Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

The horse also said ;

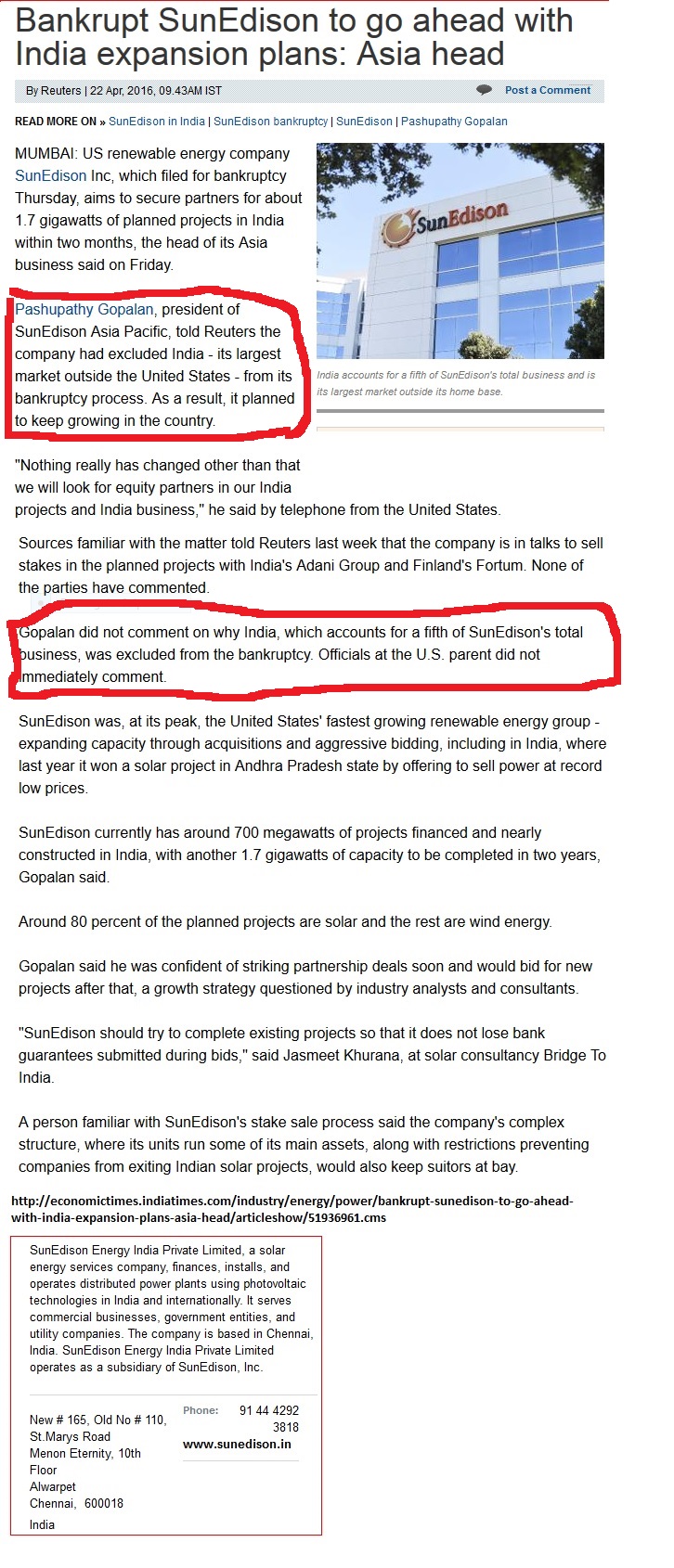

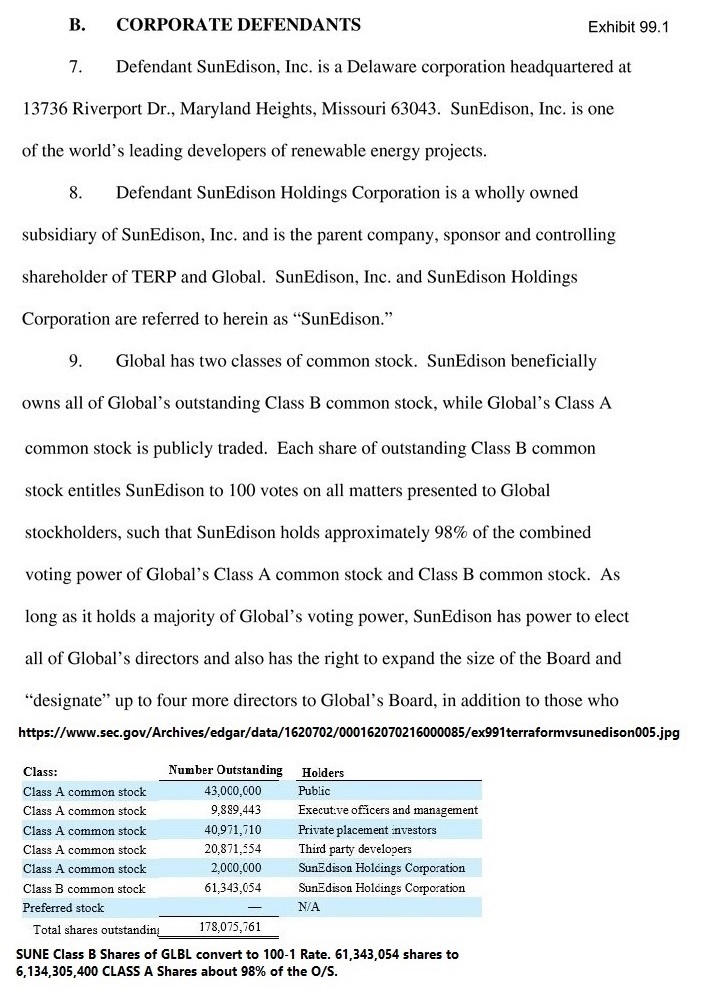

upon the effective date (the date the company emerges from the chapter 11 proceedings), all shares in the current company will be deemed to be cancelled. At this time, the effective date has not been determined as the Plan confirmation has not occurred.

This is straight from the horses mouth...

Pursuant to the Plan of Reorganization and the Disclosure Statement, upon the effective date (the date the company emerges from the chapter 11 proceedings), all shares in the current company will be deemed to be cancelled. At this time, the effective date has not been determined as the Plan confirmation has not occurred. You may view the Plan and Disclosure Statement on the Prime Clerk website here:

https://cases.primeclerk.com/sunedison/Home-DocketInfo?DocAttribute=2751&DocAttrName=PANAMP%3BDISCLOSURESTATEMENT

Well then, let's make money in short order.

This will all be over in short order so if it's going to do anything it better do it quick before shares are cancelled.

SUNEQ has gone from 0.005 to 0.035 a good 600% , can it pull another from 0.02 to 0.12 we will see...

If you look at the trade tape and look at all the buys today, they have all been small, just a bunch of small time retail dreamers hoping for a miracle here, nothing more. Folks holding will lose everything soon once shares are cancelled.

Shhhhhh.... Silence is Golden ;)

Food for thought;

FW: Are you seeing more debtors in Chapter 11 use rights offerings to restructure their balance sheet and raise exit capital? What benefits can be gained from a rights offering in this context?

Sharp: Rights offerings became more prevalent in the wake of the credit market implosion. As a method to obtain financing at the conclusion of Chapter 11 proceedings, debtors have looked to rights offerings when traditional financing options were limited. Utilised not only as a vehicle to restructure their balance sheet and obtain exit financing, subscriptions also provide debtors with a strategic opportunity to influence the future of the company. Eligible holders who exercise their rights become owners of the company. By strategically targeting and controlling who is allowed to participate in the offering, debtors continue to play a major role in determining the future owners of the company.

Helfat: Since the credit crisis of 2007, Chapter 11 debtors have increasingly turned to rights offerings as a vehicle to finance their emergence from Chapter 11 bankruptcy. Rights offerings, which provide an alternative source of capital to traditional secured loans, are especially beneficial when traditional sources of financing are limited and/or prohibitively expensive – as has been the case over the past few years. Another benefit to rights offerings in the Chapter 11 context is the potential to exempt the new securities from the registration requirements of the US securities laws, because in certain circumstances Section 1145(a)(2) of the US bankruptcy code provides an exemption to registration.

Milmoe: A significant number of recent bankruptcy cases have utilised a rights offering in connection with their emergence from bankruptcy, including Vertis, Visteon, American Media, Aleris, Penton Media, Six Flaggs, Spansion and Tronox. While originally designed as a capital-raising technique, rights offerings tend to be used in bankruptcy because of two other attributes: fairness and value validation. In the often contentious context of bankruptcy, disputes about value are commonplace. A classic dispute involves a new money investor asserting that the enterprise value of the debtor is lower than the value proposed by existing creditors, and thus the ‘new money’ should receive a higher portion of the company’s value than existing creditors. A rights offering in which creditors are afforded the opportunity to co-invest on the same terms as the ‘new money’ investor can stifle if not fully abrogate such debate. Similarly, where it is undisputed that an investment in the restructured company is at an attractive valuation, the fairness of permitting impaired creditors or equity holders to participate in the reorganised company’s future upside may be helpful in garnering support for a plan of reorganisation.

FW: To what extent can investors use a rights issue for defensive and offensive positioning?

Helfat: Investors, such as hedge funds and other non-traditional lenders, often use rights offerings for both offensive positioning – as a sword – and defensive positioning – as a shield. When used as a sword, rights offerings provide investors with an opportunity to increase their ownership interest in the reorganised company and their control over the reorganised company’s corporate governance, often at a discount to the reorganised company’s perceived value. When used as a shield, rights offerings provide investors with a vehicle to protect their existing investment from dilution, or being eliminated entirely, in the Chapter 11. Of course, a Chapter 11 rights offering is not for everyone, as certain investment funds are prohibited from participating in the offering due to internal restrictions.

Milmoe: By offering to underwrite or ‘backstop’ a rights offering – take up all or a portion of the shares offered which are not subscribed for – an investor can increase the percentage of its investment in the debtor, while at the same time earning a handsome ‘backstop fee’. A similar result can be achieved by existing investors if the rights offering contains an over-allotment provision – for instance, that offerees are permitted to acquire – usually on a pro rata basis – the rights which are not subscribed for by other offerees. This can be particularly true to the extent that it is known that some prospective offerees are unable, as a result of institutional policy or regulation, or unwilling to subscribe for new shares. A well heeled and enthusiastic investor may significantly increase its percentage ownership through a rights offering if it knows that other offerees will not participate. From a defensive point of view, rights offerings can permit an offeree to eliminate or at least reduce the dilutive effects of new money investors by maintaining the investor’s relative position vis-à-vis other investors.

Sharp: In the current market, rights offerings can be employed as a strategy for investors to gain a greater share of equity from the reorganised company, resulting in a stronger position and stake in the restructured companies’ capital structure. Investors are able to evaluate prior to participation if their investment will provide them with more control over the company and then determine the level of participation in the rights offering to secure the desired position. Conversely, investors can negotiate for certain key provisions to be included in the rights offering from the onset if they are large stakeholders and can negotiate structural procedures of the offering to guarantee they remain in an advantageous position.

FW: How important is it for debtors to plan and administer the rights offering process with care? In your opinion, what steps are indispensable?

Milmoe: The single most important aspect of using a rights offering in a bankruptcy is having a clear vision of the objective to be achieved. A close second is having a careful assessment of what could go wrong. If the principal purposes of the rights offering is fund raising, the debtor should fully understand what appetite investors have to invest addition funds: is there a single investor or small group of investors that is willing to backstop the offering and if so at what price? A non-backstopped rights offering to which nobody subscribed would be a failure if the purpose were fund raising. On the other hand, if the objective of the offering is to validate a lower valuation for the company, the same unsubscribed offer would be viewed as a rousing success – nobody was willing to put in money at that value so the company must be worthless. Careful thought should be given to each aspect of the offering: making the rights transferable may permit holders who do not have the wherewithal to exercise the rights to realise some value from the offering. However, it also allows an investor who wishes to substantially increase its ownership of the company’s stock to do so at an attractive price.

Sharp: From the start of a Chapter 11 case, debtors should determine key elements that will serve as a framework for the rights offering. Key criteria that debtors must establish are the type of security that will be offered, the eligibility requirements for participation in the offering, and whether to allow the transfer of rights to another party. In addition, debtors must determine if an oversubscription privilege will be available. When holders of public securities are the rights offering participants, these elements will help determine the process to be followed by the banks and brokers (the nominees). Often the backstop purchaser – who agrees to purchase any unsubscribed shares – will be influential in determining procedures, depending on their desired level of share ownership. In addition, if claims holders are also granted rights, debtors should determine the procedures to follow for disputed claims to avoid complications or delays. Once the key elements are decided upon, debtors can work with professionals to map out every stage of the offering to ensure no detail is overlooked and the most efficient administrative strategy is employed.

Helfat: At first glance, the administrative execution of a rights offering might appear straightforward. However, the process can be complicated, especially when publicly traded securities are involved, and efficient administration of a well developed strategy is often crucial to the success of the rights offering. While the structure of a Chapter 11 rights offering is largely driven by the specific facts of the Chapter 11 case in which the rights offering is to be made, the most important aspects of a rights offering almost always involve issues of valuation and the terms of the backstop investor’s commitment.

FW: The process carries a number of complications and challenges. Can you outline some of the issues surrounding eligibility requirements, pre-screening and accreditation procedures, transferability of rights, types of security and the role of backstop purchasers?

Milmoe: As noted, Section 1145(a) is not the only exemption from registration available for the issues of rights in an offering. If the rights offering in a private placement is limited to accredited investors or QIPs, the debtor need not comply with the registration requirements. Because the private placement exemption limits the kind of claimholders who may be eligible to participate in the rights offering, utilisation of the exemption may raise classification issues under the Bankruptcy Code which essentially requires that holders in the same class of creditors be treated alike whether or not they are accredited. However, as a practical matter, holders of claims of the sort that were issued solely to institutional purchasers in the first place – for example, bonds or back debt – if separately classified, may provide an opportunity to use a rights offering. While it is possible to require holders of a particular class of claims to certify that they are accredited in order to receive the consideration represented by the rights offering, if there are holders of claims in the same class that are not accredited, it will be necessary to offer to such holders other consideration which has essentially the same value as the rights offer to avoid running afoul of the anti-discrimination provisions of the Bankruptcy Code. While possible, this approach raises a whole layer of additional valuation issues.

Sharp: Once eligibility requirements are determined, the debtor must communicate with all holders regardless of whether the security is held through designated intermediaries and channels, such as the Depository Trust Company (DTC) and the nominees. In the pre-screening process, debtors must take the necessary steps to confirm eligibility which can become challenging when working through the nominees to obtain the necessary certification and eligibility of the ultimate security holder. A main consideration is whether the rights offering will be administered through the DTC or outside of it, as that will determine the manner of ensuring eligibility. This will also impact the mechanics of the transferability of rights, if allowed. If the subscription is administered outside the DTC, it will add a layer of complexity to the process since all transfers need to be tracked to allow communication with the new beneficial holders. Most rights offerings will involve a backstop purchaser as a guarantee that the debtor will achieve its financing goals. Debtors will require a commitment from their backstop purchasers to either buy any remaining, unsubscribed securities that originate from a rights offering or purchase a set number of rights. If the backstop purchasers, often a consortium, want a larger stake in the company, they may not want an oversubscription privilege, which will limit the amount of rights available to other investors. In addition, debtors should determine if funding from the backstop purchasers will be required upon exercise of the rights, before the distribution of the rights or at a later date, and set up the necessary procedures and communication strategies with all parties involved.

Helfat: In general, claims against a Chapter 11 debtor are freely transferable and can be transferred together with any subscription rights appurtenant to such claim. However, most rights offerings in Chapter 11 prohibit the transfer of the subscription rights independent from the underlying claim in order to avoid jeopardising the exemption, under Section 1145(a)(2) of the US bankruptcy code, from the registration requirement of US securities laws. When the capital to be raised from a rights offering will be used to fund a Chapter 11 plan of reorganisation, it is almost always necessary to obtain a backstop commitment in order to satisfy the feasibility requirement of plan confirmation under Section 1129(a)(11) of the US bankruptcy code. To compensate the backstop party for the risk that the rights offering will be undersubscribed, the backstop party typically requires payment of a backstop fee and the option to acquire a minimum number of securities in the reorganised company.

FW: Have objections and valuation disputes become a common feature of rights offerings? What influence can this have on the process?

Helfat: Objections to rights offerings in Chapter 11 have become quite commonplace and generally fall into one of three categories. First, objections to the incentives and protections given to the ‘backstop’ investor, including arguments that the backstop or break-up fees are unreasonably high, or that the backstop commitments are illusory or insufficient to consummate a plan of reorganisation. Second, challenges to the valuation of the reorganised debtor’s securities, and the extent of the discounted price for which the reorganised securities are being offered. Lastly, claims that a rights offering which limits participation to some but not all similarly situated creditors unfairly discriminates against the excluded creditors in violation of Section 1129(b)(1) of the US bankruptcy code. These objections can significantly influence the rights offering process. For example, a well-argued objection to the Chapter 11 debtor’s proposed back-stop investment agreement may result in a bankruptcy court-ordered auction for the right to become the backstop investor. Additionally, as illustrated by In re Washington Mutual, 442 B.R. 314 (Bankr. D. Del. 2011), an objection by a creditor excluded from participating in the rights offering might result in the bankruptcy court’s refusal to confirm the debtor’s plan of reorganisation over such creditor’s objection.

Milmoe: Assuming that interested parties have available to them the cash resources to participate in the rights offering, rights offerings tend to ameliorate objections to and disputes about valuation.

FW: When undertaking a rights offering, is it prudent to facilitate communication between all parties involved?

Helfat: Unlike outside of bankruptcy, where challenges to a proposed rights offering are uncommon, Chapter 11 provides an open venue for claimholders to challenge the structure and terms of a proposed rights offering in an attempt to further their own investment objectives. In this regard, failure to facilitate ongoing communication among the parties being affected by the rights offering can ultimately prove costly to the Chapter 11 debtor and the other interested parties seeking to consummate the offering. For example, a rights offering is typically a substantial component of the debtor’s Chapter 11 plan of reorganisation. The process of seeking approval of the plan is costly and time consuming. Failure to identify and address the objections and concerns of those parties who will be impacted by the rights offering as part of the plan process may result in plan objections that will either be costly to defend or settle, or could potentially derail the debtor’s efforts to reorganise if such objections are sustained by the bankruptcy court.

Sharp: Rights offerings present far-reaching implications for nearly all major creditors in a Chapter 11 case, including secured lenders, unsecured creditors and equity holders. It is prudent for companies to build consensus among investors and communicate with all stakeholders when contemplating or structuring a Chapter 11 rights offering to minimise potential challenges. Debtors and professionals must follow specific administrative procedures and processes to ensure they are communicating through the intermediaries and channels – for instance the DTC, brokers or banks – effectively. Debtor’s counsel must communicate with the claims and noticing agent who manages the administrative process on behalf of the debtor to ensure that the rights offerings process is executed seamlessly based upon the determined mechanics.

FW: Can you note any recent high profile court decisions on rights offerings? How might they affect the process going forward?

Sharp: In the current market, we see a variety of companies using rights offerings as a vehicle to restructure their balance sheets. No two rights offerings are the same – each one differs according to the unique circumstances of the case. A recent court decision that has played a role in the Washington Mutual case was in January 2011 when the debtor was limiting participation in the rights offering to class members who held a significant securities stake. The judge overseeing the case decided that the eligibility requirement did not meet the legal standard and concluded that the rights offering needed to be made available to all members within that particular class. This resulted in the rights offering being removed from the Plan, and may impact other cases facing similar situations.

Helfat: While the majority of creditor objections to a proposed Chapter 11 rights offering are either consensually resolved or overruled without a written decision, the United States Bankruptcy Court for the District of Delaware, in Washington Mutual, recently issued a written decision in which it sustained a creditor’s objection to a proposed rights offering. In Washington Mutual, a creditor objected to confirmation of the Chapter 11 debtor’s proposed plan of reorganisation on the basis that only creditors willing to invest $2m were eligible to participate in the proposed rights offering contemplated by the plan. In ruling that the rights offering was discriminatory, and therefore that the plan could not be confirmed over the creditor’s objection, the bankruptcy court rejected the Chapter 11 debtor’s argument that inviting all creditors to participate in the rights offering would be administratively difficult. Washington Mutual stands alone as the only recent high profile case where typical objections to rights offerings were sustained and, therefore, it is not clear what effect the decision will have on future rights offerings.

FW: What is the outlook for rights offerings in bankruptcy scenarios for the remainder of 2011?

Milmoe: While rights offerings can be useful in bankruptcies, the facts and circumstances of a particular case will dictate how significantly they will be used for the balance of 2011. Given the limitations, and because of US securities laws on the utilisations of rights offerings involving non-institutional investors, I do not anticipate that there will be a significant use of them for the remainder of 2011 for public stockholders or trade claims, except possibly as a tip where otherwise the stockholder or claimant would receive no consideration at all. Intercreditor dynamics will also pay a role in how often rights offerings will be used.

Helfat: Based on the growing use of rights offerings in large Chapter 11 bankruptcies as a cheaper alternative to secured financing facilities, a means to obtain control over the reorganised company, a mechanism to protect existing equity holders and a vehicle for institutional investors and equity sponsors to continue to realise the ‘upside’ of their capital investments in bankrupt companies, the remainder of 2011 will likely continue to see the use of rights offerings in large Chapter 11 cases.

Sharp: With the current state of the slowing US bankruptcy market, I do not foresee a rising tide of rights offerings for the remainder of 2011. However, I do foresee a continued increase in the number of debtors including rights offerings in their plan of reorganisation. If debtors have the ability to access capital from traditional means such as banks, distressed and institutional investors, alternative means for exit financing such as rights offerings will be less relied upon. However, as bankruptcy professionals de-mystify the process and become familiar with the mechanics and procedures, rights offerings will continue to be a strategic option for bankruptcy scenarios moving forward.

David M. Sharp is Director of Public Securities Services at Kurtzman Carson Consultants LLC. With over 20 years of global securities experience, David brings substantial expertise to his role. He has overseen rights offerings, subscriptions and distributions, managed treatment elections and supervised securities voting for Chapter 11 cases such as Washington Mutual, Tronox, Inc., Loehmann Holdings, Inc., and Premier International, among others. He can be contacted on +44 (917) 281 4820 or by email: dsharp@kccllc.com.

Jonathan N. Helfat is a partner at Otterbourg, Steindler, Houston & Rosen, P.C. Mr Helfat specialises in the representation of foreign and domestic banks, commercial finance companies, hedge funds and other specialty lenders and in the restructuring of secured loan transactions, including workouts, forbearance and restructuring agreements, Chapter 11 debtor-in-possession and ‘exit’ financing facilities and the use of cash collateral. He is co-general counsel to the Commercial Finance Association which he has represented in the filing of various amicus briefs before the United States Supreme Court. He can be contacted on +44 (212) 905 3626 or by email: jhelfat@oshr.com.

Gregory Milmoe is a partner at Skadden, Arps, Slate, Meagher & Flom LLP. Mr Milmoe co-leads the firm’s Corporate Restructuring Group, and has wide-ranging experience including restructurings, hostile and negotiated mergers and acquisitions, leveraged buyouts and corporate financings, and transactions involving REITs. He is listed in the K&A Restructuring Register; has been named by Turnarounds & Workouts to its list of the top dozen restructuring lawyers in America; and was named a ‘Dealmaker of the Year’ by The American Lawyer in 2007. He is a fellow of the American College of Bankruptcy. He can be contacted on +44 (212) 735 3770 or by email: gregory.milmoe@skadden.com.

© Financier Worldwide

That says nothing about common shareholders surviving, what is the point of buying post bankruptcy shares here, they are ultimately going to zero, there is nothing left.

More about rights offering Rights Offerings in Bankruptcy:

More Than New Capital

Daniel P. Winikka

Jones Day

Paul M. Green

Jones Day

Over the past decade, rights offerings

have become a valuable and frequently

used source of exit financing for

chapter 11 debtors. The increased use of rights

offerings is, in part, a result of the increased

participation of non-traditional, sophisticated

lenders in the bankruptcy process. Rights

offerings are often beneficial to all parties

involved. The debtor can obtain access to new

capital without resorting to secured financing,

and creditors or pre-bankruptcy equity security

holders can preserve their investment in the

debtor and obtain enhanced recoveries by

investing at a discount to the perceived value

of the reorganized company. Moreover, a

successful rights offering can provide a signal to

the market that there is healthy optimism in the

success of the reorganized company.

In addition to providing reorganized debtors

with access to new capital, rights offerings are

increasingly being used as a tool to effectuate

other agendas in a bankruptcy case, including

the resolution of valuation disputes and

allocating control of the new company.

The Basics of Rights Offerings

In bankruptcy, a rights offering allows a debtor

to offer creditors or equity security holders the

right to purchase equity in the post-emergence

company, usually at a healthy discount to the

assumed value of the reorganized enterprise.

The class of creditors or equity security holders

solicited for participation is generally offered

the right to purchase their pro-rata share

(i.e., the same percentage that their current

holdings represent) of the equity available

under the offering. Rights offerings typically

involve a solicitation of the eligible creditors

or equity security holders either in connection

with solicitation of the reorganization plan or

following confirmation of a plan but prior to

consummation of the plan and emergence from

bankruptcy. Because the new equity typically

is sold at a discount to assumed value, parties

often have a strong incentive to participate in

the offering to avoid dilution, provided that they

believe the offering price does in fact represent

a discount to the value of the reorganized entity.

To guarantee the reorganized debtor’s

capital needs are met, rights offerings are

usually backstopped by a third party that

agrees to purchase any unsubscribed shares.

Because the debtor’s plan of reorganization is

normally premised upon raising the financing

contemplated by the rights offering, obtaining

a backstop commitment is typically critical

to establish the feasibility of the plan at

confirmation and to avoid the possibility of a

substantial loss of time and expense soliciting

and confirming a plan that is thereafter never

consummated because sufficient funds are not

raised. Because there is always the inherent risk

that the backstop party could be required to

purchase a much larger number of unsubscribed

shares than the party desires, backstop parties

typically require payment of a backstop fee, often

ranging from three to seven percent of the total

offering. The backstop party will also typically

want assurance, through an overallotment right

or otherwise, that it will have the opportunity

to purchase a certain minimum number of

shares. To ensure its protection, the backstop

party will require that, prior to proceeding with

any solicitation of the rights offering, the debtor

seek court approval of the backstop agreement,

including the backstop fee. The backstop party

can often end up with a controlling, or at least

very influential, equity block. To obtain the

most favorable terms, debtors often shop the

backstop right, sometimes through an informal

auction process.

One of the most heavily negotiated terms of the

backstop agreement will be any material adverse

change provision. There can often be months

between the time the backstop agreement is

signed and consummation of the rights offering,

and it can be challenging to define, and reach

agreement on, what unexpected adverse

developments might permit the backstop party

to terminate the backstop commitment.

A rights offering may include oversubscription

or overallotment rights. Oversubscription rights

allow existing creditors or equity holders to

can you summarize it?

Read at prime clerk about Corning and rights offering

What is going on here? I did notice that most the buys today were rather small other than a few. I haven't followed this for long, I basically left it for dead. Won't shares be cancelled in November?

What’s the point in accumulation of a bankrupt company?

Many people and institutions got fu&$

on this company

Wonder if this breaks .03 at the open?!?

SUNEQ - bidding 27's. We'll see.

Nothing . . . today was just a few buyers trying to attract some flies. Looks like they did.

Serious question...can Corning buy everything that's left to be settled while offering a premium and leaving shareholders whole?

Would something like that fly in the courts?!? Just curious.

Yup. Suneq guna open up at 35 bucks tomorrow

LoL. Yes...I remember those folks well. Can't wait to see the crew 'reunite' should this blow past .03 before closing.

Gangster...girlfriend...Penny...I MISS them all!!!

K...that said, aside from the 'under the radar' buying I made note of last week, there's the bidder who tried getting 1mil shares early this morning. Like, who does that?!?

I know it's "polyanna" of me, but-I-entertain the dream

that we get offered shares in a new company and get saved that way.

I know all the intelligent trading experts, here, will jump on me with-both-feet for saying THAT!

There's always a reason, right? Trick usually is finding out what that reason is before PPS gets away.

I live by the rule 'someone will always know something before I do...but they can't keep it off the charts'. For 'dead companies' like SUNEQ, buying is more often then not, reflective of something potentially significant underway.

The days ahead will tell.

Bitcoin god mode.

Thing is...someone's been buying SUNEQ all of last week. It was subtle, but guessing they're now 'out of the closet' about it. Related to that upcoming asset sale? Who knows.

back for condolensces

i ate up a bag for about 4k (got 1k out safe)

and i put it all in Bitcoin, and i told each and everyone of you to do the same

that was the beginning of the year, Bitcoin was under 2k

its now approaching 5k

i wish more had listened to me, rather than grasping for straws that dont exist.

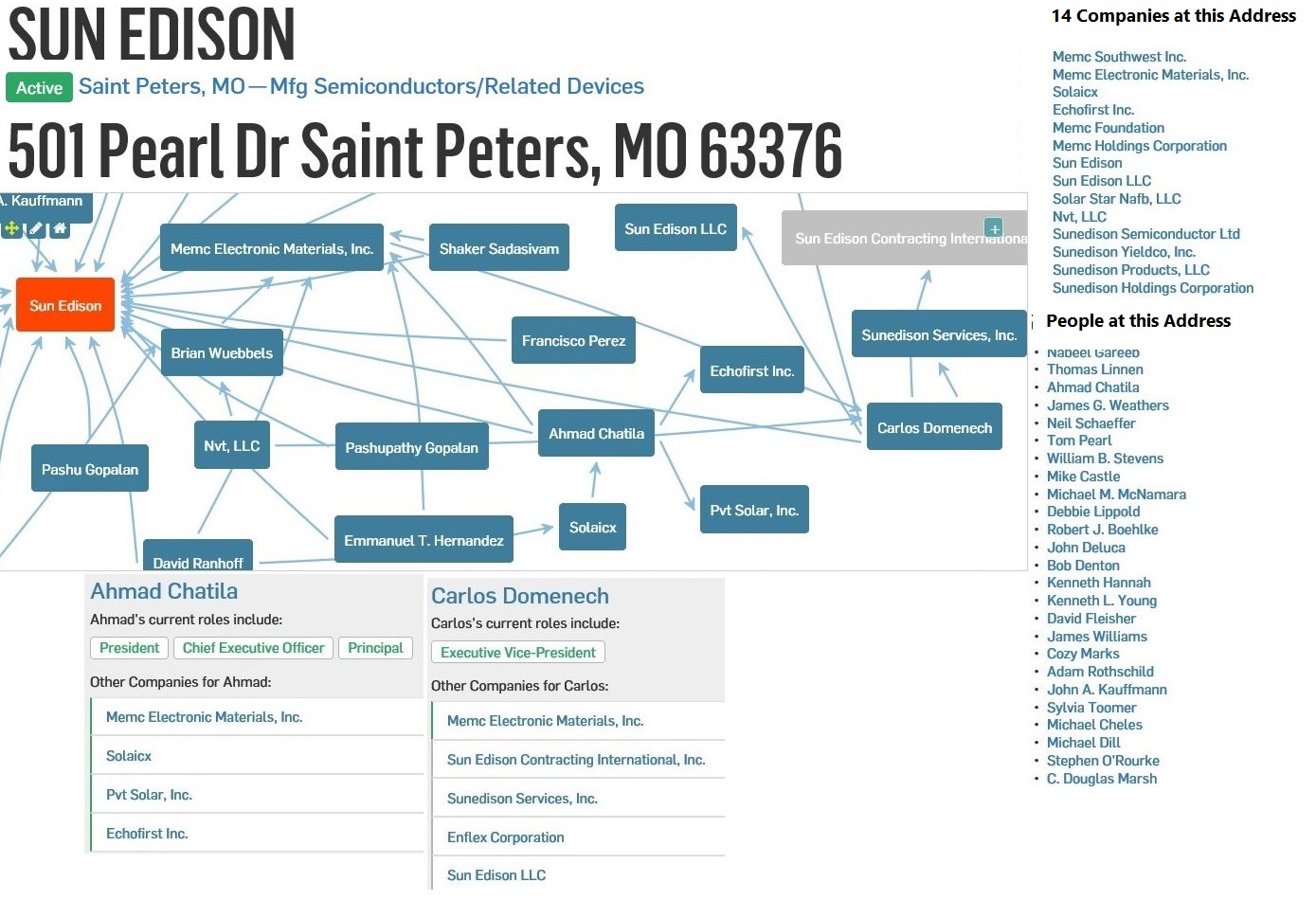

this is how capitalism kills, its steals from the workers and gives it to the Bankruptcy lawyers, and 1st lien creditors, and to the shit bag CEOs like Chatilla

we can do a better system, thats what crypto currency is all about.

Current contact for class action Shares

Matthew C. Mahady

Bernstein Litowitz Berger & Grossmann LLP

1251 Avenue of the Americas, 44th Floor

New York, New York 10020

Phone: (212) 554-1471

Fax: (212) 554-1444

matthew.mahady@blbglaw.com

1,985 of my shares qualify in this action. Do you have a contact?

https://www.blbglaw.com/cases/00283

Man how much did you lose altogether? DR*S, T*PS, SUNEQ? Are there more?

Google this:

sun edison class action lawsuit

Lots going on, so jump in if you qualify . . . good luck.

Yes I bought before the BK at about 1.50 per share. Are there still class actions you can join at this late date and what firm is the most reputable and honest. Lost over $50,000 on this POS Sune Stock.

Did you buy before the baankruptcy? Maybe.

Had a whole lot of shares here, is it worthwhile at all to join a class action suit against SuneQ? or is it too late to get to join one, and if there is still time what firm handling a case against Sune is the most honest and reputable to try and recover any losses here if that is possible at all, which seems unlikely by the comments I have read here. Thanks to anyone who knows how this all works, I know that the attorneys get almost everything but getting something back at all would be better than nothing.

"29 trillion * 2.87% magically produces the exact same amount of net income that all U.S. public companies currently produce. "

To earn 2.87% in the stock market one has to risk their hard earned money while another can merely buy

the US Treasury notes and assume no risk. Risk always commands a premium on price therefore the price return for the risk taken is unjustifiable.

Bottom line, Wall Street is a den of theives and few to none should ever invest their money here.

Since the US government is in bed with these thieves as testament with tax shelters provided within 401K's, IRA's ...ect, it is harder for most to avoid the temptation of investing with these crooks.

Folks should invest in other avenues for capital return of equity.

Every U.S. publicly traded company combined produces approximately $850 billion in net income. The entire stock market is currently valued at approximately $29 trillion (info can be found on the quarterly z.1 produced by the Fed). Current 30 Y Treasury yield is 2.87%.

29 trillion * 2.87% magically produces the exact same amount of net income that all U.S. public companies currently produce.

It's not a coincidence :)

Sounds good to me.

Basic Math has already told me.

Only time will tell.

The market is correctly priced based on the current fed rate, which is used as a discount rate for valuation purposes. Even Buffett points that out recently. What house of cards are you referring to?

Until the house of cards comes crashing down.

Stocks are trading higher than they ever have. What's your point?

You may wanna read the PR from the SEC so we can be on the same page.

That's an entirely different matter. The SEC enforces laws. They don't control prices of stocks.

Lol check out the 39 arrests related to the market place activities.

Lol. The SEC doesn't have anything to do with marketplaces.

Probably even psychotic by now.

And disillusioned.

|

Followers

|

284

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

36208

|

|

Created

|

08/05/06

|

Type

|

Free

|

| Moderators | |||

This board is for fundamental and technical discussion about Sunedison, Inc.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |