Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Completely agree! Hope to have some bombshell PRs drop soon though. Then we can get current again.

Great news. Too bad no one can buy lol

Yes. And it sucks. But we’ve been in limbo over last 6+ months and have been through EM thrice now. Not that that makes it any better.

High risk high reward.

https://www.accesswire.com/861991/live-on-tpt-global-techs-vme-live-ppv-app-experience-the-ultimate-mothers-day-concert-on-the-beautiful-island-of-grenada

Weird. It says it will be available on google play store. It’s not on there as the last time I looked.

Curious..if TPT solidified hotel-chain for SmartCity project(s)..yet..ahead of developments. Could be key to favorable international bookings having that foundational relationship.

Yes i'm sure they will get current sooner than later.. But in the meantime we are kind of stuck in limbo.. Which for a shareholder is the worst , Other than a stock being revoked.

Well if you’re in it for a little while it’s par for course. They are concentrating right now it seems. They will go current when the time is right imo.

Problem is it could go once that worse and become CE?. I don't agree with how you could have any value.If you can't buy it, sell it... Isn't the whole purpose of being a shareholder having value in your stock? If you can't buy or sell, I don't get it

Their team isn’t that big and if they really want to gain momentum… concentrate on what could be potential. I don’t see any reason for being current right now either so I agree.

TPT airline connections from COVID would streamline VuMe SuperApp compatibility with preflight/in-flight service

I personally can’t come up with any other explanation than what we are saying.

No. Not true. If Vume keeps going and gaining traction it’s actually a good sign.

Yes expert market sucks if you want to trade but if the company can continue with momentum and gaining value, I’m all for it. It will come out of EM in order to use the equity financing. IMO.

I will clarify that the filing / suit doesn’t blame the companies taking the loans but the ones lending / converting. So it doesn’t really look like a negative towards Tptw (imo). But it will be interesting to see what happens to the money that was borrowed and not converted yet and how it gets paid back.

Good to see Vume keeping at it.

True but hopefully the slingshot is being stretched and there is a master plan. My thought along with a few others is they want to prevent dilution at this point and there is a plan to cover some debt associated with dilution. That is what I am hoping anyway. If you look at the PR that said they had a plan to greatly increase investor value, you could easily assume this.

As long as it's on the expert market ...it's all gobblygoop

Easy-to-see down road VuMe SuperApp booking platform for these live-events..watch live remotely or in person through VuMe SuperApp

VuMe proof of concept continuing to be achieved

Very nice. Getting more content

Yep. Vume app top banner has this event on it.

Lol, you're probably the biggest fraud here, just projecting it onto everyone else.

Looks like this concert will be streamed on the VuMe Live app this Sunday

https://www.partygrenada.com/events/wide-open-concert/

Once again we have the same someone trying to divert attention from the facts …

Will update down road more

Made up gibberish. Thanks for playing

Another fraudulent-trader-group narrative: “haha you’re breakeven is .025 sucka”

Fraudulent-trader-group narrative:“riding ‘free’shares suckas..never marry the company..take profits when you can..etc”

How-many-days after market jacked-up price intentionally after select PRs did it take market to decide to start dropping price intentionally? Market took on average next day/few days after PRs knowing it takes more than that many days for updates, meanwhile these same traders dropping the price ahead of significant new shares being sold at dropped prices(aside from benefit dealer gets)so it’s a win/win for the relationship between dealer and buyer and this relationship going forward is what I’m curious about..if dealers are acting in shady manner outed by OTC, what are the chances the traders buy/selling these fraudulent shares are acting in fraudulent manner against the companies they’re choosing to trade? The fact is, the current marketcap reflects poorly on current company accomplishments and fraudulent trading practices have no legitimate defense.

Who bought and is holding these shares that will have to be returned? Seems like buyers knew the dealer, dealer waited for certain prices prior to selling them is how it works. The discount isn’t so great that they could get as good a deal for buyers at pennies when buyers are getting them triple zero subpenny… seems to me buys knew seller/dealer and this is the problem with OTC, SEC needs to make an example of this fraud this time, huge punitive damages as buyers in significant subpenny also spread false and misleading statements against the company and this is where punitive damages gets interesting as current marketcap being where it is is do to this dealer and the buyers if that’s the case..could see multibillion$ in punitive damages to be dispersed to all OTC traded companies damaged by these actions if that’s the case.

I read the filing. It’s a straight read.

Basically said this guy Kramer countered many of these otc companies into this sort of lending practice fully recognizing these are dilutive events. As I stated long ago, these guys get their money with the steep discounts and causing the sp to drop considerably in how they did this stuff in tranches.

Items 43-45 noted in the filing. Nothing to do with ‘trader groups’.

The verbiage and descriptions are straight up the same in the S1 (and other filings) that described the loans and notes.

The question is did st3 know how this would fall out when signing g up for these sort of loans (how the sp would drop considerably) and what happens next. It mentions something of not allowing any more conversions (which would be good for any outstanding loans ) but it doesn’t appear there is anything with regards to share returns / buy backs. It’s more along the lines of profits being returned. But I don’t see how these loans then get paid off.

Anyway. Shows what some of us knew all along that these loans and notes diluted and put a lot of downward pressure on the sp.

We’ve been stuck 4 years !! Nothing new

All this news now it looks like we're gonna be stuck in limbo for a while?

You got all evening to keep digging..I’ll be hitting refresh lmao..or you can wait til closer to trading hours, either way, all good

Yes sir. Time will tell.

Looks like the SEC won…SEC always wins..doesn’t mean they’re always right

Oooooph. This is deep. We still don’t know if Tptw is part of this but I’m assuming we’ll find out soon enough.

Tekmovil + filings, please sir. That’s all

If only y’all cared enough about the marketplace TPT operates in…will see how all this unfolds..if there is wrongdoing that the SEC identifies against the defendant, then TPT stands to benefit..if there’s a reversal, it should have no impact on TPT.

Slight conflict of interest to say the least.

"How can they loan money AND be a broker dealer at the same time ?"

So I guess it gets even deeper.

https://www.prnewswire.com/news-releases/naidich-wurman-llp-responds-to-sec-complaint-on-behalf-of-power-up-lending-group-ltd-geneva-roth-remark-holdings-inc-1800-diagonal-lending-llc-and-curt-kramer-302138775.html

Kramer states that the SEC “approved” this but the only problem is the SEC doesn’t approve offerings.

https://www.sec.gov/oiea/investor-alerts-and-bulletins/ia_secapproved

I guess that’s why I was asking. I don’t know either.

I hope this isn’t some ploy from TPT to eff with existing longs and investors.

If that is how this plays out it will be amazing. I would love for you to be right.

Your past my pay grade there lol.

The dealer got in trouble per the SEC report

This sets legal precedence to deter future attacks..on NASDAQ.

Still expecting $100m-$300m marketcap prior to any r/s..for NASDAQ

It is strange. I can’t comprehend why they are implying that 1800 should have been a broker dealer. It is the company (Tptw) that issues the shares through their broker and 1800 then buys them at a discount and then sells them for the profit … at least that’s how I thought it works. How can they loan money AND be a broker dealer at the same time ?

|

Followers

|

664

|

Posters

|

|

|

Posts (Today)

|

9

|

Posts (Total)

|

163889

|

|

Created

|

05/18/10

|

Type

|

Free

|

| Moderators peafunke joe botts JMC$ sloppyjones StarlingChaser WhenLambo | |||

Speed Connect™ provides wireless and satellite internet, phone to over 16,000 Customers. We connect you where you live and play. We support the small towns and rural communities that make our country flourish. Your choice to live and work next to nature does not mean that you have to be disconnected from the rest of the world. Whether you want to share family photos with faraway relatives, watch or read the daily news or relax to watch the latest episode of your favorite show — we are here to connect you to the services you need.

Speed Connect™ provides wireless and satellite internet, phone to over 16,000 Customers. We connect you where you live and play. We support the small towns and rural communities that make our country flourish. Your choice to live and work next to nature does not mean that you have to be disconnected from the rest of the world. Whether you want to share family photos with faraway relatives, watch or read the daily news or relax to watch the latest episode of your favorite show — we are here to connect you to the services you need.  Blue Collar Productions™ is a proven leader, innovator and established producer of creative content, as well as materials for advertising and marketing campaigns. In collaboration with the world's top filmmakers, entertainment studios, Fortune 500 companies and non-profits, we bring creative visions to life. From script to delivery, our creative team of writers, producers, editors and designers work closely with our clients to deliver custom media solutions that best fit their needs. Featuring A-list celebrities, C-Suite executives, thought leaders and industry experts, Blue Collar has produced thousands of hours of content that have been used for Entertainment, Marketing, Investor Relations, Corporate Communications, Employee Training, Trade Shows, Product Launches and more. In addition, our producers possess the unique ability to tell impactful stories that engage audiences while managing projects in a cost-effective and timely manner. https://www.bluecollar.com/

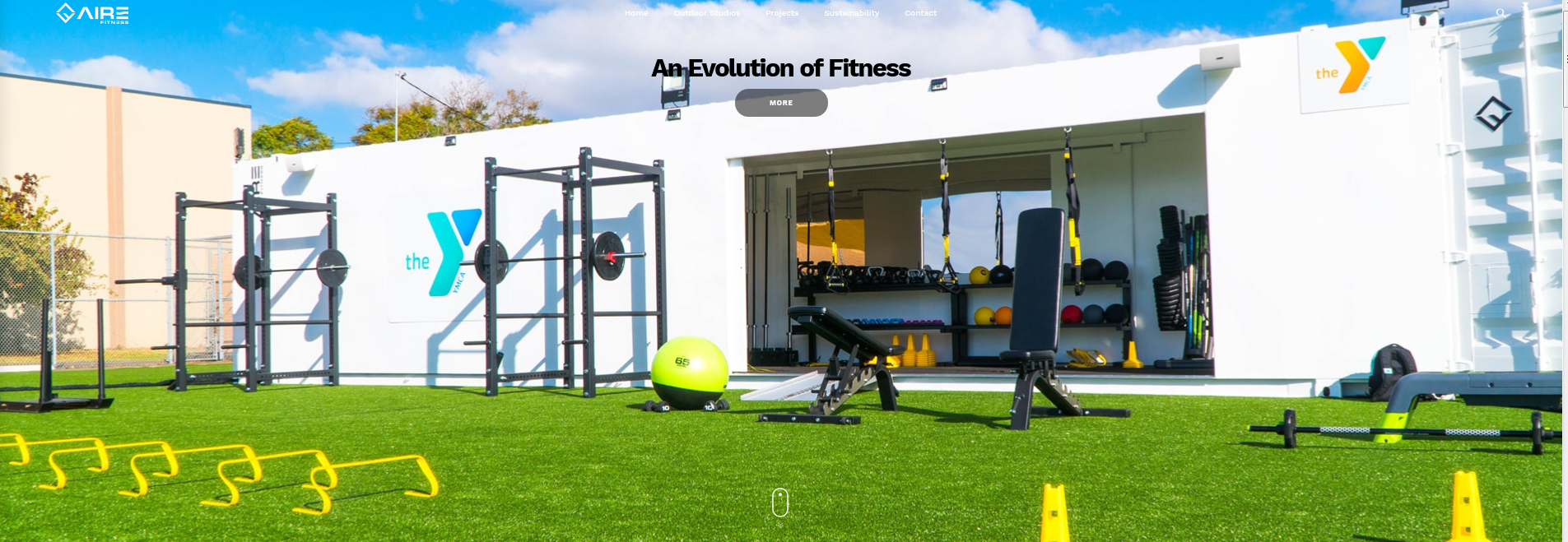

Blue Collar Productions™ is a proven leader, innovator and established producer of creative content, as well as materials for advertising and marketing campaigns. In collaboration with the world's top filmmakers, entertainment studios, Fortune 500 companies and non-profits, we bring creative visions to life. From script to delivery, our creative team of writers, producers, editors and designers work closely with our clients to deliver custom media solutions that best fit their needs. Featuring A-list celebrities, C-Suite executives, thought leaders and industry experts, Blue Collar has produced thousands of hours of content that have been used for Entertainment, Marketing, Investor Relations, Corporate Communications, Employee Training, Trade Shows, Product Launches and more. In addition, our producers possess the unique ability to tell impactful stories that engage audiences while managing projects in a cost-effective and timely manner. https://www.bluecollar.com/ Aire Fitness™ is an Evolution in Fitness. Transform a park, parking lot, rooftop, patio or any unused space! The patent-pending Aire Fitness® Outdoor Studio creates a new category in fitness: Outdoor Fitness with professional fitness equipment, until now only used indoors, is a reality. Aire Fitness® is the first portable fitness studio that can be fully customized. Endless programming opportunities!

Aire Fitness™ is an Evolution in Fitness. Transform a park, parking lot, rooftop, patio or any unused space! The patent-pending Aire Fitness® Outdoor Studio creates a new category in fitness: Outdoor Fitness with professional fitness equipment, until now only used indoors, is a reality. Aire Fitness® is the first portable fitness studio that can be fully customized. Endless programming opportunities! ViewMe Live™ is an all-in-one messaging, broadcasting and social media platform that’s here to disrupt the current landscape by combining the best features of major social media apps, plus a suite of value-adding services.

ViewMe Live™ is an all-in-one messaging, broadcasting and social media platform that’s here to disrupt the current landscape by combining the best features of major social media apps, plus a suite of value-adding services.Nothing in the contents transmitted on this board should be construed as an investment advisory, nor should it be used to make investment decisions. There is no express or implied solicitation to buy or sell securities. The author(s) may have positions in the stocks or financial relationships with the company or companies discussed and may trade in the stocks mentioned. Readers are advised to conduct their own due diligence prior to considering buying or selling any stock. All information should be considered for information purposes only. No stock exchange has approved or disapproved of the information here.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |