Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Happy Thanksgiving!

The Real Cost of a Thanksgiving Dinner

The higher cost of gas, turkey feed and other things means the Thanksgiving meal will cost an average of 13 percent more this year

http://www.bloomberg.com/money-gallery/2011-11-16/the-real-cost-of-a-thanksgiving-dinner.html

Think money and securities in your brokerage account are safe?

Think again. A must watch.

Gerald Celente’s gold account was emptied by MF Global

http://www.infowars.com/gerald-celentes-gold-account-was-emptied-by-mf-global/

The recent bankruptcy of financial stalwart and Wall Street casino failure MF Global in the US, has claimed a new and unlikely victim. Following the company’s glorious collapse, Trends Research founder Gerald Celente had his own six figure gold investment account completely looted by chapter 11 trustees, and he is fighting to get it back.

Is this where I find the Super Committee?

Ron Paul: Obama Presidency On The Verge Of Being A "Dictatorship"

http://www.realclearpolitics.com/video/2011/11/09/ron_paul_obama_presidency_on_the_verge_of_being_a_dictatorship.html

Obama's new Christmas Tree Tree Tax

http://blog.heritage.org/2011/11/08/obama-couldnt-wait-his-new-christmas-tree-tax/

LOL. Funny but also sadly enough, it is pretty much true. I guess it depends on which group one wants his executioner to be.

LOLOLOLISSIMO!!!

Fatty Foods Addictive as Cocaine in Growing Body of Science

By Robert Langreth and Duane D. Stanford

Nov. 2 (Bloomberg) -- Cupcakes may be addictive, just like cocaine.

A growing body of medical research at leading universities and government laboratories suggests that processed foods and sugary drinks made by the likes of PepsiCo Inc. and Kraft Foods Inc. aren’t simply unhealthy. They can hijack the brain in ways that resemble addictions to cocaine, nicotine and other drugs.

“The data is so overwhelming the field has to accept it,” said Nora Volkow, director of the National Institute on Drug Abuse. “We are finding tremendous overlap between drugs in the brain and food in the brain.”

The idea that food may be addictive was barely on scientists’ radar a decade ago. Now the field is heating up. Lab studies have found sugary drinks and fatty foods can produce addictive behavior in animals. Brain scans of obese people and compulsive eaters, meanwhile, reveal disturbances in brain reward circuits similar to those experienced by drug abusers.

Full article here: http://www.businessweek.com/news/2011-11-06/fatty-foods-addictive-as-cocaine-in-growing-body-of-science.html

Extreme Poverty Is Now At Record Levels – 19 Statistics About The Poor That Will Absolutely Astound You

#1 According to the U.S. Census Bureau, the percentage of "very poor" rose in 300 out of the 360 largest metropolitan areas during 2010.

#2 Last year, 2.6 million more Americans descended into poverty. That was the largest increase that we have seen since the U.S. government began keeping statistics on this back in 1959.

#3 It isn't just the ranks of the "very poor" that are rising. The number of those just considered to be "poor" is rapidly increasing as well. Back in the year 2000, 11.3% of all Americans were living in poverty. Today, 15.1% of all Americans are living in poverty.

#4 The poverty rate for children living in the United States increased to 22% in 2010.

#5 There are 314 counties in the United States where at least 30% of the children are facing food insecurity.

#6 In Washington D.C., the "child food insecurity rate" is 32.3%.

#7 More than 20 million U.S. children rely on school meal programs to keep from going hungry.

#8 One out of every six elderly Americans now lives below the federal poverty line.

#9 Today, there are over 45 million Americans on food stamps.

#10 According to the Wall Street Journal, nearly 15 percent of all Americans are now on food stamps.

#11 In 2010, 42 percent of all single mothers in the United States were on food stamps.

#12 The number of Americans on food stamps has increased 74% since 2007.

#13 We are told that the economy is recovering, but the number of Americans on food stamps has grown by another 8 percent over the past year.

#14 Right now, one out of every four American children is on food stamps.

#15 It is being projected that approximately 50 percent of all U.S. children will be on food stamps at some point in their lives before they reach the age of 18.

#16 More than 50 million Americans are now on Medicaid. Back in 1965, only one out of every 50 Americans was on Medicaid. Today, approximately one out of every 6 Americans is on Medicaid.

#17 One out of every six Americans is now enrolled in at least one government anti-poverty program.

#18 The number of Americans that are going to food pantries and soup kitchens has increased by 46% since 2006.

#19 It is estimated that up to half a million children may currently be homeless in the United States.

Sadly, we don't hear much about this on the nightly news, do we?

This is because the mainstream media is very tightly controlled.

I came across a beautiful illustration of this recently. If you do not believe that the news in America is scripted, just watch this video

Debt Increased $203 Billion in Oct.--$650 for Every Man, Woman and Child in America

By Terence P. Jeffrey

November 2, 2011

(CNSNews.com) - The federal government’s debt increased by $203,368,715,583.63 in the month of October, according to the U.S. Treasury.

That equals about $650 per person for each of the 312,542,760 people the Census Bureau now estimates live in the United States.

At the end of September, the total national debt stood at $14,790,340,328,557.15, according to the Bureau of the Public Debt. By the end of October, it had risen to $14,993,709,044,140.78.

The debt increased far more this October than it did last October. Between the last day of September 2010 and the last day of October, the debt rose from $13,561,623,030,891.79 to 13,668,825,497,341.36—for an increase of $107,202,466, 449.57.

October is the first month of the federal fiscal year. If the debt were to increase by an average of $203 billion for the remaining 11 months of the year, the national debt would increase by $2.436 trillion for the year.

http://www.cnsnews.com/news/article/debt-increased-203-billion-oct-650-every-man-woman-and-child-america

Some 15% of U.S. Uses Food Stamps

November 1, 2011, 4:53 PM ET

By Phil Izzo

Nearly 15% of the U.S. population relied on food stamps in August, as the number of recipients hit 45.8 million.

Food stamp rolls have risen 8.1% in the past year, the Department of Agriculture reported, though the pace of growth has slowed from the depths of the recession.

The number of recipients in the food stamp program, formally known as the Supplemental Nutrition Assistance Program (SNAP), may continue to rise in coming months as families continue to struggle with high unemployment and September’s data will likely include disaster assistance tied to the destruction and flooding caused by Hurricane Irene.

Mississippi reported the largest share of its population relying on food stamps, more than 21%. One in five residents in New Mexico, Tennessee, Oregon and Louisiana also were food stamp recipients.

Food stamp rolls exploded during the downturn, which began in late 2007. Even after the recession came to its official end in June 2009, families continued to tap into food assistance as unemployment remained high and those lucky enough to find jobs were often met with lower wages.

For full article, go here: http://blogs.wsj.com/economics/2011/11/01/some-15-of-u-s-uses-food-stamps/?mod=wsj_share_twitter

Someone Is Going To Jail For This:

MF Global Caught Stealing Hundreds Of Millions From Customers?

http://justiceleague00.blogspot.com/2011/11/someone-is-going-to-jail-for-this-mf.html

Submitted by Tyler Durden on 10/31/2011 21:06 -0400

Say you are the head back office guy at MF Global, it is the close of trading on Thursday, the firm has already completely drawn downon its revolver, and all the resulting cash in addition to all the firm's cash at your disposal in affiliated bank accounts, up to and including petty cash, has been used to satisfy margin demands due to declining collateral value, yet the collateral calls just won't stop, and impatient voices on the other side of the phone line demand you transfer even more cash over immediately or else risk default proceedings commenced against you within minutes. What do you do? Do you go ahead and tell your superior that the firm is broke even though the co-opted media is trumpeting every 5 minutes that "MF Global is fine", knowing full well you will be immediately fired for being the bearer of bad news, or do you assume that courtesy of your uber-boss being the former head of the Vampire Squid, and thanks to infinite moral hazard which after Lehman made sure nobody would ever fail ever again, that there is simply no way that you will be left without some miraculous rescue, if only you can last one more day, and as a result proceed to "commingle" someclient funds with the firm's cash. It turns out that at MF Global you do the latter... over and over... until you have literally stolen hundreds of millions from the firm's client accounts in hopes that the miracle rescue will come on Friday... then over the weekend... and then you realize no miracle is coming, partly because your actions have been exposed, partly because miracles only exist in fairy tales. The next thing you know, your firm is bankrupt and hundreds of clients are about to learn that all their money is gone. Poof. This is not a fictional tale. This is precisely what very likely happened at MF Global in the past 72 hours. And someone has to go to jail. That someone, if indeed this criminal act is proven to have taken place, should be none other than Jon Corzine himself.

The sad truth of just how low Wall Street has fallen comes to us courtesy of the New York Times:

Federal regulators have discovered that hundreds of millions of dollars in customer money have gone missing from MF Global in recent days, prompting an investigation into the company’s operations as it filed for bankruptcy on Monday, according to several people briefed on the matter.

The revelation of the missing money scuttled an 11th hour deal for MF Global to sell a major part of itself to a rival brokerage firm. MF Global, the powerhouse commodities brokerage run by Jon S. Corzine, had staked its survival on completing the deal.

As for the details:

What began as nearly $1 billion missing had dropped to less than $700 million by late Monday. It is unclear where the money went, and some money is expected to trickle in over the coming days as the firm sorts through the bankruptcy process, the people said.

But regulators are examining whether MF Global diverted some customer money to support its own trades as the firm teetered on the brink of collapse. If that was the case, it could violate a fundamental tenet of Wall Street regulation: Customers’ money must be kept separate from company money.

And just like in the Lehman collapse where tens if not hundreds of international prime brokerage hedge fund clients, due to no fault of their own, found themselves insolvent after their cash ended up being caught at the London Lehman office (the details of how that money was illegally transferred from London to the US is a different topic entirely) and never to be seen again except to satisfy general unsecured claims, so thousands of MF clients are about to realize that money they thought they had, even if completely unencumbered with other assets, read pure cash, read money not at risk, is now gone forever, and they will have to wait years until the bankruptcy process determines if the claim deserves priority status to the unsecured bondholders. Best case: assume a 70% haircut on the money, if it is every to be seen again at all.

So who can be sued? Who can be blamed for this malicious and purposeful criminal act? Why everyone from the back office clerk presented in the thought experiment above, all the way up to the man at the very top, Jon himself, who, like in every other act of Wall Street impropriety will plead stupidity and deny he ever knew of this crime. Unfortunately, our criminal regulators, who will be just as complicit in clearing him of all wrongdoing, will aid and abet this latest destruction of faith in US capitalism.

What happens next? Why customers at all other brokerages, all other exchanges, afraid that their money will suffer the same fate as MF, even if they transact with perfect solvent clearers and agents, will proceed to pull their money, as they know they have nobody to trust but their own prudent and forward looking actions. Which in turn will start the kind of liquidity drain that killed not only Lehman, but froze money markets, and with that brought the complete capital markets to a standstill, only to be thawed after the Fed pledged multiples of the US GDP to rescue Wall Street in October of 2008.

And that, dear reader, is called unintended consequences, and how the bankruptcy of a small exchange can avalanche into a crippling Ice Nine of what is left of capital markets all over again, courtesy of crony capitalism, rampant criminality and a regulator and enforcement body that is more fascinated with midget porn than any regulating or enforcing of the very firms it hopes to get an assistant general counsel job from in a few short years.

http://www.businessweek.com/1999/99_04/b3613001.htm

Jobless US vets say military experience not valued

Sat Oct 29, 2011 3:50pm EDT

* Vet jobless rate 2.6 pct higher than general population

* As wars wind down, lawmakers and groups focus on issue

By Roy Strom

NAPERVILLE, Ill, Oct 29 (Reuters) - When Matthew Burrell left the U.S. Army after eight years of service, he landed a job as a public relations contractor in Iraq. With a salary of $170,000, he figured military experience had finally paid off.

But five months after returning home to Chicago, 33-year-old Burrell is unemployed and his search for a job in the private sector has left him disheartened.

Despite having six years of experience as a public relations officer in the Army, he said he is treated as though he had just graduated from college.

"I can tell you for a fact that definitely in my field in public relations and marketing, private-sector companies do not value (military experience)," Burrell said.

Burrell, along with many of what the Department of Labor says are 235,000 unemployed veterans from the Iraq and Afghanistan wars, has run into a vexing problem.

Many U.S. companies, and sometimes veterans themselves, do not know how to translate military experience into civilian skills. There is a disconnect between companies demanding a college degree and veterans giving confusing descriptions of their military experience to civilian employers.

That disconnect has contributed to veterans having an unemployment rate 2.6 percent higher than the general population, according to September's Bureau of Labor Statistics unemployment report.

As U.S. involvement in Iraq and Afghanistan winds down, lawmakers and organizations are starting to address the issue.

The Obama administration this week announced steps that include encouraging community health centers to hire 8,000 veterans over the next three years, and improving training opportunities for military medics to become physician assistants.

The U.S. Chamber of Commerce said it hopes to get 15,000 veterans hired through 100 job fairs around the country for veterans this year. One of those job fairs was held recently in Naperville, a Chicago suburb, giving 86 companies the chance to meet more than 600 veterans.

'TONE THAT DOWN'

One problem is that veterans need to explain more clearly to companies the value of their experience, said Kevin Schmiegel, vice president of veterans' employment programs at the Chamber of Commerce.

Hiring managers who have not served in the military are often bewildered by the jargon used by soldiers and weapons specialists, said Becky Brillon, who heads a program at the Community Career Center in Naperville.

A military job title might be listed like this: "25 Romeo visual and media equipment operator and maintainer."

"If somebody was artillery, or a sharpshooter or a sniper, you have to tone that down in the civilian world. It's more about being detail-oriented, precise and focused," she said.

On the flip side, private employers should give more credit to the experience and skills veterans acquire in the military, Schmiegel said.

Some military jobs, like a mechanic or technician, are fairly easily adapted to the private sector. But military credentials and certificates for other forms of training do not seem to carry much weight.

Rick Combs, a 27-year-old who retired as a sergeant in the Army, says he was given management training in the military. So far that training has not translated into a comparable private-sector job.

"You can come in, and slap something down that says, 'Here, the military says I can lead people. Give me a department and I will make it dance for you,'" Combs said. "I haven't had the opportunity on the civilian side yet."

http://www.reuters.com/article/2011/10/29/economy-jobs-veterans-idUSN1E79R24F20111029

Decimation of the Western banks?

-This is the latest from GEAB (a European Think-Tank) These guys have a pretty good track record on their economic predictions. They are calling for a banking crises of huge proportions in the first half of 2012 --one that would undoubtedly eclipse the problems of 2008-2009 by a wide margin. Interestingly enough, as seen in my previous post, today the Vatican came out and called for a single world central bank and one world currency. Thus could become the prevailing call in the face of another banking crises and would not be good for the people of the USA.

Global systemic crisis – First half of 2012: Decimation of the Western banks

http://www.leap2020.eu/GEAB-N-58-is-available-Global-systemic-crisis-First-half-of-2012-Decimation-of-the-Western-banks_a7904.html

VATICAN CALLS FOR 'CENTRAL WORLD BANK'

Vatican calls for global authority on economy, raps “idolatry of the market”

http://www.reuters.com/article/2011/10/24/idUS264245887020111024

And the march towards centralized control of the people of the Earth continues, and now with the aid of the Vatican. I find this interesting in light of the previous Pope's belief that he was the final "true Pope" prior to the age that would usher in the attempted global rule of the "anti-Christ". Others believe that the current Pope is one of the last two remaining Popes before this global event will occur.

Benedict XVI Is the Second-to-Last Pope, Says Irish Prophet Malachy

http://abcnews.go.com/International/benedict-xvi-pope-irish-prophet-malachy/story?id=8499430

What would a central world bank mean to the USA? It would be the end of our country in the way that we all know it, in my opinion. It would put us under the economic thumb of a power that does not have our best interests at heart.

that one has trouble understanding a stop sign

Desperate American Boarding Schools Scam Chinese Students:

Chinese Students Lose as U.S. Schools Exploit Need

By Daniel Golden - Oct 19, 2011 5:13 PM GMT-0400

http://www.bloomberg.com/news/2011-10-19/chinese-lose-promise-for-52-000-as-u-s-schools-exploit-need.html

Back in the USSR:

TSA begins random ROAD inspections in Tennessee...

Tennessee Becomes First State To Fight Terrorism Statewide

http://www.newschannel5.com/story/15725035/officials-claim-tennessee-becomes-first-state-to-deploy-vipr-statewide

Gotta stop all of those terrorists running up and down the highways of Tennessee.

This board is for educational purposes. It is not a price prediction board nor is it a board that offers trading ideas. On this board we sometimes talk about penny stock scams, but mostly we just offer information to people to make them reconsider the the way they look at matters of importance in investments and beyond.

This board is to help people see through the smoke and mirrors that scammers of all types and in all walks of life throw at them. .

Maybe...... maybe not ......don't put stuff on your site you don't believe in. Really.

I believe gold will eventually see new highs (so does Soros, evidently because he has been buying back in on this pullback), but 20,000 gold seems like a far reach to me. I didn't post that video because I thought he was right about his price prediction. I posted it because I thought he provided a good explanation to the layman of how monetary inflation results in price inflation and currency debasement.

Ad I stated, before,

"20,000 gold coming? Maybe and maybe not, but whether or not he is right about his target price, this guy has the market forces pegged which could make it possible. This is an excellent educational piece as to what is behind the current move in gold and other precious metals.

A must view for anyone who is confused about what makes modern markets move and monetary systems work (for about 30 to 40 years at a time) and why gold & silver may be just getting started on an upside move which will likely take them much higher than they already are."

I did why would you quote him and post that message if you don't believe.... Do you really think gold is going up after an all time high?

Hey Superman.... Are you a Fireman?

Maybe you should read the post again, sparky. Surely it wasn't that hard to understand.

So is Gold Going to 22K an ounce?

Are you Ok? You might be having a stroke. Wow......

So after going after so many "frauds" why don't you post here for your head mod pushing 22 K gold.

This board you are a mod right? Do you even post here?

Are you serious...... You bust frauds and then make a post like that? Doctor heal thyself.

What a SHOCKER! (not)

Federal Government's seat of power overtakes the Silicon Valley as highest income area in USA.

Top Income in U.S. Is...Gasp!...Wash. D.C. Area

By Frank Bass and Timothy R. Homan - Oct 19, 2011 12:00 AM GMT-0400

The typical household in the Washington metro area earned $84,523 last year, down from the $85,168 earned in 2009. Household income also dropped last year in San Jose, to $83,944 from $85,168 the previous year.

Federal employees whose compensation averages more than $126,000 and the nation’s greatest concentration of lawyers helped Washington edge out San Jose as the wealthiest U.S. metropolitan area, government data show.

The U.S. capital has swapped top spots with Silicon Valley, according to recent Census Bureau figures, with the typical household in the Washington metro area earning $84,523 last year. The national median income for 2010 was $50,046.

The figures demonstrate how the nation’s political and financial classes are prospering as the economy struggles with unemployment above 9 percent and thousands of Americans protest in the streets against income disparity, said Kevin Zeese, director of Prosperity Agenda, a Baltimore-based advocacy group trying to narrow the divide between rich and poor.

“There’s a gap that’s isolating Washington from the reality of the rest of the country,” Zeese said. “They just get more and more out of touch.”

Full article here: http://www.bloomberg.com/news/2011-10-19/beltway-earnings-make-u-s-capital-richer-than-silicon-valley.html

Pat Buchanan's SUICIDE OF A SUPERPOWER: The Suicide of Liberty

By Paul Craig Roberts on October 12, 2011

Pat Buchanan's latest book, Suicide of a Superpower, raises the question whether America will survive to 2025. The question might strike some readers as unduly pessimistic and others as optimistic. It is unclear whether the US, as we have known it, will survive its next presidential election.

Consider the candidates. Liberal law professor Jonathan Turley, who was likely to have been an early Obama supporter, now wonders if Obama is “the most disastrous president in our history.” Despite Obama’s failure, the Republicans can’t come up with anyone any better. One Republican candidate admires Alan Greenspan, the Federal Reserve chairman who gave us financial deregulation and the financial crisis. Another is ready for a preemptive strike on Iran. Yet another thinks the Soviet Union is a grave threat to the United States. None of these clueless dopes are capable of presiding over a government.

Anyone who has been paying attention knows that the “superpower” is over-extended financially and militarily. The US is currently involved in six conflicts with Syria, Lebanon, Iran, and Pakistan on the waiting list for full fledged military attacks and perhaps invasions. Russia is being encircled with missile bases, and war plans are being drawn up for China.

Where is the money going to come from when the country’s debt is bursting at the seams, the economy is in decline, and unemployment on the rise?

Washington thinks that the money can simply be printed. However, enough has already been printed that the rest of the world is already suspicious of the dollar and its role as reserve currency.

As John Williams has said, the world could begin dumping dollar assets at any time.

I don’t think we can dismiss Buchanan’s concern as pessimistic.

Buchanan documents his concern across a wide front. For example, the combination of mass immigration and its consequent demographics together with the “diversity cult” means the end of “white America” and the transformation of what once was the dominant population into a disadvantaged underclass.

Buchanan cites a Wall Street Journal article by Ron Unz published 12 years ago. Unz found that white American gentiles who would be considered Christian are dramatically under-represented in America’s elite universities, which provide the elites who dominate government, business, and the professions.

Unz reported that white Americans who comprised 70% of the US population made up only 25% of Harvard’s enrollment and that the composition of the student bodies at Yale Princeton Columbia, Berkeley, and Stanford was much the same.

Asians who comprised 3% of the US population comprised one-fifth of Harvard’s enrollment, and Jews, who comprised 2.5% of the population comprised between one-fourth and one-third of Harvard’s student body.

As Buchanan puts it, the country’s native-born majority has relegated its own progeny to the trash bin of history.

Buchanan doesn’t address the question whether the rest of the world will miss white America. Considering the endless wars and astounding hypocrisy and immorality associated with white America since the collapse of the Soviet Union two decades ago, the world is likely to cheer when power slips from the hands of what Leonard Jeffries termed the “ice people,” that is, people without souls or feelings for others. Americans are so wrapped up in the myth of their “exceptionalism” that they are oblivious to the world’s opinion. American soft power, once a foundation of US influence, has been squandered, another reason the “superpower” status is crumbling.

Financial deregulation and the consequent financial crisis, collapse of the real estate market, and evictions of millions of Americans from their homes have greatly dimmed America’s economic prospects. However, as Buchanan points out, the offshoring of US jobs and industry under the guise of “free trade” has damaged the middle class, halted the growth in consumer purchasing power and left many college graduates without careers.

In the first decade of the 21st century, the Bush/Cheney years, America lost one-third of its manufacturing jobs. During this decade, Michigan lost 48% of its manufacturing jobs, New Jersey lost 39%, and New York and Ohio lost 38%.

During this decade, the US incurred trade deficits totaling $6.2 trillion, of which $3.8 trillion is in manufactured goods. In other words, imports of manufactured goods are a larger cause of the trade deficit than oil imports. Early in the decade the US lost its trade surplus in advanced technology products. In recent years the US has run up $300 billion in trade deficits in advanced technology products with China alone. As Macy Block’s site, Economy in Crisis, documents, foreigners have used their huge dollar earnings to buy up American companies, with the consequence that foreign earnings on US investments now exceed US earnings abroad, thus worsening the current account deficit.

Although Buchanan makes many points, this is not his best book. He becomes lost in old arguments that no longer make sense, such as the claim that the poor vote away the property of the rich, and he ignores the destruction of the US Constitution in the name of “the war on terror,” which has transformed the US into a police state.

Conservatives are stuck in the canard that democracy is a tool used by the poor to provide themselves with benefits at the expense of the rich. Buchanan cites statistics of those on welfare, food stamps, Medicaid, and so on as evidence that the rich are being plundered. Yet, the facts are the opposite. The distribution of income has completely reversed since the 1960s.

In the 1960s, the top 1 percent received 11% of the income gains, and the bottom 90% received 65%, leaving 24% of income gains for the 9% of richest Americans just below the top 1%. In the first decade of the 21st century, these figures have reversed. The top 1% receive 65% of the income gains and the bottom 90% receive 12%, leaving 23% for those rich Americans in the 91-99 percentile.

If recent history (Yugoslavia, Soviet Empire) is a guide, Buchanan is probably correct that a country whose population consists of diverse ethnic and racial groups is less likely to share a common interest and enjoy political stability. However real this threat, it is not comparable to the threat to American identity of a destroyed Constitution.

The Bush/Cheney/Obama regimes have shredded the constitutional protections that gave American citizens their liberty. By dictate alone, the executive branch has acquired the power, prohibited by the Constitution, to incarcerate citizens indefinitely without presenting evidence and obtaining conviction. According to the US government, a secret executive branch panel now exists that has acquired from somewhere the unaccountable power to put citizens on a list to be assassinated without due process of law merely on the basis of an unproven government assertion. How does this differ from Stalinist Russia and Gestapo Germany?

The transformation of the US into a police state has been achieved quickly and with scant protest. Congress and the courts are silent. The media is silent, as are the law schools and bar associations. Out of 535 US Senators and Representatives, only Ron Paul has protested the destruction of liberty.

Buchanan is concerned that America might not survive until 2025. Instead, shouldn’t we be concerned that the American police state could last that long? Shouldn’t we be worried that the police state will survive yet another presidential election, or even one more day?

http://www.vdare.com/articles/the-suicide-of-liberty

America's debt woe is worse than Greece's

By Laurence J. Kotlikoff, Special to CNN

September 20, 2011 -- Updated 1043 GMT (1843 HKT)

"To grasp the magnitude of our nation's insolvency, consider what tax hikes or spending cuts are needed to eliminate our fiscal gap. The answer is an immediate and permanent 64% increase in all federal revenues or an immediate and permanent 40% cut in all federal noninterest spending.

Such adjustments go miles beyond anything Congress and the president are considering. No wonder. They are focused on limiting growth in the official debt, while ignoring what's happening to the unofficial debt. To understand the thickness of their blinders, note that the fiscal gap, after inflation, grew by $6 trillion last year, whereas the official debt grew by only $1 trillion. Hence, our leaders are looking at one-sixth of the problem."

For full article, go here:

http://edition.cnn.com/2011/09/19/opinion/kotlikoff-us-debt-crisis/index.html?hpt=hp_t2

A Nation of Woosies

No doubt about it, the USA has become a nation of pansies. Now we arrest 8 year old girls for punching adults. Oh the horror of the 8 year old female rogue. Throw them in the hoosegow

http://www.staradvertiser.com/news/breaking/129864273.html

In America The Rule Of Law Is Vacated

by Paul Craig Roberts on August 31, 2011

With bank fraudsters, torturers, and war criminals running free, the US Department of Justice (sic) has nothing better to do than to harass the famous Tennessee guitar manufacturer, Gibson , arrest organic food producers in California and send 12 abusive FBI agents armed with assault rifles to bust down yet another wrong door of yet another innocent family, leaving parents, children, and grandmother traumatized.

What law did Gibson Guitar Corp break that caused federal agents to disrupt Gibson’s plants in Nashville and Memphis, seize guitars, cause layoffs, and cost the company $3 million from disrupted operations?

No US law was broken. The feds claim that Gibson broke a law that is on the books in India.

India has not complained about Gibson or asked for the aid of the US government in enforcing its laws against Gibson. Instead, the feds have taken it upon themselves to both interpret and to enforce on US citizens the laws of India. The feds claim that Gibson’s use of wood from India in its guitars is illegal, because the wood was not finished by Indian workers.

This must not be India’s interpretation of the law as India allowed the unfinished wood to be exported. Perhaps the feds are trying to force more layoffs of US workers and their replacement by H-1B foreign workers. Gibson can solve its problem by firing its Tennessee work force and hiring Indian citizens on H-1B work visas.

In Venice, California, feds spent a year dressed up as hippies purchasing raw goat milk and yogurt from Rawesome Foods and then, decked out in hemp anklets and reeking of patchouli, raided with guns drawn--always with guns drawn--the organic food shop. The owner’s crime is that he supplied the normal everyday foods that I grew up on to customers who requested them. For this heinous act, James C. Stewart faces a 13 count indictment and is held on $123,000 bail.

How did raw milk become a “health threat?” Far more Americans have died from e-coli in fast food hamburgers and from salmonella in mass produced eggs and chicken. Like many of my generation, I was raised on raw milk. Mathis Dairy delivered it to the homes in Atlanta. Even decades later a person could purchase Mathis Dairy’s raw milk in Atlanta’s grocery stores. How did supplying an ordinary staple become a crime?

The FBI agents who broke down Gary Adams door in Bellevue, Pennsylvania, claim they were looking for a woman. Why does it take 12 heavily armed FBI agents to apprehend a woman? Are FBI agents that effete? If the feds can never get the address right, how do we know they have the name and gender right?

I can remember when it only took one policeman to deliver a warrant and to arrest a person, and without gun drawn and without breaking down the door, tasering or shooting the object of arrest. It turns out that the FBI agents who broke into the Adams home not only were at the wrong address but also didn’t even have a search warrant had they been at the correct address.

The practice of sending heavily armed teams into American homes has resulted in many senseless murders of US citizens. The practice must be halted and SWAT teams disbanded. SWAT teams have murdered far more innocents than they have dangerous criminals. Hostage situations are rare, and they are best handled without violence.

Jose Guerena, a US Marine who served two tours in Bush’s Iraq War was murdered in his own home in front of his wife and two small children by a crazed SWAT team, again in the wrong place, who shot him 60 times. When his wife told him that there were men sneaking around the house, he picked up his rifle and walked to the kitchen to see what was going on and was gunned down. The hysterical SWAT team fired 71 shots at him without cause. Brave, tough, macho cops out defending the public and murdering war heroes. /

I have seen studies that show that police actually commit more acts of violence against the public than do criminals, which raises an interesting question: Are police a greater threat to the public than are criminals? On Yahoo I just searched “police brutality” and up came 4,840,000 results.

Meanwhile, the real master criminals, such as Dick Cheney, who, if tried for his actions at Nuremberg, would most definitely have been executed as a war criminal, run free.

Cheney is all over TV hawking his memoirs. On August 29, interviewed by Jamie Gangel on NBC’s Dateline, Cheney again proudly admitted that he authorized torture, secret prisons, and illegal wiretapping. These are crimes under US and international laws.

Cheney claims breaking laws against torture is “the right thing to do” if “we had a high-value detainee and that was the only way we can get him to talk.”

Three questions immediately come to mind that no member of the presstitute media ever asks.The first is, why does Cheney think the office of Vice President, President, or Attorney General has the power to “authorize” breaking a law? Our vaunted “rule of law” disappears if federal officials can authorize breaking laws.

The second is, what high-value detainees is Cheney talking about? Donald Rumsfeld declared the Guantanamo detainees to be “the most dangerous, best-trained, vicious killers on the face of the earth.” But the vast majority had to be released when it turned out, after years of their lives were spent in a torture prison, that the vast majority of the detainees were hapless innocents who were sold to the stupid Americans by war lords as “terrorists” for bounties. To save face, the US government has held on to a few detainees, but hasn’t enough confidence in their alleged guilt to put them on trial in a court of law.

The third is why does Cheney think that he knows better than the accumulated documented evidence that torture doesn’t produce truthful or useful information. If the person under torture is actually a terrorist, he knows that his tormentors don’t know the answers that they are looking for and so he or she can tell the torturers whatever serves

the tortured victim’s purposes. If the person under torture is innocent, he has no idea what the answers are and seeks to discover what his torturer wants to hear so that he can tell him.

As Glenn Greenwald makes clear, Dick Cheney, who presided “over policies that left hundreds of thousands of innocent people dead from wars of aggression, constructed a worldwide torture regime, and spied on Americans without the warrants required by law” is now being feted and enriched thanks to “the protective shield of immunity bestowed upon him by the current administration.”

Meanwhile Gibson Guitar faces prosecution because of the feds’ off-the-wall interpretation of a law in India, and the owner of Rawesome has a 13-count indictment for supplying customers with a food staple that was a part of the normal diet from colonial times until recently.

In America we have the rule of law--only the law is not applied to banksters and members of the executive branch but, as Greenwald says, is only applied to “ordinary citizens and other nations’ (unfriendly) rulers.”

A country this utterly corrupt is certainly no “light unto the world.”

http://www.vdare.com/articles/in-america-the-rule-of-law-is-vacated

$20,000 Gold Coming?

Maybe and maybe not, but whether or not he is right about his target price, this guy has the market forces pegged which could make it possible. This is an excellent educational piece as to what is behind the current move in gold and other precious metals.

A must view for anyone who is confused about what makes modern markets move and monetary systems work (for about 30 to 40 years at a time) and why gold & silver may be just getting started on an upside move which will likely take them much higher than they already are.

LOL!! That's just pathetic...

Rebels Fan Across Libya Dressed as Condoleezza Rice

Foolproof Plan, Rebel Commanders Say

August 26, 2011

TRIPOLI (The Borowitz Report) – In an all-out effort to capture Libyan dictator Muammar Gaddafi, rebels fanned out across the country today dressed as former U.S. Secretary of State Condoleezza Rice.

Donning bright pink pantsuits and black pumps, the fifteen thousand rebels blanketed the Middle Eastern nation, hoping to create a honey trap of sorts for Mr. Gaddafi, whose unrequited crush on Secretary Rice has come to light in recent days.

In the latest revelation, a diary recovered from Col. Gaddafi’s battered compound details the origins of his passion for the woman he referred to as “my sweet Condoleezza.”

“It was love at first sight,” he said of his meeting with the former Secretary of State in 2008. “I was immediately turned on by her hard-to-spell name.”

Rebel field commander Awad Daiki said that with thousands of fierce fighters disguised as Rice, the military mission dubbed Operation Condoleezza was sure to be a success.

“Once we will have Gaddafi in our clutches, there will be cause for celebration,” he said. “Plus, we can’t wait to get out of these heels.”

http://www.borowitzreport.com/

The Inexplicable War on Lemonade Stands

http://www.forbes.com/sites/erikkain/2011/08/03/the-inexplicable-war-on-lemonade-stands/

WOW!

At first, I thought you were talking about Steven Yehuda Moskowitz's and Micahel Lee Metter's travels to Switzerland!

LOL

I'm sure their days (and nights) are very busy. They just don't seem to be doing the right things.

They can't exactly stay at the local Holiday Inn

I agree that it isn't a good idea for them to take lavish holidays in this economic climate.

But that article, typical of the Daily Mail, is more than a bit overdone. All presidents and their families go on vacation, and security has to be provided, while they're in office and after. They can't exactly stay at the local Holiday Inn.

And they pay for their own food and drink.

FIRST LADY OF LUXURY TRAVEL: HIGHLIGHTS FROM THE OBAMAS' LAVISH GETAWAYS OVER THE PAST 12 MONTHS

GIRLS' TRIP TO SPAIN: AUGUST 2010

The exact cost is unclear as Mrs Obama and her 40 friends footed many personal expenses, such as hotels and meals themselves.

But the U.S. taxpayer would have paid for the First Lady's 68-strong security detail, personal staff, and use of presidential jet Air Force Two.

Per diems for the secret service team runs at around $281 each - nearly $98,000 for the length of the summer break.

Use of Air Force Two, the Air Force version of a 757, comes in at $149,900 for the round trip. This does not include time on the ground.

Mrs Obama's personal staff, of which there are an unknown amount and might cost considerably more per day, should also be taken into account.

CHRISTMAS BREAK IN HAWAII: DECEMBER 2010

According to the Hawaii Reporter, the bill for the $1.5m trip included:

$63,000 on an early flight bringing Mrs Obama and the children to Hawaii ahead of the President.

$1,000,000 on Mr Obama’s return trip from Washington on Air Force One.

$38,000 for the ‘Winter White House’ beach property rental.

$16,000 to rent nearby homes for Secret Service and Navy Seals.

$134,000 for 24 White House staff to stay at the Moana Hotel.

$251,000 in police overtime.

$10,000 for an ambulance to be on hand at all times

SKI TRIP TO VAIL: FEBRUARY 2011

Mrs Obama and her daughters stayed at the Sebastian hotel on Vail Mountain, where rooms cost more than $2,400 for multi-bedroom suites.

The family appear to have flown there on Air Force Two.

They were escorted to the resort by a motorcade of about a dozen vehicles, including 15 state and local law enforcement officers

SUMMER HOLIDAY ON MARTHA'S VINEYARD: AUGUST 2011

The Blue Heron Farm estate, where the Obama family are currently staying, rents for about $50,000 a week.

According to U.S. News and World Report, the Coast Guard is required to keep ships floating near the property, the presidential helicopter and jet remain at the ready and security agents will be on 24-hour duty.

http://www.dailymail.co.uk/news/article-2029615/Michelle-Obama-accused-spending-10m-public-money-vacations.html

Expensive massages, top shelf vodka and five-star hotels: First Lady accused of spending $10m in public money on her vacations (in the past one year)

The Obamas' summer break on Martha's Vineyard has already been branded a PR disaster after the couple arrived four hours apart on separate government jets.

But according to new reports, this is the least of their extravagances.

White House sources today claimed that the First Lady has spent $10million of U.S. taxpayers' money on vacations alone in the past year.

Full article here:

http://www.dailymail.co.uk/news/article-2029615/Michelle-Obama-accused-spending-10m-public-money-vacations.html

A Government that is totally clueless.

Job Growth That is Hurting The U.S. Economy

An article by John Merlene in this past Tuesday’s Investor’s Business Daily discusses the rapid growth in employment among federal government regulatory agencies in recent years.

The article says that while the U.S. private sector employment shrank 5.6%, federal regulatory agencies have seen their combined budgets grow a healthy 16%, and their employment rolls are up 13%.

What are all these new employees doing? The article says they have been churning out new rules. The Federal Register, a proxy of regulatory activity, saw its page number grow by 18% in 2010 alone. According to the article, 379 new rules were imposed last month alone…and another 4,200 are in the pipeline.

This is weighing heavily on the U.S. economy, and hurting its competitiveness. Business owners see an increasing regulatory burden as a deterrent to starting new businesses, expanding, and hiring employees.

The reality is that business owners and entrepreneurs have better chance to create long-term employment opportunities than does the government. However, apparently some in government have a different viewpoint. The article ends with a quote from an Environmental Protection Agency (EPA) document this past February stating that "in periods of high unemployment, an increase in labor demand due to regulation may have a stimulative effect that results in a net increase in overall employment."

A net increase in overall employment? Really?

http://www.guildinvestment.com/

Investor Risk Perceptions Shifting

"We have identified three levels of risk in the current market:

• Least risky

Emerging countries that are lenders to the developed world.

• Moderately risky

The once venerable U.S. is trading like a country in decline.

• Most risky

Western European nations that do not have the flexibility to lower the value of their currency by printing money (members of the Eurozone)."

Full article here: http://www.guildinvestment.com/

|

Followers

|

95

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

6222

|

|

Created

|

03/28/07

|

Type

|

Premium

|

| Moderator overachiever | |||

| Assistants Tina Fire Lane | |||

,

,

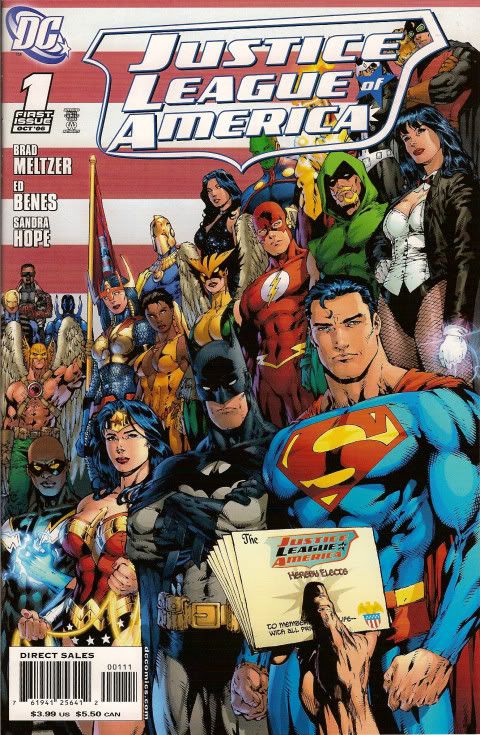

Welcome to the Super Hero Justice League!!

Here we discuss scams, scammers and legitimate enterprises.

Our mission is to help stamp out crime from the microcap markets, thereby helping those who try to do it the right way!

There are many legitimate companies which have done their best to run honest enterprises in the microcap sector. But they are being ruined by all the scamming and fraud which has taken place in PennyLand. They can't easily raise money anymore because many of the people who like to take risk in the sector have been wiped out by fraudsters!

Who are the fraudsters? Let's out them. Lets Fry them, Lets ROAST THEM!

The crooked promoters, financiers and criminal small company management have ruined it for the honest guy.

Let's all band together and do what we can to clean up the markets. If you know a legit company and feel it is one of the ones which need defending, discuss it here.

If you know of a scam that needs outed, discuss it here. We stand for Truth Justice and The American Way!

Team America Flunk Yeah! Coming to Save the Fluddermucking day Yeah!

Mission Critical Resources

(More will be supplied on a Need-To-Know basis)

http://finance.yahoo.com/

SEC RULES (Securities and Exchange Commission's up-to-date rules)

http://www.sec.gov/rules/final.shtml

National Association of Securities Dealers (NASD) Online Manual

http://nasd.complinet.com/nasd/display/index.html

SEC & SEC filings

http://www.sec.gov/

http://www.secfilings.com/

http://us1.institutionalriskanalytics.com/SEC/SEC_Listing.asp?yr=2006&cik=1316645&b=x

http://www.edgar-online.com/

http://knobias.10kwizard.com/

Pinksheets related info.

http://www.pinksheets.com

OTCBB info / Daily List (symbol and share structure changes for OTCBB stocks)

http://www.otcbb.com

MM Behaviors and Roles

http://www.investorshub.com/boards/read_msg.asp?message_id=17273959

DTC Important Notices B# CUSIP Search

portal.dtcc.com/cre1/dtcorgapp/cusipSearch.do

FBI

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009#securities

FCC.Gov

http://www.fcc.gov/eb/

Chart Links

http://stockcharts.com

Money 101 (their ibox gives a good quick overview)

http://www.investorshub.com/boards/board.asp?board_id=7489

Scam Check List

http://www.investorshub.com/boards/read_msg.asp?message_id=18390379

Daytrading Mistakes

http://www.investorshub.com/boards/read_msg.asp?message_id=18390481

Naked Short Selling (Darkside of the looking glass)

http://www.investorshub.com/boards/read_msg.asp?message_id=18392557

Warren Buffet Web Interview

http://www.investorshub.com/boards/read_msg.asp?message_id=18575793

It's A tough battle between the Super Heroes and the Evil Ones!!!

Stockasaurus Rex meets Supergirl and The Justice League is conceived!

THE VILLAINS OF THE EVIL MICROCAP UNDERGROUND EMPIRE!

TODAY'S VEXING QUESTION! What's inside the BHUB shell?

Let's have a look!

Hmmm...Nothing there yet!

IDWD

Code named: Flash Fraud Dance

Rumored Spy Cam Shot Of IDWD's Pat Downs Hard At Work Creating Websites For The Next Pump

Yassar Rabbani and Pat Downs at a widely attended IRRR Awards Banquet

Yassar Rabbani Khawar before his head was turned radioactive by the arch-villain Patrick The Penguin Downs.

Yassar now sells lollipops and shoeshines according to a recently built website

Pat The Penguin, Downs--Original Mugshot

Previously busted for Felony Stock Fraud, Grand Theft and Forgery, this crime boss is back in business!

Patrick Downs Most Recent Mugshot (August 2007)

A Life of Crime Takes It's Toll

Convict David Rupley seems to have shared an address with Downs.

Convict David Rupley seems to have shared an address with Downs. Partner in cons?

Partner in cons?

CKYS

Code named: The Bionic Loser

CKYS claimed US Government contracts until the Justice

Department had the CEO arrested for concocting the lies

James Edward Plant, CEO Of CKYS. Arrested by the FBI

James Edward Plant, CEO Of CKYS. Arrested by the FBI

PNMS HIJINKS

Code Named: South American Dirty Laundry

PNMS CEO Mike "Ten Large" Terrell promised shareholders PNMS would provide audited financials on the company in March of 2007, but when it came time to deliver

them, he came up with one of the most outlandish excuses ever given to penny stock players. Terrell had the audacity to tell PNMS shareholders that it

would be "illegal" for the company to deliver on it's promise due to Panamanian law. His subsitute for audited financials was a brief table offered as an unaudited financial statement on the company's website. Such a statement could have been prepared in approximately one hour since none of the numbers were backed with adequate footnotes and could hardly be trusted by anyone with an IQ which exceeeds that of a common gnat. In unusual fashion, PNMS

has not even bothered to upload these unaudited "financials" to pinksheets.com, thereby avoiding being made answerable to as few as possible over the

claims made by the company.

Pedro the Panamanian Kool Aid Man

Additional problems concern an announced, but never delivered land dividend. The company's explanation for why this dividend was not given to it's shareholders is wholly inadequate.

With up to 6 billion shares outstanding, PNMS has fallen from a post 7/12/2005 reverse-split high of about 4 cents a share to less than 2 tenths of a penny

while the company claims assets have grown from less than $500,000.00 to more than 100 million "against the law to verify" dollars. Shareholders have

lost nearly everything, but the company keeps its offices in the prestigious Crescent Court complex just outside of Downtown Dallas.

In an attempt to explain the pathetic price performance of PNMS stock, typical cries of "It's from the short sellers" have surfaced. Unfortunately for the

proponents of this suggestion, the most recent short interest report from the NASD shows a total short interest of only 243,968 shares, or about $400.00

worth. This amount of stock sold short would not effect the price of PNMS at all.

Mike Ten Large Terrell of PNMS proves that some microcap CEOs

must believe their shareholders to be little more than village idiots.

Ten LargeTerrell, looking ragged after a presumed all nighter on shareholder money.

Ten LargeTerrell, looking ragged after a presumed all nighter on shareholder money.

QBID

QBID  SLJB ex-CEO Petar Vucicevich

SLJB ex-CEO Petar Vucicevich GECC COO Jim Bolt

GECC COO Jim Bolt

USXP

Code named: Luggage Loot

USXP CEO Richard Altomare

For several years, Altomare told shareholders he was a former US Marine Captain. The United States Marine Corp denied it and he dropped it from his bio.

Adjusted for a one for 70 reverse split in 1998, as of 6/30/2006, the USXP shell had issued 979.575 billion shares since it was created. It is worse now.

The current O/S is over 16 billion shares. This has made Altomare a very rich man, but with the USXP stock price mired at a tenth of a penny, his

shareholders have not been so lucky.

USXP's Richard Altomare. Living la Vida Loca in Boca Raton

The man responsible for losses totaling over $85 million dollars at USXP

The CEO may lose millions for the company while shareholders are wiped out and he lives high on the hog, but investors can take heart in one thing.

USXP has sponsored a race car complete with all the side benefits for Mr. Altomare!

BCIT con artist, Mario Pino aka "The Strip Joint Swindler"

Pino was also CEO of the MLON scam

His scams are busted, but he is still at large. BEWARE! He could be lurking in a topless bar near you

His scams are busted, but he is still at large. BEWARE! He could be lurking in a topless bar near you

UPDATE! PINO HAS NOW BEEN ARRESTED!

A life of fraud and drug abuse has certainly taken it's toll on this con artist

Booked in Maricopa County Jail: 01-15-2008

Sex: MALE

Race: WHITE

D.O.B: 02-22-1971

Height: 5'11

Weight: 155

Eye: BROWN

Hair BROWN

In Custody For:

001 FELONY COUNT OF FUGITIVE OF JUSTICE

001 FELONY COUNT OF DANGEROUS DRUG-POSS/USE

001 FELONY COUNT OF MARIJUANA-POSSESS/USE

001 FELONY COUNT OF DRUG PARAPHERNALIA-POSSESS/USE

CSHD Scam

Code named: Bonded Whiskey

CEO Rufus Paul Harris presided over one of the most devastatingly fast pump and dumps in Penny Stock History! While always giving his shareholders

a parting drunken wish of "Godspeed", Harris insisted CSHD had assets of up to 5 billion dollars and phantom interest income in the millions which would

allow the company to build a moonbase among other absurd claims.

With victimized churchgoers buying in a frenzy, the stock zoomed from .08 to 4.00 but the SEC did not agree with Harris and sued the company and

Rufus Paul in Federal Court ordering him to cease and desist from making such claims.

Recently, information has come to light that a Federal Grand Jury has been convened to consider criminal charges against those behind the CSHD scam.

The sordid affair has buried shareholders with CSHD now trading at a price of approximately 2 to 5 cents.

Rufus Paul Harris with his ever present best friend, a glass of Crown Royal. Rufus recently spent

two weeks in jail for his part in a bar fight in a Georgia tavern on New Years Eve, 2006.

Never one to be found without drink in hand, Rufus drunkenly blundered his way into infamy

Never one to be found without drink in hand, Rufus drunkenly blundered his way into infamy

Another enemy of the Super Hero Justice League!

The infamous terrorist, Osama "Stretch" Bin Laden

The infamous terrorist, Osama "Stretch" Bin Laden

The Global Developments, Inc (GDVM) Scam, code named:

A Den of Underworld Moles

Featuring The Briner Group with partners otcfilers.com, and West Coast Stock Transfer, backed by the notorious "Dr Evil", Erwin Liem.

Former Briner Group clients and victims are suing. The most famous of which is The World Hockey Association (WHKA), led by former hockey great

Bobby Hull. The WHA claims Briner and his associates have caused immeasurable damages to their league and company which caused WHKA stock to

plummet from approximately one dollar to below one penny.

In another New Jersey action, a controlling shareholder of BGUE claims her personal stock was stolen by Briner and he that basically hijacked the shell

and issued stock to related parties with whom there was no arm's length distance in a scheme to enrich Briner and his partners at the expense of the real shareholders of BGUE.

GDVM stock plunged from a split adjusted $2500.00 per share to a mere 1.65 during the one year preceeding the resignation of Boss Lex Luthor Briner. Less

than one month later, the stock was buried at 52 cents as the disaster continued. Shareholders were completely wiped out as all attempts to average down

proved fruitless! Briner stepped down from GDVM on 4/03/07 in what appears to us to be a forced resignation. Briner is a 30 year-old Vancouver Securities

Lawyer and also runs John D Briner Law Corp., a firm specializing in securities law. Boss Briner has previously postured himself in the media as an

anti-fraud activist. Heaven help us all! Within approximately 30 days, the SEC has halted two companies under Operation Spamalot in which GDVM has

claimed a substantial interest. Even more GDVM "portfolio companies" have been flagged for spam by spamnation.com.

The shady GDVM players, led by Vancouver's Briner Clan

John D. "Lex Luthor" Briner Former CEO of GDVM:

Resigned In Disgrace 4/3/07

, Esther Briner

, Esther Briner , Julius Briner Of Numa Numa fame,

, Julius Briner Of Numa Numa fame,  Surfer Boy

Surfer Boy

Witness Julius Briner, aka. "Orange Julius" doing the Numa Numa on YouTube!

http://www.youtube.com/v/60og9gwKh1o

We will stop at nothing to catch all outlaws. Lil Kim is next!,

THE SUPERHEROS OF THE JUSTICE LEAGUE!

This is us after a hard days work. Time to debrief and reload for another villain.

And then we go party! No one can do it like us!

Our fans show their appreciation for our crime fighting skills.

We are the international jet setter Superhero Justice League Team America!

JOIN THE WORLD'S MOST APPRECIATED TEAM OF FRAUD BUSTERS!

THE FATE OF THE MICROCAP UNIVERSE IS IN YOUR HANDS!

Men and women alike are free to join our powerful fraud busting group!

Our Newest Super Hero Member

Miss Hawaii USA

Miss Hawaii USA Team America Sweetie

Team America Sweetie

Team America Members "Home Town Honeys"

Team America Likes Budweiser and other Great American Brews!

Relaxing After A Tough Day

Waiting For Their SuperHeros To Return From Missions

|

Posts Today

|

0

|

|

Posts (Total)

|

6222

|

|

Posters

|

|

|

Moderator

|

|

|

Assistants

|

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |