and 30 percent, respectively, in January.

http://www.reuters.com/article/rbssTechMediaTelecomNews/idUSTP31552120081230

Taiwan's ex-president back behind bars pending corruption trial

A Taiwanese court Tuesday ordered ex-president Chen Shui-bian to be locked up pending his trial on corruption charges that the former leader has dismissed as a witch hunt by the China-friendly government.

The Taipei District Court's decision reversed an earlier ruling and saw the former pro-independence leader sent back to the Tucheng detention centre outside the capital after spending just over two weeks free pending trial.

The judges said in their ruling they feared Chen could collude with other suspects, destroy evidence or flee the island unless he was detained.

The ruling is the latest twist in a long-running saga involving the former leader, who was arrested in November and charged with embezzlement and money laundering only to be released on December 13.

Since then, Chen and his lawyers had been battling state prosecutors' attempts to have him put back in custody.

Chen, who left office in May after serving a maximum two terms as president, is the island's first former leader to be detained on criminal charges and faces life in prison if convicted.

One of the former president's lawyers, Cheng Wen-lung, described the ruling as "unfair" and vowed to appeal.

"The ruling is not a surprise, because apparently it is the result of politics intervening in justice," the lawyer said. "My client... said he would keep striving to prove his innocence," he said.

Shortly before the court session opened, Chen's lawyers had asked the three judges not to review an earlier decision made by a different panel of judges in the same court.

The change of the judges "indicated that [President] Ma Ying-jeou has been trying everything he can to put the former president into jail", said parliamentarian Lai Ching-teh of the pro-independence opposition Democratic Progressive Party (DPP), which Chen once led.

Another DPP parliamentarian, Kao Chih-peng, threatened to take supporters on to Taipei's streets to protest against what he said was political persecution, an allegation denied by Ma's ruling Kuomintang.

Chen, 58, has repeatedly insisted that the charges against him are politically motivated, accusing Ma's Beijing-friendly government of leading a witch hunt.

The former president and his wife, Wu Shu-chen, are accused of embezzling 104 million Taiwan dollars (3.15 million US) in public funds and accepting a bribe of about 12 million US dollars in a land purchase deal.

Prosecutors also allege that Wu took a kickback of 2.7 million US dollars in a construction project.

Their son and daughter-in-law were also charged with money laundering.

Chen, who came to power eight years ago pledging to fight corruption, has admitted his wife wired 20 million US dollars abroad but said the money was from past campaign funds and she did so without his knowledge.

His family has agreed to turn over 21 million US dollars found in their Swiss bank accounts to the Taipei government.

No date for Chen's trial or his next court appearance had yet been set, a court official said.

http://asia.news.yahoo.com/081230/afp/081230085148int.html

http://www.worldjournal.com/wj-tw-news.php?nt_seq_id=1824718

Taiwan media urge fair trial for indicted ex-president

Taiwan's media Saturday called for a fair trial and urged the public to stay calm after the island's former pro-independence president Chen Shui-bian was charged with corruption.

A slightly thinner and tired-looking Chen -- who went on hunger strike while in detention -- was released on bail early Saturday after being charged with embezzlement and money laundering with 13 others including his wife and son.

Prosecutors say the 58-year-old Chen, the first ex-leader to face trial here, and his wife Wu Shu-chen made illegal gains of some 45 million US dollars from embezzling public funds and taking bribes from local businessmen.

Their son Chen Chih-chung and daughter-in-law Huang Jui-ching were also indicted for money laundering in connection with the massive case, which has captivated Taiwan for months.

"I want to thank my lawyers, members of the Democratic Progressive Party and my supporters who have given me huge encouragement," Chen said after his release.

"I am grateful to those who cared for, supported and looked after me so I could get through the hardest and loneliest 32 days of my life in prison," he said.

Taipei's Apple Daily called the politically charged case a "milestone" for the rule of law in Taiwan and urged the judges to make their decision based on the evidence alone.

"The case will have a profound impact on Taiwan ... to become a milestone to further Taiwan's democracy and its rule of law," it said.

"We urge the judges to focus on the evidence ... while politicians and commentators should respect the judicial system so the case can become a positive lesson in Taiwan," it said.

The pro-independence Liberty Times voiced similar sentiments in an editorial.

"Whether a former president is guilty or not depends on the evidence ... He is innocent until proven guilty according to the law and his right to due process should be protected," the newspaper said.

The English-language China Post also called for calm for the upcoming trial. Taiwan has a turbulent history and has frequently been rocked by large-scale protests in recent years.

"All the people should wait patiently for the outcome of the trial ... They shouldn't do anything to influence the judges in any way, because the rule of law in Taiwan is at stake," it said.

"We should show the world that Taiwan is a democracy where anybody who commits a crime, be he a man on the street or a former president, is duly punished."

Prosecutors have vowed to seek "the severest punishment" for Chen. Legal experts say he could face life in prison if convicted.

Chen, who pledged to clean up Taiwanese politics when he broke the KMT party's 50-year grip on power in 2000, left office in May after serving the maximum two four-year terms as president.

The ex-leader, who angered Beijing with his pro-independence policies, has repeatedly accused the island's current China-friendly government of mounting a witch hunt against him.

http://asia.news.yahoo.com/081213/afp/081213065912asiapacificnews.html

Taiwan's ex-president Chen indicted

Former Taiwanese President Chen Shui-bian was indicted Friday on several corruption charges, including embezzlement and accepting bribes. Chen, whose term ended in May, was accused of embezzling 600 million New Taiwan dollars ($18 million). Prosecutors say he also took bribes, laundered money and illegally removed classified documents from the president's office. Chen has denied wrongdoing and insisted the charges were politically motivated.

http://us.cnn.com/2008/WORLD/asiapcf/12/12/taiwan.chen/index.html?iref=hpmostpop

Court orders detention of Taiwan ex-president

http://topics.cnn.com/topics/chen_shui_bian

EWT and GRMN getting ready

Applied Materials to cut 1,800 jobs; profit falls 45%

By Rex Crum, MarketWatch

Last update: 5:40 p.m. EST Nov. 12, 2008

Comments: 5

SAN FRANCISCO (MarketWatch) -- Applied Materials Inc. on Wednesday reported a fourth-quarter profit that fell 45% as the semiconductor-and-solar panel equipment maker delivered weaker sales due to broad declines in corporate spending on technology products. The company also said it would slash 1,800 jobs in order to cut its costs over the next year.

EWT making nice formation

Taiwan Semiconductor Manufacturing Co. (TSM) is considering acquiring 60% of Singapore's Chartered Semiconductor Manufacturing Ltd. (CHRT) from Temasek Holdings Pte. Ltd., the Economic Daily News reported Saturday, citing unnamed market sources.

My posting is for my own entertainment, do your own DD before pushing your buy/call button

Gold toilet tycoon dies suddenly

A jewellery tycoon famed for creating the world's most expensive toilet has died suddenly at his Hong Kong home, local media says.

Lam Sai-wing, 53, the creator of a $HK38 million ($A5.88 million) gold toilet listed in the Guinness Book of World Records, was found dead on 27 Sep 2008 in his luxury apartment on Hong Kong's Bowen Road, the South China Morning Post reported today.

Thousands of people visit his company's showroom in Hong Kong every week to see the solid-gold toilet, which sits in a garish bathroom with gold fittings, including a gold toilet brush holder.

The self-made millionaire, who moved to Hong Kong from China aged 22, was inspired to build the toilet by his boyhood hero, the Russian revolutionary Vladimir Lenin, who said gold should be used to make toilets after the victory of socialism to remind people of capitalist waste.

http://www.thewest.com.au/default.aspx?MenuId=2&ContentID=99975

Butchered around the Global

after LEH failure and MER sold to BAC

how are you doing Dr?

White House: US Closely Watching Unrest In Thailand

Last update: 9/4/2008 9:41:04 AM

Taiwan looking to bridge the Strait

Weekend presidential vote expected to aid political, economic ties with China

The end of Taiwan's lost decade may be in sight, with presidential elections this weekend seen heralding a change in the Asian island's fortunes.

No matter which candidate emerges victorious in the Saturday vote, the result is expected to usher in an era of improved relations with China and help bring an end to what some analysts say has been 10 years of meandering for Taiwan's stock market and its economy.

"Taiwan stands on the brink of policy-led change that will reinvigorate the stagnating domestic economy," wrote Peter Sutton, an analyst with CLSA Asia-Pacific Markets. The election is viewed as a turning point in terms of both closer economic and cultural ties with China. Emerging markets page.

http://tinyurl.com/26eepz

Decisive victory for Ma Ying-jeou

FIRST ON THE AGENDA: Ma, who has promised to strike a peace deal in a bid to end decades of cross-strait tension, called on China to dismantle its missiles aimed at Taiwan before the two sides can engage in peace talks

By Mo Yan-chih, Ko Shu-ling and Shih Hsiu-chuan

Chinese Nationalist Party (KMT) candidate Ma Ying-jeou and his running mate Vincent Siew scored an overwhelming victory in yesterday's fourth direct election for president, taking nearly 60 percent of the vote to defeat Democratic Progressive Party (DPP) candidate Frank Hsieh and his vice presidential candidate Su Tseng-chang.

http://www.taipeitimes.com/News/front?pubdate=2008-03-23

Taiwan presidential rivals trade barbs in last debate

Taiwan's presidential election rivals traded accusations over the stuttering economy and relations with China as they faced off Sunday in their last head-to-head debate before the March 22 vote.

With former Taipei mayor Ma Ying-jeou of the opposition Kuomintang holding an apparently unassailable lead in opinion polls, the televised encounter was seen as one of the last chances for rival Frank Hsieh to make inroads.

Ma's campaign strategy has focused on ways to revive the economy, using the same promises of growth and jobs that propelled the KMT to a sweeping victory in January parliamentary elections.

He said the Democratic Progressive Party (DPP), which Hsieh belongs to, was to blame for the sluggishness of the economy over the past eight years.

"It has come to the point that people cannot stand it any more," he said.

"Please recall the 80 percent approval rate when Chen Shui-bian was first elected in 2000.

"People had a very high expectation on the DPP... but eight years later, people's dreams have burst... the DPP owes the people an apology," Ma said.

Outgoing Chen of the DPP was elected president in 2000, ending the KMT's 51-year grip on power, and was re-elected in 2004.

Ma pledged to revitalise the economy by allowing mainland Chinese to invest in the local property market, introducing more Chinese tourists and launching direct transport links with the mainland, which has been cut off since 1949 when Taiwan and China split at the end of a civil war.

Ma is in favour of closer ties with China, which sees the island nation as part of its territory awaiting reunification -- by force if necessary -- while Hsieh and the DPP lean toward independence.

The KMT candidate also guaranteed to boost domestic demand by investing up to four trillion Taiwan dollars (129.8 million US) on various development projects.

"I do agree on opening up chartered flights, allowing more Chinese tourists and things like that," Hsieh retorted, "but Taiwan's sovereignty must not be sacrificed."

He said he was strongly opposed to Ma's proposal of a "common market" with China -- closer ties in spheres such as trade, travel and employment -- and said that recognising Chinese qualifications would threaten the jobs of Taiwanese workers.

"No national leader should rest the hopes of his country on the 'goodwill' of another country," particularly one hostile to Taiwan, he added, noting that China had more than 1,000 missiles pointing toward the island.

While Ma says his "common market" would help revitalise the economy, a key concern for voters, Hsieh insists it would be tantamount to creating a single "China market" that would undermine Taiwan's sovereignty.

"Please vote for Ma if you favour the 'one China common market.' Otherwise, please vote for me," Hsieh said.

The latest opinion poll published late Saturday -- one of the last allowed before the election -- showed Ma increasing his lead over Hsieh.

While Ma saw his support unchanged at 54 percent from a week earlier, Hsieh slipped two points to 28 percent, according to the survey carried out by the television network TVBS.

Forty percent of those questioned said they favoured Ma's proposed "common market" with China, with 28 percent against.

To beef up his theme of economic renewal, Ma has promised annual growth of six percent, up from the currently estimated 4.5 percent, and a three percent drop in unemployment within eight years.

March 22 will also see Taiwanese vote on referendums on joining the United Nations. It lost its seat to China in 1971 and has tried ever since to return, only to be blocked by Beijing.

2008 Taiwan Presidential Election: First official debate with citizen journalists' participation

Before the main vote of 2008 Taiwan Presidential Election on March 22, the Public Television Service (PTS Taiwan) held the first official TV debate in the PTS Taiwan Building in Taipei, Taiwan. To improve interactions between two candidates (Frank Hsieh and Ma Ying-jeou) and potential citizen journalists in Taiwan, PTS Taiwan exclusively invited 20 nominated citizen journalists (CJs) to join this special debate and asked for their questions on-site. The new format was supported by several news organizations in Taiwan.

Before this main debate, PTS Taiwan requested several questions with "30-seconds question challenge by citizens" and ultimately selected 20 questions from varied fields including finance, economics, agriculture, industry, environment, population, territory rehabilitation policy, gender, human rights, education, diplomacy, differences between cities and countrysides, Cross-Strait (China, Hong Kong, and Taiwan) relationships, national position, culture, and racism.

After the debate, the Central News Agency asked several participating CJs about their satisfaction with the debate format. However, several CJs criticized the answers to their questions as "hollowed answers", while some CJs thought the answers were unexpected for the public.

On the other side, several academic professors were satisfied with their performances and on-site reaction, and a former legislator from Taiwan, Teh-fu Huang, commented on the debate:

http://tinyurl.com/277qm7

TSMC Board Proposes Dividend of NT$3.0 Cash and 0.5% Stock Per Share

Hsinchu, Taiwan, R.O.C., February 2008 – TSMC’s (NYSE: TSM) Board of Directors today adopted a proposal recommending distribution of NT$3.0 cash dividend per common share and 0.5 percent stock dividend (5 shares for every 1,000 owned). The proposal will be discussed and brought to a vote at the Company’s regular shareholders’ meeting scheduled for June 13, 2008.

TSMC’s Vice President and Chief Financial Officer, Ms. Lora Ho said that at its meeting today the Board of Directors:

1. Approved the 2007 Business Report and Financial Statements. Revenue for 2007 totaled NT$322,630 million and net income was NT$109,177 million, with earnings per share of NT$4.14.

2. Approved a proposal for distribution of 2007 profits and capitalization of capital surplus:

(1) Cash dividend of NT$3.0 per share and 0.2% stock dividend will be proposed to common shareholders. In addition, the board will propose another 0.3% share issuance from capitalization of capital surplus. Combined, common shareholders will be entitled to a 0.5% stock distribution, or 5 shares for every 1,000 held.

(2) Employee profit sharing will be distributed in both stock and cash. Profit sharing will amount to approximately 393.99 million new shares and NT$3,939.9 million cash.

3. Approved the cancellation of 800 million treasury shares purchased from the open market as well as reduction of capital stock by NT$8,000 million, and set February 27, 2008 as the record date for said capital reduction.

4. Approved capital appropriation of US$400 million (approximately NT$12,800 million) to increase twelve-inch wafer capacity at 45nm processes in Fab 12.

5. Appointed Y.P. Chin and Dr. N.S. Tsai as Vice Presidents of TSMC.

6. Approved scheduling of the 2008 Regular Shareholders’ Meeting for 9:30 a.m. on June 13, 2008 at the Auditorium in Fab 12, TSMC (8, Li-Hsin Rd. 6, Hsinchu Science Park, Hsinchu, Taiwan).

After the distribution and capitalization of capital surplus as well as cancellation of repurchased shares, TSMC’s current capital stock of NT$264.3 billion will be approximately NT$261.5 billion.

http://www.webwire.com/ViewPressRel.asp?aId=59613

Taiwan stocks - Factors to watch

Here are news stories and press

reports that may affect the Taiwan stock market on Friday.

REUTERS HEADLINES

> Taiwan's GDP growth eases in Q4, slowdown to persist[nTP329392]

> Taiwan's Fubon Fin to enter private banking in March[nTP28924]

> Micron, Nanya Tech agree tech licence, chip JV-source[nTP20269]

> Microsoft upbeat on 2008 sales to Taiwan PC makers [nTP4855]

> Taiwan bank turnaround looks to wealth management [nTP347637]

> Taiwan relaxing China investment limits case by case[nTP21345]

> Formosa plans refinery maintenance from March 10 [nSP180560]

> Want Want kicks off $1.5 bln HK IPO pre-marketing [nHKG26793]

> Taiwan Sugar passes on U.S. corn, soy due to price [nTP1759]

> Taiwan stocks at 1-mth closing high on HP results [nTP174767]

> Taiwan dlr rises on stocks, U.S. rates; c.bank offset[nTP5814]

> Foreign trading in Taiwan stocks [nTP170358]

> US stocks sink on energy's slide, recession worry [nN21506921]

LOCAL PRESS REPORTS

-- Bejing Vantone is aiming to become the first mainland

Chinese tenant in Taipei 101, Taiwan's tallest building, the

Commercial Times reported.

-- Real estate mogul Donald Trump is searching the Taipei

area for property investment opportunities, the Commercial Times

reported.

http://www.reuters.com/article/marketsNews/idINTP2919320080222?rpc=611

|

Followers

|

7

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

183

|

|

Created

|

05/14/04

|

Type

|

Free

|

| Moderators | |||

Taiwan Stock Exchange:

http://en.wikipedia.org/wiki/Taiwan_Stock_Exchange

Taiwan Stock Exchange

From Wikipedia, the free encyclopedia

The Taiwan Stock Exchange Corporation (TSEC) is a financial institution, located in Taiwan, Republic of China, located at 17 Po-Ai Road, Taipei, Taiwan. The TSEC was established in 1961 and began operating as a stock exchange on 9 February 1962.

The current chairman of the TSEC is Mr. Sean Chen.

Taiwan Stock Exchange Official Site:

http://www.tse.com.tw/ch/index.php

Yahoo charts (TWII is real time - SSE is not):

,

,

Taiwan specific News Link:

http://asia.news.yahoo.com/taiwan.html

http://www.worldjournal.com/wj-twnews.php (Chinese Version)

HK: Hang Seng Index

http://www.hsi.com.hk/

http://asia.news.yahoo.com/hong-kong.html

http://asia.news.yahoo.com/china.html

Chinese Stocks(in Chinese):

http://www.worldjournal.com/pages/fn_asianmkts

Key Issues: US Eastern Daylight Time = 12 hours opposite of Taipei

UTC/GMT Offset Standard time zone: UTC/GMT +8 hours

http://www.timeanddate.com/worldclock/city.html?n=241

http://hk.myblog.yahoo.com/beautiful-mandy

Reason for Live http://www.youtube.com/watch?v=ut3AhmclYNc&NR=1

Bo_Event_薄熙来 http://ap.ntdtv.com/b5/20120311/video/90843.html

NK_Rocket http://v.ifeng.com/v/cxwx/index.shtml#28c82bd3-5f51-4a9c-ab63-7dbbd0040199

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |