Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I think it benefits them more if they keep it at a higher price then just plane RS just because its low. The company is actually making good revenue and growing plans are set.

there has been no confirmation that the reverse split is off, therefore holding this is very risky

Don't ever sell your losses, sell your profits only.

I got more,,, I heard .01 by end of day

I got more,,, I heard .01 by end of day

The stock is getting ready for another major breakout past 008 IMO, stair stepping to heaven $SSOK

Waiting for u come slap my 150k at 0.005

0059 is the 1st major support, we'll see a penny soon $SSOK

0.005 or 0.5???

.003 is history now. This one has real business and no issues with SEC. 5 cents is possible

Damn, the money is just pouring in, $SSOK is officially the best stock in the OTC today, great accumulation to say the least.

Great news here!!! Holding all my shares! $SSOK

1 dollar or .01 one cent?

This trades today like it wants to close at 01. $SSOK

wow this is huge! Time to hold or sell?

NEWS

Sunstock Inc. Announces Plans to Expand its Retail Presence to the East Coast

SACRAMENTO, Calif., March 19, 2021 (GLOBE NEWSWIRE) -- Sunstock Inc. (OTC: SSOK), involved in the buying, selling and distribution of precious metals, today announces its plans to open a second, larger storefront located on the East Coast.

The Company’s current store in Sacramento, Mom’s Silver Shop, sells gold, silver and rare coins to customers and investors. The store continues to experience steady gains in both product demand and foot traffic, prompting management to consider a second location. In exploring a new storefront, Sunstock has decided to relocate its headquarters to a region with strong demand but a more favorable sales tax than California.

“We always operate from a ‘how-do-we-grow-from-here’ perspective when exploring options best suited for our industry, company and shareholders,” stated Sunstock CEO Jason Chang. “Based on the demand we see for precious metals and the goals we have as a company, it makes sense to open a larger location that can better house our inventory and accommodate a greater number of customers. We will provide additional updates as we select our second location and begin to build our marketing strategy for the area.”

Sunstock will continue to operate Mom’s Silver Shop in Sacramento, build its inventory of precious metals, and advance on its broader expansion plans to grow revenues by selling wholesale to other retailers.

About Sunstock Inc.:

Sunstock Inc. (OTC: SSOK) is involved in the distribution of precious metals, primarily gold. The Company pursues a “ground to coin” strategy, whereby it uses its wholesale and retail channels to sell these precious metals primarily through its own branded coins. For more information, visit the Company’s website at www.SunstockInc.com

Forward-Looking Statements

In addition to historical information, this press release may contain statements that constitute forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995. Forward-looking statements contained in this press release include the intent, belief, or expectations of the Company and members of its management team with respect to the Company's future business operations and the assumptions upon which such statements are based. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those contemplated by such forward-looking statements. Factors that could cause these differences include, but are not limited to, failure to complete anticipated sales under negotiations, lack of revenue growth, client discontinuances, failure to realize improvements in performance, efficiency and profitability, and adverse developments with respect to litigation or increased litigation costs, the operation or performance of the Company's business units or the market price of its common stock. Additional factors that could cause actual results to differ materially from those contemplated within this press release can also be found on the Company's website. The Company disclaims any responsibility to update any forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to differ materially from any forward-looking statement.

Contact:

Mr. Jason Chang, CEO

Enquiry@SunstockInc.com

916-860-9622

www.SunstockInc.com

like the r/s is called off

Without a doubt, the company looks like, it won't execute an R/S, the day of which was scheduled for an R/S, expired long time ago.

How we looking guys? Cancel of R/S right!

SCHEDULE 13G

https://www.otcmarkets.com/filing/html?id=14769334&guid=_X0aUWrAW8BD73h

(1) The Reporting Person, Jonathan Bates, beneficially holds investment and voting power of 130,000,000 shares of the common stock (the “Common Stock”) of Sunstock, Inc. (the “Issuer”), held by Innovative Digital Investors Emerging Technology, LP, a Delaware limited partnership (“IDIE”). Innovative Digital Investors, LLC is a Delaware limited liability company (“IDI”) which is an Exempt Reporting Adviser that serves as adviser to the IDIE for which Jonathan Bates is deemed the beneficial owner. At no time, has Jonathan Bates or any of the other Reporting Persons individually or in the collectively beneficially held or had the right to acquire (directly or indirectly) more than 9.99% of the Issuer’s Common Stock at any time.

(2) Based on 2,884,677,703 shares of the Issuer’s common stock outstanding as of November 24, 2020.

(1) On or about December 30, 2019, Innovative Digital Investors Emerging Technology, LP, a Delaware limited partnership (“IDIE”) controlled by Jonathan Bates for which he is deemed the beneficial owner entered into an agreement with the Issuer to acquire an aggregate of 200,000,000 shares of the Issuer’s Series A Preferred Stock (the “Series A Preferred Stock”) and warrants (the ”Warrants”) to purchase up to 100,000,000 shares of the Issuer’s Common Stock in exchange for $150,000. The $150,000 was paid by IDIE to an escrow account at Sutter Securities and subsequently delivered to creditors of the Issuer on January 31, 2020. Each one (1) share of Series A Preferred Stock is convertible one (1) share of the Issuer’s Common Stock. The Warrants were exercisable at the price of $.0003. Mr. Bates converted the Series A Preferred Stock and exercised the Warrants during the year ended December 31, 2020. The Series A Preferred Stock designation and the terms of the Warrant include an equity blocker clause that prevented IDIE from converting the Series A or exercising the Warrants in an amount which would cause IDIE to hold more than 9.99% of the Issuer’s Common Stock. IDIE acquired shares of the Issuer’s Common Stock upon conversion of the Series A Preferred stock as follows: 70,000,000 common shares on July 14, 2020, 30,000,000 common shares on July 23, 2020, 50,000,000 common shares on July 30, 2020 and 50,000,000 common shares on December 8, 2020. On March 31, 2020, IDIE acquired an aggregate of 98,214,286 shares of the Issuer’s common stock upon exercise of the Warrants at the price of $.0003 per share. During March April and May of 2020, IDIE acquired an aggregate of 3,337,019, 963,555 and 45,000 shares in open market transactions at an average price of $.0027, $.0031, and $.0031 respectively, per share. IDIE sold the following shares of the Common Stock of the Issuer: (i) 2,740,000 shares purchased in the open market on June 30, 2020, (ii) 98,214,286 shares received upon exercise of the warrant on July 17, 2020, (iii) 70,000,000 shares on July 29, 2020, and (iv) 1,560,574 on August 10, 2020. At no time, has IDIE or any of the other Reporting Persons beneficially held or had the right to acquire (directly or indirectly) more than 9.99% of the Issuer’s Common Stock.

At no time, has IDIE or any of the other Reporting Persons individually or in the collectively beneficially held or had the right to acquire (directly or indirectly) more than 9.99% of the Issuer’s Common Stock.

As of January 19, 2020, IDIE holds an aggregate of 130,000,000 shares of the Common Stock of the Issuer.

(2) Based on 2,884,677,703 shares of the Issuer’s common stock outstanding as of November 24, 2020.

(1) The amount reflected is comprised of 130,000,000 shares of the Common Stock of the Issuer held by IDIE which is controlled by Innovative Digital Investors LLC (“IDI”). IDI is an Exempt Reporting Adviser that serves as the adviser to IDIE for which Jonathan Bates is deemed the beneficial owner. On or about December 30, 2019, IDIE entered into an agreement with the Issuer to acquire an aggregate of 200,000,000 shares of the Issuer’s Series A Preferred Stock and warrants to purchase up to 100,000,000 shares of the Issuer’s Common Stock in exchange for $150,000. The funds were paid by IDIE to an escrow account at Sutter Securities and subsequently delivered to creditors of the Issuer on January 31, 2020. Each one (1) share of Series A Preferred Stock is convertible one (1) share of the Issuer’s Common Stock. The Warrants were exercisable at the price of $.0003. Mr. Bates converted the Series A Preferred Stock and exercised the Warrants during the year ended December 31, 2020. The Series A Preferred Stock designation and the terms of the Warrant include an equity blocker clause that prevented IDIE from converting the Series A or exercising the Warrants in an amount which would cause IDIE to hold more than 9.99% of the Issuer’s Common Stock. IDIE acquired shares of the Issuer’s Common Stock upon conversion of the Series A Preferred stock as follows: 70,000,000 common shares on July 14, 2020, 30,000,000 common shares on July 23, 2020, 50,000,000 common shares on July 30, 2020 and 50,000,000 common shares on December 8, 2020. On March 31, 2020, IDIE acquired an aggregate of 98,214,286 shares of the Issuer’s common stock upon exercise of the Warrants at the price of $.0003 per share. During March April and May of 2020, IDIE acquired an aggregate of 3,337,019, 963,555 and 45,000 shares in open market transactions at an average price of $.0027, $.0031, and $.0031 respectively, per share. IDIE sold the following shares of the Common Stock of the Issuer: (i) 2,740,000 shares purchased in the open market on June 30, 2020, (ii) 98,214,286 shares received upon exercise of the warrant on July 17, 2020, (iii) 70,000,000 shares on July 29, 2020, and (iv) 1,560,574 on August 10, 2020. At no time, has IDIE or any of the other Reporting Persons beneficially held or had the right to acquire (directly or indirectly) more than 9.99% of the Issuer’s Common Stock.

At no time, has IDI or any of the other Reporting Persons individually or in the collectively beneficially held or had the right to acquire (directly or indirectly) more than 9.99% of the Issuer’s Common Stock at any time.

As of January 19, 2020, IDIE holds an aggregate of 130,000,000 shares of the Common Stock of the Issuer.

(2) Based on 2,884,677,703 shares of the Issuer’s common stock outstanding as of November 24, 2020.

(1) On or about January 30, BFAM Partners LLC, a California limited liability company (“BFAM”) controlled by Jonathan Bates for which he is deemed the beneficial owner entered into an agreement with the Issuer to acquire an aggregate of 400,000,000 shares of the Issuer’s Series A Preferred Stock in exchange for $200,000. The agreement had a stated effective date of December 31, 2019. The funds were paid by BFAM to an escrow account at Sutter Securities and subsequently delivered to creditors of the Issuer on January 31, 2020. Each one (1) share of Series A Preferred Stock is convertible into one (1) share of the Issuer’s Common Stock. Mr. Bates converted the Series A Preferred Stock and exercised the Warrants during the year ended December 31, 2020. The Series A Preferred Stock designation includes an equity blocker clause that prevented BFAM from converting the Series A into an amount of common stock which would cause BFAM to hold more than 9.99% of the Issuer’s Common Stock. At no time, has BFAM or any of the other Reporting Persons beneficially held or had the right to acquire (directly or indirectly) more than 9.99% of the Issuer’s Common Stock. At no time, has BFAM or any of the other Reporting Persons individually or in the collectively beneficially held or had the right to acquire (directly or indirectly) more than 9.99% of the Issuer’s Common Stock.

(2) On or about February 19, 2021 BFAM gifted the 90 million shares it held to The Center, a charitable entity. As of March 2, 2021, BFAM holds an aggregate of 0 shares of the Common Stock of the Issuer.

Item 1(a) Name of Issuer:

SunStock, Inc.

Item 1(b) Address of Issuer’s Principal Executive Offices:

111 Vista Creek Circle, Sacramento, California 95835

Item 2(a) Name of Person Filing:

Jonathan Bates

Innovative Digital Investors Emerging Technology, LP

Innovative Digital Investors, LLC

BFAM Partners, LLC

The foregoing are sometimes referred to individually as the “Reporting Person” or together collectively as the “Reporting Persons”.

Item 2(b) Address of Principal Business Office or, if none, Residence:

Jonathan Bates

206 South Helberta Avenue

Unit A

Redondo Beach, CA 90277

Innovative Digital Investors Emerging Technology, LP

1240 Rosecrans Avenue

Suite 120

Manhattan Beach, CA 90266

BFAM Partners, LLC

206 South Helberta Avenue

Unit A

Redondo Beach, CA 90277

Innovative Digital Investors, LLC

1240 Rosecrans Avenue

Suite 120

Manhattan Beach, CA 90266

Item 2(c) Citizenship:

Jonathan Bates - United States citizen

Innovative Digital Investors Emerging Technology, LP is a Delaware Limited Partnership

Innovative Digital Investors, LLC, a Delaware limited liability company

BFAM Partners, LLC is a California Limited Liability Company

NEWS OUT ! Sunstock Inc. Announces Update on Plans to Accept Ethereum

https://www.otcmarkets.com/stock/SSOK/news/story?e&id=1828368

SACRAMENTO, Calif., March 03, 2021 (GLOBE NEWSWIRE) -- Sunstock Inc. (OTC: SSOK), involved in the buying, selling and distribution of precious metals, today announces that its legal counsel is establishing the procedures necessary for the Company to use the Ethereum network as a payment option.

As previously announced, Mom’s Silver Shop, located in Sacramento, Calif., in coming months will allow investors and customers to make transactions using Ether. Sunstock’s legal team is managing the setup and execution of the new payment method, which Company management believes will increase revenues, reduce processing fees, and attract more clients.

“We are pleased to announce that we remain on track to accept certain cryptocurrency for gold, silver and rare coin purchases beginning in June of 2021,” stated Sunstock CEO Jason Chang. “Our legal counsel is diligently working to ensure we are efficient, prepared and capable of offering flexible payment options to our customers and investors. Demand for precious metals remains strong, and as we continue to build our inventory of gold and silver, we are also anxious to open a new revenue stream and integrate digital assets.”

About Sunstock Inc.:

Sunstock Inc. (OTC: SSOK) is involved in the distribution of precious metals, primarily gold. The Company pursues a “ground to coin” strategy, whereby it uses its wholesale and retail channels to sell these precious metals primarily through its own branded coins. For more information, visit the Company’s website at www.SunstockInc.com

Forward-Looking Statements

In addition to historical information, this press release may contain statements that constitute forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995. Forward-looking statements contained in this press release include the intent, belief, or expectations of the Company and members of its management team with respect to the Company's future business operations and the assumptions upon which such statements are based. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those contemplated by such forward-looking statements. Factors that could cause these differences include, but are not limited to, failure to complete anticipated sales under negotiations, lack of revenue growth, client discontinuances, failure to realize improvements in performance, efficiency and profitability, and adverse developments with respect to litigation or increased litigation costs, the operation or performance of the Company's business units or the market price of its common stock. Additional factors that could cause actual results to differ materially from those contemplated within this press release can also be found on the Company's website. The Company disclaims any responsibility to update any forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to differ materially from any forward-looking statement.

Contact:

Mr. Jason Chang, CEO

Enquiry@SunstockInc.com

916-860-9622

www.SunstockInc.com

Sunstock Inc. to Accept Ethereum for Payment at California Coin Shop

https://www.otcmarkets.com/stock/SSOK/news/story?e&id=1819144

SACRAMENTO, Calif., Feb. 23, 2021 (GLOBE NEWSWIRE) -- Sunstock Inc. (OTC: SSOK), involved in the buying, selling and distribution of precious metals, today announces that in the second half of 2021, its retail coin shop will begin accepting ethereum to increase revenues for the Company.

Located in Sacramento, Calif., Mom’s Silver Shop buys and sells gold, silver and rare coins to investors and customers. Sunstock believes it will be the first coin shop in the United States to accept ethereum for payment.

“Cryptocurrency is becoming more widely accepted and is soaring in value. We want to take advantage of this opportunity to increase revenues while adjusting to consumer payment preferences,” stated Sunstock CEO Jason Chang. “As we recently announced, Mom’s Silver Shop will also allow customers to pay with bitcoin, beginning in June. We are pleased to be among the growing number of businesses around the world to accept cryptocurrency payments.”

About Sunstock Inc.:

Sunstock Inc. (OTC: SSOK) is involved in the distribution of precious metals, primarily gold. The Company pursues a “ground to coin” strategy, whereby it uses its wholesale and retail channels to sell these precious metals primarily through its own branded coins. For more information, visit the Company’s website at www.SunstockInc.com.

Forward-Looking Statements

In addition to historical information, this press release may contain statements that constitute forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995. Forward-looking statements contained in this press release include the intent, belief, or expectations of the Company and members of its management team with respect to the Company's future business operations and the assumptions upon which such statements are based. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those contemplated by such forward-looking statements. Factors that could cause these differences include, but are not limited to, failure to complete anticipated sales under negotiations, lack of revenue growth, client discontinuances, failure to realize improvements in performance, efficiency and profitability, and adverse developments with respect to litigation or increased litigation costs, the operation or performance of the Company's business units or the market price of its common stock. Additional factors that could cause actual results to differ materially from those contemplated within this press release can also be found on the Company's website. The Company disclaims any responsibility to update any forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements which include, but are not limited to, comments that involve future events and conditions, which are subject to various risks and uncertainties. Except for statements of historical facts, comments that address resource potential, upcoming work programs, geological interpretations, receipt and security of mineral property titles, availability of funds, and others are forward-looking. Forward-looking statements are not guarantees of future performance and actual results may vary materially from those statements. General business conditions are factors that could cause actual results to differ materially from any forward-looking statement.

Contact:

Mr. Jason Chang, CEO

Enquiry@SunstockInc.com

916-860-9622

www.SunstockInc.com

Source: Sunstock, Inc.

© 2021 GlobeNewswire, Inc.

I agree, worth a gamble nonetheless, especially with all the crazy things happening in stock market lately

I don't think so either..but time will tell, I personally like the company and one way or another they are looking for value.

I meant I don't think they will go through with it

As per Schedule 14 C the 20 day period has expired already. it's exactly one month today.

https://www.otcmarkets.com/filing/html?id=14633754&guid=FisaUaSmWjA7Gyh

The Company will need to file the Reverse Stock Split Certificate of Amendment to the Certificate of Incorporation with the Delaware Secretary of State in order for the Reverse Stock Split Certificate of Amendment to become effective. Under federal securities rules and regulations, we may not file the Reverse Stock Split Certificate of Amendment until at least 20 days after the mailing of this Information Statement to our Stockholders. The Company intends to file the Reverse Stock Split Certificate of Amendment as soon as practicable following the expiration of such 20-day period and following the receipt of approval from FINRA, however, our Board reserves the right not to proceed with the amendment at any time before the filing of the Reverse Stock Split Certificate of Amendment.

While our acceptability for ultimate listing on one of the NASDAQ markets or an exchange is presently remote, we believe that it is in the interests of our Company to adjust our capital structure in the direction of conformity with the NASDAQ structural requirements. At the current date, even with the proposed changes we would not meet NASDAQ criteria. NASDAQ requirements change constantly. There is no assurance that the proposed changes with meet NASDAQ requirements or any other exchange when, and if, we are otherwise qualified. There is no assurance that we will qualify for NASDAQ.

They might want to go higher in value prior to that, it would only make sense to do so since their goal is to upgrade to a higher tier OTCQB.

Besides..if the stock can maintain a price above a penny for a certain period it does qualify for a higher tier, therefore a R/S would not be necessary...

..and the only thing they have to do in order to climb well above a penny is an official PR canceling the proposed R/S...and that's what I'm betting on $SSOK

https://www.otcmarkets.com/filing/html?id=14633754&guid=FisaUaSmWjA7Gyh

Due to the current number of issued and outstanding shares of common stock as of ____________, 2021 (2,844,677,703 compared to the authorized of 5,000,000,000 common shares), and with the need to seek new funding through issuance of common stock, the Company is poorly positioned under its current market share price. The Company is authorized to issue 5,000,000,000 shares of its common stock. The Company is seeking to uplist to the OTCQB, however its stock price must close above $0.01 per share for 30 days prior to application so a reverse split is necessary. Therefore, a reverse split would allow the Company the ability to uplist to OTCQB.

Betting they pull the proposed r/s, best of luck all!

Sunstock Inc (PK) (SSOK)

0.0054 ? -0.00123 (-18.55%)

Volume: 22,450,276 @02/19/21 3:57:40 PM EST

Bid Ask Day's Range

0.0053 0.0065 0.00499 - 0.007

SSOK Detailed Quote

Yes, that's why I haven't jumped back in.

No one knows. They just PR it and caused a panic and lots of believers had to cut their loss (after promising no RS) and moved on. Not nice.

What's the date for the R/S?

Been in vacation this week can't wait to be back at my desk on monday to try to figure out what the hell is going on here lol GLTA!

SSOK to a penny!!!

Sunstock Inc (PK) (SSOK)

0.0091 ? 0.0035 (62.50%)

Volume: 55,475,315 @02/17/21 10:51:22 AM EST

Bid Ask Day's Range

0.009 0.0091 0.0056 - 0.0095

SSOK Detailed Quote

$SSOK @ .0095!

$SSOK @ .009!

$SSOK @ .007!

Can't feel bad for anyone BigMoney... you win some, you lose some. It could down much more from here.

Feel bad for those who bought in the high 6s. This company is not S.H friendly and dishonest.

Yep, agree. It's a Bear Trap for sure for the unsuspecting...

You need to read this. Silver squeeze

#silver #silverprice #silversqueeze pic.twitter.com/EKdpU7aXF3

— Silly Sheep (@SillySheep9) February 14, 2021

This CEO has zero credibility and his R/S (after promising of no rs) came out of nowhere cost people some coins.

Is there any way to tell when the r/s will occur?

|

Followers

|

108

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

5120

|

|

Created

|

11/02/17

|

Type

|

Free

|

| Moderators | |||

Source: http://www.sunstockinc.com/about

Sunstock, Inc. is a public company and is involved in the buying, selling and distribution of precious metals, primarily gold. The Company pursues a “ground to coin” strategy, whereby it acquires mining assets as well as rights to purchase mining production and sells these metals primarily through retail channels including their own branded coins. The company emphasizes investment in enduring assets that we believe will provide our shareholders a ‘resource to retail’ conversion upside. Our goal is to provide our shareholders with an exceptional opportunity to capture value in the precious metals sector without incurring many of the costs and risks associated with actual mining operations. The Company is ideally positioned for scale and growth.

Sunstock, Inc. founded in 2012 is based in Sacramento, California. The Company currently operates one precious metals retail store under Mom’s Silver Shop in Sacramento, California.

The Company has plans to raise capital in order to strengthen its ability to grow Mom’s Silver Shop revenues. Revenues for 2019 were over $6.1M vs $2.8M in 2018.

The Company also plans to raise capital in order to acquire or partnership with one or more micro gold mines in order to advance it’s ground to retail philosophy of becoming a pure gold play.

The Business: Precious Metals

Mom’s Silver Shop specializes in buying and selling gold, silver, and rare coins, and is one of the leading precious metals retailers in the greater Sacramento metropolitan area. We are also partnering with Apmex to sell their inventory in our shop with an online portal available to customers.

In order to boost sales, Sunstock has determined that the inventory must be increased in order to draw in even larger investors/customers.

The Company believes that monetary policies adopted by the United States, the European Union, China and Japan may cause an increase in inflation. Gold and silver have traditionally served as a hedge against economic uncertainty and high inflation and stock market losses.

At the present time, the Company does not anticipate or foresee a material effect on this line of its business from existing or probable governmental regulations.

The Company’s strategy is to secure funding in order to allow them to secure more products on a timely basis as well as receive better price rates. This will allow us to enter the wholesale market and sell to other dealers.

We also want to begin selling wholesale to other retailers which will boost our sales by $25,000,000 per year, initially. Potentially this can reach into the $100,000,000s/per year range in just a few years.

The Business: Mining

Announcing Sunstock’s intention to become a pure gold play stock, with plans to own a complete Vertical Integration in the gold industry. The Company intends to acquire mineral rights and gold mining assets to compliment it’s already strong and growing gold distribution business. We anticipate acquisition prices in the $5,000,000 to $10,000,000 range. The mines we are considering are producing upwards of 60,000 ounces of gold per year. The cost to mine and refine this gold is anticipated at $1,000 per ounce. We will sell at spot price.

We plan to hire a designer to produce custom designs for us in gold bullion coins. These coins will be in limited quantities of 15 to 30 thousand ounces per quarter. In addition to selling these limited edition coins through our own retail operations we will also sell them through Karat Bar, which has about a 500,000 person sales force. With our prices set at spot, we anticipate brisk sales. Compare this to $25 over spot for Canadian Maples or $35 over spot for American Eagles. We foresee a profit margin of $400+ per ounce. This could net us $45 – $48 million per year in profit at today’s gold prices, and a gross revenue of $200,000,000 per year.

The whole world mines about 109.6 million ounces of gold per year. We hope to produce 1/10 of 1% of the total supply of gold in the world.

The Company is in talks to acquire or partnership with several assets that could potentially produce billions in revenue over 5-10 years. We are focused on projects that already own significant amounts of unrefined – but already mined – gold ore.

Mr. Jason Chang is the Founder, Chairman, Chief Executive Officer and Investor Relations Officer of Sunstock, Inc. Mr. Chang began his career in the hospitality industry in the family business operating several hotels throughout California. Mr. Chang has over 20 years of hospitality management experience. He has excellent communication skills, time-management skills, and overall organizational skills.

Mr. Jason Chang is a highly motivated individual who excels at whatever he does. He has been preparing and researching for this venture for the past few years. His strategic planning and execution make him well suited to lead the Company.

Dr. Ramnik Clair received his medical degree in India and immigrated to the United States in 1983. He completed his medical residency in New York and has subsequently served in his medical practice as a sole practitioner. Dr. Clair intends to assist Sunstock, Inc. in building long term relationships with his client base.

AUSTIN, Texas, Aug. 06, 2020 (GLOBE NEWSWIRE) -- SmallCapVoice.com, Inc. (“SCV”) today announces the availability of a new interview with Sunstock, Inc. (OTC PINK: SSOK) CEO Jason Chang, who discusses the development of the Company’s business model and the increasing value of gold and silver.

The full interview can be heard at https://www.smallcapvoice.com/8-6-20-smallcapvoice-interview-sunstock-ssok

Click here for Twitter home page here

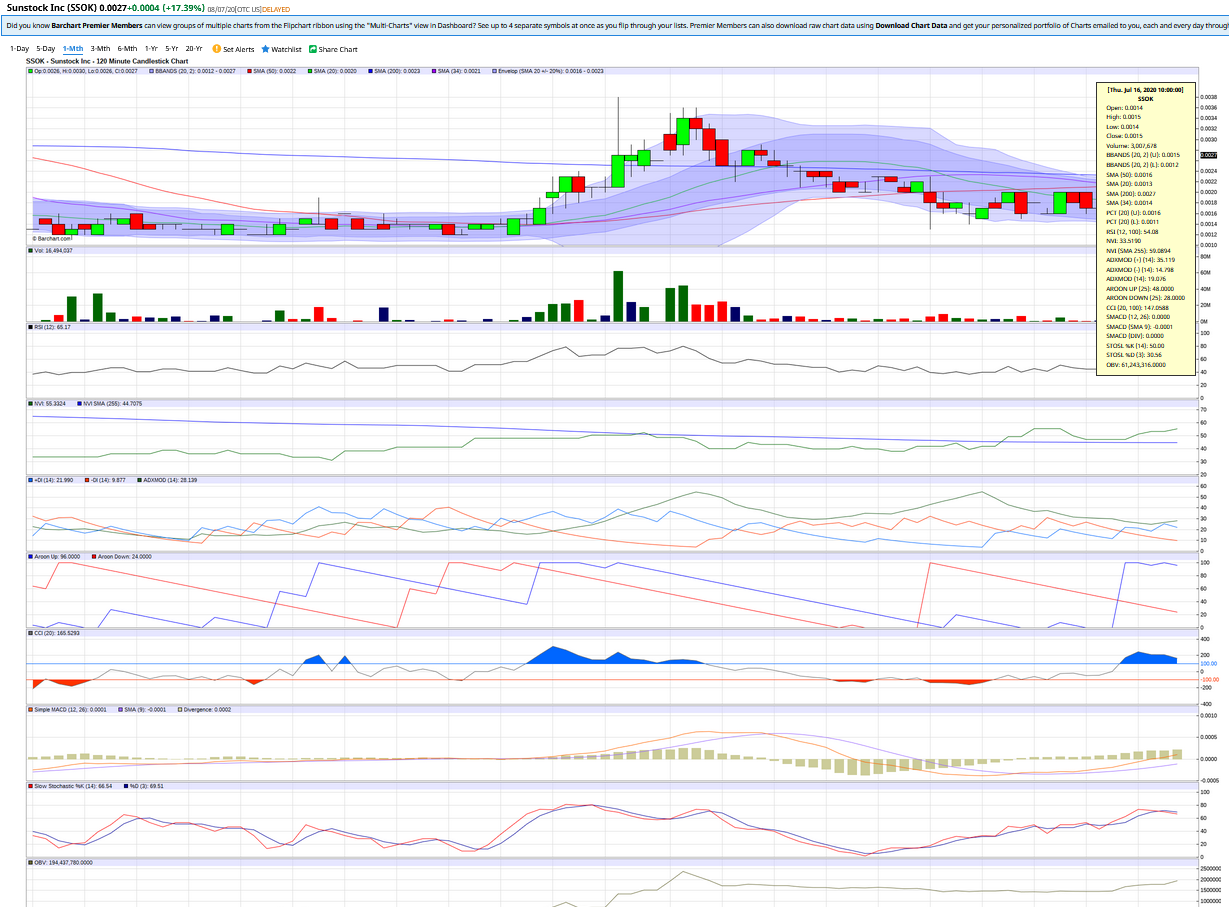

August 2020 Barchart

Find the complete chart details here

4-MOS-SEMI BREAKOUT @ 2'S MEDIUM BREAKOUT @ 3'S MAJOR BREAKOUT @ 4'S MAJOR MAJOR BREAKOUT @ 5.5'S

$SSOK RECENT DD....

11/20/2020 News....

Sunstock, Inc. Initiates Process of Uplisting to OTCQB Venture Market

http://www.globenewswire.com/news-release/2020/11/06/2121964/0/en/Sunstock-Inc-Initiates-Process-of-Uplisting-to-OTCQB-Venture-Market.html

10/26/2020 Tweet....

As we continue to grow our business model and bring forth our plan of uplisting,

we are currently in the process of engaging a PCAOB firm with experience in our sector, stay tuned for our process.

https://twitter.com/SunstockI/status/1320613524196962304?s=19

10/19/2020 News....

Sunstock, Inc. involved in the buying, selling and distribution of precious metals, today announces it has purchased 20 ounces of gold.

http://www.globenewswire.com/news-release/2020/10/19/2110582/0/en/Sunstock-Inc-Purchases-20-Ounces-of-Gold-Continues-to-Increase-Inventory.html

10/14/2020 News....

Sunstock, Inc. involved in the buying, selling and distribution of precious metals, today announces it has purchased 4,300 ounces of silver,

adding to the Company’s existing inventory.

http://www.globenewswire.com/news-release/2020/10/14/2108678/0/en/Sunstock-Inc-Purchases-4300-Ounces-of-Silver.html

08/11/2020 News....

Sunstock, Inc. announced that Company CEO Jason Chang recently stated, "Between July, 10th, 2020 and to August 10th, 2020,

the price of the silver was up over 55% and the price of gold has been up over 13% over the last 30 days.”

http://www.globenewswire.com/news-release/2020/08/11/2076500/0/en/Sunstock-Inc-CEO-Forecasts-Rapid-Growth-from-Silver-Sales.html

08/06/2020....

SmallCapVoice.com, Inc. (“SCV”) today announces the availability of a new interview with Sunstock, Inc. CEO Jason Chang,

who discusses the development of the Company’s business model and the increasing value of gold and silver.

The full interview can be heard at: https://www.smallcapvoice.com/8-6-20-smallcapvoice-interview-sunstock-ssok/.

$SSOK https://www.otcmarkets.com/stock/SSOK/disclosure

https://www.otcmarkets.com/stock/SSOK/news

https://www.otcmarkets.com/stock/SSOK/security

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |